MEMBERS ONLY

On-Balance Volume (OBV) Indicator Suite Short-Term Divergences

by Erin Swenlin,

Vice President, DecisionPoint.com

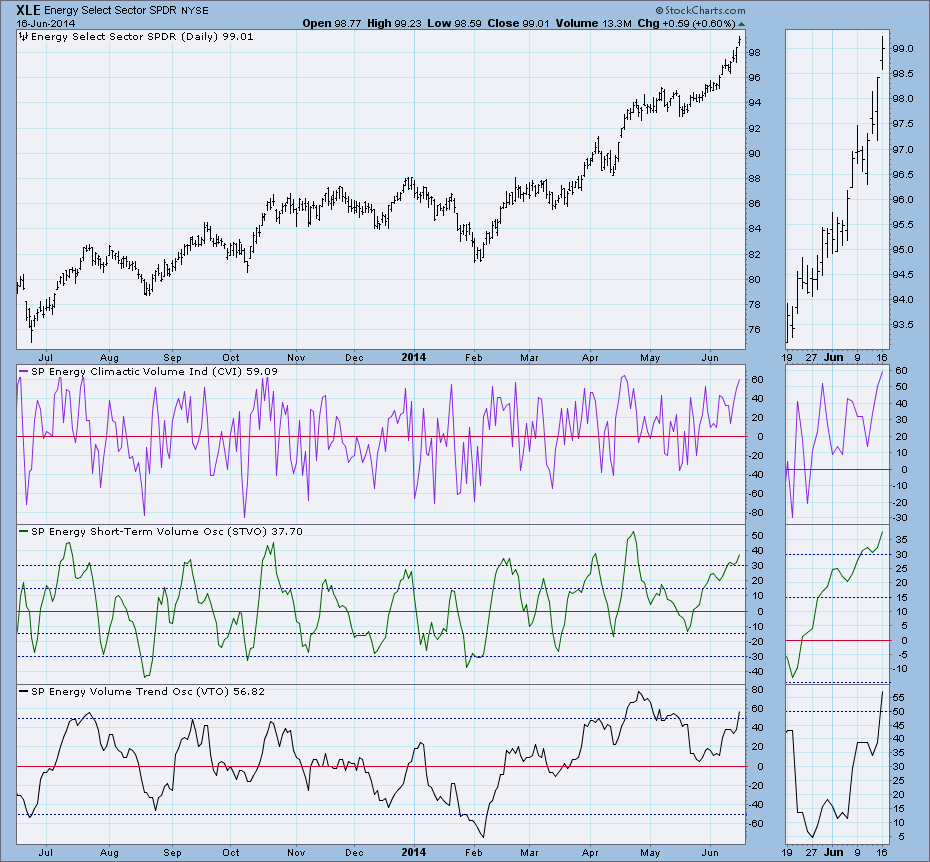

The DecisionPoint On Balance Volume (OBV) indicator suite that consists of three related indicators: Climactic Volume Indicator (CVI), Short-term Volume Oscillator (STVO), and Volume Trend Oscillator (VTO). All of these indicators are derived from the basic OBV calculation (To read more about On-Balance Volume click here). To construct the DecisionPoint...

READ MORE

MEMBERS ONLY

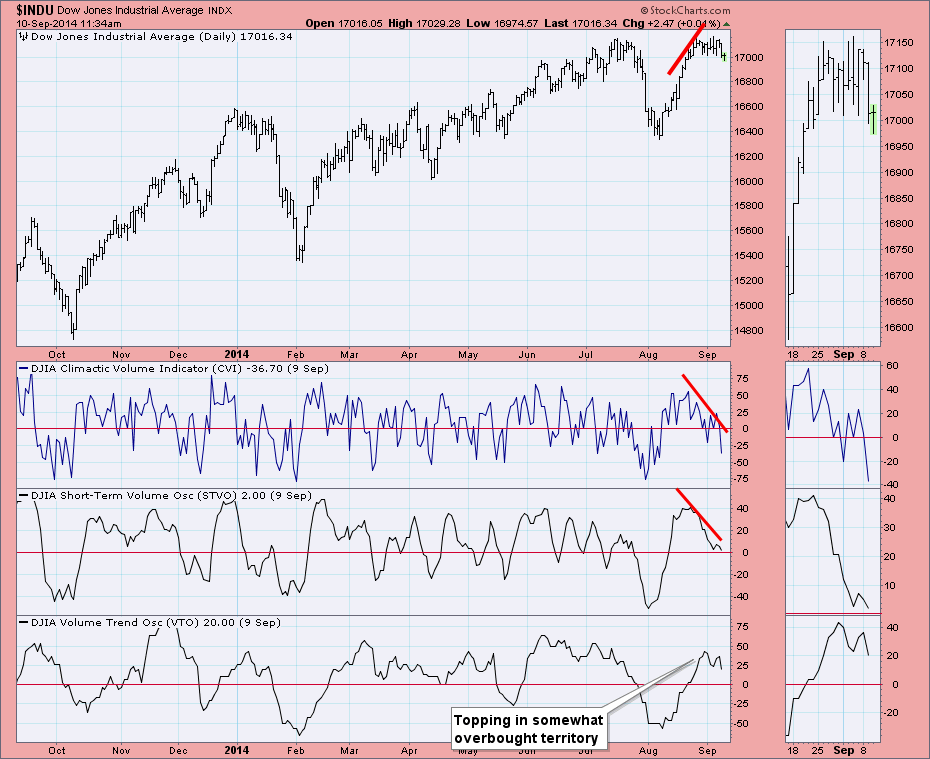

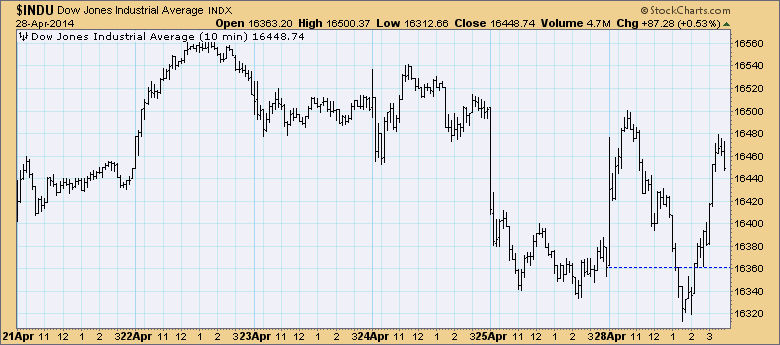

Volume Drying Up On DJIA

by Erin Swenlin,

Vice President, DecisionPoint.com

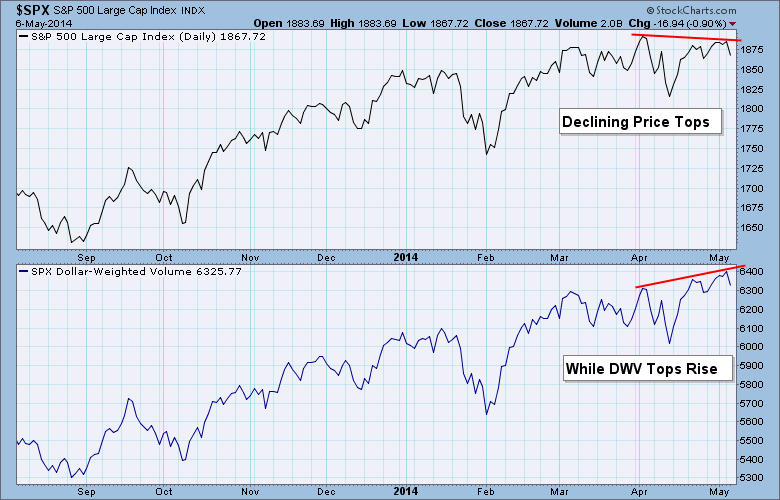

Dollar-Weighted Volume (DWV) is a short-term indicator. Generally the DWV and the price index run pretty close together, with tops confirming tops and bottoms confirming bottoms. What we look for are positive/negative divergences and for instances where volume doesn't confirm price, meaning that volume either leads or...

READ MORE

MEMBERS ONLY

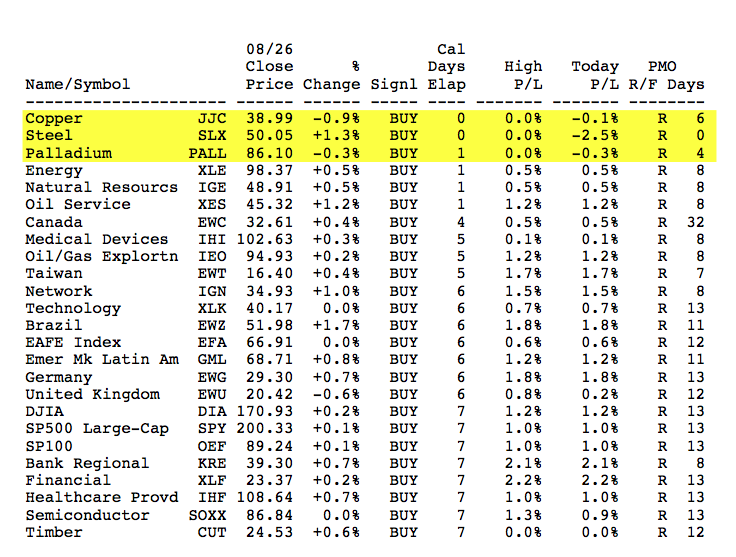

Three Metals Heat Up With New PMO BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

Looking at today's DecisionPoint ETF Tracker, I noticed three new PMO BUY signals on Copper (JJC), Steel (SLX) and Palladium (PALL). Gold (GLD) and Silver (SLV) are still suffering and haven't joined the party. Below is a cross-section of the DP ETF Tracker report where I...

READ MORE

MEMBERS ONLY

"Tracking" Down Investments With DecisionPoint Tracker Reports

by Erin Swenlin,

Vice President, DecisionPoint.com

I thoroughly enjoyed speaking at ChartCon 2014 and meeting so many that were thirsty to learn more about DecisionPoint indicators, charts and reports. At the end of my presentation, I briefly demonstrated how the DecisionPoint Tracker reports can be used to "bottom fish". It appears there are quite...

READ MORE

MEMBERS ONLY

Gold Breaks Out From Falling Wedge

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday, gold rallied and broke out from the bullish descending wedge that was formed over the past month or so. The technical expectation of a falling wedge pattern is a breakout and it happened. Remember, that the only expectation of wedge patterns is a breakout (falling wedge) or breakdown (rising...

READ MORE

MEMBERS ONLY

Indicators Oversold and Reaching Extremes

by Erin Swenlin,

Vice President, DecisionPoint.com

We've been watching our DecisionPoint indicators very closely over the past week as they have moved into neutral and now oversold territory. All three time frames are technically bearish as the indicators continue to fall without bottoming. Carl had written about a minor selling climax in the DecisionPoint...

READ MORE

MEMBERS ONLY

Five Charts To Keep An Eye On

by Erin Swenlin,

Vice President, DecisionPoint.com

Periodically I like to run a scan that gathers stocks and ETFs that have a PMO that has been rising for three days and has the 50-EMA above the 200-EMA. Here's what I like about this scan. First, if the 50-EMA is above 200-EMA that implies that the...

READ MORE

MEMBERS ONLY

Market Indexes Breaking Down

by Erin Swenlin,

Vice President, DecisionPoint.com

The Russell 2000 is not the only index struggling right now. If you look at the Nasdaq Composite, Dow Utilities, S&P 400 and S&P 600, you'll see similar breakdowns.

The Russell 2000 has been traveling upward in a bearish ascending wedge. The expectation was...

READ MORE

MEMBERS ONLY

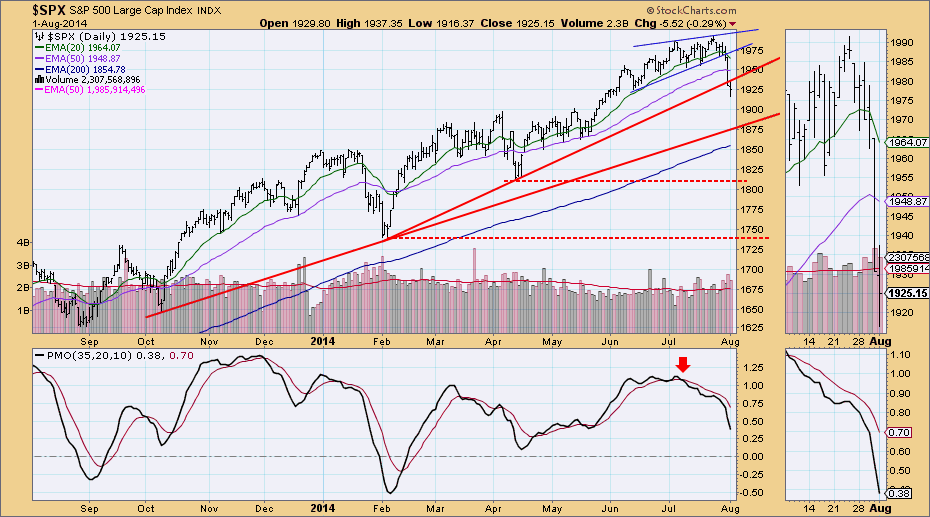

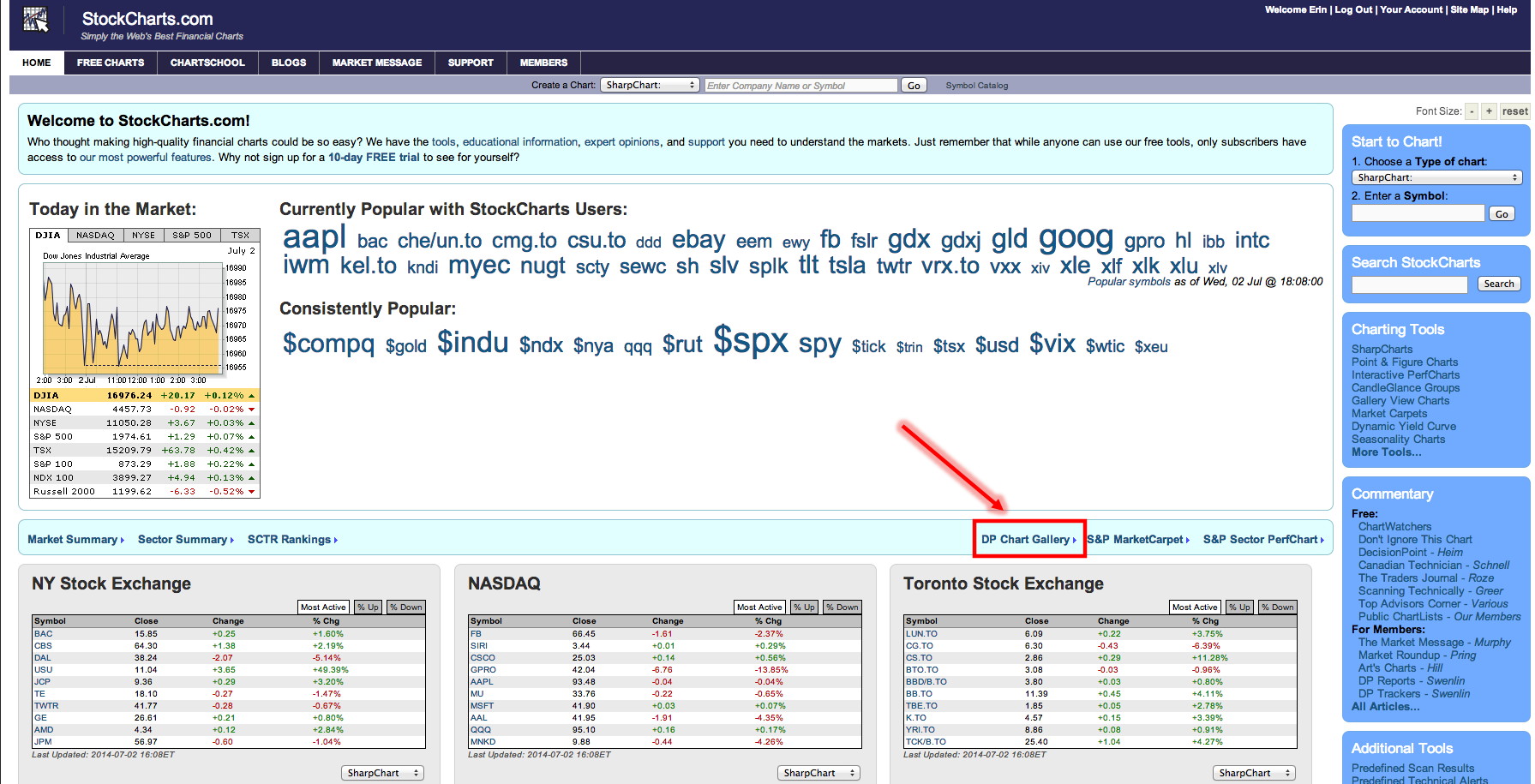

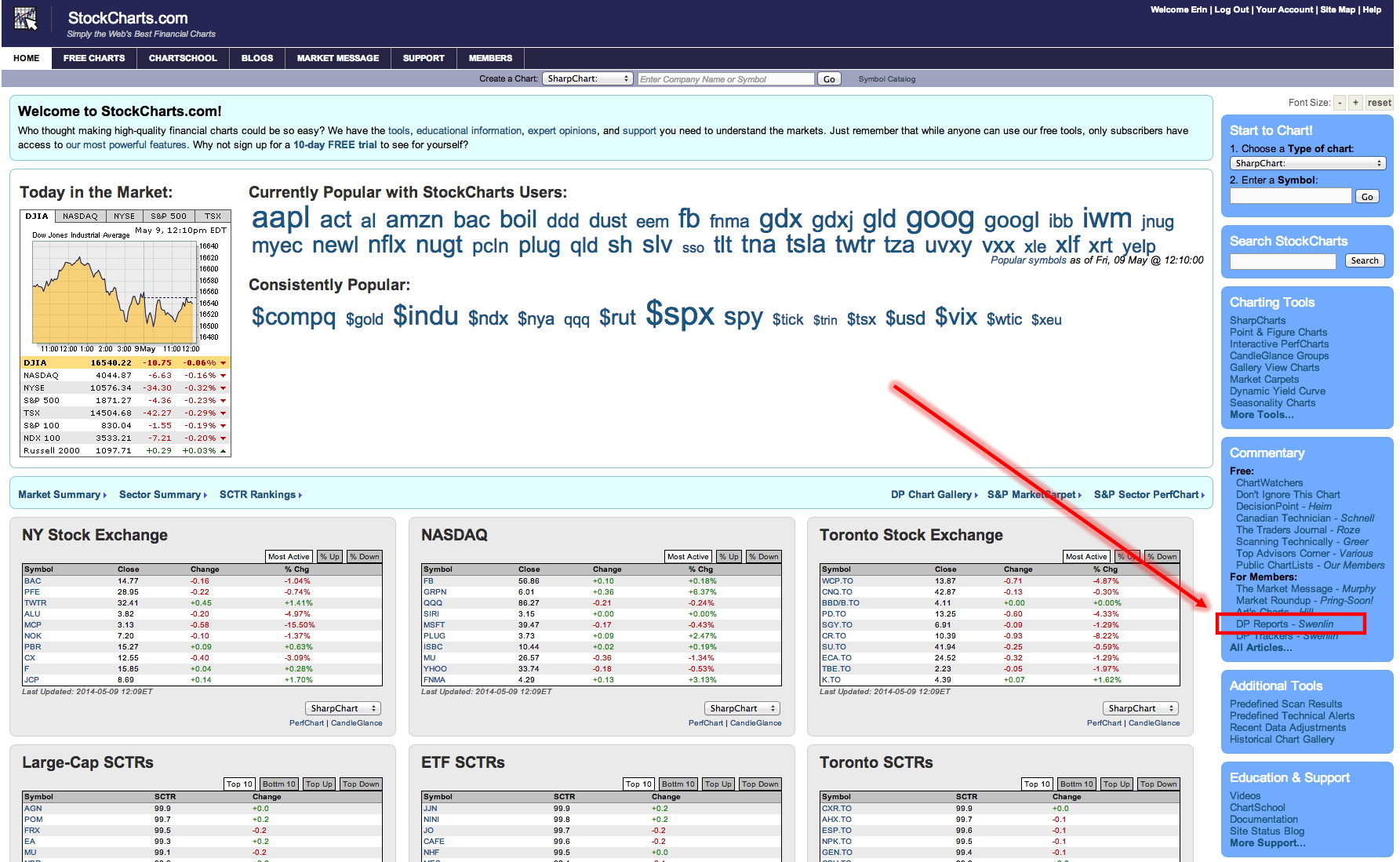

DecisionPoint Gallery Review

by Erin Swenlin,

Vice President, DecisionPoint.com

Periodically I like to do a review of the charts in the DecisionPoint Gallery, available in the 'free' area of StockCharts.com. You'll find the link to the gallery on the home page.

First is the $SPX daily chart. I've annotated the intermediate-term ascending...

READ MORE

MEMBERS ONLY

Copper - New PMO and Trend Model BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

The two cornerstone indicators for DecisionPoint analysis are the PMO and the intermediate- and long-term Trend Models. The DP ETF Tracker report, found in the DecisionPoint Trackers blog, lists not only percentage changes and PMO relative strength for the select ETFs we follow, it lists the PMO BUY and SELL...

READ MORE

MEMBERS ONLY

Analyzing On-Balance Volume Indicators On Select Sectors

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint On Balance Volume (OBV) indicator suite consists of three related indicators: Climactic Volume Indicator (CVI), Short-term Volume Oscillator (STVO), and Volume Trend Oscillator (VTO). All of these indicators are derived from the basic OBV calculation.

On-Balance Volume was invented by the late Joe Granville. It is a basic...

READ MORE

MEMBERS ONLY

Intermediate-Term Indicators No Longer Congested

by Erin Swenlin,

Vice President, DecisionPoint.com

For some time, our intermediate-term indicators have been oscillating in a tight range. But since the breakout rally began, readings are now setting themselves apart. Let's look at a few charts from the DP Chart Gallery.

First is the daily chart for the SPX. Price broke out above...

READ MORE

MEMBERS ONLY

Weekly PMO Readings Insightful

by Erin Swenlin,

Vice President, DecisionPoint.com

In many cases, we all spend a lot of time looking at daily charts and varying indicators. The Price Momentum Oscillator (PMO) using daily, weekly and monthly data to create a unique value for the chart you're looking at. The daily PMO may be reacting quite differently in...

READ MORE

MEMBERS ONLY

New DecisionPoint Subscribers and StockCharts Beginners Welcome!

by Erin Swenlin,

Vice President, DecisionPoint.com

I'm sure that you have seen the information on the upcoming ChartCon 2014 in August, but you may not know that this convention is not just for StockCharts veterans. In fact, it will be invaluable to those new to StockCharts.com.

To the DecisionPoint subscribers that followed us...

READ MORE

MEMBERS ONLY

PMO BUY Signals Reviewed From DP 152 Blue Chip Tracker Report

by Erin Swenlin,

Vice President, DecisionPoint.com

The DP Tracker reports are full of information on a variety of stocks and ETFs. Here is a link to a blog with more information on DP Trackers and how to find and use them.

I took at look at Friday's DP 152 Blue Chip Tracker Report to...

READ MORE

MEMBERS ONLY

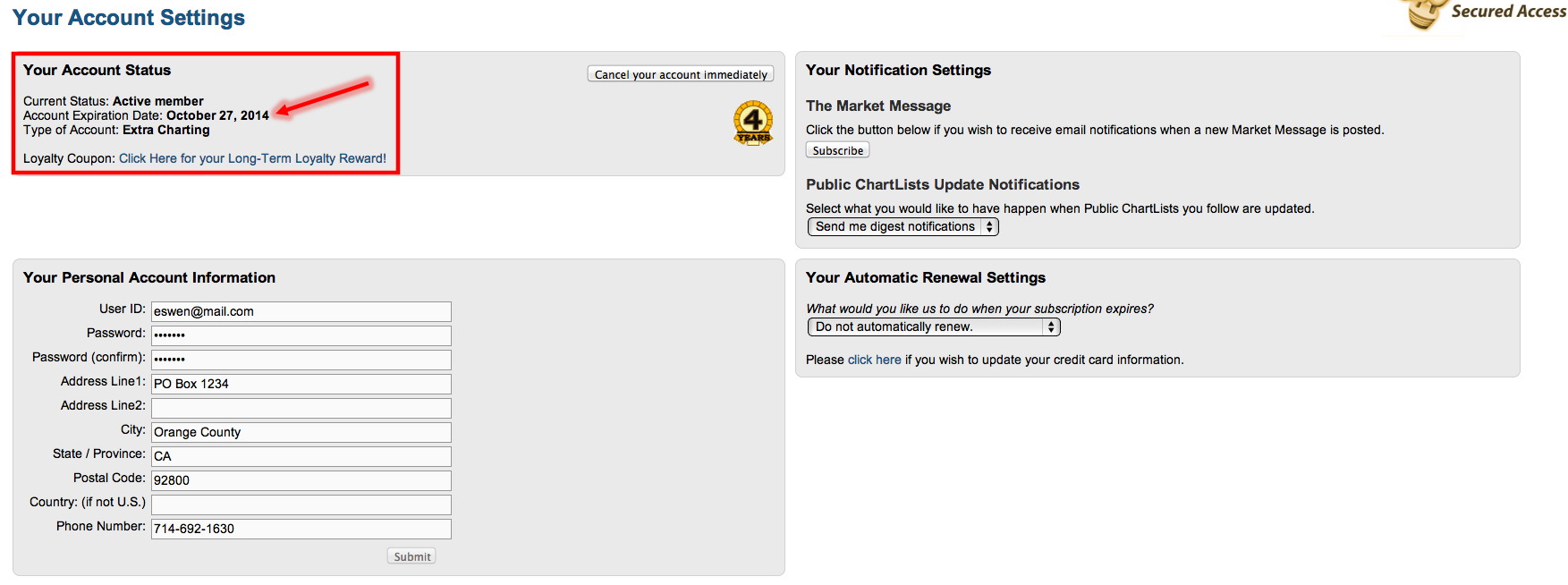

DP Subscribers: Renew Your StockCharts Subscription For Less Than Your DP Subscription!

by Erin Swenlin,

Vice President, DecisionPoint.com

Just a reminder that the majority of DecisionPoint.com subscribers will be losing their StockCharts.com access (and consequently access to the majority of DP content) unless they renew now. Questions have been coming in to the Support Team regarding the cost difference and what they are getting for their...

READ MORE

MEMBERS ONLY

Using PMO BUY Signals on DP SPX-Plus Tracker Report

by Erin Swenlin,

Vice President, DecisionPoint.com

One of my favorite ways to use the DP Tracker Reports is to call one up and take a look at brand new PMO BUY/SELL signals that have been generated by the PMO crossing over its EMA. Today I specifically pulled up the DP SPX-Plus Tracker Report 4. This...

READ MORE

MEMBERS ONLY

Market at a Decision Point - DP Gallery Review

by Erin Swenlin,

Vice President, DecisionPoint.com

A week-end look at the charts in the DP Chart Gallery tells us that the market, having just reached and pushed above horizontal resistance, is at a decision point. Will price be turned away or will it make a decisive breakout move? Let's look at what the DecisionPoint...

READ MORE

MEMBERS ONLY

USO Breaks Out

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, USO broke out above overhead resistance from the bullish ascending triangle. This move confirms the PMO BUY signal that was generated two days ago when the PMO crossed above its 10-EMA.

This breakout came on high volume which is positive. The next area of resistance would be at the...

READ MORE

MEMBERS ONLY

DecisionPoint Trackers: Timing Signals and Strength Rankings Across the Markets

by Erin Swenlin,

Vice President, DecisionPoint.com

Before there were scans, there were DecisionPoint Tracker Reports. While my scans are useful, the Tracker reports still provide some of the best timing and ranking information around to help you sniff out investment opportunities across the major indexes, ETFs, S&P 400, 500 & 600, mutual funds and...

READ MORE

MEMBERS ONLY

Don't Lose Your DecisionPoint Content! Renew Now!

by Erin Swenlin,

Vice President, DecisionPoint.com

This article is directed mainly at current DecisionPoint.com subscribers, but if you need information on how to renew your subscription, read on! As part of the merger between StockCharts.com and DecisionPoint.com, all DP subscribers were given complimentary "Extra" StockCharts membership accounts so that they could...

READ MORE

MEMBERS ONLY

DecisionPoint Market Recap and Expanded Market Summary

by Erin Swenlin,

Vice President, DecisionPoint.com

The last two days I filled you in on the DP Alert Daily Report and the DP Daily Update, both in the DP Reports blog. Today I'll cover the Market Recap and Expanded Market Summary Reports. Both are concise summaries of market action from not only today, but...

READ MORE

MEMBERS ONLY

The DP Alert Daily Report - One Stop For Market Posture and Timing Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

DecisionPoint.com has been providing table/spreadsheet reports for years. Each report provides a complete review of the market day, in addition to comparisons to previous days and to other indexes and sectors. In a glance you can see numerically what the market has accomplished as well as the actual...

READ MORE

MEMBERS ONLY

DecisionPoint Daily Blog Now On StockCharts.com!

by Erin Swenlin,

Vice President, DecisionPoint.com

I received numerous emails and concerns throughout this DP to StockCharts transition period from DecisionPoint subscribers regarding the possible loss of the DP Daily Blog. I'm happy to report that it has been moved to the StockCharts.com blog section under "DP Reports". It has a...

READ MORE

MEMBERS ONLY

Revisiting the PMO Watch List - Looking Good!

by Erin Swenlin,

Vice President, DecisionPoint.com

About a week ago I wrote a blog article that looked at momentum changes that I picked up from my favorite PMO scan. The charts were interesting but needed confirmation of the momentum change with a breakouts and/or PMO BUY signals. I checked these charts out again and they...

READ MORE

MEMBERS ONLY

Equal-Weight Utilities ETF (RYU) Hits All-Time Closing High

by Erin Swenlin,

Vice President, DecisionPoint.com

The Utilities sector in general has been doing well with price traveling higher and higher within a rising trend channel since mid-March. In the past few weeks, price did falter and break slightly below the trend channel, but it has recuperated and it stayed above its 20-EMA. The PMO during...

READ MORE

MEMBERS ONLY

Bearish: Dollar-Weighted Volume Rises While Prices Fall

by Erin Swenlin,

Vice President, DecisionPoint.com

Over 10 years ago, Carl Swenlin developed an indicator called Dollar-Weighted Volume (DWV). DWV is variation of On-Balance Volume (OBV), which was developed by the late Joe Granville. DWV is calculated by multiplying the daily volume of each stock in a given market index by the closing price, then adding...

READ MORE

MEMBERS ONLY

Bull Kiss

by Erin Swenlin,

Vice President, DecisionPoint.com

I wrote an article a few days ago pointing out that the PMO had a positive crossover generating a PMO crossover BUY signal on the SPX. Indicators were not behind the BUY signal and a day later the PMO turned back down toward its EMA, leaving us wondering whether it...

READ MORE

MEMBERS ONLY

American Express (AXP) and PIMCO (PMX) Added To PMO Rising Watch List

by Erin Swenlin,

Vice President, DecisionPoint.com

I hadn't run my favorite PMO Rising scan in about a week so I decided to see if any charts showed up that were worthy of adding to my PMO Watch List. The scan I use is below:

[exchange is NYSE]

AND [Daily SMA(20,Daily Volume) >...

READ MORE

MEMBERS ONLY

Short-Term Indicators Ignore Positive Close

by Erin Swenlin,

Vice President, DecisionPoint.com

The market had a volatile day, swinging up, dipping low and then recovering to close up. Expectation on a rally would be short-term indicators switching direction and maybe even making climactic moves.

Looking at the daily bar chart, price still looks like it is topping out. Yesterday's high...

READ MORE

MEMBERS ONLY

PMO Buy Signal Lacks Confirmation

by Erin Swenlin,

Vice President, DecisionPoint.com

After breaking out from a short-term declining trend channel, the market seems to be losing steam. But, is it? The PMO has just had a positive crossover its 10-EMA triggering a PMO Buy signal.

We may be looking at a fake-out PMO Buy signal like we saw in early April....

READ MORE

MEMBERS ONLY

Customizing Gallery View For DecisionPoint (Or Your Personal Style)

by Erin Swenlin,

Vice President, DecisionPoint.com

One of the features that I used frequently on the DecisionPoint.com website was Gallery View in the ChartTool. I was happy to learn that you can not only use Gallery View on Stockcharts.com to get an in depth view on a stock, ETF, etc., but you can customize...

READ MORE

MEMBERS ONLY

Creating A Workflow ChartList

by Erin Swenlin,

Vice President, DecisionPoint.com

With the release of several DecisionPoint ChartPacks (to learn more about them and how to install them click here), many users have expressed that they are overwhelmed by the quantity of quality indicator charts. This is not news to me, we had the same feedback from new users to the...

READ MORE

MEMBERS ONLY

Gold Making A Move

by Erin Swenlin,

Vice President, DecisionPoint.com

I pointed out a bullish Reverse Head and Shoulders possibly forming last week on Gold. It's still in play in my opinion, but the longer-term horizontal trading range, being a pattern that has been around longer, holds a bit more weight on what gold's next move...

READ MORE

MEMBERS ONLY

Jury Duty, Blackjack and Crystal Balls

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, I decided to pull from my archives of blogs written for Decision Point. In my opinion, this blog article states the simplicity of Decision Point Analysis. I have retooled it to include more up to date charts, as it was originally written in February of 2012. Enjoy!

JURY DUTY,...

READ MORE

MEMBERS ONLY

GOLD Reverse Head and Shoulders

by Erin Swenlin,

Vice President, DecisionPoint.com

While I was reviewing the Gold daily 1-year chart, I noticed after Friday's close that we could be looking at a bullish reverse head and shoulders pattern forming up. I've annotated what I view as a left shoulder and head along with where we would look...

READ MORE

MEMBERS ONLY

Anemic Breakout Through Double-Bottom Neckline

by Erin Swenlin,

Vice President, DecisionPoint.com

On Monday I wrote a blog "Double-Top to Double-Bottom?". I thought a review and update would be a great follow-up today, especially given the story the charts are telling.

We did get a breakout above the neckline of the double-bottom formation and if you look at this formation...

READ MORE

MEMBERS ONLY

Double-Top To Double-Bottom?

by Erin Swenlin,

Vice President, DecisionPoint.com

Ah, the bull market that wouldn't die. The DP Chart Gallery revealed some interesting charts today, starting with the SP500 Daily Chart. What appeared to be a bearish double-top formation is now looking like a bullish double-bottom. Maybe it is time to chalk it up to being a...

READ MORE

MEMBERS ONLY

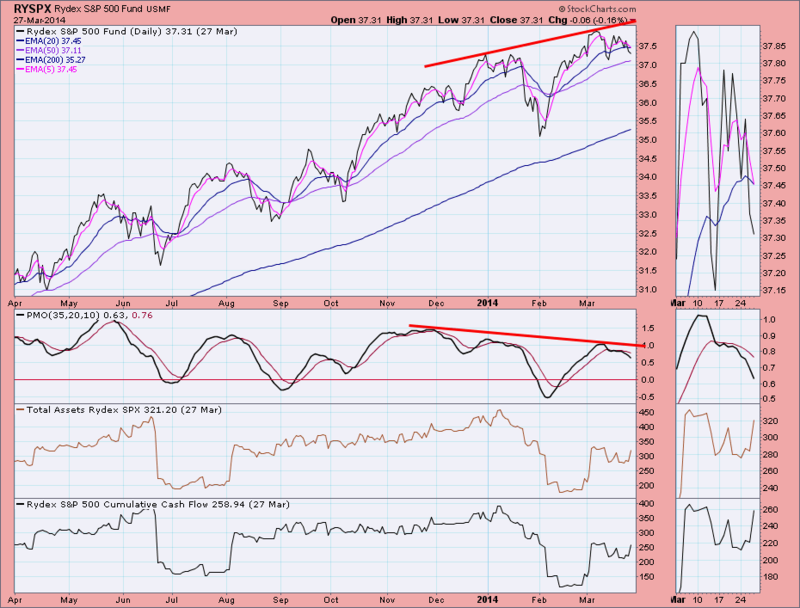

Numerous Negative PMO Divergences On Rydex Funds

by Erin Swenlin,

Vice President, DecisionPoint.com

I noticed a number of PMO negative divergences appearing on the Rydex Funds while clicking through the assets and cashflow charts in the DecisionPoint Rydex ChartPack. Not only are there negative divergences, many of these funds are still showing a large amount of assets and cashflow into them.

Take a...

READ MORE

MEMBERS ONLY

Reading Sentiment Using ICI Monthly Mutual Fund Statistics

by Erin Swenlin,

Vice President, DecisionPoint.com

The Investment Company Institute (ici.org) compiles statistics on mutual funds and publishes them monthly. There is a one month delay between the end of the month being reported and publication, so the data on the charts below, while being updated this week goes through Feburary. Amounts shown on the...

READ MORE