MEMBERS ONLY

DP Bulletin: Dow Industrials ($INDU) Generate Weekly PMO BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

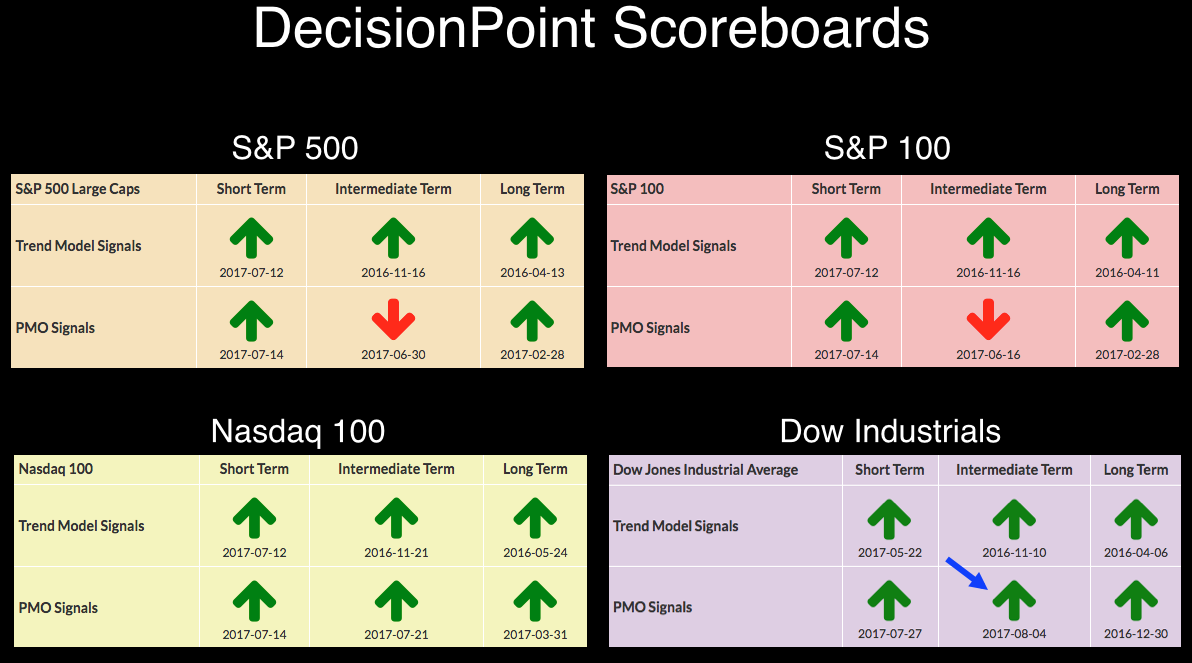

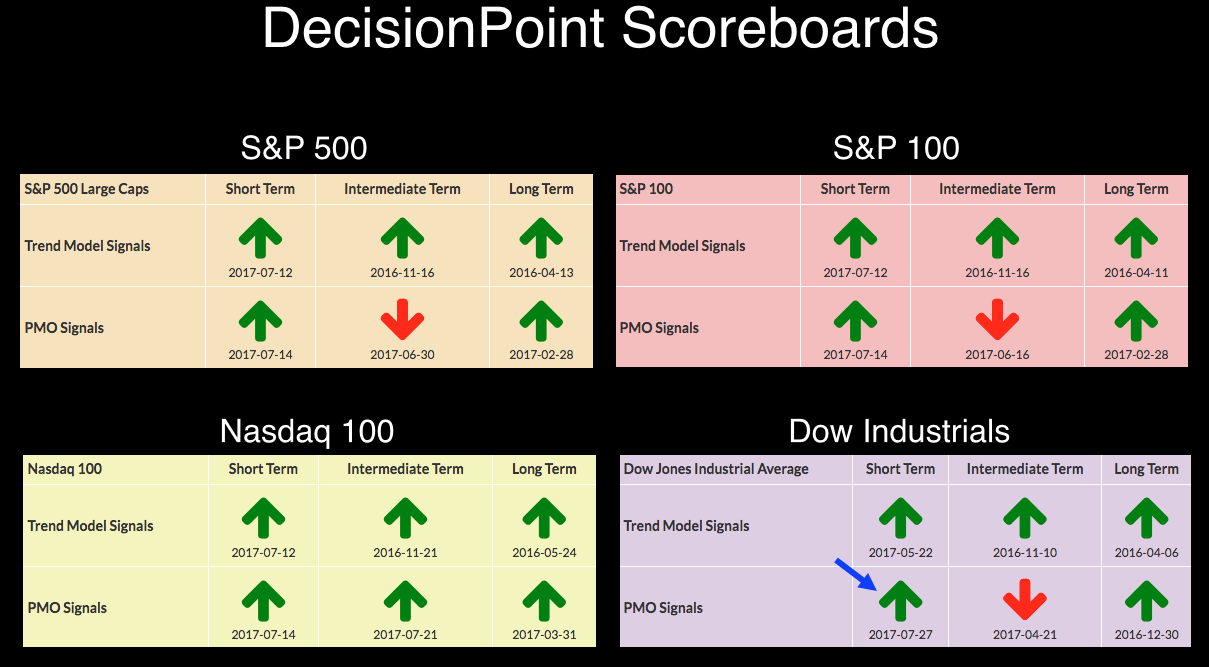

Today the weekly PMO for the Dow Jones Industrial Average ($INDU) crossed up through its signal line and generated a weekly PMO BUY signal.

We can see on the weekly chart that the PMO has been running flat well above the zero line since April, which indicates that price has...

READ MORE

MEMBERS ONLY

DP Alert: New BUY Signal for Crude (USO)

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today a new IT Trend Model (ITTM) BUY signal was generated by U.S. Oil Fund (USO), our surrogate for crude oil, when the 20EMA crossed up through the 50EMA. This looks like a case where the signal is a bit late in arriving due to the severe selling that...

READ MORE

MEMBERS ONLY

DP Alert: Gold Generates New BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Gold generated a new IT Trend Model (ITTM) BUY signal as the 20EMA crossed up through the 50EMA. In the last year there have been six ITTM signal changes, and price has been running flat for six months, a configuration that facilitates even more whipsaw. There is, however, more to...

READ MORE

MEMBERS ONLY

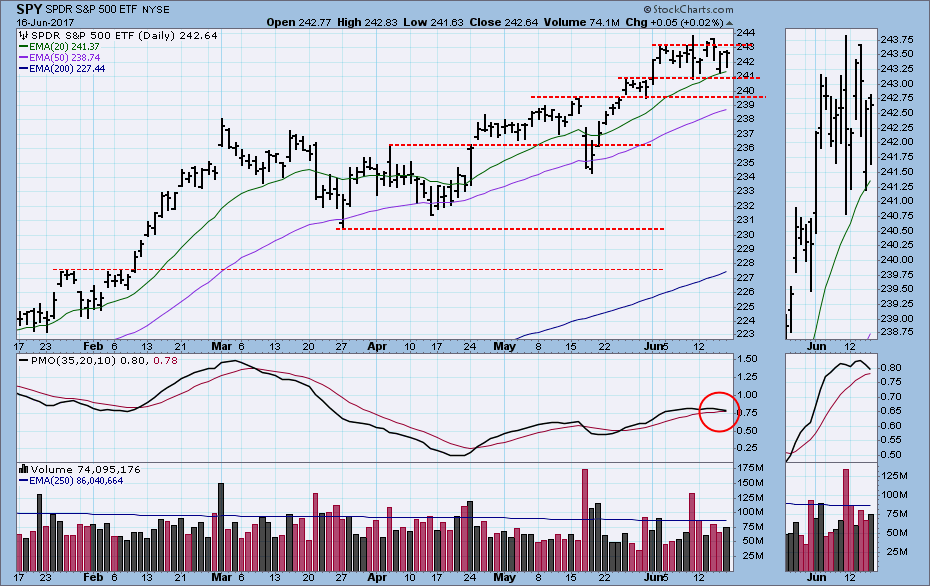

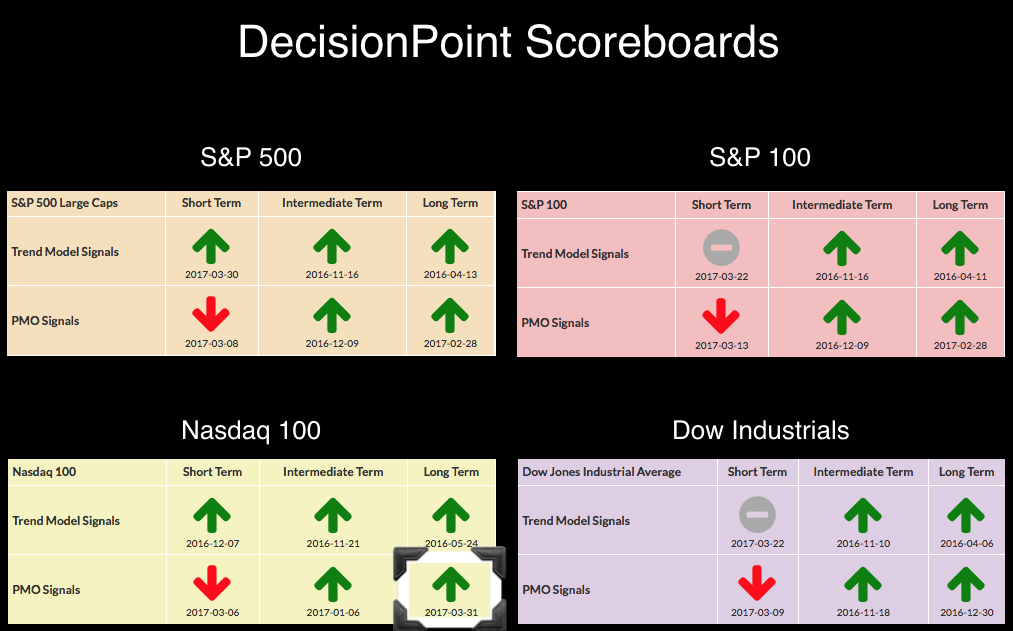

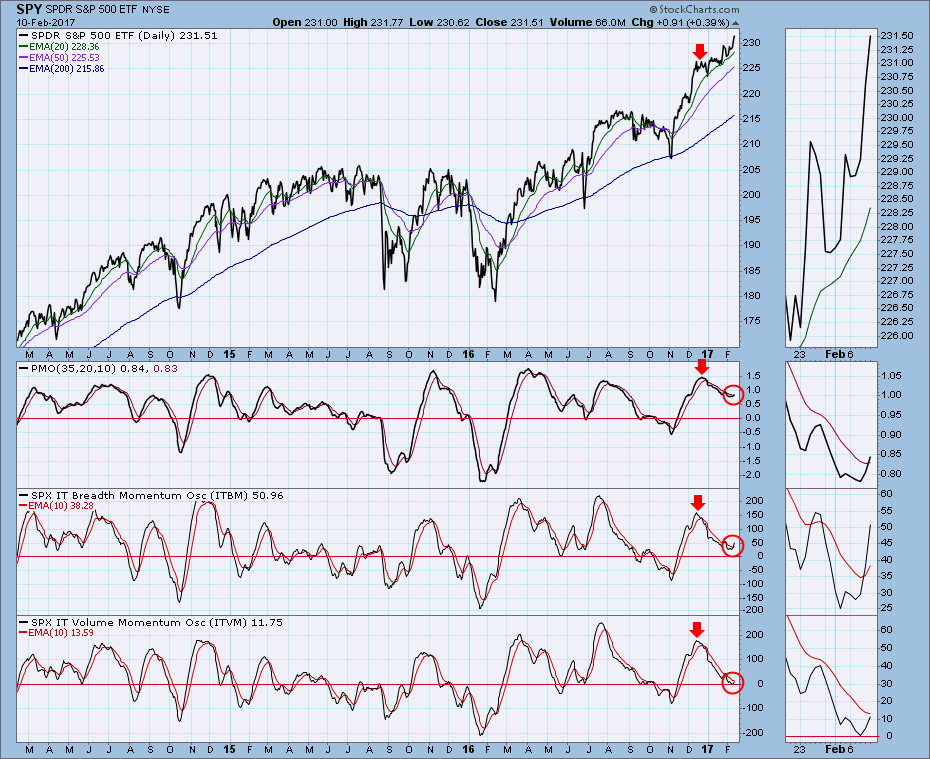

DecisionPoint Weekly/Monthly Wrap -- Possible Top

by Carl Swenlin,

President and Founder, DecisionPoint.com

There is always something for the market to wait for. Last week it was options expiration, and this week it was the Fed meeting. There was nothing new from the Fed, so there were no market hiccups as a result. SPY made new, all-time highs again this week. On Thursday...

READ MORE

MEMBERS ONLY

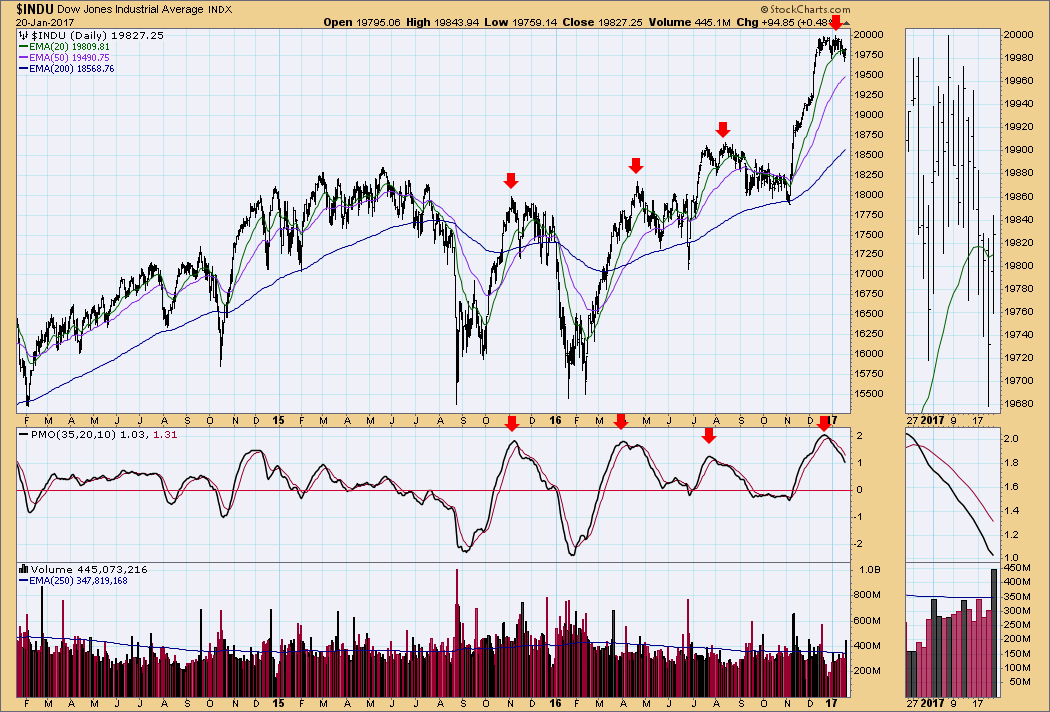

DP Bulletin: Dow Industrials ($INDU) Trigger PMO BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today the Dow Industrials ($INDU) PMO signal changed from a SELL to a BUY.

The just retired SELL signal was only three days old because the daily PMO is currently very flat and close to its signal line. In this configuration the PMO is subject to frequent whipsaw signal changes....

READ MORE

MEMBERS ONLY

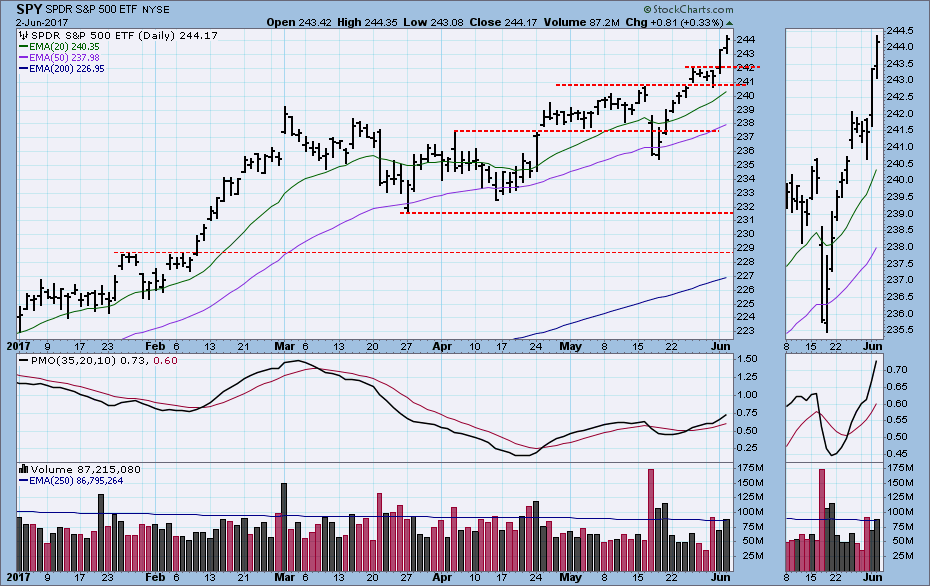

DecisionPoint Weekly Wrap -- Another Breakout to New, All-Time Highs

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week the market broke out of a month-long rounded top to new, all-time highs. This week there was a short snapback to the point of breakout, then on Wednesday it once again broke to new, all-time highs. Thursday and Friday it again pulled back to the point of breakout....

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Dollar In Trouble

by Carl Swenlin,

President and Founder, DecisionPoint.com

Rounded top, schmounded top. This week the market couldn't have cared less as it broke through to new, all-time highs. The headline regarding the dollar is not exactly news, but the dollar is getting particularly weak. More on that below.

The DecisionPoint Weekly Wrap presents an end-of-week assessment...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Still Topping

by Carl Swenlin,

President and Founder, DecisionPoint.com

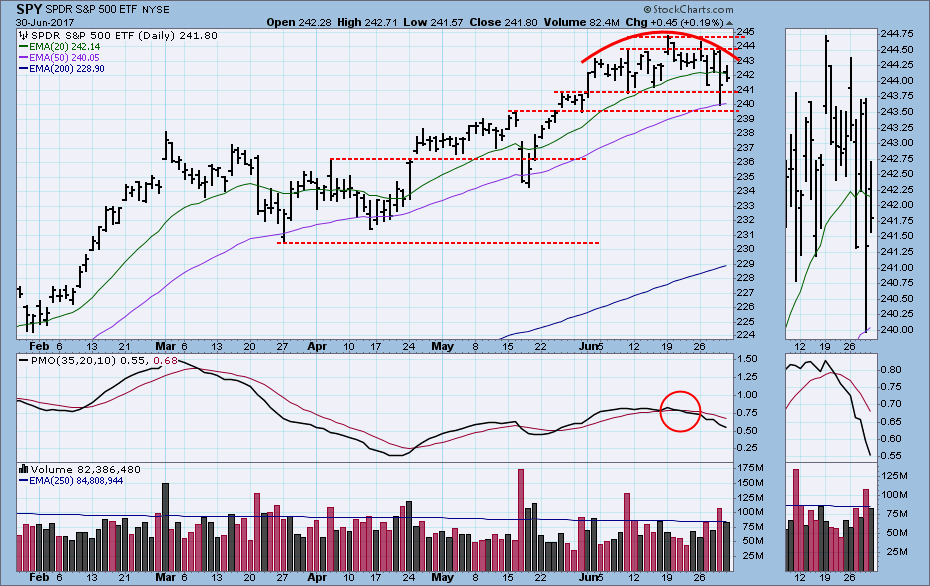

During a holiday week we don't expect much action, and this week was no exception. The market has been grinding away in a narrow range since the beginning of June, and a rounded top has formed. A rounded top is bearish, but in this persistent bull market it...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly/Monthly Wrap -- Topping In Progress?

by Carl Swenlin,

President and Founder, DecisionPoint.com

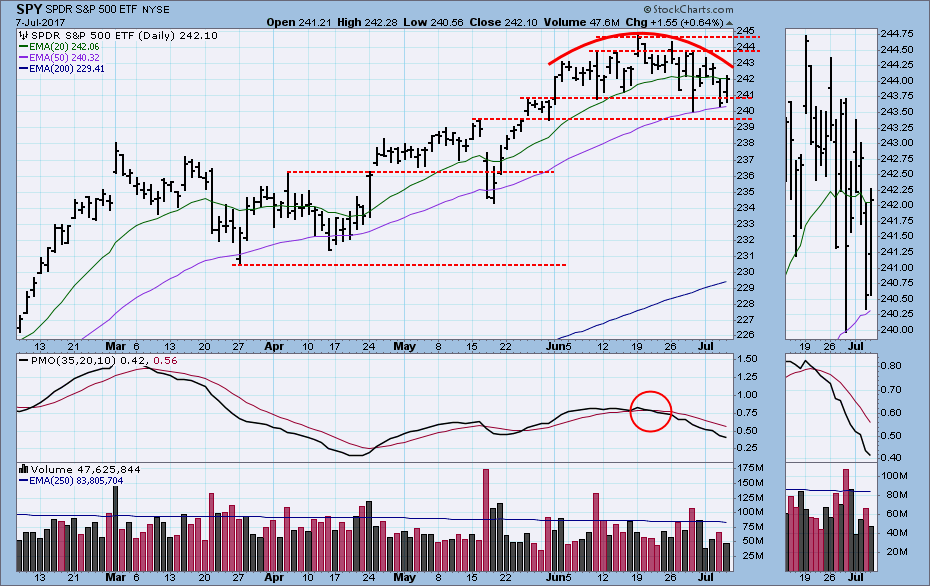

June has been a tedious month for the market with SPY being confined mostly within a three point range. I can't help noticing the rounded shape of June's price activity, which makes me think we may be seeing a rounded top leading to a period of...

READ MORE

MEMBERS ONLY

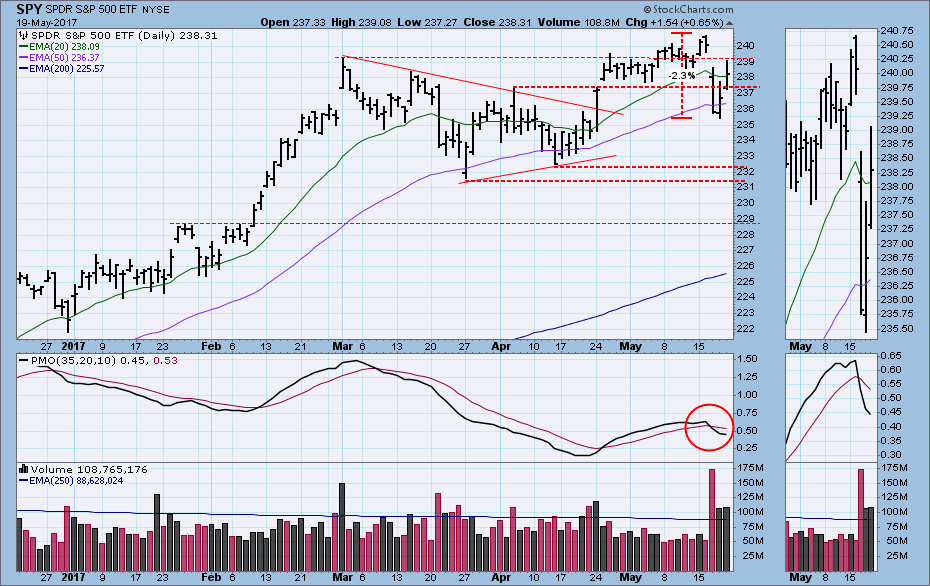

DecisionPoint Weekly Wrap -- Troubling Negative Divergences

by Carl Swenlin,

President and Founder, DecisionPoint.com

SPY began the week with a breakout on very high volume that subsequently looks like a minor blowoff, as price retreated back into the June trading range. The expansion of New Highs on Monday failed to match the climactic level of New Highs on June 2, and a PMO top...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Market Indicators Look Bad

by Carl Swenlin,

President and Founder, DecisionPoint.com

About three weeks ago I began looking for the market to consolidate or correct because of price being very overbought based upon its extreme departure from the 200EMA. So far we have two weeks of price churning sideways, and that has gotten the technical indicators in a condition that promises...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Record Highs, Then Reversal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote: ". . . the spike in S&P 500 New Highs makes me think that the market may be on the verge of another consolidation or correction that could last several weeks." I still think that outlook is viable, based upon this week's price...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- New Highs Climax

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote: ". . . our short- and intermediate-term indicators suggest that we will see a few more weeks of rally before another correction/consolidation." In the first two days of this short week price continued to consolidate the prior week's advance, and then the rally continued...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Participation Fading

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I said that I was expecting the market to do a little more work on the downside before the bull market resumed, but the market had other ideas. Prices continued to rally, and on Thursday SPY broke to new, all-time highs. Volume expanded on that day, but it...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Break and Bounce

by Carl Swenlin,

President and Founder, DecisionPoint.com

In our Conclusions section of the Weekly Wrap last week, I expressed my heightened level of caution due to the negative condition of our indicators. On Monday a nice rally to new, all-time highs gave me cause to doubt my assessment, but the rally stalled on Tuesday, and the bottom...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Rally Stalls

by Carl Swenlin,

President and Founder, DecisionPoint.com

I thought that last week's breakout was the initiation of a new rally that would continue this week. But no. This week price moved back below the breakout level, but strangely this failure did not develop into a more serious breakdown either. Price just continued to churn sideways,...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Bad Week for Gold and Crude

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote regarding SPY: "Consolidation may continue for a bit, and it is possible that price will move lower toward the point of the breakout and fill Tuesday's gap; however, the charts in all three time frames are bullish, and I favor a breakout to...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly/Monthly Wrap -- Seasonality Turning Bearish

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote: "My posture is to look for an up move next week, and as last week, a daily PMO bottom will be the first, if not infallible, clue that the market is done correcting. If an upside breakout follows, I will believe it." As it...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap 4/21/2017 -- Correction Over?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote, "The first necessary signal that the correction is over would be for the daily PMO (Price Momentum Oscillator) to turn up." That happened on Thursday, but there was no follow through on Friday due to, I believe, it being options expiration day, which tends...

READ MORE

MEMBERS ONLY

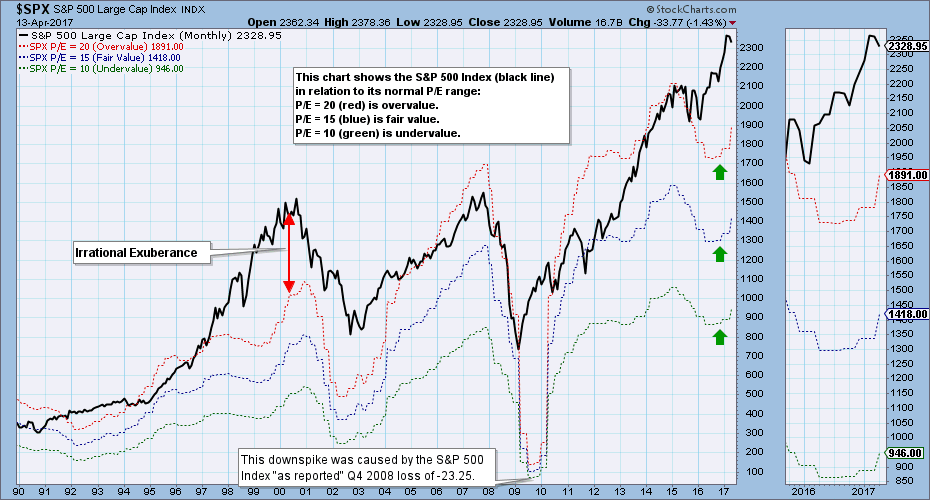

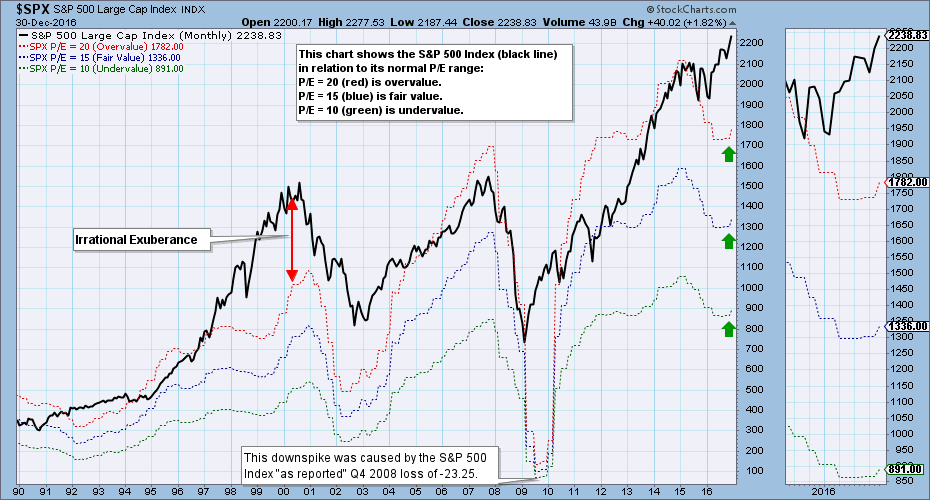

DecisionPoint Weekly Wrap 4/13/2017 -- Market Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings results for 2016 Q4 are in, and the market is still grossly overvalued. The chart below shows the S&P 500 Index (black line) in relation to where it would be if it were undervalued (green line), fair value (blue line), or overvalued (red...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap April 7, 2017

by Carl Swenlin,

President and Founder, DecisionPoint.com

*** IMPORTANT NOTE: We are making some changes to our DecisionPoint blogs and webinars starting on April 1st.Click here for more details. ***

Despite a negative reaction to Fed comments, and the U.S attack on a Syrian air base, the market held steady within the current corrective phase. The 10-minute...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap 3/31/17

by Carl Swenlin,

President and Founder, DecisionPoint.com

*** IMPORTANT NOTE: We are making some changes to our DecisionPoint blogs and webinars starting on April 1st. Click here for more details. ***

The DecisionPoint Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil,...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap 3/24/17

by Carl Swenlin,

President and Founder, DecisionPoint.com

*** IMPORTANT NOTE: We are making some changes to our DecisionPoint blogs and webinars starting on April 1st. Click here for more details. ***

Welcome to the DecisionPoint Weekly Wrap, where I make an end-of-week assessment of the internal condition, and trend of the stock market (S&P 500), the U....

READ MORE

MEMBERS ONLY

AAPL: Correction Due

by Carl Swenlin,

President and Founder, DecisionPoint.com

Apple (AAPL) has rallied +60% from its May 2016 low, which was also the the low for the previous bear market for AAPL. The price advance for the last month-and-a-half has been pretty vigorous, but the PMO (Price Momentum Oscillator) has topped and crossed down through its signal line, so...

READ MORE

MEMBERS ONLY

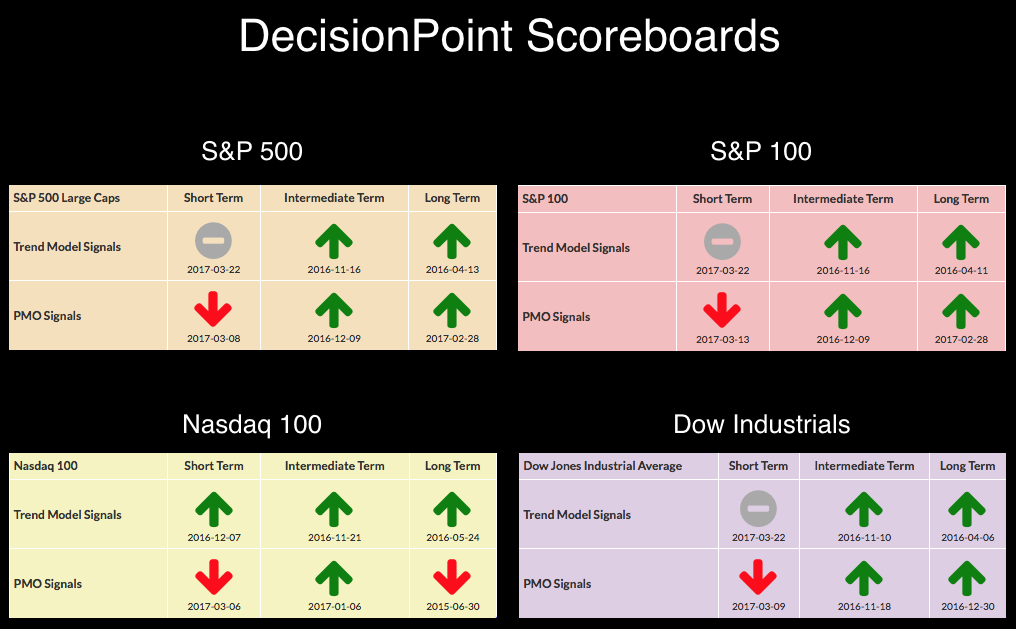

SPY: Short-Term Indicators Positive

by Carl Swenlin,

President and Founder, DecisionPoint.com

Trying to attribute every market up or down tick to news/fundamental events is a fool's errand, but every once in a while the connection between seems pretty obvious. The day after President Trump's address to congress, the market gapped up in response; however, it immediately...

READ MORE

MEMBERS ONLY

GOLD: Slight Breakdown

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday gold broke below the rising trend line that forms the bottom of a rising wedge pattern. A breakdown was expected because that is the normal and highly reliable resolution of most rising wedge patterns. The minimum downside target is 1180, but downside estimates for rising wedge patterns are...

READ MORE

MEMBERS ONLY

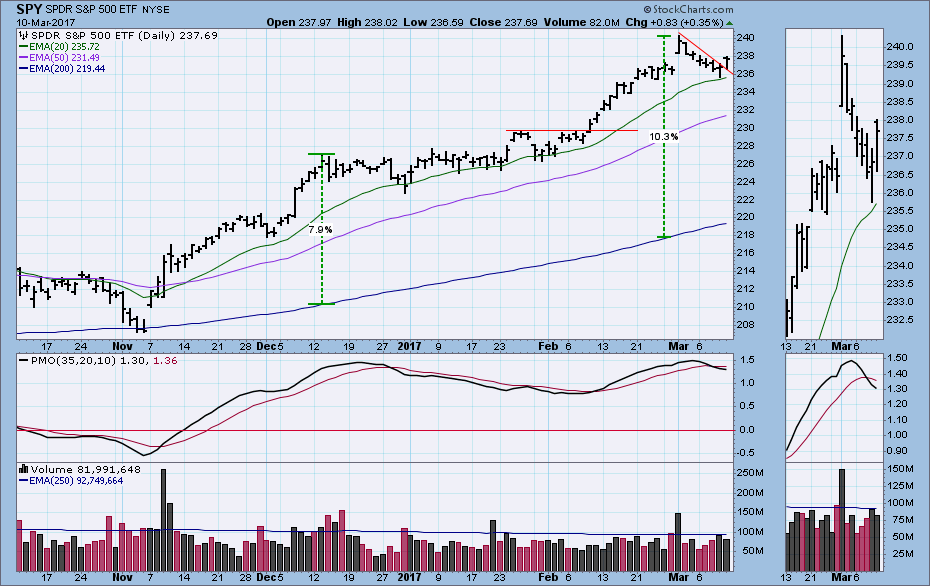

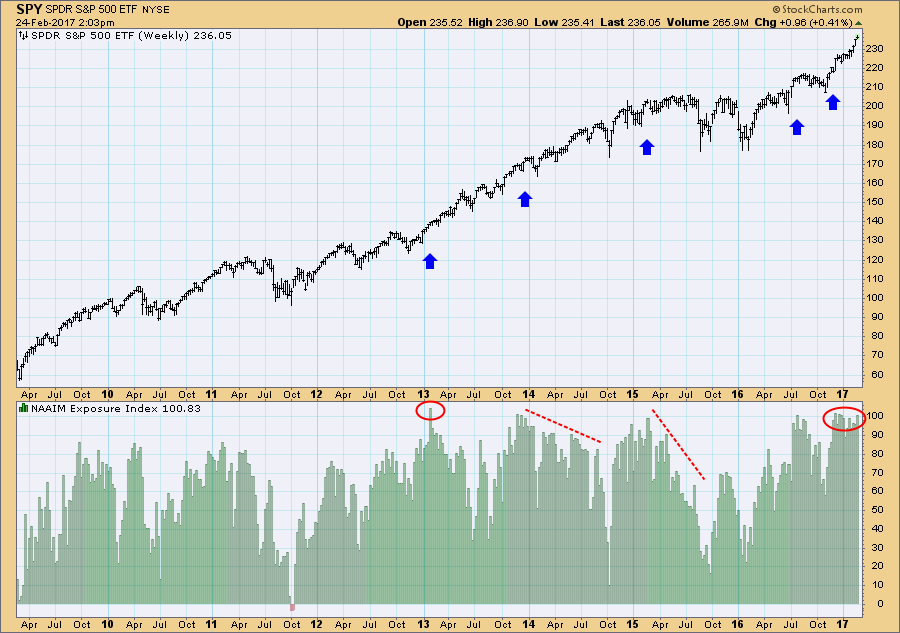

Sentiment: Investment Managers Very Bullish

by Carl Swenlin,

President and Founder, DecisionPoint.com

One of the sentiment indicators we follow is the Exposure Index (EI) for the National Association of Active Investment Managers (NAAIM). It is probably somewhat better than other measures of sentiment because it shows how professionals have actually deployed their assets. The far right of the chart shows a recent...

READ MORE

MEMBERS ONLY

SPY: Price Is Stretched

by Carl Swenlin,

President and Founder, DecisionPoint.com

While the 200EMA (exponential moving average) smooths daily prices over a long period of time and shows us the trend within that time frame, it also acts as a moving base line of price. As we watch daily prices depart from the 200EMA, we can get a sense of how...

READ MORE

MEMBERS ONLY

What Happened to the Correction?

by Carl Swenlin,

President and Founder, DecisionPoint.com

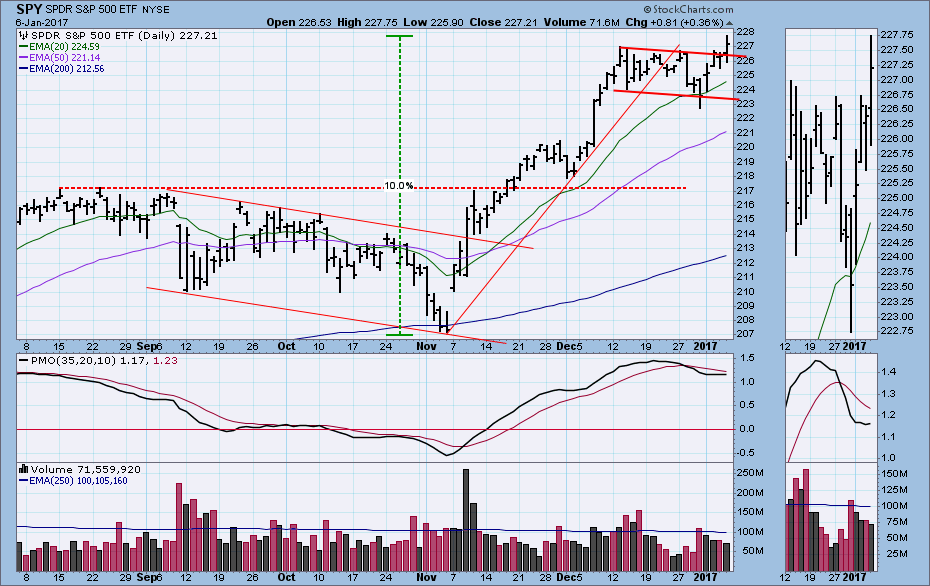

Just before Christmas I wrote an article saying I was expecting a correction or consolidation because our primary intermediate-term indicators had all topped. On the chart below we can see the annotations (down arrows) I made at the time, and we can see what actually happened. There was a small...

READ MORE

MEMBERS ONLY

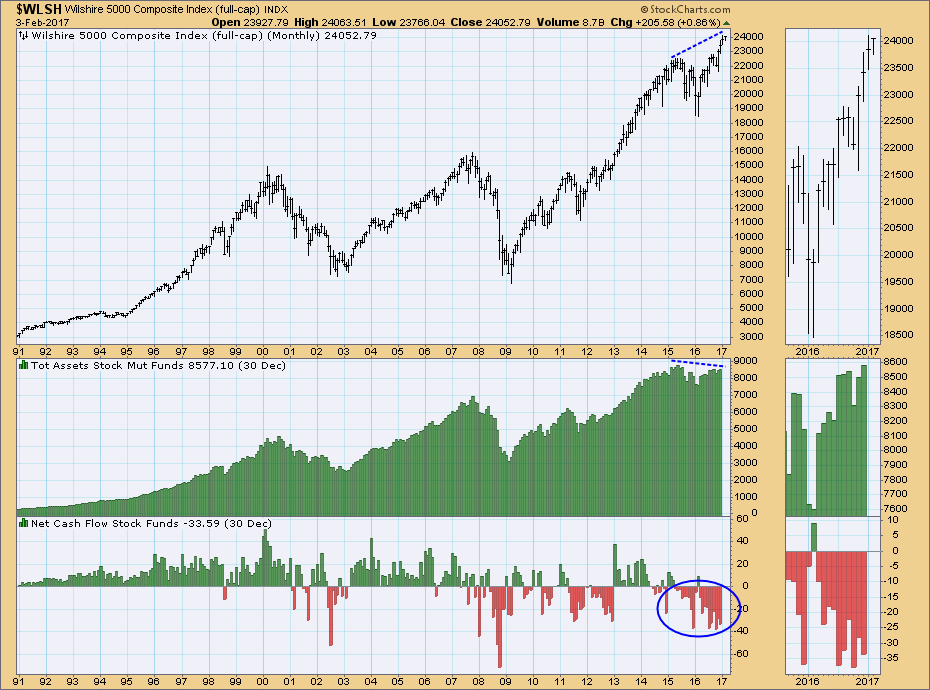

Net Cash Flow Going In Wrong Direction

by Carl Swenlin,

President and Founder, DecisionPoint.com

With some broad market indexes making record highs, one would think that total mutual fund assets would be following suit. But no. As of the end of December Total Stock Mutual Fund Assets were still below the record highs set in 2015, and are failing to confirm record price highs....

READ MORE

MEMBERS ONLY

Gold Rally Stumbles

by Carl Swenlin,

President and Founder, DecisionPoint.com

After correcting nearly -20% from the July 2016 top, gold rallied off the December low, hitting a rally high on Monday. Then it spent the rest of the week correcting, dropping below horizontal support set last year. It also dropped below the 20EMA and 50EMA, which action turned those EMAs...

READ MORE

MEMBERS ONLY

Dow Stocks in Bear Markets

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Dow Jones Industrial Average is clearly in a bull market, having made a strong move in November and December to new, all-time highs and coming within less than a half point of reaching 20,000; however, as I perused the charts of the 30 Dow components I found three...

READ MORE

MEMBERS ONLY

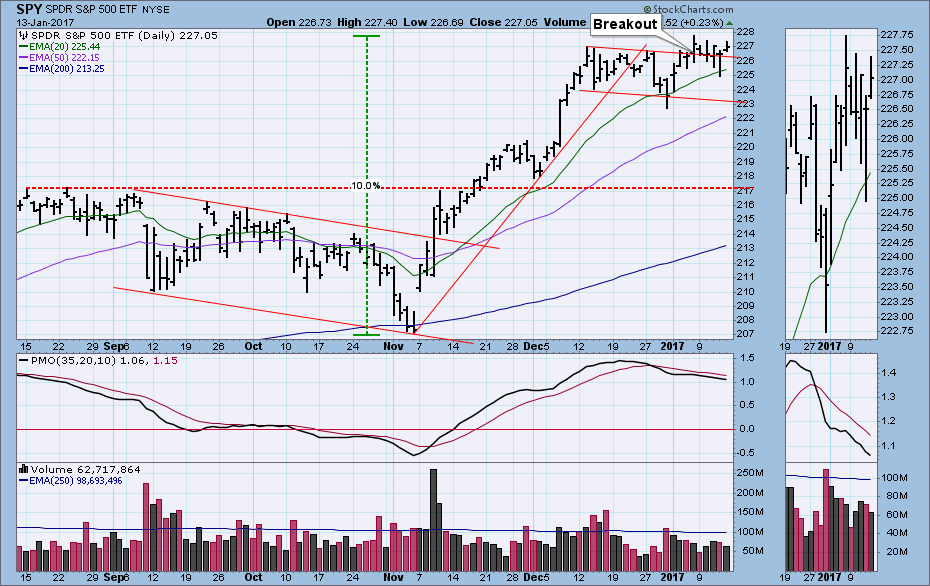

Market Action Changes Our Focus

by Carl Swenlin,

President and Founder, DecisionPoint.com

At the close of the prior week, a breakout from a flag formation had us questioning if the market was too overbought for the breakout to lead to higher prices. My conclusion was that there was plenty of room to the upside before our indicators got uncomfortably overbought. Brilliant! Unfortunately,...

READ MORE

MEMBERS ONLY

Does New Rally Have Good Technicals?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Two weeks ago I was looking for a price top. Strictly speaking, we got one, but the decline was short-lived (three days), and the low was the last low in a four-week flag formation. The new rally off that low was strong enough to fuel a breakout to new, all-time...

READ MORE

MEMBERS ONLY

2016 Q3 Earnings: Market Overvalued but Earnings Trend Favorable

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week S&P 500 preliminary earnings results for 2016 Q3 were in, and the market is still grossly overvalued. On the plus side, however, earnings turned up and are projected to move higher over the next year.

The chart above shows the S&P 500 Index (black...

READ MORE

MEMBERS ONLY

On Alert for a Top

by Carl Swenlin,

President and Founder, DecisionPoint.com

In the last few weeks the market has moved into a bullish pennant formation. In doing so it also violated the rising trend line on Thursday, but the trend line penetration has sideways, rather than sharply down, so I think the pennant carries more weight. Nevertheless, medium-term indicators are sufficiently...

READ MORE

MEMBERS ONLY

Bears Inside the Bull

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote about the ongoing bull market -- the secular bull market, beginning in 2009, and, displayed on the chart, the cyclical bull that began in February of this year. But in spite of a broad market rally, individual sectors are not uniformly bullish. Of the ten sectors...

READ MORE

MEMBERS ONLY

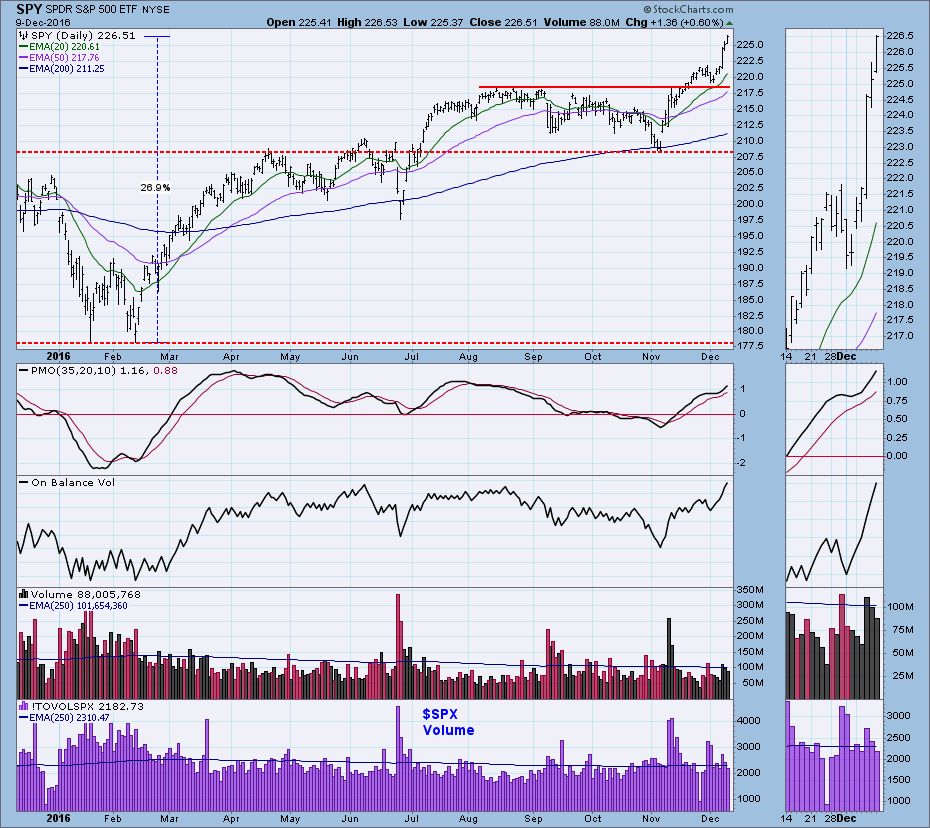

SPY: Bull Market Seems Secure

by Carl Swenlin,

President and Founder, DecisionPoint.com

In a post-Brexit article I wrote back in July I concluded that we were in a cyclical bull market that launched off the February lows. At the time there had been a decisive breakout above important resistance at about SPY 208.00. From there the campaign-burdened market meandered sideways until...

READ MORE

MEMBERS ONLY

SPY: Is the Trump Rally Pausing or Over?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market has rallied about +6.5% from the November low, but less than half of that can be attributed to the election results. As of the close on Tuesday, November 8, it was widely believed that Clinton would be the winner. When the opposite result emerged, the market rallied...

READ MORE

MEMBERS ONLY

GOLD: Bear Market

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday gold entered a bear market when the 50EMA crossed down through the 200EMA. The preceding bull market began with a rally off the December 2015 lows and hit its high in July after a more than +30% advance. From there it went into correction mode for five months,...

READ MORE