MEMBERS ONLY

BULL/BEAR BATTLE THIS WEEK

The S&P 500 ETF (SPY) firmed this week and found some support. The ETF hit support from the 40-week moving average and broken resistance. The 40-week moving average is equivalent to the 200-day moving average and this level is important to the long-term trend. Resistance stems from the...

READ MORE

MEMBERS ONLY

MARKET OVERSOLD AND DANGEROUS

A month ago I wrote an article stating that I thought that the 20-Week Cycle was cresting and that we should expect a decline into the cycle trough that would probably break down through the support provided by the bottom of the trading channel, setting up a bear trap. So...

READ MORE

MEMBERS ONLY

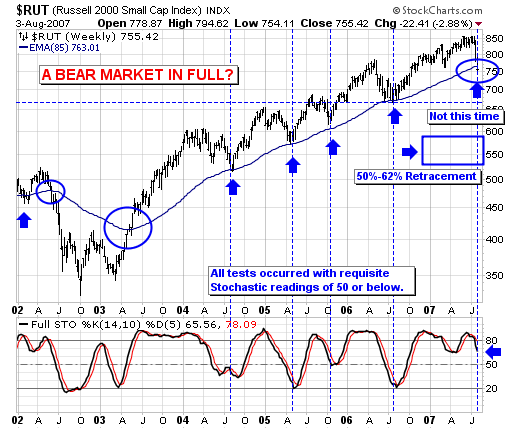

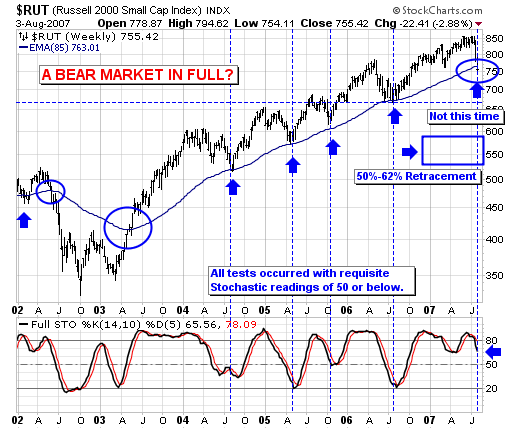

A BEAR MARKET IN FULL?

Last week was a treacherous week indeed, with stock prices falling universally. That said, one of the "weakest indices" was related to the US small cap arena, and specifically to the Russell 2000 Index ($RUT). In the past, RUT led the market higher, but that changed last year...

READ MORE

MEMBERS ONLY

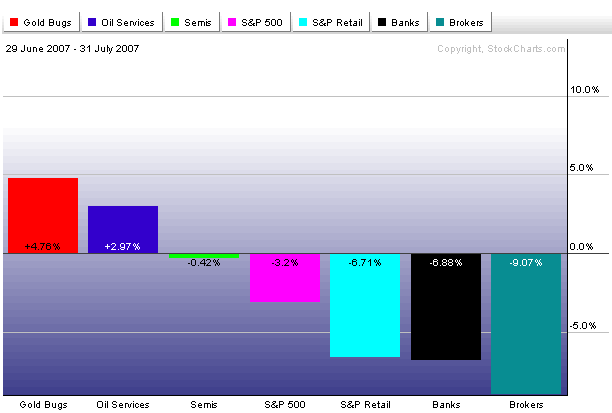

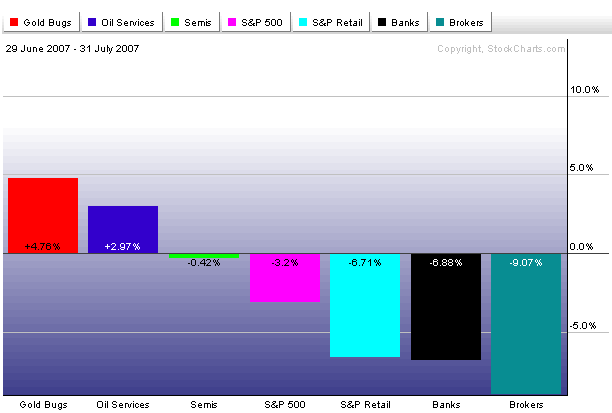

JULY PERFORMANCE FIGURES CARRY A MESSAGE

The chart above shows "John's Latest Performance Chart" that reflects the market's stronger and weaker groups during the hightly volatile month of July. All are plotted around the S&P 500 which lost 3.2% during July. [The S&P can also...

READ MORE

MEMBERS ONLY

THE BATTLE OF 13,200

The troops are mustered. The swords are out. The orders have been posted. The pieces are in place. The die has been cast. (The metaphors are getting lame.

) However you want to say it, the battle line for the Bulls and the Bears has been drawn. Can you spot it...

READ MORE

MEMBERS ONLY

DON'T IGNORE HISTORY

We discuss so many different technical scenarios that sometimes we lose sight of what history has taught us. It's time to pause for a bit after a very nice rally in the equity markets and see what history has to say. For purposes of this discussion, all numbers...

READ MORE

MEMBERS ONLY

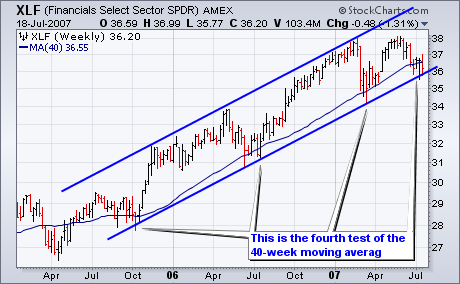

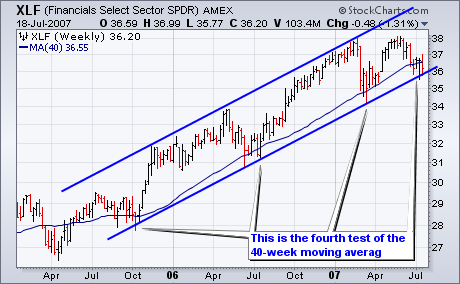

THE MOMENT-OF-TRUTH FOR FINANCE

Despite a sharp decline over the last six weeks, the Finance SPDR (XLF) remains in a long-term uptrend on the weekly chart and support is at hand. The Finance SPDR (XLF) met resistance at 38 twice this year and declined to around 36-36.5 in June and July. The lower...

READ MORE

MEMBERS ONLY

GOLD: LONG-TERM PICTURE LOOKING SHAKEY

On Thursday our trend model for gold switched to a buy, which means our medium-term posture is bullish on gold; however, when I looked at a very long-term chart of gold I saw something that gave me a slightly queasy feeling. What I saw was that gold is forming a...

READ MORE

MEMBERS ONLY

SMALL CAPS FAIL TO SET NEW HIGHS

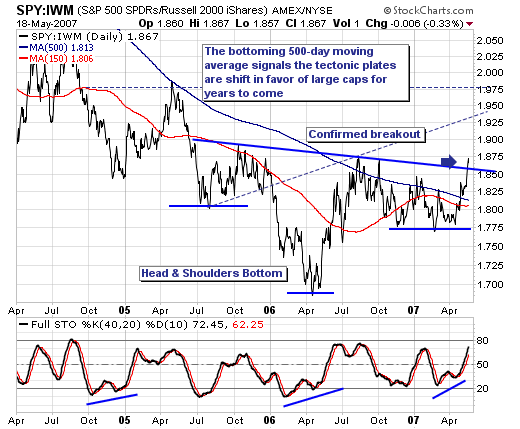

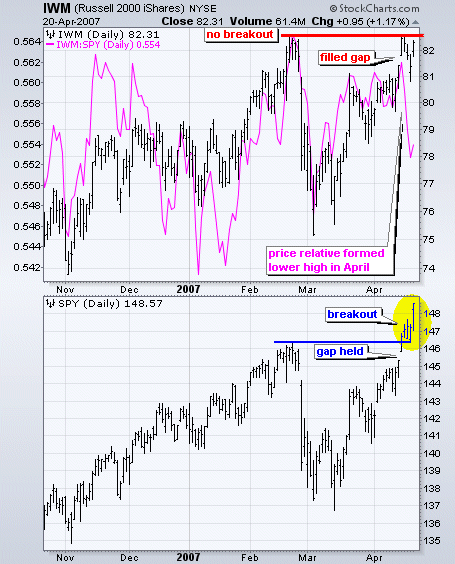

I suggested Friday that part of the recent weakness in market breadth figures was most likely due to the fact that most of the recent buying has been in large cap stocks, and that small cap indexes had yet to hit new highs. That discrepancy is shown in the chart...

READ MORE

MEMBERS ONLY

SCANNING FOR DOLLARS

Recently, we've seen a big increase in the number of people sending in questions about our scanning feature. Here's an article that I wrote about creating and running scans waaaaay back in October of 2002. While the example scan's results and charts are out...

READ MORE

MEMBERS ONLY

THE WEAK DOLLAR COULD STRENGTHEN YOUR PORTFOLIO

The U.S. Dollar Index is approaching levels not seen since 1992. The reasons are fairly obvious. Global interest rates are on the rise and our own interest rates have been on hold for 8 straight meetings. As foreign interest rates rise, foreign currencies generally strengthen, weakening the US dollar...

READ MORE

MEMBERS ONLY

20-WEEK CYCLE CRESTING

When performing market analysis it is best to first look at the long-term view of what is happening because it provides us with the relevant context for analysis of shorter-term market action. With this in mind, on the weekly bar chart we can see that the S&P 500...

READ MORE

MEMBERS ONLY

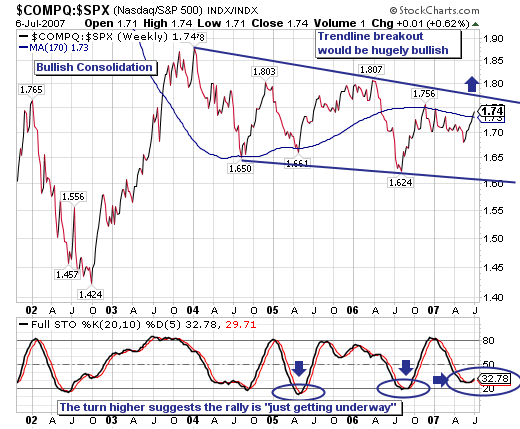

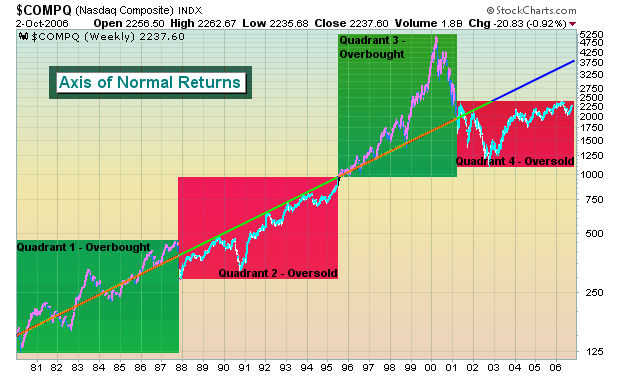

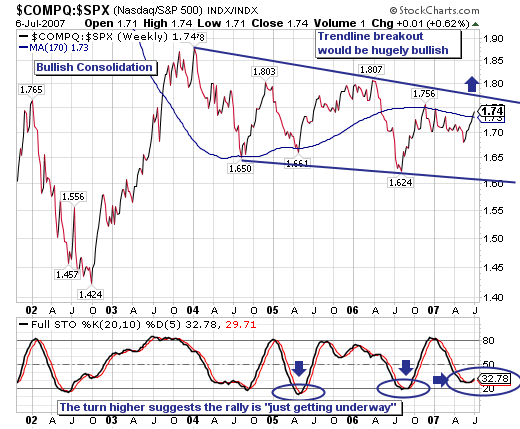

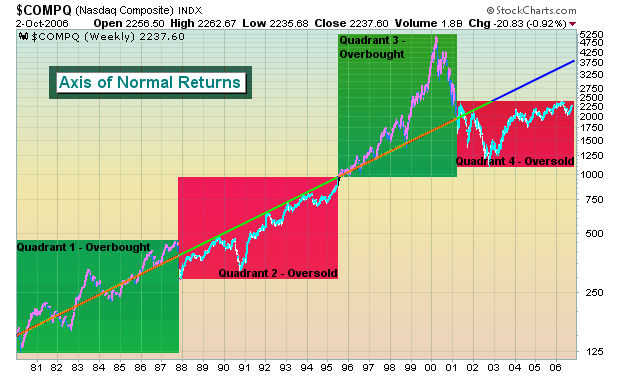

NASDAQ/S&P 500 RATIO

In November-2006, we noted that if one previewed the NASDAQ Composite/S&P 500 Ratio, one would find a very well pronounced and bullish consolidation forming. Well, its been 3 ½ years and the consolidation is still forming; however, there are emerging technical signs that a major breakout is forthcoming...

READ MORE

MEMBERS ONLY

DATAFEED PROBLEMS CONTINUE

In case you've been under a rock, we have been having severe problems with our intraday datafeed during the past two weeks. We've created a detailed page explaining the problem and the current status of the solution. Click here to get the latest information....

READ MORE

MEMBERS ONLY

A TOUR OF OUR NEW DATACENTER

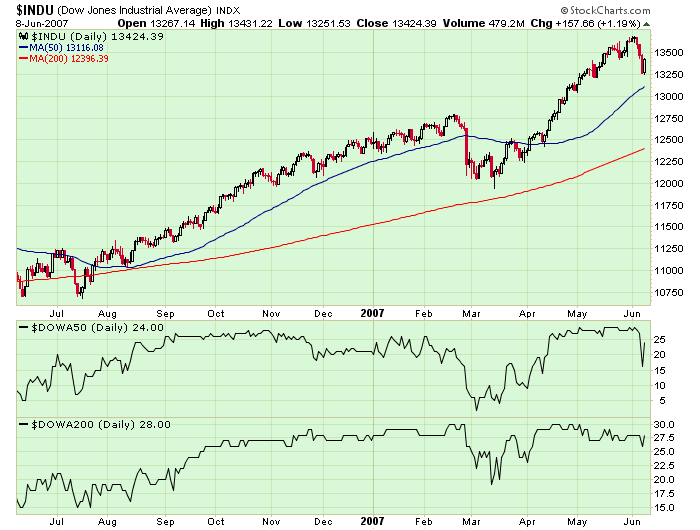

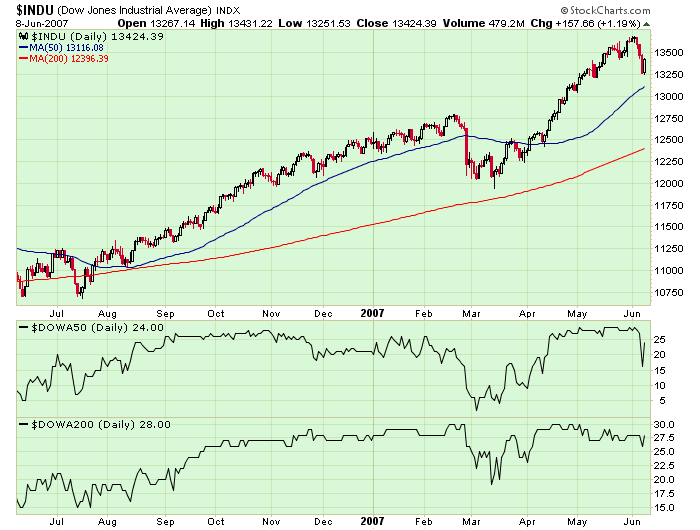

The Dow is poised to re-test the 13,700 level next week. If it is able to break above that level, it will be a very bullish development indeed. Given that the Dow has faltered just below that level twice in the previous two months, odds are it will fail...

READ MORE

MEMBERS ONLY

FLIGHT TO SAFETY RATIO

I discussed many months ago how the rotation from the tech-heavy NASDAQ to the safety of the Dow Jones evolves over time. As earnings disappoint and growth slows, money moves away from the high octane growth stocks to the more conservative components of the Dow. That's what we...

READ MORE

MEMBERS ONLY

S&P MIDCAP ETF TESTS KEY SUPPORT

The S&P Midcap ETF (MDY) remains in an uptrend for now, but a lower high and waning upside momentum are cause for concern. The ETF established support around 160-161 with reaction lows in May and June. In addition, the rising 50-day moving average marks support in this area....

READ MORE

MEMBERS ONLY

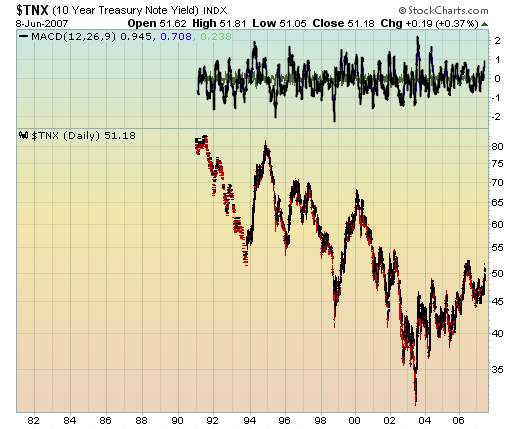

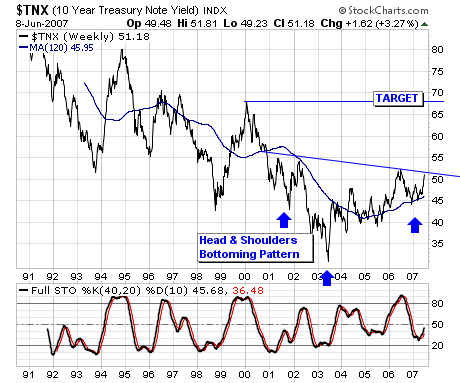

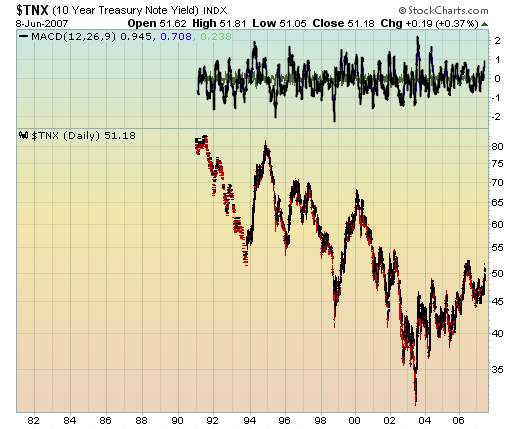

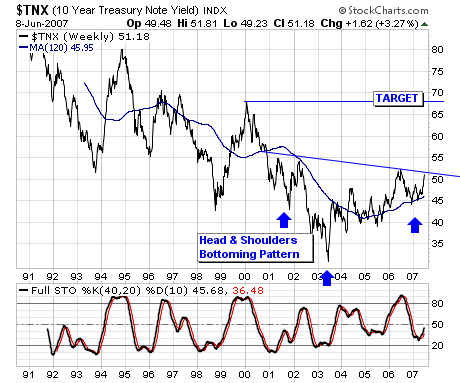

BONDS CONTINUE TO WEAKEN

On our first chart, a daily bar chart, we can see that bonds have been weakening for several months, with the most dramatic decline occurring in the last month or so. The question that comes to mind is whether this weakness is a correction in a longer-term up trend or...

READ MORE

MEMBERS ONLY

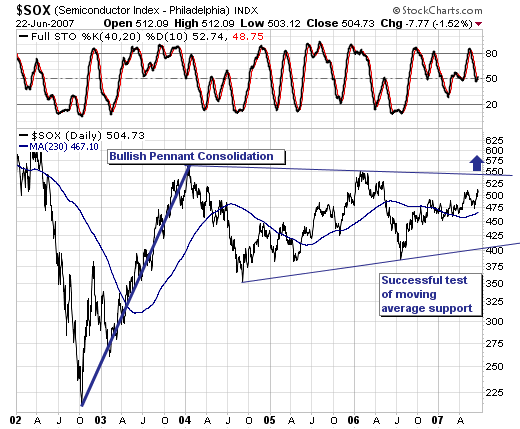

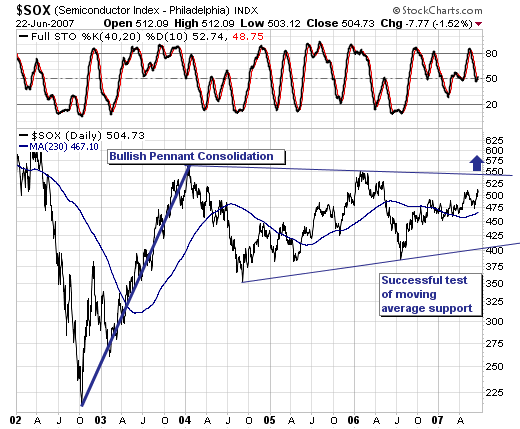

LOOKING AT THE SEMICONDUCTOR INDEX

Last week's stock market correction was rather "brutal" to be sure; however, we believe that the balance of evidence suggests at this time it is nothing more than a correction and more likely a consolidation to higher highs. If this is so, then we want to...

READ MORE

MEMBERS ONLY

SERVER ROOM MOVE COMPLETED!

It took w-a-y longer than it was supposed to but all of our servers are now fully moved into our new, cooler, more powerful datacenter. The new datacenter will allow us to continue adding newer, more powerful computers that will allow our site to run even faster.

CHART SNAPSHOTS BACK...

READ MORE

MEMBERS ONLY

SUBPRIME CONCERNS HURT BANKS AND BROKERS

Growing concerns about the fallout in the subprime mortgage market caused heavy selling in banks and brokers today. Today's selling more than wiped out yesterday's rebound in the financial group. Chart 1 shows the Financials Sector SPDR (XLF) undercutting yesterday's intra-day low. It'...

READ MORE

MEMBERS ONLY

SIX SIMPLE STEPS FOR FINDING GREAT STOCKS

This week, I thought we'd revisit an article I wrote way back in November of 2001 about the "Six Steps" you can take at StockCharts.com to quickly guage the overall health of the market and find great stock opportunities. While the graphs are all out-dated...

READ MORE

MEMBERS ONLY

A GOLDEN OPPORTUNITY

The market periodically finds reasons to selloff, even in bull markets. This past week it was all about interest rates. You could see it coming. Interest rates had been rising for the last month. The yield on the 10 year treasury bond increased from 4.61% on May 8th to...

READ MORE

MEMBERS ONLY

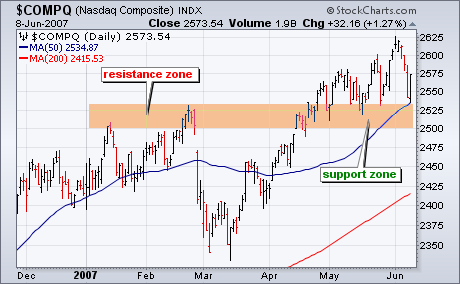

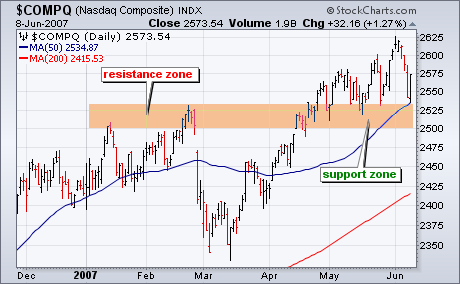

NASDAQ RECOVERS

The Nasdaq held support and led the market higher on Friday. Even though Thursday's decline was quite drastic, the Nasdaq never broke support from its May lows and the medium-term uptrend remains. Nasdaq support is just above 2500 and extends back to the January highs. The index established...

READ MORE

MEMBERS ONLY

CORRECTION AT LAST!

We have been watching prices trend higher for several weeks, even as internal strength trended lower and warned that price weakness could be ahead. Finally, this week prices broke down in a big way, signaling the start of a correction that could last at least a few weeks.

Our first...

READ MORE

MEMBERS ONLY

MARKET FOCUSING ON 10-YEAR NOTE YIELD

Last week saw stocks sell off rather sharply for several days, of which the catalyst was the sharp rise in bond yields as inflation and too strong growth concerns too center stage. Since bond yields are now the tail wagging the stock market dog - we think it imperative to...

READ MORE

MEMBERS ONLY

NEW SERVER ROOM STATUS

We've moved about 70% of our servers into our new server room where our new chiller plant keeps the temperature a "toasty" 60F degrees at all times. We are working as hard as we can to ensure that there are as few interruption as possible as...

READ MORE

MEMBERS ONLY

TRACKING THE DOW'S INTERNAL HEALTH

Things got a little bumpy last week as the Dow had a big "down" day on Thursday. Friday's recovery was reassuring, but was any lasting damage done? One of the best ways to examine the overall "health" of the Dow is to look at...

READ MORE

MEMBERS ONLY

TAKE ME OUT TO THE BALLGAME

Folks, we're merely in the second or third inning of a nine inning game. Let there be no doubt, the bulls are in charge. And they will remain in charge. This current bull rally goes beyond interest rates, earnings, inflation, blah, blah, blah. It's not that...

READ MORE

MEMBERS ONLY

DOLLAR TRYING TO TURN UP

The U.S. Dollar is trying to turn up for the fourth time since it topped in 2004, but this bottom looks more promising than the prior three. While the long-term trend is down, this bottom is the third confirmation of the descending wedge formation, a technical configuration which normally...

READ MORE

MEMBERS ONLY

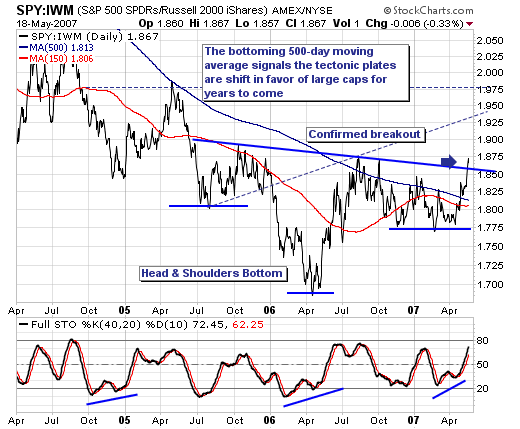

PLATES STILL SHIFTING

We recently featured the S&P 500 Large Cap vs. Russell 2000 Small Cap ratio surrogate using the ETFs SPY:IWM; with the implication that the tectonic plates were shifting beneath the markets, with large caps slowly, but surely coming back to favor at the expense. This was simply...

READ MORE

MEMBERS ONLY

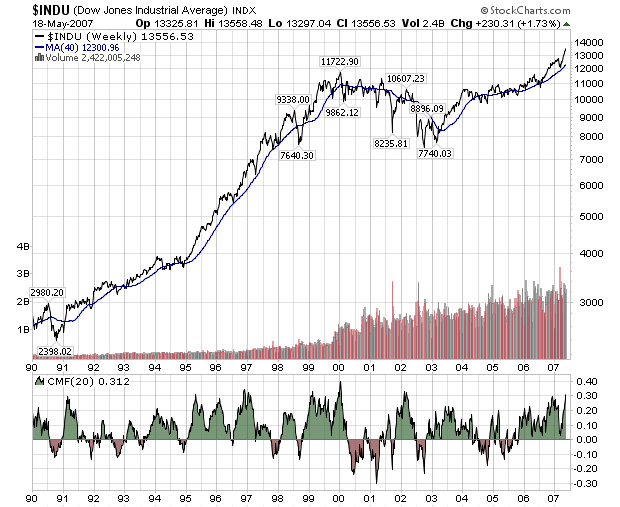

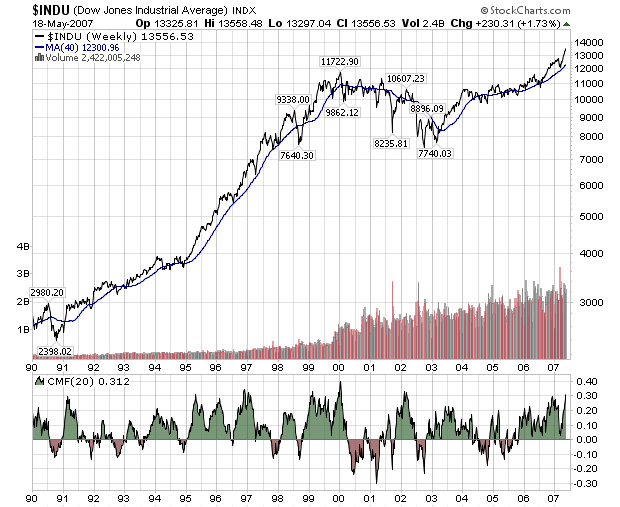

DOW IN PERSPECTIVE

The Dow Jones Industrials continues to rise week after week setting new records as it goes. I thought it would be good to take a quick look back and see if history can teach us anything about what the Dow does to signal the end of these long up-trends. Here&...

READ MORE

MEMBERS ONLY

SEMICONDUCTORS FINALLY MAKE THEIR BREAK

We've been watching and following the semiconductors for the past many months, awaiting their attempt to join the stock market's rally. But it hadn't happened....until this past week. We have remained steadfastly bullish over the past couple years and became very bullish when...

READ MORE

MEMBERS ONLY

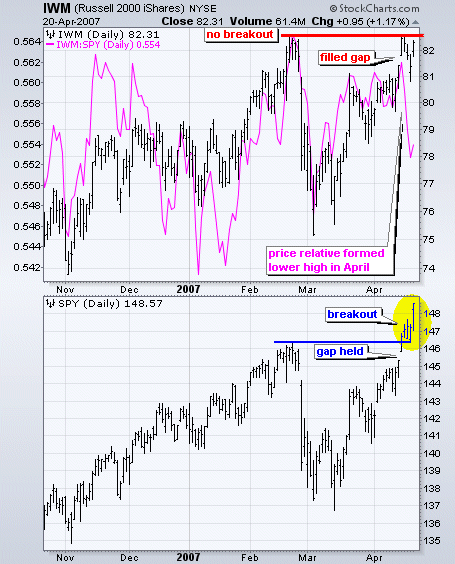

THOSE LAGGING SMALL CAPS

Even though the Dow is trading at all time highs and the S&P 500 is trading above 1500 for the first time since 2000, the Russell 2000 continues having trouble with resistance around 830. Thinking in terms of Dow Theory, I view this as a non-confirmation. A bull...

READ MORE

MEMBERS ONLY

MARKET IS BULLISH BUT OVERBOUGHT

The weekly chart of the S&P 500 Index below reveal that prices are behaving in a very bullish fashion. The index has broken above the gradually rising trend channel that prevailed from 2004. In March prices pulled back and successfully tested the support provided by the top of...

READ MORE

MEMBERS ONLY

NETWORK SPEED, CHILLER

NOTHING SPECIAL HAPPENING HERE - NOPE - It's certainly not worth your time to completely read Chip's article this week. Nope. I'd just skip it entirely.

NETWORK SPEED BACK TO NORMAL WITH ZERO ERRORS! - We've been slowly and steadily getting the...

READ MORE

MEMBERS ONLY

XAU INDEX IS TESTING ALL-TIME HIGH

One of the most consistent of all intermarket relationship is the inverse relationship between gold assets and the U.S. Dollar. Nowhere is that more evident than in the chart below. The green line plots the U.S. Dollar Index (which measures the dollar against six foreign currencies. The Euro...

READ MORE

MEMBERS ONLY

TAKE ADVANTAGE OF US, PLEASE!

Our Spring Special is running throughout the month of May! Let me repeat that in case you missed it: Our Spring Special is on from now until May 31st! Sorry for the blatant plug, but every time one of these special periods end, we get flooded with message from people...

READ MORE

MEMBERS ONLY

EARTH DAY HIATUS

Look for Tom's commentary next time....

READ MORE

MEMBERS ONLY

SMALL CAPS LAGGING LARGE-CAPS

The Dow Diamonds (DIA) moved to a new all time high this past week and the S&P 500 ETF (SPY) recorded a multi-year high. En route to these highs, both exceeded their late February highs and large-caps are showing relative strength. In addition, both gapped higher on Monday...

READ MORE