MEMBERS ONLY

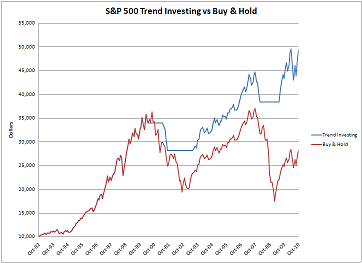

Passive versus Active Management

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I spent a lot of time discussing technical analysis and want to help readers try to understand its value by discussing passive versus active management.

Passive means that the investor or manager does not change the portfolio components except for occasional, usually based upon the calendar, rebalancing to some preconceived...

READ MORE

MEMBERS ONLY

Why Technical Analysis?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Technical analysis offers an unbiased truth about the markets. I am writing this article because I have a large number of new readers. I addressed this subject a few years ago.

If one is going to follow and utilize a particular discipline, hopefully they have done a thorough investigation as...

READ MORE

MEMBERS ONLY

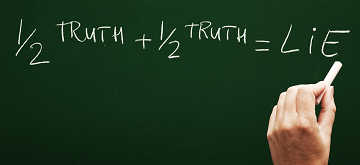

What We Know That Isn't So - part 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Investment-Related “Believable” Misinformation Makes Successful Investing Hard Work

This article is a continuation of the previous article. You should read the preliminary information provided in that article first.

Diversification protects against losses. Harry Markowitz won a Nobel Prize in 1990 for his ground-breaking research on diversification (modern portfolio theory) in...

READ MORE

MEMBERS ONLY

What We Know That Isn't So

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Investment-Related “Believable” Misinformation Makes Successful Investing Hard Work

Exceptional discipline and objectivity will keep you from falling victim to short-term emotion and chasing something new, even though you know your long-term methods are sound. The uncertainty of the market requires a methodology that allows you to participate in most of...

READ MORE

MEMBERS ONLY

Discipline, Discipline, Discipline!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Discipline is the Key! You should look up the definition for both the noun and the verb.

Over the years I've stressed the importance of having discipline in any investment strategy, and that is certainly still the case. A couple of years ago, when the market was in...

READ MORE

MEMBERS ONLY

Things That Can Screw Up Your Investing!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’ve written before about heuristics and cognitive biases in my Know Thyself series from a couple of years ago. Here I put together a list of them with short definitions and explanations. That space between your ears is generally a horrible investment decision maker.

Anchoring Bias – Too often investors...

READ MORE

MEMBERS ONLY

Friends Don't Let Friends Buy and Hold

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The timing of this article is appropriate. Part of this was written by Tim Chapman who was a founder of PMFM, the company I worked with and later became Stadion. I liked its message so am updating it with this article. I remember back when I was managing money, I...

READ MORE

MEMBERS ONLY

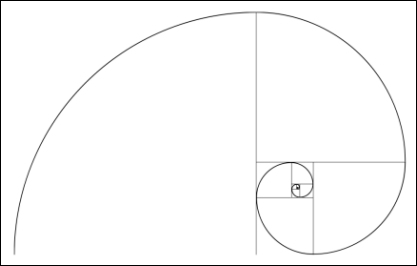

Junk Science; Junk Analysis!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I don’t think I have offended anyone in quite a while and feel I’m not doing my job if I don't try to periodically; so here goes!

Often a simple mathematical series of numbers can sometimes get misinterpreted (promoted) to be something magical. My personal favorite...

READ MORE

MEMBERS ONLY

Volatility and The World's Greatest Investor

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

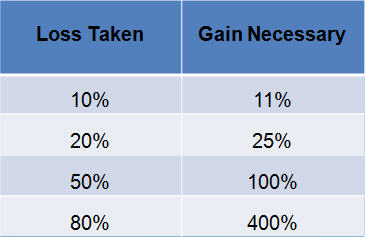

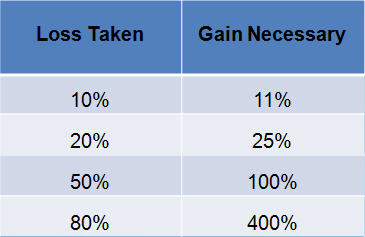

I've written before about the cost of volatility, both financially and emotionally, and in light of the volatility we saw in 2018, now is a good time to revisit that issue (while it is not an issue). In 2018, after many sizable down moves, then prices bounced up...

READ MORE

MEMBERS ONLY

RISK

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Dictionary.com says: Risk is the exposure to the chance of injury or loss; a hazard or dangerous chance. American Heritage Dictionary says: Risk is the possibility of suffering harm or loss; danger. These are just two of the many entries and these were just for the noun. Risk in...

READ MORE

MEMBERS ONLY

Relative Performance

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

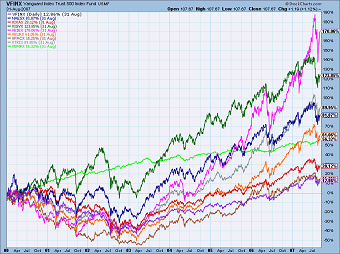

First of all, you cannot retire on relative performance. Relative performance is often a valuable tool, but is also a marketing concept dreamed up by financial pundits who rarely outperform the market. Table A is a table of various asset classes and their relative performance since 2009, with the last...

READ MORE

MEMBERS ONLY

Dollar Cost Averaging

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Dollar cost averaging is simply the act of making like dollar investments on a periodic basis, say every month or every quarter. It is sold as a technique because they want you to believe that no one can outperform the market. There are many papers written on this subject and...

READ MORE

MEMBERS ONLY

The Enemy in the Mirror

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I am a retired money manager and want to share some thoughts on that profession and investors in general. Portfolio management is as much about managing emotions as it is about correlations, standard deviations and Sharpe ratios. Over the decades much has been written about the “math” of portfolio management...

READ MORE

MEMBERS ONLY

Reliability of Pattern Recognition

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

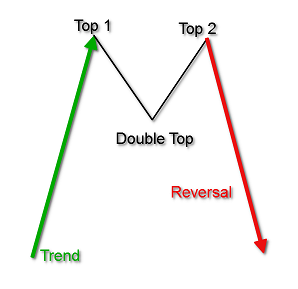

I developed this method primarily for candle pattern identification when I wrote my book, Candlestick Charting Explained (the book was first published in 1992 and now is in its third edition). The reliability concept equally applies to any type of pattern, including the many chart patterns widely used in technical...

READ MORE

MEMBERS ONLY

Pair Analysis - 4

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This will wrap up the Pair Analysis series. In this article I will show:

Some basic statistics on the pairs I used in the analysis.

The top 50 pairs based on performance.

The bottom 50 pairs based on performance.

The Sharpe Ratio is a measure of return and risk, with...

READ MORE

MEMBERS ONLY

Pair Analysis - 3

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The is the third article on Pair Analysis. Here I will show the results for several different pair combinations with reduced commentary. If you have not read the previous two articles on Pair Analysis, I strongly suggest you do so before continuing with this one.

Recall, the pair analysis is...

READ MORE

MEMBERS ONLY

Pair Analysis - 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

To prove that I read all comments, here are some pair charts and data that is updated to 12/31/2018. First a review of what pair analysis is.

My pair analysis is accomplished on weekly data. Think of the ratio line like this: when it is moving upward it...

READ MORE

MEMBERS ONLY

Core Rotation Strategy

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article expands on the pair analysis discussed in the previous article. In that article I showed a simple process of trading a ratio of non-correlated ETFs, in particular the S&P 600 Small Cap (IJR) and the BarCap 7 to 10-year Treasury ETF (IEF). Using a 4% trigger...

READ MORE

MEMBERS ONLY

Pair Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I remember following Martin Zweig years (decades) ago and in fact used one of the techniques he described in his book, “Winning on Wall Street,” in the mid-1980s' (1984 to be exact). In it he described a really simple technique using his unweighted index (ZUPI); trading it on a...

READ MORE

MEMBERS ONLY

Bear Markets and Drawdowns - 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is a continuation of the previous article. The Dow Jones Industrial Average, also referred to as The Dow by the financial media, is a price-weighted measure of 30 U.S. blue-chip companies. The Dow covers all industries with the exception of transportation and utilities, which are covered by the...

READ MORE

MEMBERS ONLY

Bear Markets and Drawdowns

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The month of December 2018 was a bad month for the market; the rally in the last week of the month was nice but small compared to the month’s decline. 2019 has so far continued the upward move, so I thought it was time to show some data on...

READ MORE

MEMBERS ONLY

Did 2018 Meet Your Expectations?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Welcome to 2019! I was born in the 1940s and am delighted to be here. If you were a trend follower with reasonable stop placement, 2018 was a tough year. If you were a trend follower without reasonable stop placement, you are scared, if not panicky. If you were a...

READ MORE

MEMBERS ONLY

Help! I've Fallen and I Can't Get Up

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Well, what do you think of 2018 so far? As a trend follower, it has been difficult. Reminds me of 2011, which happened to be the worst year my 25-year-old model has ever had. Chart A shows the Dow Jones Industrial Average for all of 2011 with some data before...

READ MORE

MEMBERS ONLY

Article Summaries: 9/2018 - 12/2018

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article, such as this one, that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two...

READ MORE

MEMBERS ONLY

Interview with Japanese Trader: Takehiro Hikita - Part 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is the final part of an interview with Takehiro Hikita; see the first part here.

Mr. Takehiro Hikita has graciously provided me with a large amount of insight into the candle pattern philosophy. I have never met anyone so devoted to the detailed study of a concept as he....

READ MORE

MEMBERS ONLY

Interview with Japanese Trader: Takehiro Hikita - Part 1

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is a lengthy interview, so this article will be the first half, followed next week by the second part. Mr. Takehiro Hikita has graciously provided me with a large amount of insight into the candle pattern philosophy. I have never met anyone so devoted to the detailed study of...

READ MORE

MEMBERS ONLY

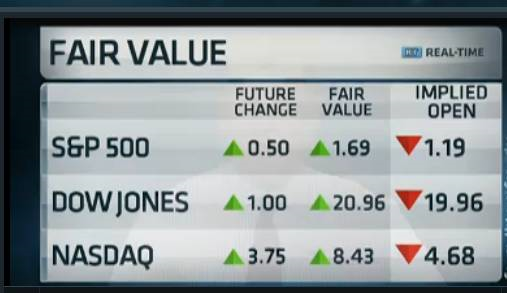

Infatuation with Morning Futures Fair Value

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Infatuation: in·fat·u·a·tion

Noun: infatuation; plural noun: infatuations

An intense but short-lived passion or admiration for someone or something.

I cannot begin to tell you how often I am asked about morning futures fair value to tell me if I’m going to invest that day based...

READ MORE

MEMBERS ONLY

Thoughts on Technical Indicators

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There is a myriad of technical indicators available to traders, and regardless of which indicators are used, blending them with other tools and good charting skills can produce a more in-depth picture of the price action. For example, a stock may be approaching a support level defined by a trend...

READ MORE

MEMBERS ONLY

The Intellectual Void

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m always trying to come up with new ideas for articles and don’t mind if I cross the line a little bit even if it offends a few – I just don’t want to offend everyone; certainly not all at once. This one is going to do just...

READ MORE

MEMBERS ONLY

Advantages and Disadvantages of Using Breadth

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Consider a period of distribution (market topping process) such as 1987, 1999, 2007, 2011, etc. As an uptrend slowly ends and investors seek safety, they do so by moving their riskier holdings such as small cap stocks, into what is perceived to be safer large cap and blue-chip stocks. This...

READ MORE

MEMBERS ONLY

Authors and Newsletter Writers

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

A couple of weeks ago I wrote about all the various types of technical analysts (Technical Analysts!); in this article I add to that list the authors and newsletter writers.

Authors

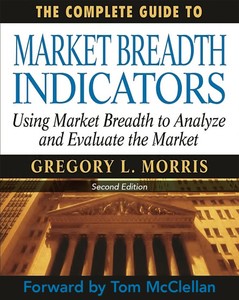

Well, I’ve written four books, two were essentially research projects (Candlestick Charting Explained and The Complete Guide to...

READ MORE

MEMBERS ONLY

Momentum - Rate of Change

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Too often I see a basic misunderstanding between Momentum, Rate of Change, and Price Difference. Let me try to make it clear. They are essentially the same thing.

Momentum

Momentum deals with the rate at which prices are changing, kind of like acceleration and deceleration. Here is the formula for...

READ MORE

MEMBERS ONLY

Technical Analysts!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

After 45+ years as a technical analyst I have found that this breed of folks comes in many sizes and flavors. I can write about each of them simply because I have at one time or another been there, done that, and still doing it. In doing this I’ll...

READ MORE

MEMBERS ONLY

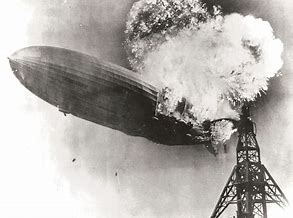

Hindenburg Omen Update

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The Hindenburg Omen has been touted often lately. I thought I’d share with you information about it that I obtained directly from its creator, James Miekka. Most of the below came from the second edition of my “The Complete Guide to Market Breadth Indicators.” It is only available from...

READ MORE

MEMBERS ONLY

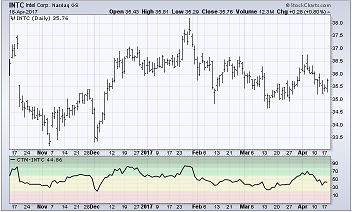

Building a Rules-Based Trend Following Model - 14

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I spent a great deal of time working on an asset commitment model using the Chande Trend Meter (CTM) and believe I have something worth sharing. Tushar defines ranges for CTM based on the degree of trendiness and I have assigned Asset Commitment percentages to those pre-defined ranges. Table A...

READ MORE

MEMBERS ONLY

"Believable" Misinformation Is a Danger to Long-Term Retirement Goals

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Many investment "truths" seem to go unchallenged but are in fact, very clearly just myths. Buy and hold investing is a good long-term strategy, economists are good at predicting the markets, diversification will protect you from losses, compounding is the eighth wonder of the world, missing the best...

READ MORE

MEMBERS ONLY

Weight of the Evidence - 3

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In the past two articles on Weight of the Evidence my goal was to show you how you can use Tushar Chande’s Chande Trend Meter (CTM) in a trend model. I stated previously that my digital weight of the evidence also provides levels that define buying parameters, stop loss...

READ MORE

MEMBERS ONLY

Article Summaries: 5/2018 - 8/2018

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE

MEMBERS ONLY

Weight of the Evidence - 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In my previous article called Weight of the Evidence (WoEv) I compared my Weight of the Evidence with Tushar Chande’s Chande Trend Meter (CTM). I also mentioned I was happy that Tushar had this indicator since I cannot divulge the exact details of my Weight of the Evidence. A...

READ MORE

MEMBERS ONLY

Weight of the Evidence

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In my recent Building a Rules-Based Trend Following Model series, I talked extensively about the Weight of the Evidence. This is my measure to tell me what the market is doing based upon nine different technical measures made up of price, breadth, and relative strength (PBR, like the beer). Tushar...

READ MORE