MEMBERS ONLY

Norfolk Southern Falls Sharply From Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Norfolk Southern (NSC) is a railroad company and a key part of the Dow Transports. The chart below shows NSC hitting resistance around 75 and falling over 1% today. Notice that MACD barely made it back in positive territory on the last bounce. Another downturn from here would surely turn...

READ MORE

MEMBERS ONLY

SPY Could be in the Fifth of the Fifth, but Uptrend Rules for Now

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs are in uptrends and overbought. In general, it is much better to pick bottoms than tops in uptrend. Even though SPY, QQQ and IWM are overbought and ripe for a pullback, picking a short-term top is challenging when the bigger trend is clearly up. Overbought conditions...

READ MORE

MEMBERS ONLY

Charts: BA, CHK, DAL, NVDA, POT, SBUX, TYC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BA Underperforms with Support Break.

POT Challenges Channel Resistance.

Plus CHK, DAL, NVDA, POT, SBUX, TYC

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for...

READ MORE

MEMBERS ONLY

Eight of Nine Sector Bullish Percent Indices are Trending Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Bullish Percent Index (BPI) shows the percentage of stocks on Point & Figure buy signals within a specific group. Even though bulls have the edge when the BPI is above 50%, chartists also need to watch the direction of the BPI. The image below shows six sector BPI charts...

READ MORE

MEMBERS ONLY

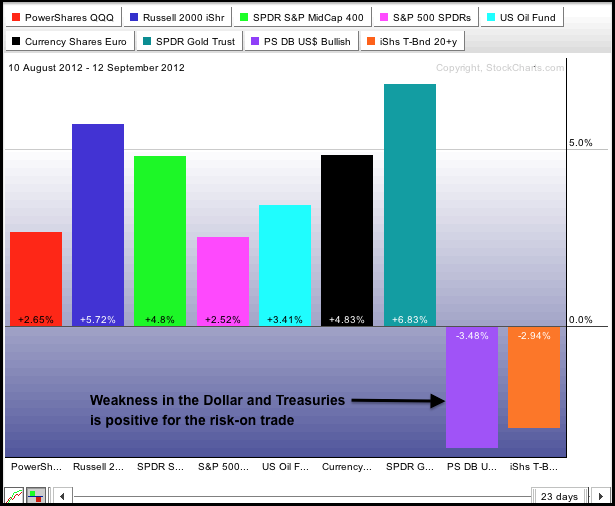

Stocks are Overbought and Dollar/Treasuries are Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Is it really this easy? Does another round of quantitative easing insure higher equity prices over the next few months? Well, the stock market agrees as the major index ETFs hit new highs last week and remain in clear uptrends. Also note that stocks were strong during prior periods of...

READ MORE

MEMBERS ONLY

Quantitative Easing and the S&P 500 Since 2008

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on Thursday after the Fed announced another round of quantitative easing, and extended their gains on Friday. Obviously, the stock market is pleased with the announcement. The chart below shows the S&P 500 since September 2008 and the yellow areas mark the beginning-end of the prior...

READ MORE

MEMBERS ONLY

Several 52-week Highs Grace the Technical Alerts Page

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StocksCharts.com has a new technical alerts page that shows key milestones for dozens of ETFs and indices. On Thursday, September 13th, note that 10 securities recorded new 52-week highs. These include the Nasdaq, Russell 2000, Dow, S&P 500 and six sector SPDRs.

Click this image for a...

READ MORE

MEMBERS ONLY

New Highs Reinforce Bullish Indicators

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With new highs in the major index ETFs, there is little doubt where the bulk of the evidence lies. The bulls are clearly in charge of this market right now. The NYSE AD Line hit a new high, the NYSE AD Volume Line is near its spring high and NYSE...

READ MORE

MEMBERS ONLY

Dollar Becomes Even More Oversold as Stocks Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Judging from the reaction, it appears that the stock market is quite happy with a third round of quantitative easing. The major index ETFs surged with the S&P 500 ETF (SPY) and Dow Industrials SPDR (DIA) gaining around 1.5%. All sectors were up with the Finance SPDR...

READ MORE

MEMBERS ONLY

Semiconductor ETF Tests Two Key Moving Averages SMH

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big surge above 33, the Market Vectors Semiconductor ETF (SMH) peaked in mid August and declined back to support in the 32.50 area. Support here stems form broken resistance, the rising 200-day SMA and the rising 50-day SMA. A successful test and break above 33 would be...

READ MORE

MEMBERS ONLY

Weakness in Treasuries and the Dollar is Positive for Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered again on Wednesday and then closed with small gains. All of the major index ETFs were up with the S&P MidCap 400 SPDR (MDY) leading the way (up a mere .52%). Six of the nine sectors were higher with the Energy SPDR (XLE) and Technology SPDR...

READ MORE

MEMBERS ONLY

Charts of Interest: ADBE, GRMN, LUV, QCOM, SKUL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADBE Hits Resistance in Gap Zone.

LUV Forms Triangle after Surge.

Plus GRMN, QCOM, SKUL

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves...

READ MORE

MEMBERS ONLY

Coffee Surges off Support with Big Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart in the main window shows December Coffee Futures ($KCZ12) finding support above the June low and surging above the late August high. The indicator window shows the Coffee ETN (JO) with a similar pattern. These breakouts are bullish as long they hold. A move back below the breakout...

READ MORE

MEMBERS ONLY

QQQ Falls Back as Apple Event Looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered around in positive territory on Monday and ended the day with small gains. A little indecision is understandable given the recent gains and the news flow over the next few days. Key happenings include the German constiutional court ruling and the Apple event today, the FOMC policy statement...

READ MORE

MEMBERS ONLY

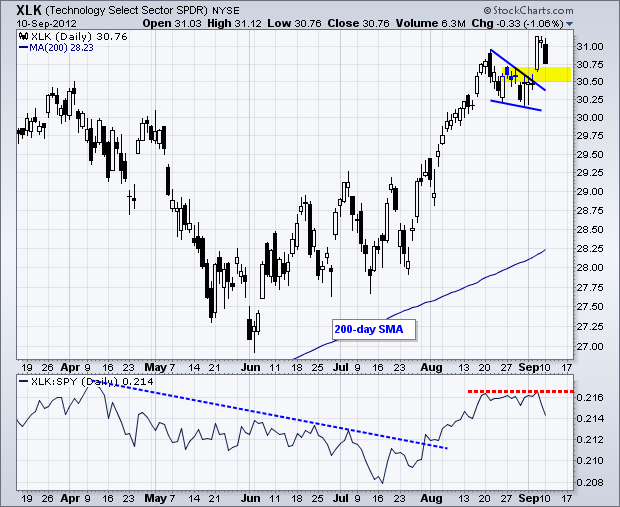

XLK Starts Underperforming - TLT Hits Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved lower on Monday as traders booked some profits from last week's rally. The Nasdaq 100 ETF led the way lower as Apple's big event approaches. Apple investors appear to be getting cold feet as the stock fell over 2% on Monday. The Russell 2000...

READ MORE

MEMBERS ONLY

Charts: BOOM, BRCM, CSX, DUK, KLAC, MCHP, MDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BOOM forms large descending triangle.

KLAC gaps and forms bear flag.

Plus BRCM, CSX, DUK, MCHP, MDR

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

Dollar Extends Downtrend and Becomes Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their gains on Friday and the S&P 500 finished with its biggest weekly gain since early July. This key benchmark index cleared its spring highs and closed at a 52-week high on Friday. Five of the nine sector SPDRs were up on Friday. The technology sector...

READ MORE

MEMBERS ONLY

Dow Challenges Spring Highs on 30pt Point & Figure Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The P&F chart below shows the Dow Industrials using 30 points per box and a three box reversal method. With the August dip and September surge, the Dow is challenging the prior highs and tracing out a large inverse head-and-shoulders pattern. A break above these highs opens the...

READ MORE

MEMBERS ONLY

Arch Coal Leads Resurgent Coal Group

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The coal group has been one of the worse performers this year, but coal stocks moved sharply higher the last two days. Arch Coal (ACI) is showing some signs of life with a falling wedge breakout on three days of good volume. The July-August highs mark the next resistance zone...

READ MORE

MEMBERS ONLY

Net New Highs Surge on the NYSE and Nasdaq

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a big surge on Thursday, stocks broke out of their funk and the indicator summary improved a notch. Techs continue to lead the market overall. The Nasdaq AD Line broke triangle resistance, Nasdaq Net New Highs surged to their highest levels since early July and the Technology SPDR (XLK)...

READ MORE

MEMBERS ONLY

SPY Breaks Wedge Resistance with Gap - USO Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A mixed up Wall Street turned into a raving bull as stocks surged ahead of today's employment report. Rumor has it that Super Mario, Draghi, not Gabelli, inspired the bulls. It kind of makes the employment report an after thought. Consensus calls for non-farm payrolls to add 125,...

READ MORE

MEMBERS ONLY

Sandisk and Micron Light Up the Tech Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The technology sector is lighting up the market carpet with a sea of green. Notice that memory makers Sandisk (SNDK) and Micron (MU) are leading the charge. Both gapped higher on their price charts. Hard-disk maker Seagate (STX) is the only loser in this group.

Click this image for a...

READ MORE

MEMBERS ONLY

SPY Consolidation Looks Like a Fourth Wave

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was another mixed day on Wall Street as stocks meandered on either side of unchanged. The major index ETFs were mixed as well with the Dow Industrials SPDR (DIA) and Russell 2000 ETF (IWM) edging higher, but the Nasdaq 100 ETF (QQQ) and S&P MidCap 400 SPDR...

READ MORE

MEMBERS ONLY

Charts of Interest: ACN, ANF, BCR, BG, HSP, XRX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BCR Breaks Consolidation Resistance with Good Volume.

XRX Forms Pennant Near Key Retracement.

Plus ACN, ANF, BG, HSP

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to...

READ MORE

MEMBERS ONLY

Ford Breaks Out as MACD Crosses above its Signal Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ford (F) came across the bullish MACD scan as the MACD line moved above its signal line (9-day EMA of MACD). On the price chart, F formed a falling wedge at the end of August and broke wedge resistance with a surge the last three days. The late August low...

READ MORE

MEMBERS ONLY

IWM Breaks Triangle Resistance and Shows Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Economic reports triggered some early selling pressure, but stocks managed to rebound with small-caps leading the charge. The ISM Manufacturing Index showed weakness as the key indicator dipped below 50 (49.6). Anything below 50 indicates a contraction in the manufacturing sector. This was further exasperated by weakness in construction...

READ MORE

MEMBERS ONLY

Aroon Crosses Bearish for the Industrials SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Industrials SPDR (XLI) is under pressure today after a weak manufacturing report. The chart below shows XLI falling to a support zone marked by broken resistance and the June trend line. This sets up an important test because the Aroon down crossed above Aroon green and hit +100 for...

READ MORE

MEMBERS ONLY

Gold and Oil Surge as Stocks Extend Consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs surged the first two weeks of August and then consolidated the last two weeks. With the medium-term trends clearly up, the odds favor a bullish resolution to these consolidations. However, we could see some serious volatility in the coming weeks as the news flow surges in...

READ MORE

MEMBERS ONLY

Charts: AA, AMTD, APC, DHR, EA, MSFT, UNM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AA Firms at 61.80% Retracement.

EA Surges off Broken Resistance with Big Volume.

Plus AMTD, APC, DHR, MSFT, UNM

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

NET NEW HIGHS WEAKEN BUT REMAIN POSITIVE AND BULLISH OVERALL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the S&P 1500 Index ($EIS) is trading near its spring highs and within a few percent of a 52-week high, Net New Highs have shown less strength since early July and divergences have formed. Keep in mind that less strength is not the same as weakness....

READ MORE

MEMBERS ONLY

Nasdaq Summation Index Struggles at Zero Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq Summation Index ($NASI) rebounded in July and then hit resistance near the zero line in July-August. The indicator is still moving higher because it is above its 10-day EMA. A break below this EMA would signal a downturn and be bearish for Nasdaq breadth.

Click this image for...

READ MORE

MEMBERS ONLY

Net New Highs Weaken and Volatility Indices Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The top pickers are circling the wagons as we roll into September, October, the election, the fiscal cliff, a Euro crisis and a Chinese slow down. Even though this is enough to push one to the sidelines, keep in mind that most of this is probably already priced into the...

READ MORE

MEMBERS ONLY

Techs Lead Lower as QQQ Gaps Below Triangle Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks pulled back as traders moved aside ahead of Fed Chairman Bernanke's speech at Jackson Hole this morning. Truth be told, I think the three economic reports are more important that his speech, which will probably walk a fine line and repeat the last FOMC policy statement. Factory...

READ MORE

MEMBERS ONLY

Monsanto and Corn Moving Step-for-Step

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows Monsanto (MON) with black candlesticks and the Corn ETF ($CORN) as a red dashed line. Notice how these two fell together in April and early May, and then surged together in June and July. The Correlation Coefficient confirms this relationship with a positive reading since mid...

READ MORE

MEMBERS ONLY

IWM Starts Outperforming - UUP Firms Near Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading volume is low, the last two dog days of summer are here, we are heading into a three day weekend and Fed Chairman Bernanke is speaking from Jackson Hole at 10AM tomorrow. The first three items argue for another listless session. The fourth item, Chairman Bernanke, is clearly the...

READ MORE

MEMBERS ONLY

Charts of Interest: AMCC, AMAT, EMC, FISV, FLEX, MSI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

EMC Forms Pennant after Double Bottom Breakout.

FISV Recovers after Island Reversal.

Plus AMCC, AMAT, FLEX, MSI

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

October Sugar Bounces off Support as StochRSI Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

October Sugar fell sharply the last five weeks, but found support near the June lows and surged on Tuesday. The indicator window shows StochRSI moving below .20 it late July and remaining below .50 as the downtrend extended into late August. The surge above .80 shows an upside momentum thrust....

READ MORE

MEMBERS ONLY

XRT Holds Channel Breakout - SPY Holds Wedge Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remained mixed and directionless on Tuesday. The Dow Industrials SPDR (DIA) and S&P 500 ETF (SPY) edged lower, while the Russell 2000 ETF (IWM) and S&P MidCap 400 SPDR (MDY) edged higher. The latter two were up around a 1/2 percent. Three sectors were...

READ MORE

MEMBERS ONLY

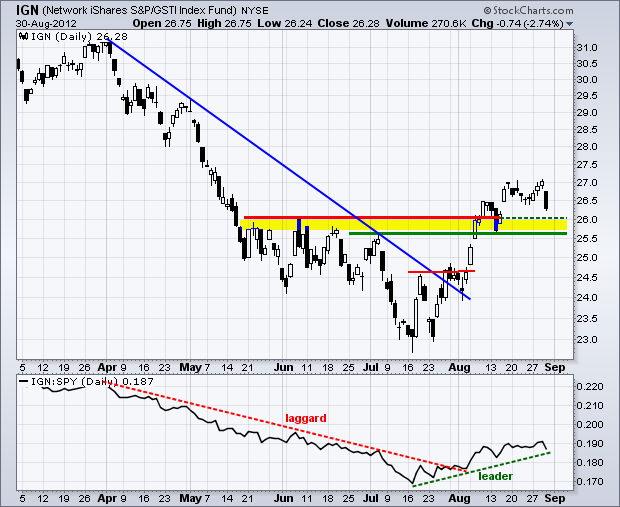

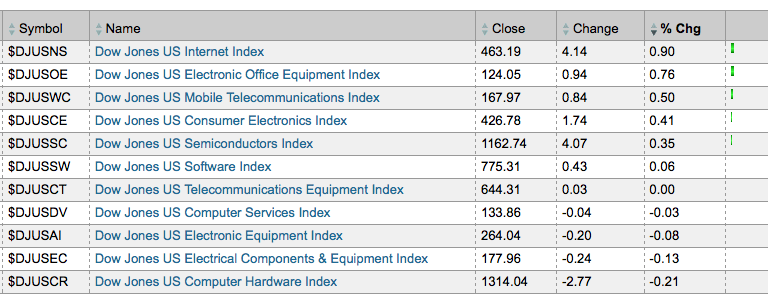

Internet and Electronic Office Equipment Lead Tech Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Browsing through the technology sector via the sector summary reveals relative strength coming from the internet ($DJUSNS) and electronic office equipment ($DJUSOE) groups. Baidu (BIDU) is up for internet and Xerox (XRX) is leading office equipment.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

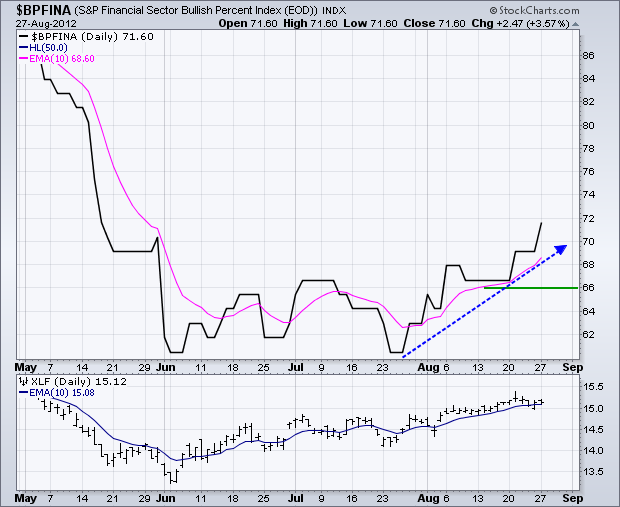

Finance BPI Continues to Climb - SPY Holds Wedge Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were all mixed up with no place to go on Monday. Techs and small-caps showed some strength as the Nasdaq 100 ETF (QQQ) and Russell 2000 ETF (IWM) edged higher. These miniscule gains were offset by small losses in the S&P 500 ETF (SPY) and the Dow...

READ MORE