MEMBERS ONLY

DP WEEKLY WRAP: New All-Time Highs, but Not for Small-Cap Stocks

by Carl Swenlin,

President and Founder, DecisionPoint.com

While the broad market indexes are currently making all-time highs, the S&P 600 Small-Cap Index (IJR) is struggling and remains about -14% below its all-time highs. This lack of small-cap participation is a concern, because the large-caps can't carry the market forever. The OBV is currently...

READ MORE

MEMBERS ONLY

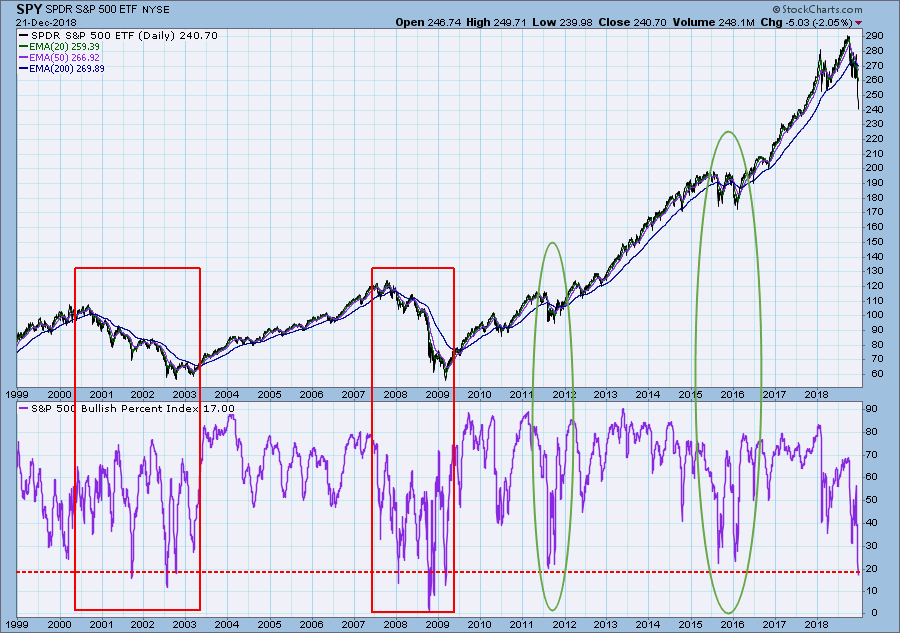

DP WEEKLY WRAP: Watch Out For BPI Trend Breaks

by Carl Swenlin,

President and Founder, DecisionPoint.com

With the S&P 500 and NASDAQ Composite making or equaling all-time highs, it would be appropriate to check the participation behind this up surge. The Bullish Percent Index (BPI) measures the percentage of stocks in a given index that have point & figure BUY signals. In January of...

READ MORE

MEMBERS ONLY

EARNINGS: 2019 Q1 Finalized; S&P 500 Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 earnings for 2019 Q1 have been finalized. The following chart shows us the normal value range of the S&P 500 Index, as well as where the S&P 500 would have to be in order to have an overvalued P/E of...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Waiting for an Excuse to Do Something

by Carl Swenlin,

President and Founder, DecisionPoint.com

So much of the time it seems we are waiting for some event that will determine what the market is going to do next. Last week it was waiting for the Fed. This week it was waiting for the meeting between President Trump and President Xi tomorrow. What the market...

READ MORE

MEMBERS ONLY

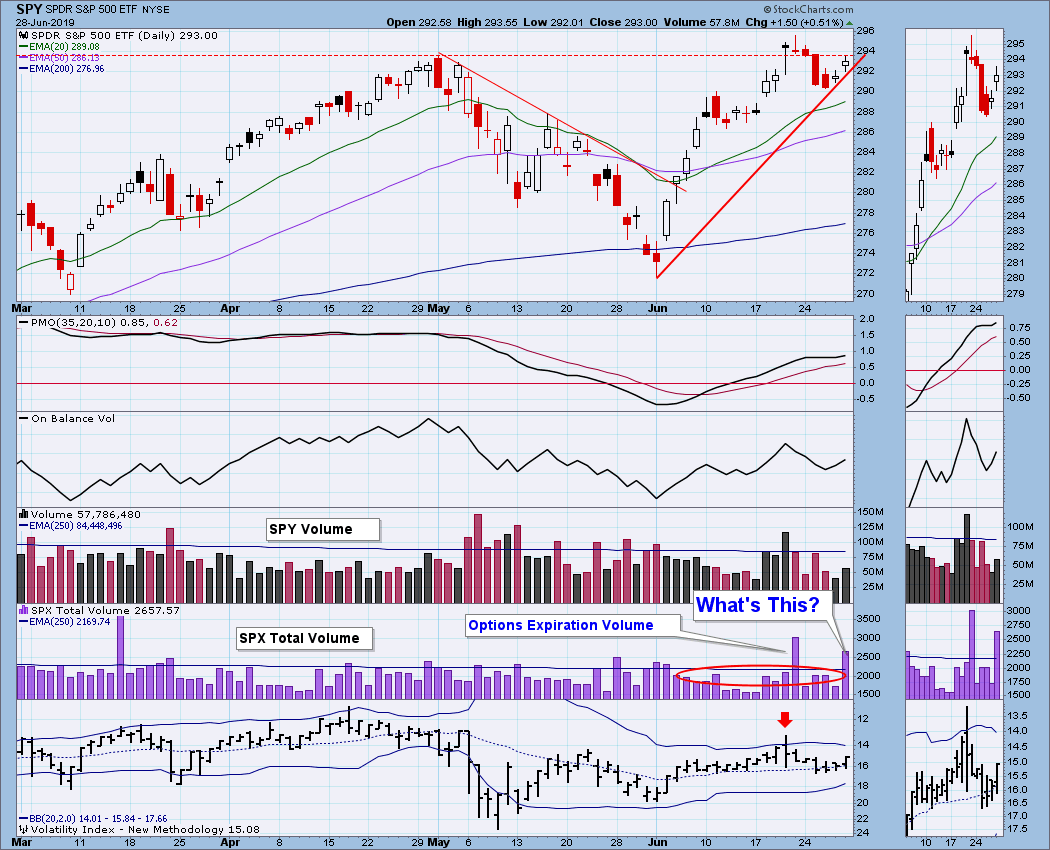

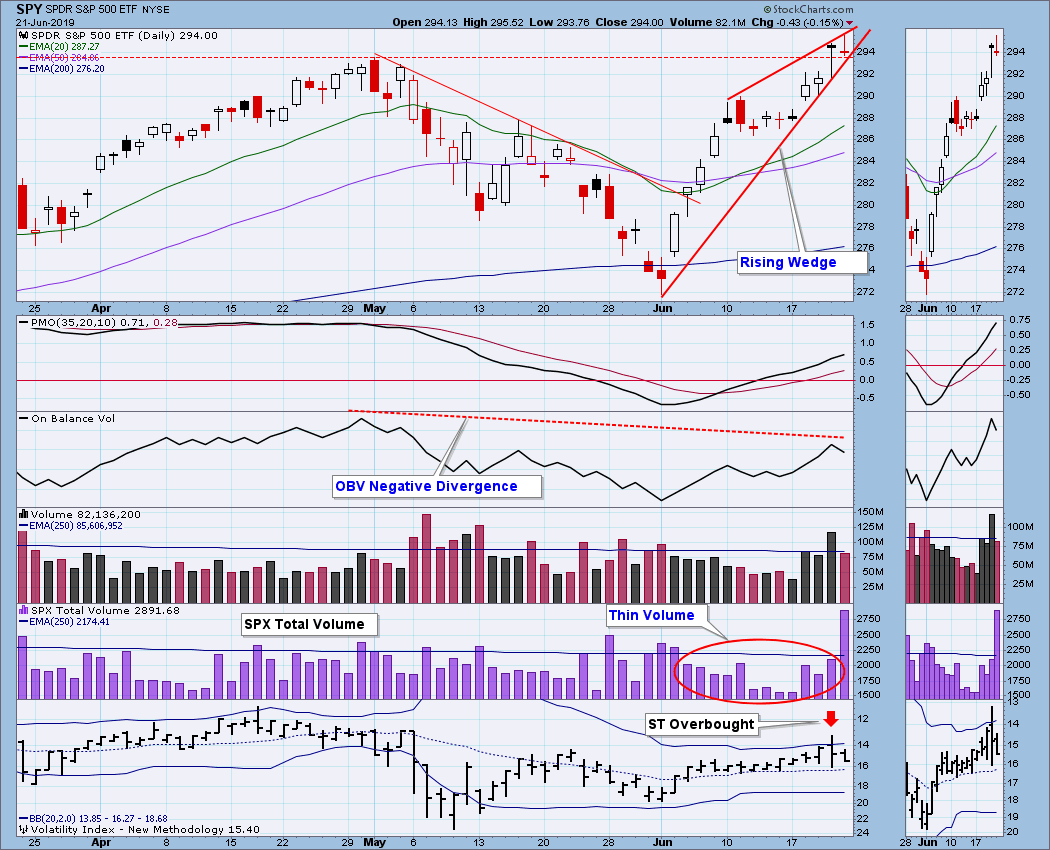

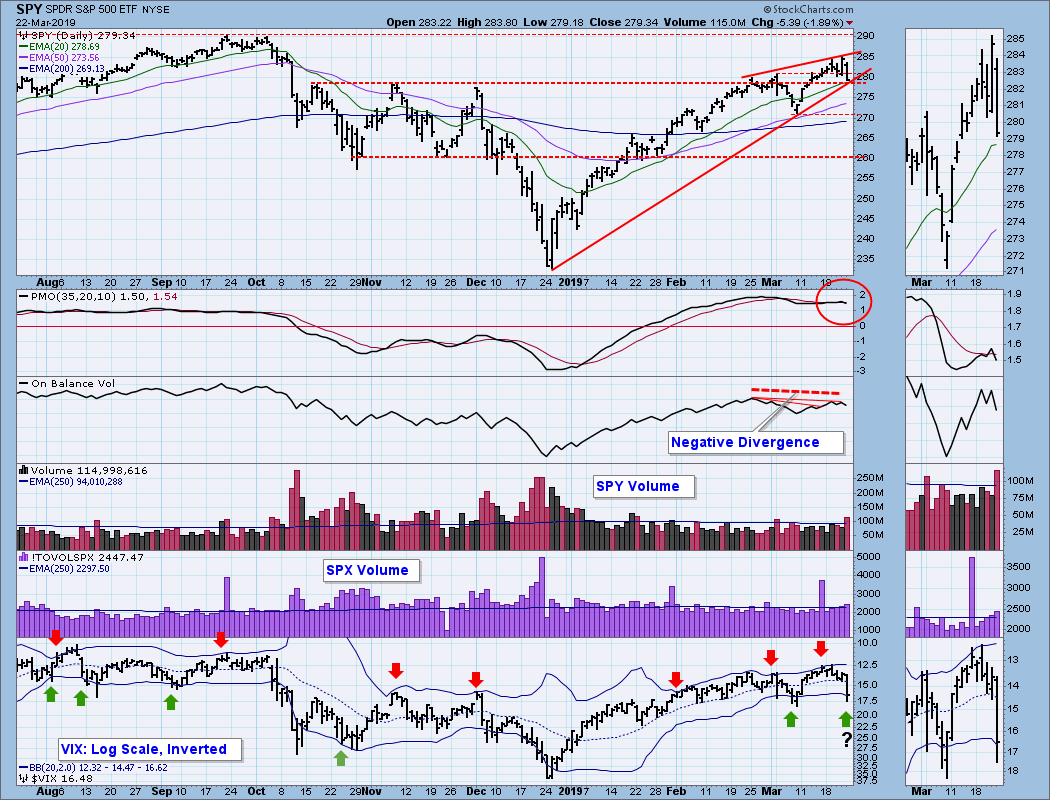

DP WEEKLY WRAP: Short-Term Bearish Indications

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market closed at an all-time high on Thursday, then on Friday it hit an all-time intraday high; however, there are some technical problems: (1) a bearish rising wedge pattern has formed; (2) there is an OBV negative divergence; (3) volume has been thin since the June low; and (4)...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Market Quiet Ahead of Fed; Gold Has Long-Term "Smile"

by Carl Swenlin,

President and Founder, DecisionPoint.com

Sometimes I can be a little slow on the uptake, and the monthly gold chart is the latest example. This week it dawned on me that gold is in its seventh year of forming a bullish saucer, which would be the reverse equivalent of a bearish rounded top. After activating...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Volume Ratio Spikes Flag ST Market Turns

by Carl Swenlin,

President and Founder, DecisionPoint.com

Some time ago on StockCharts TV I discussed volume ratios and how higher than normal ratios help identify climactic events and possible turning points. This week on Tuesday we had such an event when the SPX up volume divided by down volume produced a ratio of over 15. I have...

READ MORE

MEMBERS ONLY

DP WEEKLY/MONTHLY WRAP: Intermediate-Term Trend Model Back to NEUTRAL from BUY

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today the SPY 20EMA crossed down through the 50EMA and the IT Trend Model for SPY changed from BUY to NEUTRAL. As usual, this signal is an information flag to encourage us to take a closer look at the situation. In this case, the price breakdown is associated with a...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: "Golden Cross" Index Generates SELL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

When the 50EMA crosses up through the 200EMA, it is commonly known as a "Golden Cross," because it signals the potential for a long-term bullish outcome. For the sake of consistency, in DecisionPoint parlance we refer to the 50/200EMA relationship as the Long-Term Trend Model (LTTM), which...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Double Top Scenario Still Fits

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I asserted that the market was in the process of forming a major double top. This week, in spite of some price action attempting to refute that assertion, the double top is still evolving. So far the rally attempt appears to have failed, and the thin volume says...

READ MORE

MEMBERS ONLY

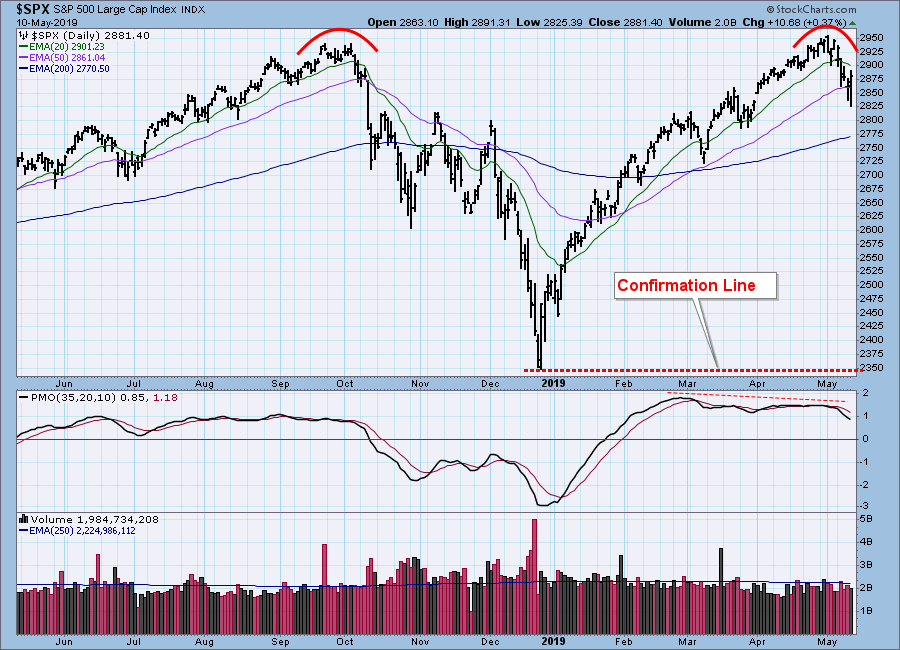

DP WEEKLY WRAP: Double Top In Progress

by Carl Swenlin,

President and Founder, DecisionPoint.com

A few weeks ago, when the market began challenging the 2018 price highs, I pointed out that there was a potential for a double top. Since then, a second top has clearly formed, and the potential for more downside must be considered. The double top confirmation line is drawn across...

READ MORE

MEMBERS ONLY

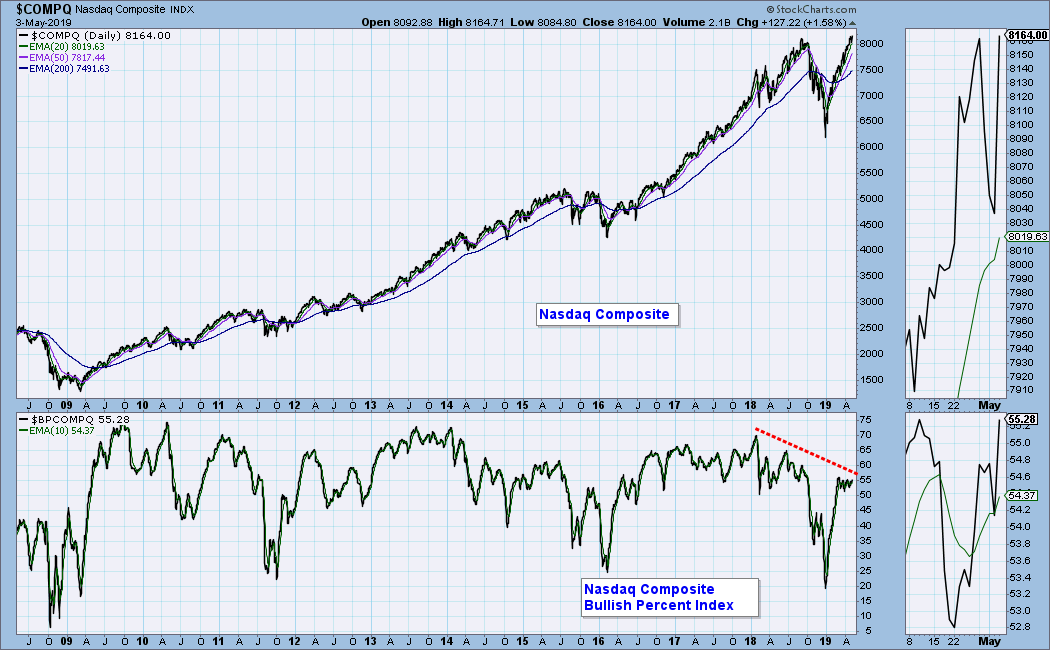

DP WEEKLY WRAP: Nasdaq Composite Record High Not Supported by Internals

by Carl Swenlin,

President and Founder, DecisionPoint.com

This week the Nasdaq Composite Index closed at a new, all-time high, but the Bullish Percent Index (BPI) is a long way from confirming that. The BPI is the percentage of Nasdaq Composite stocks that are on point and figure BUY signals, and Friday's reading is 55%. That...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Steady, Quiet Advance. What's Up?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Since the market gapped up on the first of April, it has been quietly moving higher, making marginal new, all-time highs. Volume has been a bit thin, particularly for SPY. I think that thin volume is a reflection of the low volatility, and of investors happy to sit quietly, not...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: New All-Time Highs, or Not?

by Carl Swenlin,

President and Founder, DecisionPoint.com

As we can see on the chart below, none of the major market indexes have exceeded their previous all-time highs. So why are we having this discussion? The point is that price history for traditional market indexes is not adjusted for dividends, so they do not reflect a true total...

READ MORE

MEMBERS ONLY

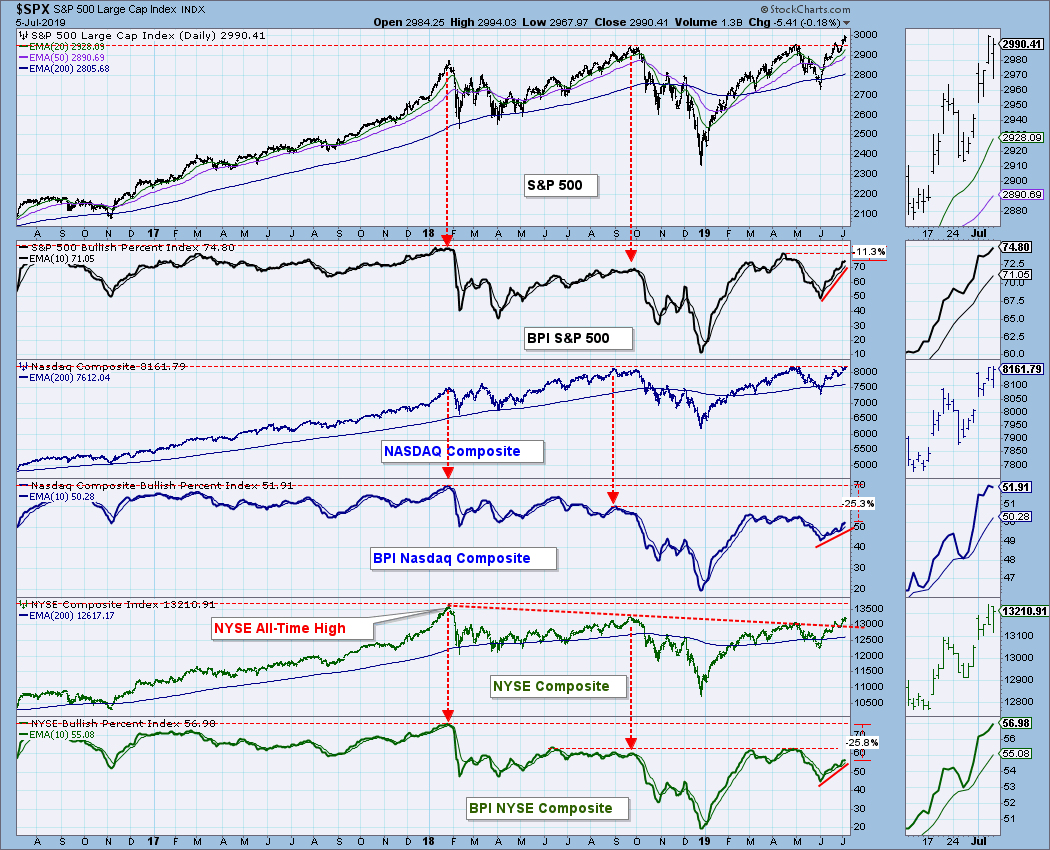

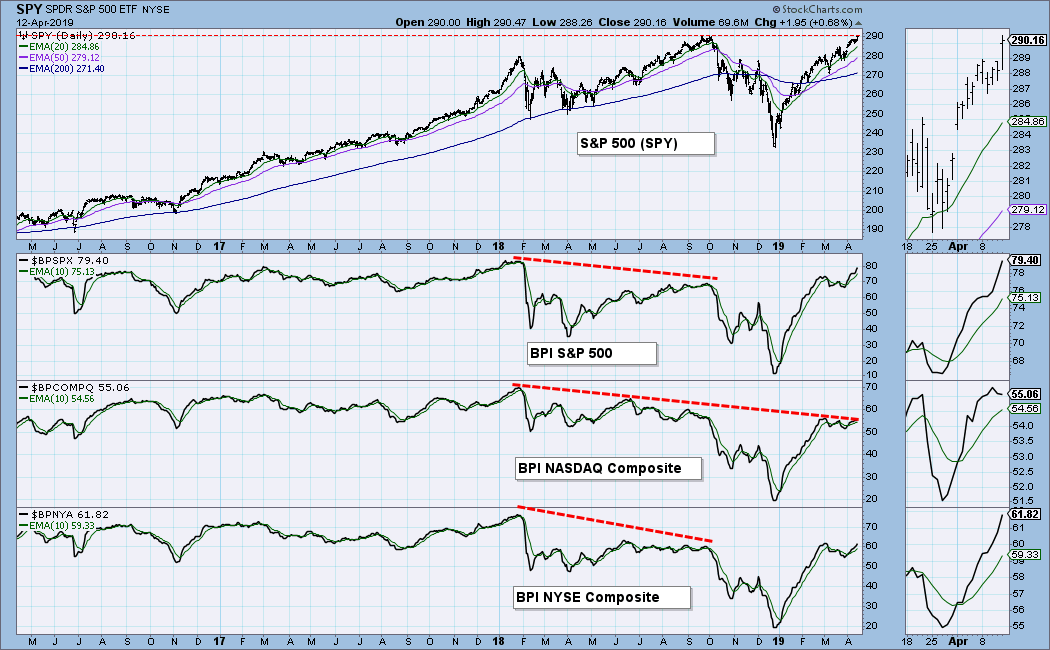

DP WEEKLY WRAP: Nasdaq and NYSE Bullish Percent Lagging Behind

by Carl Swenlin,

President and Founder, DecisionPoint.com

One of the market indicators available on StockCharts.com is the Bullish Percent Index (BPI), which calculates the percentage of stocks in a given index that are on point and figure BUY signals. On the chart below we can see the BPI for the S&P 500, the Nasdaq...

READ MORE

MEMBERS ONLY

EARNINGS: 2018 Q4 Finalized; S&P 500 Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings for 2018 Q4 have been finalized, and with a P/E of 21.4, the market is above the normal value range and very overvalued. The following chart shows us the normal value range of the S&P 500 Index. It shows us where...

READ MORE

MEMBERS ONLY

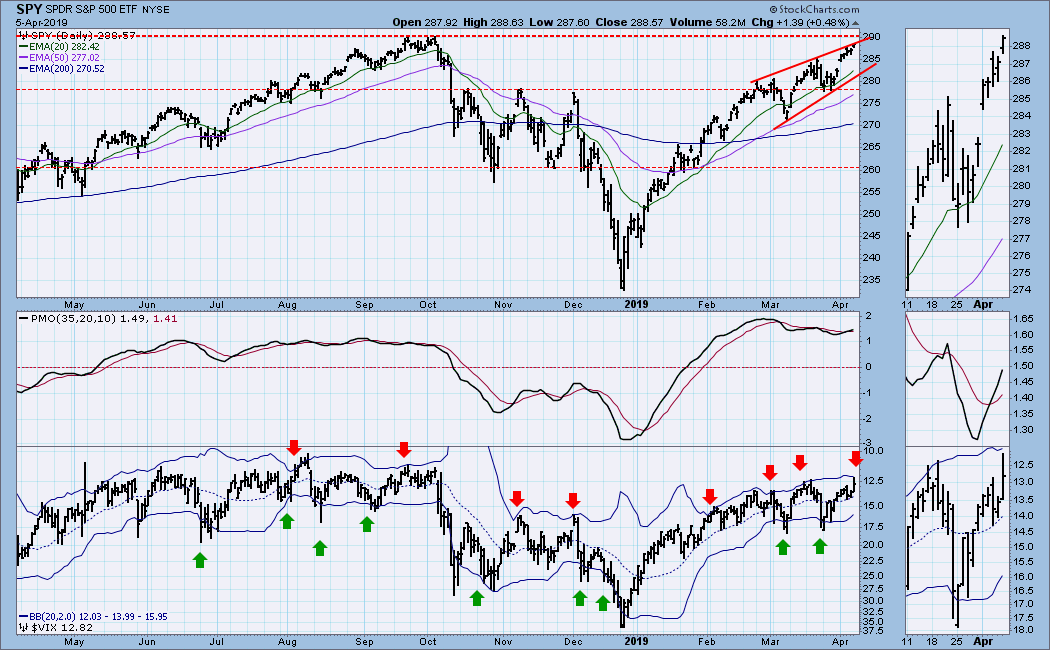

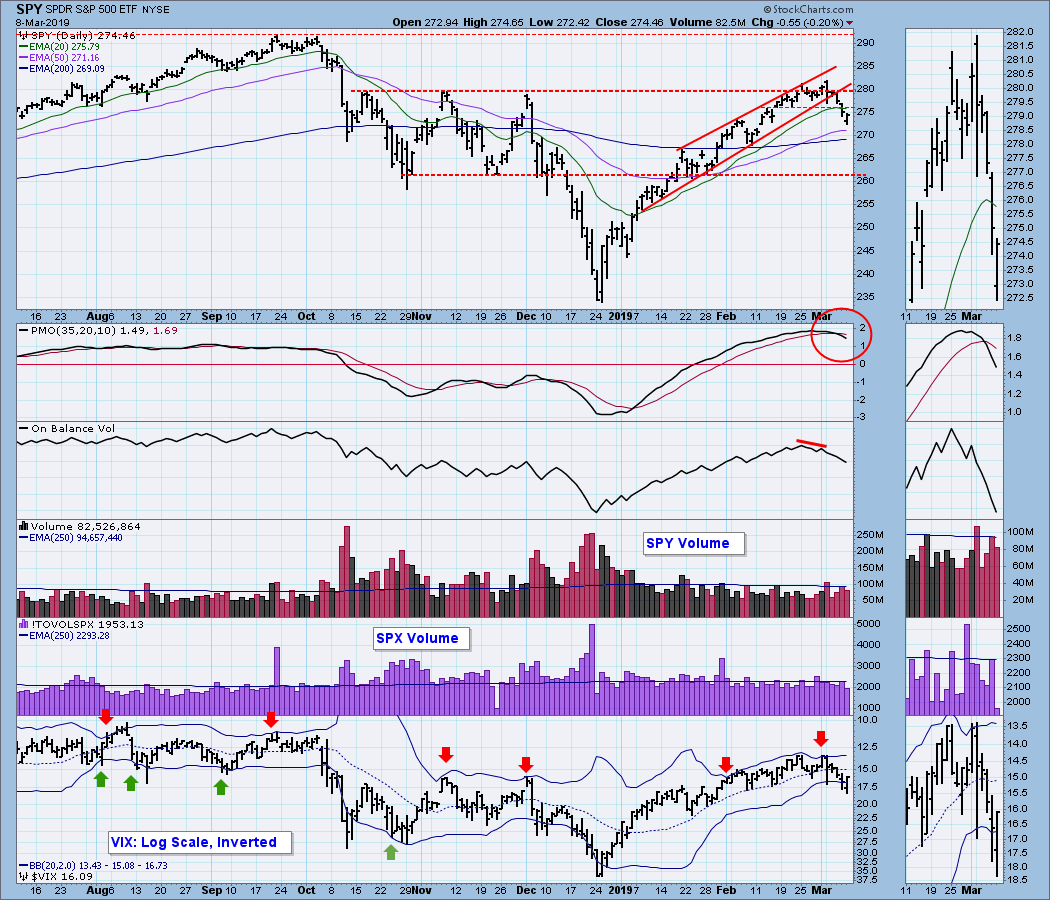

DP WEEKLY WRAP: Overhead Resistance Near; VIX Overbought

by Carl Swenlin,

President and Founder, DecisionPoint.com

An inverted VIX with Bollinger Bands is a pretty good overbought/oversold indicator, and it is overbought when the VIX hits the upper band as it almost did today. "Almost" might be good enough this time, or we may have to wait a few days for the real...

READ MORE

MEMBERS ONLY

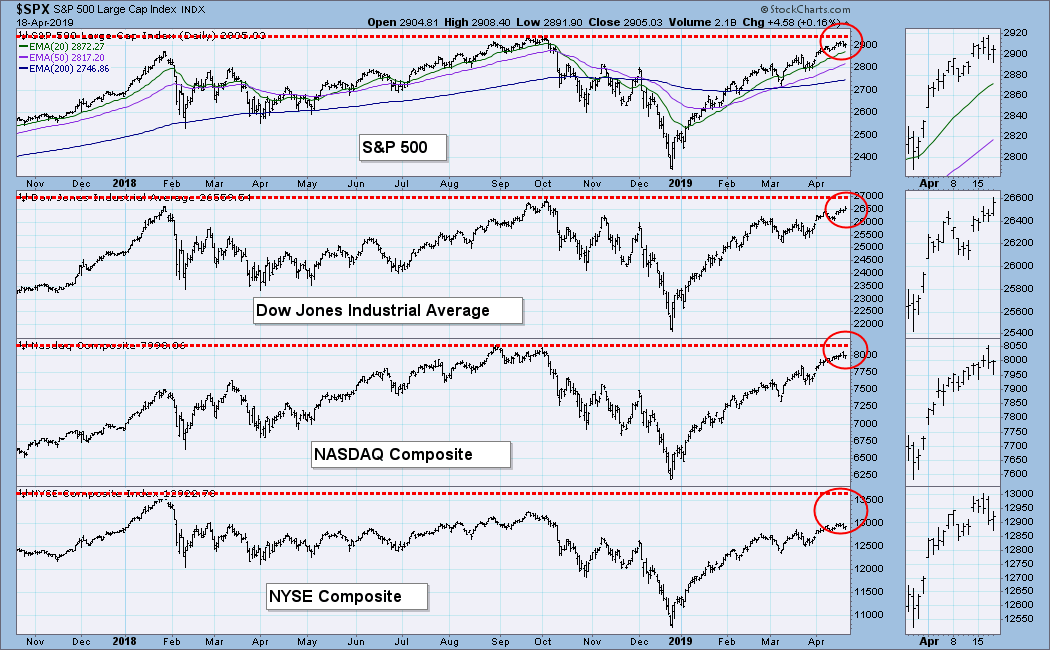

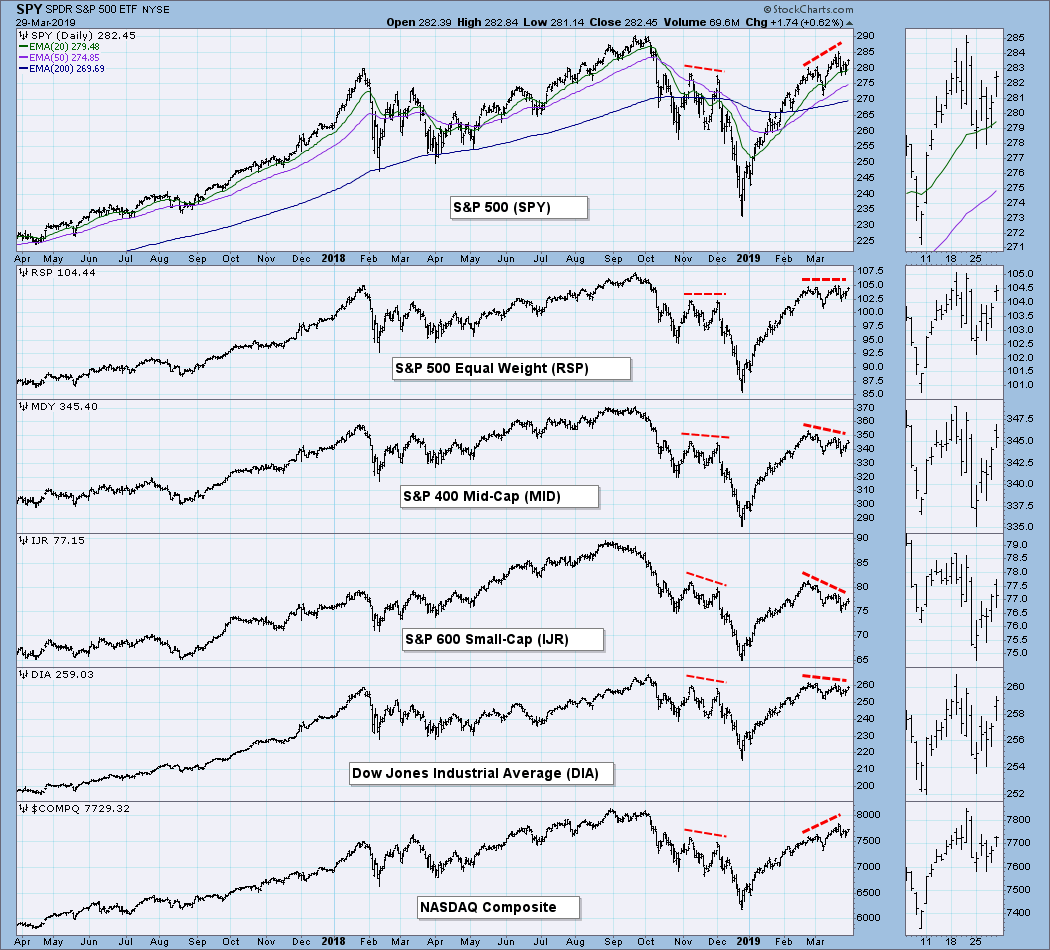

DP WEEKLY/MONTHLY WRAP: Broad Market Divergences

by Carl Swenlin,

President and Founder, DecisionPoint.com

This is a new chart I will be adding to my weekly commentary. My concentration has always been on the S&P 500 Index, but I realized that I needed to broaden my scope somewhat to include other segments of the the broad market, and this is my first...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Fakeout Breakout; Bond Blastoff

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week certain indicators had me looking for a short-term market top, and on Wednesday it looked as if it had arrived. But no. On Thursday the market moved to new rally highs on volume that wasn't too little or too much, so I thought that looked like...

READ MORE

MEMBERS ONLY

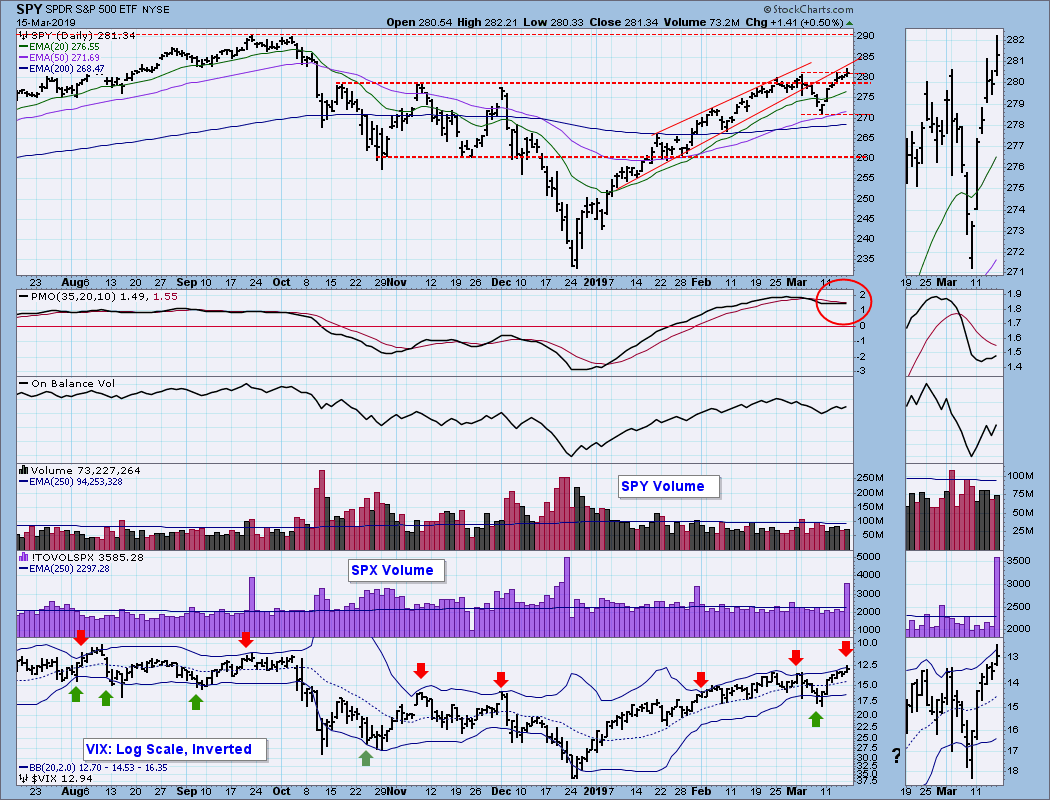

DP WEEKLY WRAP: Short-Term Top Soon?

by Carl Swenlin,

President and Founder, DecisionPoint.com

At the end of last week I was looking forward to some more selling to extend the decline that had started from the March 4 top. But no. Price rebounded off last Friday's low, eventually setting a new high for the rally off the December lows. However, on...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Market Breaks, Gold Fakes

by Carl Swenlin,

President and Founder, DecisionPoint.com

It took over two weeks, but the market top we've been looking for finally materialized. Price broke down through a rising bottoms line that goes back to the beginning of January. Also violated was the bottom of the trading range that has lasted over two weeks. At very...

READ MORE

MEMBERS ONLY

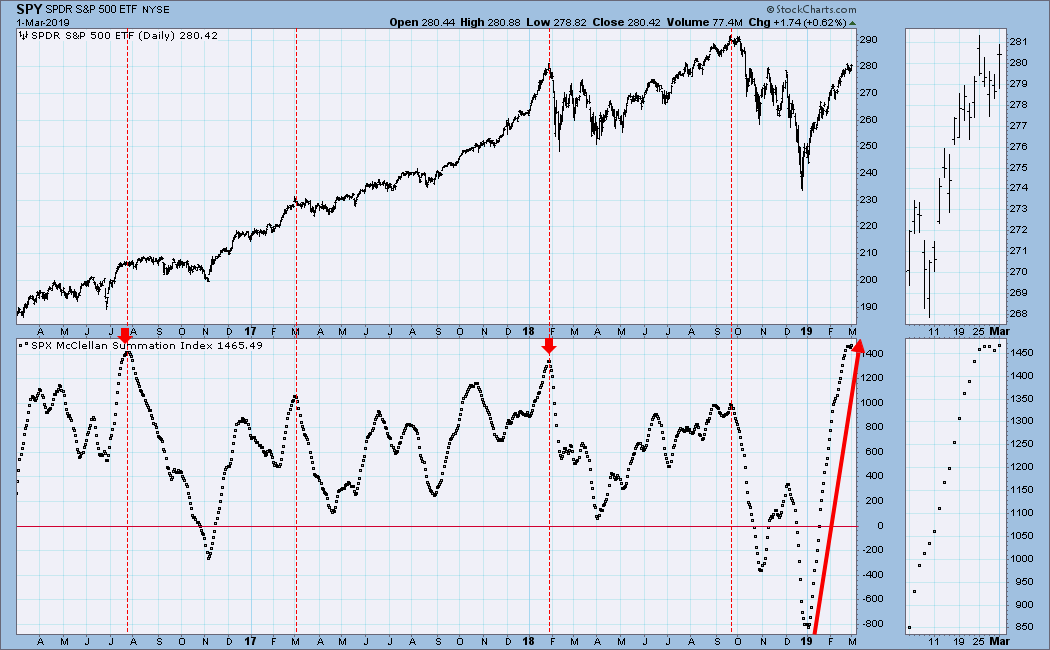

DP WEEKLY/MONTHLY WRAP: Internals Overbought and Topping

by Carl Swenlin,

President and Founder, DecisionPoint.com

The McClellan Summation Index (ratio-adjusted version) has had the longest uninterrupted upside run since 2003, when the market was coming up off of the 2000-2002 bear market lows. The indicator is very overbought and it is trying to top, so we should expect some kind of corrective action over the...

READ MORE

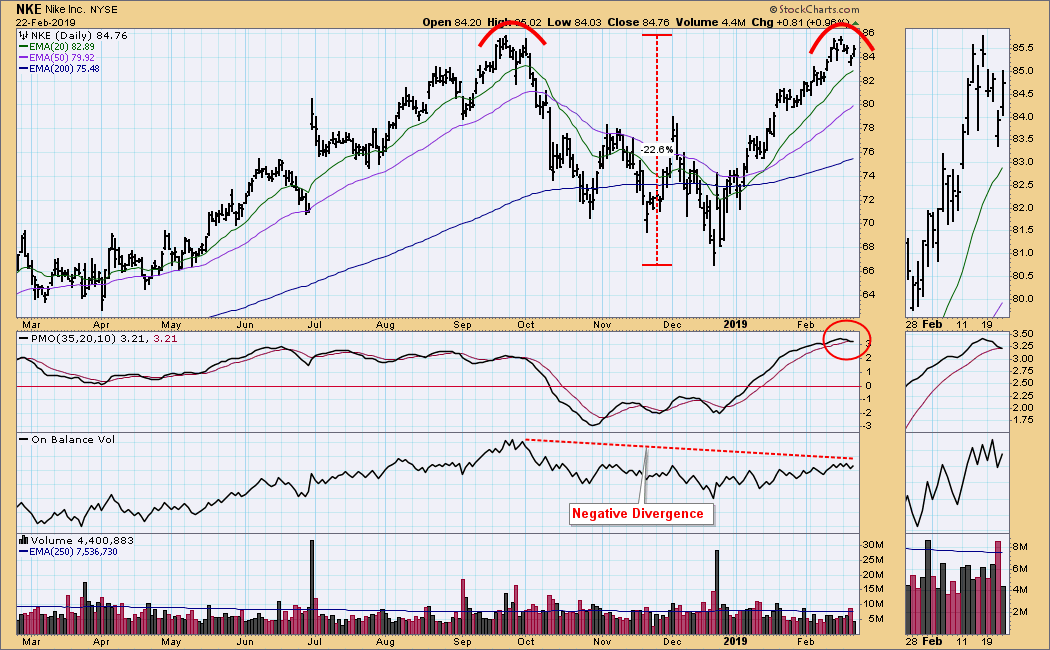

MEMBERS ONLY

DP WEEKLY WRAP: Looking At NKE Technicals

by Carl Swenlin,

President and Founder, DecisionPoint.com

In a basketball game on Wednesday a Nike shoe literally peeled off the foot of 285-pound, 6-foot-7-inch Zion Williamson. The resulting knee injury was regrettable, but the reporting of the incident was rather amusing. For one thing, the video of the incident ran over, and over, and over. I considered...

READ MORE

MEMBERS ONLY

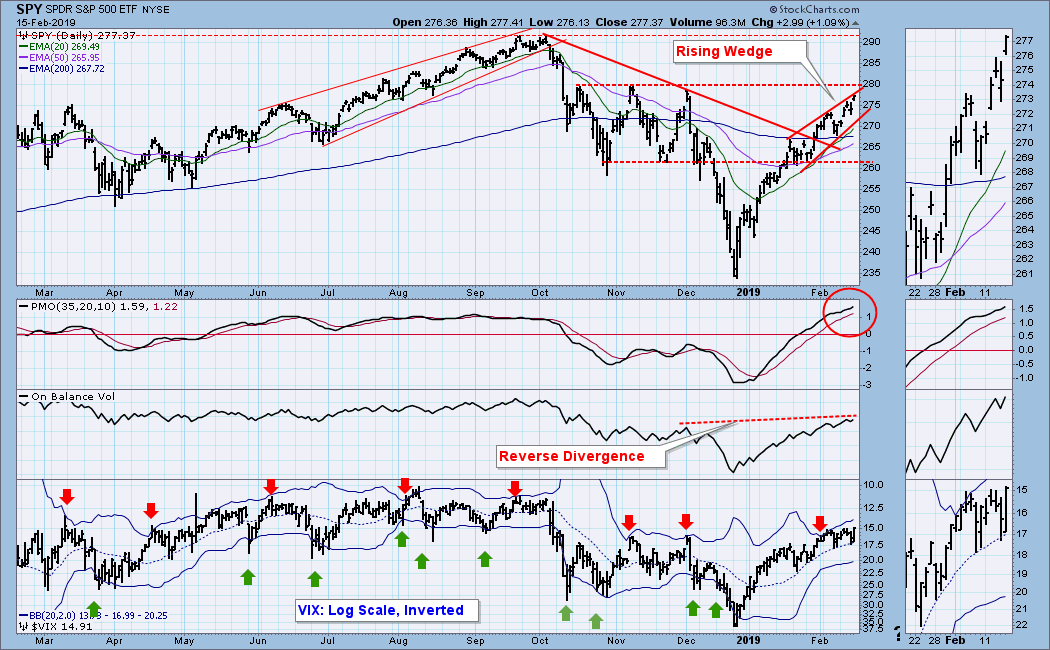

DP WEEKLY WRAP: Negative Signs Still Haven't Delivered

by Carl Swenlin,

President and Founder, DecisionPoint.com

There are some indicators that have been warning of a price top for a couple of weeks, but the market just keeps powering upward. (1) There is an OBV reverse divergence, where the OBV has exceeded its December top well ahead of price. This means that heavy volume hasn'...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: The Pleasure/Pain Cycle

by Carl Swenlin,

President and Founder, DecisionPoint.com

I have a theory about the market that I'm thinking of tuning up for submission to the Nobel Prize committee. It goes like this: (1) Things get better and better until they are as good as they are going get. (2) Then they get worse and worse until...

READ MORE

MEMBERS ONLY

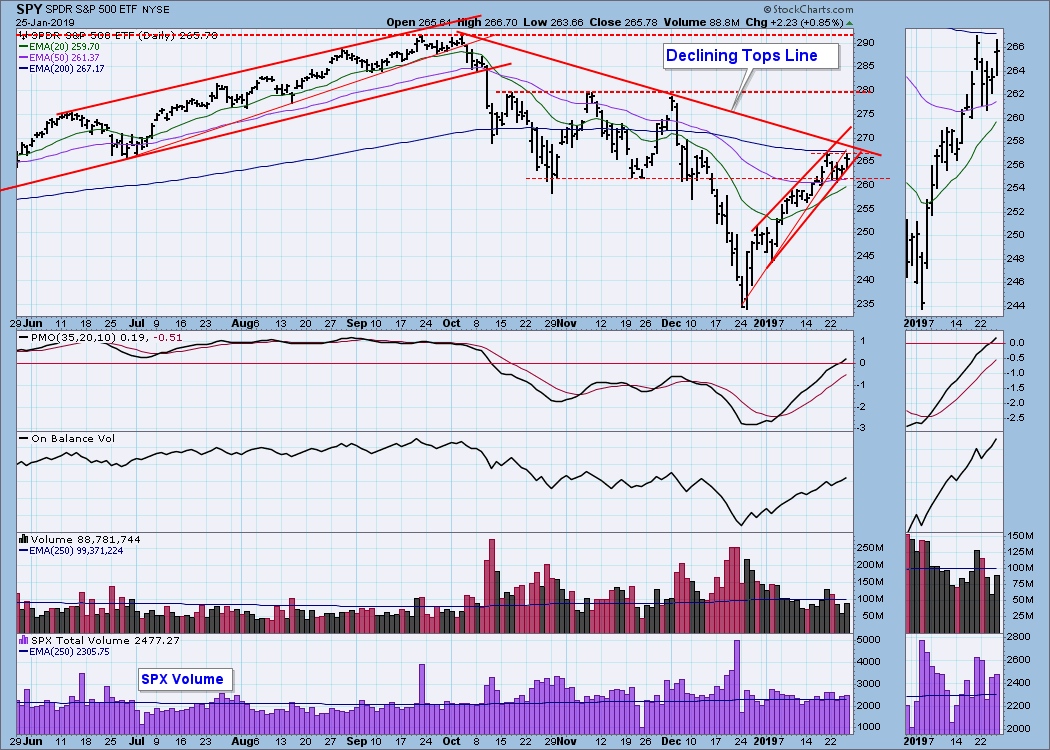

DP WEEKLY WRAP: SPY Breakout and New BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Thursday, on expanding volume, SPY broke above the declining tops line drawn from the October Top, and at the same time it broke above the 200EMA. Then on Friday the SPY 20EMA crossed up through the 50EMA causing the IT Trend Model to change from NEUTRAL to a BUY...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Rising Wedge Breakdown Sets Less Accelerated Rising Trend Line

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week we were focused on the SPY rising wedge formation, the technical expectation for which was that it would break down. Well, on Tuesday it did break down, but there was no follow through afterwards. Instead, it moved sideways for two days, then rallied on Friday, challenging Monday'...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Trade News Dominates; Technicals Lurk

by Carl Swenlin,

President and Founder, DecisionPoint.com

Just last week I wrote: There are two impending fundamental events to which the market is likely to react positively: (1) resolution of the trade issues with China; and (2) ending the government shutdown. Assuming that either event actually comes to pass, positive short-term reaction can be expected from either...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Expect Breakdown from Rising Wedge

by Carl Swenlin,

President and Founder, DecisionPoint.com

One of my favorite chart patterns is the wedge. Rising or falling, they arrive frequently and usually resolve predictably. On this chart there happen to be two rising wedge formations. The first one led us into the bull market top in September/October of 2018. It resolved downward, as expected,...

READ MORE

MEMBERS ONLY

EARNINGS: S&P 500 P/E Overvalued, But Back In Normal Range

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings for 2018 Q3 have been finalized. The following chart shows us the normal value range of the S&P 500 Index. It shows us where the S&P 500 would have to be in order to have an overvalued P/E of 20...

READ MORE

MEMBERS ONLY

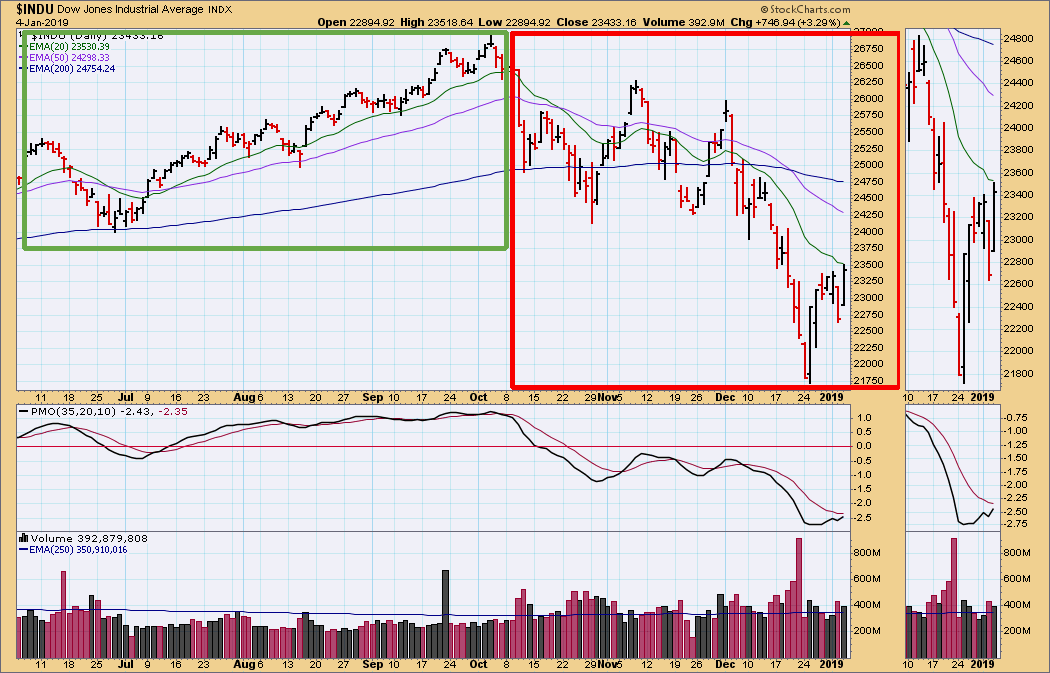

DP Weekly Wrap: The Market Eats the Shorts Again, but Context Helps Preserve Sanity

by Carl Swenlin,

President and Founder, DecisionPoint.com

With another short-covering rally, I am reminded that the primary benefit of using price charts is that they provide context. For example, I look at the TV and see that the Dow is up 800+ points, and I think holy cow what is going on? Do I need to completely...

READ MORE

MEMBERS ONLY

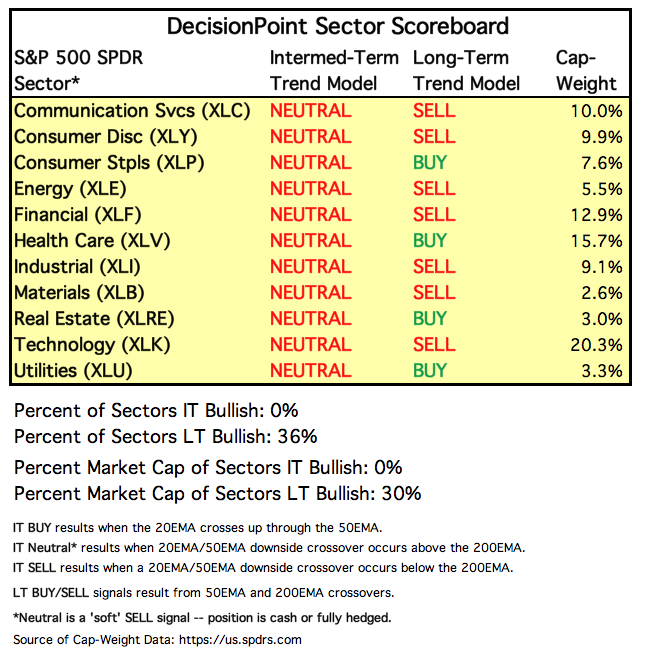

DP Weekly/Monthly Wrap: Unanimously Not Bullish

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday the signal for the Utilities sector changed from BUY to NEUTRAL, making it the last of the 11 S&P 500 sectors to lose its bullish stance. NEUTRAL sounds kind of, well, neutral, but it is really a 'soft' SELL signal because the position changes...

READ MORE

MEMBERS ONLY

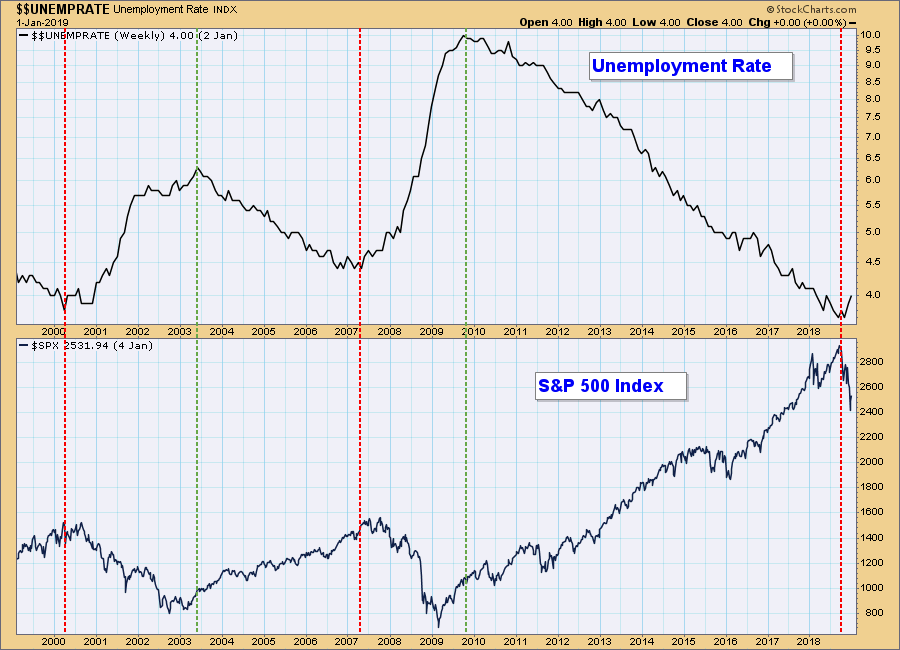

DP Weekly Wrap: Are Things As Bad As They're Going To Get?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Less than three months ago there was a great lament about how employers couldn’t fill job positions because of a shortage of job seekers. This week FedEx announced voluntary employee buyouts, presumably to reduce payroll. In view of this, I offer you the Swenlin Basic Economic Theory: Things get...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Bear Market? Never Seen One.

by Carl Swenlin,

President and Founder, DecisionPoint.com

The chart below shows the entire period during which I have been involved in stock market analysis, and, as you can see, the title of this article definitely does not apply to me. If a decline of -20% or more qualifies as a bear market, then I have experienced seven...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Still In Trading Range Despite Fireworks

by Carl Swenlin,

President and Founder, DecisionPoint.com

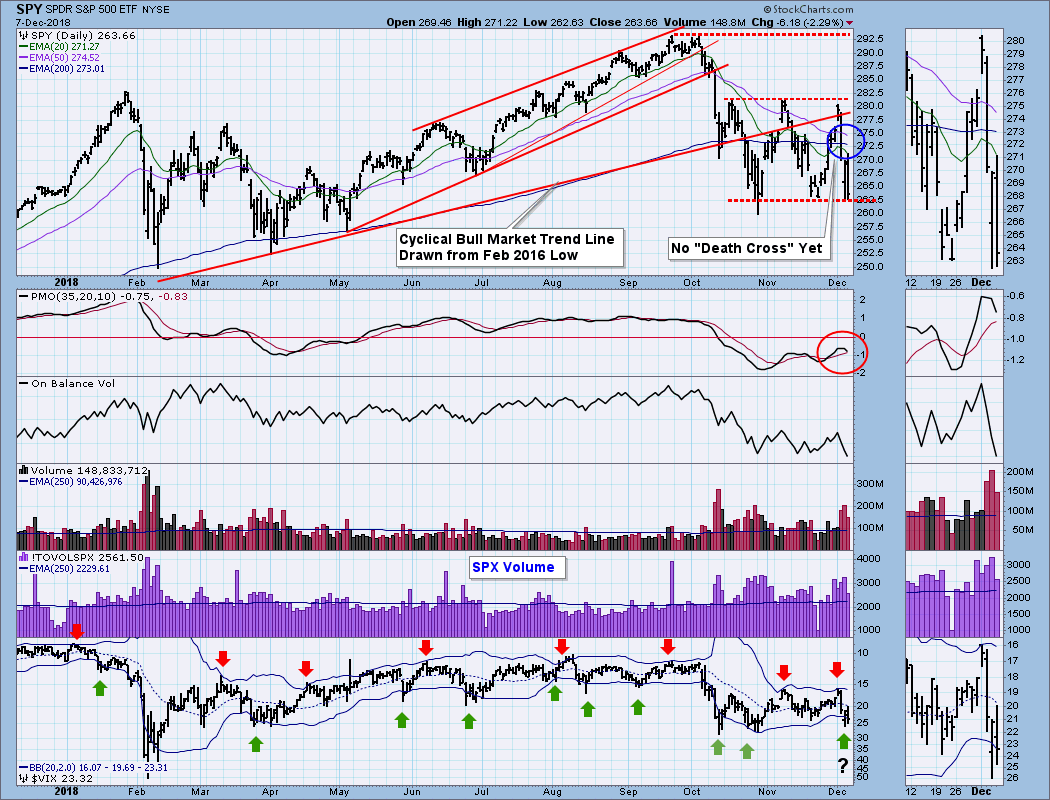

There will probably be a lot of people mentioning that today there was a "Death Cross" on the S&P 500 chart, and this is important because a Death Cross means that the price index has entered a bear market. Specifically, on the $SPX chart (not shown)...

READ MORE

MEMBERS ONLY

DP Weekly/Monthly Wrap: The Monkey Did It

by Carl Swenlin,

President and Founder, DecisionPoint.com

I usually spend my days at my desk noodling on the computer, reading, and casually watching business television with the sound off. (My idea of retirement.) With no sound to distract/annoy me, the most dangerous part of the TV watching is the endless stream of headline banners that announce...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Looks Like a Bear to Me

by Carl Swenlin,

President and Founder, DecisionPoint.com

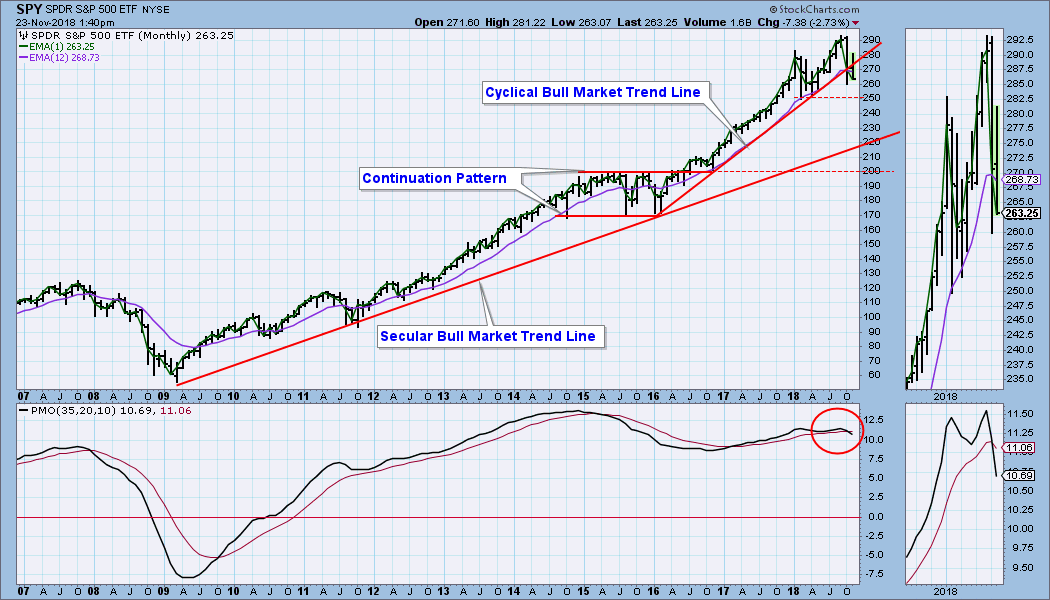

This monthly chart doesn't become final until the end of this month (next Friday), but there is strong evidence here that we are in a bear market. The cyclical bull market rising trend line has been decisively broken, and the monthly PMO is below the signal line and...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Does SPY Have Bullish Reverse H&S? Gold Sentiment Is Looking Contrarian

by Carl Swenlin,

President and Founder, DecisionPoint.com

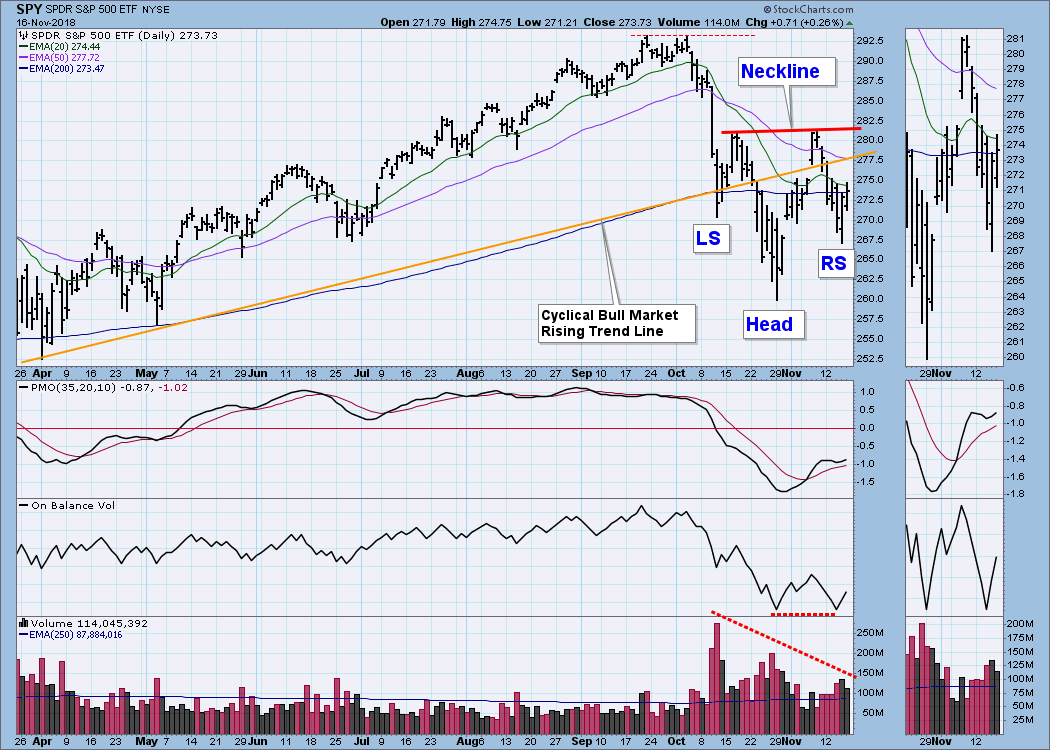

A lot of people are seeing a reverse head and shoulders pattern developing, and it is really not hard to spot. From Friday's close, it will take a rally of a little less than 3% for price to reach the neckline. Add another 4.5% and new, all-time...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Break or Fake?

by Carl Swenlin,

President and Founder, DecisionPoint.com

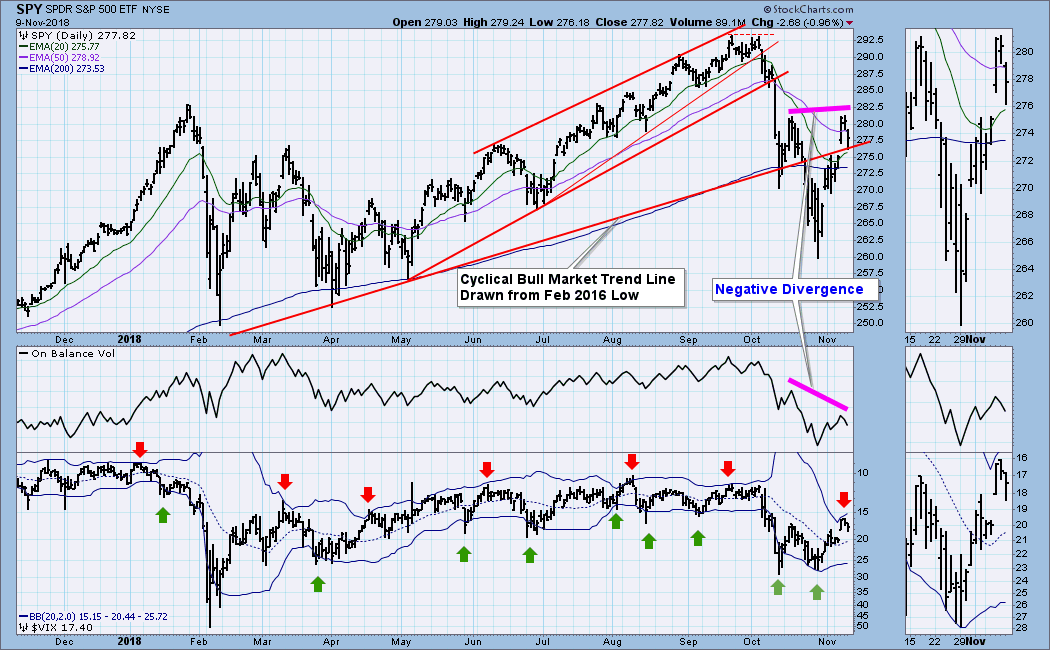

Last week SPY was below the cyclical bull market rising trend line. This week there was a post-election pop on Wednesday that caused SPY to recapture that rising trend line. Will that breakout hold, or is it a fakeout? There are two features on the daily chart that say to...

READ MORE

MEMBERS ONLY

AAPL: Another Parabolic Breakdown

by Carl Swenlin,

President and Founder, DecisionPoint.com

Apple, Inc. (AAPL) is nothing if not repetitive. AAPL experiences frenzied, parabolic advances that are followed by equally dramatic corrections. This has happened no less than three times in the last 11 years with an average correction of -48%. Now it appears to be happening again, as price has recently...

READ MORE