MEMBERS ONLY

In Gear with Relative Strength

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoffians find Relative Strength analysis to be very useful and illuminating. Relative Strength studies can be like having X-ray vision. With Relative Strength tools, one can see important hidden secrets about the health of a stock or industry group. Relative Strength analysis is simple and straightforward to apply and is...

READ MORE

MEMBERS ONLY

Stair Step to Profits

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s look back at 2016, Wyckoff style. As Wyckoffians, our mission is to sharpen our skills and to gain some ideas about how 2017 could unfold. The past year began with a stiff correction that cascaded into a Selling Climax in January. A classic Accumulation formed between January and...

READ MORE

MEMBERS ONLY

Enjoying the Short Term View

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoff has a fractal quality, and thus, the Method essentially works in all timeframes. The trained eye can see the price structures unfolding whether it be on a weekly vertical chart or the shortest term intra-day chart. Let us see if we can drill into the shorter timeframe and find...

READ MORE

MEMBERS ONLY

Going for the Gold

by Bruce Fraser,

Industry-leading "Wyckoffian"

Group rotation has recently brought to life moribund sectors such as the financials, materials, and industrials. Gold was largely forgotten in the aftermath of the election. At times, it is in lockstep with the broad stock market, and at other times it is marching to its own drummer. After a...

READ MORE

MEMBERS ONLY

Holiday Chartfest

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Holiday Season is a joyful time of year. Wyckoffians appreciate the year-end and anticipate the year to come. This period of reflection and planning is best enjoyed by studying lots of charts. Here we offer a few charts to enhance your year-end fun. May you find lots of additional...

READ MORE

MEMBERS ONLY

The Inner Game of Wyckoff

by Bruce Fraser,

Industry-leading "Wyckoffian"

Looking back over this soon to be concluded year could be a very useful exercise. Let us put a twist on this ‘lookback’ to supercharge the exercise and improve our Wyckoff Method of trading. Mental rehearsal can be a valuable technique for strengthening trading skills. With this technique we take...

READ MORE

MEMBERS ONLY

There are No Free Lunches

by Bruce Fraser,

Industry-leading "Wyckoffian"

As this year comes to an end, investors and traders begin thinking about the year ahead. Wyckoff as a tape reading process is concerned with what the current position indicates about the future direction of markets. Ideally Wyckoffians develop their tape reading skills (chart analysis) to a level where market...

READ MORE

MEMBERS ONLY

Why Point and Figure Works

by Bruce Fraser,

Industry-leading "Wyckoffian"

We are often asked to explain the rationale for why the horizontal Point and Figure (PnF) method works for estimating price objectives. The horizontal PnF method which requires judgment and nuance to employ, is rarely used these days, yet it works surprisingly well. The judgment required is in knowing how...

READ MORE

MEMBERS ONLY

Get Your Motor Going

by Bruce Fraser,

Industry-leading "Wyckoffian"

Recently Toyota Motors (TM) has shown signs of life after a long cyclic decline. There seems to be a rhythm between the swings in the price of TM and the trend of the dollar. A strong dollar can improve profit margins of the Japan based auto manufacturer. The current rising...

READ MORE

MEMBERS ONLY

Main Street vs. Wall Street

by Bruce Fraser,

Industry-leading "Wyckoffian"

When a bull market begins, near the end of a recession in business activity, the fed is actively pumping money into the banking system. This new money seeks a place to go where it can work the hardest. During the early stages of the economic recovery the real economy is...

READ MORE

MEMBERS ONLY

The Broadening Top Formation

by Bruce Fraser,

Industry-leading "Wyckoffian"

My very first technical analysis book was “Technical Analysis of Stock Trends” by Robert Edwards and John Magee (5th edition). How I loved that book! I read and reread it and endlessly studied the charts. In my estimation it is one of the most important technical analysis books ever published....

READ MORE

MEMBERS ONLY

Wyckoff Doodles

by Bruce Fraser,

Industry-leading "Wyckoffian"

When markets become dull and listless, Wyckoffians tend to doodle. Currently equity markets seem to be marking time while waiting for the results of the presidential election. The best way for the Wyckoff Nation to prepare is to keep reading the tape (in the form of chart analysis). One of...

READ MORE

MEMBERS ONLY

Does Lightening Strike Twice?

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method is a trend following and trend management system. It seeks to identify the pre-conditions to the emergence of a rising (or falling) trend, with the intention of participating in that trend for the duration of it. The Method is timeless and is often used for other means,...

READ MORE

MEMBERS ONLY

Wyckoff Nation

by Bruce Fraser,

Industry-leading "Wyckoffian"

In the Wyckoff Nation we appreciate how the Wyckoff Method provides context. This is an advantage unique to this approach of chart analysis. We have learned that a process unfolds during the formation of Accumulation and Distribution. The perspective of context follows from becoming intimate with the nuances of this...

READ MORE

MEMBERS ONLY

Wyckoff Bonding

by Bruce Fraser,

Industry-leading "Wyckoffian"

The US Treasury Bond market is largely dominated by the activities of the Federal Reserve Bank. For seven years the Fed has maintained a policy of zero to one quarter percent interest rates. In December 2015 the Fed raised the Fed Funds rate to a range of ¼% to ½%, and since...

READ MORE

MEMBERS ONLY

Wyckoff Chartfest

by Bruce Fraser,

Industry-leading "Wyckoffian"

In the glow of the great ChartCon event, I am simply at a loss for words. It was a festival of charts and technical analysis. Being in the company of these super talented (and legendary) technicians was an experience. I am sure this vibe was oozing out of your computer...

READ MORE

MEMBERS ONLY

An AAPL for Your Thoughts

by Bruce Fraser,

Industry-leading "Wyckoffian"

So many important events happen in the fall of the year; school starts, football season begins, new television programming is introduced. But, for many, the momentous event is the reveal of the latest Apple iPhone. This year the pundits had a collective yawn over the new features of the iPhone...

READ MORE

MEMBERS ONLY

Tracking Big Footprints

by Bruce Fraser,

Industry-leading "Wyckoffian"

Two of the most elusive and rare phenomena in the world are; 1) a Big Foot (Sasquatch) sighting and 2) evidence of the Composite Operator. In both cases we start by tracking their footprints. By stalking and following these footprints we hope for an infrequent sighting of these elusive creatures....

READ MORE

MEMBERS ONLY

Action - Test

by Bruce Fraser,

Industry-leading "Wyckoffian"

A cornerstone of the Wyckoff Methodology is the concept of the Action and the resulting Test of prices. Price has a surge of power when it emerges into a Markup Phase or a Markdown Phase. During the Markup Phase prices rise on an imbalance of buying power that exceeds the...

READ MORE

MEMBERS ONLY

Phase Analysis. Two Case Studies

by Bruce Fraser,

Industry-leading "Wyckoffian"

Accumulation is a process, from beginning to end. The purpose of Accumulation is to create an environment where the Composite Operator (C.O.) is able to accumulate large quantities of stock. This is referred to as Absorption. A long and robust stock uptrend follows Accumulation. The Absorption of stock is...

READ MORE

MEMBERS ONLY

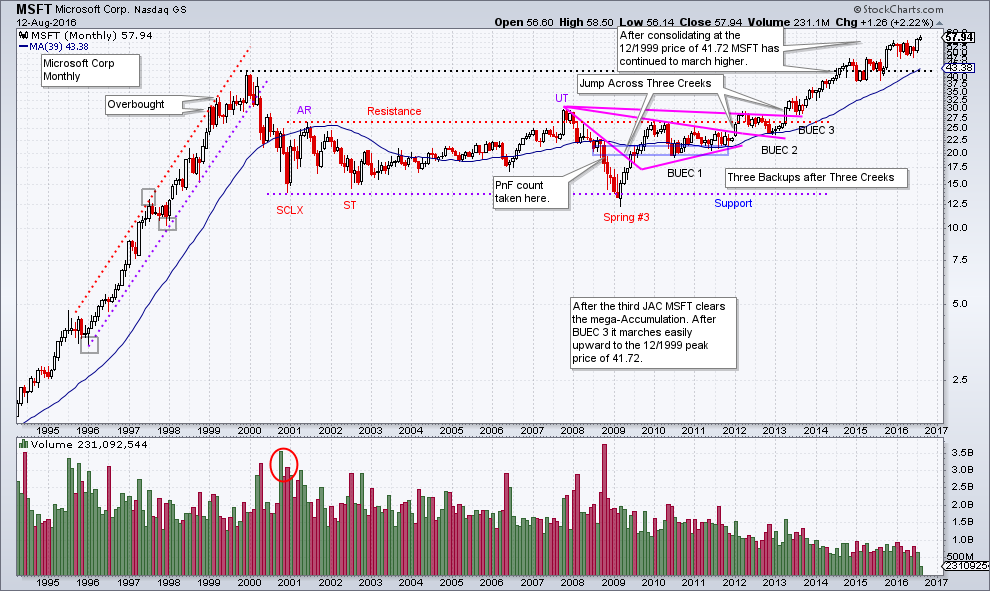

The Really Big Picture

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method scales down into smaller timeframes. It also is very effective in large timeframes. We have spent much time and attention evaluating daily and weekly charts (and intraday charts). Now we will turn our attention to monthly charts where a decade or more of data can be evaluated....

READ MORE

MEMBERS ONLY

A Gaggle of Groups

by Bruce Fraser,

Industry-leading "Wyckoffian"

So much time is spent on the study of the S&P 500 ($SPX) and other broad market indexes that we forget to have a look at the core themes that make up the performance of the entire market. Let’s take some time to review the underlying sectors...

READ MORE

MEMBERS ONLY

Beach Reads

by Bruce Fraser,

Industry-leading "Wyckoffian"

During the long hot summer, it is a wise idea for Wyckoffians to go to the beach (or the pool) and relax, recharge, and do some light reading. My favorite summer reads are…. Charts!! What could possibly be more relaxing and enjoyable. So get your tablet (or laptop), find a...

READ MORE

MEMBERS ONLY

Point and Figure Pie in the Sky?

by Bruce Fraser,

Industry-leading "Wyckoffian"

During the bear market that ended in 2009, the broad market indexes traced out a large base. Using the horizontal Point and Figure counting methodology, a Wyckoffian could generate a very large price objective. The countline was at the 8,100 level on the Dow Jones Industrial Average, with a...

READ MORE

MEMBERS ONLY

Getting on the Gas

by Bruce Fraser,

Industry-leading "Wyckoffian"

Since 2008 natural gas has been in a downtrend and has generally under-performed crude oil, common stocks and other commodities. Recent price strength for natural gas could be indicating change is in the air. Is this a sign of better days ahead or just a tease before prices sag and...

READ MORE

MEMBERS ONLY

Gold Fever

by Bruce Fraser,

Industry-leading "Wyckoffian"

My grandfather and great grandfather were gold miners. They took their ‘grubstake’ to Alaska and the mountains of California. After many adventures they succeeded with a small working gold mine in Northern California. You should know this when reading this post as, by heredity; I may have a touch of...

READ MORE

MEMBERS ONLY

Stupid Chart Tricks

by Bruce Fraser,

Industry-leading "Wyckoffian"

Stupid Chart Tricks are obscure rules of thumb in chart analysis that are helpful in your trading. These tricks are actually not stupid, they are clever and useful and generally unknown. Over the years we pick up these tips and tricks and incorporate them into daily chart analysis. We use...

READ MORE

MEMBERS ONLY

breXit and O's

by Bruce Fraser,

Industry-leading "Wyckoffian"

Using the Dow Jones Industrials ($INDU) as a proxy for the U.S. stock market, let’s look at the market’s response to the Brexit vote. Is there a Wyckoffian theme unfolding that possibly provides some early advice on how to proceed from here?

Wyckoffians think in terms of...

READ MORE

MEMBERS ONLY

Putting It All Together

by Bruce Fraser,

Industry-leading "Wyckoffian"

Mr. Wyckoff created a methodology that requires the trader to use judgment for positioning trades. We live in an era where sophisticated computer algorithms are all the rage in trading circles. These automated systems are designed to remove trading judgment from the human process and build it into the computer’...

READ MORE

MEMBERS ONLY

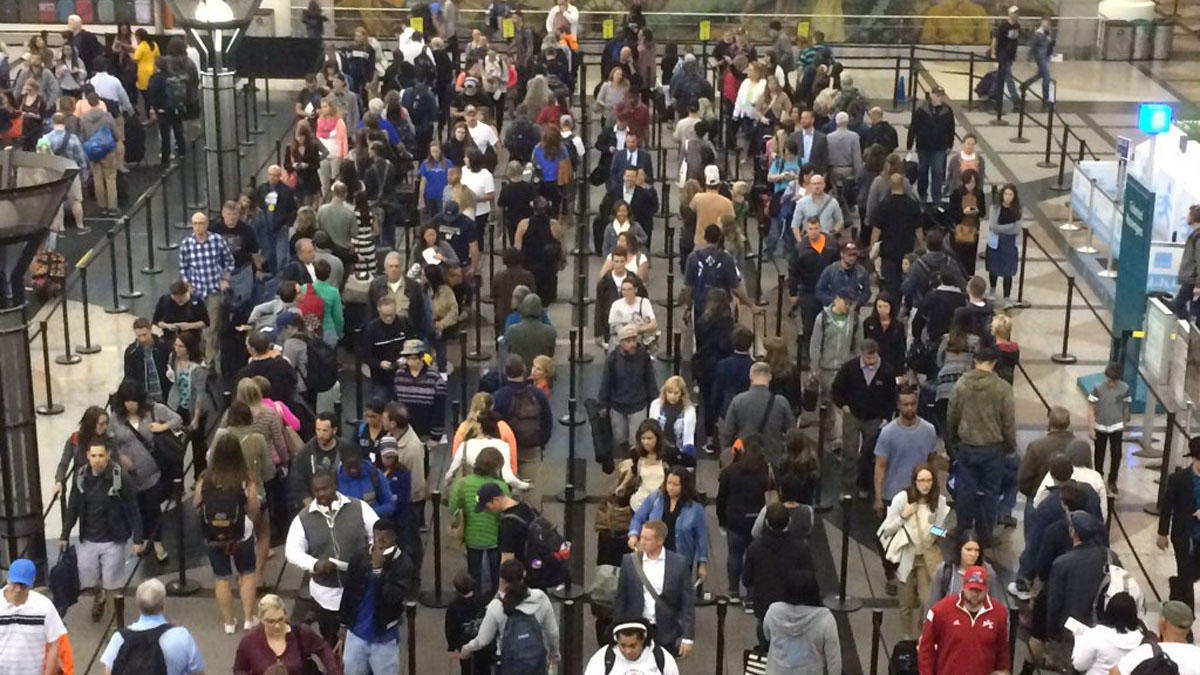

The Unfriendly Skies

by Bruce Fraser,

Industry-leading "Wyckoffian"

Mr. Wyckoff’s counsel was to learn how to read the tape and then to determine buying and selling decisions by the price action. For Mr. Wyckoff ‘reading the tape’ was best done by plotting the price onto a chart and then interpreting the chart. Our mission in ‘Wyckoff Power...

READ MORE

MEMBERS ONLY

How Now Charles Dow?

by Bruce Fraser,

Industry-leading "Wyckoffian"

My first teaching assignment at Golden Gate University was the survey course, FI352 ‘Technical Analysis of Securities’. This course is devoted to the study of the major technical analysis methods. It is a wonderful course for becoming familiar with the vast body of knowledge that is technical analysis. When I...

READ MORE

MEMBERS ONLY

Group Stink

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s continue our discussion of scanning the market with a top down approach. Recall that we proposed a process of first evaluating the stock market (S&P 500), followed by the Sectors and then the Industry Groups. With a quick scan the best and the worst Sectors and...

READ MORE

MEMBERS ONLY

Wyckoff Group Think

by Bruce Fraser,

Industry-leading "Wyckoffian"

Finding the best emerging stock ideas can seem like finding a needle in a haystack. The goal is to organize your market analysis in such a way that you can drill down into the market structure and find leadership quickly and efficiently. There are many good ways to survey the...

READ MORE

MEMBERS ONLY

Wyckoff Power Charting. Happy Birthday!

by Bruce Fraser,

Industry-leading "Wyckoffian"

We have reached the one year anniversary of the Wyckoff Power Charting blog. Many thanks for being enthusiastic and supportive readers. Let’s pause and look back at what we did in the first year.

Richard D. Wyckoff’s emphasis was, first and foremost, to educate investors about the ‘Real...

READ MORE

MEMBERS ONLY

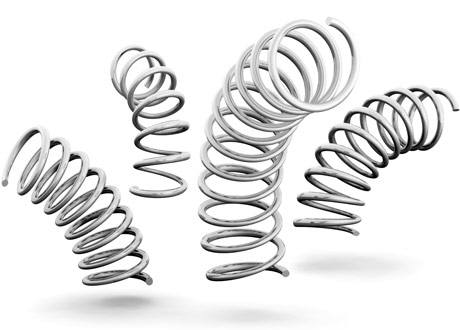

Springing into Action

by Bruce Fraser,

Industry-leading "Wyckoffian"

Stepping Stone Reaccumulation (SSR) formations are significant yet common. An SSR is a pause where the stock rests before resuming the uptrend. SSR formations often have a signature of making the lowest low early in the pause (in the first third to half of the total time spent in the...

READ MORE

MEMBERS ONLY

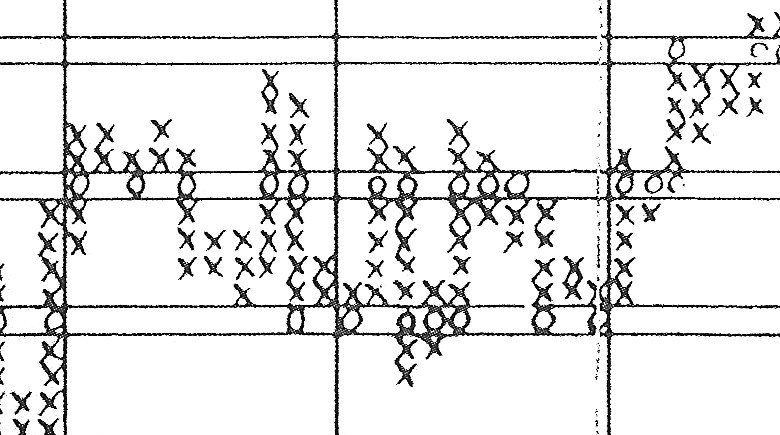

Current Point and Figure Counts

by Bruce Fraser,

Industry-leading "Wyckoffian"

The concept of Cause and Effect is at work in markets constantly. This Wyckoff Law is codified and measured using Point and Figure charts. These charts are robust tools for measuring market potential or cause that has been built and then expended. Let’s take a survey of the current...

READ MORE

MEMBERS ONLY

Trading the Reaccumulation

by Bruce Fraser,

Industry-leading "Wyckoffian"

When a stock enters a robust uptrend it can go on for a long period of time, for years in some cases. But eventually even the best uptrend needs a rest. Leading up to this pause, the ownership quality of the float deteriorates. Strong handed Composite Operators lock up much...

READ MORE

MEMBERS ONLY

Wyckoff Skill Building

by Bruce Fraser,

Industry-leading "Wyckoffian"

There are no absolutes in trading financial markets. The best market operators are exceptional risk managers. The Wyckoff Method seeks conditions where a high likelihood of success is probable. Wyckoffians systematically search for the clues that precede a stock becoming a persistent and long term leader. Some of these characteristics...

READ MORE

MEMBERS ONLY

Wyckoff Buy Strategies

by Bruce Fraser,

Industry-leading "Wyckoffian"

When initiating a campaign our mission is to buy when the stock is ready to emerge into a major uptrend. Uptrends begin when periods of Accumulation are complete and the majority of the available supply of shares has been absorbed. This is the juncture when stock is held by strong...

READ MORE

MEMBERS ONLY

Stalking the Trade

by Bruce Fraser,

Industry-leading "Wyckoffian"

No matter your investment timeframe, consider your trade to be a campaign. A campaign has steps or actions from beginning to end. A campaign has mental state management from beginning to end. Mental states vary from the patience of stalking to the aggressiveness of taking profits to conclude the trade....

READ MORE