MEMBERS ONLY

Noise is Deafening!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Just in the course of a normal week, we are bombarded with information from sources such as the FED, television analysts, brokerage firm analysts, economists’ projections, newspapers, junk mail, neighbors, war reporters, fake news, etc. Making investment decisions without a plan or methodology is truly a gamble. And to think...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 13

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I may seem to be wandering around when it comes to this series on model building, but I think that keeps the interest a little higher; maybe not. Rules and guidelines are a critical element to a good trend following model; in fact, any type of model. Once you have...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 12

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m going to return to discuss the final part of my Weight of the Evidence. As a reminder this is a collection of price and breadth measures designed to tell me if the Nasdaq Composite is in an uptrend or not. You might want to review some of the...

READ MORE

MEMBERS ONLY

Fear and Greed

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I cannot tell you the number of times an investor has asked, “Considering the difficulties of the past few months, do you still believe in your investment process?” These questions always concerned me because I never once considered not believing in my process for managing money just because of short-term...

READ MORE

MEMBERS ONLY

Markets do Trend!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

For the last couple of decades, I have classified myself as a trend follower. Mind you, this is not market timing. Market timing involves guessing at tops and bottoms. A trend follower will NEVER get in at the bottom or out at the top. It depends on how quickly his/...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 11

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m going to continue discussing the ranking and selection of issues for trading. I cannot possibly go into great deal on each of the ranking measures I have used over the years, but future articles will discuss some of the more important ones.

Mandatory Measures

Once you have your...

READ MORE

MEMBERS ONLY

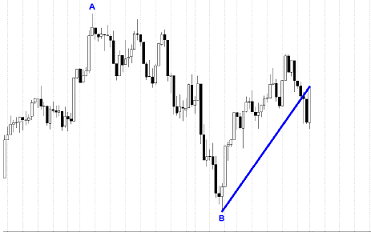

Pullback Rally Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The Pullback Rally Analysis is not a ranking measure but a technique for determining the relative strength of issues by looking at the most recent rally from a previous pullback. Measure the amount of the pullback in percent, then measure the current rally up to the current date in percent....

READ MORE

MEMBERS ONLY

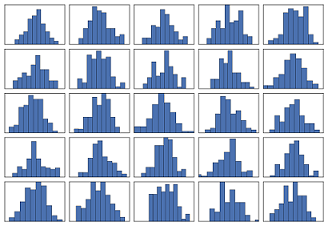

Distribution

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Distribution is the term often referred to as the topping process in the stock market. Before we go any further I want to say this loud and clear: I am not calling a top in the market. As you hopefully know by now I am just a humble trend follower....

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 10

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m going to change the focus for a while; for my own sanity and probably for yours. We have talked about a weight of the evidence approach and some of the indicators used in that approach. This approach tells us when to invest in the market and how much;...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 9

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

One of my trend following indicators was created because I felt that there were some issues with market breadth that needed attention. For example, the Friday after Thanksgiving. The market is only open a few hours and trading volume is very light. There are price changes but nothing exceptional. However,...

READ MORE

MEMBERS ONLY

Article Summaries: 12/2017 - 4/2018

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 8

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Another price-based measure I use in my weight of the evidence is called Adaptive Trend. This was modeled after an indicator from the Bloomberg service called Trender. Adaptive Trend identifies price swings based on the daily trading range. It uses Average True Range (ATR), exponential smoothing, and standard deviation as...

READ MORE

MEMBERS ONLY

General Comments on Trend Following

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Since there are many new readers, I thought an overview on trend following might be appropriate. As I have stated often, I use a market analysis methodology called trend following. Sometimes it should be called trend continuation. Why? My trend analysis works on the thoroughly researched concept that once a...

READ MORE

MEMBERS ONLY

Aftcasting

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Wall Street is loaded with experts who make forecasts on the future market direction and market level many times a day. If you see a rather serious technical analyst on television, you can count on the talking head interviewer to ask him/her where the market is going. They must...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 7

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article is a follow up of the previous one in this series - Building a Rules-Based Trend Following Model - 6. Table A is an example of the detailed research behind each of the various indicators used in the weight of the evidence. This example uses over 30 years...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 6

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

It is time to start getting into the measures/indicators to be used in the model. Note: When I was presenting at the big wire houses, I used the term measures as seemed to be easier for advisors to understand. Now, dealing primarily with technical analysts, indicators seems more appropriate....

READ MORE

MEMBERS ONLY

Execution!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I am on record stating that most technical analysts do not trade with real money. I have no hard data to support that brash statement, rather it is my observation after speaking at hundreds of seminars and conferences and knowing hundreds of technical analysts. Many are famous. Many call themselves...

READ MORE

MEMBERS ONLY

Whipsaws!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I had another article planned but think writing about something that just occurred in the market is a much better learning/teaching experience. Trend following has one issue that will constantly plague the investor and usually at the least expected time, and that is whipsaws. I must admit, I think...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 5

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The significant components of my Weight of the Evidence are Price Measures and Breadth Measures. All of my Price Measures use the Nasdaq Composite Index which I have written about many times. If using the same price, then the difference between most price indicators is to offer varying time periods;...

READ MORE

MEMBERS ONLY

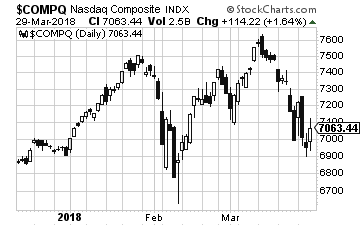

Thoughts on the Current Market

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I rarely, if ever, discuss the current market or offer any market analysis. StockCharts.com has many expert technical analysts that already do a bang up job on this. However, since I am writing a series on Building a Rules-Based Trend Following Model, I thought I would tell you how...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 4

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

We have covered most of the preliminary issues such as digital measures and compound measures. This article will discuss the concept of Weight of the Evidence. I have been fond of a weight of the evidence approach for over 30 years. The concept of “weight of the evidence” came from...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 3

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

We are still in the preliminary stages of defining tools that will be used in the rules-based trend following model. Here I want to explain a unique concept I call Compound Digital Measures. They are an advanced form of the Digital Measures discussed in the BaR-BTFM – 2 (Building a Rules-Based...

READ MORE

MEMBERS ONLY

Did 2017 Meet Your Expectations?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Welcome to 2018! I was born in the 1940s and am delighted to be here. If you were a trend follower with reasonable stop placement, 2017 was a fabulous year. If you were a buy and hold investor in most stocks, then 2017 was a fabulous year. If you were...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In my first article of this series I outlined the concepts that would be discussed in this series. See HERE. In this article we need to discuss some of the building blocks that will be used and how to interpret them.

Description of Binary and Analog Measures

I actually prefer...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m going to start a new series of articles on building a rules-based trend following model. For a host of reasons, I cannot provide readers complete details of the trend following model I currently use, but I can simulate most of the concepts in various examples, so you will...

READ MORE

MEMBERS ONLY

Article Summaries: 7/2017 - 11/2017

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE

MEMBERS ONLY

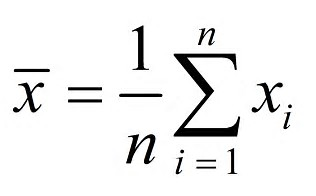

The Deception of Average

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I mentioned in the last article I would discuss ‘average’ soon; so here it is, sooner than I thought.

The “World of Finance” is fraught with misleading information. The use of average is one that needs a discussion. Chart A is a chart showing the compounded rates of return for...

READ MORE

MEMBERS ONLY

WHY do Most Investors do so Poorly?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are a number of companies that track performance for various asset classes, including the performance of investors. Table A, from J.P. Morgan, shows the Average Investor’s 20-year annualized returns of only 2.3%. I have reproduced the small print below the table because it explains the process...

READ MORE

MEMBERS ONLY

Zahorchak Revisited

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

A couple of years ago I introduced a trend following technique which I first learned in the late 1970s. I thought this would be a good time to review it; especially since this technique is now available in StockCharts.com’s symbol catalog.

A trend follower’s lament:

“Only the...

READ MORE

MEMBERS ONLY

The Wisdom of Montier

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I honestly do not know when or where I first heard of James Montier but believe it was a turning point in my investing and money management. Behavioral Finance / Investing is a relative newcomer to the world of investing, or at least the identification and writing about it. The human...

READ MORE

MEMBERS ONLY

Maintain a Proper Perspective

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Watching the evening news can give you a misleading and often wrong perspective on the stock market. Most commentators mention whether the Dow Jones Industrial Average was up or down and by how much, and that is just about the complete financial report, even though the Dow Jones’ 30 large...

READ MORE

MEMBERS ONLY

WHY Breadth?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I have written often about market internals or market breadth. In fact, there was a whole series of articles as I was updating my “The Complete Guide to Market Breadth Indicators” book. The articles began with CGMBI; there were 10 of them, all back near the beginning of my article...

READ MORE

MEMBERS ONLY

Aerodynamics for Investors

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Oh no! He is losing it! I have stated a few times that the well seems to be running low; this article might confirm that. Here is an attempt to turn basic aerodynamics into an investment process.

Where:

CL is the coefficient of Lift

p is the density of air...

READ MORE

MEMBERS ONLY

Gurus and Experts

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Why do investors / traders like predictions? The prediction industry is not just Wall Street, there are business forecasting companies, economic analysis and forecasting, sales forecasting, on and on. However, Wall Street seems to have the least talent of the bunch. Here are some reasons I think investors / traders like predictions:...

READ MORE

MEMBERS ONLY

Fake News!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I have written about how inept the news is when it comes to the financial and stock markets before. Since I am retired I am trying to wean myself from the news. It isn’t easy as I’ve been a news junky for decades. In this article, I’m...

READ MORE

MEMBERS ONLY

Misunderstanding Average

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Did you hear about the six-foot tall Texan that drowned while wading across a stream that averaged only 3 feet deep? The “World of Finance” is fraught with misleading information. The use of average is one that needs a discussion.

Figure A shows how easily it is to be confused...

READ MORE

MEMBERS ONLY

Bear Market Preparedness

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Here is the scenario: You believe we are near a top in the market. I won’t bother to discuss what makes you think that, but if you do, then here is a sampling of things to consider. I was originally going to do this in an enumerated list, but...

READ MORE

MEMBERS ONLY

What Will You do When the Bear Arrives?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I would imagine there are many readers that are fairly new to market analysis and in particular, technical analysis. We have had 10 bear markets in the S&P 500 Index since 12/30/1927 and 15 bear markets in the Dow Jones Industrial Average since 2/17/1885....

READ MORE

MEMBERS ONLY

WHY Standard Deviation is a Poor Measure of Risk

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I will attempt to show that high sigma is a much more frequent event than modern finance thinks it is. A few examples using the Dow Industrials back to 1885 on a daily basis are shown. Each begins with determining a look-back period to determine the average daily return and...

READ MORE

MEMBERS ONLY

Article Summaries - 3-2017 to 6-2017

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE