MEMBERS ONLY

Three Technology Stocks in Make or Break Scenarios

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses in on three key charts to watch in the technology sector as investors anxiously await NVDA earnings and Friday's inflation data. He also shares two important charts for tracking improving market breadth conditions and highlights the...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Two Bearish Turnaround Plays

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave completes a five-part series covering ten charts to watch in August 2024, breaking down to stocks in established downtrends. What would we need to see to confirm a rotation from a distribution phase to an accumulation phase, and where...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Best Healthcare Stocks for August 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, honing in on two Health Care stocks showing renewed signs of strength. He also breaks down how earnings releases relate to price trends, and how investors should...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Two Key Defensive Plays

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, with a focus today on Utilities and Real Estate. Why do low-beta, high-income stocks do so well in bearish market phases, and do we still see signs...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Two Tempting Consumer Staples Names

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, focusing on potential ideas in the Consumer Staples sector. Are dividend-paying defensive names the way to ride out a period of market uncertainty?

This video originally premiered...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Two Magnificent 7 Stocks Worth Watching

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave kicks off a five-part series covering ten charts to watch in August 2024, starting with two mega-cap growth stocks testing key resistance levels. Will they power up to new all-time highs into September?

This video originally premiered on August...

READ MORE

MEMBERS ONLY

What Inflation Fear? Strong Retail Sales Fuel Growth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong up day for growth leadership names, with ULTA and NVDA powering higher after retail sales numbers pushed aside inflation fears. He notes the cautious positioning in the NAAIM Exposure Index, Bitcoin's failed attempt to...

READ MORE

MEMBERS ONLY

Head and Shoulders Top for Semiconductors?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how breadth conditions have evolved so far in August, highlights the renewed strength in the financial sector with a focus on insurance stocks, and describes how the action so far in Q3 could be forming a potential head-and-shoulders...

READ MORE

MEMBERS ONLY

The Growth Trade is Back!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps an epic rally in mega cap growth stocks, with NVDA up over 6% and META threatening a new 52-week high. Dave highlights how gold and bond prices continue to rise in the face of stronger stocks, and breaks...

READ MORE

MEMBERS ONLY

Why Bonds and Gold Are Outperforming Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy Monday for the equity markets, as gold tests new all-time highs and interest rates continue to plummet. He highlights the stock to bond ratio, revisits the classic 60:40 ratio favored by investors, and breaks down...

READ MORE

MEMBERS ONLY

Three Market Sentiment Indicators Confirm Bearish Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The VIX reaching 65 signals extreme volatility and elevated risk of market downside

* The AAII Survey is close to showing more bears than bulls, which would line up with previous corrections

* The NAAIM Exposure Index indicates that money managers were rotating to defensive positioning in early July

While...

READ MORE

MEMBERS ONLY

How the PROS Time Entry Points

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a special all-mailbag episode, answering viewer questions on optimizing entry points for long ideas, best practices for point & figure charts, and the relationship between gold and interest rates.

See Dave's chart showing Zweig Breadth Thrust...

READ MORE

MEMBERS ONLY

Will the S&P 500 Break 5000 by September?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week saw the major equity averages continue a confirmed pullback phase, with some of the biggest gainers in the first half of 2024 logging some major losses. Is this one of the most buyable dips of the year? Or is this just the beginning of a protracted decline with...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Key Trendline as Growth Stocks Plunge

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave previews earnings releases from TSLA and GOOGL, breaks down key levels to watch for SPOT, GE, and more, and analyzes the discrepancy between S&P 500 and Nasdaq breadth indicators.

See Dave's MarketCarpet featuring the Vanilla...

READ MORE

MEMBERS ONLY

Small Caps Surge, Markets React to TSLA & GOOGL Earnings

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave previews earnings releases from TSLA and GOOGL, breaks down key levels to watch for SPOT, GE, and more, and analyzes the discrepancy between S&P 500 and Nasdaq breadth indicators.

This video originally premiered on July 23, 2024....

READ MORE

MEMBERS ONLY

The Stock Market is Bracing for Earnings IMPACT!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down today's upside recovery day for stocks, then shares the charts of TSLA, NVDA, and more. He also illustrates the conflicting messages from AAII and NAAIM sentiment surveys, and also highlights the VIX testing the key...

READ MORE

MEMBERS ONLY

Hindenburg Omen: The Truth, Effects, and Duration

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on the best time frames for viewing charts, insights on using Vanguard ETFs for sector rotation, the duration and effect of the Hindenburg Omen indicator, how stocks are indexed in Dow Jones Groups on StockCharts, and...

READ MORE

MEMBERS ONLY

What Does a Market Top Look Like?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

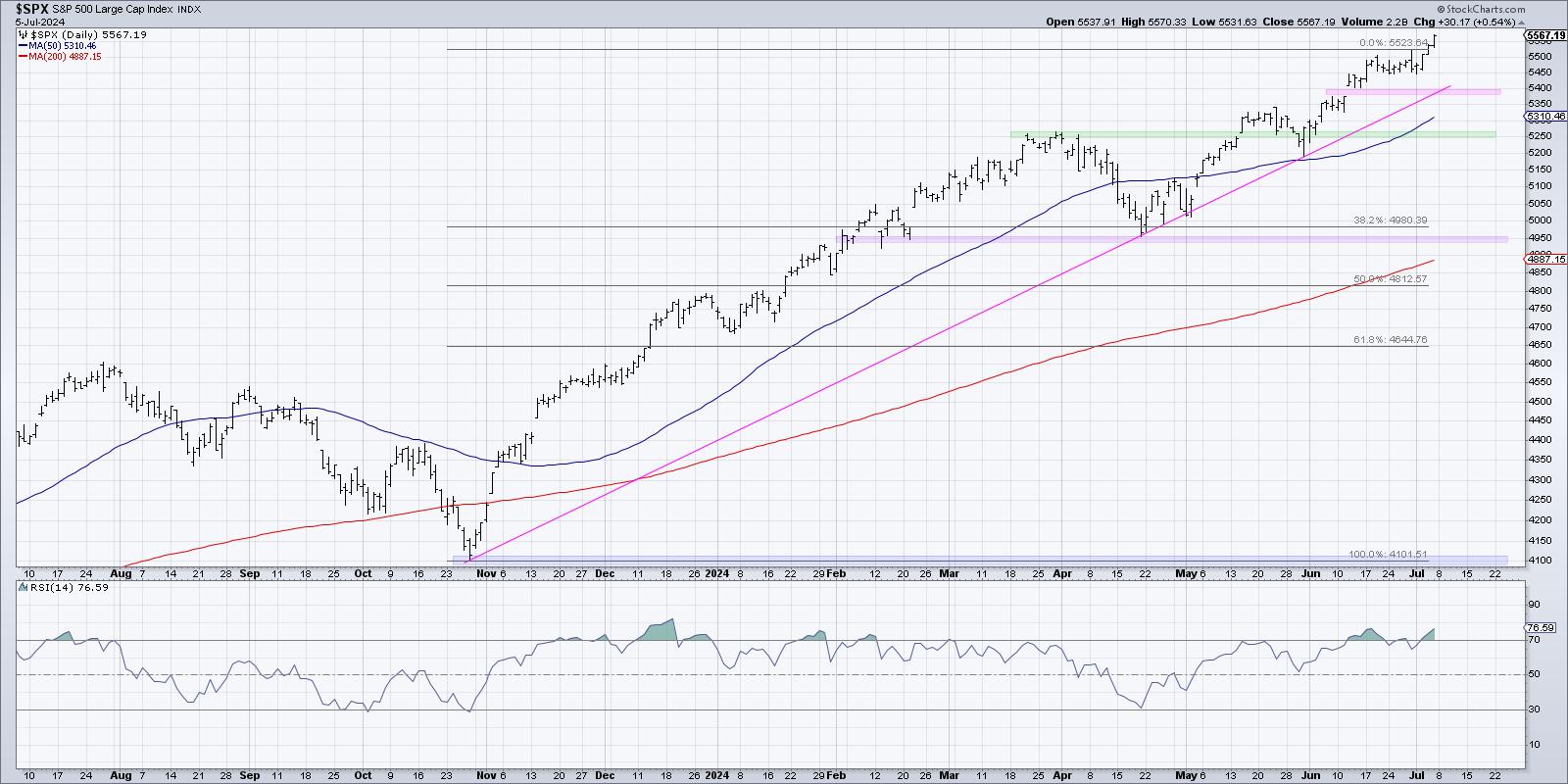

The S&P 500 remains in a primary uptrend, as confirmed by a fairly consistent pattern of higher highs and higher lows. But what would confirm that a top is in place for our major equity benchmarks? To answer that, it may be helpful to review other charts that...

READ MORE

MEMBERS ONLY

VIX SPIKES! Is a Market Correction Coming?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares a market update including key levels to watch for the S&P 500 index, what a VIX above 15 means for a possible market correction, the improvement in value-oriented sectors, and why DPZ may be the world&...

READ MORE

MEMBERS ONLY

Dow Theory Bull Confirmed! What Happens Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave comments on the Newer Dow Theory signal, improving market breadth conditions, impact of lower interest rates, and key levels to watch for GLD, UNH, CAT, and BAC. He also breaks down today's rally driven by small caps...

READ MORE

MEMBERS ONLY

Small Caps & Value Sectors are Booming (For Now)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a strong Monday for value stocks, with the Financial and Energy sectors leading the S&P 500 and Nasdaq to new highs. He shares an update on the Hindenburg Omen, how Bitcoin has regained its 200-day moving...

READ MORE

MEMBERS ONLY

How To Manage Risk Using Technical Analysis!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave completes a three-part series based on the successful "Top Ten Charts" episodes ofThe Final Bar. Today, he wraps the series with talks about risk management and how to use technical analysis tools to better manage risk vs....

READ MORE

MEMBERS ONLY

The BEST Way to Track Stock and ETF Performance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave continues a three-part series on selecting top charts to follow every month. In this second episode, Dave reviews charts he and Grayson Roze selected in May and June, reflecting on what has happened, what has...

READ MORE

MEMBERS ONLY

Identifying Top Charts with Upside Potential in 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave begins a three-part series on selecting top charts to follow every month. In this first episode, he shares how he and Grayson Roze select the charts to include in the Top 10 lists using the...

READ MORE

MEMBERS ONLY

The Chart to Help Navigate a Summer Market Top

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Value sectors have been consistently underperforming the benchmarks since the April market low

* Technology has outperformed the S&P 500 as well as other growth sectors in 2024

* Defensive sectors like Utilities and Consumer Staples may be the most important to watch, as they can demonstrate investor...

READ MORE

MEMBERS ONLY

Technology Shares SOAR to New All-Time Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave recaps a shortened trading session marked by strength in the technology sector, potential breakouts in gold stocks, and key levels to watch as the S&P 500 index makes a new closing high on...

READ MORE

MEMBERS ONLY

Should You Be Worried About Poor Market Breadth?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave celebrates the S&P 500 closing above 5500, laments the lack of market breadth, and provides updates on the infamous Hindenburg Omen. He also breaks down key levels to watch on charts of V,...

READ MORE

MEMBERS ONLY

AAPL and TSLA Kick Off Q2 With BREAKOUTS!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave lays out the strong seasonal pattern for the S&P 500 in July, highlights the breakouts in AAPL and TSLA, shares the painful breakdowns in MGM, WM and CCL, and addresses the sudden rise...

READ MORE

MEMBERS ONLY

Top 10 Stocks to Watch in July 2024!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they run through top 10 charts to watch in July 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into...

READ MORE

MEMBERS ONLY

Can the S&P 500 Move Meaningfully Higher Without NVDA?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

2024 has been a year marked by exceptional returns for a relatively small number of high-flying growth stocks. In recent weeks, top performers like Nvidia (NVDA) have pulled back, and Super Micro Computer (SMCI) remains well below its all-time high from earlier this year. So can the major equity benchmarks...

READ MORE

MEMBERS ONLY

The 4 Best Tech Stocks to Watch Now!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares charts for Palo Alto Networks, Arista Networks, Adobe Systems, and Fortinet, four tech stocks that are all pushing higher despite major indexes remaining sideways going into Friday's economic releases. He also breaks down the chart of...

READ MORE

MEMBERS ONLY

Two Consumer Stocks Popping to New Swing Highs!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps Wednesday's late-stage rally for the S&P 500. He analyzes the charts of FDX, TSLA, RIVN, AMZN, and GLW, and reviews what a stronger US Dollar could mean for the SPX and Nasdaq.

See Dave&...

READ MORE

MEMBERS ONLY

Cruise Line Stocks Just Exploded! Here's What You Need to Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights technical analysis takeaways for NVDA, ENPH, PNR, GLD, and Bitcoin. He also breaks down the sudden resurgence in stocks like CCL, the benefits of long-term trend analysis on the weekly chart of the Nasdaq 100 (QQQ), and how...

READ MORE

MEMBERS ONLY

Nvidia Plunges Over 6% to Mark the End of the AI Trade?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the rapid and concerning deterioration in semiconductors, with stocks like NVDA and AVGO pushing lower after last week's bearish candle patterns. He then dives into the downturn in Bitcoin, the impressive recovery for energy stocks, and...

READ MORE

MEMBERS ONLY

Why Technical Analysis Does NOT Work for Leveraged ETFs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on using technical indicators on leveraged and inverse ETFs like SOXL and SOXS, buying breakouts below the 200-day moving average, upside targets for gold, and whether the $USD is in a primary uptrend.

See Dave'...

READ MORE

MEMBERS ONLY

Bearish Engulfing Patterns Forming on NVDA & MU

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a day where technology shares struggles, with leading names like NVDA and MU dropping bearish engulfing patterns to indicate short-term distributions. He also addresses the ongoing divergence between large caps and small caps, the upside potential for energy...

READ MORE

MEMBERS ONLY

NVDA Wreaks Havoc on Technology Benchmark

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave celebrates Nvidia's rise to overtake Microsoft (MSFT) as the largest company by market cap, creating chaos in the Technology Sector ETF (XLK) with implications for Apple (AAPL). He points out that 10% of the S&P...

READ MORE

MEMBERS ONLY

It's TOO EARLY to Be Bullish on Tesla

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down an upside follow-through day for the S&P 500 and Nasdaq, and highlights the continued weakness in market breadth indicators. Dave identifies key levels to watch for GLD, FSLR, ENPH, TSLA, AVGO, and BIO. Focusing in...

READ MORE

MEMBERS ONLY

Could the QQQ Turn Dramatically Lower?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There is no denying the strength of the bullish primary trend for stocks off the April low. The Nasdaq 100 index continues to make new all-time highs, closing just under $480 on Friday after gaining about 3.5% over the last week. But will this incredible uptrend continue into July...

READ MORE

MEMBERS ONLY

Breadth Thrust Can Validate a New Bull Phase for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave describes how the "breadth thrust", popularized by legendary market strategist Martin Zweig, can help to validate a new bull phase for stocks. He answers viewer questions on pairs trades, running technical indicators like RSI on price ratios,...

READ MORE