MEMBERS ONLY

This Is What Overbought Looks Like

by Carl Swenlin,

President and Founder, DecisionPoint.com

It occurred to me that some of our primary indicators have created a teachable moment. Specifically, our short-term and intermediate-term indicators are both at fairly extreme overbought levels, and now is a good time to talk about what that means.

The Swenlin Trading Oscillators for breadth and volume (STO-B and...

READ MORE

MEMBERS ONLY

DP Trading Room: Gold vs. Gold Miners & Silver

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl talks about the market conditions and trends, then dives into the metals and discusses possible entries. He explains how to use premium/discounts to determine sentiment for Gold and Silver, then covers yield inversions. Erin presents the sector...

READ MORE

MEMBERS ONLY

DP Trading Room: End of the Bear Market?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl takes questions from the audience on his opinions regarding Silver, Gold and what he's looking for as an end to the bear market. Meanwhile, Erin looks under the hood at leading sectors Technology and Consumer Discretionary,...

READ MORE

MEMBERS ONLY

DP Trading Room: Energy Ready to Heat Up?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl and Erin cover the indicators and live market action. Erin takes a deep dive into the Energy sector, among others that appear promising. Stocks reviewed include PayPal (PYPL), Carl's take on Amazon (AMZN) and Apple (AAPL)...

READ MORE

MEMBERS ONLY

The DP Trading Room: Bear Market Special!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the session with his market overview, spending extra time on Crude Oil. He answers quite a few viewer questions, including a discussion of his famous P/E chart, and elaborates on questions regarding Energy. He and Erin...

READ MORE

MEMBERS ONLY

Sectors Don't Look So Bad - "Bear Market Special" Coming to a Close!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

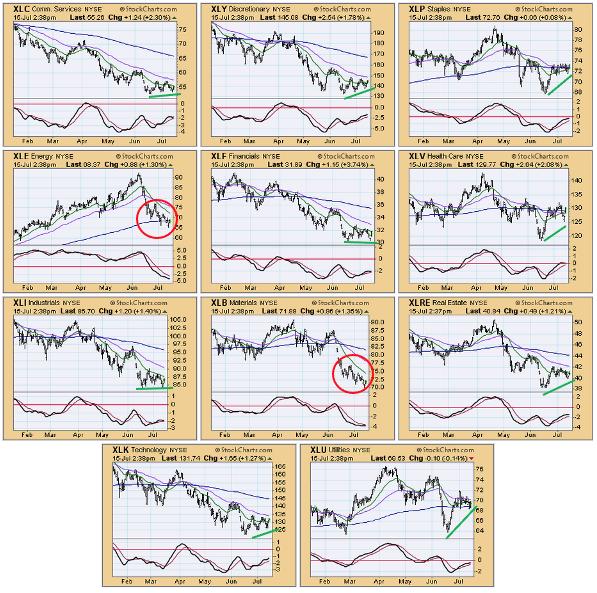

While we have negative long-term expectations for the market, we notice that most of the eleven S&P sectors are looking rather bullish intermediate-term. Only two sectors -- Energy and Materials -- have been making new lows, but the rest are either showing rising bottoms from the June low...

READ MORE

MEMBERS ONLY

The DP Trading Room: NVDA at a Buy Point?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

Carl and Erin present the premiere of StockCharts TV's new series, The DecisionPoint Trading Room! Carl takes questions on options, his favorite indicators and market trend following. Erin deep dives into Technology, Healthcare and Real Estate, plus covers symbol requests.

This video was originally recorded on July 11,...

READ MORE

MEMBERS ONLY

2022 Q1 Earnings Are In and Valuations Are No Longer Extreme

by Carl Swenlin,

President and Founder, DecisionPoint.com

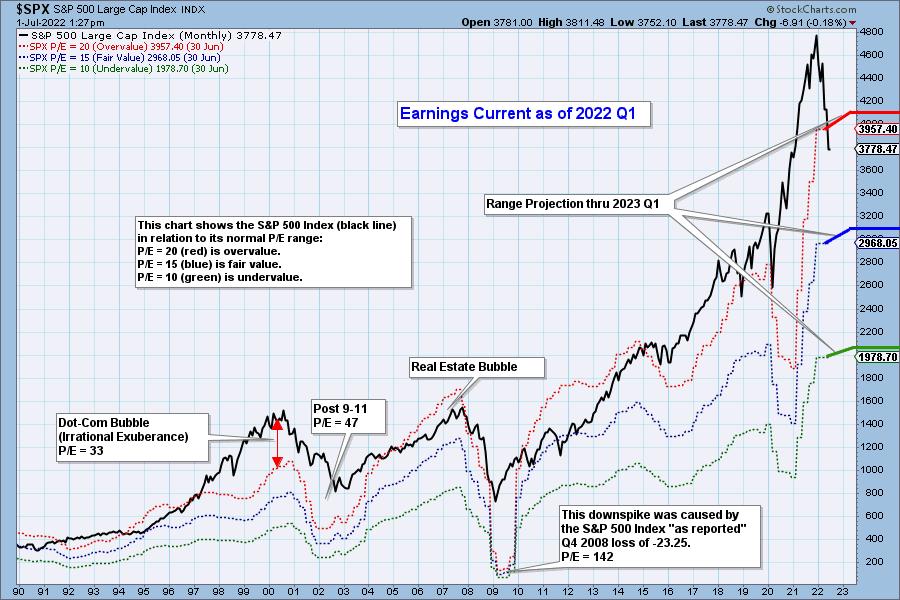

The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an...

READ MORE

MEMBERS ONLY

Golden Cross and Silver Cross Indexes Deeply Oversold

by Carl Swenlin,

President and Founder, DecisionPoint.com

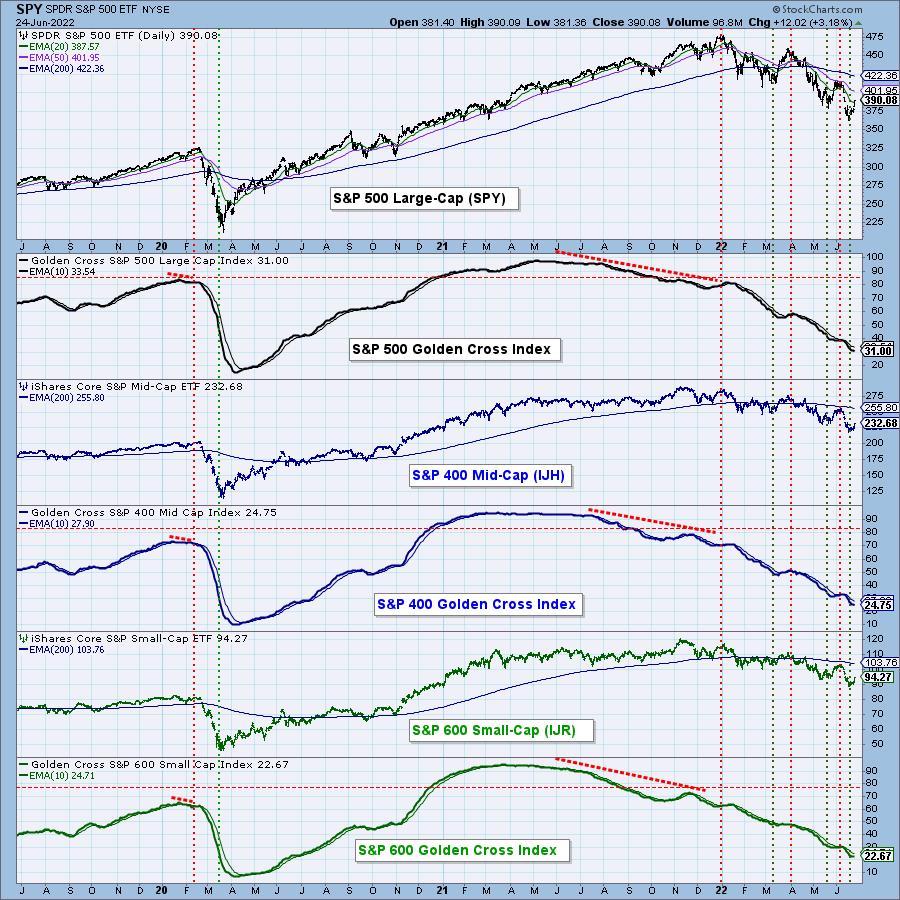

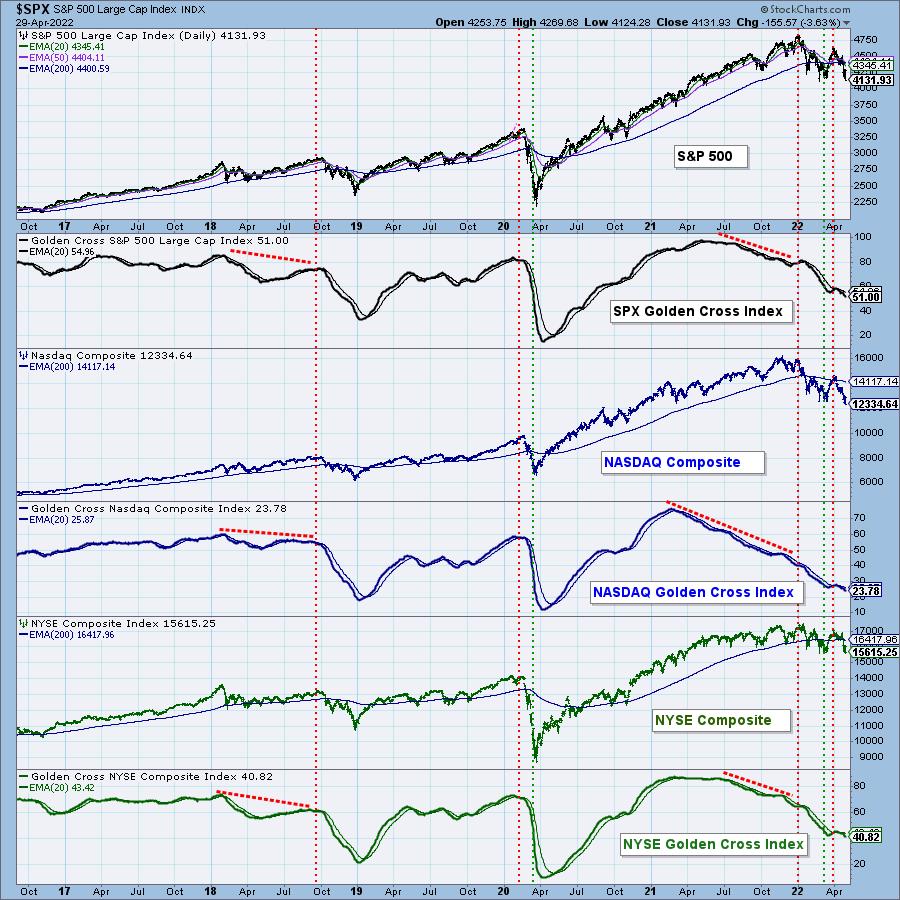

When the 50-EMA crosses up through the 200-EMA, it is commonly known as a Golden Cross, because it infers a positive long-term price trend. Our Golden Cross Index (GCI) shows the percentage of stocks in a given index with a golden cross condition. This chart shows the GCI readings for...

READ MORE

MEMBERS ONLY

A Bad Day for Natural Gas (UNG)

by Carl Swenlin,

President and Founder, DecisionPoint.com

"The best laid schemes o' mice an' men. Gang aft a-gley".

--Robert Burns

Or as a Yiddish saying goes: "Man plans, God laughs." There is no better example of this than what has happened with natural gas this month. With energy supplies being challenged...

READ MORE

MEMBERS ONLY

DP TV: Bitcoin Crash, SPY in Ruins - Now What?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin spend time discussing not only the current market chaos, but also looking at history as a guide. They give their perspectives on two prior bear markets and what it could mean for the markets now. Carl talks about the possible end of...

READ MORE

MEMBERS ONLY

DP TV: Digestion... or Indigestion?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss their short-term bullish expectations and whether they are still valid under current market conditions. Carl covers "breadth with depth" indicators for Nasdaq, NYSE and Mid- and Small-caps. Erin dives into two sectors "under the hood" to find...

READ MORE

MEMBERS ONLY

"Those Who Do Not Learn from History . . .

by Carl Swenlin,

President and Founder, DecisionPoint.com

. . . are doomed to repeat it." The essence of that pithy observation is generally attributed to writer and philosopher George Santayana. I don't think it is usually applied to the stock market, but it should be, and looking at historical charts is the best way to learn from...

READ MORE

MEMBERS ONLY

Great Rally But Lacked Conviction

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following is a complimentary copy of Friday's subscriber-only DP Weekly Wrap. Want this content in your email box every market day? Subscribe to the DP Alert without delay!

It was a volatile trading week, with investors breathing a sigh of relief on today's positive close....

READ MORE

MEMBERS ONLY

DP TV: Downside Targets for FAANG+ and Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl walks viewers through the FAANG+ mega-cap stocks. Using earnings per share and P/E, Carl shows how to find "fair value" support. Erin discusses oversold indicators now versus 2020 bear market low. She then analyzes technical support levels on the major indexes...

READ MORE

MEMBERS ONLY

What the Heck Just Happened?!!

by Carl Swenlin,

President and Founder, DecisionPoint.com

Yesterday's monster rally was not expected by most people, me included, and it left me a little disoriented. For weeks the Fed has been expected to raise interest rates by 50 basis points, and the realization of that expectation should have caused the market to sell off, shouldn&...

READ MORE

MEMBERS ONLY

DP TV: Time for Inverse ETFs?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

How low can we go? On this episode of DecisionPoint, Carl walks viewers through the FAANG+ mega-cap stocks. Using earnings per share and P/E, Carl shows how to find "fair value" support. Erin discusses oversold indicators now versus 2020 bear market low. She then analyzes technical support...

READ MORE

MEMBERS ONLY

Long-Term Participation at One-Year Lows and Bear Market Levels

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Golden Cross Index (GCI) and Silver Cross Index (SCI) give a much better picture of market breadth than any advance-decline based indicator. And, rather than breadth, we think of them as giving an accurate measure of participation -- the percentage of stocks participating in the up or down pressures...

READ MORE

MEMBERS ONLY

Death Cross for Technology Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following is an excerpt from this week's subscriber-only DecisionPoint ALERT Weekly Wrap.

Today, the Technology Sector (XLK) 50-day EMA crossed down through the 200-day EMA, effecting what is widely (and dramatically) known as a Death Cross. In our vernacular, we call it a LT Trend Model SELL...

READ MORE

MEMBERS ONLY

DP TV: Carl's Take on Interest Rate Inversions

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl starts off the program with his famous "Grab Bag" addition. He reveals his thoughts on the current yield inversions. Is he worried? Carl reviews the exclusive DecisionPoint indicator sets and his thoughts on Bitcoin, Oil, Bonds, Dollar and Gold. Erin then gives...

READ MORE

MEMBERS ONLY

DP TV: Carl's Hedge on Interest Rates

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Erin opens the show by letting viewers know that, in the DP Free Trading Room, she had been asked about hedging rising interest rates. Carl reminds viewers of his hedge against rising rates with this ETF he presented weeks ago. In his "Grab Bag&...

READ MORE

MEMBERS ONLY

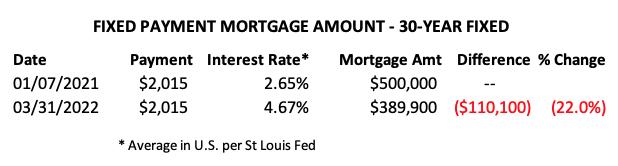

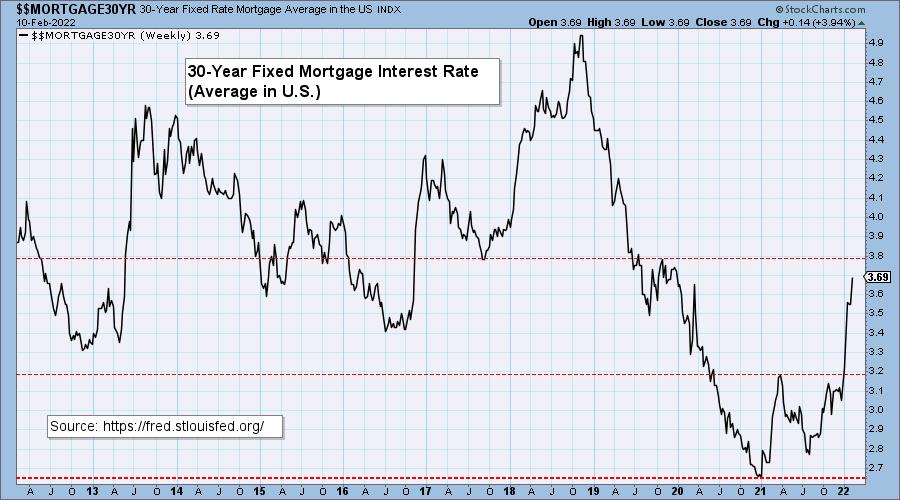

Revisiting the Vertical Rise in Mortgage Rates

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following is an excerpt from this week's subscriber-only DecisionPoint ALERT Weekly Wrap.

We have been commenting on mortgage rates for several months, and this week we finally saw a report on Fox Business that reported on the problem of rising mortgage rates. Also, for a couple of...

READ MORE

MEMBERS ONLY

Bear Market Breakout?

by Carl Swenlin,

President and Founder, DecisionPoint.com

At DecisionPoint.com we have been operating on the assumption that we are in a bear market. We won't know for sure until the market declines 20% or more, but that seems a bit late to begin responding to what appears to be bear market action.

The market...

READ MORE

MEMBERS ONLY

DP TV: Carl Explains Unadjusted Data Charts

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl opens the show with a look at the Chevron (CVX) chart he discussed last week. He realized an error in his analysis and decided to give us some instruction on how to use unadjusted data on StockCharts.com. He talks about the implications of...

READ MORE

MEMBERS ONLY

DP TV: Where's the Strength? Hot Industry Groups!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl opens the show with his "Grab Bag" and a deep dive into the Technology sector. How far could Apple (AAPL) fall? Carl gives us his take on options expiration and reviews DecisionPoint indicators. Erin walks viewers through the short and intermediate-term Relative...

READ MORE

MEMBERS ONLY

DP TV: Carl's 70-50 Chart Pattern Rule

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl takes center stage, bringing his "70-50 Chart Pattern Rule" -- experienced-based analysis of determining follow-through on a chart pattern -- to the table. He walks viewers through the mega-cap stocks, the FAANG, as well as Tesla (TSLA). He reviews the status of...

READ MORE

MEMBERS ONLY

Technology Sector and Tech Indexes in "Official" Bear Markets

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

It occurred to us, after we discussed the "Death Crosses" (50-day EMA dropping below the 200-day EMA) on the NDX and Nasdaq 100 in yesterday's subscriber-only DecisionPoint Alert, that we should investigate the actual damage done. The tech-heavy NDX and Nasdaq 100 are in bear markets,...

READ MORE

MEMBERS ONLY

DP TV: "Russia Effect" on Energy and Solar

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl opens with a look at the Russia ETF (RSX) to help viewers visualize the impact the war sanctions are having on the Russian market. Not only is Russia's market affected, but the effects are pushing Crude Oil to the roof, so the...

READ MORE

MEMBERS ONLY

Six Bear Markets and Five Bull Markets In Under Three Years

by Carl Swenlin,

President and Founder, DecisionPoint.com

Periodically, to scare the kiddies we bring out the boogie man chart of the 1929-1932 Bear Market. It is a stunning picture upon which I have gazed many times. A decline of nearly ninety percent in just under three years. Recently,it occurred to me that there is much more...

READ MORE

MEMBERS ONLY

DP TV: This Indicator Called the 2020 Bear Market Low

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl discusses the three and half "Bubbles" that have been getting bigger and considers what pins might pop them. He also discusses the DecisionPoint outlook on the market, a possible downside exhaustion climax and his thoughts on Gold. Erin shows you the powerful...

READ MORE

MEMBERS ONLY

Squeezing the Real Estate Bubble

by Carl Swenlin,

President and Founder, DecisionPoint.com

In a January 20 article Jeremy Grantham proposed that there are currently bubbles in housing, equities, and bonds, and a half-bubble in commodities. In this article I will only address the current housing bubble. An immediate response might be, "What bubble?" We continue to hear how inventories are...

READ MORE

MEMBERS ONLY

DP TV: Whipsaw Whiplash!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl gives us his perspective on what today's late-day whipsaw means for the market in the short- and intermediate-term. There were two new sector neutral signals and two more are ready to lose intermediate-term buy signals as well. Erin gives us her analysis...

READ MORE

MEMBERS ONLY

2021 Q3 Earnings Perspective

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an...

READ MORE

MEMBERS ONLY

DP TV: Six Important Stocks in Bear Market

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl takes the reins and leads our discussion, examining how the trading environment has changed over the years and what that means for today's markets. He analyzes the top 10 market cap stocks in the S&P 500 or the "S&...

READ MORE

MEMBERS ONLY

DP TV: Participation Sickly Across the Board

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, after reviewing the current market conditions and price charts, Carl shares a new spreadsheet summary that displays the Silver Cross Index (SCI) and Golden Cross Index (GCI) percentages for all of the sectors and major markets. He discusses the underlying fissures in the foundation. Erin...

READ MORE

MEMBERS ONLY

DP TV: Nasdaq "Under the Hood"

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl reviews our exclusive DecisionPoint indicators, followed by an analysis of Bitcoin, 10-Year Treasury Yield, Bonds, Gold, Crude Oil and the Dollar. This week, he talks about participation using the Golden Cross Index (GCI) and Silver Cross Index (SCI) across the broad market indexes. Spoiler...

READ MORE

MEMBERS ONLY

DP TV: Is Sentiment Bearish Enough?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, after Carl reviews the SPY and DecisionPoint indicators, Erin walks viewers through the sector CandleGlance with Carl's comments. They then roll into their Sentiment charts (put/call ratio, NAAIM Exposure and Rydex Ratio) and discuss whether sentiment was bearish enough for a market...

READ MORE

MEMBERS ONLY

DP TV: Market Bias Bearish in All Timeframes

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl walks viewers through the broad markets using the Golden Cross Index and Silver Cross Index. As part of the indicator review today, Carl and Erin discuss how to determine market bias using participation and the Golden Cross/Silver Cross Indexes. Currently, the bias is...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Gray Swan? - Black Friday/Cyber Monday Sale is ON!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

(Our holiday gift to you... today's ChartWatchers article is a reprint of today's subscriber-only DP Weekly Wrap.)

Today, it was announced that we are faced with another COVID variant. This was not exactly a "black swan" event, something no one imagined, but maybe we...

READ MORE

MEMBERS ONLY

DP TV: Focus on Defensive Utilities

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl walks viewers through the market and the DecisionPoint indicators on the broad markets, as well as the S&P 400/600. Get his thoughts on shrinking participation! He covers 10-year yield and long Bonds (TLT), along with Bitcoin, Crude Oil, the Dollar and...

READ MORE