MEMBERS ONLY

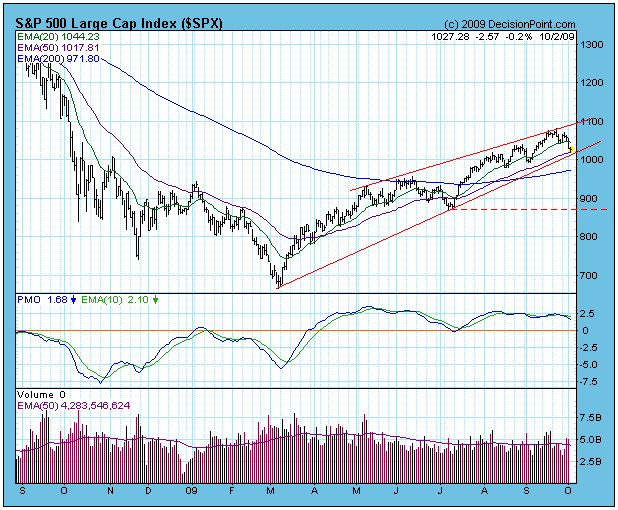

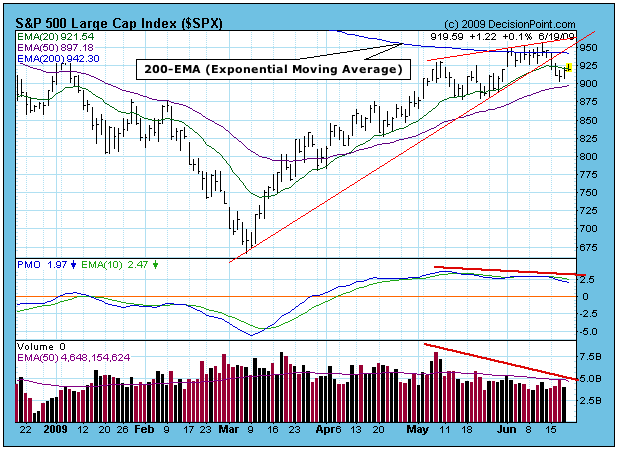

SUPPORT STILL HOLDS CORRECTING PRICES

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market has begun another correction, but so far no serious technical damage has been done. The S&P 500 remains within the grasp of an ascending wedge formation, the dominant feature on the daily chart. On Friday prices hit their lowest level of the correction, but they remained...

READ MORE

MEMBERS ONLY

BULL MARKET RULES STILL APPLY

by Carl Swenlin,

President and Founder, DecisionPoint.com

For weeks we have been looking for a correction, and a time or two we experienced some trepidation that the bull market might be over, but all the market has done is produce a series of minor pullbacks. At the present it is trying to break out of a rising...

READ MORE

MEMBERS ONLY

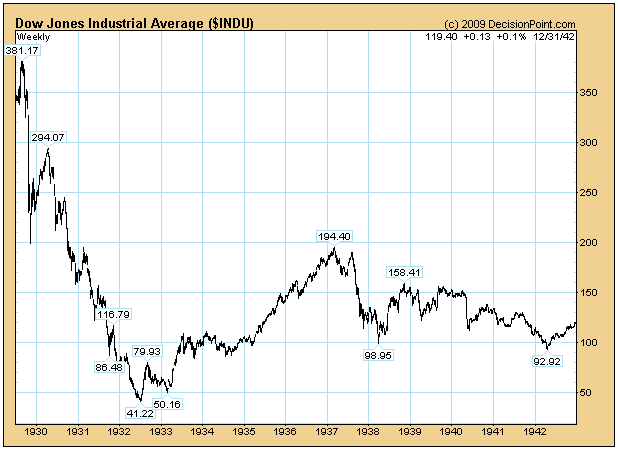

LOOKING BACK

by Carl Swenlin,

President and Founder, DecisionPoint.com

I continue to get mail from people who question how it is possible to be bullish in the face of the worst fundamentals since the Great Depression, so I thought it would be useful to look at a chart of the 1929 Crash and the decade that followed it.

Squeezed...

READ MORE

MEMBERS ONLY

LONG-TERM BUY SIGNAL

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Tuesday of this week our long-term model for the S&P 500 switched from a sell to a buy signal. While it is a simple model -- the signals are generated by the 50-EMA crossing over the 200-EMA -- it can also be very effective, capturing a gain...

READ MORE

MEMBERS ONLY

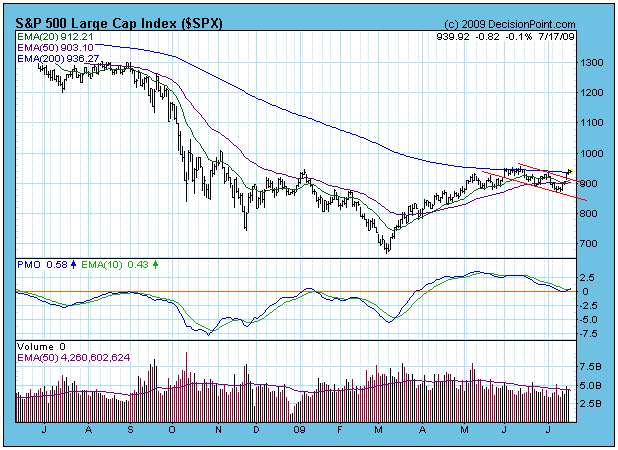

HOPING FOR A PULLBACK

by Carl Swenlin,

President and Founder, DecisionPoint.com

Since the price lows of early-July, the market has moved relentlessly higher, penetrating the important resistance posed by the 200-EMA. When this rally began, a narrow window of fairly low-risk opportunity was presented. Those who missed it are now hoping that prices will pull back far enough to provide another...

READ MORE

MEMBERS ONLY

BREAKDOWN BECOMES BEAR TRAP

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I presented an alternate scenario to the head and shoulders breakdown and projected decline:

"While the bearish case seems strongest at this point, a bullish outcome is not impossible. Bullish forces have weakened, but it is not at all clear that the bear market has resumed. A...

READ MORE

MEMBERS ONLY

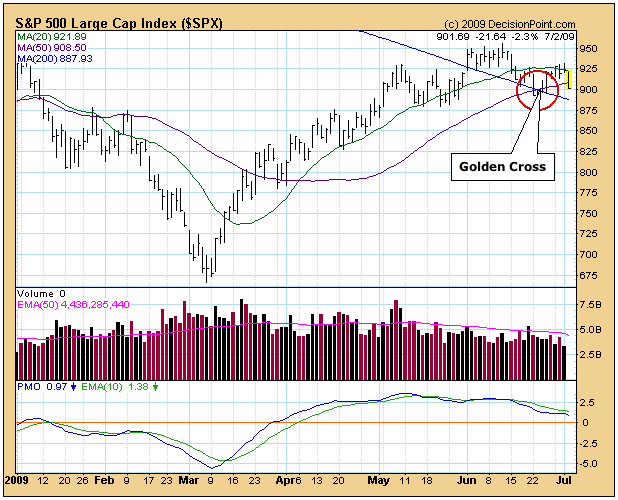

GOLDEN CROSS

by Carl Swenlin,

President and Founder, DecisionPoint.com

About a week ago the S&P 500 50-SMA (simple moving average) crossed up through the 200-SMA. (See chart below.) This is known as a "Golden Cross" because it is interpreted by many as a sign that the market is turning long-term bullish. Of course, this generated...

READ MORE

MEMBERS ONLY

BREAKDOWN AND SNAPBACK

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Monday, in predictable fashion, prices broke down from the ascending wedge pattern we've been watching. Then, after a correction of 5%, prices began a snapback move up toward the recently violated support line (now overhead resistance). Prior to the breakdown, you will notice that overhead resistance was...

READ MORE

MEMBERS ONLY

IMPORTANT RESISTANCE ENCOUNTERED

by Carl Swenlin,

President and Founder, DecisionPoint.com

On the chart below we could attach a callout window to the rally that began in March and entitle it "Bull Market Rules Apply". Bull market rules generally mean that bullish setups will almost always resolve positively, and that bearish setups will usually fail to execute, because the...

READ MORE

MEMBERS ONLY

REVERSE HEAD AND SHOULDERS FORMING?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The ascending wedge pattern we discussed last week has broken down as we expected. Considering that the market has rallied nearly 40%, I think it is reasonable to expect more corrective action.

The next development to watch is the possible formation of a reverse head and shoulders. We currently have...

READ MORE

MEMBERS ONLY

STEADY ADVANCE PERSISTS

by Carl Swenlin,

President and Founder, DecisionPoint.com

I have been referring to the slow, steady advance of the last few weeks as a "correction". To be more specific, it is a "running correction", which means that prices have moved higher as indicators have chopped sideways and lower. This is evident on the chart...

READ MORE

MEMBERS ONLY

PULLBACK IS LIKELY, BUT NOT GUARANTEED

by Carl Swenlin,

President and Founder, DecisionPoint.com

The bear market rally has continued to move prices higher, and the strength is greatest in the smaller-cap stocks. For example, the S&P 500 has rallied 30% from the March lows, but the Rydex S&P Equal Weight ETF (RSP) has advanced 45%. Looking through the list...

READ MORE

MEMBERS ONLY

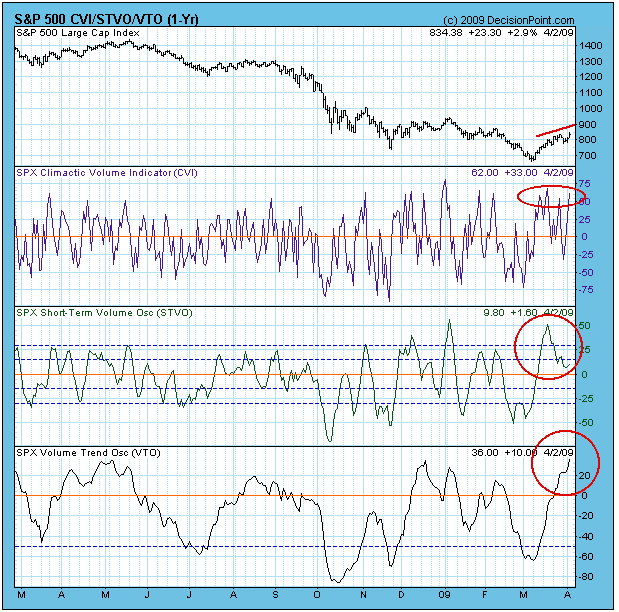

RALLY CONTINUES

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last Friday I said we should be looking for a short-correction because the CVI (Climactic Volume Oscillator) was very overbought, and prices were approaching overhead resistance. There was a very small correction, but prices kept moving higher, while the CVI zigzagged at overbought levels. We also observed the STVO (Short-Term...

READ MORE

MEMBERS ONLY

SHORT-TERM TOP

by Carl Swenlin,

President and Founder, DecisionPoint.com

Quite a few years ago I used to write a daily newsletter, but I decided to give it up because it got tiresome trying to invent new ways to say the same thing over and over. More important, having to form an opinion on the market every single day, especially...

READ MORE

MEMBERS ONLY

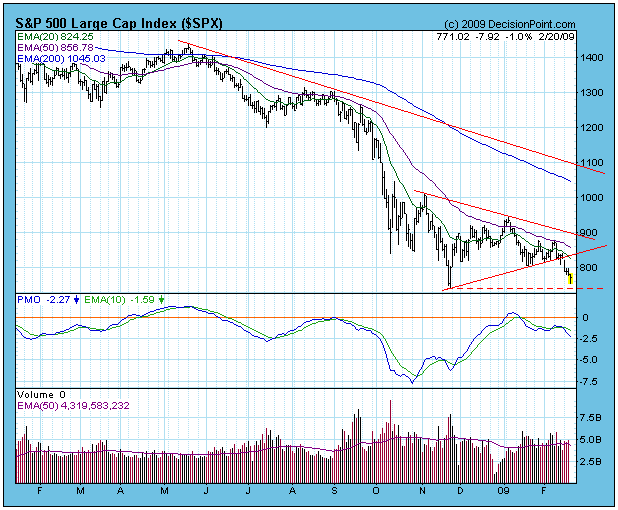

BREAKDOWN!

by Carl Swenlin,

President and Founder, DecisionPoint.com

At the end of last week the S&P 500 had declined to and had settled on the support created by the November lows. It was poised to either rally and lock in a double bottom, or break down. On Monday prices broke down through support, and by Thursday&...

READ MORE

MEMBERS ONLY

RETEST

by Carl Swenlin,

President and Founder, DecisionPoint.com

The long-awaited retest of the November lows has finally arrived. The S&P 500 is still slightly above that support, but the Dow has penetrated it. Even though every rally since November has been greeted with intense hope of a new advance that would end the bear market, the...

READ MORE

MEMBERS ONLY

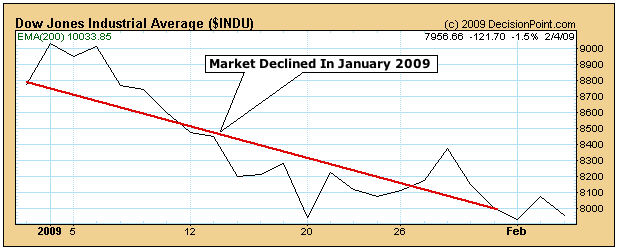

JANUARY FORECASTS A DOWN YEAR

by Carl Swenlin,

President and Founder, DecisionPoint.com

Research published by Yale Hirsch in the "Trader's Almanac" shows that market performance during the month of January often predicts market performance for the entire year. The January "barometer" has been particularly prescient in odd years (the first year of a new Congress), with...

READ MORE