MEMBERS ONLY

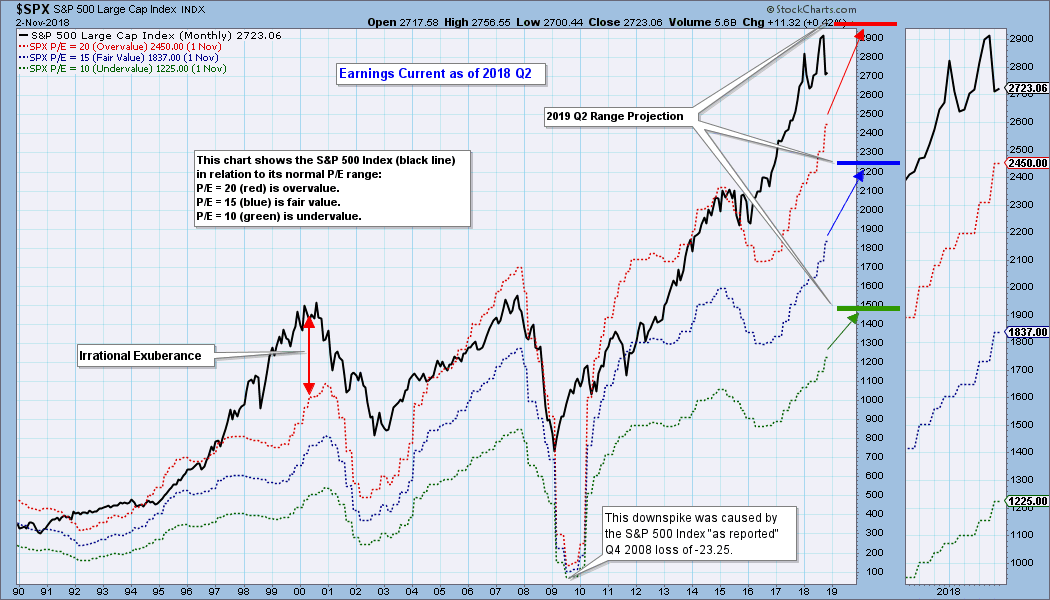

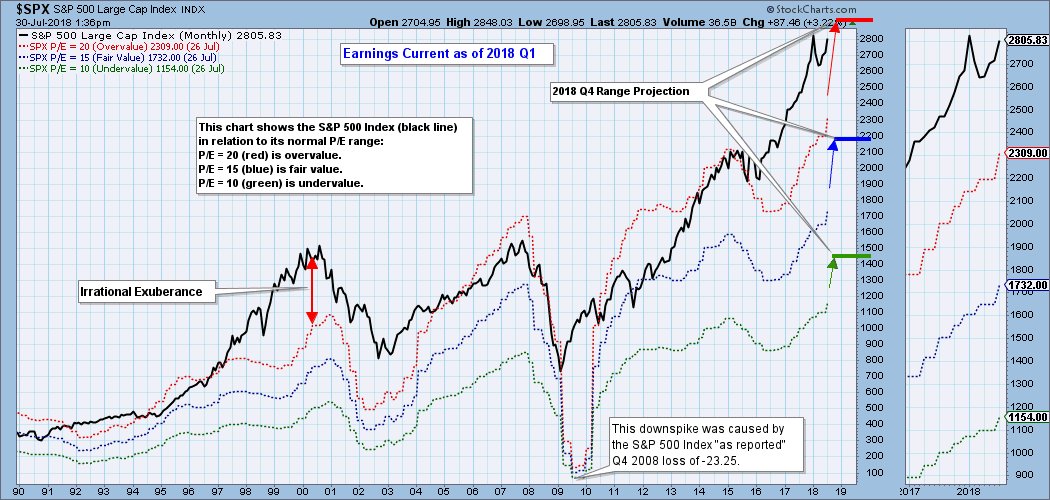

Market Overvalued Even on Forward Earnings

by Carl Swenlin,

President and Founder, DecisionPoint.com

Charts of fundamental data are as useful as price charts in helping us visualize fundamental context and trends. In the case of earnings, the following chart shows us where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line)...

READ MORE

MEMBERS ONLY

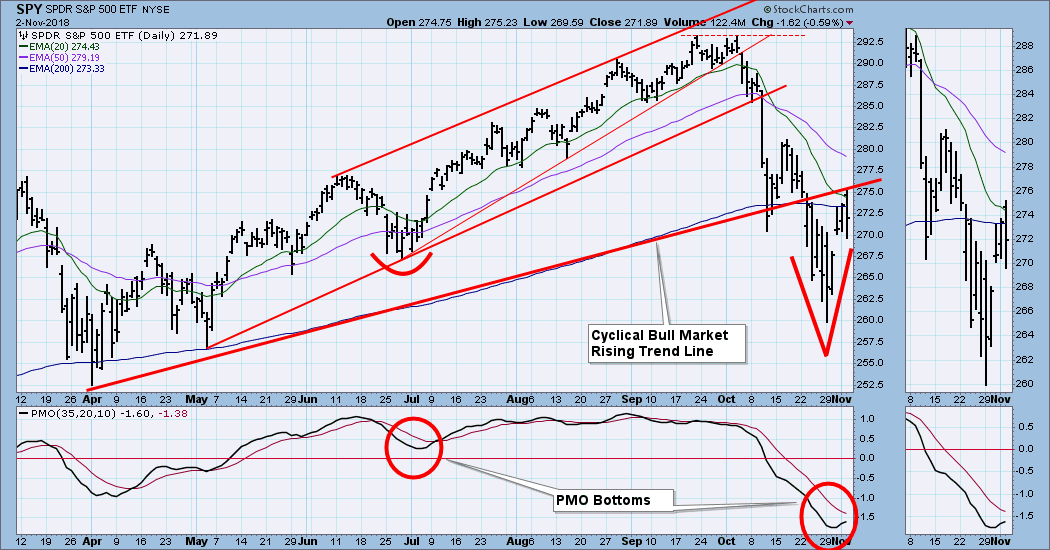

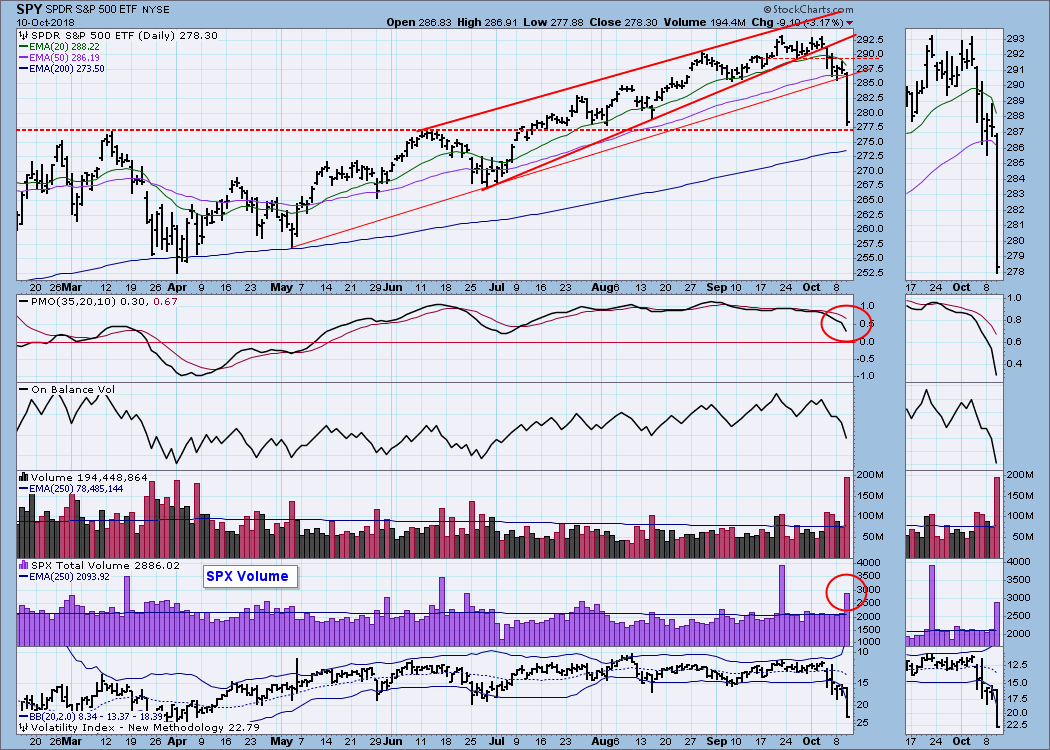

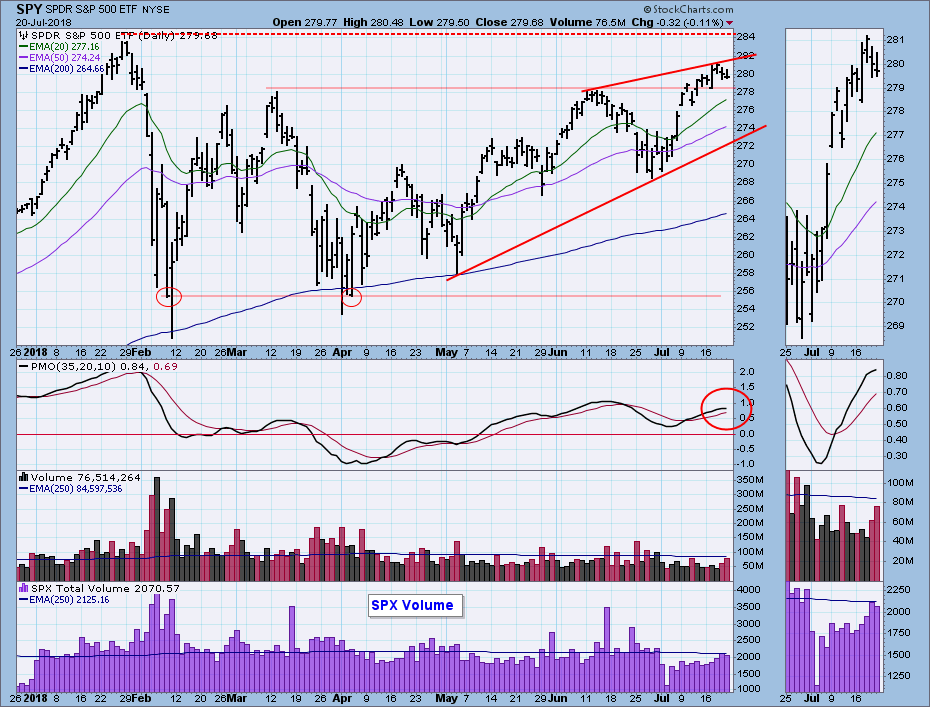

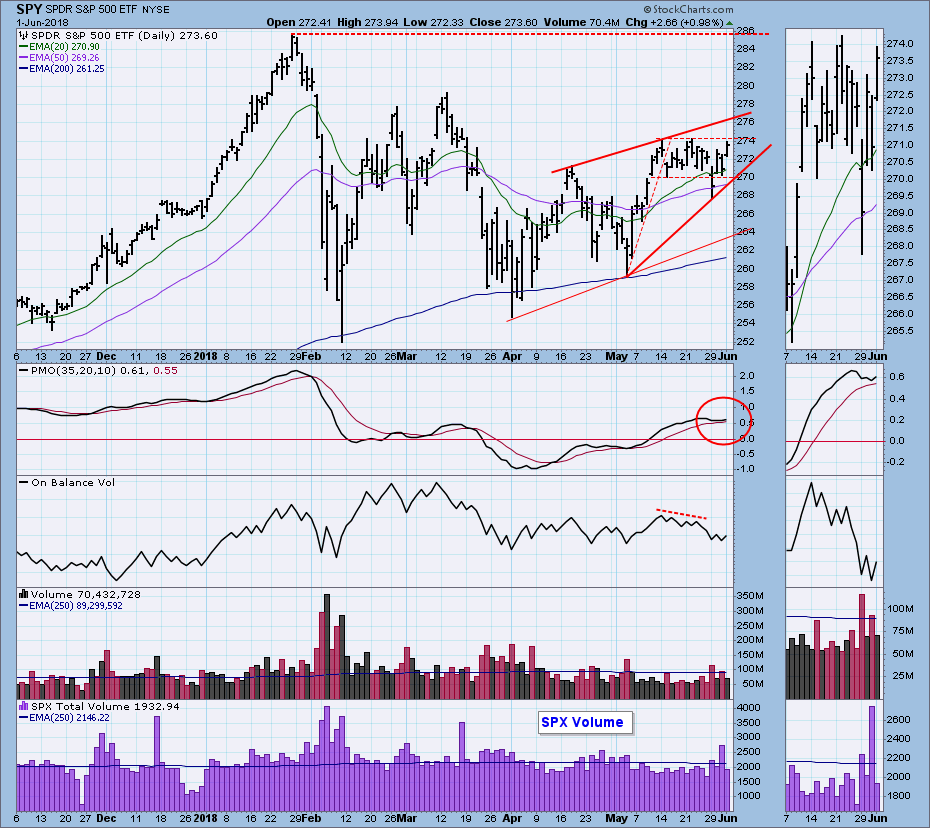

DP weekly Wrap: Not a Good BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

In the Weekly Wrap I have been saying that a short-term buy of SPY should not be considered until the daily PMO turns up. As it happens, the PMO turned up on Thursday, but I must confess that I wasn't thrilled. When the Price Momentum Oscillator (PMO) turns...

READ MORE

MEMBERS ONLY

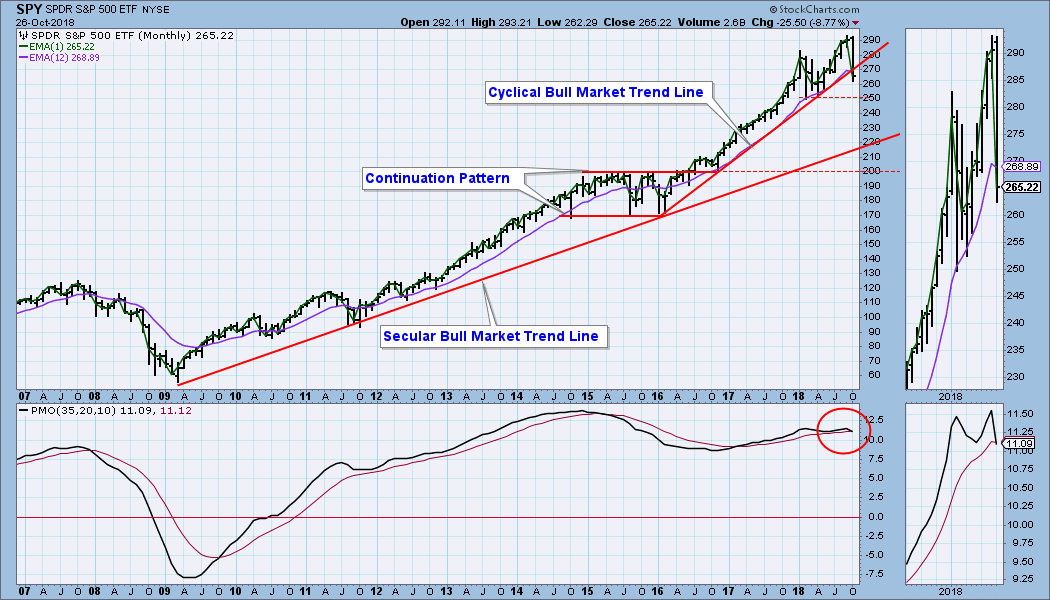

DP Weekly Wrap: Bull Market Trend Line Broken

by Carl Swenlin,

President and Founder, DecisionPoint.com

I normally don't show an in-progress monthly chart because a monthly chart isn't final until the end of the month, but this week's market action was so severe, I thought that a 'big picture' view would be most helpful. The cyclical bull...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Bear Market Yet? Waiting for Retest. Gold New BUY Signal.

by Carl Swenlin,

President and Founder, DecisionPoint.com

Despite a great rally on Tuesday, a sharp decline on Thursday took it all back, and the market finished the week barely changed. This was an options expiration week, so I think that probably had something to do with it. As of last week, I was expecting some chop in...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Picking Bottoms

by Carl Swenlin,

President and Founder, DecisionPoint.com

"The road to trading glory is littered with the bodies of those who tried to pick bottoms."

-- Carl Swenlin (once upon a bad day)

To use an expression made popular by the late Kennedy Gammage, bottom picking is for "swingin' riverboat gamblers." To be...

READ MORE

MEMBERS ONLY

Where Is Support?

by Carl Swenlin,

President and Founder, DecisionPoint.com

After a day like this, the first question I ask is where is support? That question is not fully answered on this daily chart, but there is something worth noting here. Volume for SPY was huge -- 248% of the 250-day average -- but SPY is a trading instrument and...

READ MORE

MEMBERS ONLY

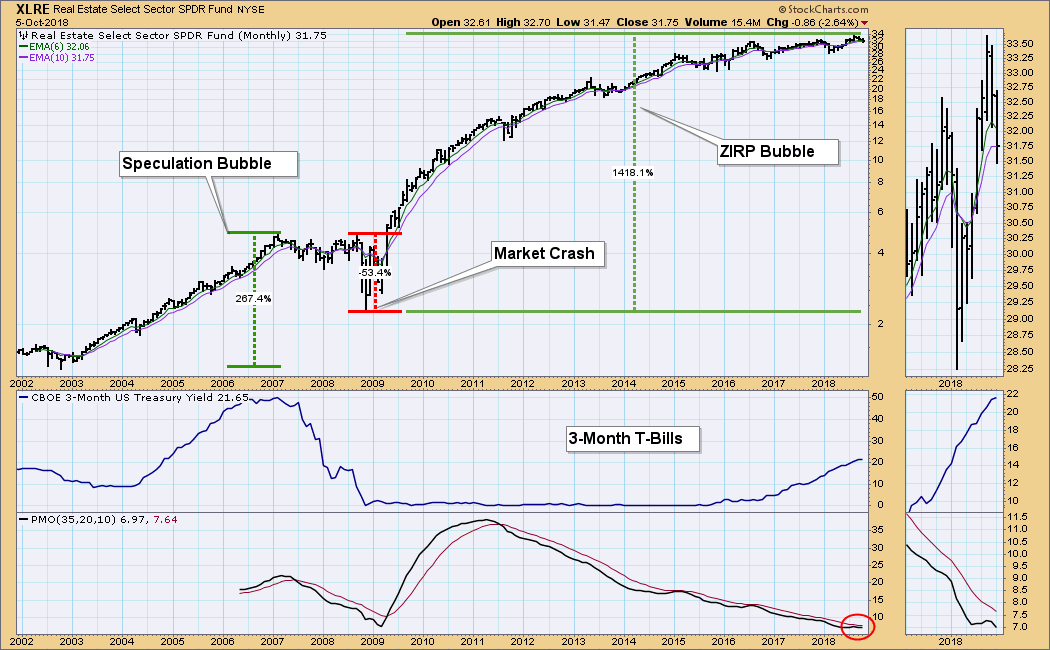

DP Weekly Wrap: Will Real Estate Be the Killer? Again?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The root cause of the Financial Crisis was real estate speculation combined with Wall Street's perennial, casual disregard for other people's money. After the real estate market crashed, the zero interest rate policy (ZIRP) was put forth in order to see that real estate speculators were...

READ MORE

MEMBERS ONLY

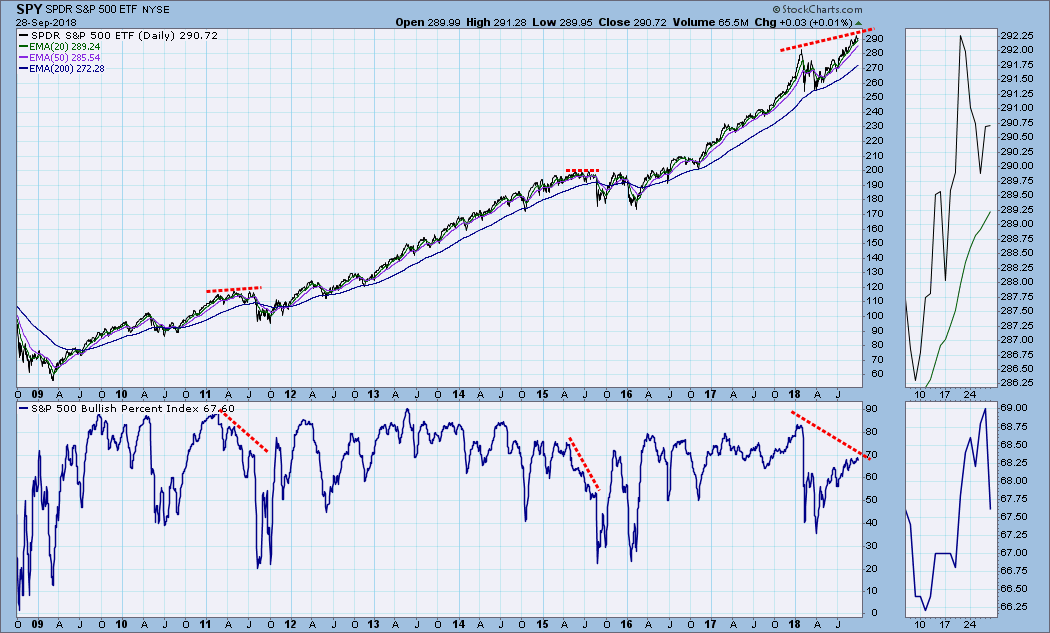

DP Weekly/Monthly Wrap: Failure to Thrive

by Carl Swenlin,

President and Founder, DecisionPoint.com

This chart was added almost as an afterthought in last Friday's DP Weekly Wrap, but throughout the week I kept thinking that it should elevated to the lead chart this week. The Bullish Percent Index (BPI) shows the percentage of S&P 500 stocks with point and...

READ MORE

MEMBERS ONLY

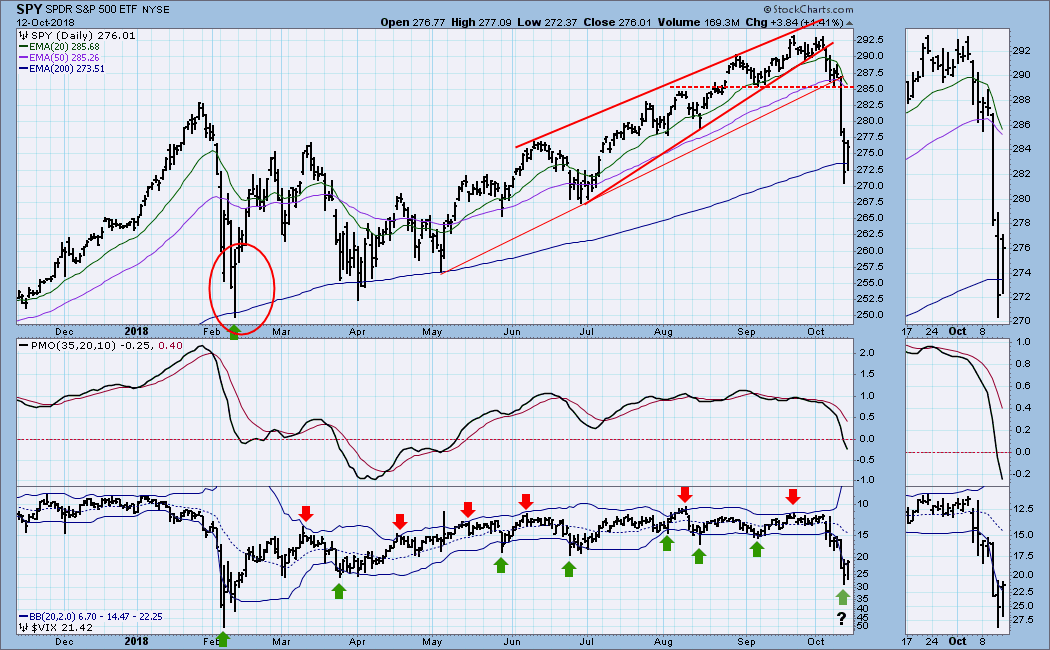

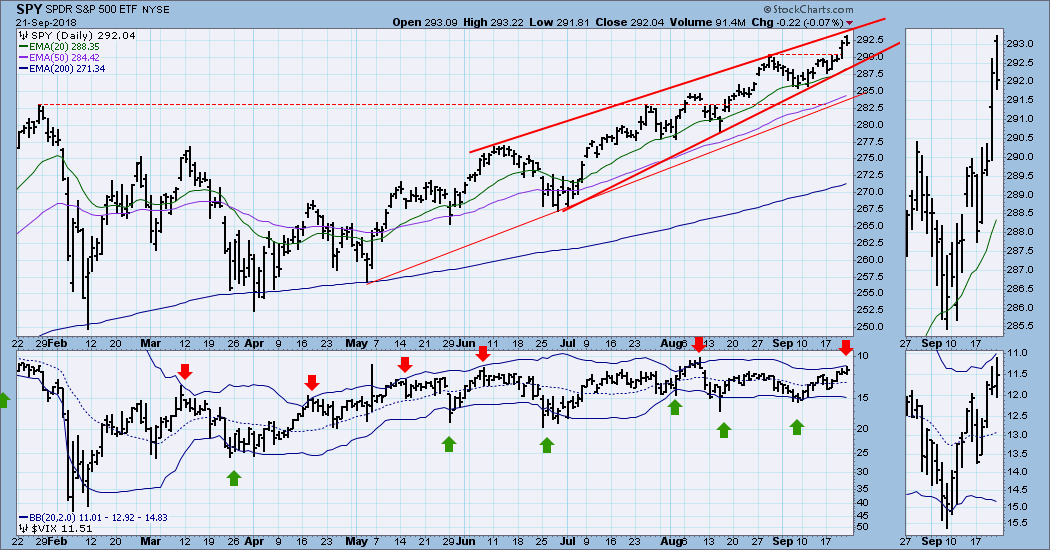

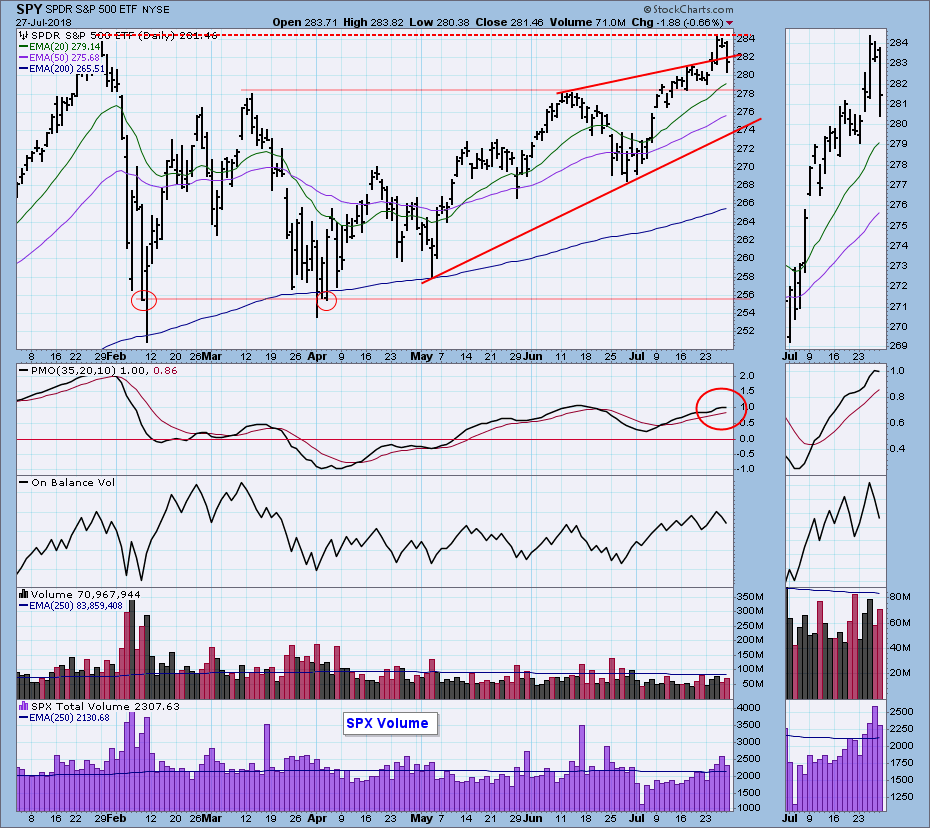

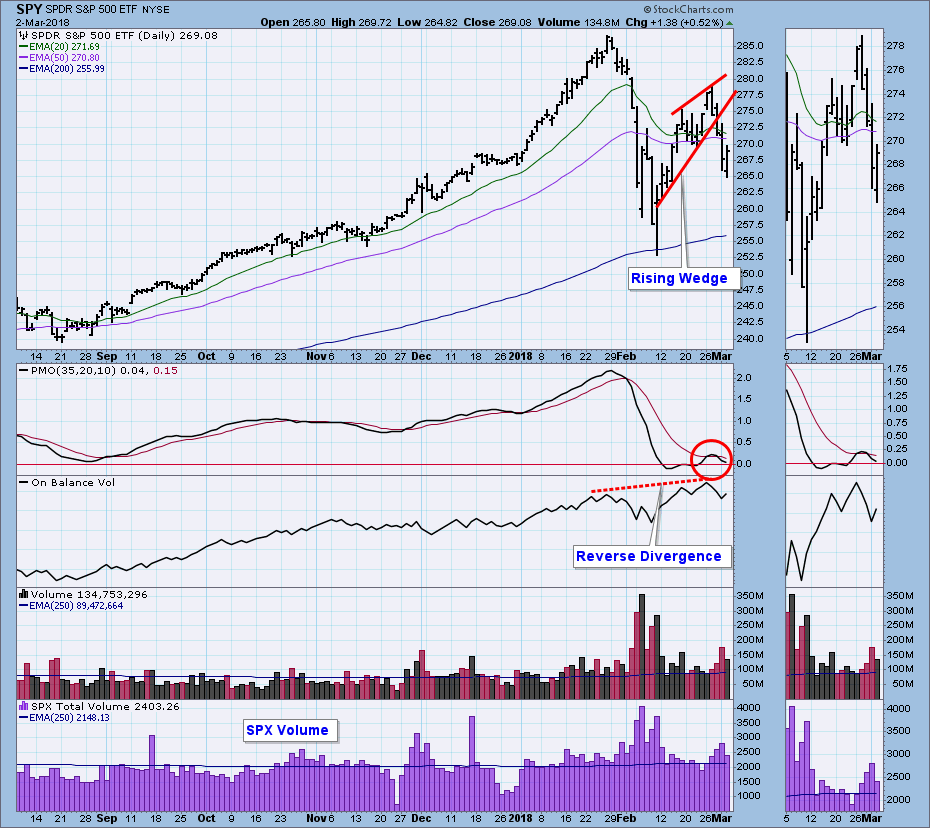

DP Weekly Wrap: Two Indications of a Short-Term Top

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market (represented by SPY) has nearly reached the top of a rising wedge formation, and the VIX has reached the top Bollinger Band on our reverse scale display. There is no guarantee, but there is a pretty good chance that a short-term top is very near. There is also...

READ MORE

MEMBERS ONLY

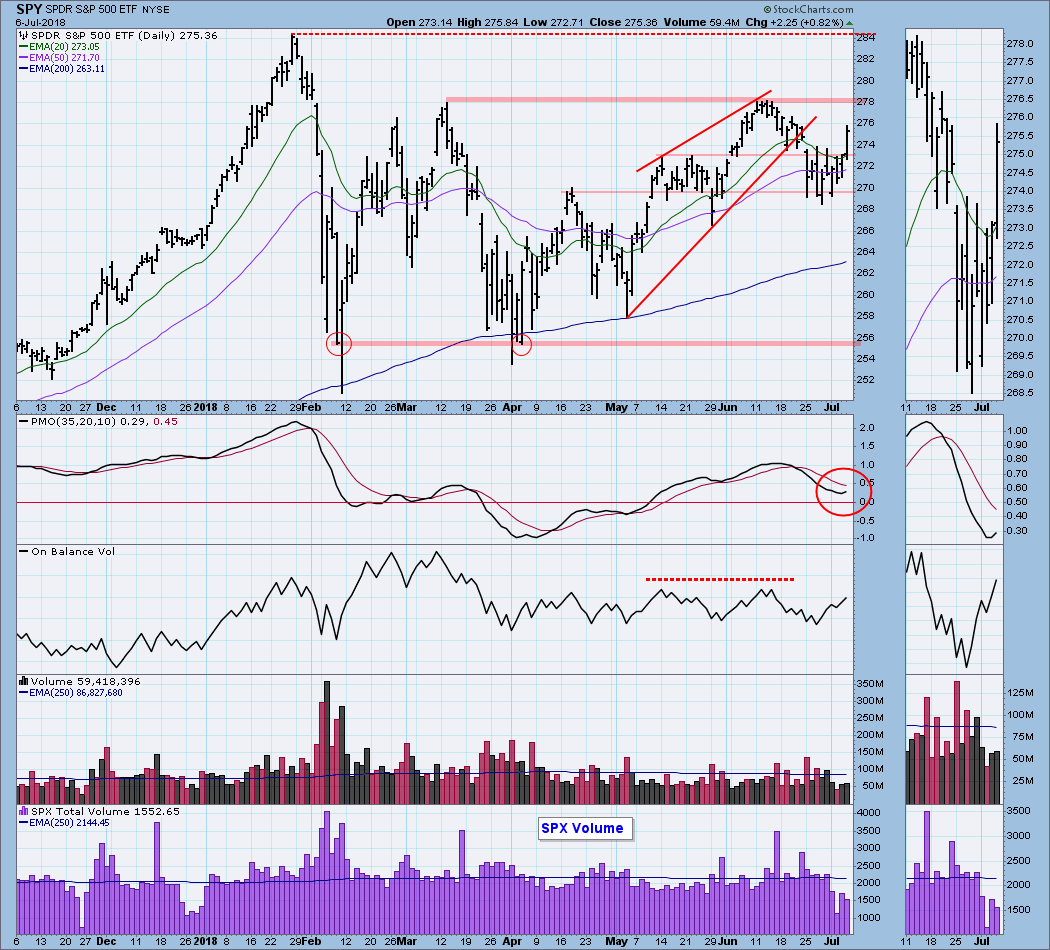

DP Weekly Wrap: Gap Cleared. What's Next?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I was concerned that the VIX had topped but had failed reach the top band on the chart -- a similar configuration occurred in January before the crash. This week the VIX moved close to the top of the channel, so I think we can consider that the...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: A Gap I Don't Like

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week we were looking at a possible bearish island reversal on one hand, and nascent parabolic advance on the other. This week's decline filled the island gap, making the island proposition moot. The decline also reached down to touch the parabolic arc, but so far that '...

READ MORE

MEMBERS ONLY

DP Weekly/Monthly Wrap: Is Another Parabolic Advance Beginning?

by Carl Swenlin,

President and Founder, DecisionPoint.com

This week, as the market once again broke out of the cyclical bull market rising trend channel, it occurred to me that perhaps another parabolic advance was getting under way. On Wednesday I was a guest of Erin and Tom on MarketWatchers LIVE, and I gave a more detailed account...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: SPY New All-Time Highs; Crude New BUY Signal; Has Gold Bottomed?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday SPY made new, all-time intraday and closing highs, exceeding the records set on Tuesday. The daily PMO has been very flat and holding at around +1 since the end of July. This summarizes the steady price rise during that period and does not present a problem. There is,...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Pushing New Highs, but Volume Not Impressive

by Carl Swenlin,

President and Founder, DecisionPoint.com

On an options expiration week we normally expect low volatility, and that is what we got this week. Despite somewhat dramatic, but opposite, moves on Wednesday and Thursday, the SPY trading range for the week was a little over two percent, and the difference between the weekly closing high and...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Skinny Breakout Fails

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I said I expected to see new, all-time highs for SPY, and on Monday that expectation was fulfilled in a marginal way. While I didn't say I expected that the market would close higher this week, it was implied, but the market's low volume...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Apple Hits $1 Trillion

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Thursday, when Apple's (AAPL) market cap went over the $1 trillion mark, Dennis Gartman (The Gartman Letter) said something to the effect that this is the kind of thing we see at market tops, not in the middle of a long advance. I felt the same way....

READ MORE

MEMBERS ONLY

Fundamentals: Market Still Extremely Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

What's a technical guy doing talking about fundamentals? Well, I believe that charts of fundamental data are as useful as price charts in helping us visualize fundamental context and trends. In the case of earnings, the following chart shows us where the S&P 500 would have...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Strange Behavior

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I thought we had a good setup for a short-term market top and correction, but news of possible progress toward a resolution of trade issues with the EU spurred the market (SPY) higher to challenge all-time highs. Funny thing, though, there was no follow through on Thursday, and...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Dull Options Expiration Week; Next Week May Be More Exciting

by Carl Swenlin,

President and Founder, DecisionPoint.com

I normally expect options expiration week to be dull, and with this week's range of less than one percent, I was not disappointed. I was also looking for a short-term pullback, but that did not materialize (probably because of options expiration); however, our array of indicators say that...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Bonds Long-Term BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday the Long-Term Trend Model (LTTM) for long bonds (TLT) generated a long-term BUY signal. How that happens is that the 50EMA crosses up through the 200EMA, an event more commonly known as the "Golden Cross," because big money is sure to follow (just kidding). When we...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: SPY Short-Term BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Wedges are a favorite of mine because they are so reliable. For example, there is a high probability that rising wedge formations will resolve downward, so it is usually best to wait for this resolution and the aftermath before going long. Two weeks ago SPY broke down from a rising...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Monthly Charts Finalized

by Carl Swenlin,

President and Founder, DecisionPoint.com

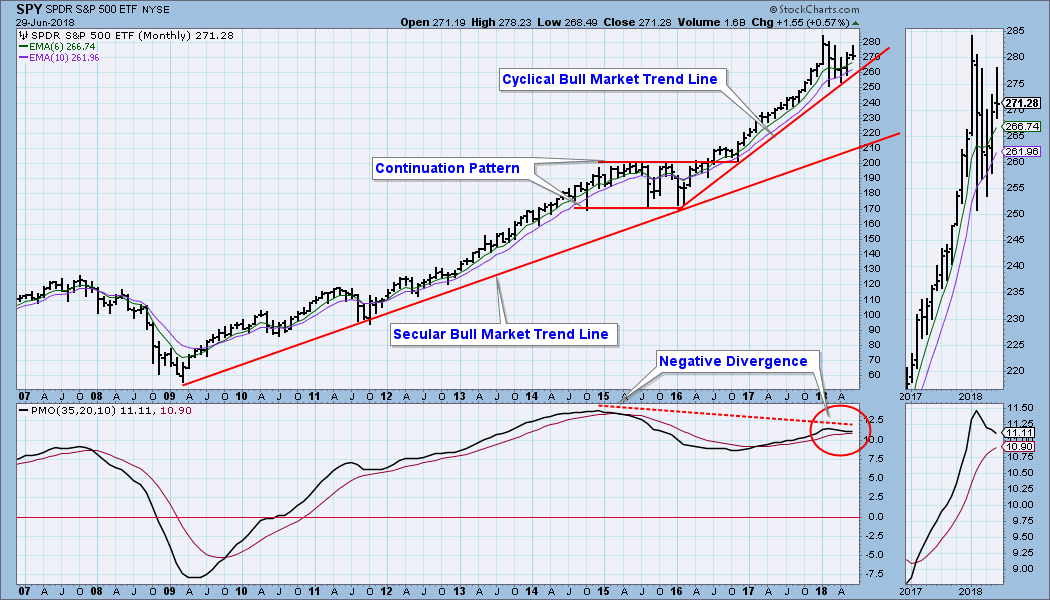

Monthly charts were finalized on Friday, so we can get an up-to-date assessment of the very long-term. On the SPY monthly chart below, note that the cyclical bull market up trend has taken price on a very wide departure from the secular bull market rising trend line. The monthly PMO...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Market Trying to Correct; Gold LT SELL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

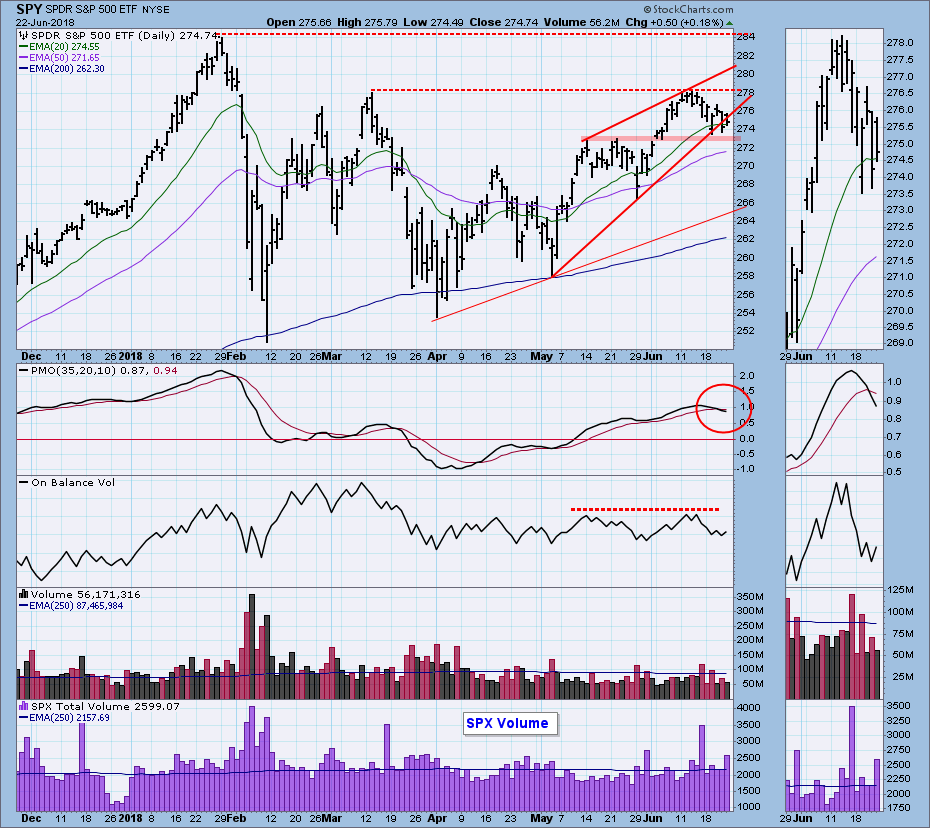

The market has been turned back from the horizontal resistance drawn across the March top, but it has managed to stay above the support drawn across the May tops. However, there is still the mechanism of the bearish rising wedge pattern, which is reinforced by an OBV negative divergence, and...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Market Still Strong

by Carl Swenlin,

President and Founder, DecisionPoint.com

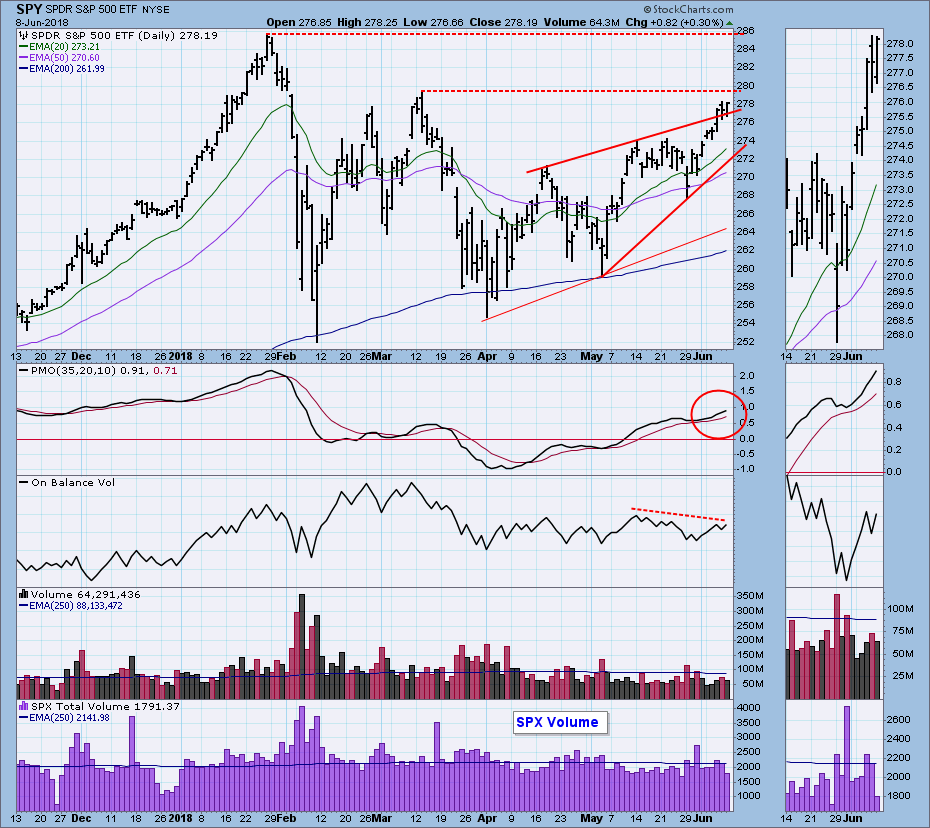

The bearish rising wedge formation we had been watching resolved upward last week, though not by a decisive margin. This week price reached, then retreated from horizontal resistance, forming a top which created a new rising wedge formation. In spite of the modest pullback early Friday, price was virtually unchanged...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Market Approaching Overhead Resistance

by Carl Swenlin,

President and Founder, DecisionPoint.com

Rising wedge formations normally resolve downward, but sometimes they don't. While I was expecting the normal bearish resolution of the current rising wedge, the market wasn't having it, and it pressed higher for a breakout on Wednesday. There has been no follow through yet, but price...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: A Pullback Is Still Likely

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote: ". . . the market seems to be set up for a pullback or correction. . . . Recent declines have been very short-lived, so I can't make a case for anything too serious." What we got on the first trading day of this week was a sharp...

READ MORE

MEMBERS ONLY

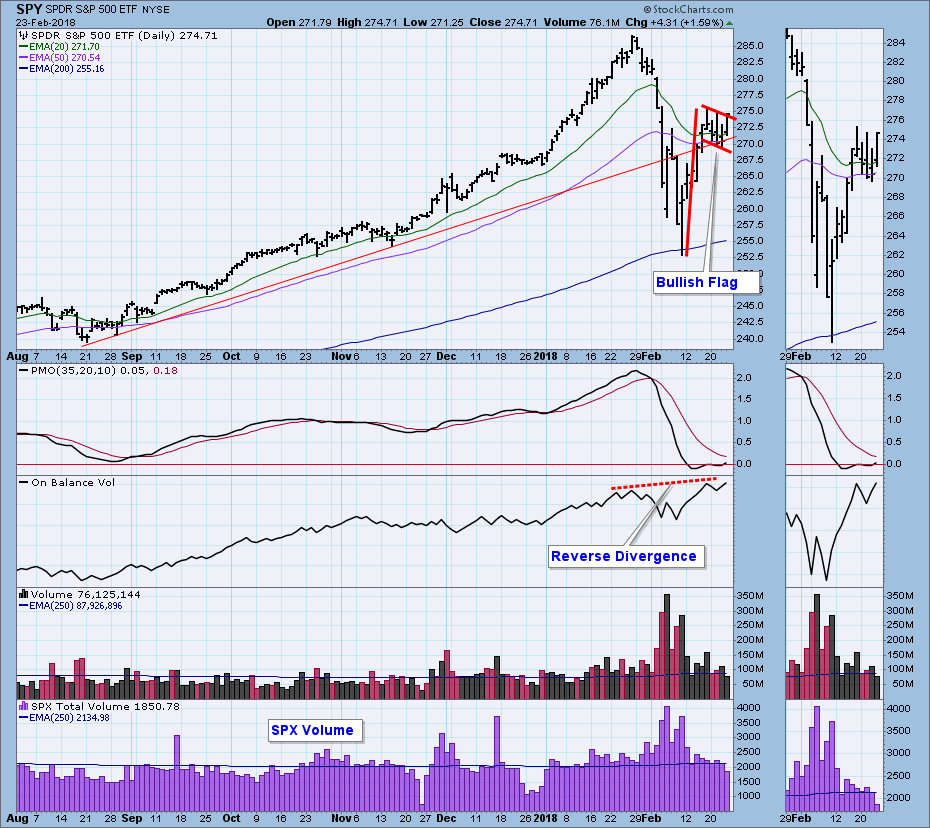

DP Weekly Wrap: From Flag to Churn

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I thought we had a good outlook based upon a bullish flag formation, but this week the market just added more sideways movement. We could still make a case for a flag being in place, but a good flag should slant down off the flagpole as a sign...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Bullish Flag Forming

by Carl Swenlin,

President and Founder, DecisionPoint.com

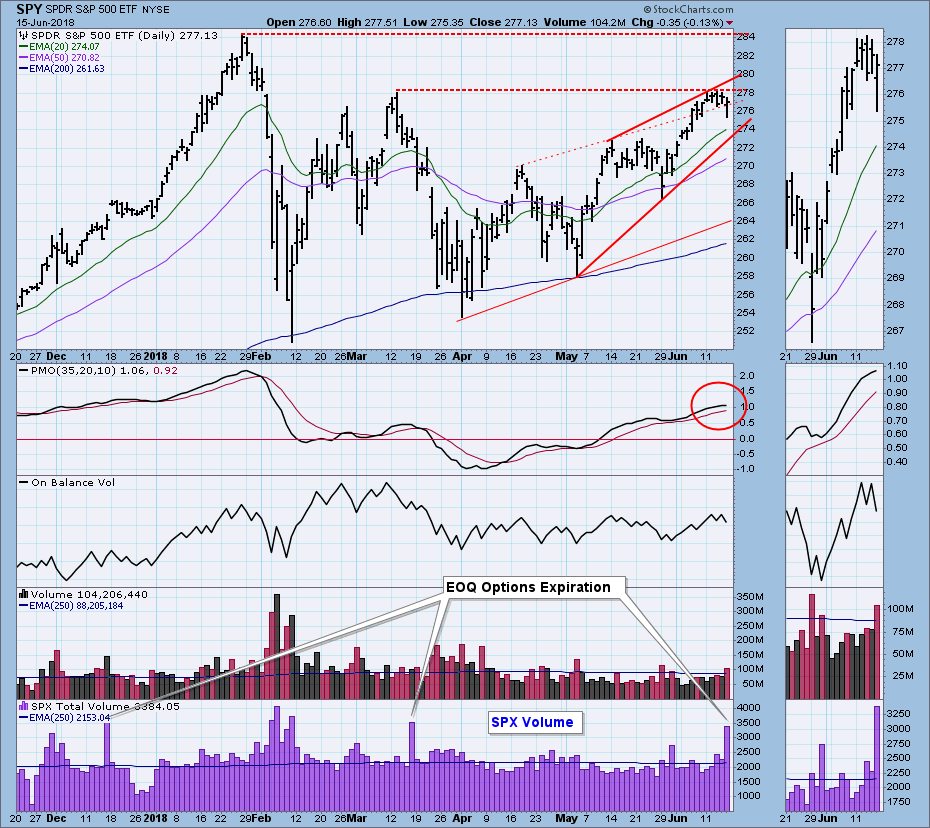

Back in the day, options expiration days were characterized by high volatility and exceptionally high volume; however, in recent years the market stays relatively calm, and the high volume only appears at the end of each quarter. These expectations were not disappointed in today's trading. In fact, the...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: SPY New BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday the SPY 20EMA crossed up through the 50EMA, generating an Intermediate-Term Trend Model (ITTM) BUY signal for the broad market (SPY). Does this mean that I will have to reconsider my assumption that we are in a bear market? Well, I can hardly avoid it, but I still...

READ MORE

MEMBERS ONLY

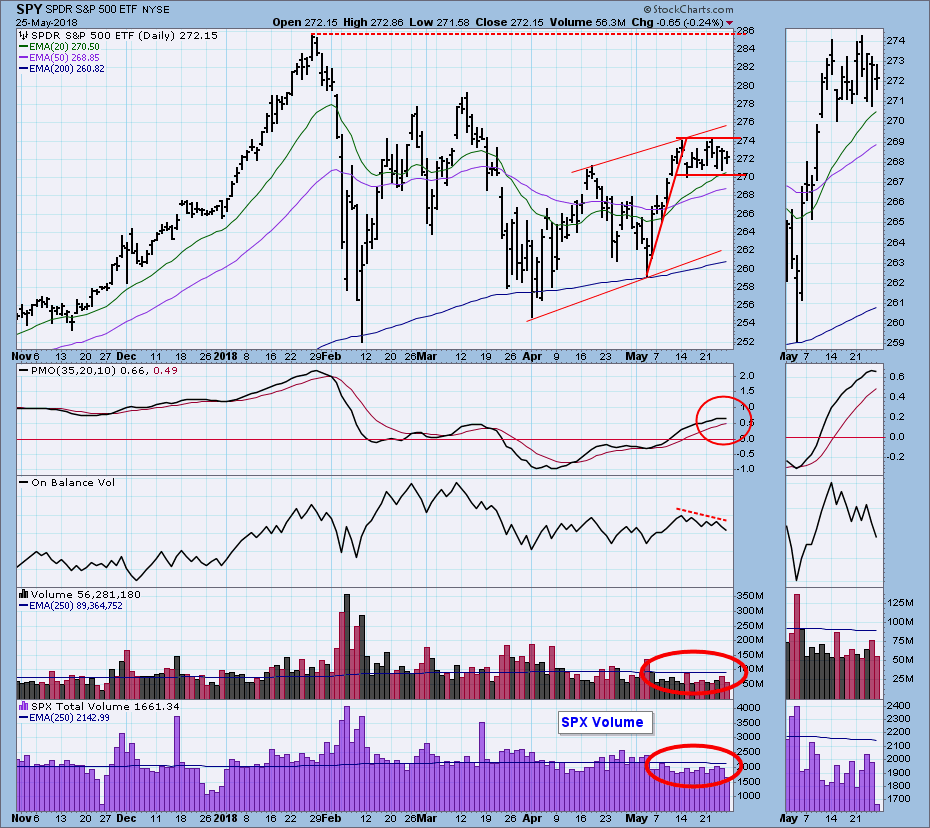

DP Weekly Wrap: Strong Finish, but Where's the Love?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Thursday the market recovered nicely from an early selloff, and today it had a strong finish. But in the market, volume equals love, and the short volume on Friday was barely a peck on the cheek. On my SPY chart I like to show, in addition to SPY volume,...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Consumer Discretionary (XLY) Back on BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Consumer Discretionary sector (XLY) switched from NEUTRAL to BUY when the 20EMA crossed up through the 50EMA. For me this is a low-confidence signal because XLY has been moving sideways, with price chopping above and below those EMAs with enough range to cause the dreaded whipsaw. Also undermining my...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Technology Whipsaw

by Carl Swenlin,

President and Founder, DecisionPoint.com

The technology sector (XLK) switched from NEUTRAL to BUY on Thursday, but reversed from BUY to NEUTRAL on Friday. The problem is that recent sideways price movement has squeezed the 20EMA and 50EMA very close together, and price movement above or below the EMAs can cause whipsaw signals. To review,...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Weak Volume Undermines Rally

by Carl Swenlin,

President and Founder, DecisionPoint.com

Market action was a little choppy this week, but SPY managed to eke out a small gain; unfortunately, volume was weak and did not confirm the rally. The PMO bottomed and crossed up through the signal line, giving a PMO BUY signal. But the PMO is running kind of flat,...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Choppy Week Closes Down

by Carl Swenlin,

President and Founder, DecisionPoint.com

On the SPY chart last week I thought I saw a reverse flag formation, although it was not as tightly defined as I would like. This week the market thrashed around pretty badly, and although the flag didn't become more visible, there is still a ragged cluster of...

READ MORE

MEMBERS ONLY

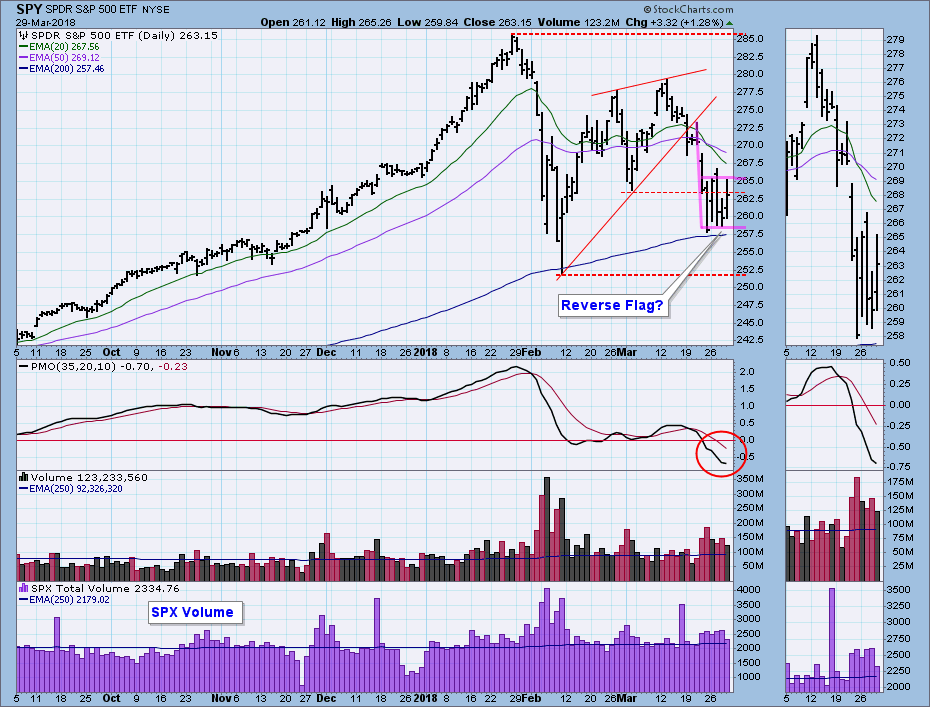

DP Weekly/Monthly Wrap: Is That a Reverse Flag?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week the market broke down from a rising wedge pattern and dove into a scary decline. This week was choppy and wild, but price stayed within a somewhat ragged range that looks to me like a bearish reverse flag formation. Price remained above the 200EMA, and every day volume...

READ MORE

MEMBERS ONLY

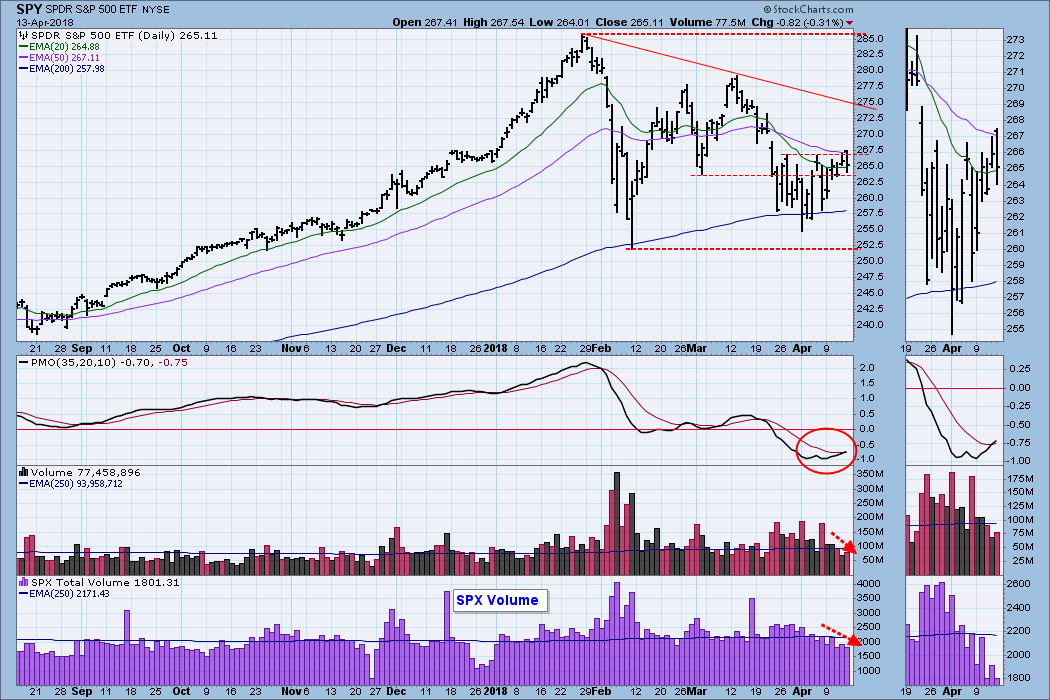

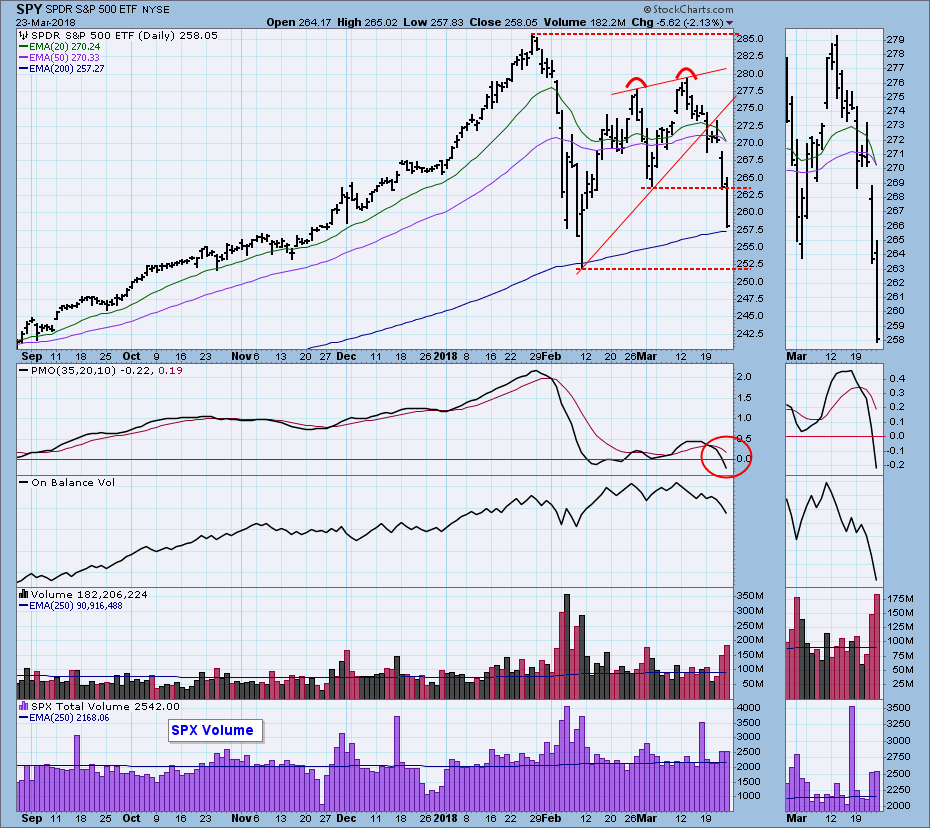

DP Weekly Wrap: Sixteen-Month BUY Signal Ends

by Carl Swenlin,

President and Founder, DecisionPoint.com

This week the rising wedge we had identified resolved downward, as expected. Once that happened, we needed to provide a context that could help determine an initial downside target, so we focused on the double top confirmation line, drawn across the low between the tops. That line was violated on...

READ MORE

MEMBERS ONLY

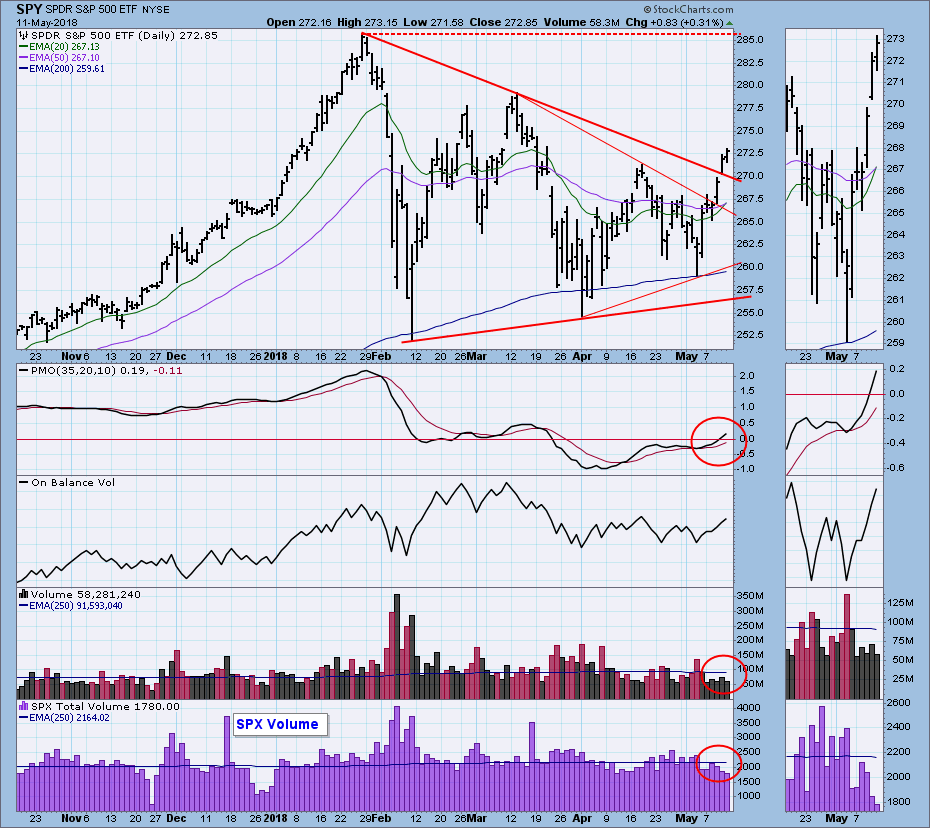

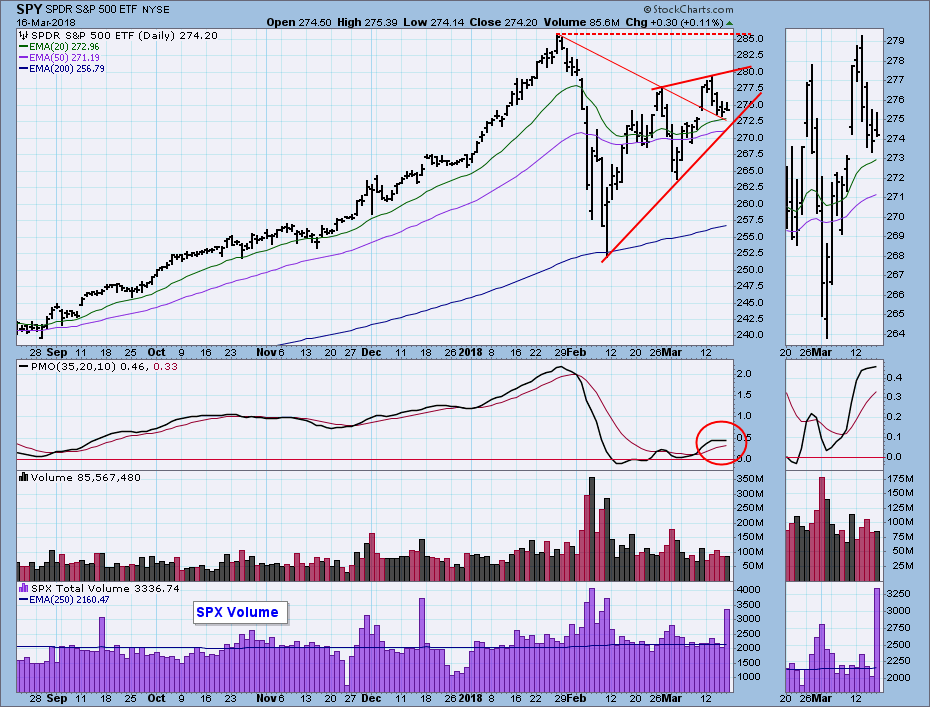

DP Weekly Wrap: Bearish Rising Wedge Appears

by Carl Swenlin,

President and Founder, DecisionPoint.com

First, the super high S&P 500 volume today was because of options expiration, so don't read anything else into it.

Last Friday's encouraging breakout is looking like a short-term bull trap , as the market pulled back to the declining tops line support this week....

READ MORE

MEMBERS ONLY

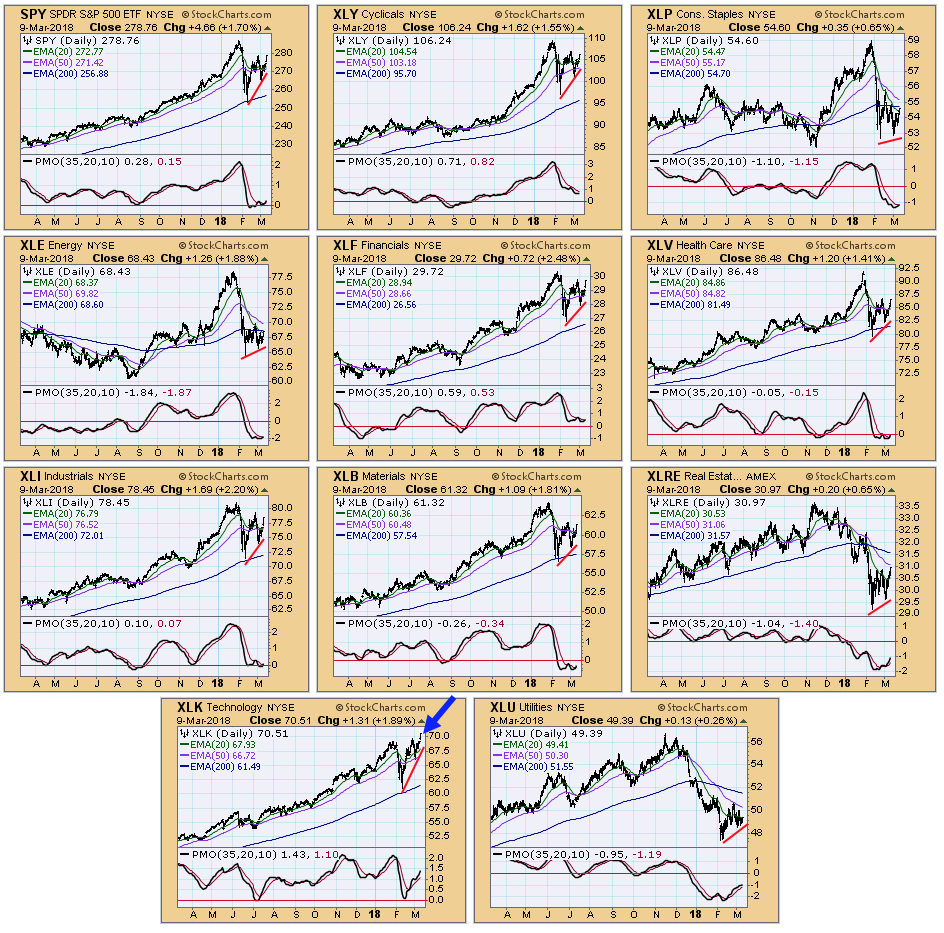

DP Weekly Wrap: Double Bottoms Abound

by Carl Swenlin,

President and Founder, DecisionPoint.com

Friday was an exceptionally positive day, as prices advanced on good news regarding North Korea and jobs. Here are charts of the S&P 500 (SPY) and the 10 major sectors. The recurring theme we see is the double bottom. One exception is Utilities (XLU), which hasn't...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Breakout Fakeout and Broken Wedge

by Carl Swenlin,

President and Founder, DecisionPoint.com

At last Friday's close we were faced with SPY pushing at the top of a bullish flag formation (not annotated). On Monday there was a strong breakout that proved to be a fakeout. On Tuesday price topped and fell back to the top of the flag, and at...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Promising Flag Formation

by Carl Swenlin,

President and Founder, DecisionPoint.com

Nothing has happened this week to support my belief that we are in a bear market. If the market were in that much trouble, it seems to me that this week it should have headed lower. Instead, it has consolidated and formed a bullish flag formation. If the flag fulfills...

READ MORE