MEMBERS ONLY

Indicator Summary Update on Saturday, May 7th

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I will wait for Friday's reaction to the employment report before updating the indicator summary. The breadth charts and intermarket charts will also be updated on Saturday morning....

READ MORE

MEMBERS ONLY

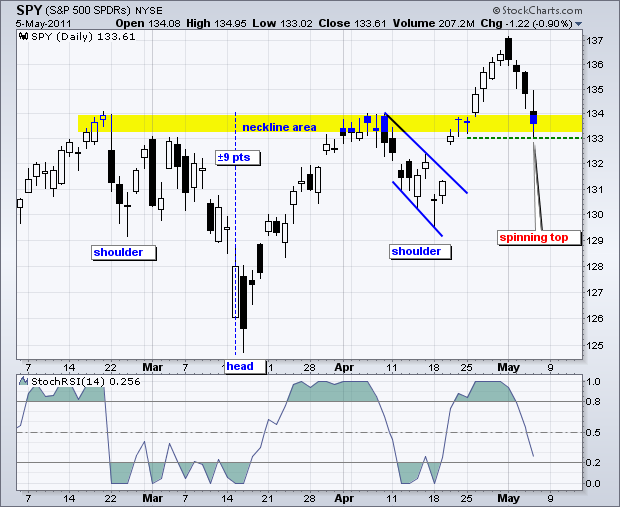

SPY Forms Spinning Top in Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Admittedly, the decline over the last four days has been sharper than expected for a mere pullback. This decline started right after Monday's gap open around 137. On a high to low basis, the ETF moved from 137 to 133 in just four days (almost 3%). And now...

READ MORE

MEMBERS ONLY

SPY on the Verge of Weekly Bearish Engulfing Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a strong open on Monday and weakness the rest of the week, the S&P 500 ETF (SPY) formed a long black candlestick that engulfed the prior white candlestick. The week is not yet finished because Friday remains. A close below last week's open would forge...

READ MORE

MEMBERS ONLY

Euro Plunges after New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro Currency Trust (FXE) hit a new 52-week high Wednesday, but gave it all back with a sharp decline early Thursday. As of 11AM ET Thursday, FXE is down around 2% from Wednesday's high. That's quite a drop. Support, however, is near as the ETF...

READ MORE

MEMBERS ONLY

SPY Nears Support Zone with Falling Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY continued its throwback with a close below 135 and the third down day in a row. This does nothing to change the medium-term trend, which remains up. The gap and flag breakout started it all and the inverse head-and-shoulders breakout forged a new 52-week high. Broken resistance turns into...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, CSCO, F, FFIV, KLAC, MSFT, NTAP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Forms Bull Flag after Breakout.

KLAC Firms at Fibonacci Retracement.

CSCO Traces out Pennant Consolidation.

Plus F, FFIV,MSFT,NTAP.

***********************************************

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Hanging Man and Bearish Engulfing Weigh on XLF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a bounce off support in April, the Finance SPDR (XLF) came under pressure with a hanging man at the end of April and a bearish engulfing at the beginning of May. These two bearish candlesticks affirm resistance from the early May high. It is possible that a falling flag...

READ MORE

MEMBERS ONLY

SPY Moves into Throwback Mode

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY followed through on Monday's bearish Belt Hold candlestick with a decline on Tuesday. The ETF dipped all the way to 135, but a late afternoon bounce pushed it back to 135.73 by the close. The decline to 135 was not a very deep dip - yet...

READ MORE

MEMBERS ONLY

HBAN Battles Resistance with a little Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After going nowhere for two months, Huntington Bancshares (HBAN) is once again battling consolidation resistance. The stock has been stuck between 6.3 and 6.9 since the beginning of March. With the market down sharply on Tuesday, the stock is showing some resilience with a small gain. A break...

READ MORE

MEMBERS ONLY

SPY Forms Bearish Belt Hold Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a strong open and weak close on Monday, the overall picture for SPY remains unchanged. A bearish Belt Hold formed on Monday. These are long black candlesticks that form after an advance. Neckline resistance from the inverse head-and-shoulders breakout turns into the first support zone to watch on any...

READ MORE

MEMBERS ONLY

Charts of Interest: ACI, BSX, CAKE, GCI, LEN, NFLX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ACI Forms Bear Wedge. CAKE Gaps Down from Resistance. GCI Breaks Flag Resistance. Plus BSX,LEN and NFLX.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

Bearish Engulfing Patterns Pile up for $CHK

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging in late February, Chesapeake (CHK) worked its way lower with three bearish engulfings and a dark cloud pattern. The April bounce above 33.5 may be stymied as the stock formed another bearish engulfing on Monday. Check out our bearish engulfing scan for more.

Click this image for...

READ MORE

MEMBERS ONLY

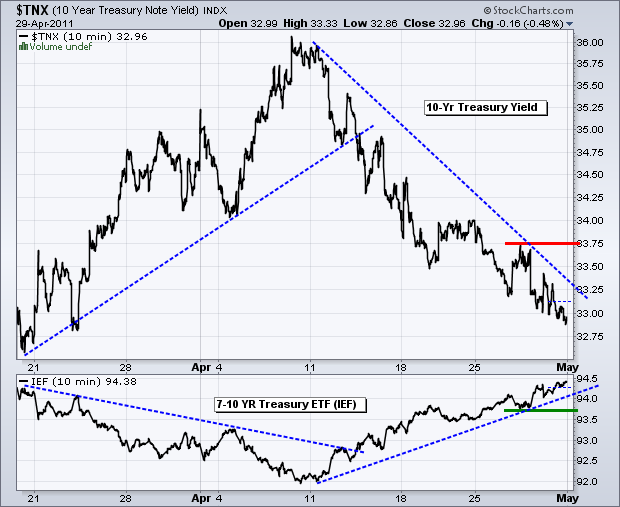

Stocks and Bonds Show No Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It is a strange pairing, but stocks and bonds are both in strong uptrends. We can also throw in strong uptrends for gold, oil and the Euro. The Dollar is the one left out in the cold with a strong downtrend. The rally in bonds is a bit perplexing. QE2...

READ MORE

MEMBERS ONLY

LUV Forges Bear Trap with Failed Support Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Southwest Airlines (LUV) broke support with high volume in late April, but quickly recovered this support break with a surge back above 11.60 the last few days. Despite this quick recovery, signs of indecision are showing with the upper shadows in the candlesticks. There is a resistance zone around...

READ MORE

MEMBERS ONLY

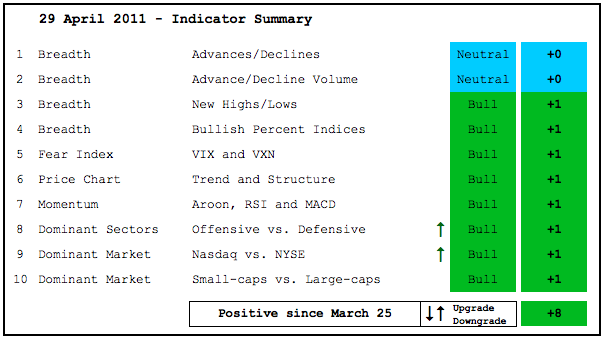

Relative Strength in Techs Boosts Indicator Summary

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

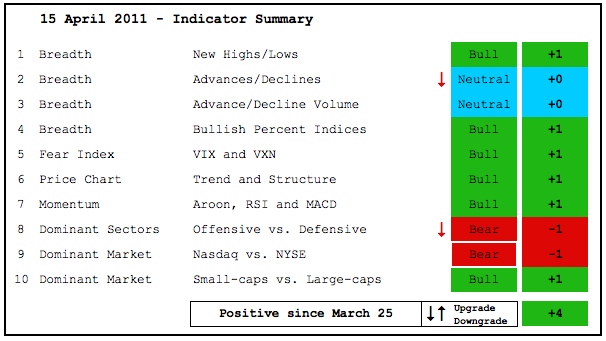

Even though the finance sector remains a laggard, newfound relative strength in technology is picking up the slack. Led by semis, the Nasdaq and the Technology ETF (XLK) surged almost 5% the last seven trading days. Renewed leadership from techs is a positive for the market overall. There is some...

READ MORE

MEMBERS ONLY

SPY Builds on Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change on the daily chart or 60-minute chart as SPY extends after its breakouts. Broken neckline resistance becomes the first support level to watch on the daily chart.

Key Economic Reports/Events:

Fri - Apr 29 - 08:30 - Personal Income and Spending

Fri - Apr...

READ MORE

MEMBERS ONLY

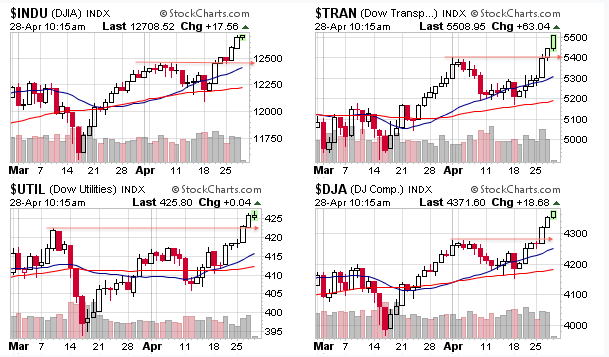

All Four Dow Averages Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials, Dow Transports, Dow Utilities and Dow Composite all broke above their March-April highs and recorded 52-week highs this week. From a Dow Theory stand point, the new highs in the Industrials and Transports are especially promising because they affirm the uptrend.

Click this image for a live...

READ MORE

MEMBERS ONLY

Neckline Resistance Turns First Support for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change on the daily chart. The S&P 500 ETF (SPY) broke above neckline resistance that extends from late February to early April. This is another 52-week high that simply re-affirms the long-term uptrend. Traditionally, broken resistance turns into support. This suggests that the 133-134 area...

READ MORE

MEMBERS ONLY

Charts: AMCC, ASEI, GCI, IDCC, ISRG, ORLY, PNRA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ASEI Hits Broken Resistance with Wedge. GCI Surges on Big Volume and then Consolidates. PNRA Declines on High Volume. Plus AMCC,IDCC,ISRG,ORLY

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock...

READ MORE

MEMBERS ONLY

Semiconductor HOLDRS Challenges 2011 Highs SMH

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It all started with the Intel earnings effect five days ago as the Semiconductor HOLDRS (SMH) gapped above 35. After stalling for two days, the ETF continued hiher and is now challenging the February-March highs. Semis are starting to show relative strength again and this bodes well for techs.

Click...

READ MORE

MEMBERS ONLY

SPY Breaks Neckline Resistance ahead of Fed Announcement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Please note that Thursday's commentary will be posted a little later in the morning (between 9 and 10AM ET). With a strong open and strong close, the S&P 500 ETF (SPY) broke above neckline resistance that extends from late February to early April. This is another...

READ MORE

MEMBERS ONLY

Airline Index Bounces of Key Retracement and Breaks Trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Is this bounce for real or just another dead-cat bounce? The Amex Airline Index ($XAL) hit the 62% retracement area in mid April and surged above the wedge trendline on Tuesday. Also notice that MACD formed a bullish divergence and moved above its signal line. Things are looking up for...

READ MORE

MEMBERS ONLY

Charts: APC,ARO,GE,IMN, JPM,LMT,MSFT,RSH,UIS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARO Forms Dark Cloud at Resistance. GE Form Huge Bearish Engulfing. JPM Consolidates at Key Support. Plus APC,IMN,LMT,MSFT,RSH and UIS.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock...

READ MORE

MEMBERS ONLY

Bonds Consolidate Ahead of Fed Statement and Conference

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It could be a big week for bonds. The Fed meets this week with a policy statement scheduled at 12:30PM ET. This is earlier than normal because Bernanke is holding a press conference later in the afternoon. Jeeze, like we don't have enough excitement already. So now...

READ MORE

MEMBERS ONLY

Healtcare and Staples Show Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though stocks are up over the last 30 trading days, sector leadership leaves something to be desired. The Finance is badly lagging, while the materials and energy sectors are leading. Also notice that the healthcare and consumer staples show relative strength.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

SPY Holds Gap and Challenges Neckline Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, the S&P 500 ETF (SPY) is tracing out a clear inverse head-and-shoulders pattern over the last 2-3 months. The shoulders feature equal lows around 129.5 and the highs in the 133-134 area mark neckline resistance. Notice how the right shoulder also formed a...

READ MORE

MEMBERS ONLY

Intraday Gap Scan Shows Early Movers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The predefined scans page at StockCharts.com is updated throughout the day. Checking just after the open is an easy way to spot early movers, both up and down. The runaway gap-up scan featured over 5 NYSE stocks and 16 Nasdaq stocks at 10:14AM ET. Among these runaway gaps,...

READ MORE

MEMBERS ONLY

SPY Traces Out Inverse Head and Shoulders Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The short-term trend is now up with a flag breakout and big gap. On the daily chart, an inverse head-and-shoulders is taking shape now that the right shoulder low has formed a reaction low near the left shoulder low. The neckline resistance zone resides around 133-134, which is where SPY...

READ MORE

MEMBERS ONLY

Charts of Interest: BBT,DF,ILMN, JNPR,MBI,SLM,STT,TXN,XRX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

JNPR Surges off Retracement Zone. MBI Forges a Bear Trap. XRX Breaks Flag Resistance.

Plus BBT, DF, ILMN, MBI, STT, TXN

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise)...

READ MORE

MEMBERS ONLY

A Hammer and Gap Lead to Breakout at Qlogic

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The hammer and gap play is everywhere this week. It started with an intraday recovery on Monday and continued with a gap-surge on Wednesday. QLGC formed such a combo over the last three days and broke above the early April trendline.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

SPY Starts Fills Most of Monday's Gap with a Rebound

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulls simply refuse to buckle. Despite a gap down on Monday and sharp decline Monday morning, stocks rebounded on Monday afternoon and continued strong on Tuesday. The ability to immediately recover should serve notice to the bears. QQQ formed a massive hammer on Monday and closed strong on Tuesday....

READ MORE

MEMBERS ONLY

Materials Sector Remains Strong in Market Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P Sector Market Carpet provides a colorful snapshot of sector performance over a given timeframe. The screen grab below shows a 5-day Price Performance Market Carpet. Stocks in the materials sector are up an average of 1.7% the last five days (leading). Stocks in the technology...

READ MORE

MEMBERS ONLY

SPY Begins Wave C Down with a Gap and Sharp Decline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Before diving headfirst into some Elliott wave counts, please note that the overall trends take precedent. The overall trend on the daily chart (medium-term) remains up and the overall trend on the 60-minute chart (short-term) remains down. There are, at least, two Elliott counts possible on the S&P...

READ MORE

MEMBERS ONLY

Charts of Interest: ADBE,AXP, CRM,DHI,GERN,PNRA,SHLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADBE Maintains Tight Consolidation. AXP Challenges Resistance. PNRA Forms Bear Flag. Plus CRM,DHI,GERN and SHLD.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to...

READ MORE

MEMBERS ONLY

Apple Forms Piercing Line in Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple (AAPL) declined into its support zone with a close below 330 on Friday. After a weak open and further weakness early Monday, the stock moved higher and closed strong to firm a piercing line. This bullish candlestick reversal is featured on the predefined scans page. Also notice that volume...

READ MORE

MEMBERS ONLY

Setting Wave C Target for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are a few negatives working against the stock market right now. First, bonds have been rising and yields falling - even though inflationary pressures appear to be building. Despite gold and the Inflation Indexed Bond ETF (TIP) moving to new 2011 highs last week, normal bonds were also strong....

READ MORE

MEMBERS ONLY

INFLATION-INDEXED BONDS AND GOLD SURGE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

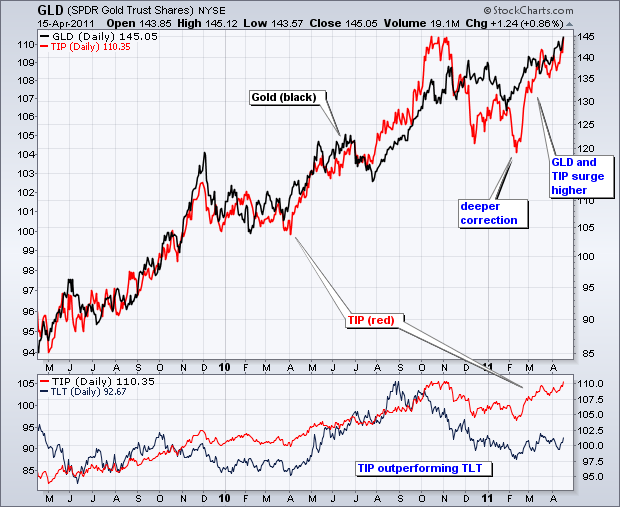

The positive relationship between the Inflation Indexed Bond ETF (TIP) and the Gold SPDR (GLD) went through a rough patch in December-January, but got back on track the last two month. First, note that both remain in clear uptrends. The chart below shows TIP (red) and GLD (black) surging to...

READ MORE

MEMBERS ONLY

Intuit Hits New High as Tax Day Hits

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intuit (INTU), the maker of Turbo Tax Software, appears to like tax day. The stock broke above wedge resistance with a long white candlestick on Thursday and hit a 52-week high on Friday, April 15th.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Nasdaq Breadth, Techs and Finance Weigh on Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary is weighed down by relative weakness in the Nasdaq and some key sectors. First, the Nasdaq has been underperforming the NY Composite since early January. Second, the Nasdaq AD Line and AD Volume Line are weaker than the NYSE AD Line and AD Volume Line. Third, the...

READ MORE

MEMBERS ONLY

Broken Support and Gap Turn Resistance for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

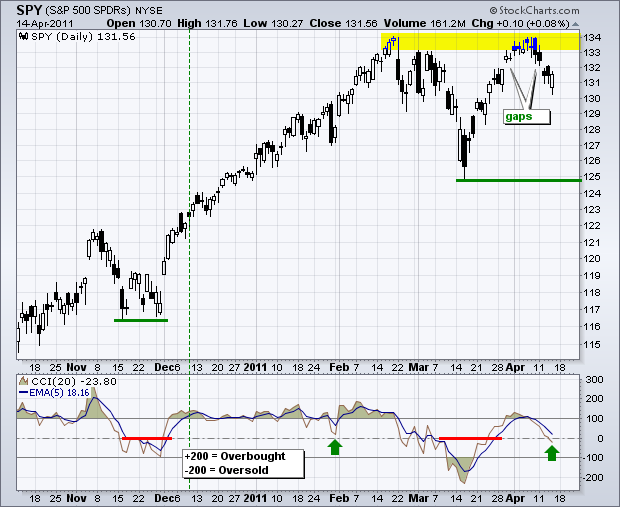

SPY managed to open weak and close strong, but has yet to fill Tuesday's gap and reverse the short-term downtrend. For now, the island reversal remains in play and has yet to be proven otherwise. CCI continues to drift lower and has yet to turn up. I overlaid...

READ MORE