MEMBERS ONLY

Mind Games That Can Kill Investors

by Gatis Roze,

Author, "Tensile Trading"

More often than not, most successful investors will admit that while investing may seem relatively simple, it’s not easy at all. Handling the emotional challenges requires ongoing diligence and effort long after the mechanics of actual trading become intuitive. From my experience teaching for over two decades, the biggest...

READ MORE

MEMBERS ONLY

News Flash: Fundamental Investors Joining Chartist Investors, New Powerful Visualized Dividends

by Gatis Roze,

Author, "Tensile Trading"

I have three objectives for this blog. First, to invite and encourage fundamental investors to embrace the value of visualized dividends which can now be plotted on a chart along with price. Secondly, to nudge all investors to consider allocating a percentage of their portfolios to dividend yielding stocks, both...

READ MORE

MEMBERS ONLY

Yes - Successful Investors Must Be Like Loving Parents

by Gatis Roze,

Author, "Tensile Trading"

As any accomplished trader will tell you, investors should think of their equity positions as their children. They should act like parents who love all their children equally, nurturing each and every one with care. My trading journal seems to suggest that I’ve been a bad parent at times....

READ MORE

MEMBERS ONLY

Former Wall Street CEO: Guest Blogger

by Gatis Roze,

Author, "Tensile Trading"

For over fifty years, Harvey Baraban has been an active stock market investor. For over twenty-five years, he has been my mentor, friend and trading buddy. Drawn together by a mutual shared passion for the markets, I am grateful to Harvey on many fronts, not the least being that he...

READ MORE

MEMBERS ONLY

The Birth of a New Investor

by Gatis Roze,

Author, "Tensile Trading"

General George Patton once said, “A good plan implemented today is better than a perfect plan implemented tomorrow.”

I just had a front row seat for the birth of a new investor, and the experience was not at all what I expected. Few births probably are. Before I lose you...

READ MORE

MEMBERS ONLY

A Big Trading Mistake I Made So You Won't Have To!

by Gatis Roze,

Author, "Tensile Trading"

I’ve learned that you have to be very thick-skinned to be a trader or a blogger. Many of my blogs are lifted directly from the pages of my old trading journals, and as I write about these former trades, I am very conscious not to sugar-coat it or make...

READ MORE

MEMBERS ONLY

Youthful Investors versus Grizzly Veterans: Beer versus Wine

by Gatis Roze,

Author, "Tensile Trading"

At a recent seminar, I was asked by a sharp young investor how much trading rules had changed since I began trading way back in 1905. He didn’t actually say 1905, but the tone and cadence of the question gave him away. By pure chance, I had just picked...

READ MORE

MEMBERS ONLY

Over 150 Fresh Tradeable Insights: The Tensile Trading ChartPack Update 6.0

by Gatis Roze,

Author, "Tensile Trading"

For both existing ChartPack users as well as investors who have not yet downloaded the ChartPack – or perhaps don’t fully understand the many benefits of how to maximize its use – I’m pleased that a free video and user manual is now available for your review. Grab a cup...

READ MORE

MEMBERS ONLY

My Methodology Allocation Beats Asset Allocation

by Gatis Roze,

Author, "Tensile Trading"

From what I’ve seen of most investors’ asset allocations, it’s a maze. My personal asset allocation is better described as a labyrinth. Unlike a maze that attempts to make you mentally confused and physically lost, a labyrinth provides a path towards inner calm and mental clarity. My labyrinth...

READ MORE

MEMBERS ONLY

My One and Only New Year's Resolution

by Gatis Roze,

Author, "Tensile Trading"

Every January, investors throughout the world pledge to improve themselves and their financial management efforts. Only a select few truly succeed in these eager commitments. Let this be your nudge to join the ranks of those select few.

In past years, I’ve often fallen into the trap of making...

READ MORE

MEMBERS ONLY

Only the 58 Navigators Matter

by Gatis Roze,

Author, "Tensile Trading"

Of the approximately 6,000 stars visible to the naked eye, only 58 are considered navigator stars. Since antiquity, these essential stars have guided mankind to many new horizons. This wisdom came to me on a brokerage house Holiday card.

If you have ever stood atop a mountain at night...

READ MORE

MEMBERS ONLY

Academics Prove that Trading the Markets Contributes to Your Longevity

by Gatis Roze,

Author, "Tensile Trading"

Yes, the fountain of youth really does exist, and academic research is increasingly proving it to be found amidst your investment portfolio. A growing body of scholarly research shows that, in many ways, life can get better as we get older and being an active investor can contribute in significant...

READ MORE

MEMBERS ONLY

Why Successful Investors Embrace the Laws of Grouping

by Gatis Roze,

Author, "Tensile Trading"

Fish swim in schools. Birds fly in flocks. Humans follow grouping principles too. Gestalt psychologists describe these as the Laws of Grouping and the stock market most definitely acknowledges these laws at its core.

My own trading methodology leans heavily on these principles to such an extent that I actually...

READ MORE

MEMBERS ONLY

You Only Get 2,000 Profitable Trades Per Lifetime: Use Them Wisely!

by Gatis Roze,

Author, "Tensile Trading"

The National Football League can prove statistically that top running backs, such as Marshawn Lynch of the Seatte Seahawks, have a football lifespan of approximately 2,000 ball carries in their careers before their productivity falls off a cliff. Major League Baseball has similar statistics for the number of throws...

READ MORE

MEMBERS ONLY

Stock Market Mastery: Blending Fundamental & Technical Analysis Part I

by Gatis Roze,

Author, "Tensile Trading"

The Harvard Business Review (November, 2014) just published its list of the Best Performing CEOs. This list should interest investors since these top 50 CEOs have been undeniably effective in delivering total shareholder returns which averaged 1,350% while on the job. That translates into a 26.2% annual return!...

READ MORE

MEMBERS ONLY

Five Advantages Individual Investors Have Over Institutional Investors

by Gatis Roze,

Author, "Tensile Trading"

The walls of advantage once held by institutional traders over individual investors have come crashing down. Emerging from the dust, there now marches an entire army of real advantages that individual investors hold over their formerly superior big brothers.

In the worlds of fundamental information, charting tools and trading costs,...

READ MORE

MEMBERS ONLY

Wizard Investing: Assembly Required, Construction Prohibited

by Gatis Roze,

Author, "Tensile Trading"

Read the Market Wizard books. These remarkable investors use proven off-the-shelf tools and indicators which they then assemble into whatever profitable methodology that they’re most comfortable with. What they don’t do is construct black boxes with proprietary indicators and complex algorithms and then proceed to make billions. Yet...

READ MORE

MEMBERS ONLY

Definition of Money Management

by Gatis Roze,

Author, "Tensile Trading"

Google “money management” and you’ll get back a quagmire of non-sequiturs, disjointed, inconsistent and incomplete information. There is no single comprehensive definition. There isn’t even any number of consistently similar definitions. Yet what do most Market Wizards disclose as one of the keys to their success: money management....

READ MORE

MEMBERS ONLY

A Virtual PhD in Institutional Style Investing: Tensile Trading ChartPack Update 5.0

by Gatis Roze,

Author, "Tensile Trading"

Each quarter, I present you with the ultimate equity shopping list. A virtual 5-star smorgasbord of alluring delights, showcasing the stocks that Fidelity is presently buying in each of its 40 Select Sector Funds. This is no newsletter XXX hypothetical model portfolio of recommendations. Rather, it is the actual equities...

READ MORE

MEMBERS ONLY

CAN SLIM on Steroids

by Gatis Roze,

Author, "Tensile Trading"

Profitable investing demands a unique type of profitable thinking. Once you've achieved this consistently in your thinking and investing, you are ready to move on to focusing on how best to nudge the probabilities in your favor with respect to all elements of your methodology. Specifically, the example...

READ MORE

MEMBERS ONLY

Why Investors Need to Appreciate Fine Wines

by Gatis Roze,

Author, "Tensile Trading"

As I sip my 2008 Cabernet Sauvignon, I ponder all the similarities between myself, as an investor, and Marty Clubb – the extraordinary winemaker at L’Ecole 41 in Walla Walla whose wine I am enjoying. His vines produce sensational wines because he diligently prunes the branches as any widely acclaimed...

READ MORE

MEMBERS ONLY

Smart Beta Funds Leading to Stupid Choices

by Gatis Roze,

Author, "Tensile Trading"

The latest wave on Wall Street’s beach of complexity and opaqueness is a new type of ETF fund referred to as a Smart Beta Fund. I’ve even heard these new funds referred to as Bionic Beta Funds. Consider this a case-in-point and follow-up to my blog last week...

READ MORE

MEMBERS ONLY

Wall Street's Complexity versus Investors' Profits & Simplicity

by Gatis Roze,

Author, "Tensile Trading"

“Any darn fool can make something complex; it takes a genius to make something simple.” -- Pete Seeger

As a long-time trader, I am living breathing proof that simplicity and profits are positively correlated while complexity and profits are inversely correlated. In other words, as my 25 year investing career...

READ MORE

MEMBERS ONLY

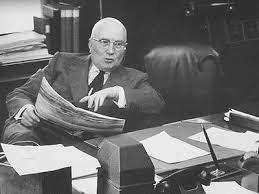

Gerald Loeb's Battle Plan for Investment Survival

by Gatis Roze,

Author, "Tensile Trading"

Sometimes the things that need to be said can’t be said any better than they were said in the past. I’m a big fan of Gerald Loeb (1899-1974), the man Forbes called the most quoted man on Wall Street. I’ve written about this extraordinary investor before.

https:...

READ MORE

MEMBERS ONLY

A Game of 21: 21 Investors / 21 Rules

by Gatis Roze,

Author, "Tensile Trading"

I don’t know of any college in the world that offers you a higher return per unit of effort than the value of a proper investment education. I believe a solid investment education is one of the most high leverage activities an individual can possibly do.

Bold statement, yes,...

READ MORE

MEMBERS ONLY

You Do Want To Be A Type D Investor!

by Gatis Roze,

Author, "Tensile Trading"

I have two things in common with Richard Sherman, the Seattle Seahawks’ Super Bowl star. We both graduated from the same university and we both have two personalities. Sherman articulated that fact nicely the other day when he explained to the press corps that he has his game face for...

READ MORE

MEMBERS ONLY

Now Commission-Free Trades!!

by Gatis Roze,

Author, "Tensile Trading"

Just announced: Schwab, Fidelity and Ameritrade are offering all individual investors infinite commission-free trades! Now that I have your attention, let me tell you that in actual fact they aren’t doing any such thing, but as an investor, you should adopt that “free” mindset. The reality of today’s...

READ MORE

MEMBERS ONLY

How to Invest with Your Own Pit Crew

by Gatis Roze,

Author, "Tensile Trading"

You wouldn’t ever try to change the tires on a moving car, would you? You wouldn’t go to a dentist who hadn’t finished his dental degree, would you? Yet investors every day seem to do exactly the equivalent by investing in the stock market with little or...

READ MORE

MEMBERS ONLY

My Top 12 Takeaways from ChartCon 2014

by Gatis Roze,

Author, "Tensile Trading"

It was wonderful to see so many familiar faces this past weekend at the ChartCon 2014 Conference. I know I walked away a more energized trader with a handful of new tactical options and strategies and a number of tradeable ideas I’m presently working through.

Listed below are some...

READ MORE

MEMBERS ONLY

Evidence-Based Trading for Dummies

by Gatis Roze,

Author, "Tensile Trading"

Robin Griffiths, the renowned technical strategist, once opined that “Trading is a traffic light system. At a traffic light, you wait for it to turn green and then you go. You don’t try to predict when it’ll go green.”

Unfortunately, far too many investors believe that to achieve...

READ MORE

MEMBERS ONLY

How I Get Re-Energized as an Investor

by Gatis Roze,

Author, "Tensile Trading"

Donald Trump was quoted as saying “Get going. Move forward. Aim high. Plan a takeoff. Change your attitude and gain some altitude. Believe me, you’ll love it up here.”

I will admit that in the middle of summer, my passion for the markets ebbs. As I talk to my...

READ MORE

MEMBERS ONLY

Tradeable Insights from the Past Quarter: Tensile Trading ChartPack Update #4

by Gatis Roze,

Author, "Tensile Trading"

One of the highest leverage activities – if not THE highest leverage activity – that investors should focus on is to organize their routines, analysis and portfolios in a manner that maximizes tradeable opportunities. Some investors will bump about for decades before they achieve a system that effectively analyzes the markets and...

READ MORE

MEMBERS ONLY

Bob Farrell: 10 Timely Reminders from a Wall Street Legend

by Gatis Roze,

Author, "Tensile Trading"

As markets make new highs, investors often befriend a dangerous new companion. He’s the greedy little devil that sits on your shoulder and whispers in your ear – assuring you that this market will make you wealthy as he coaxes you to buy more and ignore the naysayers.

As I...

READ MORE

MEMBERS ONLY

Memory Tricks for Investors

by Gatis Roze,

Author, "Tensile Trading"

As Oscar Wilde aptly said, “Memory is the diary that we all carry with us.” It’s July 4th, and I’m coaching kids about timing and firecrackers. Not too different from coaching investors about timing and selling equities. Most grownups have learned from experience -- perhaps some more than...

READ MORE

MEMBERS ONLY

The Most Important Question Every Investor Must Answer!

by Gatis Roze,

Author, "Tensile Trading"

Have you ever met a famous investor at a cocktail party or event, taken his or her advice on a stock and lost money? You are not alone. It may have been a sensational timely trade and the famous one made a 30% gain in four weeks while you held...

READ MORE

MEMBERS ONLY

The Probability Buster Chart: Improved & Strengthened

by Gatis Roze,

Author, "Tensile Trading"

A powerful profit-enhancing tool has just been refined and put on steroids. Back in December of 2013, I wrote a blog titled “Possibly the Single Best Visual Analysis Chart Ever.” Bill, my good friend at Stockcharts.com, is an exceptional developer, and he figured out a way to make this...

READ MORE

MEMBERS ONLY

Invest Like You Drive & Put $$$ in Your Pockets

by Gatis Roze,

Author, "Tensile Trading"

I spent the weekend with my friend Dan, a prison chaplain, who always seems to have unique and useful insights. This visit was no exception. Yes, understanding the parallels between prisoners and investors will put money in your pockets. Here is his insight on decision making amongst the two populations....

READ MORE

MEMBERS ONLY

How the Markets Have Changed Me Over 25 Years: Part II

by Gatis Roze,

Author, "Tensile Trading"

“It is good to have an end to journey toward; but it is the journey that matters, in the end.” -- Ernest Hemingway

And quite a transformative journey it has been. Previously, I shared a number of the key lessons and changes I’ve experienced as I’ve evolved through...

READ MORE

MEMBERS ONLY

This Could Change Your Life! How You Can Mimic Wall Street's Best & Profit Handsomely: Part II

by Gatis Roze,

Author, "Tensile Trading"

This is a continuation of last week’s popular blog about how individual investors can outperform institutional money managers. For many novice investors, it’s all about their egos. For us seasoned investors, it’s all about stocks that can make us money. We’ll use any and every advantage...

READ MORE

MEMBERS ONLY

This Could Change Your Life! How You Can Mimic Wall Street's Best & Profit Handsomely:Part 1

by Gatis Roze,

Author, "Tensile Trading"

This should be illegal. If I was a hedge fund or mutual fund manager, I’d be thoroughly upset, but since I’m not, let me show you a unique and powerful advantage that exists for us individual investors.

You may be familiar with a new breed of ETFs that...

READ MORE