MEMBERS ONLY

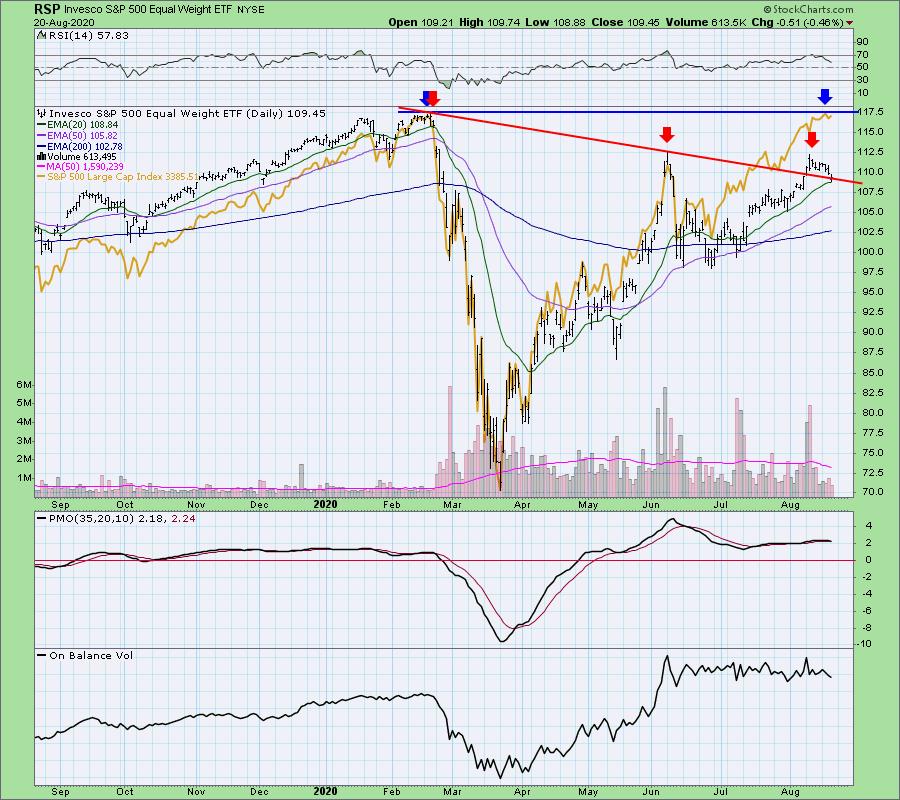

Equal-Weight S&P 500 (RSP) Weaves Bearish Tale + Free DP Trading Room Monday with Carl!

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday I had the pleasure of doing a podcast with FinancialSense.com's James Puplava (I'll send the link out to the DecisionPoint free email list when I have it - sign up on the DecisionPoint.com homepage). We talked at length about the "top ten&...

READ MORE

MEMBERS ONLY

DP Show: How Do Stock Splits Work?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss current market conditions for the major indexes. Given Apple (AAPL) and Tesla (TSLA) are preparing for stock splits, Carl gives viewers a complete tutorial on stock splits, how they work, how they compare to dividends and more! Carl highlights Gold and...

READ MORE

MEMBERS ONLY

DP Show: Is It Time to Leave Technology Behind?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss the demise of Technology and the resurgence of Industrials. Should we leave Technology behind? Negative divergences still persist on major indexes, so Erin discusses her strategy of using trailing stops to maximize profit with excellent protection when the overall market is...

READ MORE

MEMBERS ONLY

Two Industrial Sector Stocks that are Prepared to Perform!

by Erin Swenlin,

Vice President, DecisionPoint.com

On Wednesday afternoon, as I was preparing to record the DecisionPoint show, I did a scan of the sectors in preparation and the Industrial Sector SPDR (XLI) caught my eye after a nice gap up. I scanned my Tuesday DecisionPoint Diamonds and, sure enough, I had presented an Industrial stock...

READ MORE

MEMBERS ONLY

DP Show: Sky's the Limit for Gold (and Silver!)

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin reviews the technicals on the DecisionPoint Scoreboard Indexes (SPX, NDX, OEX & Dow) and points out some negative divergences on primary indicators that are troubling her bullish outlook. Carl discusses how Gold Premiums and Discounts are calculated and the implications of seeing high discounts...

READ MORE

MEMBERS ONLY

DP Show: Gold Rush - Worry or Rejoice?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl discusses his recent article on Gold. The yellow metal is enjoying a huge rally, but should we be excited or nervous? Carl and Erin both give you their strategies on taking advantage of (and protecting profits during) this parabolic move. Erin outlines some short-term...

READ MORE

MEMBERS ONLY

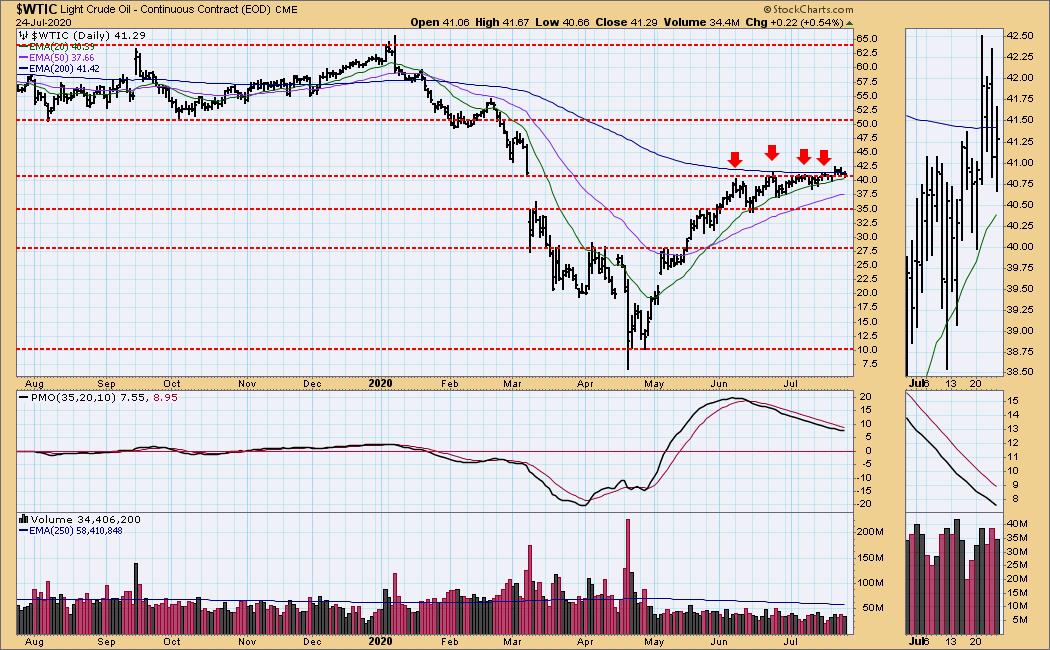

Energy Sector Heating Up - Here are Possible Winners

by Erin Swenlin,

Vice President, DecisionPoint.com

I have been watching the Energy sector closely this week. $WTIC, which I follow daily in the DecisionPoint Alert report, finally broke out and, although the Price Momentum Oscillator (PMO) hasn't turned up, Oil prices are staying above the 20-EMA and have made an attempt to get back...

READ MORE

MEMBERS ONLY

Bullish Market Bias - Can't Beat 'Em, Join 'Em

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss negative divergences and BUY signal divergences that are being defeated by a strong bullish bias in the market. Carl looks at breadth anomalies. Apple (AAPL)'s parabolic (or should we say "vertical") price movement should give Apple investors...

READ MORE

MEMBERS ONLY

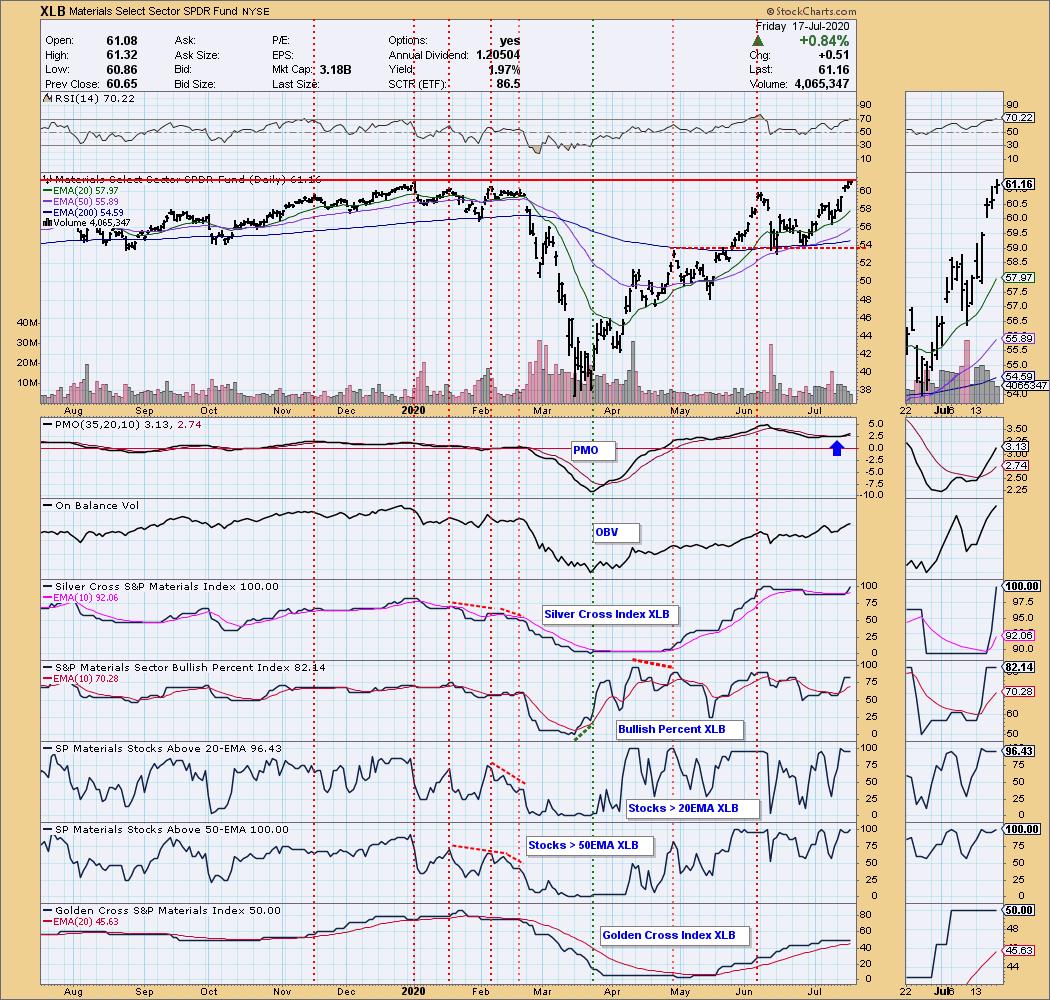

The "Diamonds" of the Materials Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of my preparation of the "DecisionPoint Diamonds Report", I seek areas that are showing leadership, and the Materials sector has been doing just that. Materials was up 5.47% on the week, which was only second to Industrials at 5.87%. The "darling" of...

READ MORE

MEMBERS ONLY

DP Show: New BUY Signal for the SPY!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss their outlooks for the market based on new signals and divergences popping up on the charts. Erin focuses in on the Dollar, Gold and Gold Miners. Carl brings his wisdom discussing Earnings outlooks that aren't in line with price...

READ MORE

MEMBERS ONLY

DP Show: First Quarter Earnings Are In!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl reviews the DecisionPoint charts that track "fair value" based on earnings and earnings estimates. We now have actual 1st quarter earnings added to the charts! It's already eye-opening, but what to expect for the 2nd quarter? Erin focuses in on...

READ MORE

MEMBERS ONLY

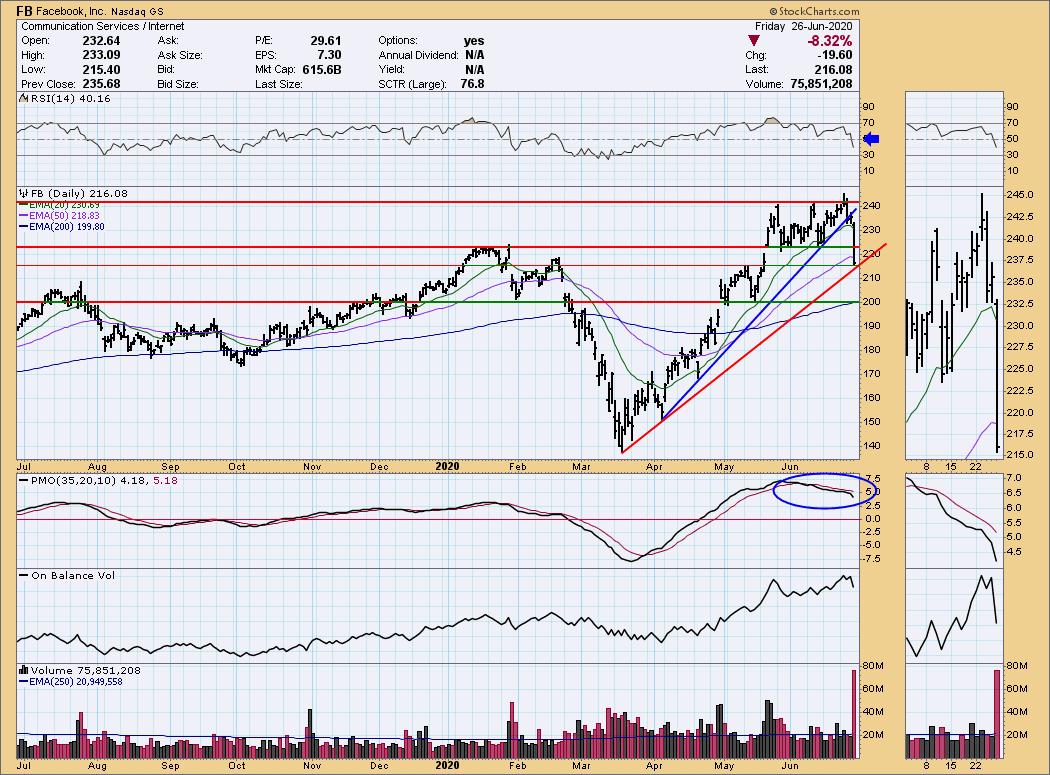

FAANG Stocks: Darlings and Duds

by Erin Swenlin,

Vice President, DecisionPoint.com

I decided to take a look at the FAANG stocks to see which ones are experiencing damage (duds) and which ones are continuing to show internal strength despite the S&P 500 stalling before reaching all-time highs. There are definitely some winners and losers. I must say that, overall,...

READ MORE

MEMBERS ONLY

DP Show: Market Bias Impacts Index Price

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin reviews the Nasdaq 100's PMO BUY Signal and its whipsaw back into a SELL signal on Wednesday. Carl showed us his new "market bias" view of the Swenlin Trading Oscillators (STOs) and IT Breadth/Volume (ITBM/ITVM). The shift is...

READ MORE

MEMBERS ONLY

DP Show: PMO SELL Signals Despite Bullish Bias

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin review four new Price Momentum Oscillator (PMO) SELL signals on four of the major market indexes. Even the Nasdaq 100's new highs didn't prevent that PMO SELL signal. Erin discusses climactic indicators and how they can be leading...

READ MORE

MEMBERS ONLY

The Bottom of the Chart Isn't Support - UNG Proves the Point

by Erin Swenlin,

Vice President, DecisionPoint.com

I remember hearing (and still hearing) from other analysts that one should remember that the bottom of the chart isn't a support level. This is especially true when you are looking at a stock that has been making new all-time lows. Yesterday, a DecisionPoint Diamonds reader requested I...

READ MORE

MEMBERS ONLY

DP Show: Nasdaq 10,000 Dissection Reveals Negative Divergences

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, with the Nasdaq hitting 10000 on Wednesday, Carl and Erin take a deep dive into exclusive DP indicators for the Nasdaq to reveal some surprising negative divergences. Carl discussed the concept of "single-entry bookkeeping" and the false optimism it can create. Erin finishes...

READ MORE

MEMBERS ONLY

Semiconductors Breaking Out!

by Erin Swenlin,

Vice President, DecisionPoint.com

As I reviewed my scans to write the "DecisionPoint Diamonds" report, I noticed a theme in Technology, particularly in the Semiconductor industry group (SOXX). I zeroed in on my favorites to present in today's DecisionPoint Diamonds report (if you'd like to see those charts,...

READ MORE

MEMBERS ONLY

DP Show: Today's Market Eerily Similar to Bear Market Prequel

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin begin by analyzing the day's market, after which Carl discusses the similarities between this rally and the rally into the bear market crash. They discuss confirmations and non-confirmations on indicators and perform a thorough review of the sectors, including Silver...

READ MORE

MEMBERS ONLY

Reader Question: "Why Look at Weekly Charts?"

by Erin Swenlin,

Vice President, DecisionPoint.com

I love getting email from my readers and this particular email was great. He felt like he was asking a ridiculous question, but it is a common one that I don't think is asked out loud. This reader asked the question in the context of my DP Diamonds...

READ MORE

MEMBERS ONLY

DP Show: How to Choose the Best Indicators

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, following a discussion of current market conditions, Carl discusses the importance of choosing the right indicators for your charts and explains his rationale for including the indicators that DecisionPoint uses regularly. Carl also discusses the concept of bear markets and bear market rallies. Erin finishes...

READ MORE

MEMBERS ONLY

DP Show: Can the Market Continue Up, Up, Up?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin and Carl begin the show with a lively discussion of current market conditions after yet another breakout on Wednesday. Should investors expect even higher prices? Looking at exclusive DecisionPoint.com indicators, Carl and Erin have the answers! Carl examines SPX earnings and compares the...

READ MORE

MEMBERS ONLY

How To Catch Mid-Day Market Reversals

by Erin Swenlin,

Vice President, DecisionPoint.com

I received an email after trading on Wednesday 5/14 that included a great question about catching mid-day reversals:

"I struggle the most in days like today (5/14) where the market goes one way and then it changes direction. How do you identify when that is happening?

Your...

READ MORE

MEMBERS ONLY

DP Show: Selling Exhaustion or Initiation?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, after looking at the latest DP signal scoreboards, Carl and Erin discuss the recent deep dive in prices on the 10-minute bar chart and the implications shorter-term. A look at the bigger picture shows the very negative configuration of the indicators. Many parallels can be...

READ MORE

MEMBERS ONLY

DP Show: 20% of SPX Stocks May Be Cut Next Year

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin's topic of the day was bankruptcy and the S&P 500. They discuss the difference between Chapter 11 and Chapter 7 bankruptcies and how that could affect the make up of the S&P 500. They discussed the...

READ MORE

MEMBERS ONLY

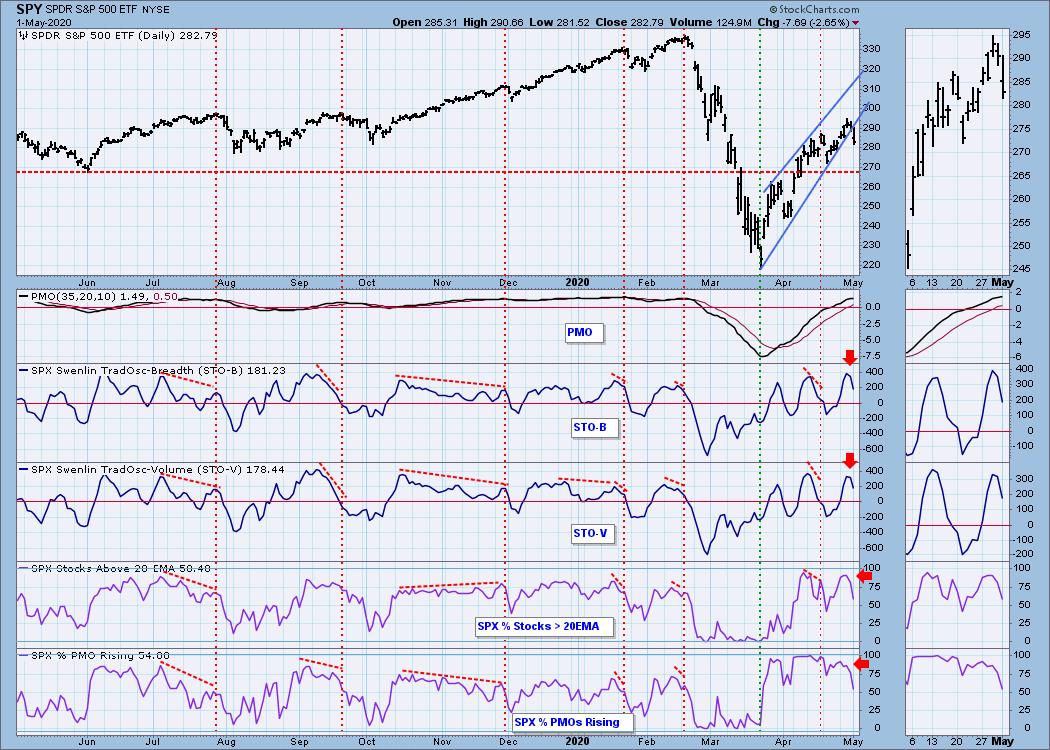

Swenlin Trading Oscillators Gave Warning... Again!

by Erin Swenlin,

Vice President, DecisionPoint.com

Yet again, the Swenlin Trading Oscillators gave our readers early warning for today's decline. I have written about their previous successes in ChartWatchers, but I wanted to report back to you that they are continuing to be leading indicators. Below is an excerpt from yesterday's DecisionPoint...

READ MORE

MEMBERS ONLY

DP Show: Eye-Popping Rally on Possible Treatment

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin reviewed everything from the Case-Schiller Home Price Index to SPX Earnings Estimates and Gilead Sciences (GILD). Erin covered brand new scan results that uncovered a few names you might want to consider. Big-name companies reported earnings today, so they revealed the charts...

READ MORE

MEMBERS ONLY

DP Show: Polishing a Few Diamonds in the Rough

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl opens the show with a market overview looking particularly at short- and intermediate-term indicators. Carl and Erin comment on the bullish bias that seems to be prevalent in this rally off bear market lows. Erin looks at the Gold Miners' big breakout and...

READ MORE

MEMBERS ONLY

Is Technology the New Defensive Sector?

by Erin Swenlin,

Vice President, DecisionPoint.com

While co-hosting the WealthWise Women show with me yesterday, Mary Ellen McGonagle said something that got my attention and filled me with intrigue. To summarize, she said that she was finding that the Technology sector is becoming more of a defensive one in the face of the coronavirus. That is...

READ MORE

MEMBERS ONLY

DP Show: Technology Sector's Reverse Divergence

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin talk about some of the short-term technicals that are beginning to suggest weakness under the surface. Carl explains reverse divergences for On-Balance Volume (OBV) and price both with respect to Technology (XLK) and in general. Erin reveals what our dynamite Swenlin Trading...

READ MORE

MEMBERS ONLY

DP Show: Bullish Percent Index and Q4 2019 Earnings

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin look at the current market conditions and the bullish indicators that are appearing in the short- and intermediate-term timeframes. Carl points out that the Bullish Percent Index (BPI) for the S&P isn't a lagging indicator, whereas our Silver...

READ MORE

MEMBERS ONLY

DecisionPoint Short-Term Indicators Are Nailing It!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's ChartWatchers article is an updated excerpt from the DecisionPoint Alert Report for subscribers:

I pointed out to my subscribers on Thursday that, with all of the volatility, our short-term indicators seem to be more on point than usual. Below, I've included three indicator charts that...

READ MORE

MEMBERS ONLY

DP Show: Bargain v. Earnings - Recession v. Depression

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin cover a variety of topics. To start, new momentum BUY signals have appeared, but enthusiasm should be tempered based on the bear market technicals. Looking at the DecisionPoint Earnings chart, Carl and Erin examine the concept of "bargains." Finally, they...

READ MORE

MEMBERS ONLY

DP Show: Deflationary Depression - Bear Market Support

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl talks about the concept of "deflationary depression" and the implications. Carl and Erin discuss current technical levels for price and also look at the technical levels based on earnings at overvalue, fair value and undervalue. Carl reported on the "Big Four&...

READ MORE

MEMBERS ONLY

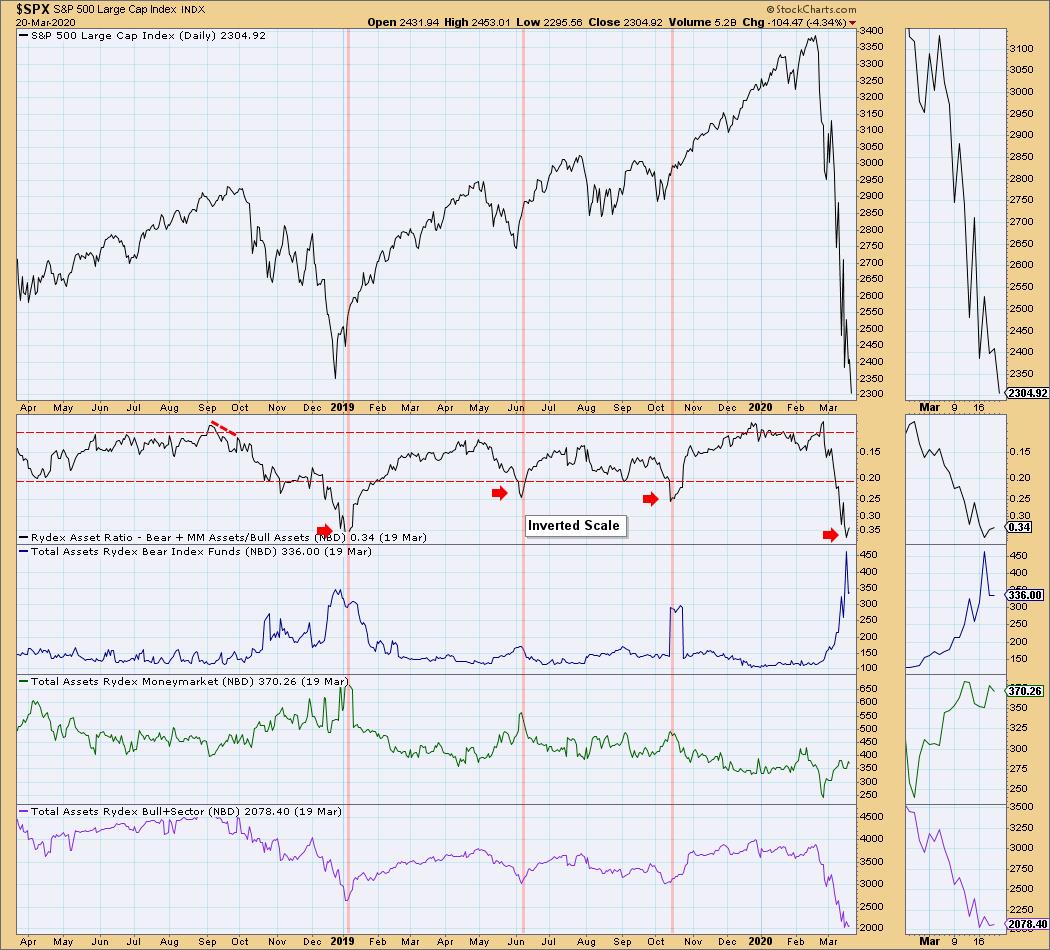

Is Sentiment Bearish Enough? Erin Swenlin & Mark Young Explain

by Erin Swenlin,

Vice President, DecisionPoint.com

I'm so excited to report sentiment to you this weekend with commentary added from Mark Young of WallStreetSentiment.com. We are seeing extraordinarily high bearish sentiment on most of our charts; however, I don't think we are bearish enough based on extremes we've previously...

READ MORE

MEMBERS ONLY

DP Show: Bear Market Implications - Real Estate Concerns

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss several topics including, of course, the bear market environment, along with global markets, broad markets and a few individual stocks you should see. Additionally, they analyze the implications of the Fed rate interest levels and the current and possible effects to...

READ MORE

MEMBERS ONLY

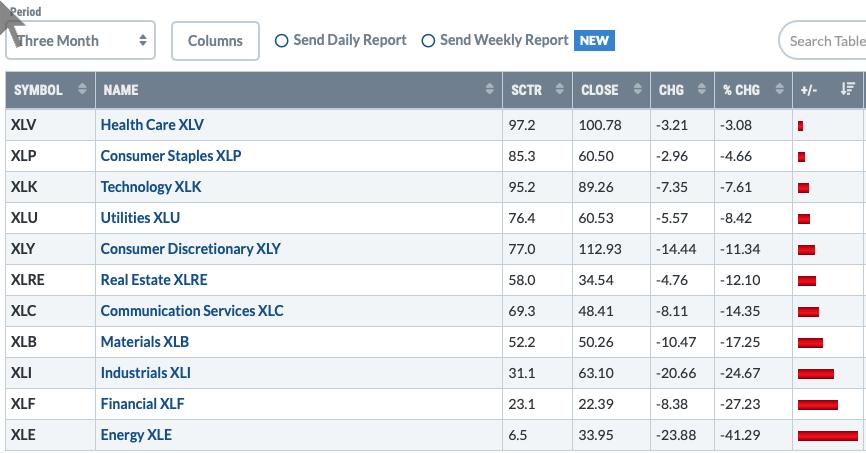

DP Show: How Low Can It Go? Seven Sectors in Bear Markets

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss valuations following another brutal day in the markets, along with what they are projecting as possible lows in the markets. Seven sectors are in bear markets right now. Carl and Erin look at each sector and their indicators to demonstrate the...

READ MORE

MEMBERS ONLY

Are We Oversold Enough Yet?

by Erin Swenlin,

Vice President, DecisionPoint.com

Before I get started, I wanted to let everyone know that DecisionPoint.com "Charter Member" discounts end this weekend! If you've thought about subscribing, now would be the time! You'll find back issues (samples) of the DP Alert and Diamonds from last year in...

READ MORE

MEMBERS ONLY

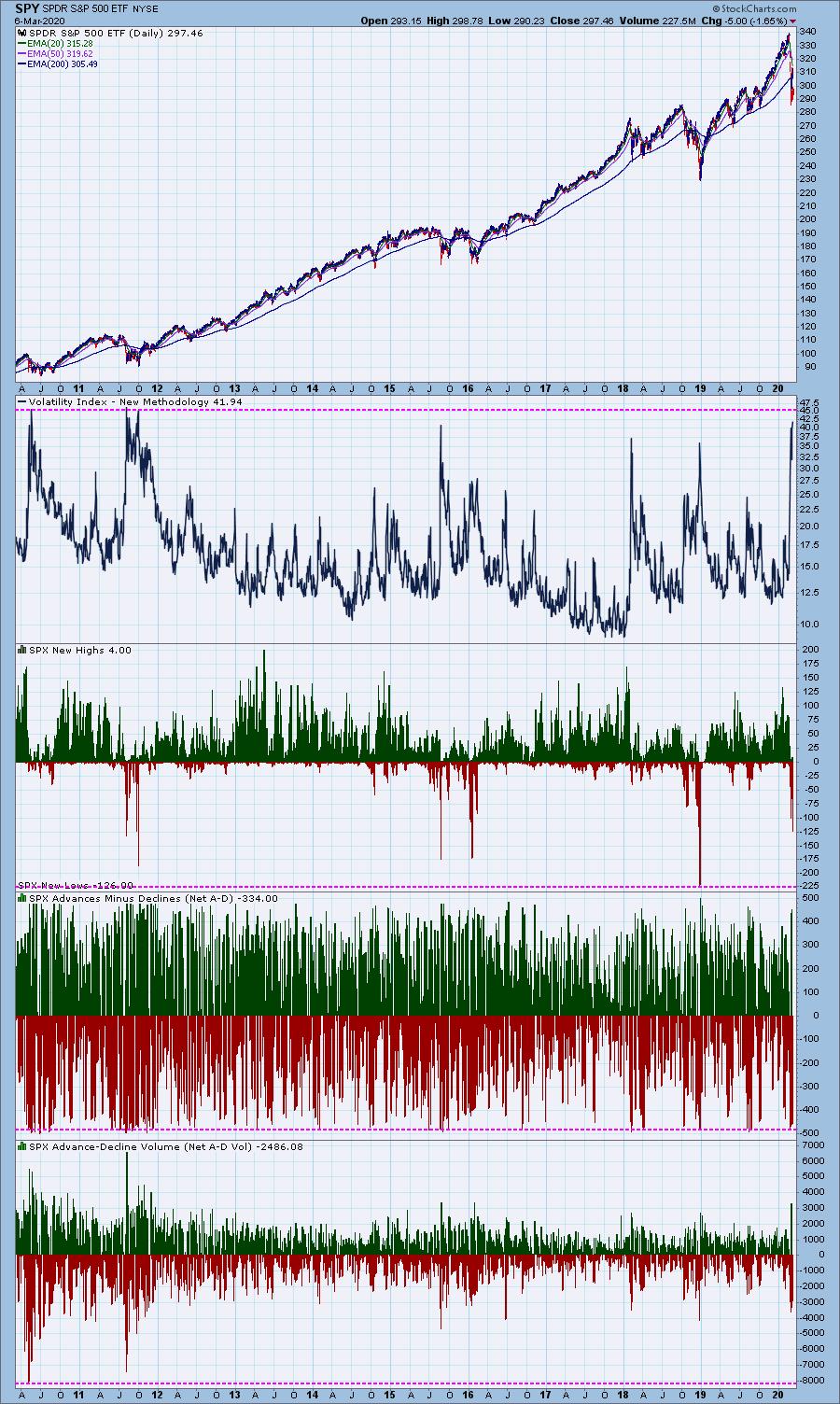

DP Show: Roller Coaster + Bear Market Rules + Sector Update

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss the current condition of the market with a summary of exclusive DecisionPoint indicators. The two open the show with a review of "bear market rules" and Carl explains his rationale for this being a bear market in the making....

READ MORE

MEMBERS ONLY

DP Alert: We Were Warned (Part II)

by Erin Swenlin,

Vice President, DecisionPoint.com

As I sat in the jury room today waiting for my panel to be called, I watched from my phone the crazy market action. It just figured I'd be stuck there without my giant display screen to decipher charts. Since Carl's article today was called "...

READ MORE

MEMBERS ONLY

20+ Year Treasury Bond ETF (TLT) Breaks Out to New All-Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

This week's big winners were $GOLD and TLT, though the Dollar also did fairly well. Carl will be writing about these three (as well as Oil) in this week's edition of the "DecisionPoint Weekly Wrap" on DecisionPoint.com (We would love to have you...

READ MORE