MEMBERS ONLY

Intermediate-Term Trend Model BUY Signal on GOLD

by Erin Swenlin,

Vice President, DecisionPoint.com

GOLD: As of 1/12/2015 Gold is on a Trend Model BUY signal. The LT Trend Model, which informs our long-term outlook, is on a SELL signal as of 2/15/2013, so our long-term posture is bearish.

The big news for gold is that for the first time...

READ MORE

MEMBERS ONLY

DP Weekly Update: Backing Off - January 9, 2015

by Erin Swenlin,

Vice President, DecisionPoint.com

Here's the DecisionPoint weekly view of the current market situation. After the recent bounce, price took a break and backed off today.

The purpose of the DecisionPoint Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market...

READ MORE

MEMBERS ONLY

Carl Swenlin, Overachiever

by Erin Swenlin,

Vice President, DecisionPoint.com

I thought our subscribers might appreciate a quick update on why we missed our DP Daily Update in the DP Reports blog for the first time since we started it on the old DecisionPoint website.

Yesterday morning, Carl went in for triple bypass surgery. Well, leave it to Carl to...

READ MORE

MEMBERS ONLY

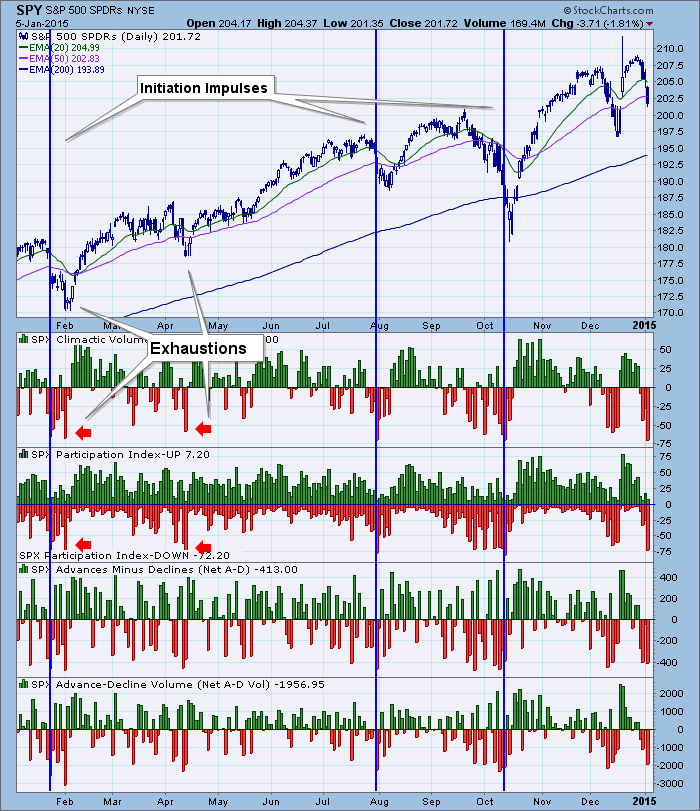

Ultra-Short-Term Initiation Impulses

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint ultra-short-term indicator suite consists of the Climactic Volume Indicator (CVI), Participation Index (PI) and Net Breadth Indicators. This indicator set exploded with very negative climactic readings today. When we see these "spikes" or "climaxes", we try to determine whether they are initiation or exhaustion...

READ MORE

MEMBERS ONLY

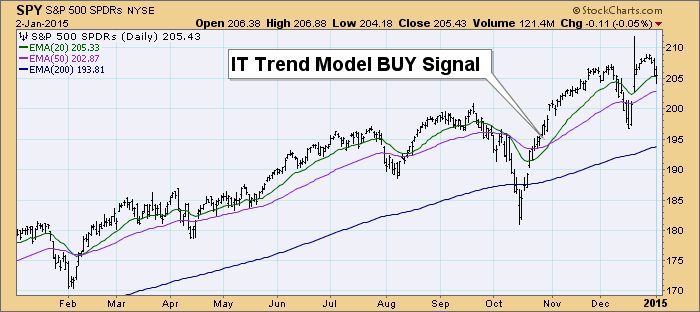

The DecisionPoint Trend Model Picture for 2015

by Erin Swenlin,

Vice President, DecisionPoint.com

Now that 2014 has drawn to a close, analysts are reviewing history and hoping to prognosticate about 2015. I'd like to review some of the DecisionPoint Trend Model charts for not just the S&P 500 (SPY), but also for the dollar, gold, oil, commodities and bonds....

READ MORE

MEMBERS ONLY

DP Weekly Update: The Pullback Continues

by Erin Swenlin,

Vice President, DecisionPoint.com

Despite the low volume of holiday trading, there was still a distinct price top that formed during the past two weeks. An ultra-short-term positive is that price broke out from overhead resistance that had formed starting Wednesday.

The purpose of the DecisionPoint Daily Update is to quickly review the day&...

READ MORE

MEMBERS ONLY

Champagne Toast to a Martini, Shaken Not Stirred

by Erin Swenlin,

Vice President, DecisionPoint.com

As we close out 2014 and prepare to toast in the New Year, I thought it would be interesting to research one of the companies that produces champagne. Turns out one of the largest producers of champagne and other alcoholic beverages is LVMH - Moet Hennessy Louis Vuitton (LVMUY). As...

READ MORE

MEMBERS ONLY

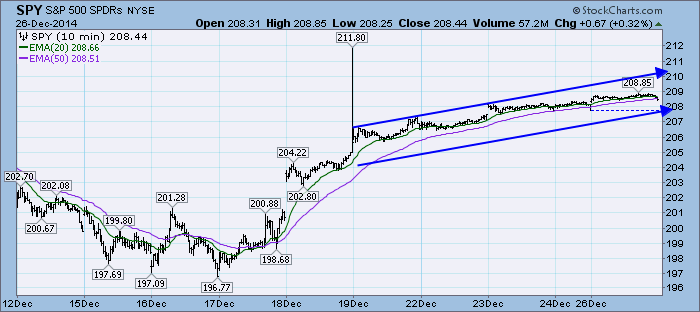

DP Weekly Update - December 26, 2014

by Erin Swenlin,

Vice President, DecisionPoint.com

In general, price has been consolidating in a slightly elevated trend. The holiday week has been uneventful as far as market action, although we did see a Price Momentum Oscillator (PMO) crossover on the SPY.

The purpose of the DecisionPoint Daily Update is to quickly review the day's...

READ MORE

MEMBERS ONLY

Creating a Workflow ChartList

by Erin Swenlin,

Vice President, DecisionPoint.com

With the release of several DecisionPoint ChartPacks (to learn more about them and how to install them click here), many users have expressed that they are overwhelmed by the quantity of quality indicator charts. This is not news to me, we had the same feedback from new users to the...

READ MORE

MEMBERS ONLY

DP Weekly Update: Market Digests Rally on Options Expiration - December 19, 2014

by Erin Swenlin,

Vice President, DecisionPoint.com

After two days of a strong rally, the market paused today, likely digesting the big move. Additionally, we usually see flat market action on options expiration days accompanied by high volume. The strange spike from the last 10 minutes yesterday held up so it wasn't a mistake.

The...

READ MORE

MEMBERS ONLY

"Tracking" Investment Opportunities

by Erin Swenlin,

Vice President, DecisionPoint.com

We all want to find the best available investment opportunities, but sometimes it isn't that easy. With the market turning around and a bottom forming on the recent correction, many are looking for a way to get in. A great scan can help, but if you are in...

READ MORE

MEMBERS ONLY

Gold Breaks Out

by Erin Swenlin,

Vice President, DecisionPoint.com

As of 8/21/2014 Gold has been on a DecisionPoint Intermediate-termTrend Model SELL signal. Reason being that the 20-EMA crossed below the 50-EMA on 8/21/14 while the 50-EMA was below the 200-EMA. Because the 50-EMA moved below the 200-EMA, the DecisionPoint Long-TermTrend Model moved to a SELL...

READ MORE

MEMBERS ONLY

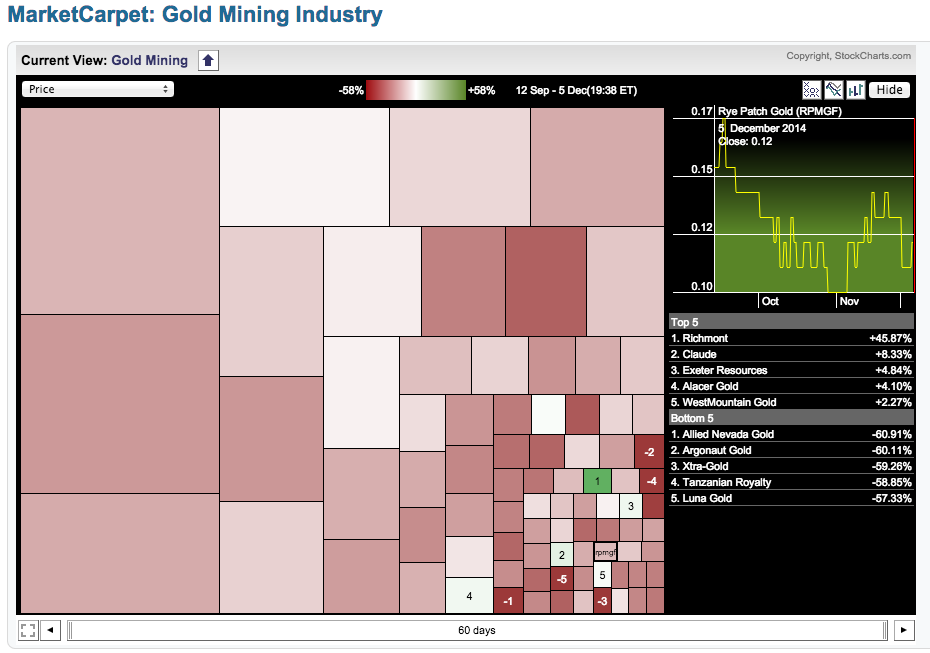

Gold Miners: How Low Can They Go?

by Erin Swenlin,

Vice President, DecisionPoint.com

I wrote a blog article some time back that questioned whether the Gold Miners stocks had finally hit rock bottom. I concluded that it was a good set-up for a bottom but there was still plenty of room for decline before they hit all-time lows. The stocks in the Gold...

READ MORE

MEMBERS ONLY

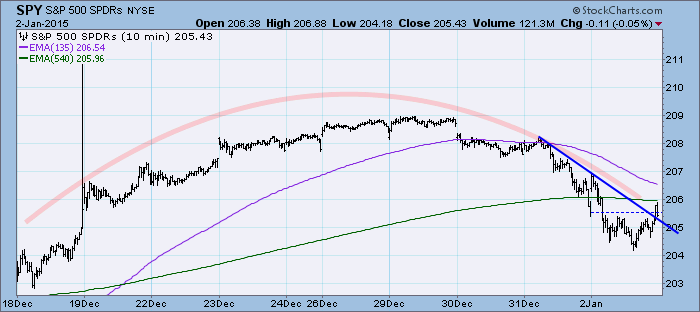

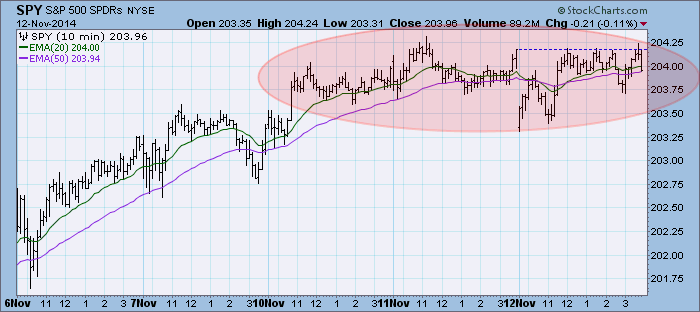

DP Weekly Update: Bearish Wedges

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday I was able to annotate very short-term trend lines on the 10-minute bar chart. A bearish ascending wedge is visible and while price broke below in the 20 minutes of trading it did manage to close above. I don't think that this is the execution of this...

READ MORE

MEMBERS ONLY

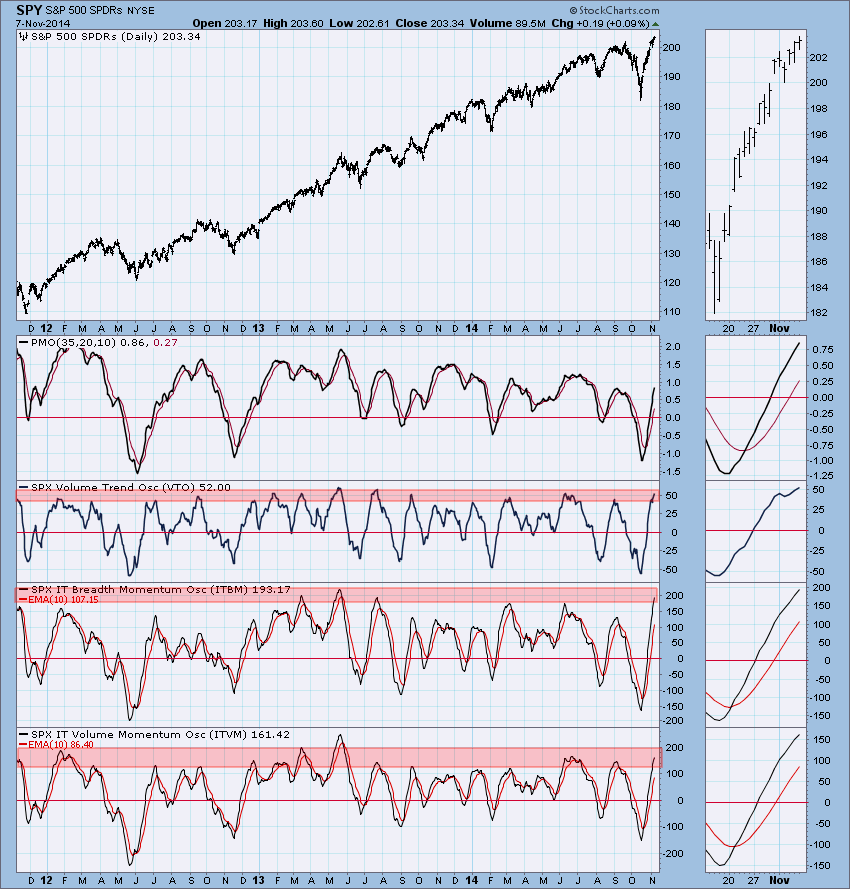

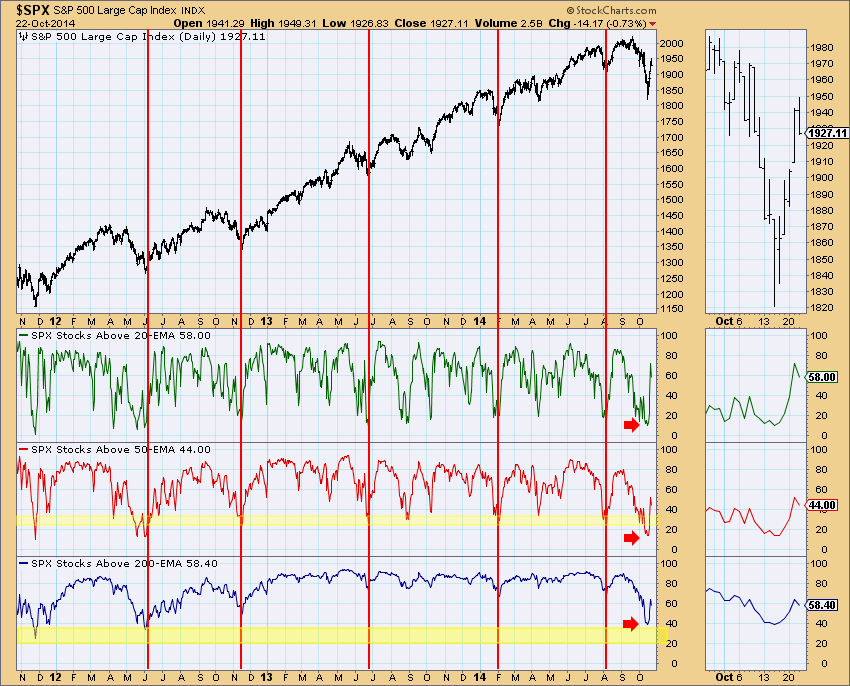

Long-Term Indicator Tops Warn of Market Top

by Erin Swenlin,

Vice President, DecisionPoint.com

We have been watching intermediate- and long-term market conditions using our DecisionPoint indicator sets and DecisionPoint Chart Gallery. Longer-term indicators have been overbought for some time. But as you'll see, some of these indicators can hang out in overbought territory for awhile. The key is to see when...

READ MORE

MEMBERS ONLY

DP Weekly Update: Stocks Flat; Big Drop for Crude - November 28, 2014

by Erin Swenlin,

Vice President, DecisionPoint.com

The market closed slightly lower but it remained within the narrow range of the previous four trading days.

The purpose of the DecisionPoint Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market (S&P 500), the nine...

READ MORE

MEMBERS ONLY

DP Weekly Update: Rally Cools Quickly - November 21, 2014

by Erin Swenlin,

Vice President, DecisionPoint.com

Note: The DP Weekly Update will now be published every Friday so we can analyze the final weekly charts.

Price surged on the open likely helped by China lowering its interest rates for the first time in two years. After that it was all downhill. The bull flag executed first...

READ MORE

MEMBERS ONLY

What Does a DecisionPoint Trend Model "Neutral" Signal Mean?

by Erin Swenlin,

Vice President, DecisionPoint.com

It was rightly brought to my attention that I haven't really explained what DecisionPoint Trend Model signals imply, especially the "Neutral" signal. First, remember that these "signals" are really "attention flags" to give you a heads up on a possible price reversal...

READ MORE

MEMBERS ONLY

DP Weekly Update: Indicators Turn Back Down - November 19, 2014

by Erin Swenlin,

Vice President, DecisionPoint.com

NOTE: The DP Weekly Update will be moving to Fridays. That way you'll get a review of the weekly charts as well as the regular commentary.

After breaking out yesterday, price broke down. The breakdown actually began at the end of yesterday where we noted that it could...

READ MORE

MEMBERS ONLY

Bond Timer of the Year?

by Erin Swenlin,

Vice President, DecisionPoint.com

I don't like to toot my own horn, but Chip suggested I do today! Most of you are not aware that the DecisionPoint Trend Model signals have been tracked for many years by Timer Digest, a professional publication for market timers. In this monthly issue, I was listed...

READ MORE

MEMBERS ONLY

Metal Health

by Erin Swenlin,

Vice President, DecisionPoint.com

Forgive me! I couldn't resist that cheesy headline stolen from the Quiet Riot album title. The headline is true, metals had a healthy day, as did other natural resource ETFs. I've highlighted notable ETFs right from our DecisionPoint ETF Tracker Report found in the DP Tracker...

READ MORE

MEMBERS ONLY

DP Weekly Update: Small Price Top

by Erin Swenlin,

Vice President, DecisionPoint.com

Price continues to consolidate. The market seems to be disinterested in a breakdown.

The purpose of the DecisionPoint Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market (S&P 500), the nine SPDR Sectors, the U.S....

READ MORE

MEMBERS ONLY

Intermediate-Term Indicators Overbought Again

by Erin Swenlin,

Vice President, DecisionPoint.com

As I wrote my DP Daily Update today, I noticed that our intermediate-term indicators have joined our short-term indicators in very overbought territory. You'll note from the previous tops, this generally means the market is ready to correct, pull back or at the very least consolidate so that...

READ MORE

MEMBERS ONLY

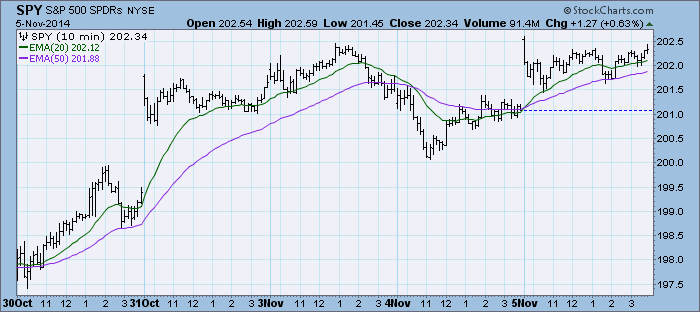

DP Weekly Update: More All-Time Highs - November 5, 2014

by Erin Swenlin,

Vice President, DecisionPoint.com

The market was up all day making new all-time highs, but still spent the majority of the day moving sideways.

The purpose of the DecisionPoint Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market (S&P 500)...

READ MORE

MEMBERS ONLY

Six-Month Seasonality Turns Favorable

by Erin Swenlin,

Vice President, DecisionPoint.com

With the end of October, which is sometimes referred to as "Black October", six-month seasonality switches from Bearish to Bullish. You'll find our seasonality table in the DP Reports blog on the DP Alert Daily Report. You'll see the section extracted below:

This is...

READ MORE

MEMBERS ONLY

Announcing the NEW "DP Weekly Update"!

by Erin Swenlin,

Vice President, DecisionPoint.com

For those of you who don't know, I publish a DP Daily Update in the DP Reports blog. Everyday I analyze the same charts to give you continuity and the opportunity to truly understand our premier market indicators. Along with the S&P 500, I review '...

READ MORE

MEMBERS ONLY

Bullish Flags are Waving

by Erin Swenlin,

Vice President, DecisionPoint.com

Today I ran my regular scan to find stocks or ETFs that are rising on fresh momentum. (The scan is listed at the bottom of this blog article.) The results were very interesting as nearly half of the charts showed bullish flag formations. These formations are short-term continuation patterns that...

READ MORE

MEMBERS ONLY

DP Chart Gallery - Indicators that are Talking

by Erin Swenlin,

Vice President, DecisionPoint.com

I actually review most of the charts in the DP Chart Gallery for my DecisionPoint Daily Update everyday, but there are a few that I don't often survey. With the market correcting, bottoming and today, pausing, I wanted to see all of what we have in the Chart...

READ MORE

MEMBERS ONLY

Getting a Jump on Apple

by Erin Swenlin,

Vice President, DecisionPoint.com

Apple, Inc. (AAPL) gets plenty of press and so I debated even bringing it up. However, they reported earnings after the bell and beat expectations. Despite weak iPad sales, the huge iPhone 6 and Mac sales have investors excited. Last I'd heard it was up over 1% in...

READ MORE

MEMBERS ONLY

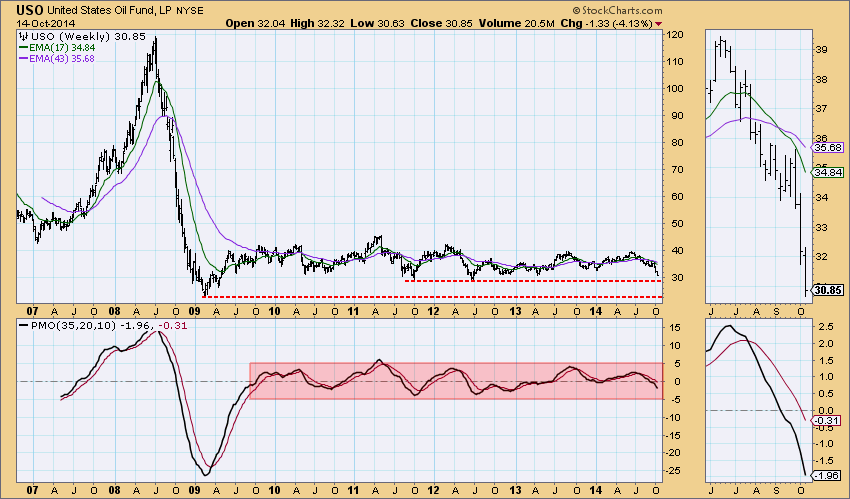

USO Prepares to Test 2011 Lows

by Erin Swenlin,

Vice President, DecisionPoint.com

United States Oil Fund (USO) is one of the "big four" that I analyze on a daily basis in the DecisionPoint Daily Update which you can find in the "DP Reports" blog. The other three of the "big four" are UUP (Dollar), Gold and...

READ MORE

MEMBERS ONLY

Gold Miners Rally! Is This The Bottom?

by Erin Swenlin,

Vice President, DecisionPoint.com

I noticed on today's DP ETF Tracker Report, where ETFs are sorted by percent change, that Gold Miners hit it big today. Gold Miner ETFs and stocks, while tied to gold, will not necessarilytrade and travel with gold prices. However, as of late they have been dropping just...

READ MORE

MEMBERS ONLY

Ebola Stocks

by Erin Swenlin,

Vice President, DecisionPoint.com

Today on Fox Business News channel, the panel of "Making Money" discussed the biotech stocks that are the makers or researchers for ebola virus pharmaceuticals. I thought it would be interesting to analyze the charts since their discussion was primarily based on fundamentals. All of these stocks have...

READ MORE

MEMBERS ONLY

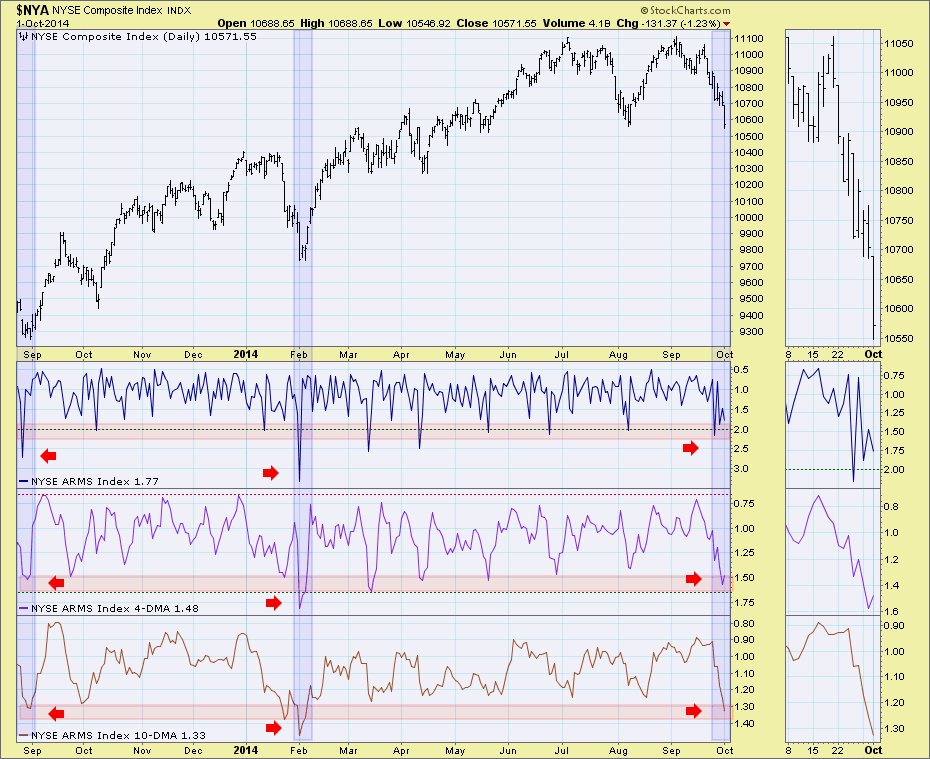

Oversold Readings On The TRIN

by Erin Swenlin,

Vice President, DecisionPoint.com

The TRIN or Short-Term TRading INdex, better known as the Arms Index, is a breadth indicator that was developed by Richard Arms in 1967. The index is calculated by dividing the Advance-Decline Ratio by the Advance-Decline Volume Ratio. Because it is an oscillator, we can use it to identify short-term...

READ MORE

MEMBERS ONLY

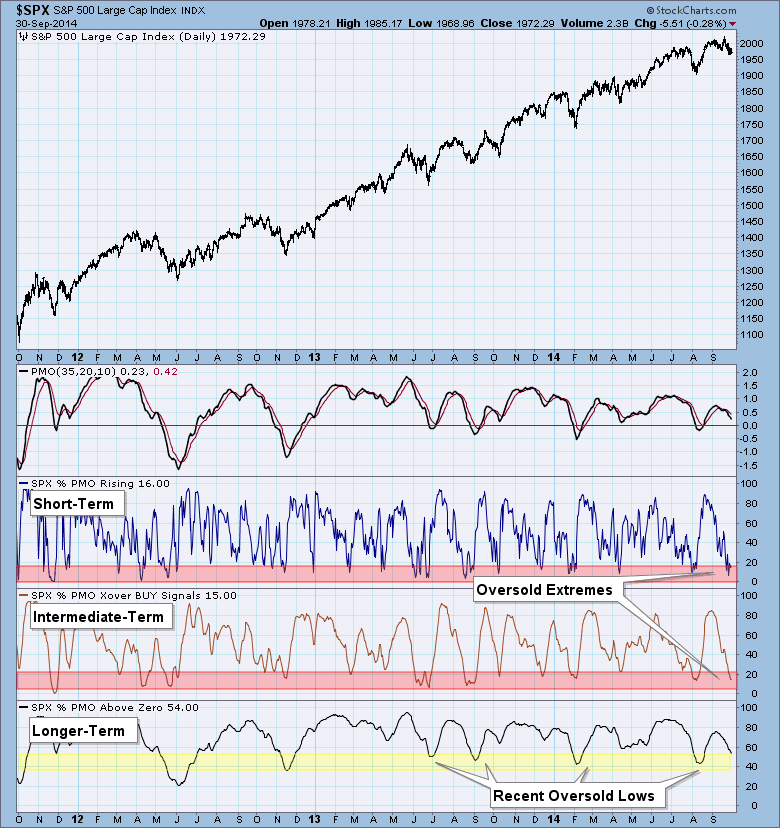

PMO Analysis Identifies Short-Term Extremely Oversold Conditions

by Erin Swenlin,

Vice President, DecisionPoint.com

The Price Momentum Oscillator (PMO) is a measure of internal strength and momentum. You can read more about the PMO in ChartSchool. Every stock, index, ETF, mutual fund has a PMO value each day. It can be rising or falling, have a crossover BUY signal (or not) generated by the...

READ MORE

MEMBERS ONLY

Ultra-Short-Term Indicator Climactic Readings: Initiation or Exhaustion?

by Erin Swenlin,

Vice President, DecisionPoint.com

At ChartCon last month, I had quite a few questions from attendees regarding our ultra-short-term indicators and how you distinguish a positive or negative spike in readings as either a price initiation or exhaustion. We had a great example this week. Readers of the DP Daily Update were able to...

READ MORE

MEMBERS ONLY

Possible Double-Bottom On Monsanto

by Erin Swenlin,

Vice President, DecisionPoint.com

This afternoon while going over the DP Tracker Report for the S&P 500, I checked the new Price Momentum Oscillator (PMO) BUY signals on the SPX-Plus Tracker to see if there were any signals that looked promising. There was one--Monsanto (MON).

First glance at the thumbnail, we see...

READ MORE

MEMBERS ONLY

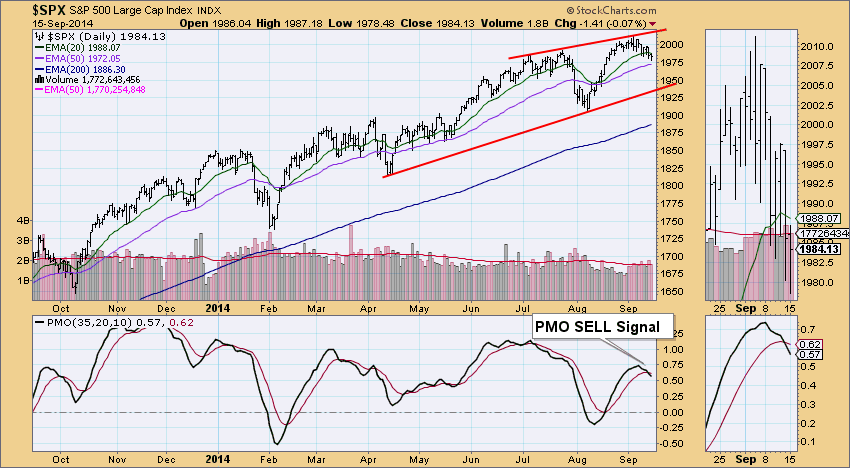

Indicators - Bearish To Bullish Overnight?

by Erin Swenlin,

Vice President, DecisionPoint.com

I recently received an email from a DP Daily Update subscriber:

" On 9/16 [in the] DecisionPoint [blog] you wrote, "Indicators in all time frames are quite bearish." (First sentence of second to last paragraph.)

On 9/18 [in the] Decision Point Reports [blog] you wrote, "...

READ MORE

MEMBERS ONLY

Have You Checked the DecisionPoint Chart Gallery Lately?

by Erin Swenlin,

Vice President, DecisionPoint.com

The free DecisionPoint Chart Gallery is a hidden gem with the link sitting in the middle of the StockCharts Homepage. You may want to review it daily (if you don't already!). The S&P 500 charts are free to view, but as a member you can also...

READ MORE

MEMBERS ONLY

UUP Reflects the Parabolic Price Rise of the Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

We all know that the dollar has been on a roll...but how much of a roll? Unfortunately, it is moving too high too quickly causing parabolic price rise visible on the charts for UUP.

A parabolic "bubble" generally occurs after a consolidation or basing pattern followed by...

READ MORE

MEMBERS ONLY

Gold Sentiment Hits Bearish Extremes

by Erin Swenlin,

Vice President, DecisionPoint.com

Central Gold Trust (GTU) is a closed-end mutual fund, which means that it trades like a stock on the NYSE. The fund owns only gold -- the metal, not stocks. Closed-end funds trade based upon the bid and ask, without regard to their net asset value (NAV). Because of this,...

READ MORE