MEMBERS ONLY

"It's not nice to fool Mother Nature!"

by Carl Swenlin,

President and Founder, DecisionPoint.com

In the venerable

Click here to register in advance for the recurring free DecisionPoint Trading Room! Recordings are available!

Happy Charting! - Carl

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint...

READ MORE

MEMBERS ONLY

DP TV: Power ETFs Pack a Punch

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin cover a wide range of subjects today, from current market conditions and the VIX to Bitcoin and Tesla (TSLA) to Natural Gas (UNG) and a Sector review. Carl discusses a group of funds that have weathered most storms and are poised to...

READ MORE

MEMBERS ONLY

Natural Gas (UNG) Coming to Life

by Carl Swenlin,

President and Founder, DecisionPoint.com

I have been watching the Natural Gas ETF (UNG) as a potential trading vehicle for about a year. My attention is focused on the long side, but opportunities of that nature have been limited. There was a rally of +65% last summer, but that reversed in August, going into a...

READ MORE

MEMBERS ONLY

Short Stoppers: From GameStop to Silver

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl begins with the topic of the GameStop (GME) short kill, coining the phrase "Short Stoppers" - and news suggests that the Short Stoppers are moving their interest to Silver. Carl looks at the Silver chart and discusses the implications. Erin takes a...

READ MORE

MEMBERS ONLY

DP TV: Homebuilders and Solar Sizzling

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl covers the major market and gave his take on the current conditions for the "Big Four"--Dollar, Gold, Oil and Bonds. A new Price Momentum Oscillator (PMO) SELL Signal has appeared on Oil. Erin analyzes the hot Home Builder industry group and...

READ MORE

MEMBERS ONLY

Participation Mixed and Not Encouraging

by Carl Swenlin,

President and Founder, DecisionPoint.com

We like to monitor broad market participation, asking how many stocks are actually taking part in a market advance. A good way to do this is to track the percentage of S&P 500 stocks that are above their 20EMA (short-term), 50EMA (medium-term), and 200EMA (long-term). On the chart...

READ MORE

MEMBERS ONLY

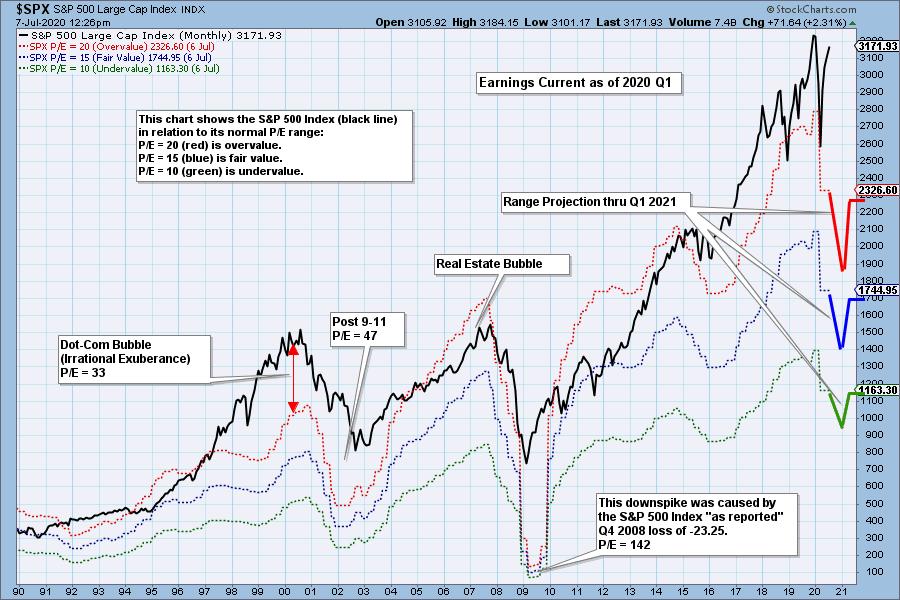

S&P 500 Earnings 2020 Q3: The Most Overvalued Market Ever?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On an almost daily basis we hear experts on the subject complaining that this the most overvalued market ever. While our chart doesn't quite confirm that claim, we would agree that it could easily be true using a different methodology. And there is no question that the market...

READ MORE

MEMBERS ONLY

What Could Possibly Go Wrong?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

It is hard to see any downside when you're making a lot of money, which is why people can't resist a bubble. From the Tulip Mania, to DotCom Fever, to the Real Estate Crisis, for many people the appeal of easy and fast money cannot be...

READ MORE

MEMBERS ONLY

DP TV: Rising Wedge Resolves Downward

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market opened the year with a bang as the SPY experienced an onslaught of selling. In this episode of DecisionPoint, Carl and Erin review the price action in conjunction with their indicators to determine if this is the beginning or the end of this selling climax. They take a...

READ MORE

MEMBERS ONLY

Gold's Tortured Progress

by Carl Swenlin,

President and Founder, DecisionPoint.com

I frequently use the word "tortured" when discussing gold because so much of the time any progress it makes comes with great pain and suffering. In August GLD broke above the resistance line drawn across the 2011 price top. It was a decisive break, meaning that the breakout...

READ MORE

MEMBERS ONLY

DP TV: What We're Expecting in 2021

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin reveal their 2021 expectations as they review the major indexes, global markets and "Big Four" - Dollar, Gold, Oil and Bonds. After analyzing current market conditions, Carl and Erin explain why you should expect a difficult week as the overvalued...

READ MORE

MEMBERS ONLY

Time for an Energy Break?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Energy Sector has been a top performer in the last six weeks, rallying over 50% since the October low. Now it is beginning to look as if it is in the process of topping. On the chart below we can see that wedge patterns have played a major role...

READ MORE

MEMBERS ONLY

DP TV: Sentiment Too Bullish in Overvalued Market

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

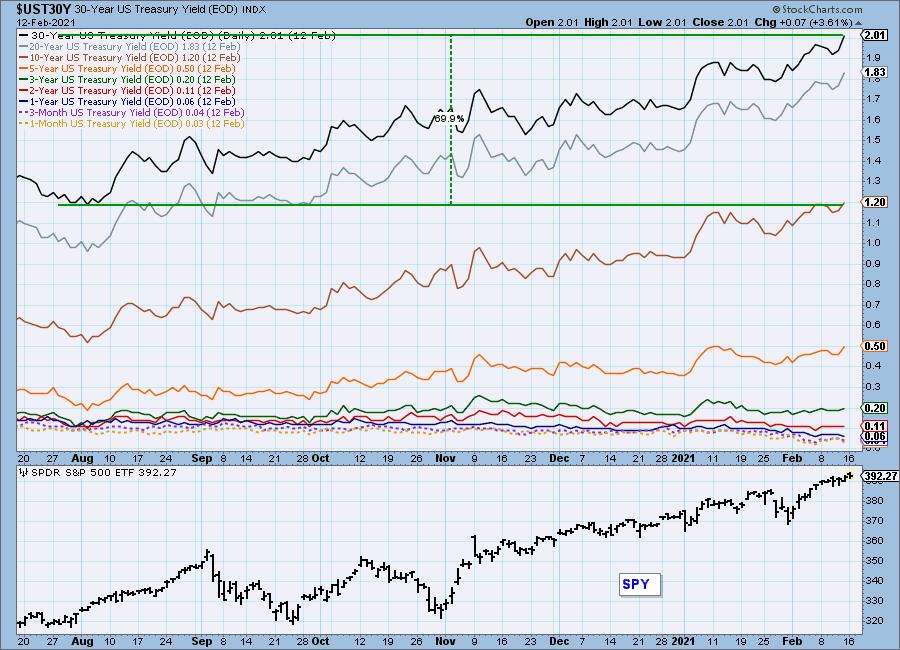

In this episode of DecisionPoint, Carl opens the show by analyzing SPY market action, but also schools us on how to determine when the market is "overvalued" or "undervalued." (Currently, it is highly overvalued.) Carl also displays many DP indicators that are extremely overbought and accompanied...

READ MORE

MEMBERS ONLY

DP TV: Monthly Charts Go Final! + Extended Cyber Monday Deal

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

With today being the final day of the month, DecisionPoint "books" the current signals from the monthly charts. In this episode, Carl discusses the importance of monthly PMO direction changes, as many times the crossover signals arrive late. Today, there were TWO monthly PMO direction changes of special...

READ MORE

MEMBERS ONLY

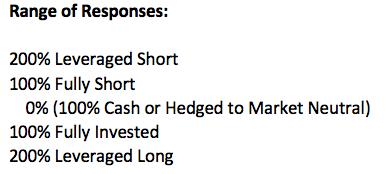

Assessing Market Bias

by Carl Swenlin,

President and Founder, DecisionPoint.com

We have all heard that "a rising tide raises all boats," and at DecisionPoint.com we have come to think of the direction of the market tide as being a bias that can benefit or work against our trading positions. As regular market participants, we may have a...

READ MORE

MEMBERS ONLY

DP TV: 3000 Level for SPX?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, as we head into the holiday week, Carl and Erin talk about why the Dow sometimes seems to outperform the SPX (today was a great example!). Carl follows up on Climax Analysis and how it can give you the very short-term signals of exhaustion or...

READ MORE

MEMBERS ONLY

DP TV: Dow Forecast 2021

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin follow up their discussion regarding very short-term initiation and buying climaxes that have occurred recently. They look at the difference between Friday's initiation climax and the possible exhaustion climax that could be giving us a short-term attention flag regarding this...

READ MORE

MEMBERS ONLY

Typical Climax Aftermath

by Carl Swenlin,

President and Founder, DecisionPoint.com

At DecisionPoint.com we watch for what we call "climax days." These are days when large price moves are accompanied by spikes in New Highs or New Lows, Net Advances minus Declines, Net Advancing Volume minus Declining Volume, and SPX Total Volume.

There are two kinds of climaxes:...

READ MORE

MEMBERS ONLY

DP TV: Big Rally, Big Bust

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

It was a climactic day, but does it have the gas to inspire a follow-up rally this week? In this episode of DecisionPoint, Carl looks at Gold and Gold Miners to see if today's damage will weigh heavy on the week. Carl also walks through the sectors and...

READ MORE

MEMBERS ONLY

DP TV: Volume Ratio Climactic Indicators

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, after analyzing current market conditions with the DecisionPoint indicators with Erin, Carl introduces us to some indicators he's rediscovered for recognizing climactic conditions - the UP/DOWN Volume Ratio and DOWN/UP Volume Ratio, developed by Dr. Martin Zweig in his book Winning...

READ MORE

MEMBERS ONLY

DP Show: Black Monday and Big Blue (IBM)

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, after reviewing the SPY and the DecisionPoint indicators, Carl gives us a history lesson on Black Monday 1987, which happened 33 years ago today! He points out warning signs that came ahead of the hatchet that had stock prices down more than 20% in one...

READ MORE

MEMBERS ONLY

DP Show: 2020 Q2 Earnings Revealed!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

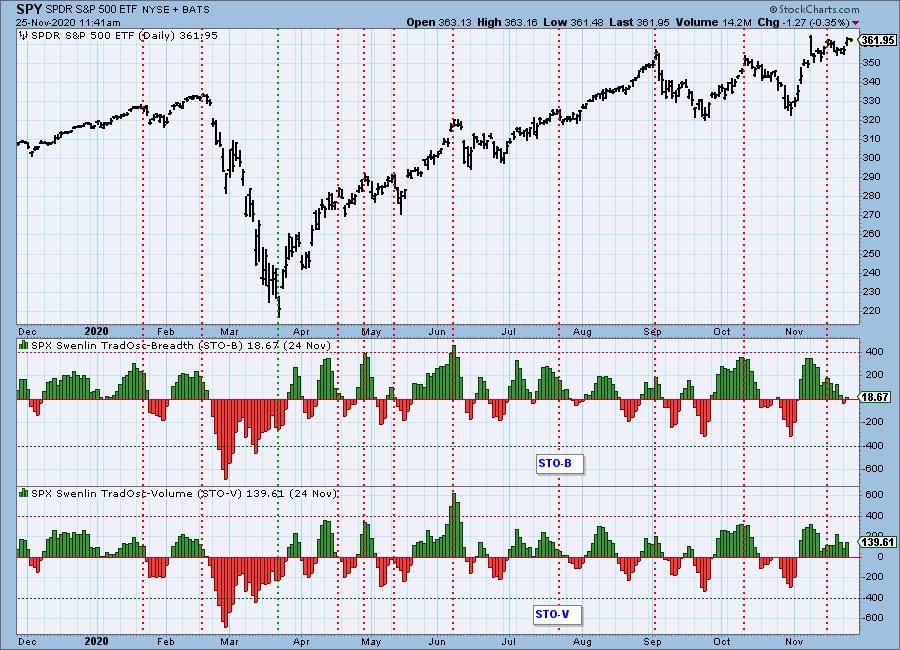

The market has been running higher and higher and, in this episode of DecisionPoint, Carl and Erin break down the implications of the current vertical rally in technology and the accelerated rising trend for the SPX. Swenlin Trading Oscillators (STOs) could be revealing important information regarding the stamina of the...

READ MORE

MEMBERS ONLY

S&P 500 Earnings 2020 Q2: Market Still Extremely Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

As a new earnings season begins, let's look at the finalized results of the last earnings period. The S&P 500 earnings results for 2020 Q2, based upon GAAP earnings (Generally Accepted Accounting Principals), show that the S&P 500 is, as usual, far above the...

READ MORE

MEMBERS ONLY

DP Show: Stalking Energy Stocks - Options Mania

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin give us the current market conditions to prepare you for the week ahead. Both discuss what "climax analysis" is all about. Monitoring climactic readings in breadth and the VIX can give you strong clues as to market action in the...

READ MORE

MEMBERS ONLY

DP Show: Hammering Into a Selling Exhaustion?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin talk extensively about the current conditions of the SPY and the climactic indicators that suggest a possible selling exhaustion. Erin discusses the "hammer" candlestick and the implications when considered alongside an exhaustion climax. Carl elaborates on his articleabout the "...

READ MORE

MEMBERS ONLY

"A Man's Got to Know His Limitations"

by Carl Swenlin,

President and Founder, DecisionPoint.com

That's the line spoken by Dirty Harry in Magnum Force right after he blew away his crooked boss. I also personally use that line to curb any tendency toward hubris I might have. For example, if you put me and Greg Morris in the same room, there is...

READ MORE

MEMBERS ONLY

DP Show: Time to Jump Back into Natural Gas?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin debate whether it's time to jump back in to Natural Gas (UNG). Erin zeroes in on the Nasdaq and Technology Sector (XLK) to determine if today's bounce is a beginning of finer things to come; she takes a...

READ MORE

MEMBERS ONLY

Don't Forget This About Splits

by Carl Swenlin,

President and Founder, DecisionPoint.com

On August 31, AAPL stock split 4 for 1 and TSLA split 5 for 1. On several occasions prior to that date I tried to make DecisionPoint ALERT readers and DecisionPoint Show viewers aware that stock splits often occur in the vicinity of price tops. It doesn't happen...

READ MORE

MEMBERS ONLY

DP Show: What's Up with the VIX?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

What's up with the VIX and breadth? And what are they telling us about the market this week? A big news item for this edition of DecisionPoint is a New Long-Term PMO BUY signal for the SPX, but the Apple (AAPL) and Tesla (TSLA) splits, along with the...

READ MORE

MEMBERS ONLY

DP ALERT: Sentiment Is Too Bullish

by Carl Swenlin,

President and Founder, DecisionPoint.com

The NAAIM Exposure Index hit 106.56 this week, which is the second highest reading in the history of this indocator (the highest being in December 2017, a few weeks before the January 2018 market top).

NAAIM (National Association of Active Investment Managers)member firms who are active money managers...

READ MORE

MEMBERS ONLY

DP Show: Will These Bull Market Bubbles Pop?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin look back at the dot com bubble and discussed why many are talking "bubbles," given the voracity of the Bull Market coming out of the March lows. Carl zeroed in on Apple (AAPL) then and now, before then discussing a...

READ MORE

MEMBERS ONLY

DP Show: How Do Stock Splits Work?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss current market conditions for the major indexes. Given Apple (AAPL) and Tesla (TSLA) are preparing for stock splits, Carl gives viewers a complete tutorial on stock splits, how they work, how they compare to dividends and more! Carl highlights Gold and...

READ MORE

MEMBERS ONLY

DP Show: Is It Time to Leave Technology Behind?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss the demise of Technology and the resurgence of Industrials. Should we leave Technology behind? Negative divergences still persist on major indexes, so Erin discusses her strategy of using trailing stops to maximize profit with excellent protection when the overall market is...

READ MORE

MEMBERS ONLY

DP Show: Sky's the Limit for Gold (and Silver!)

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin reviews the technicals on the DecisionPoint Scoreboard Indexes (SPX, NDX, OEX & Dow) and points out some negative divergences on primary indicators that are troubling her bullish outlook. Carl discusses how Gold Premiums and Discounts are calculated and the implications of seeing high discounts...

READ MORE

MEMBERS ONLY

DP Show: Gold Rush - Worry or Rejoice?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl discusses his recent article on Gold. The yellow metal is enjoying a huge rally, but should we be excited or nervous? Carl and Erin both give you their strategies on taking advantage of (and protecting profits during) this parabolic move. Erin outlines some short-term...

READ MORE

MEMBERS ONLY

Bullish on Gold, but Getting Nervous

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Monday, gold rallied above the top in 2011 and made new, all-time highs. I've been more or less bullish on gold for several years, but it hasn't always been particularly easy, because gold's progress could usually best be described as "tortured."...

READ MORE

MEMBERS ONLY

Bullish Market Bias - Can't Beat 'Em, Join 'Em

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss negative divergences and BUY signal divergences that are being defeated by a strong bullish bias in the market. Carl looks at breadth anomalies. Apple (AAPL)'s parabolic (or should we say "vertical") price movement should give Apple investors...

READ MORE

MEMBERS ONLY

AAPL Advance Is Too Steep

by Carl Swenlin,

President and Founder, DecisionPoint.com

Apple (AAPL) has a history of sharp, parabolic price advances, followed by vertical collapses. Normal spacing between the tops runs from about two to four years, but recent periodicity has become compressed. The top in early 2020 arrived only about 15 months after the 2018 top, and it appears to...

READ MORE

MEMBERS ONLY

DP Show: New BUY Signal for the SPY!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss their outlooks for the market based on new signals and divergences popping up on the charts. Erin focuses in on the Dollar, Gold and Gold Miners. Carl brings his wisdom discussing Earnings outlooks that aren't in line with price...

READ MORE

MEMBERS ONLY

S&P 500 2020 Q1 Earnings: Lies, Damned Lies, and Earnings Estimates

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 preliminary earnings results for 2020 Q1 are out, and based upon GAAP (Generally Accepted Accounting Principals) earnings, the S&P 500 is far above its normal value range. The following chart shows us the normal value range of the S&P 500 Index,...

READ MORE