MEMBERS ONLY

As Goes NVDA, So Goes the Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I find semiconductors to be an important group to watch, given that they essentially provide the "backbone" to our modern information economy. Pretty much every product we use at this point has a chip involved, so if chip makers are doing well, then I can assume the economy...

READ MORE

MEMBERS ONLY

Making Sense of Mass Hysteria

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Friday's sudden 3-4% drop felt like a wake-up call of sorts. At least it did for me, as I remained bearish through much of the recent rally phase. How could the market rally given all the macro headwinds -- inflationary pressures, higher interest rates, a hawkish Fed?

Tony...

READ MORE

MEMBERS ONLY

I'm Calling the Top in the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

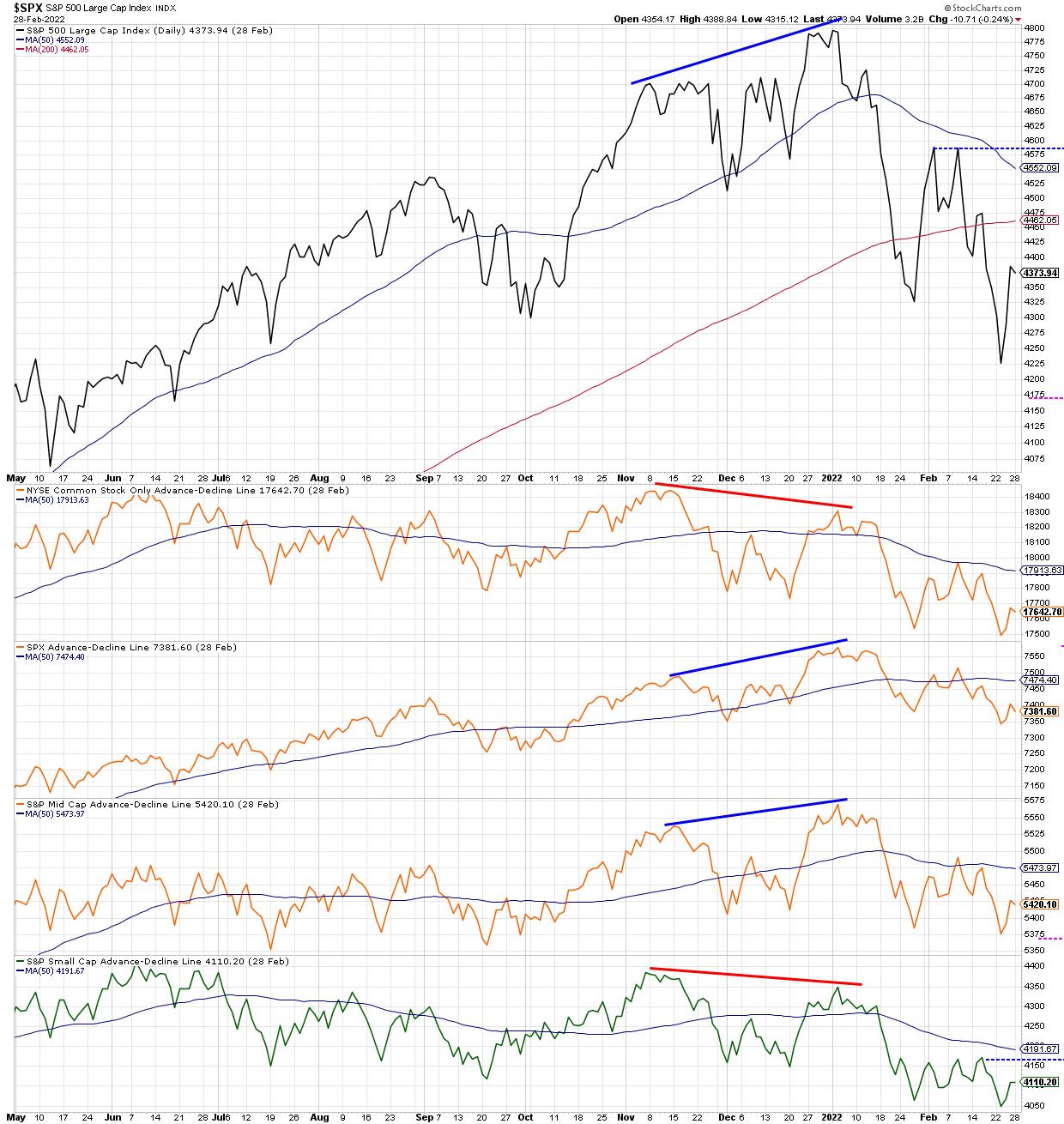

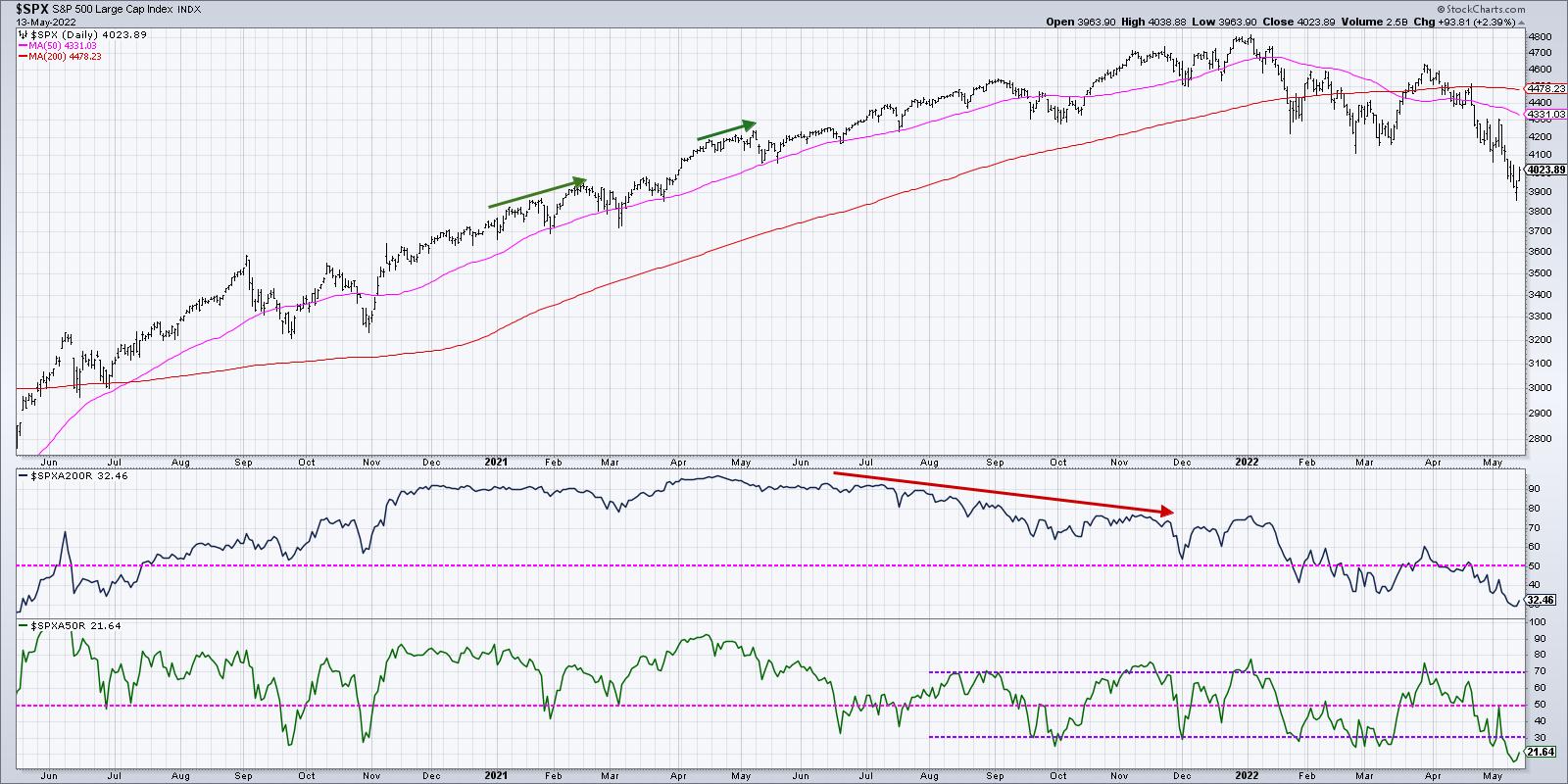

A key breadth indicator, which has indicated every swing top thus far in 2022, generated another sell signal on Friday.

By the way, in case you're wondering, today's title is a direct reference to my friend Tom Bowley's quite well-timed show on StockCharts TV,...

READ MORE

MEMBERS ONLY

Can The Final Bear Turn Out the Lights?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

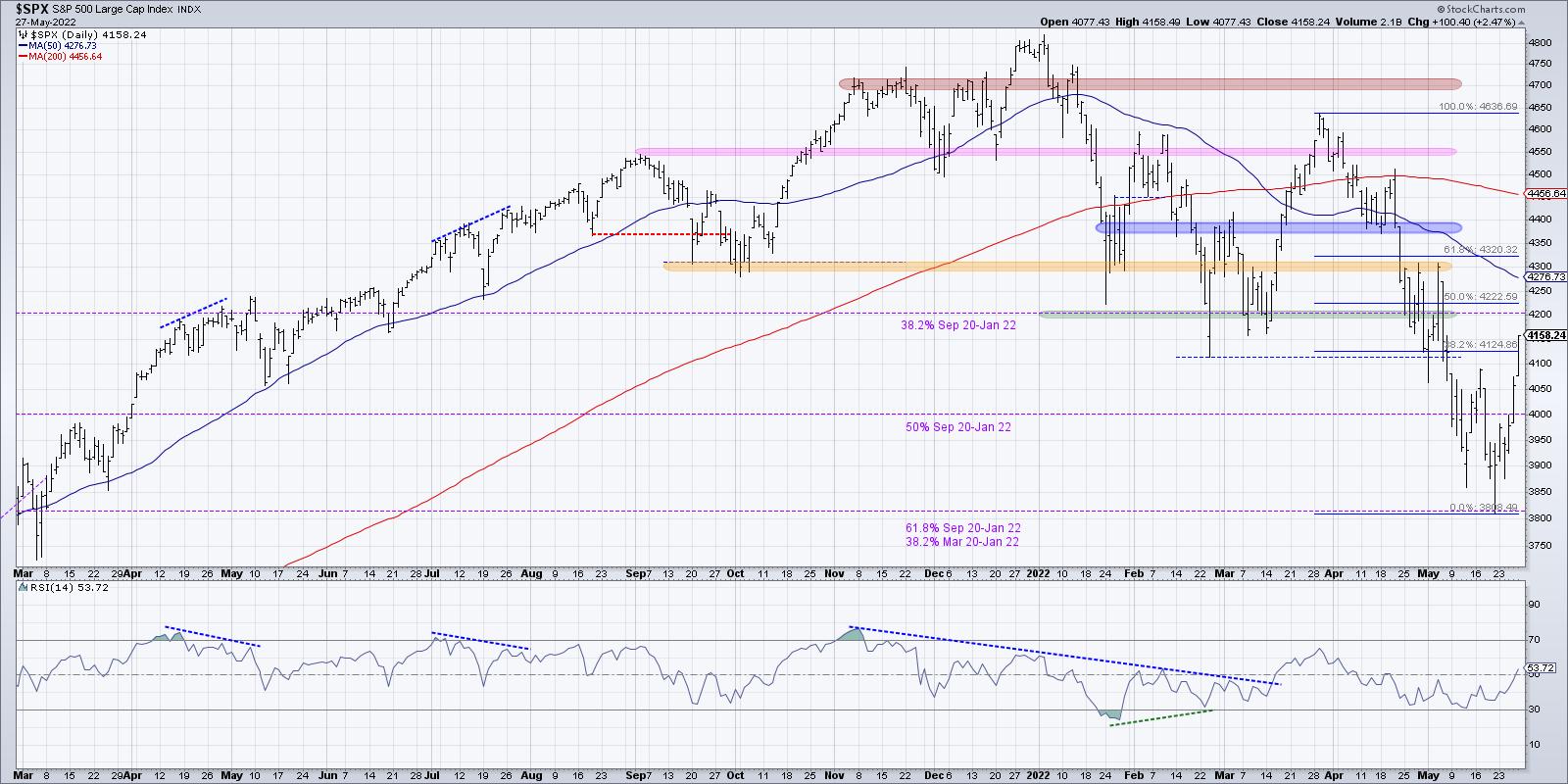

Since the initial rally off the June low, we've been reinforcing the importance of upside resistance in the 4150-4200 range. This is based on an initial Fibonacci retracement off the lows, and also happens to be the peak from early June.

On Wednesday, we finally closed above this...

READ MORE

MEMBERS ONLY

Why a Lower VIX is Bearish for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the VIX is often termed the "fear gauge" because of its inverse relationship to stocks, it's really more of a measure of volatility -- implied volatility, that is, which means it's looking at the S&P 500 options market, which then "...

READ MORE

MEMBERS ONLY

Why Breadth is Bullish... For Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

If you found this article through the Saturday, August 6 ChartWatchers newsletter, please click on this link to read this week's article instead.

If I had just one thing to use to understand the markets and predict what was coming next, it would be a daily chart of...

READ MORE

MEMBERS ONLY

It's All About That 50-Day Moving Average

by David Keller,

President and Chief Strategist, Sierra Alpha Research

For the last couple months, when someone would bring up some bullish argument, my response would usually be something like, "Sure, but we're still below the 50-day moving average."

I've learned that this game is all about identifying a key level, price, signal, or...

READ MORE

MEMBERS ONLY

Financials Rallied on Friday, But Is It Enough?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The top gainer in the S&P 500 index on Friday was Citigroup (C), up over 13% on a strong earnings report. So the chart is obviously bullish, right?

Not so fast.

It is very easy to get drawn into short-term signals like one-day price movements. But the trick...

READ MORE

MEMBERS ONLY

What Happens if FAANGs Break Out?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

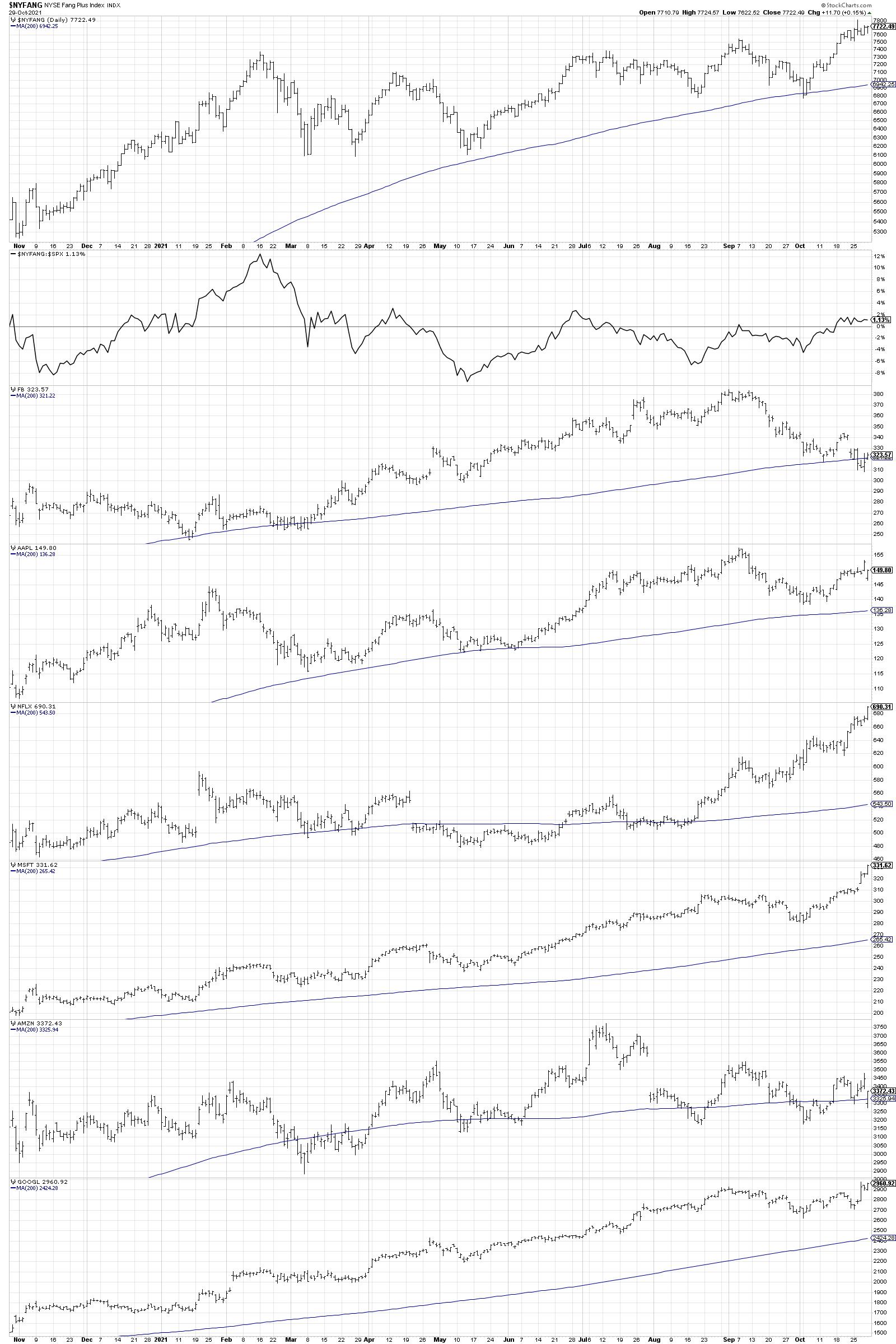

Despite the long-term macro trends of higher interest rates, higher inflation and a hawkish Fed, growth stocks have managed to log some pretty decent gains in recent weeks.

I've spoken often on the importance of the FAANG stocksdue to their outsized influence on our very growth-oriented equity benchmarks....

READ MORE

MEMBERS ONLY

New Low for Semiconductors is Not Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Semiconductors are what I consider a "bellwether" group. These companies truly provide the backbone of the modern information economy, so, when these stocks are doing well, the economic conditions are most likely strong. The SMH is featured a number of times on my Mindful Investor Live ChartList, mainly...

READ MORE

MEMBERS ONLY

All Eyes on Technology Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Most of my conversations this week on The Final Barwere related to the tactical upswing in risk assets this week, paired with the realities of a long-term bear market phase.At what point does the market rally enough that a short-term gain becomes more of a long-term recovery?

Well, first...

READ MORE

MEMBERS ONLY

Looking For a Bottom? Watch RSI.

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When the market is in a confirmed downtrend, which I certainly believe it is, your investor game needs to rotate from a focus on capital growth to a focus on capital preservation.As long as the trend remains negative, and the price momentum remains bearish, there is no real reason...

READ MORE

MEMBERS ONLY

One Chart to Rule Them All

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of my early mentors, Ralph Acampora, suggested that, if you want to understand the trend in the S&P 500, you simply need to look at the chart of the S&P 500.What is the trend? Are we seeing higher highs or lower lows? Where are...

READ MORE

MEMBERS ONLY

Lighter Volume Screams Market Top

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've written that bear market rallies can be sudden, severe and seductive. The move off the lows in May certainly seems to check all three boxes!Using analysis of price action, breadth indicators and volume techniques, I'll show how the similarities between the current market upswing...

READ MORE

MEMBERS ONLY

Why Bear Market Rallies Are So Seductive

by David Keller,

President and Chief Strategist, Sierra Alpha Research

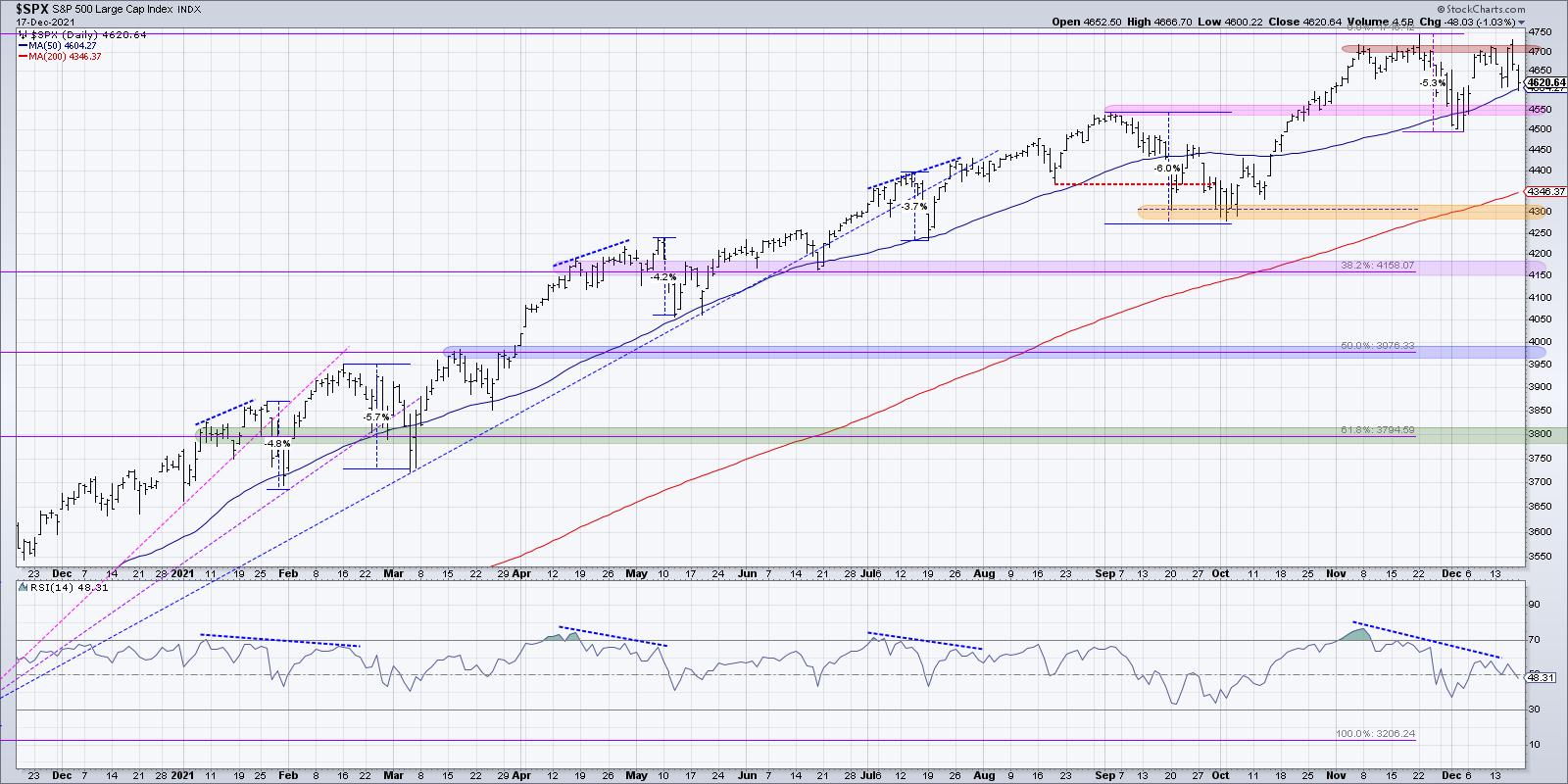

2022 has been a clear bear market phase for risk assets, particularly the equity markets. The signs were building in January, seemed validated by a new low in February, then were absolutely confirmed with the failed breakout above 4600 in late March.

Somewhere in the first three months of the...

READ MORE

MEMBERS ONLY

How to Smile During a Bear Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

It is super difficult to disconnect from the emotional impact of investing. I've often spoken of the dangers of endowment bias, where we tend to hold on to a losing position despite very clear evidence that we should cut our losses.As legendary technical analyst Ralph Acampora told...

READ MORE

MEMBERS ONLY

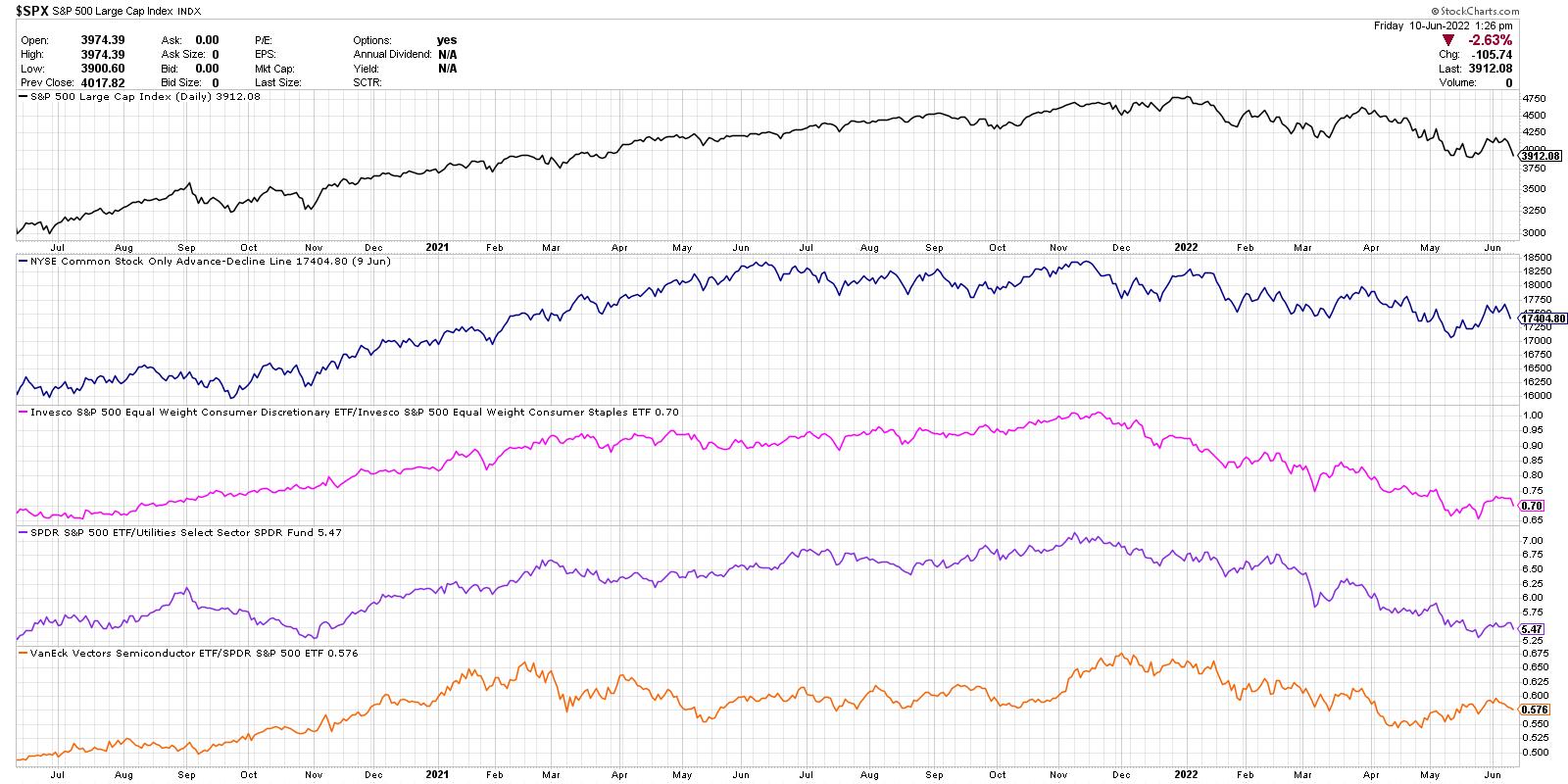

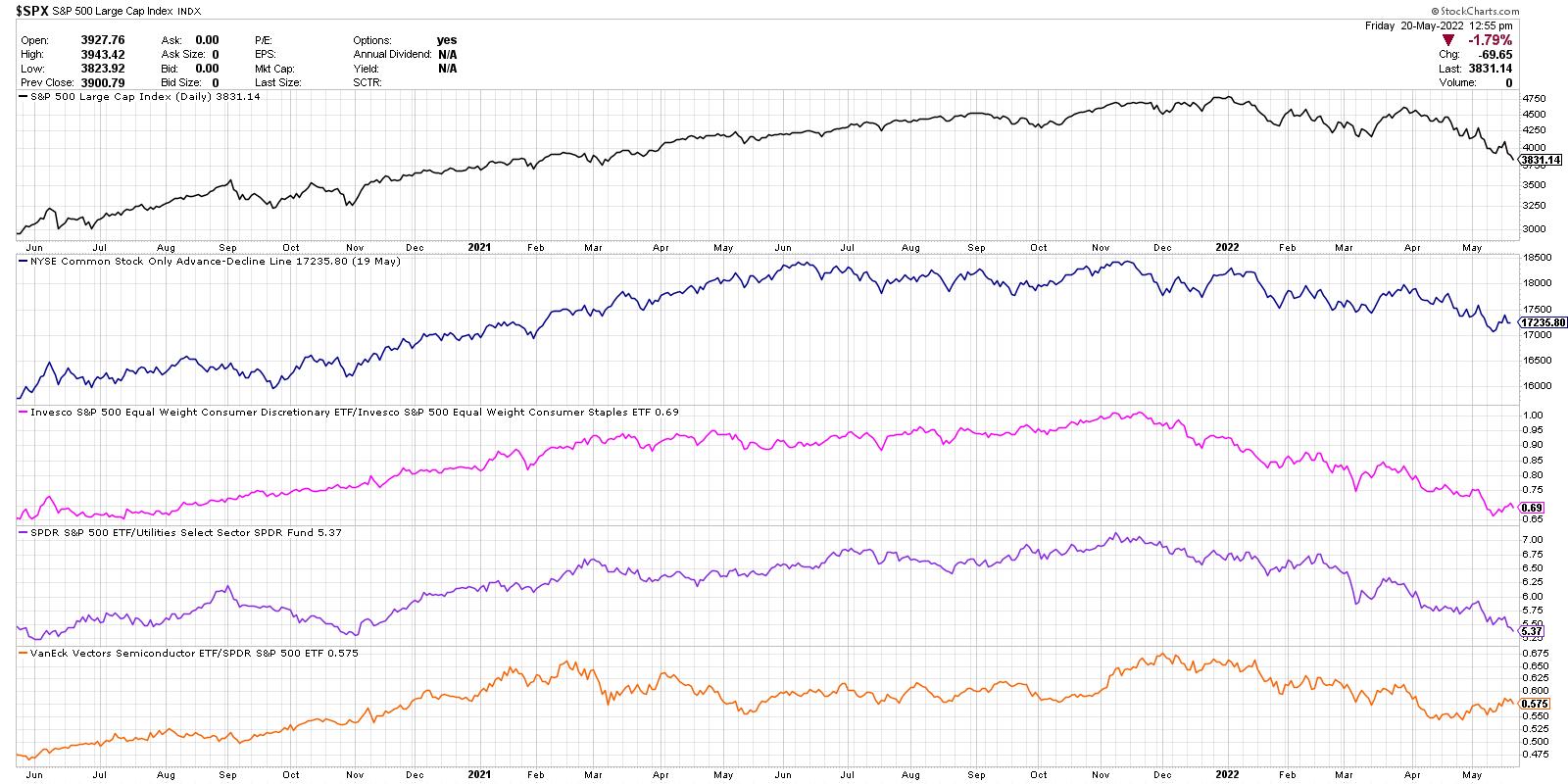

This Chart Says More Downside for S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We are now in the seasonally weakest half of the year, which is why "sell in May and go away" comments have made the annual rounds. While the Sell in May approach has not been particularly successfulin recent years, it is indeed based on the general tendency of...

READ MORE

MEMBERS ONLY

The Most Important Chart of the Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Some of my most painful experiences as an investor have come when I have been undisciplined. I would get away from my daily and weekly routines, act rashly when I noticed a compelling chart, and usually end up regretting that decision in a big way. I learned that, by going...

READ MORE

MEMBERS ONLY

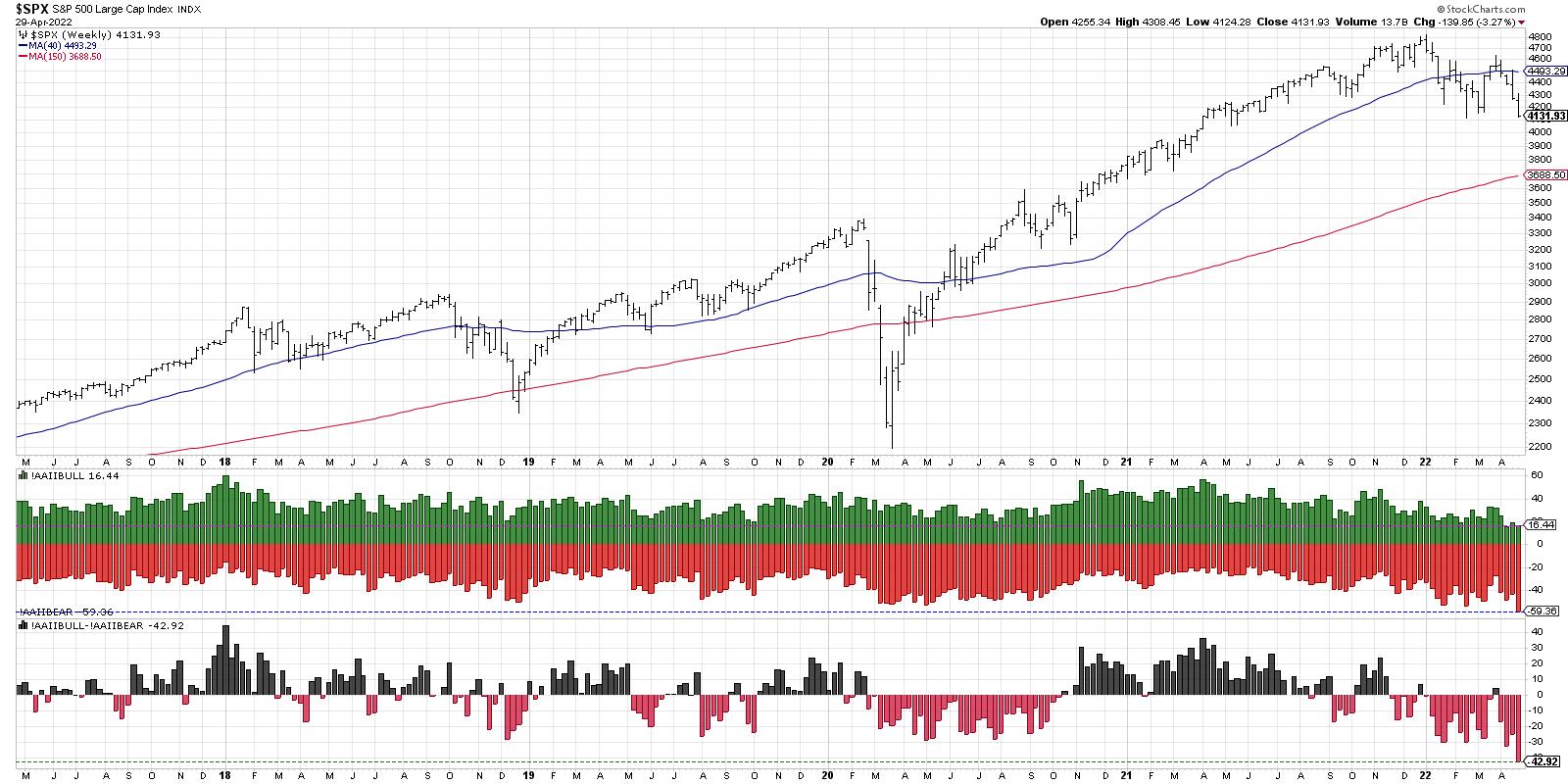

Key Sentiment Indicator at Bearish Extreme

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My weekly investment routine involves a review of key sentiment indicators every Thursday. This is mainly because the survey data I review is usually updated on Wednesday and Thursday of each week, so it's a perfect time to reflect on survey data (how investors are voting with their...

READ MORE

MEMBERS ONLY

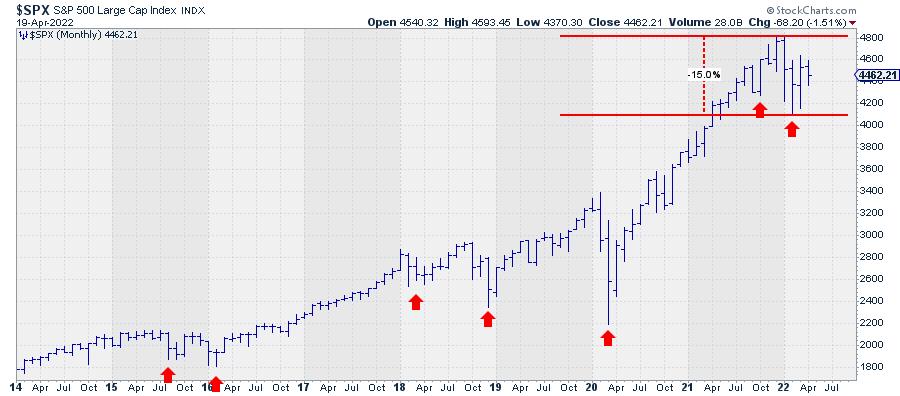

Updated Downside Targets for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Back in January, I shared a video with four potential outcomes for the S&P 500 index. These ranged from the "very bullish" view, where the SPX would rise to 5000 and beyond to the "very bearish" view involving a retest of long-term Fibonacci levels....

READ MORE

MEMBERS ONLY

How to Ride Out the Bear Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

How can we ride out this bear market? Before we can answer that question, we first have to define what qualifies as a bear market. Very often, a decline of 20% or more from the most recent high is used as a yardstick to define a bear market. That seems...

READ MORE

MEMBERS ONLY

Flailing Financials Finally Finished?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week's release of the Fed's March meeting minutes painted the picture of a hawkish Fed committed to raising rates to curb inflation. These latest comments from the Fed helped to push the Ten-Year Treasury Yield ($TNX) higher, finishing the week just above 2.7%.

This...

READ MORE

MEMBERS ONLY

Utilities vs. Technology - Which Sector Wins?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In a fantastic sign of the times, I find myself writing an article with a legitimate discussion as to which of these two sectors has a more attractive technical setup - Utilities or Technology.

For younger investors, the idea that anything other than Technology would be leading the market is...

READ MORE

MEMBERS ONLY

The Renewed Rise of Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In hosting The Final Bar on StockCharts TV, I get the opportunity to ask successful traders and market practitioners which charts are top of mind in their process at any given time.I've found this to be a fantastic way to track market sentiment from some of the...

READ MORE

MEMBERS ONLY

The Two Directions for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Jesse Livermore famously said, "There is a time to go long, time to go short and time to go fishing."

On a Fed meeting day, I often find that it's one of those "fishing" days. Plenty of speculators will try and game this meeting...

READ MORE

MEMBERS ONLY

The Line in the Sand for AAPL

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The major equity averages finished the week in a position of weakness, with the S&P 500 index once again testing the key support level of 4200.

We've talked about the 4200 level many times for the S&P 500, most recently in terms of that...

READ MORE

MEMBERS ONLY

Playing Price Swings and the Risks of Leverage

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"There is nothing more painfully bullish than a bear market rally."

- Dave Keller, The Final Bar, February 24, 2022

We've been tracking the signs of distribution since November of last year. As the S&P 500 made new highs into December and January, the...

READ MORE

MEMBERS ONLY

The Indicator to Watch for DIS and $SPX

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The current chart of Walt Disney Co. (DIS) provides a perfect case study on how the Relative Strength Index (RSI) can be used to better understand the underlying trend in a stock.

Disney rallied off its March 2020 low along with most other names, but the real outperformance began in...

READ MORE

MEMBERS ONLY

S&P 500 Using Ichimoku Cloud Model

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The Ichimoku cloud model (often just referred to as the "cloud model") is a traditional Japanese technical indicator which actually combines three separate trend-following devices. I spent some time on Japanese trading desks earlier in my career, and was always fascinated at how much I would see candlestick...

READ MORE

MEMBERS ONLY

Downside S&P Projections Using Fibonacci

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I recently posted a video on four potential paths for the S&P 500, from the very bullish (S&P gets over 4800 in the next six weeks) to the very bearish (S&P breaks below 4000).Today, I wanted to dig a little deeper into using...

READ MORE

MEMBERS ONLY

Hindenburg Omen Signals Downside Potential

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The Hindenburg Omen is a bit of a controversial indicator. I often get asked about it from financial media outlets, as the name itself is enough to stir up investor fear. What is this indicator, and what can it tell us about current market conditions?

The Hindenburg Omen was developed...

READ MORE

MEMBERS ONLY

Why is SPX 4550 So Important?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

So far in 2022, we've seen elevated volatility, yet another test of the 50-day moving averagefor the S&P 500, and renewed strength incyclical sectors over growth. If you were looking for a nice break after the uncertainty of 2021, I'm sure you are quite...

READ MORE

MEMBERS ONLY

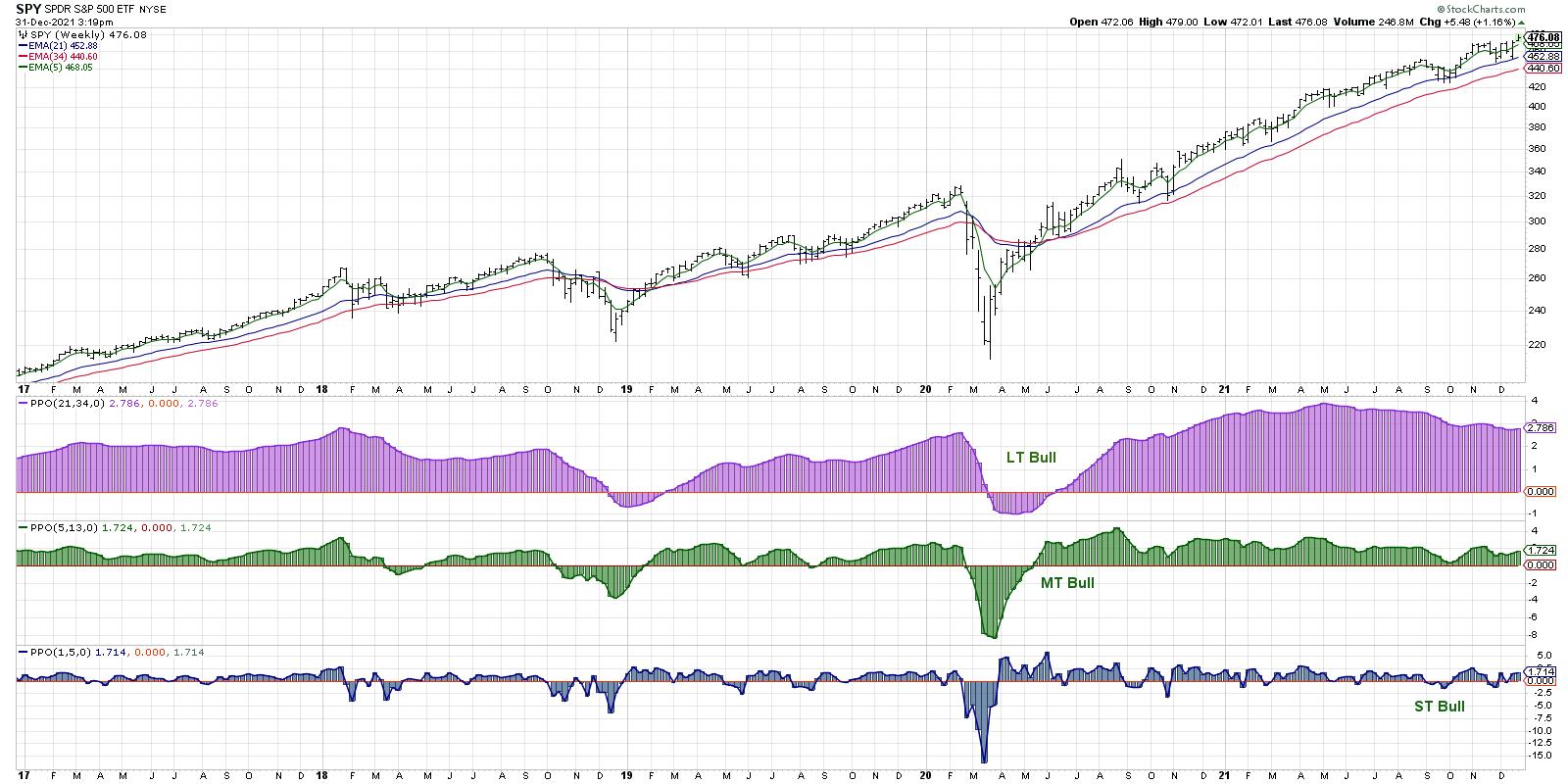

Ten Questions to Ask Yourself at Year-End

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The week between Christmas and New Year's is a special week for me. I actually call it "Power Week", and it is basically a week-long process of taking a step back from the "flickering ticks" of day-to-day life to focus on the long-term.

Part...

READ MORE

MEMBERS ONLY

Top Five Charts of 2021

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Try to summarize 2021 in one word.

"Rotational."

"Uncertain."

"Volatile."

Perhaps all of the above?

This year has been all about leadership rotation, with growth names, value stocks and even defensive sectors all spending some time as the strongest performers in a given month....

READ MORE

MEMBERS ONLY

Bearish Divergence Continues for S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

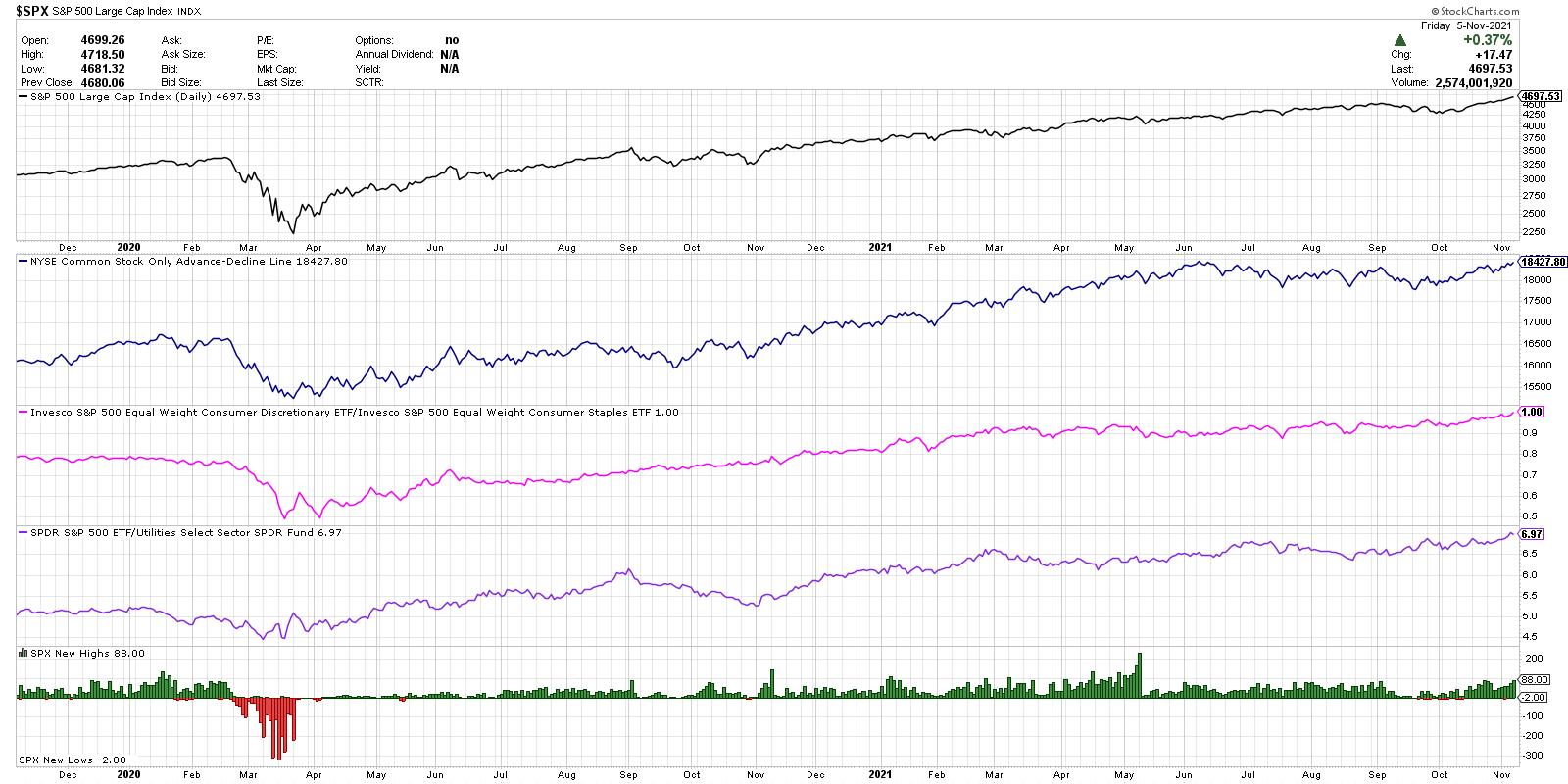

Something changed on November 5, 2021.

The S&P 500 had successfully broken up through the previous resistance level around 4550; early November saw the benchmark continue higher to finally reach 2700 on November 5th. Until that first Friday in November, the S&P 500 appeared to be...

READ MORE

MEMBERS ONLY

Spike in Volatility Bearish for Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The VIX spiked above 30 this week, making that the highest level since January 2021. But is a rapid rise in volatility necessarily bearish for stocks?

In my conversation with Marc Chaikinearlier this week onThe Final Bar, we talked about the move higher in the VIX and how that relates...

READ MORE

MEMBERS ONLY

Five Stocks I'm Watching Next Week

by David Keller,

President and Chief Strategist, Sierra Alpha Research

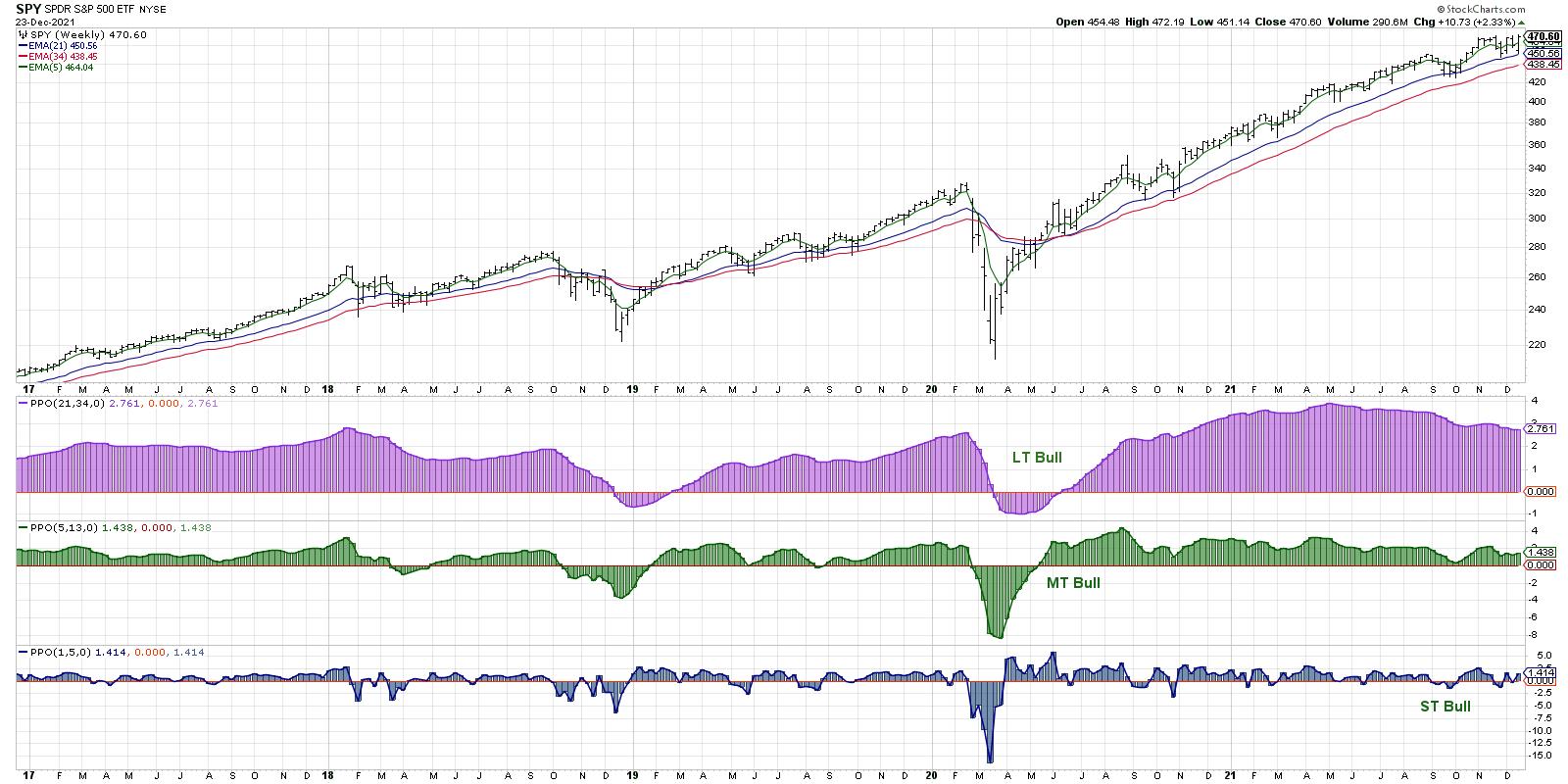

My Market Trend Modelremains positive on all three time frames, which means I focus on three main goals: identify breakout opportunities with upside potential, lean into positive trends that continue to work and, lastly, look for signs of weakness that may indicate thebull market phase is exhausted.

On Friday'...

READ MORE

MEMBERS ONLY

When is the S&P 500 No Longer Bullish?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

One of the best parts of hosting The Final Bar on StockCharts TVis the opportunity to compare notes with some of the top technical analysts and traders in the markets.In my recent discussions, we've discussed new highs for the S&P 500, Nasdaq, Russell 2000, Dow...

READ MORE

MEMBERS ONLY

The Best FANMAG Stock Through Year End

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Investors often think of the FAANG stocks as one basket of names. Either the mega cap tech and communication trade is working, or it isn't. But, as a review of the charts will reveal, these stocks can actually be differentiated using their price and relative profiles.

So which...

READ MORE

MEMBERS ONLY

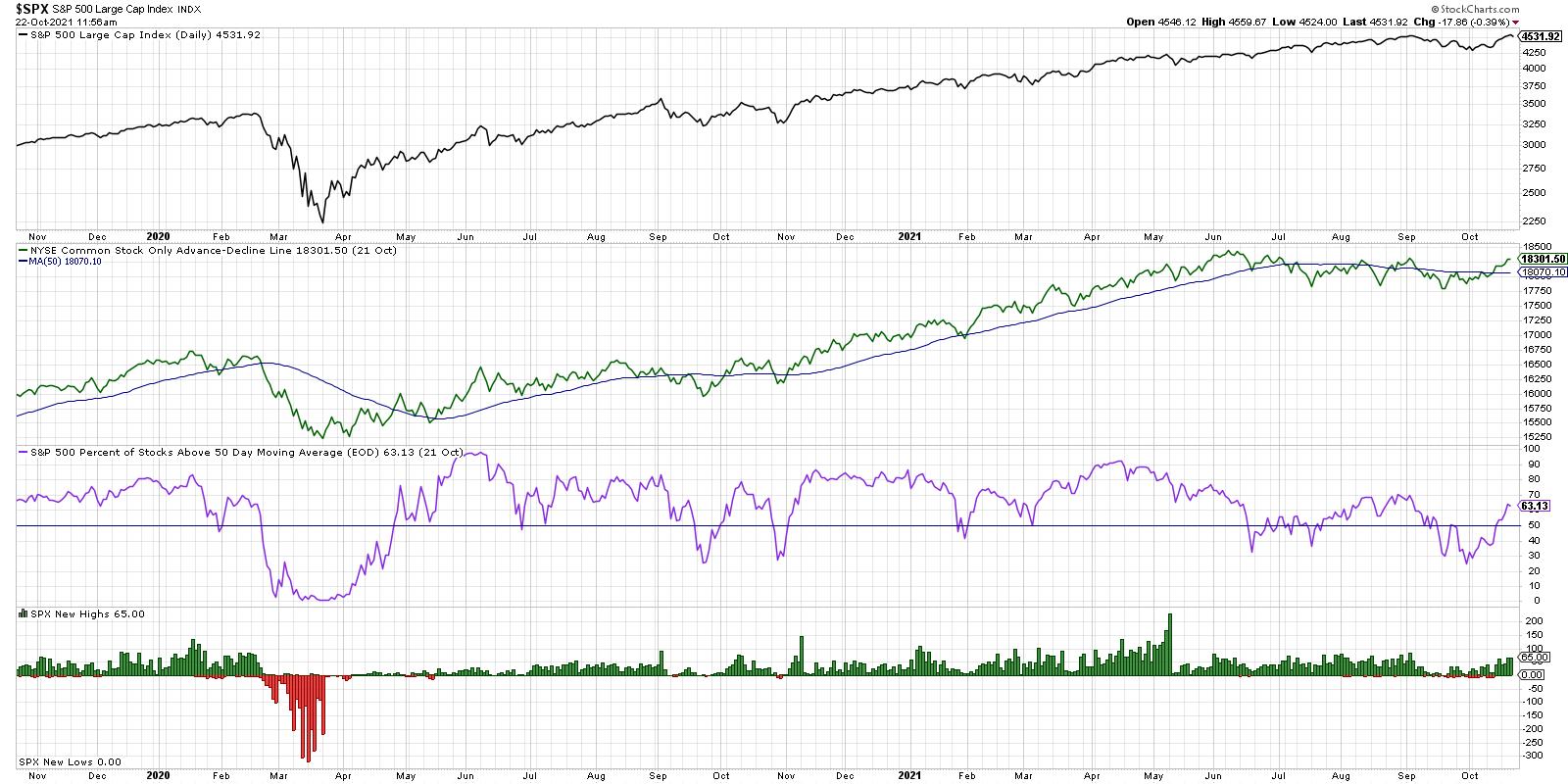

Why Breadth Matters as S&P Tests 4550

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The worst crime that an analyst can commit is remaining bearish in the face of a rising market. -Richard Russell

The S&P 500 has now round tripped from its early September high around 4550 and the low around 4300 in early October. Will there be enough buying power...

READ MORE