MEMBERS ONLY

Hot Gold Drops & Shaky Semis Pop

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

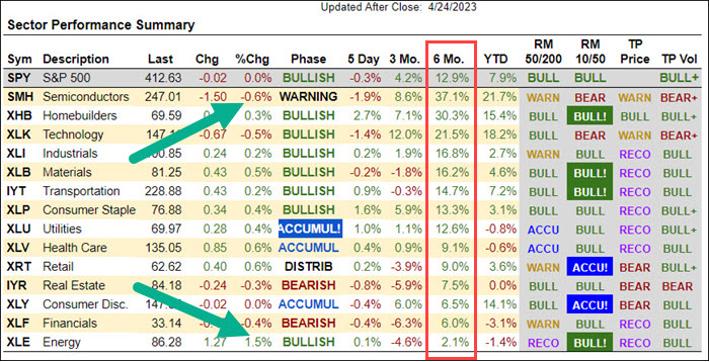

Today, I've got a handful of bullish stock charts for your ChartLists next week, the importance of which begins with the above table. You can find this Sector Summary table updated daily at www.marketgauge.com/sectors.

If you were watching the market last week, it probably didn&...

READ MORE

MEMBERS ONLY

Another Market Collapsing

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

The real reaction to today's Fed meeting is likely to happen tomorrow.

All eyes and ears were on Chairman Powell today. Most notable was how he and the markets were clearly uncomfortable with the press conference, but it was not until it was finished that the markets all...

READ MORE

MEMBERS ONLY

Will the Fed Make Gold Shine?

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Stocks began the day weak—weaker than most traders probably realized. As you can see in the intra-day chart below, short-term momentum, as measured by Real Motion, had rolled on Monday. As a result, when the SPDR S&P 500 ETF (SPY) broke its 30-minute Opening Range low (as...

READ MORE

MEMBERS ONLY

When to Buy in May

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

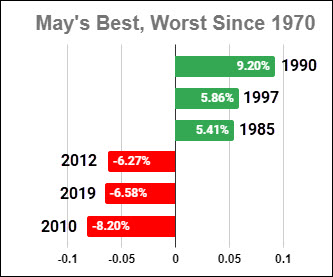

The common refrain, "Sell in May..." gives this month a bad rap, but it doesn't deserve it.

May is historically one of the least volatile months of the year, as measured by its closing average return in the S&P 500 index. Since 1970, its...

READ MORE

MEMBERS ONLY

How to Trade Big Earnings Gaps

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Earnings season is often filled with big gaps, and it's easy to look at them as big opportunities to catch a big move quickly. However, it's also easy to get burned by entering trades right before the earnings announcement.

We have a different way to use...

READ MORE

MEMBERS ONLY

UPSidedown Earnings Sink Stocks

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Weak earnings and even worse conference calls drove United Parcel Service, Inc. (UPS) and First Republic Bank (FRC) down right from the open, then even lower as the day unfolded. Between these stocks, two of the market's primary fears came to the forefront—a weakening consumer and problems...

READ MORE

MEMBERS ONLY

Leaders Lost & Laggards Won

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

There's a simple professional trader's tactic for anticipating intraday market reversals near the levels that later become the high or the low of the day. This tactic worked perfectly at calling today's high of the day in SPY (and the QQQ, IWM, and DIA)...

READ MORE

MEMBERS ONLY

SMH Bulls are Skating on Thin Ice

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

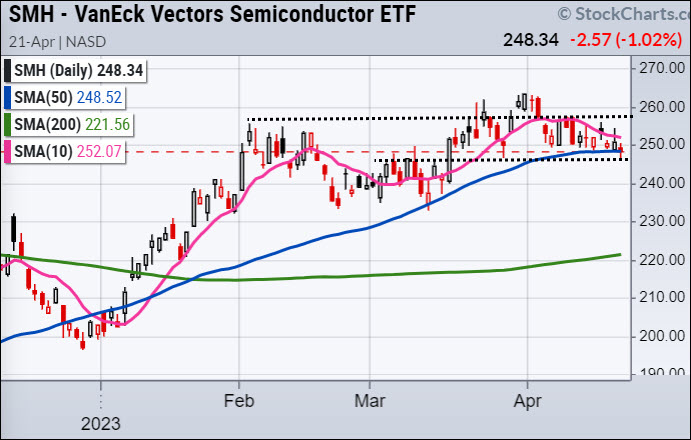

Heads up, you wouldn't know it by looking at its daily chart, but the SMH is skating on some very thin ice.

Since the market's lows in October 2022, the SMH has been one of the recent bull rally's earliest and most influential supporters,...

READ MORE

MEMBERS ONLY

Best August Since 1986. Now What?

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

This article was originally written on August 31st, 2020.

Today, the SPY ended its best August performance since 1986 with a market message that is well worth paying attention as soon as tomorrow and well into September. Fortunately for me (and you), a lot of pieces of today's...

READ MORE

MEMBERS ONLY

A Unique Market Indicator for Monday

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

The weekend is the time to step back and look at the Modern Family's weekly trends and inflection points. This week, there are several interesting multi-timeframe patterns developing on the daily and weekly charts; some bullish, others bearish.

Before jumping into the charts, let me remind you about...

READ MORE

MEMBERS ONLY

Big Red Flag for Stocks on Fed Day

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Today, while the SPY and QQQ were pushing to new highs, the VXX was telling a dramatically different story, which is a warning sign for a potential imminent correction.

The VIXX (Volatility Index ETF) is commonly referred to as a fear gauge, so it naturally tends to go up when...

READ MORE

MEMBERS ONLY

Patterns Combust into Panic

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

If you were to look at the Modern Family you'd see a quiet August trading day waiting to hear Fed Chair Powell's speech tomorrow. Grandpa Russell (IWM) fell asleep and closed down for the day firmly stuck in a two-week bullish flag. Meanwhile, SMH edged higher...

READ MORE

MEMBERS ONLY

No Recovery Happening Here

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

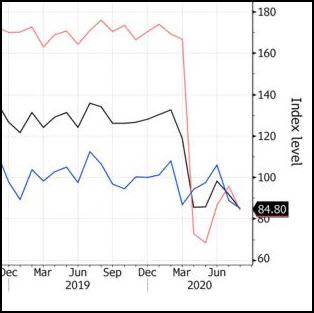

Today's chart (below) is the consumer confidence survey data, which today hit its lowest level since 2014.

At the same time, data on new home sales, as well as earnings from home builder Toll Brothers (TOL), are at their best levels in years. It seems a little inconsistent...

READ MORE

MEMBERS ONLY

A Secret Buy Signal

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Today was the first time that the SPY opened lower than the prior day's low since July 24th. The same is true for the QQQ. Grandpa Russell did it just last week, but not since July 7th prior to that.

The significance of this pattern is twofold:

1....

READ MORE

MEMBERS ONLY

The Fed: Friend or Foe?

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

With so much attention being paid to AAPL reaching a valuation of $2 trillion, I decided to see if AAPL's market cap would make it into the IMF's list of the world's richest countries based on GDP.

In fact, it does! Can you guess...

READ MORE

MEMBERS ONLY

Blowout Earnings Report in WMT Benefits its Competition

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

There were several market messages in today's price action. Starting from the top...

The SPY finally closed at an all-time higha nd, after what seems like weeks of anticipating this moment, it closed over the level by fractions of a percent and a doji pattern. This follows a...

READ MORE

MEMBERS ONLY

Stocks Like Mondays

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

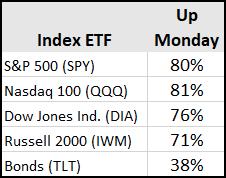

It was a quiet news day, but Mondays don't need news to go up. Today's image above represents the percentage of times that Mondays have closed higher than their Friday close since the March bottom.

It's also worth noting that not only does Monday...

READ MORE

MEMBERS ONLY

Did You Know This About XRT and TLT?

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

As the S&P 500 struggles to rise a fraction of a percentage point to be able to achieve the status of reclaiming its February all-time high level...

Imagine you could go back to February 19th, 2020. The SPY has just closed at a new all-time high, and news...

READ MORE

MEMBERS ONLY

If This Line Doesn't Hold, Stocks May Get Hit

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

While the media is obsessively focused on cheering for the S&P 500 to close at a new all-time high, the bond market is quietly collapsing.

TLT broke its 50-DMA today and has now had its second worst 5-day slide since the March 2020 meltdown.

The last time bonds...

READ MORE

MEMBERS ONLY

This Base Breakout Should Concern You

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Today's chart is one that every investor should keep an eye on (but most will not), as that double bottom base breakout pattern is in a market that has been declining for almost a decade! However, there's good reason to believe it could wake up like...

READ MORE

MEMBERS ONLY

Mish Warned You About Junk Bonds...

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Will today's market tremors shake the QQQ out of its solidly bullish 4-month channel?

On April 14th, the QQQ broke above its 50 DMA (blue line) and began the trend that you see above. A steady trend line with 6 points is an impressive feat. Today's...

READ MORE