MEMBERS ONLY

SPX Scoreboard Adds Buy Signals - Is Correction Over?

by Erin Swenlin,

Vice President, DecisionPoint.com

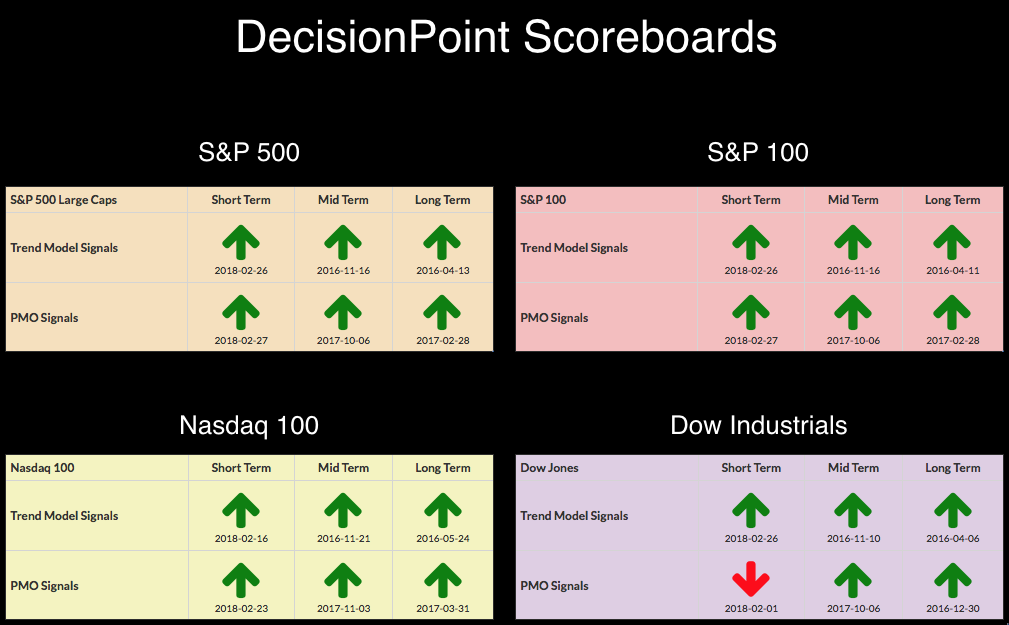

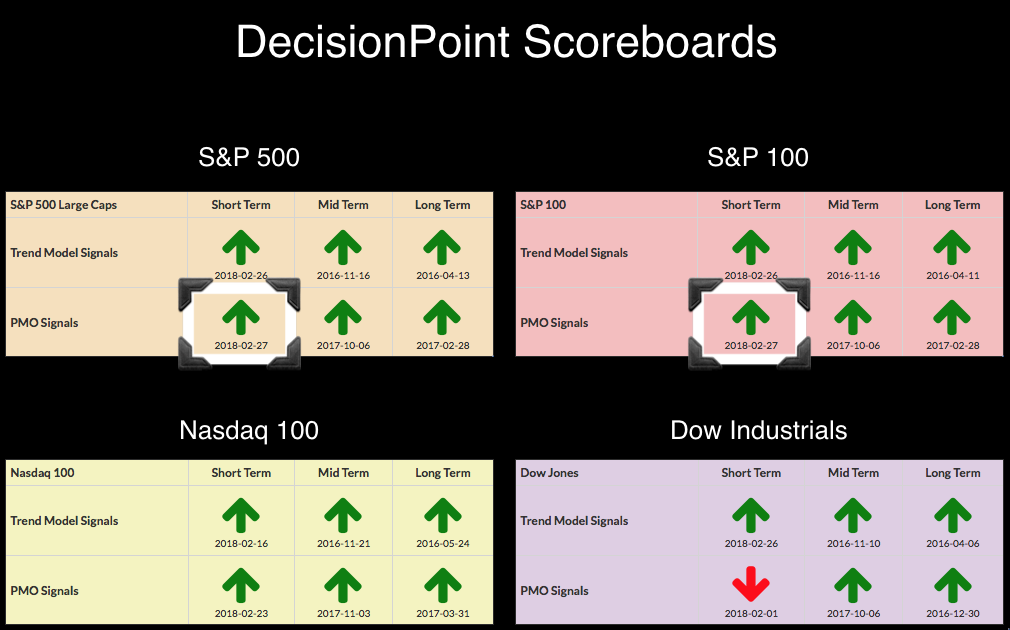

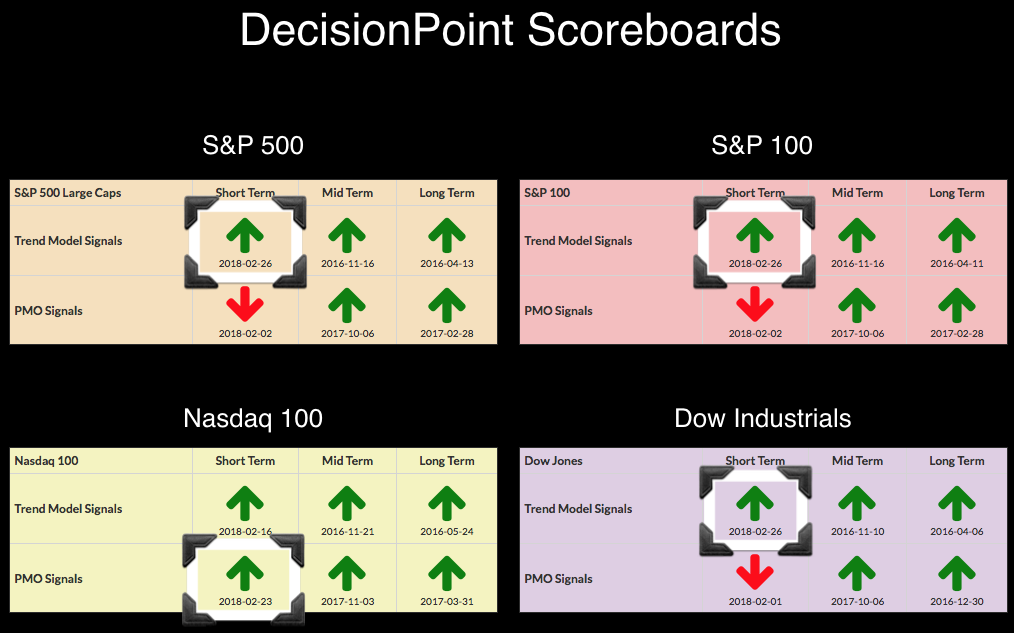

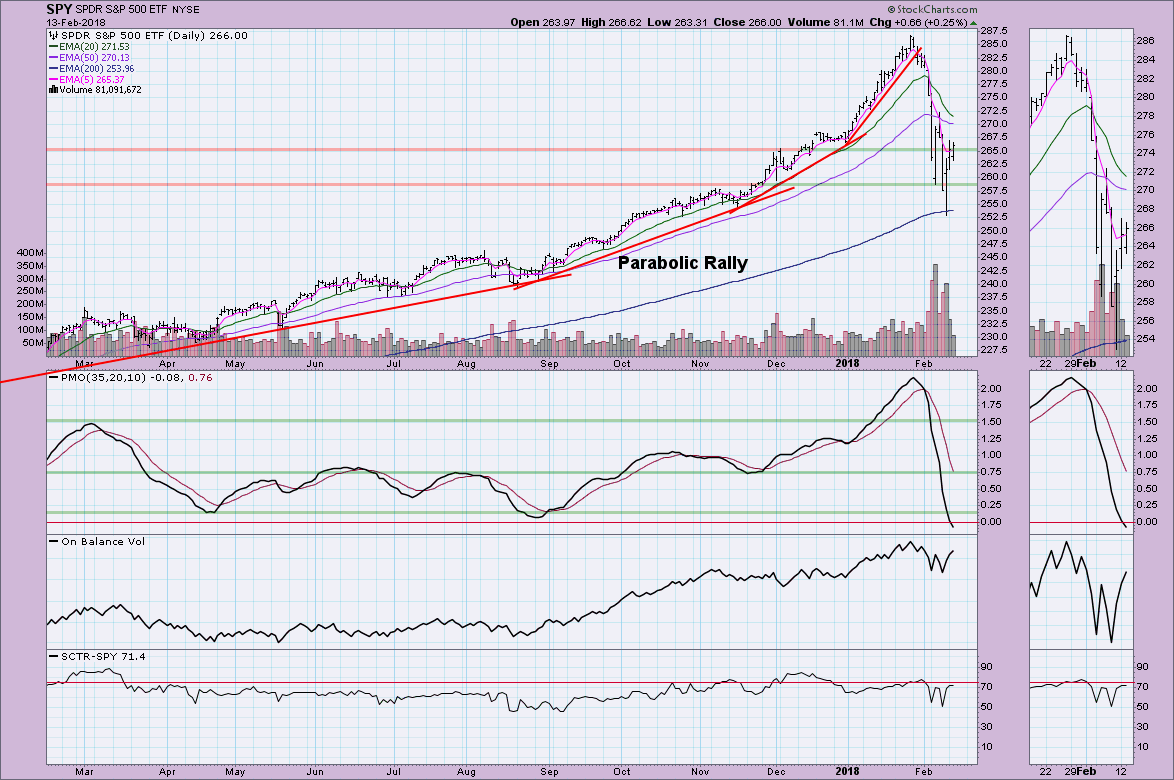

Let's get that title question answered right now...No, I don't think the correction is over. Yes, today we got both a ST Price Momentum Oscillator (PMO) BUY signal and an ST Trend Model BUY signal. The chart still has problems.

We had Tushar Chande on...

READ MORE

MEMBERS ONLY

DP Alert: Mixed Messages Warrant Caution

by Erin Swenlin,

Vice President, DecisionPoint.com

It's days like today that I find it frustrating to write (probably why this is posted late). It's not really writers' block, but the many mixed messages or lack of messages I'm getting on the charts right now. I could probably make a...

READ MORE

MEMBERS ONLY

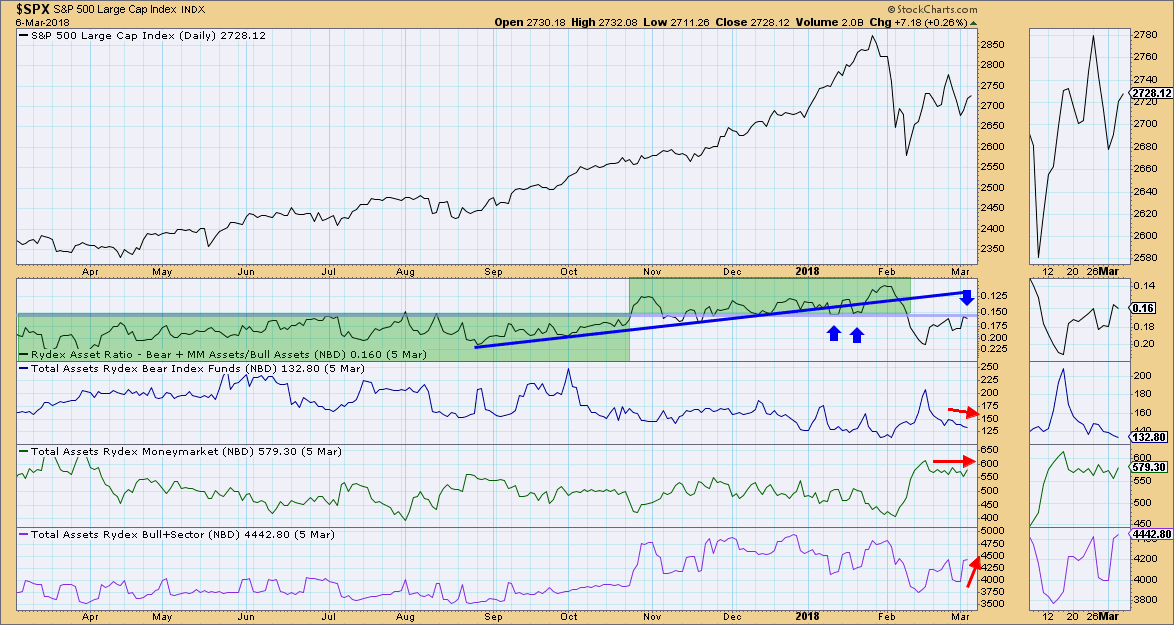

Rydex Ratio Turns Down - Bullish Sentiment = Bearish Implications

by Erin Swenlin,

Vice President, DecisionPoint.com

I decided to take a look at the Rydex Ratio today to see what the daily assets might be telling us as far as "actual money" sentiment. Here's a refresher for those new to the Rydex Ratio and sentiment readings in general. First, sentiment tells us...

READ MORE

MEMBERS ONLY

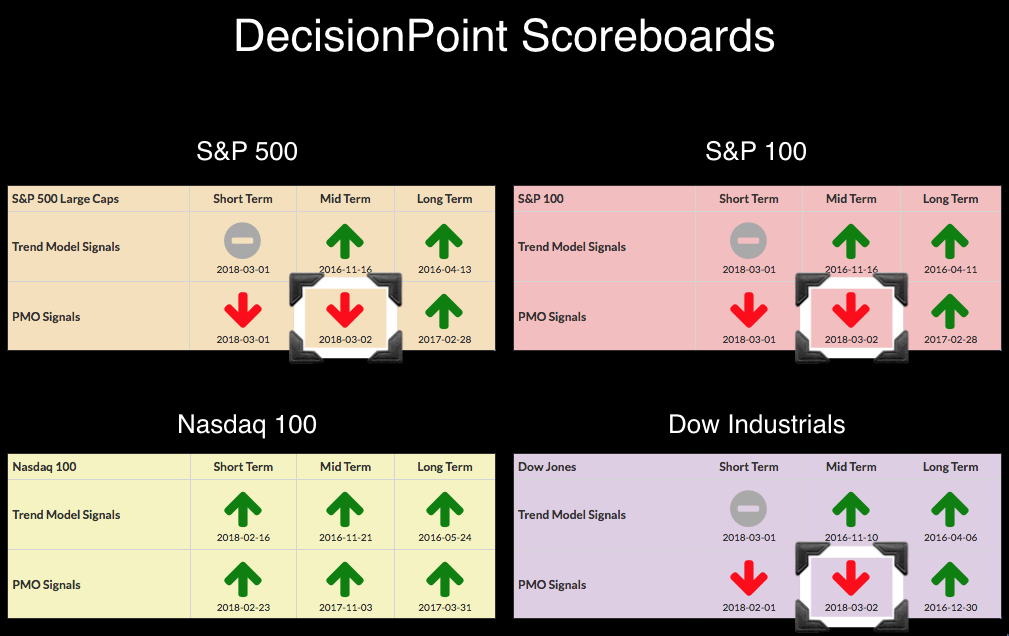

Bearish Bias - Weekly PMOs Log New SELL Signals on DP Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

I did a review of the monthly charts Wednesday and noticed a bearish bias. Today three new Intermediate-Term Price Momentum Oscillator (PMO) SELL signals arrived. The weekly PMOs crossed below their signal lines which triggered these signals. Weekly charts are presenting bearish characteristics.

After looking at all three of these...

READ MORE

MEMBERS ONLY

DP Bulletin: Scoreboards Lose BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

After deep declines today, the DP Scoreboards lost most of their short-term BUY signals. Rising wedges had appeared on the daily charts and today's decline confirmed it. The expectation is a breakdown from the wedge. The NDX is showing the most relative strength as it continues to cling...

READ MORE

MEMBERS ONLY

Monthly Chart Review of Major Indexes, Dollar, Gold, Oil and Bonds - Good, Bad & Ugly

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has closed on the final day of February. This means that DecisionPoint monthly indicators have "gone final" which is the perfect time to review those signals and take a long-term view of the markets and the DecisionPoint "Big Four"- $USD, $GOLD, $WTIC &...

READ MORE

MEMBERS ONLY

DP Bulletin: SPX and OEX New BUY Signals - Beware Outside Reversal Days

by Erin Swenlin,

Vice President, DecisionPoint.com

Two items I need to call your attention to. First, the PMOs crossed their signal lines on the SPX and OEX to trigger ST PMO (Price Momentum Oscillator) BUY signals. The Dow's PMO is stubbornly staying below its signal line, but that should disappear tomorrow given it'...

READ MORE

MEMBERS ONLY

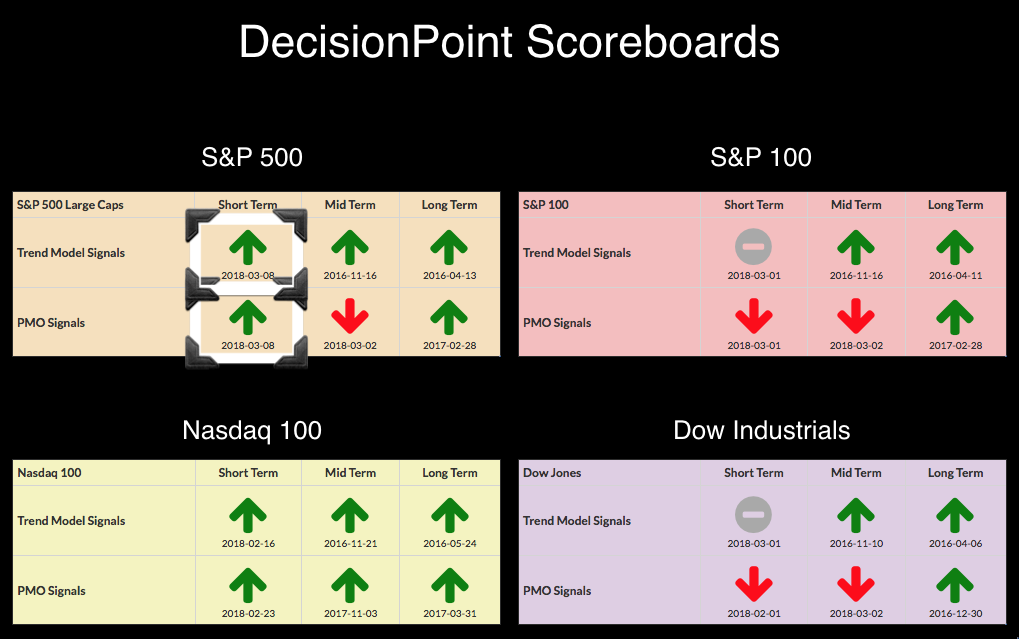

Flags Execute on Major Indexes - New BUY Signals on DP Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

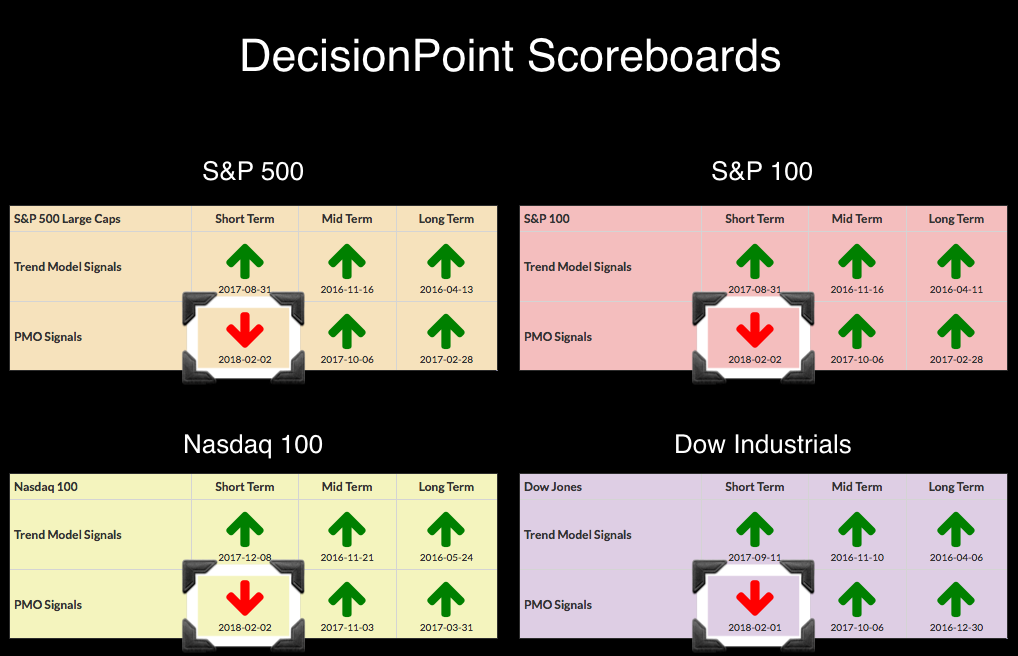

The DP Scoreboard transformation actually began on Friday when the NDX grabbed a new PMO BUY signal after already logging a ST Trend Model BUY signal. It appears the other indexes are falling in line as their 5-EMAs crossed above 20-EMAs to generate ST Trend Model BUY signals too. When...

READ MORE

MEMBERS ONLY

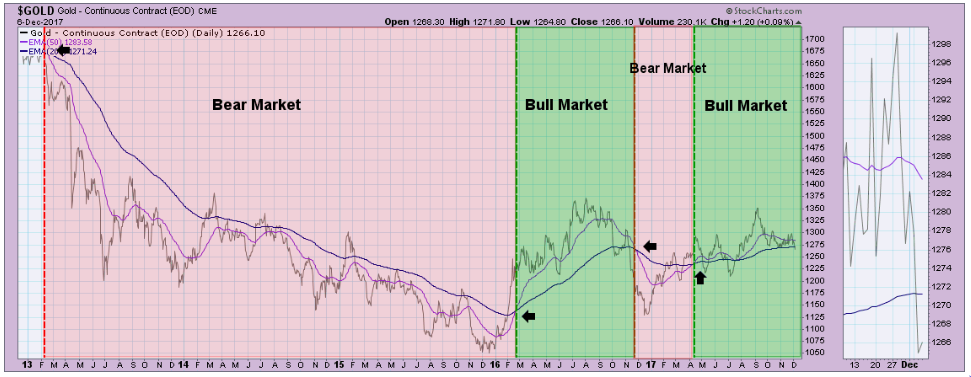

Why So Down on Gold?

by Erin Swenlin,

Vice President, DecisionPoint.com

I was asked during the MarketWatchers LIVE program today about my thoughts regarding Gold v. Dollar and particularly, why I'm bearish on Gold right now. I'll explain.

The chart for Gold is bearish on many counts. First there is the PMO with its "bear kiss&...

READ MORE

MEMBERS ONLY

DP Alert - ST Indicators Suggest Pullback

by Erin Swenlin,

Vice President, DecisionPoint.com

The NDX switched back to a Short-Term Trend Model BUY Signal on the DecisionPoint Scoreboards. The 5-EMA crossed above the 20-EMA which triggered the signal (the chart is below the scoreboards for your review).

The purpose of the DecisionPoint Alert Update is to quickly review the day's action,...

READ MORE

MEMBERS ONLY

Bull or Bear Market Rules?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today on MarketWatchers LIVE, I did a workshop on bull and bear market rules. You'll hear many technicians discuss "bull market rules apply" or vice versa. The question is pertinent and timely right now. The jury is still out on whether we are about to enter...

READ MORE

MEMBERS ONLY

DP Alert: Bullish Indicators - Gold Surges...For Now

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards didn't show any improvement from last week as the neutral and sell signals remained in the short term. PMO SELL signals are not yet on the weekly charts for these indexes, but they are lining up. If we see a pullback on the recent rally,...

READ MORE

MEMBERS ONLY

Indicators Turning Up But is Correction Over?

by Erin Swenlin,

Vice President, DecisionPoint.com

The question that continues to arise this month is, "Is it over?". This correction was deeper than many expected or was about as deep as expected but it occurred so quickly. I'm finally getting some good news on my intermediate-term indicators, but not enough for me...

READ MORE

MEMBERS ONLY

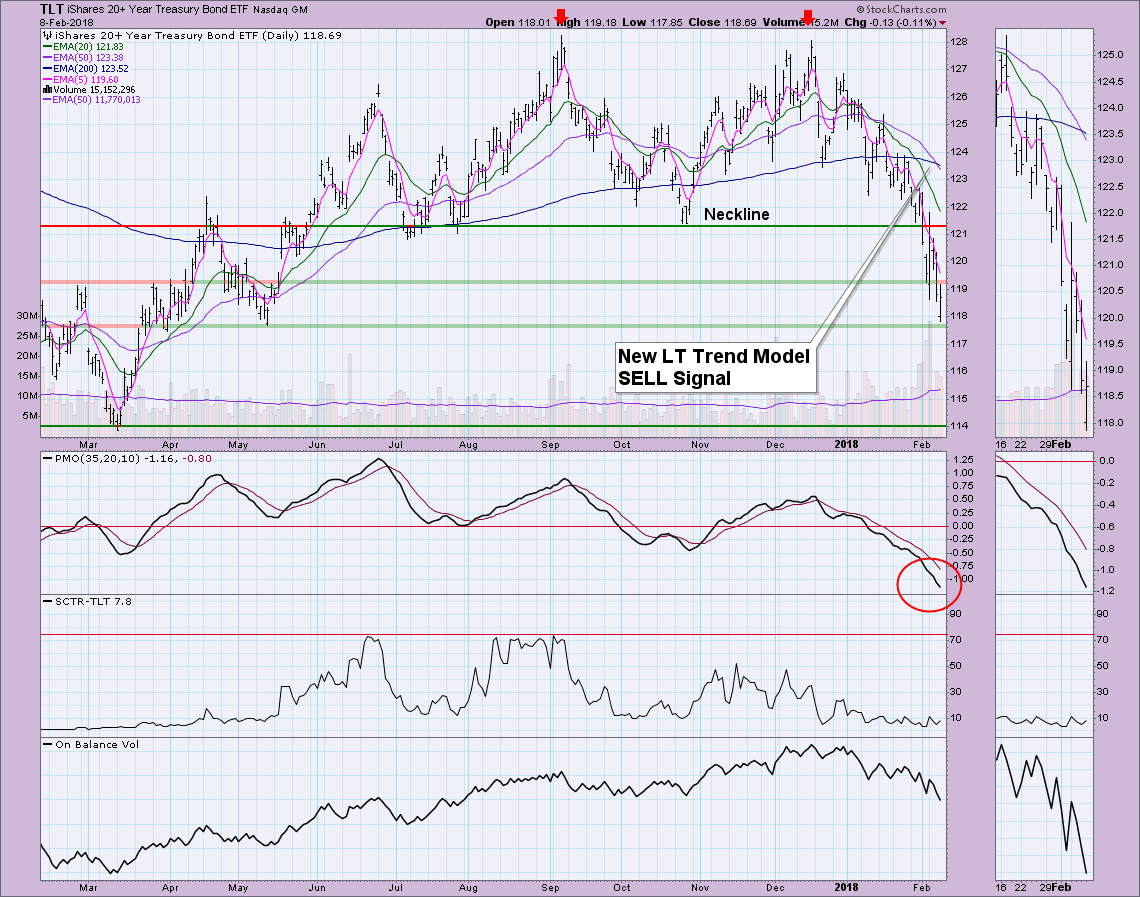

DP Bulletin: TLT New Long-Term Trend Model SELL Signal - ST Indicators Extremely Oversold

by Erin Swenlin,

Vice President, DecisionPoint.com

Two charts you should look at now. I mentioned yesterday that TLT was going to see a Long-Term Trend Model SELL signal today and it did. Additionally, ST indicators which had turned up have turned back down and have reached down into very oversold extremes.

While the PMO may appear...

READ MORE

MEMBERS ONLY

DP Alert: New PMO BUY Signal on Dollar - TLT Narrowly Misses Long-Term SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

No one can deny that this correction has been difficult and it has certainly left investors uneasy. However, the VIX is calming down somewhat and the Swenlin Trading Oscillators have bottomed. I don't think the market is completely out of the woods from an intermediate-term indicator perspective. UUP...

READ MORE

MEMBERS ONLY

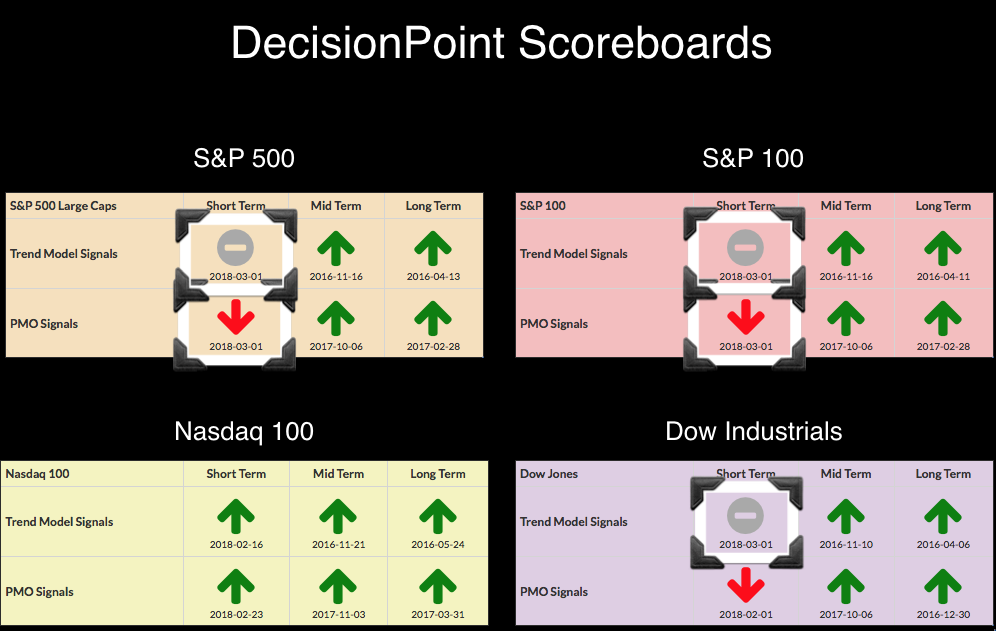

DP Bulletin: ST Trend Model Neutrals on Scoreboard Indexes - PMO SELL for Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

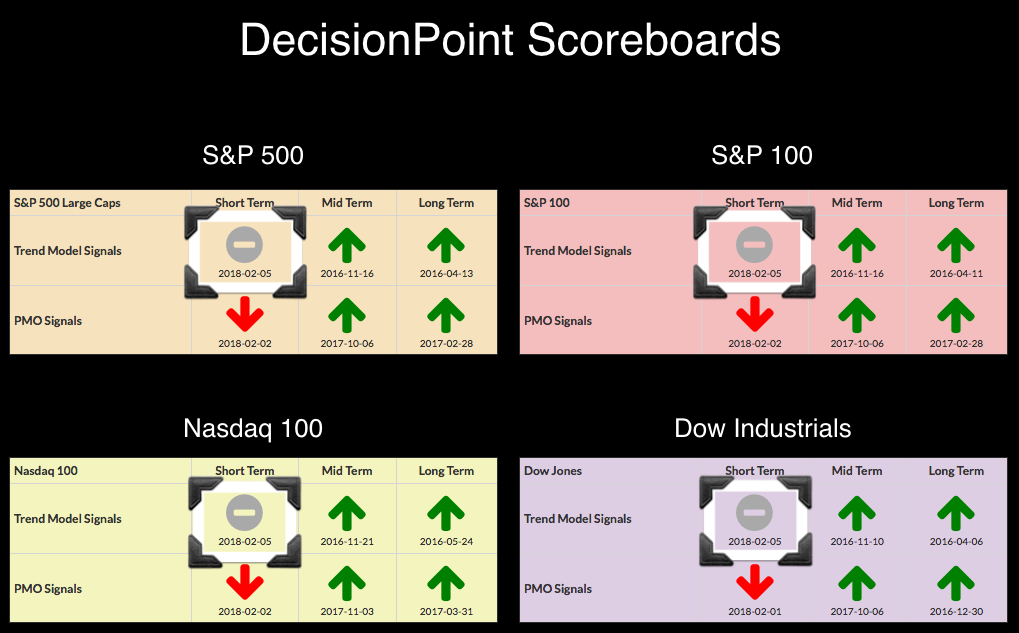

Today all four Scoreboard indexes (NDX, INDU, SPX & OEX) logged new Short-Term Trend Model Neutral signals. These signals arrived when the 5-EMA crossed below the 20-EMA while the 20-EMA was above the 50-EMA. In addition, we saw a new PMO SELL signal on Gold. I've included the...

READ MORE

MEMBERS ONLY

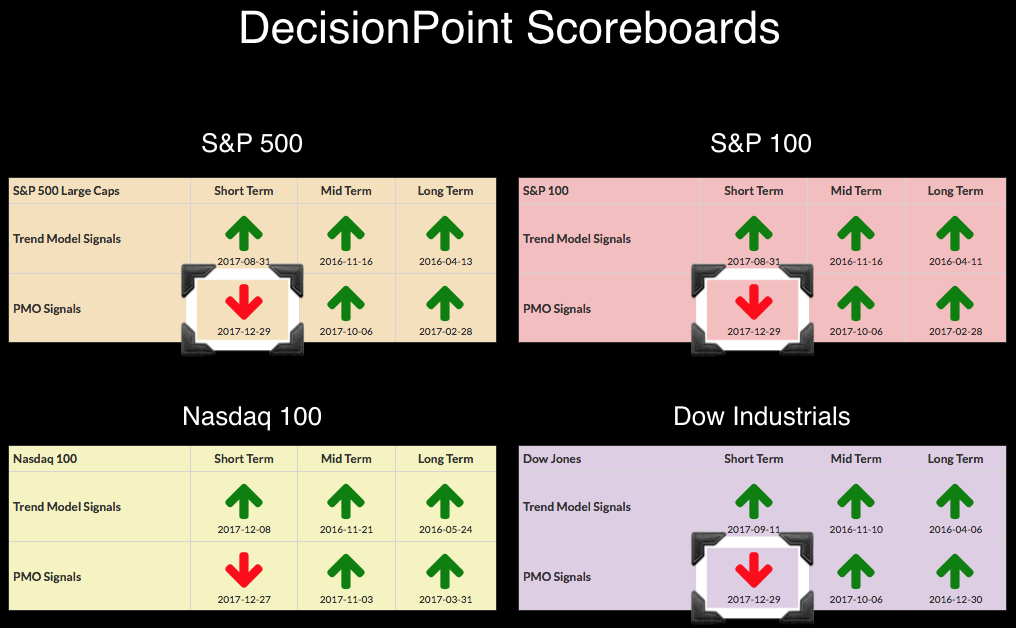

DecisionPoint Scoreboards Seeing Red, But ST Indicators Very Oversold Already

by Erin Swenlin,

Vice President, DecisionPoint.com

It's been nearly a month since we saw our last signal changes to the DecisionPoint Scoreboards, but with the pullback over the past week, momentum turned negative and now we are seeing new Price Momentum Oscillator (PMO) SELL signals on all four!

The Dow actually incurred its PMO...

READ MORE

MEMBERS ONLY

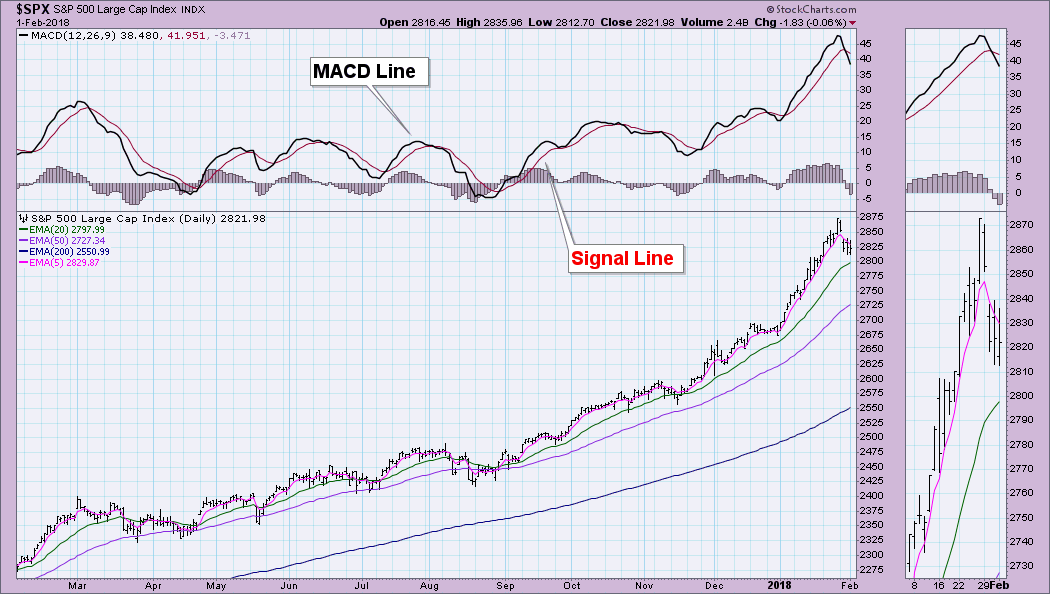

What's the Difference Between the PMO (Price Momentum Oscillator) and MACD/PPO?

by Erin Swenlin,

Vice President, DecisionPoint.com

I am often asked first, "What's the difference between the PMO and the MACD (or PPO)?" which is usually followed by, "Why do you prefer the PMO?". I'll answer the second question right now. As a mother loves her child, so do...

READ MORE

MEMBERS ONLY

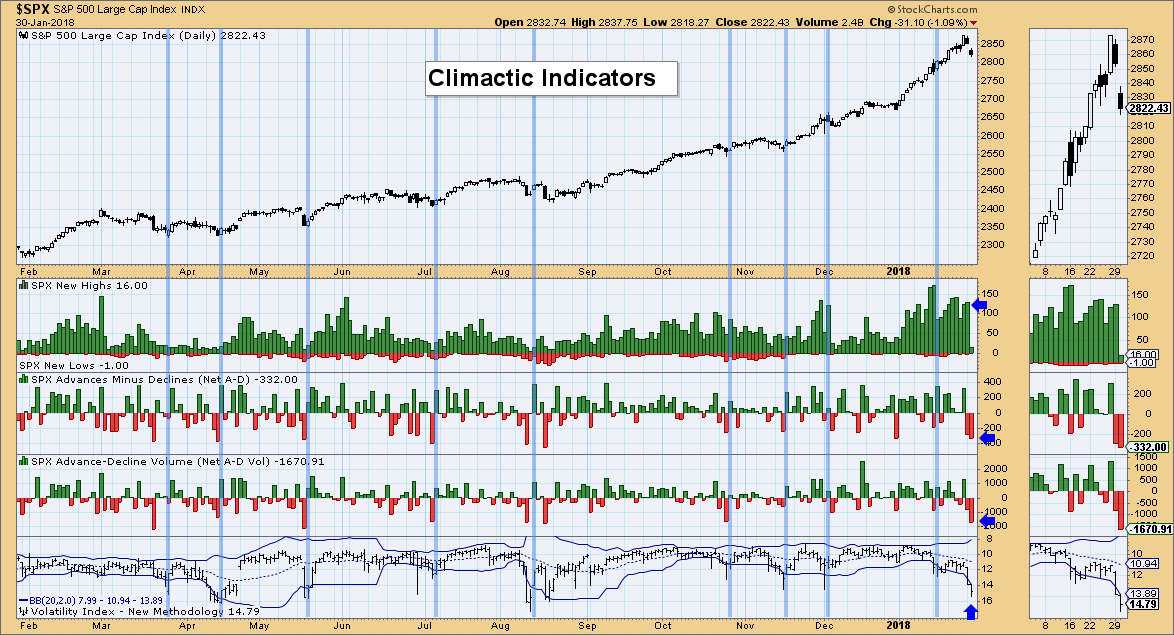

$VIX Flying High, This Has Bullish Implications

by Erin Swenlin,

Vice President, DecisionPoint.com

One chart that I have been watching very closely is the DecisionPoint Climactic Indicator chart. I use this chart to give me an idea of very short-term sentiment and how to use it to determine possible tops and bottoms. Today I'm seeing some extremes that could be telling...

READ MORE

MEMBERS ONLY

Mid-Cap and Small-Cap ETFs Deteriorating (IJH & IJR)

by Erin Swenlin,

Vice President, DecisionPoint.com

It is very tough to find weakness in the major indexes as they continue to fly higher. However, I was reviewing my DecisionPoint LIVE ChartList and noted that we are seeing a few warning signs on the small and mid-cap ETFs, IJR and IJH.

Currently, both IJH and IJR have...

READ MORE

MEMBERS ONLY

Volatility Indexes for NDX ($VXN) and Gold ($GVZ) Suggest Rally Pop Ahead

by Erin Swenlin,

Vice President, DecisionPoint.com

Many of you may not be aware, but DecisionPoint has charts for most of the volatility indexes in the DecisionPoint Market Indicator ChartPack. We're in the process of updating the ChartPack, but there's no reason you can't download it now and enjoy the plethora...

READ MORE

MEMBERS ONLY

DP Alert: Bull Flag Executes on USO! New Upside Target

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards remain green as momentum is positive and price trends continue higher in this seemingly unending bull market rally. I'm seeing a few cracks in the pavement right now in the short-term indicators with a negative divergence between breadth and volume. USO began executing a bull...

READ MORE

MEMBERS ONLY

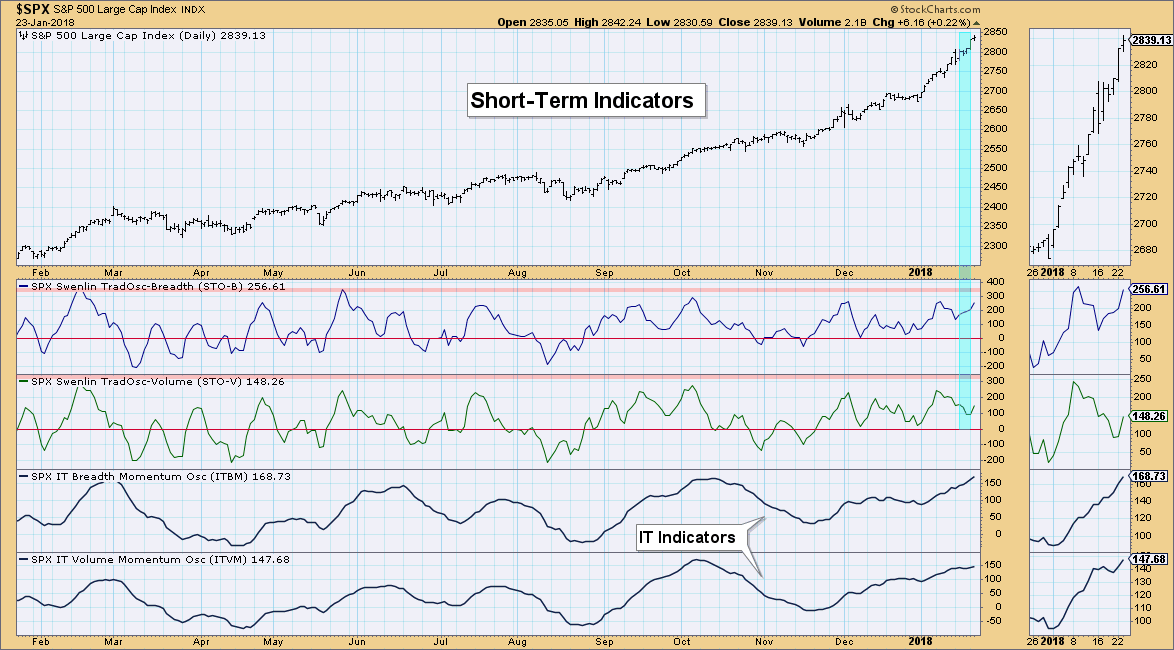

Near-Term Divergence Ends Between Swenlin Trading Oscillators (STOs), Intermediate Term Remains

by Erin Swenlin,

Vice President, DecisionPoint.com

On Monday's MarketWatchers LIVE program during the "DecisionPoint Report", I highlighted a divergence between the Swenlin Trading Oscillators (STOs). I admitted that I hadn't seen a divergence lasting over a day or two. These are short-term indicators that generally travel in concert. The difference...

READ MORE

MEMBERS ONLY

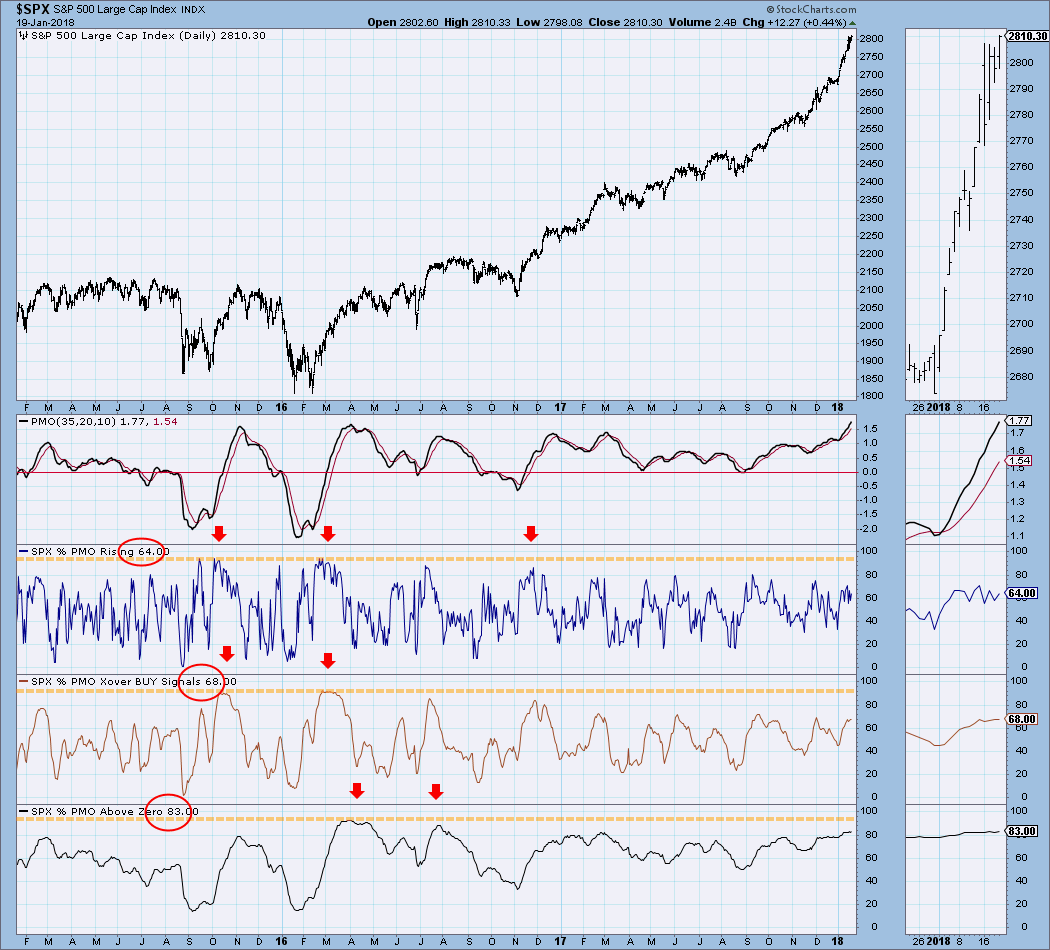

PMO Analysis Chart - Market Isn't As Overbought As You Think

by Erin Swenlin,

Vice President, DecisionPoint.com

Most of you are familiar with the Price Momentum Oscillator (PMO) and its use on my individual stock, ETF, index charts. However, by analyzing the health of the PMOs within an index, we are able to get a reliable market indicator.

The PMO Analysis charts that are in the DecisionPoint...

READ MORE

MEMBERS ONLY

Anatomy of a Trade: Kelly Services (KELYA) - Stops/Targets/Evaluation

by Erin Swenlin,

Vice President, DecisionPoint.com

One of my favorite segments to do and watch on the MarketWatchers LIVE show M-F 12:00p - 1:30p EST is the "Anatomy of a Trade". Tom Bowley, my co-host, is a very short-term trader and generally has a handful of trades to discuss. However, I'...

READ MORE

MEMBERS ONLY

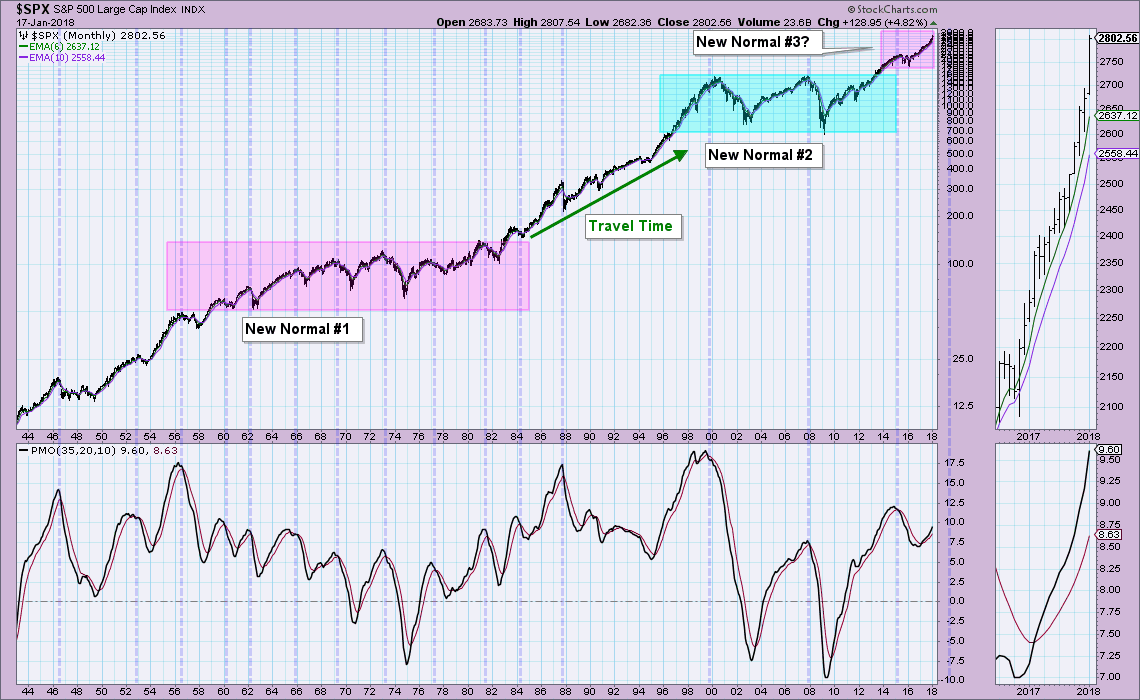

DP Alert: Market Overbought or the "New Normal"? - UUP H&S Executing As Expected

by Erin Swenlin,

Vice President, DecisionPoint.com

As we watch the SPX continue to move higher in parabolic fashion, it's of course natural to begin to worry about a market collapse. During today's MarketWatchers LIVE show, Tom and I went over what we think are good "alerts" to the bear market...

READ MORE

MEMBERS ONLY

Bad News for Bonds - New IT Trend Model Neutral - 30-Yr Yields Prepare for Breakout

by Erin Swenlin,

Vice President, DecisionPoint.com

Today I received notice that TLT had triggered a new Intermediate-Term Trend Model (ITTM) Neutral signal. I decided to take a look at $TYX to see if yields were lining up with the action on TLT. Of course the relationship between TLT and $TYX is inverse, so a bearish TLT...

READ MORE

MEMBERS ONLY

DP Alert: Bullish Indicators, But isn't it Time for a Pause? - Flag or Island Reversal on USO?

by Erin Swenlin,

Vice President, DecisionPoint.com

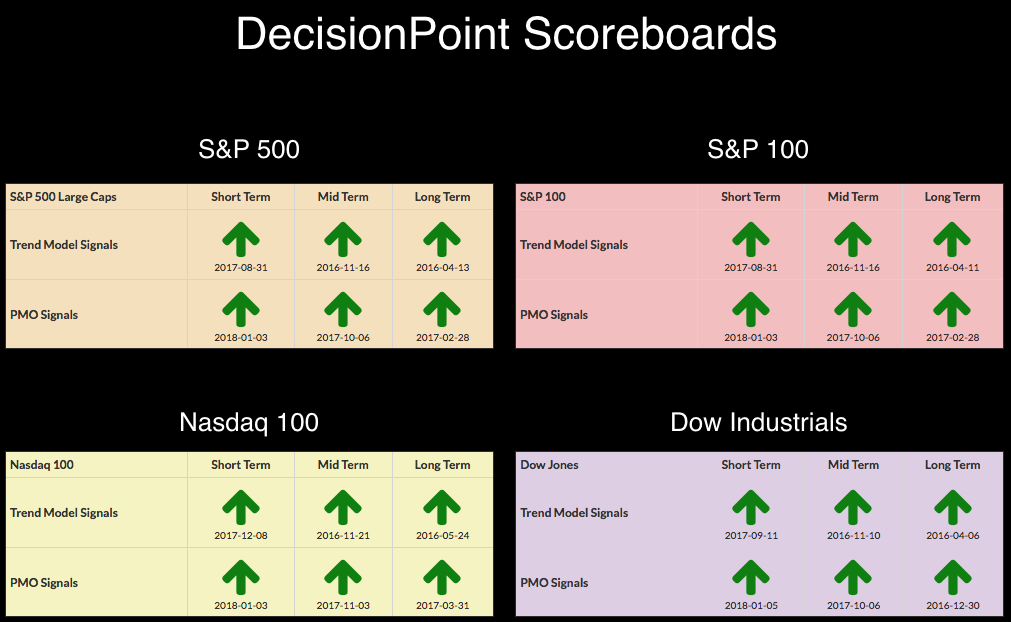

Carl always told me that you shouldn't put questions in the title of your articles unless you plan on answering them. I will. First, I want to point out the all green DecisionPoint Scoreboards. As I told listeners this morning, since I've been tracking these Scoreboards...

READ MORE

MEMBERS ONLY

DP Bulletin: Dow Regains PMO BUY Signal - DP Scoreboards ALL Green

by Erin Swenlin,

Vice President, DecisionPoint.com

A quick bulletin to let you all know that we got a new PMO BUY signal on the Dow. I've been writing about this the past few days so no one should be surprised. At this point my concern again is for more whipsaw if the market takes...

READ MORE

MEMBERS ONLY

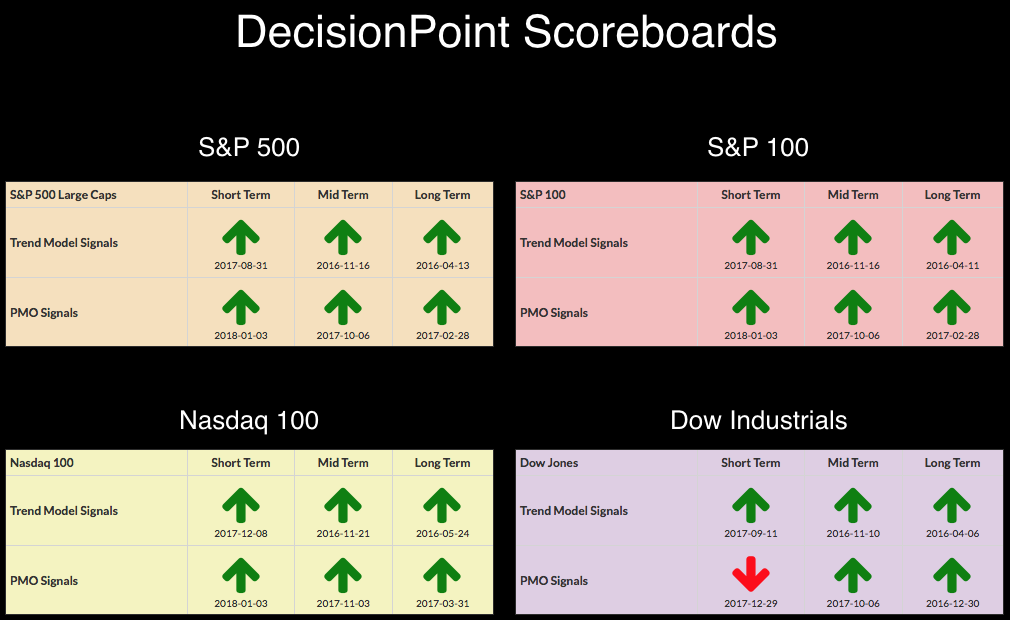

Dow Finally Breaks Out

by Erin Swenlin,

Vice President, DecisionPoint.com

If you look at the DP Scoreboards below, you'll note that the Dow is the only Scoreboard with "red" on it. It is highly likely that red arrow or PMO SELL signal will evaporate tomorrow if we see a follow-on rally or even a slight rise....

READ MORE

MEMBERS ONLY

DP Alert: Whipsaw Back to BUY Signals - Dow Left Out

by Erin Swenlin,

Vice President, DecisionPoint.com

I had a bad feeling about the array of PMO SELL signals that appeared Friday and Tuesday. It wasn't worry about an upcoming decline, more the concern we'd see a whipsaw right back to BUY signals, which we did. Interestingly, the Dow was left out and...

READ MORE

MEMBERS ONLY

Pausing Market Triggers Whipsaw PMO SELL Signals on DP Scoreboards - New ITTM BUY Signal for Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday, the SPX, OEX and Dow logged new PMO SELL signals. This was a function of the market consolidating and holiday trading, but it is important to note that these signals are arriving in overbought territory for these PMOs. After today's trading, their PMOs are already decelerating...

READ MORE

MEMBERS ONLY

DP Alert: NDX Logs New SELL Signal - Gold Shines - ST Indicators Rising Again

by Erin Swenlin,

Vice President, DecisionPoint.com

I hope you and yours had a fantastic and warm Christmas! As Bob Cratchit so eloquently put it, "I was making rather merry yesterday". The holidays continue as does holiday trading into the new year. We received a new PMO SELL signal on the NDX, so I'...

READ MORE

MEMBERS ONLY

DP Bulletin: Dollar (UUP) ITTM SELL Signal - ITTM Neutral Signals for XLU and RYU

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dollar (UUP) continues to form a bearish head and shoulders pattern in textbook fashion. The decline continues and consequently, there was a negative 20/50-EMA crossover BELOW the 200-EMA which constitutes an Intermediate-Term Trend Model (ITTM) SELL signal. For the Utilities SPDR (XLU) and Utilities Equal-Weight (RYU), new ITTM...

READ MORE

MEMBERS ONLY

DP Alert: UUP PMO SELL Signal - IT Indicators Toppy

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards remain completely "green". Hard to argue with the strength of this bull market in all three timeframes. However, the intermediate-term indicators are trying to top and have a negative crossover. ST indicators continue to fall. The Dollar looks very weak and it is getting more...

READ MORE

MEMBERS ONLY

Using Volatility Index Charts to Analyze Short-Term Trading Conditions

by Erin Swenlin,

Vice President, DecisionPoint.com

I am often asked why I use an inverted scale on my Volatility Index charts. The answer is that I find it to be an excellent overbought/oversold indicator in the short term when it's flipped. Typically it is said that if the VIX is low that is...

READ MORE

MEMBERS ONLY

DP Alert: PMO BUY for NDX Finally - Gold Sentiment Suggests Rally

by Erin Swenlin,

Vice President, DecisionPoint.com

The only red arrow left on the DP Scoreboards was erased today as the NDX triggered a PMO BUY signal on the daily chart. The last time we saw no red on the Scoreboards, it lasted about two days. The bull winds are blowing hard, so I think this all...

READ MORE

MEMBERS ONLY

Is Santa Claus Really Coming to Town for Small Caps?

by Erin Swenlin,

Vice President, DecisionPoint.com

I haven't talked Small Caps in quite awhile and I think there are some interesting points that need to be made--good and bad. First, the technicals on the S&P 600 are not looking good at all. However, Tom Bowley, my co-host on MarketWatchers LIVE and fellow...

READ MORE

MEMBERS ONLY

DP Alert: Short-Term Head & Shoulders Still Viable on Dollar (UUP)

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes to the DecisionPoint Scoreboards. The NDX is holding onto its PMO SELL signal and it still has some margin to cover before the new PMO BUY signal can generate. Of particular interest today, and of course coming on the heels of a very bullish blog on the...

READ MORE

MEMBERS ONLY

Utilities Sector Dimming - UUP Garners a New IT Trend Model BUY

by Erin Swenlin,

Vice President, DecisionPoint.com

We've seen some very interesting sector rotation this past year as the market continues to climb higher. Money doesn't seem to really be leaving the market, just rotating from one sector to the next. The Utilities sector was a good run through October and into November....

READ MORE