MEMBERS ONLY

Potential Upside for Crude Oil

by Carl Swenlin,

President and Founder, DecisionPoint.com

Earlier this week I filled my gas tank at a cost of $4.65 per gallon, up $0.25 from the last fill-up. That's the way it is in Redlands, California, and it got me to wondering how high prices might go. That, of course, depends mostly upon...

READ MORE

MEMBERS ONLY

DP TV: Materials Breakout! Bullish ETFs/Stocks!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl enlightens us on the current market conditions and zeros in on Bitcoin, Gold, Oil and Bonds. Tesla (TSLA) and Nvidia (NVDA) were in the news so Carl gives us his take. The Materials sector (XLB) broke out above resistance and has brought plenty of...

READ MORE

MEMBERS ONLY

DP TV: Is Natural Gas Prepping for a Reversal?

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this episode of DecisionPoint, Carl and Erin give you the scoop on where the SPY might be headed based on exclusive DecisionPoint indicators. Carl also reviews Gold Miners and Bitcoin, as well as Gold, Dollar, Crude and Bonds. Erin queues up the sector CandleGlance to search for strength and...

READ MORE

MEMBERS ONLY

Is Market Melt-Up Possible?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Lately I have been seeing many TV pundits predicting a market melt-up, so let's take a look at participation and see if there is a set-up compatible with that notion. Surely, the rally from the early-October lows is a good start on a melt-up, but the recent new...

READ MORE

MEMBERS ONLY

DP TV: Utilities is a Sleeper Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl opens the show with his take on the current market rally and reviews all of the "under the hood" indicators on the SPY. Carl and Erin comment on the health of all of the sectors. Erin takes a deep dive into the...

READ MORE

MEMBERS ONLY

Mortgage Rates are Rising - This Chart Says They Will Move Higher Still

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

(This is an excerpt from Thursday's (10/14) DecisionPoint Alert)

We want to watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller...

READ MORE

MEMBERS ONLY

2021 Q2 Earnings: Market Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an...

READ MORE

MEMBERS ONLY

DP TV: Sky's the Limit on Energy and Oil ETFs

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl covers the major markets with a peek at mid- and small-cap ETFs. Indicators are positive, so certainly a bullish bias. There were two new IT Trend Model signal changes on XLE and XLU. Additionally, Carl and Erin review the Financial sector "under the...

READ MORE

MEMBERS ONLY

Three Climax Days This Week That Were Right On

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

Climax analysis is something unique to DecisionPoint and we've found that "climax days" are highly accurate in determining market bottoms and tops in the very short term.

A climax is a one-day event when market action generates very high readings in (primarily) breadth and volume indicators....

READ MORE

MEMBERS ONLY

DP TV: FAANG+ Safety Net Gone!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin and Carl concentrate on what could be a Downside Exhaustion Climax. Carl covers off the broad markets and indicators with special attention to a possible exhaustion. Will it form a solid market bottom? The FAANG+ stocks (top 10 cap-weighted SPX stocks) were already showing...

READ MORE

MEMBERS ONLY

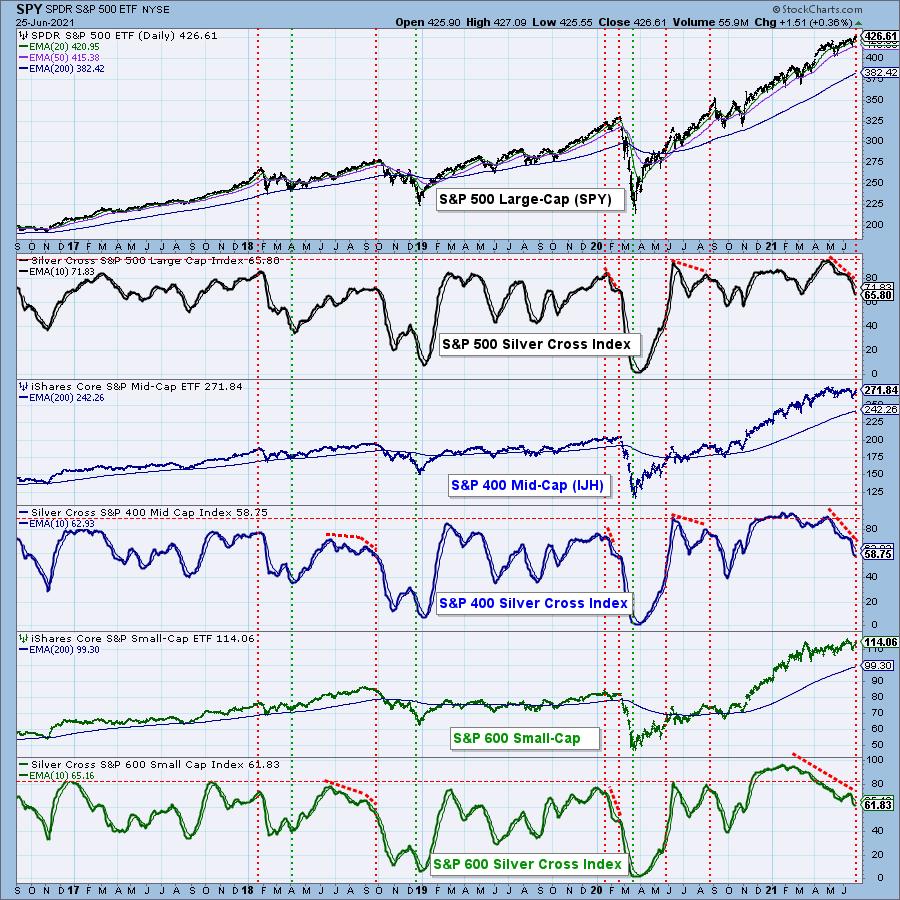

Participation Somewhat Improved, But Still Poor

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

When the 20-EMA crosses up through the 50-EMA, we consider it to be an intermediate-term BUY signal (aka Silver Cross, as opposed to the Golden Cross, to be discussed later). A few years ago, we developed the Silver Cross Index (SCI), which shows the percentage of stocks in a given...

READ MORE

MEMBERS ONLY

DP TV: Strong Industry Groups Right Now

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin turn the agenda upside down! Erin begins the show talking about three industry groups that have been showing new strength and a few stocks to review within those industry groups. Her "Diamond of the Week" takes advantage of momentum shifts...

READ MORE

MEMBERS ONLY

DP TV: Stealth Correction!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl returns to the show and brings an interesting concept to share. Carl examines DP indicators and how they are confirming a stealth correction, as suggested by David Keller. To prove his point, he reviews stocks within the Dow 30 that did not have their...

READ MORE

MEMBERS ONLY

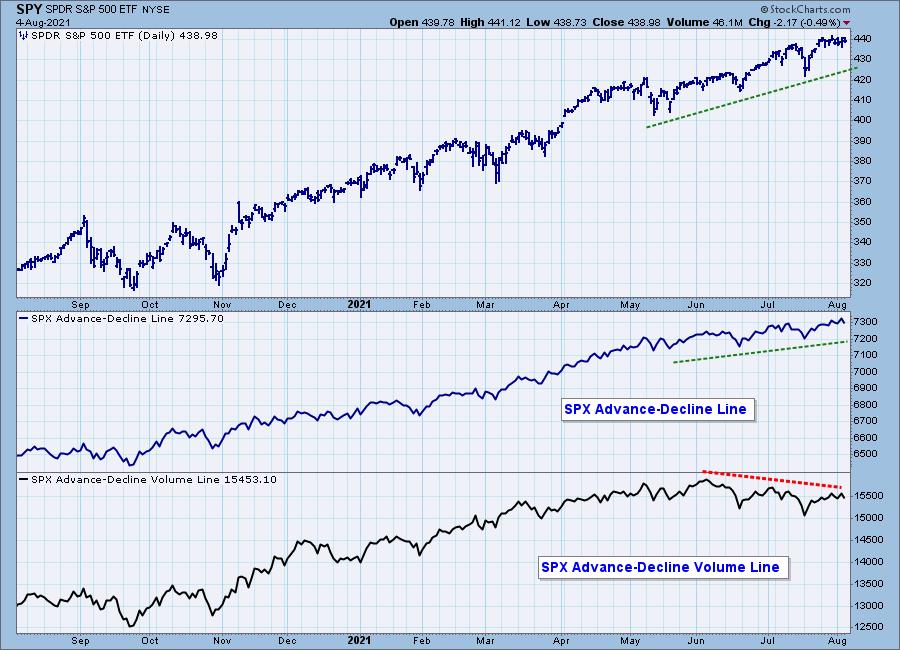

Better Breadth Indicators

by Carl Swenlin,

President and Founder, DecisionPoint.com

The other day, I was looking at the S&P 500 version of the Advance-Decline (A-D) Line, which tracks the cumulative daily advances minus declines for the SPX components. We can see that it has been confirming the market's advance for months, with a steady stream of...

READ MORE

MEMBERS ONLY

DP TV: Under the Hood - Sector Strength and Weakness

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl gives us his analysis of today's sell-off and discussed today's Downside Exhaustion Climax, showing us what to expect from this important signal and how to identify market climaxes. Erin takes a look "under the hood" at sectors that...

READ MORE

MEMBERS ONLY

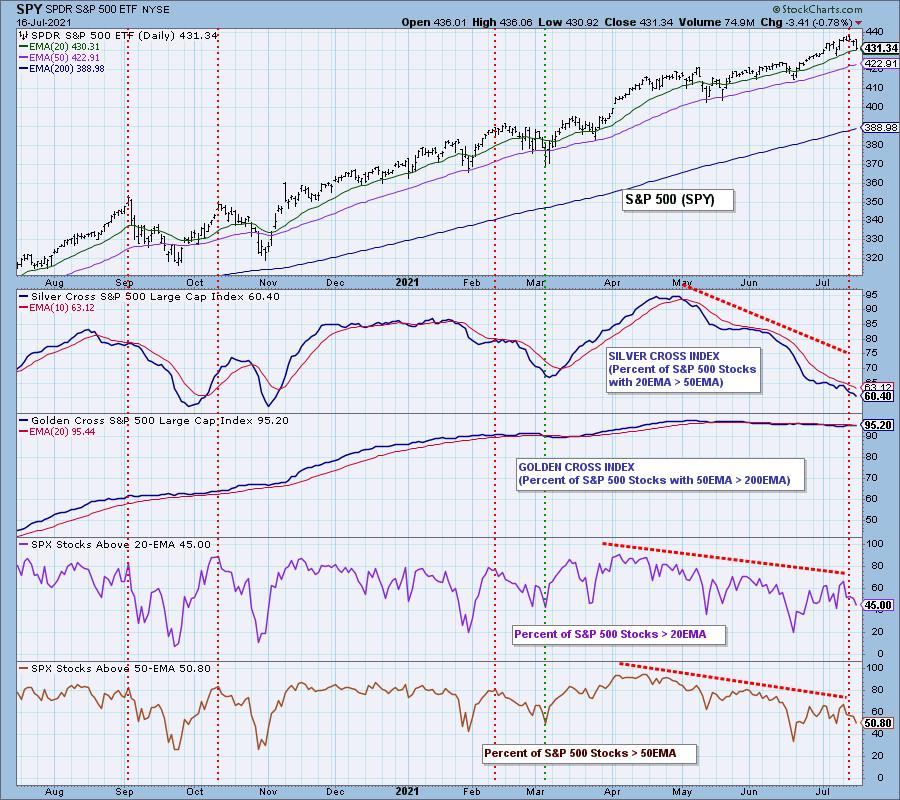

Participation Keeps Getting Worse

by Carl Swenlin,

President and Founder, DecisionPoint.com

In spite of the market making new, all-time highs this week, participation continued to deteriorate. Our focus is usually on the S&P 500 Large-Cap Index, so we'll begin with that, but mid- and small-cap stocks are really looking bad as well. The Silver Cross Index for...

READ MORE

MEMBERS ONLY

DP TV: DP Barometer of FAANG+ Stocks

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl covers the SPY and its associated indicators, paying particular attention to participation within the broad markets, as well as some observations on Disney (DIS) and Communications Services (XLC). He also takes a look at the Big Four (Dollar, Gold, Crude & Bonds) and, of...

READ MORE

MEMBERS ONLY

2021 Q1 Earnings Results: Still Massively Overvalued and Who Cares?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The normal P/E range for the S&P 500 is 10 (undervalued) to 20 (overvalued), but the P/E spike in 2009 nearly pushed that range into oblivion. The current P/E of 33.85 is the third highest in history, but it is the highest ever reached...

READ MORE

MEMBERS ONLY

Fading Participation is Still a Huge Problem

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

(This is an excerpt from today's DecisionPoint Weekly Wrap)

When the 20-EMA crosses up through the 50-EMA, we consider that to be an intermediate-term BUY signal (a "silver cross") and track the percentage of stocks with BUY signals in a given market index with the Silver...

READ MORE

MEMBERS ONLY

Bitcoin Bounces Off Important Support

by Carl Swenlin,

President and Founder, DecisionPoint.com

On the Bitcoin chart, an important support line at about 30,000 provides the base for a large rounded top. A rounded top is considered to be bearish, with the expectation that, if the support fails, much lower prices are likely. As to how much lower, let's look...

READ MORE

MEMBERS ONLY

DP TV: Short-Term Buying Initiation!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl discusses last Friday's "selling exhaustion" and today's new "upside initiation climax." Carl also reviews the DecisionPoint indicators and gives you his outlook on Gold, Gold Miners, the Dollar, Crude Oil, Bitcoin, Bonds and the 10-Year Treasury...

READ MORE

MEMBERS ONLY

Rally Is Being Undermined

by Carl Swenlin,

President and Founder, DecisionPoint.com

Most people are familiar with the Golden Cross, which is when the 50EMA of a price index crosses up through the 200EMA. The Golden Cross has positive long-term implications, but to address the intermediate-term I chose the 20EMA and 50EMA and thought it appropriate to call an upside crossover a...

READ MORE

MEMBERS ONLY

DP TV: Negative Divergences Take Center Stage

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl gives us the market review and points out numerous negative divergences that are finding their way back onto the indicator charts. He and Erin discuss how to use "cardinal highs" and "cardinal lows" to easily see negative and positive divergences....

READ MORE

MEMBERS ONLY

DP ALERT WEEKLY WRAP: SPX and OEX Generate IT PMO SELL Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

This is a copy of the "subscriber-only" DecisionPoint Weekly Wrap. It is posted each Friday for our subscribers and wraps up the week by analyzing daily and weekly charts. For more information on subscribing, click here.

Intermediate-Term Price Momentum Oscillator (PMO) signals are determined by weekly PMO crossovers....

READ MORE

MEMBERS ONLY

DP TV: Short-Term Bullish!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, the DecisionPoint indicators have Carl and Erin in a short-term bullish position. Watch to see why! Erin reviews the Technology sector and focuses in on Semiconductors and Software, two areas that are profiting from the current bullish bias in market. She offers up THREE Diamonds...

READ MORE

MEMBERS ONLY

Will Gold Continue to Strengthen Versus Cryptos?

by Carl Swenlin,

President and Founder, DecisionPoint.com

This is an excerpt from today's subscriber-only "DecisionPoint Weekly Wrap":

It has long been our belief that gold should be doing a lot better, considering the reckless spending and borrowing that is currently in progress. We have also believed that billions of dollars being diverted into...

READ MORE

MEMBERS ONLY

Nasdaq 100 Shows Significant Weakness

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Nasdaq 100 Silver Cross Index (SCI) shows the percentage of NDX stocks with the 20EMA above the 50EMA (an IT Trend Model BUY signal). The current reading is 56%, which is pretty weak, so we must wonder if it will go lower, or if it is about to improve....

READ MORE

MEMBERS ONLY

DP TV: Market Climax Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin cover a variety of topics. Carl opens the show with his "grab bag" of news items and follows up with his unique view of the markets in general. Both discuss Gold Miners (GDX) and Natural Gas (UNG). Erin finishes up...

READ MORE

MEMBERS ONLY

DP TV: New Market Sell Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl starts off by discussing outrageous market valuations and giving his thoughts on Gold and Gold Miners, as well as the Dollar, Treasury Yields, Crude Oil and the Bonds. Erin alerts viewers to new Price Momentum Oscillator (PMO) SELL signals on three major indexes. There...

READ MORE

MEMBERS ONLY

Nasdaq Internals Are Truly Dismal

by Carl Swenlin,

President and Founder, DecisionPoint.com

A DecisionPoint IT Trend Model (ITTM) BUY signal is generated when the 20EMA crosses up through the 50EMA, what we call a "Silver Cross." A few years ago we developed the Silver Cross Index, which tracks the percentage of stocks in a given index that have a silver...

READ MORE

MEMBERS ONLY

DP TV: Historic Money Inflows = Extreme Excesses

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl opens today's show by making a sobering comparison between Stock Fund money inflows of last 5 months versus the last 12 years. Get Carl's take on current market conditions and an in-depth look at the Silver Cross Index for the...

READ MORE

MEMBERS ONLY

DP TV: Swenlin Trading Oscillators Flash Warning

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin thoroughly review market price action and indicators in all timeframes. Carl spends some time discussing his sector chart annotations spotlighting Communications (XLC) and Technology (XLK). Of particular concern are the Swenlin Trading Oscillators, short-term indicators that have been quite prophetic at market...

READ MORE

MEMBERS ONLY

S&P 500 Earnings 2020 Q4: Most Overvalued Advancing Market Ever

by Carl Swenlin,

President and Founder, DecisionPoint.com

You may ask why I used the qualification of "the most overvalued advancing market." On the chart below the current P/E Ratio is only exceeded twice, but both times it happened while the market was crashing -- the dotcom crash from the 2000 top, and the financial...

READ MORE

MEMBERS ONLY

DP TV: Indicators Confirm New All-Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin review the surge to new all-time highs and reveal the indicators that are confirming this breakout. There are a few problem indicators, but in general the market is looking healthy. Hear their outlook for the SPY moving forward. Erin highlights Semiconductors and...

READ MORE

MEMBERS ONLY

DecisionPoint ALERT: The 10-Year and 30-Year Yields Break Support

by Carl Swenlin,

President and Founder, DecisionPoint.com

Flying has been described by pilots as being hours of boredom punctuated by seconds of sheer terror. Attention to detail during the boring hours can possibly reduce the number of terrifying seconds one may be forced to endure. Market analysis requires the same attention to detail, scanning the same set...

READ MORE

MEMBERS ONLY

Keeping It Simple

by Carl Swenlin,

President and Founder, DecisionPoint.com

There are a lot of people worrying about a major market top, and there are just as many (mostly in the fundamental camp) confident that we're on the verge of another major up leg. We can see the logic of both positions, so how can we sort it...

READ MORE

MEMBERS ONLY

DP TV: Silver Cross Index WARNING SIGN!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin give us a complete market overview, including Dollar, Gold, Gold Miners, Crude Oil and Bonds. Carl specifically addresses problems in crypto right now, as well as a review of valuations as they continue to get more and more overbought. Erin tells you...

READ MORE

MEMBERS ONLY

DP TV: Time to Play Defense

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin dive into the SPY, particularly into the Technology Sector with Carl reviewing the FAANG+. Erin gives us a sector overview and discusses the new rotation into defensive areas of the market. She covers her favorite sectors and defensive industry groups to consider,...

READ MORE

MEMBERS ONLY

DP TV: No Inflation?! Know These Rules!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss not only the current market conditions and indicators, but share "Farrell's Ten Rules" for all investors to know and remember! Carl gives us the current read on Bitcoin and GME, while Erin looks at the Dollar, Gold,...

READ MORE

MEMBERS ONLY

DP TV: Hot Sectors and Industry Groups

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin present their unique analysis of the market. Carl concentrates on the SPY and "The Big Four" - Dollar, Gold, Crude Oil and Bonds. Erin zeroes in on the best sectors going into the next week, then focuses in on the...

READ MORE