MEMBERS ONLY

Charts of Interest: ANF, CHS, FL, IBM, KSS, MON

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CHS Retraces 50% with Rising Wedge.

IBM Stalls Near Mid August High.

KSS Forms Triangle within Downtrend.

Plus ANF, FL, MON

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Technology ETF Traces out Bearish Engulfing at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Technology ETF (XLK) surged to its mid August high and formed a bearish engulfing. Resistance in this area is also marked by broken support. The bearish engulfing has yet to be confirmed though. Look for further weakness below 24 to confirm.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Stocks Holds Gains Despite Dip in Consumer Confidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulls held up well in the face of a bad consumer confidence report. August consumer confidence hit a two year low. Even though consumer confidence is a lagging indicator, there are fears that this could put pressure on consumer spending. Nevertheless, stocks held on to their gains and the...

READ MORE

MEMBERS ONLY

New 52-week Highs List Show Outperformers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Looking for stocks that are still in favor? Just mosy over to the pre-defined scan page for a look at the stocks making fresh 52-week highs. There were over a dozen in the Nasdaq and over three dozen on the NYSE. Hot Topic (HOTT) hit a new high after advancing...

READ MORE

MEMBERS ONLY

Charts of Interest: ADM, ALL, AMX, CMCSA, NE, PEP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADM Bounces Along with Grains.

ALL Surges on Big Volume.

PEP Breaks Triangle Trendline.

Plus AMX, CMCSA, NE

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to...

READ MORE

MEMBERS ONLY

SPY Breaks Triangle Resistance with Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued higher on Monday with another all or nothing day. Net Advancing Volume for the NYSE and Nasdaq hit +94% and +93%, respectively. All major index ETFs were sharply higher with small-caps and mid-caps leading the way. All sectors were also higher with finance leading the charge. It appears...

READ MORE

MEMBERS ONLY

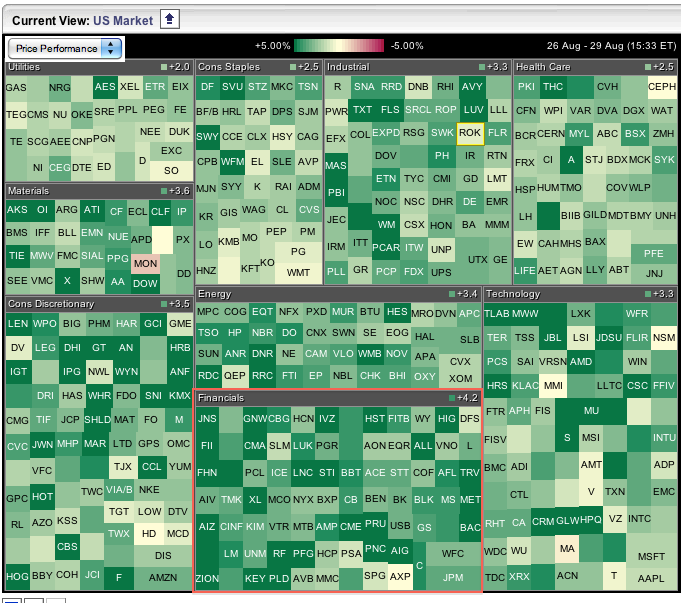

Market Carpet Shows Sea of Green for Finance Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Sector Carpet shows the finance sector leading the way higher with an aveage gain of 4.2%. Color-wise, this sector shows lots of dark green, which means many stocks were up sharply. The consumer discretionary was second with an average gain of 3.5%. On the live carpet, users...

READ MORE

MEMBERS ONLY

Stocks Reverse Early Losses to Close Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started weak ahead of Bernanke's speech, but rallied afterwards and closed relatively strong. Bernanke did not offer a QE3 and the speech produced little drama, which is just what the bulls needed. In fact, the reversal from 10AM to 12PM was quite strong. Breadth was decidedly negative...

READ MORE

MEMBERS ONLY

Euro ETF Challenges Resistance after Bernanke Speech

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro Currency Trust (FXE) seems to like what it heard from Fed Chairman Bernanke - and the Dollar did not like it. After dipping below 143 in the morning, FXE surged above 144 by mid day. The ETF is still just shy of a breakout. Look for a move...

READ MORE

MEMBERS ONLY

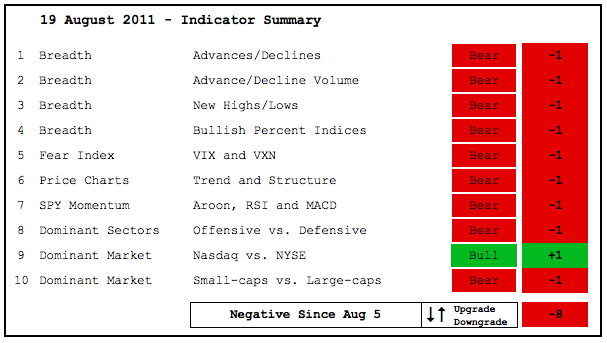

Indicator Summary Remains Negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary as the major index ETFs consolidate after their big breakdowns. New lows continue to outpace new highs. The volatility indices remain at high levels, which reflects a great amount of fear in the market place. Small-caps remain relatively weak as the $RUT:...

READ MORE

MEMBERS ONLY

SPY Traces Out ABC Flat for Wave 4

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened strong on the heels of Warren Buffet's $5 billion investment in Bank of America (BAC). However, stocks did not finish strong. Neither did BAC or the other big banks. Selling pressure took hold after this strong open and stocks closed down. The major index ETFs lost...

READ MORE

MEMBERS ONLY

XLF Fails at Resistance After Buffet Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Thursday's announcement that Warren Buffet will invest $5 billion in Bank of America (BAC) sent the Finance SPDR (XLF) sharply higher on the open. XLF opened above 13 and surged above 13.2 in the morning. These gains quickly evaporated as sellers returned. This failure reinforces resistance from...

READ MORE

MEMBERS ONLY

Late Rally Keeps Short-Term Uptrend Alive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A late rally saved the day for the bulls as the major index ETFs closed strong. The S&P 500 ETF (SPY) and Russell 2000 ETF (IWM) led the way higher with gains around 1.5%. The Nasdaq 100 ETF (QQQ) lagged with a gain that was less than...

READ MORE

MEMBERS ONLY

Charts of Interest: CVS, FNSR, GLW, MRVL, TAP, WFR, YHOO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GLW Forms Small Wedge After Surge.

MRVL Forges One Day Island Reversal.

YHOO Consolidates After Mid August Surge.

Plus CVS, FNSR, TAP, WFR

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or...

READ MORE

MEMBERS ONLY

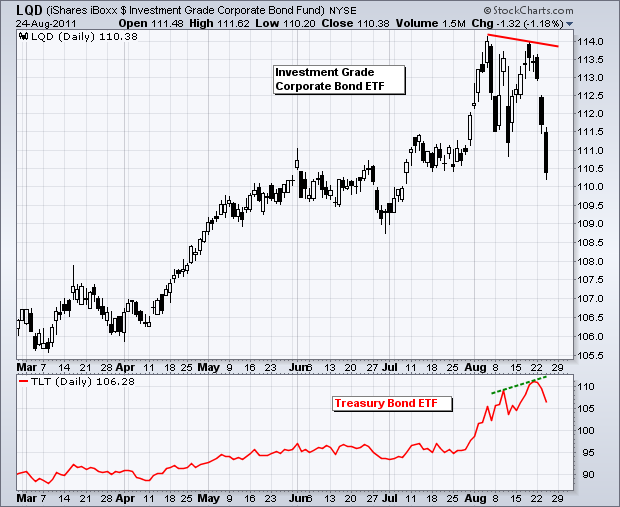

Corporate Bond ETF Takes a Tumble

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Investment Grade Corporate Bond ETF (LQD) tumbled for the third straight day and broke below its August low. This ETF formed a lower high in late August as the 20+ year Bond ETF (TLT) formed a higher high (red line chart). Investment Grade Corporate Bonds are weak relative to...

READ MORE

MEMBERS ONLY

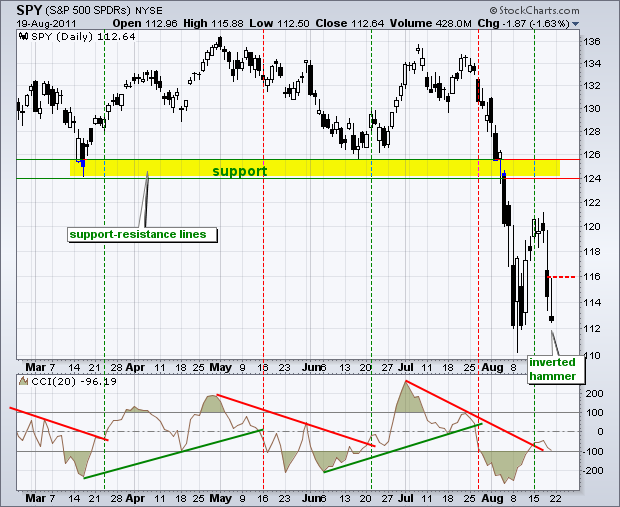

Stocks Surge with Oversold Bounce off August Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved sharply higher on Tuesday with the major index ETFs gaining 3% or more. All sectors were up with energy and consumer discretionary leading the way. Wednesday's move was certainly broad based, but still considered an oversold bounce with a larger downtrend. The first chart shows SPY...

READ MORE

MEMBERS ONLY

Best Buy Traces out an Array of Bullish Candlesticks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Best Buy (BBY) is attempting to base with several bullish candlesticks over the last two weeks. Most recently, a Harami is taking shape on Monday-Tuesday. Prior to this, BBY formed a Hammer on Thursday and an Inverted Hammer on Friday. None of these candles has been confirmed yet. Look for...

READ MORE

MEMBERS ONLY

SPY Drops Back to Prior Lows as Dollar Weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was pop and drop on Monday. Stocks opened strong, but gains quickly evaporated as selling pressure took over. Even though the major index ETFs closed near their lows for the day, they are still near support from last week's lows and the bulls are chomping at the...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, ATVI, BIIB, DE, ERTS, MCP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Returns to Broken Resistance.

BIIB Firms in 50-61.80% Retracement Zone.

DE Forms Gravestone Doji above Early August Low.

Plus ATVI, ERTS, MCP

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF...

READ MORE

MEMBERS ONLY

Gold Miners ETF Challenges Major Resistance Level

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After lagging gold the entire year, the Gold Miners ETF (GDX) is trying to play catch-up with a surge to resistance. The December 2010 and April 2011 highs mark resitance here. Overall, GDX has been stuck in a range since October 2010 and a move above resistance would break this...

READ MORE

MEMBERS ONLY

Major index ETFs Test the early August Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bottom-pickers and knife-catchers are no doubt eyeing current levels as the major index ETFs tests the early August lows. After a sharp decline the first week of August, trading turned very volatile with four consecutive 4+ percent swings in SPY (down,up,down,up). There was a little follow through...

READ MORE

MEMBERS ONLY

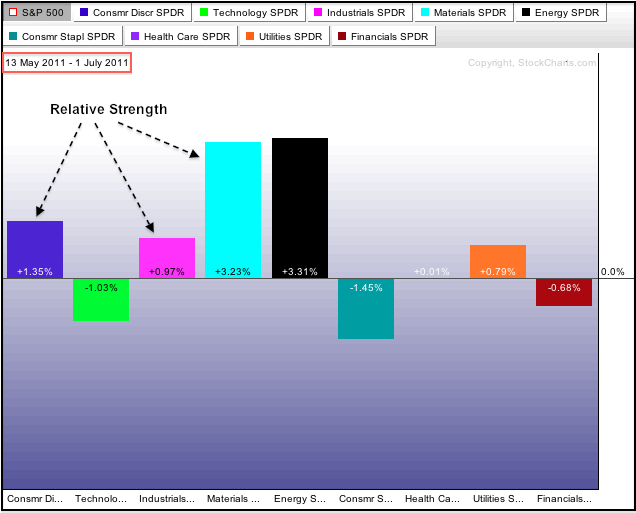

Consumer Discretionary Sector Moves from Leader to Laggard

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure since July 1st pushed the Consumer Discretionary SPDR (XLY) from a market leader to a market laggard. These Sector PerfCharts show the performance for the nine sector SPDRs relative to the S&P 500. The percentage change shown is the relative change, which equals the percent change...

READ MORE

MEMBERS ONLY

Gold and Treasuries Outperform Everything

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After holding their own until late July, stocks joined oil and the Dollar with a move lower. The chart below shows the US Treasuries Continuous Futures ($USB) and Gold Spot ($GOLD) trading at six month highs. In contrast, Light Crude Spot ($WTIC) and the S&P 500 hit six...

READ MORE

MEMBERS ONLY

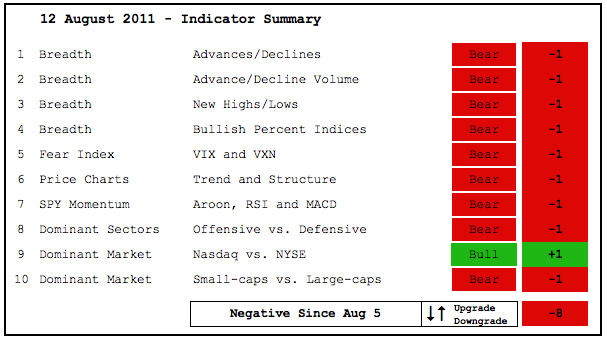

Indicator Summary Remains Decidedly Negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains decidedly negative and is unlikely to turn positive anytime soon. After some serious technical damage the last few weeks, the bulls need time to regroup and form some sort of base. At this point, I will simply follow the evidence until there are signs of a...

READ MORE

MEMBERS ONLY

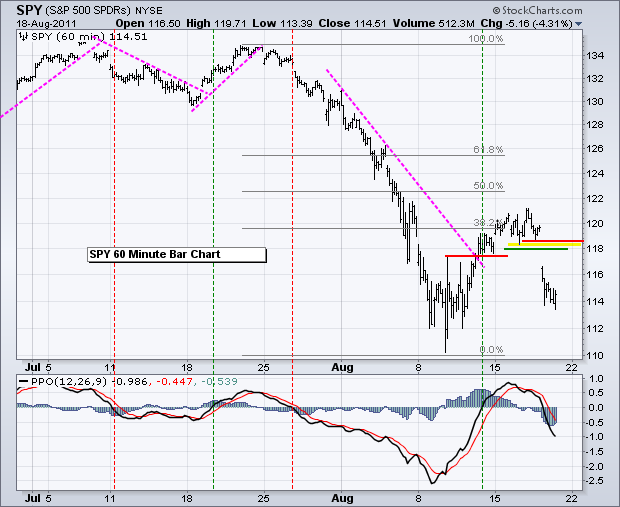

SPY Gaps Down to End Oversold Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure hit the stock market hard on Thursday as the major index ETFs declined sharply. Small-caps and mid-caps led the way lower as their respective indices declined over 5%. All sectors were lower. The defensive sectors held up the best with consumer staples and utilities declining less than 2%...

READ MORE

MEMBERS ONLY

52-week Low in Shanghai Composite Bodes Bearish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Shanghai Composite ($SSEC) peaked in November 2010 and hit a new 52-week low in August 2011. As the S&P 500 moved to a new high in April-May 2011, the index formed a lower high in mid April. A support break and 52-week low followed in the next...

READ MORE

MEMBERS ONLY

SPY Stalls at Retracement as Treasuries Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 38.2% retracements are marking resistance as the major index ETFs stutter this week. From low to high, the S&P 500 ETF (SPY) surged from 110 to 121 over the past week. Most of this move came with Thursday's surge from 113 to 119. Trading...

READ MORE

MEMBERS ONLY

Charts of Interest: GME, GR, HUM, LXK, TIN, VSI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GME Traces out Flag within Downtrend.

GR Forms Hanging Man.

TIN Bounces to Key Retracement.

Plus HUM, LXK, VSI

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

SPY and QQQ Stall Near Lower End Retracements

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks are caught between a rock (medium-term downtrend) and a hard place (short-term uptrend). After a good bounce the last few days, stocks took a breather with some weakness on Tuesday. Actually, stocks have been trading flat since Monday's gap up. This sideways action could be just a...

READ MORE

MEMBERS ONLY

Oil and Stocks Remain Positively Correlated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Correlation Coefficient is used to measure the degree of correlation between two assets. Positive correlation means they move in the same direction. Negative correlation means they move in opposite directions. The 12-Month US Oil Fund (USL) and S&P 500 ETF (SPY) are positively correlated. The 20-day Correlation...

READ MORE

MEMBERS ONLY

Charts of Interest: ABX, ANF, BBBY, NEM, RAX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts of Interest: ABX, ANF, BBBY, NEM, RAX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own...

READ MORE

MEMBERS ONLY

SPY Nears 50% Retracement as Dollar Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their gains on Monday with strong breadth. All sectors were up 1.4% or more. The Energy, Finance and Utilities SPDRs surged over 3%. NYSE Net Advances Percent hit 81% and Nasdaq Net Advances Percent finished at 61%. The NYSE number was especially strong. We can attribute this...

READ MORE

MEMBERS ONLY

10-year Treasury Yield Breaks Triangle Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Rates plunged along with stocks over the last several weeks. This makes sense because rates move lower when bonds move high. This chart shows the 10-year Treasury Yield ($TNX) breaking triangle support with a move below 24 (2.4%). Rates remain in a long-term downtrend and Treasury bonds are in...

READ MORE

MEMBERS ONLY

Oversold Bounces Extend with Key Retracements In Sight

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs are now in short-term uptrends as they bounce from oversold levels. SPY tested 112 on Monday and Wednesday with an intraday dip to 110.5 in between (Tuesday). An inverse Head-and-Shoulders formed these three days and the ETF broke above the Tuesday-Wednesday highs with Thursday'...

READ MORE

MEMBERS ONLY

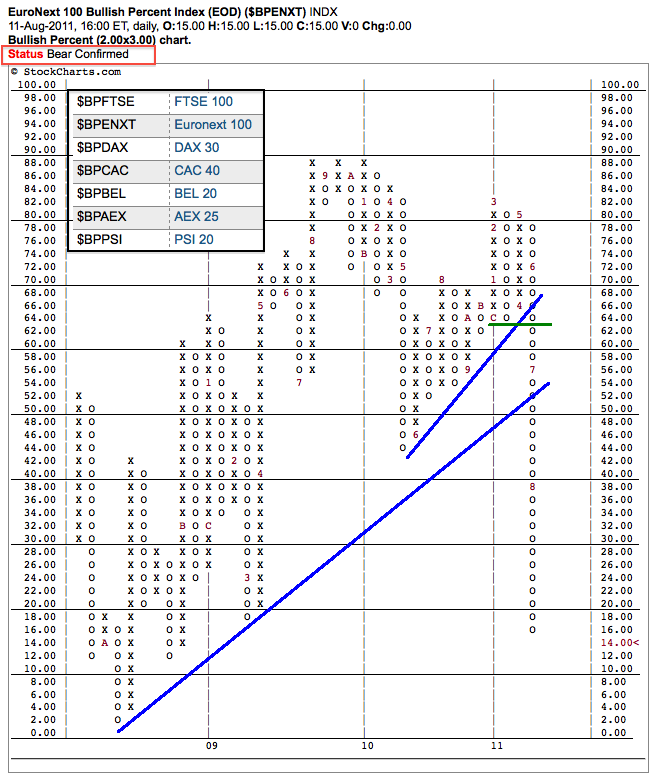

Euronext Bullish Percent Index Totally Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts.com recently added Bullish Percent Indices for some key European indices. In particular, the Euronext 100 ($BPENXT) broke support in June and continued below its 2010 low in July. There is a status bar at the top of each P&F Bullish Percent Index chart. Euronext BPI status...

READ MORE

MEMBERS ONLY

Indicator Summary Remains Deeply Negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains unchanged after a topsy-turvy week. Nine of the ten indicators are clearly in bear mode. The Nasdaq/NY Composite ratio is the only indicator considered positive because the Nasdaq is outperforming the NY Composite. Relative strength in techs is heavily outweighed by the bearish indications. Most...

READ MORE

MEMBERS ONLY

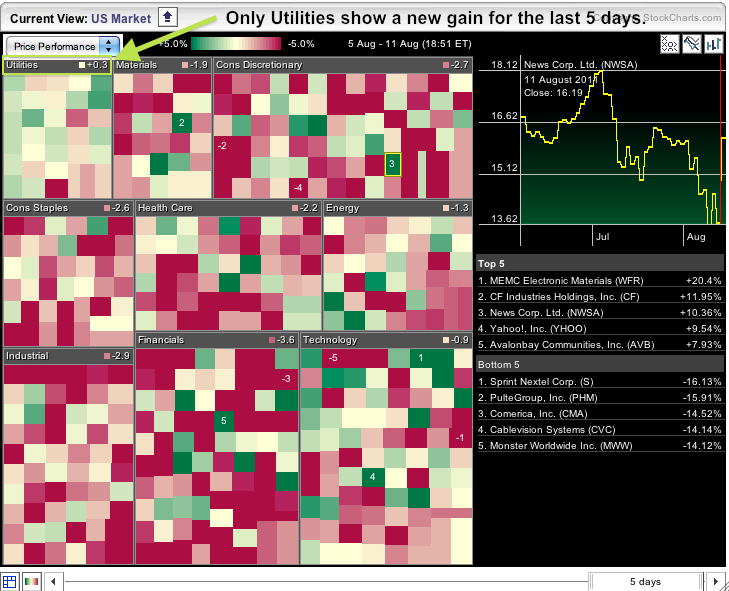

Despite Big Gain, Sector Carpet Shows Mixed Picture for the Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved sharply higher for the second time in two days, but remain mixed, at best, over the last five days. The chart below comes from the Sector Carpet. The red squares show losers, while the green squares show gainers. Notice the numbers at the top of each sector box....

READ MORE

MEMBERS ONLY

Small Caps Lead Stock Market as Bonds Tumble

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market staged another big advance in the face of adversity. This is the second such advance in the last three days. All the same, the major index ETFs remain below their closing levels from last Friday. In other words, stocks are still down for the week. Small and...

READ MORE

MEMBERS ONLY

Small Caps Lead Stock Market as Bonds Tumble $SPY $TLT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market staged another big advance in the face of adversity. This is the second such advance in the last three days. All the same, the major index ETFs remain below their closing levels from last Friday. In other words, stocks are still down for the week. Small and...

READ MORE

MEMBERS ONLY

Societe Generale Broke Down Before Headlines Hit

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Among other items, Wednesday's sharp decline in stocks was blamed on solvency issues surrounding Societe Generale (GLE.EU), a large French bank. It is, however, worth noting that SocGen, as it is called, was already in a downtrend. Moreover, the stock broke supports in early July and again...

READ MORE