MEMBERS ONLY

Time Warner Firms with Hammer at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After hitting the bullish engulfing scan on Tuesday, Time Warner is set to appear on the hammer scan for Thursday. The stock surged in February and then retraced around 50% with a decline to the 35 area. The stock has been firming in this area since mid March and a...

READ MORE

MEMBERS ONLY

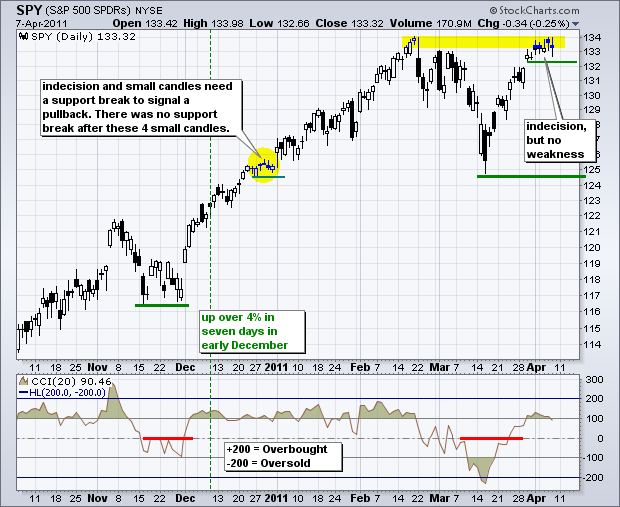

SPY Stalls after Support Break to Affirm Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The big trend on the daily chart is up as prices move from the lower left to the upper right. SPY became overbought after a big surge back to the February high and backed off this level the last four days. The ETF has actually closed lower five days in...

READ MORE

MEMBERS ONLY

Charts of Interest: ADBE, ADM, DOX, GS, PAYX, WCRX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADBE Forms Tight Consolidation. DOX Breaks Wedge Resistance with Volume. PAYX Stalls Near Retracement Resistance. Plus ADM, GS, WCRX

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

Dell Surges off Support with Good Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

For the second time in three months, Dell Inc (DELL) surged above 15 with big volume. The stock pulled back to broken resistance and bounced off support twice in mid March and early April. Today's big surge solidifies support and suggests that DELL has begun a bigger uptrend....

READ MORE

MEMBERS ONLY

SPY Gaps Below Gap for an Island Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, SPY gapped above 132 on March 30th and gapped below this level on April 12th. Technically, an island reversal formed because the gaps match around 132. Combined with last week's bearish engulfing and resistance from the February high, this little breakdown could argue for...

READ MORE

MEMBERS ONLY

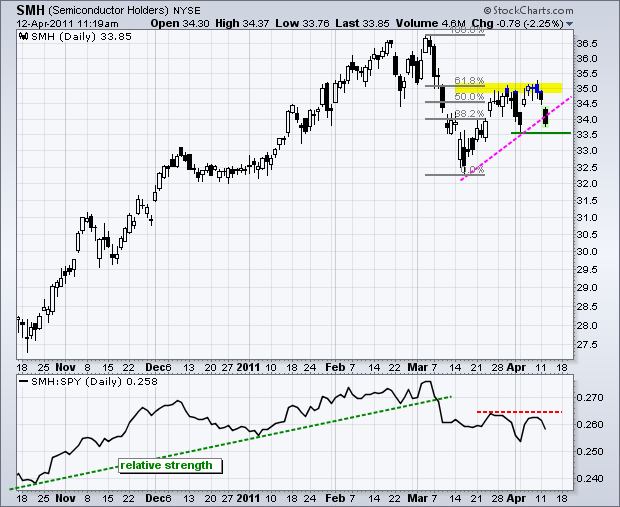

Semiconductor HOLDRS Fails at Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor HOLDRS surged at the beginning of last week, but hit resistance from the same retracement and plunged this week. The 62% retracement marked resistance in late March and again in early April. Today's gap down and trendline break are negative with a big support test at...

READ MORE

MEMBERS ONLY

SPY Tests Gap Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is not much change on the daily or 60-minute charts. The S&P 500 ETF (SPY) continues to battle resistance from the February high. Since moving above 132 on April 1st, the ETF stalled with five indecisive candlesticks and then two black candlesticks on Friday-Monday. Notice that a...

READ MORE

MEMBERS ONLY

Charts:AAPL,AMCC,AMGN,ATML, BRCM,EBAY,MS,SNE,USG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Hits Support Zone. AMGN Continues to Work Higher.

BRCM Near Support and Key Retracement.

Plus AMCC, ATML, EBAY, MS, SNE and USG

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF...

READ MORE

MEMBERS ONLY

Scan for 3 Black Crows Turns up MDY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Three Black Crows is a bearish candlestick reversal pattern with three black filled candlesticks. A candlestick is filled when the close is below the open. Despite this bearish pattern, volume remains relatively low and support from broken resistance is at hand. Click here to see our scan page with candlestick...

READ MORE

MEMBERS ONLY

Indecision Evolves into Some Selling Pressure for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, the S&P 500 ETF (SPY) continues to battle resistance from the February high. Since moving above 132 on April 1st, the ETF stalled with five indecisive candlesticks and then a long black candlestick on Friday. Notice that a spinning top preceded Friday's...

READ MORE

MEMBERS ONLY

Intermarket PerfChart Shows Commodities Surging as Dollar Plunges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Some key intermarket relationships remain alive and well in 2011. First, commodities have been moving higher as the Dollar weakens. Second, bonds have been moving lower as commodities advance. Rising commodity prices increase inflationary pressures and this in turn puts pressure on bonds.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

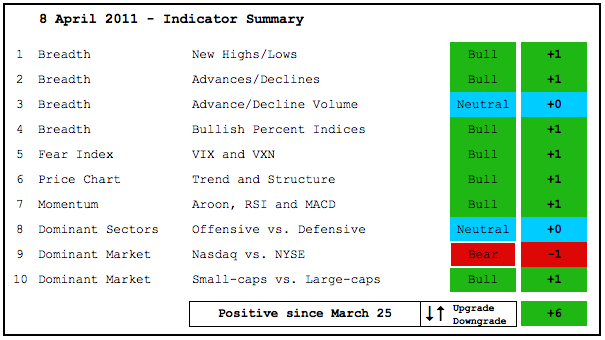

Indicator Remains Positive as Bulls Control Trends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While there are some discrepancies out there with various indicators, the weight of the evidence clearly favors the bulls. The NYSE AD Line hit a new high this week. Net New Highs expanded on both the NYSE and the Nasdaq. Small-caps are outperforming large-caps. Three of the five major index...

READ MORE

MEMBERS ONLY

Weakness in Bonds Keeps a Bid in Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bonds are breaking down and this is bullish for stocks. Stocks and bonds have been inversely correlated for some time now. Even though US interest rates are rising, the Dollar is falling and this is putting a bid into commodities. Strength in stocks is also helping commodities. These two have...

READ MORE

MEMBERS ONLY

Netflix Forms Outside Reversal at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bearish candlestick patterns marked the prior two reaction highs in Netflix and the stock formed an outside reversal on Wednesday. Strictly speaking, this is not bearish engulfing because Tuesday's candlestick is actually black. A bearish engulfing requires a white candlestick to be engulfed by a black candlestick. Therefore,...

READ MORE

MEMBERS ONLY

SPY Stalls At Resistance as Bullish Sentiment Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY is short-term overbought and at potential resistance from the February highs, but the overall trend remains up. In last night's Market Message, I pointed out that 15-day Chaikin Money Flow was negative despite a 7% surge the last 15 days. This is extraordinary. Yesterday I also read...

READ MORE

MEMBERS ONLY

Charts: AFFX,AKAM,AVP, GCI,PHM,RF,SVU,SYK,X

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AFFX Breaks Resistance with Surge. GCI Forms Bear Flag. RF Challenges Resistance. Plus AKAM, AVP, PHM, $SVU, SYK and X

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Microsoft Springs to Life with a Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a dismal February and early March, Microsoft is making up for some lost ground with a surge over the last three weeks. The stock gapped up on Tuesday with above average volume and followed through above its late March high with a good gain on Wednesday.

Click this image...

READ MORE

MEMBERS ONLY

Stocks, Bonds and the Dollar Refuse to Budge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is not much change in the overall picture. Bond yields are in uptrends, Treasuries are in downtrends, the Dollar is weak, Gold is strong, Oil remains strong and Stocks are Strong. Even though some of these trends flatted over the last few days, they remain largely intact. The 10-year...

READ MORE

MEMBERS ONLY

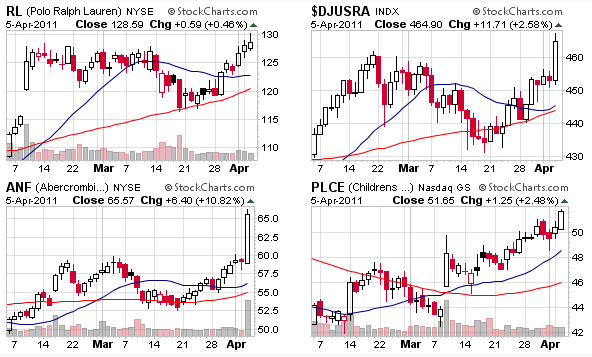

Retail Apparel Group Leads Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) surged to another 52-week high today with strength coming from the retail apparel group. Candleglance chart groups for over 50 industries can be found at the top of the third column on the FreeCharts page. This snapshot from the Retail-Apparel group shows Abercrombie & Fitch (ANF)...

READ MORE

MEMBERS ONLY

Charts: AKS,EBAY,GOOG, GTIV,NVLS,TTWO,WGO,WMT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AKS forms Rising Wedge. GOOG Returns to Broken Support. WMT Consolidates after Surge. Plus EBAY,GTIV,NVLS,TTWO and WGO.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

SPY Stalls at Resistance with Two Small Candles

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Clint Eastwood called this morning with a familiar question. Imagine the current uptrends speaking as Harry Calahan. Well, bear, do you feel lucky? Go ahead, bear, make my day. There is certainly a temptation to turn short-term bearish as SPY trades near resistance with overbought conditions. It is a risky...

READ MORE

MEMBERS ONLY

A Momentum and Price Breakout for Quadra Mining

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a rough start at the beginning of the year, Quadra Mining (QUX.TO) may be finding its feet with a high volume breakout. The stock surged to a 4-week high on the highest volume in four weeks. The indicator window shows RSI also breaking out to its highest level...

READ MORE

MEMBERS ONLY

Bonds, Dollar, Oil and Stocks Remain in Definitive Trends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are some well-defined short-term trends working over the last three weeks or so. Interest rates are moving up as bonds move lower. Oil is moving higher and the Dollar is moving lower. Stocks are trending up with small-caps leading the way. While we cannot always assume that correlation is...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS SURGE TO NEW TO NEW 52-WEEK HIGH

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite relative weakness in airlines and $108 oil, the Dow Transports surged to a fresh 52-week high on Friday. The chart below shows the Average finding support around 4900 from late February to mid March and then surging around 10% the last 2-3 weeks. Admittedly, there is an outside chance...

READ MORE

MEMBERS ONLY

Stocks Surge, but Intel Breaks Flag Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a rather broad market rally early Friday, Intel ($INTC) was under pressure with a sharp decline that broke flag support. The mid March gap proved too tough and this flag break signals a continuation lower.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Indicator Summary Strengthens as NYSE AD Line Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a whipsaw in mid March, the indicator summary is back on its positive track with more strength this past week. The Nasdaq AD Line surged over the last 11 days and the NYSE AD Line hit a new 52-week high. Furthermore, the Cumulative Net New Highs Lines both hit...

READ MORE

MEMBERS ONLY

SPY Forms Indecisive Candlesticks After Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

No change. Stocks remain strong. SPY is up over 5% the last 11 days. Small indecisive candlesticks formed after Wednesday's gap up, but the gap is holding. Even though potential resistance from the February-March highs is close and stocks are short-term overbought, there is simply no discernable selling...

READ MORE

MEMBERS ONLY

Sector Performance Outside of Energy Remains Mixed in 2011

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The sector PerfChart shows the relative performance of the nine sectors. Relative performance equals the sector gain less the gain in the S&P 500. Year-to-date, the energy sector is the only standout performer. Of the other eight, seven are relatively weak and only the industrials sector is outperforming...

READ MORE

MEMBERS ONLY

February Highs act as Magnet for Current Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remain strong. SPY is up 5.68% the last 10 days. A small indecisive candlestick formed after a gap up on the open. Even though potential resistance from the February high is close and stocks are short-term overbought, there is simply no let up in buying pressure. The turnaround...

READ MORE

MEMBERS ONLY

Charts of Interest: ABX, AEO, AMKR, BSX, FLEX, LLY, STT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ABX Forms Bull Flag. AEO Surges to Resistance. FLEX Flexes its Muscles. Plus AMRK, BSX, LLY and STT.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

Bombay Sensex Index Celebrates Semi-Final Win $BSE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The India Sensex Index ($BSE) is celebrating India's semi-final win in the Cricket World Cup with a breakout over the last few days. Actually, the breakout occurred before the win. Stocks tend to lead major sporting events by a few days (joke).

Click this image for a live...

READ MORE

MEMBERS ONLY

Don't Fight the Tape or the Trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

"Don't fight the Tape" is an old Wall Street adage. It is as true today as it was when Jesse Livermore traded in the bucket shops. First and foremost, the overall trend on the daily and weekly charts is up and has been up for some...

READ MORE

MEMBERS ONLY

Russell 2000 ETF Forges Quadruple Top Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the P&F chart, the Russell 2000 ETF affirmed support around 77 with a sharp reversal the last two weeks. This reversal was strong enough to forge a Quadruple Top Breakout as the current X-Column broke above the equal highs of the prior three X-Columns.

Click this image...

READ MORE

MEMBERS ONLY

Charts of Interest: BSX,ENR, FITB,HBI,IBOC,SLAB,TRMK

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BSX Forms Long Triangle. ENR Gaps Up off Support. FITB Consolidates near Support Zone. Plus HBI, IBOC, SLAB and TRMK.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

SPY Stalls within Prior Congestion Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The medium-term trend has been up since early September and the short-term trend turned up again with last week's break above 130. After a 4.51% run the prior seven days, the S&P 500 ETF (SPY) became short-term overbought and is now showing signs of indecision....

READ MORE

MEMBERS ONLY

Volatility Contracts as Bollinger Bands Narrow for Garmin

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging above its October high, Garmin moved into a consolidation and volatility contracted. Notice how Bollinger Band Width moved below the January low and to its lowest level in months. This volatility contraction could foreshadow a volatility expansion. Watch support and resistance for the first direction clue.

Click this...

READ MORE

MEMBERS ONLY

SPY Forms Doji after Big Run

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a 4.51% run the last seven days, the S&P 500 ETF (SPY) is short-term overbought and showing signs of indecision. Chartists do not need a momentum oscillator to figure out that SPY is short-term overbought. This 7-day rally is the strongest since the first week of...

READ MORE

MEMBERS ONLY

2011 Commodities: Oil and Silver Lead as Gold and Copper Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The year-to-date commodity PerfChart shows Silver and Oil as the big winners. Both are up more than 15%. Gold is also up, but barely as it finished 2010 near $1420. A surge over the last two weeks brought Copper back to its 2010 high.

Click this image for a live...

READ MORE

MEMBERS ONLY

Indicator Summary Flips Back to Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the indicator summary turned negative last week, I still viewed the recent decline as a correction within a bigger uptrend. We have yet to see a major topping pattern evolve and the market was entitled to a correction after a big run from late August to February. With...

READ MORE

MEMBERS ONLY

SPY and RSI Break above Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was small-caps powering the market higher on Monday and techs powering stocks higher on Thursday. Even though these two key groups are playing tag-team, the market is benefitting from strength in both groups this week. As a result, the S&P 500 ETF (SPY) broke above short-term resistance...

READ MORE