MEMBERS ONLY

Advance Decline Misc. Indicators (Chapter 6, CGMBI)

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

CH 6 Advance Decline Miscellaneous

The breadth indicators in the section could not be categorized as using the difference or the ratio of the advances and declines, so they are in the miscellaneous section.

Advance Decline Miscellaneous Indicators

Advances / Issues Traded

Advance Decline Divergence Oscillator

Advance Decline Diffusion Index

Breadth...

READ MORE

MEMBERS ONLY

Lists of Market Wisdom

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Over the decades I have collected lists of rules, guidelines, steps, etc. written by various individuals for various reasons. Most of them were created by folks after they had spent decades in the business and were sharing some things they not only learned over that time, but also strongly believed....

READ MORE

MEMBERS ONLY

Zahorchak Measure

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I'm quite certain the title of this article caused curiosity. I often use the word Measure instead of Indicator when referring to indicators that are used to measure something, such as a trend, a level of volatility, etc. I have mentioned Michael Zahorchak before. His book, “The Art...

READ MORE

MEMBERS ONLY

Advance Decline Difference Indicators (Chapter 4, Part 2 - CGMBI)

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

If you recall from the earlier article on Chapter 4, it is being presented in two parts because there are almost 50 charts in that chapter. Chapter 4, Part 1 is here. I selected the following indicators for this article, you can see by the Chart numbers below each chart...

READ MORE

MEMBERS ONLY

Driving vs. Investing

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Avoiding Potholes on the Investment Highway

While driving on a busy highway the other day it occurred to me that there are many similarities between driving an automobile and making investment decisions. I am a very careful driver and believe it or not have had only 2-3 flat tires since...

READ MORE

MEMBERS ONLY

Questions from Readers

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Over the past 6-7 months that I have been writing for StockCharts.com many truly great questions have been posed in the Comments area. I have questioned my policy of not participating in the Comments area a number of times because these questions and answers would benefit everyone or at...

READ MORE

MEMBERS ONLY

Corrections, Whipsaws, and Things that go Bump in the Day

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Most market analysts will tell you that market corrections are times when the market takes a rest and declines for more than just a few days. Ten percent has also been bandied about for years as to what makes a good correction, or at least what generally qualifies as a...

READ MORE

MEMBERS ONLY

Technical Analysis Magic

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Over the decades there are a few things that have attached themselves to technical analysis that bother me. Actually, they really don't bother me; what bothers me is when I hear someone talk about what great tools they are. It is very clear to me then, that they...

READ MORE

MEMBERS ONLY

Bear Markets! Are They a Thing of the Past?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

…Or is your measuring stick just too short? If you are starting to feel that the market really only goes up and that the risk of being invested for the long term is small, you probably need a short refresher course on the equity markets. Don’t feel bad, failing...

READ MORE

MEMBERS ONLY

Minimizing Future Regret

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

How many times have you bought something spontaneously, then after you got home regretted the decision? Most spontaneous decisions are based totally upon the emotion at the moment; a snap decision based upon a quick and often faulty evaluation. Examples might be: the big television you bought for the bedroom...

READ MORE

MEMBERS ONLY

Technical Analysis Boot Camp

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

At some point in my life I came to the conclusion that military boot camp accomplishes something that would be truly useful for investors, in particular, technical analysts. Boot camp, officer candidate school, etc. are all designed to accomplish a few things. One is to weed out those who cannot...

READ MORE

MEMBERS ONLY

Secular Bears

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Secular Bulls and Secular Bears is terminology that I don’t ever recall hearing more than 15-20 years ago. Now I see the term bandied about all of the time and often it is different in a number of ways. For full disclosure, my entire education on secular markets comes...

READ MORE

MEMBERS ONLY

Shampooing the Market

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

It seems that technical analysts on many of the electronic boards I view occasionally want to be the first to say, “I see a head and shoulders pattern in XYZ.” All too often when I look at their prognostication, I see that it often does not come close to a...

READ MORE

MEMBERS ONLY

News is Noise

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

We have Breaking News; but first, we’ll be right back after this message from our sponsor. Do you find that irritating? Baiting you with the ubiquitous breaking news anticipation, then launching into a commercial of someone selling gold because the world is coming to an end? Also, isn’t...

READ MORE

MEMBERS ONLY

Believable Misinformation

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

When we were young, we learned many things from our parents, older siblings, and teachers. Most of us generally accepted them as fact and did not bother to check to see if they were in fact true. Hey, I remember my Father telling me that if a turtle bit me,...

READ MORE

MEMBERS ONLY

Discipline is Paramount

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Over the years during hundreds of presentations I stressed that there are three primary components to a solid rules-based model; in my case it was trend following. First, you need to Measure the market. This can be a group of indicators designed to show you what the market has been...

READ MORE

MEMBERS ONLY

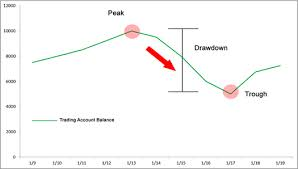

Drawdowns and New Highs

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m not sure when I heard this the first time but I’m quite sure it was a long time ago. “The markets go up most of the time,” or even to be more convincing, “The market goes up 40% of the time.” I never challenged that until I...

READ MORE

MEMBERS ONLY

Market Performance and Distributions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

When I was doing research on my book, I found that many places that offered performance data often did so in a manner that was specific for what their intended message was or tied to what they were selling. Having a strong understanding of market performance over time is important;...

READ MORE

MEMBERS ONLY

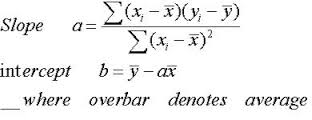

Linear Analysis, Alpha, and Beta

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article sort of ties in with the article I wrote about Modern Finance, “So What Is It with Modern Finance?” I really questioned whether something like this belonged on StockCharts.com, but finally decided that if it gave just a few folks some information that they deemed as valuable,...

READ MORE

MEMBERS ONLY

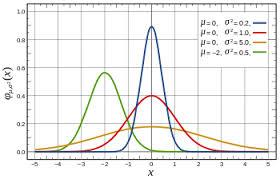

Can Statistics Help You Invest Successfully?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I honestly cannot remember taking a course in high school or college specific for statistics. I would imagine it was taught along with the many math and engineering courses I struggled through. There was nothing like a draft card with a low number to motivate the successful completion of college...

READ MORE

MEMBERS ONLY

Advance Decline Difference Indicators (Chapter 4, Part 1 - CGMBI)

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

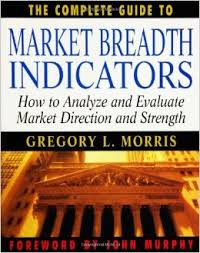

We are progressing with the rebuilding of my “The Complete Guide to Market Breadth Indicators” book. We are rebuilding the entire book using StockCharts.com tools and also including the indicators into StockCharts.com’s symbol list. This article will cover the first half of Chapter 4, which deals with...

READ MORE

MEMBERS ONLY

A Few Things "Other People" Should Know About Technical Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

As I have traveled the world giving presentations on technical analysis and money management, I have found there are a few things in technical analysis that many do not realize. Of course, I’m referring to all the other technical analysts out there, not you. Many of these are amazingly...

READ MORE

MEMBERS ONLY

What is it with Modern Finance?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The title of this article might have you thinking it doesn't belong on StockCharts.com or anywhere in technical analysis. I disagree; I think every technician needs to understand this. If for no other reason than to offer ammunition for your defense of technical analysis. For the past...

READ MORE

MEMBERS ONLY

Market Prescience - How Devine!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I just completed two weeks of golf with my wife in Florida. Would anyone like to buy a set of golf clubs whose sweet spot is unused? I’m always trying to come up with new ideas for articles and don’t mind if I cross the line a little...

READ MORE

MEMBERS ONLY

Know Thyself

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Welcome to being human! Do you really know that person you see while shaving or applying makeup? If you are going to be a successful investor/trader, you better get to know him/her and know them really well – like the back of your hand. As a human being, you...

READ MORE

MEMBERS ONLY

The Many Faces of Technical Analysts

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

After 40+ years as a technical analyst I have found that this breed of folks comes in my sizes and flavors. I can write about each of them simply because I have at one time or another been there, done that. In doing this I’ll share some stories along...

READ MORE

MEMBERS ONLY

Advance Decline Ratio Indicators (Chapter 5 - CGMBI)

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Here is the latest "Preview" chapter update from my upcoming book "The Complete Guide to Market Breadth Indicators - Second Edition" I am in the process of re-writing the original version using charts from StockCharts.com. As I complete a chapter (or most of a chapter)...

READ MORE

MEMBERS ONLY

Do Markets Trend? Why?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

For the last couple of decades I have classified myself as a trend follower. Mind you, this is not market timing. Market timing involves guessing at tops and bottoms. A trend follower will NEVER get in at the bottom or out at the top. It depends on how quickly his/...

READ MORE

MEMBERS ONLY

On Trendlines

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The goal of this article is to make you stop and think, nothing more. I cannot recall seeing someone’s chart purporting to divine the market that did not have at least one trendline drawn on it. The ubiquitous trendline is prevalent in almost everyone’s work, so much so,...

READ MORE

MEMBERS ONLY

Are you Using Chart Patterns Correctly?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

After I did the research for my book “Candlestick Charting Explained,” originally called “Candlepower” in 1991, I realized that many were looking at patterns incorrectly. This included candle patterns and classical chart patterns. This was first noticed in a few academic papers attempting to show that these patterns did not...

READ MORE

MEMBERS ONLY

Additional and Necessary Information about Market Breadth (CGMBI)

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

As I dive further into updating “The Complete Guide to Market Breadth Indicators,” I want to ensure I have laid the groundwork for a solid introduction to breadth before writing about the book’s contents. Additionally I have decided to include an occasional article about other subjects in technical analysis...

READ MORE

MEMBERS ONLY

Why Market Breadth is So Important (CGMBI)

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Editor's Note: We are very pleased to announce the return of Greg Morris - the author of "Candlestick Charting Explained", "Investing with the Trend", and "The Complete Guide to Market Breadth Indicators" - to StockCharts.com. Over the course of the coming...

READ MORE