MEMBERS ONLY

Powerhouse Stocks with Smashing Results

by John Hopkins,

President and Co-founder, EarningsBeats.com

A number of tech giants have crushed earnings expectations, something that becomes quite apparent when you look at their charts. For example, take a look at Apple (AAPL), which recently reported its numbers:

Your eyes are not deceiving you. Since the company reported its earnings on July 30, the stock...

READ MORE

MEMBERS ONLY

Those Who Are Patient Could REALLY Cash In!

by John Hopkins,

President and Co-founder, EarningsBeats.com

When Tesla (TSLA) reported its earnings last week, they smashed all expectations, both on the top and bottom line. The immediate reaction was mixed, but then we saw the tech sector in general take a hit for a few days in a row, and TSLA did not escape the selling....

READ MORE

MEMBERS ONLY

Earnings Season is Upon Us - And It's Going to Be a Wild Ride!

by John Hopkins,

President and Co-founder, EarningsBeats.com

Let me start right off the bat looking at two companies that reported earnings over the past week or so: FedEx (FDX) and Bed, Bath and Beyond (BBBY).

When FDX reported its numbers on July 1, the stock skyrocketed by 16%.

On the other hand, when BBBY reported its numbers...

READ MORE

MEMBERS ONLY

Would You Be Happy to Beat the S&P by a Mile?

by John Hopkins,

President and Co-founder, EarningsBeats.com

On Friday, April 3, I submitted my article for the ChartWatchers newsletter with the following headline: "Get Ready to be Shocked - To the Upside". As someone who has been involved in the market for many years and who has made his fair share of bad calls, this...

READ MORE

MEMBERS ONLY

How to Set Up Scans to Find Excellent Trading Opportunities

by John Hopkins,

President and Co-founder, EarningsBeats.com

Every day, there are thousands of companies to select from when looking for trading candidates. This includes companies in different sectors, of different sizes and with different prices. That's a lot of companies to choose from, so how does one go about zeroing in on the ones that...

READ MORE

MEMBERS ONLY

Identifying Stocks with High Short Interest Can Put $'s in Your Pocket!

by John Hopkins,

President and Co-founder, EarningsBeats.com

When looking for solid long trading candidates, one of the things astute traders look for are those stocks with high short interest. In other words, those stocks that traders are heavily betting against. Why, you might ask? Because if you can identify companies with a high percentage of short interest...

READ MORE

MEMBERS ONLY

STUNNING Results in Any Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

When you stop to think about the overall environment we've all been working in these past few months, it's amazing to think there are some stocks that are at their all-time highs. Of course, whenever there is a crisis, there are stocks that benefit. This is...

READ MORE

MEMBERS ONLY

Don't Let the Disconnect Between Wall Street and Main Street Derail You

by John Hopkins,

President and Co-founder, EarningsBeats.com

Last Wednesday, the NASDAQ got within just a few very strong sessions of reaching its all-time high. Let me repeat; it's All-Time High! Notwithstanding the much-needed pullback on Friday, how is this even possible, with millions of people out of work, most of America shut down and most...

READ MORE

MEMBERS ONLY

Are You "Fed-Up" Yet? If Not, You Should Be

by John Hopkins,

President and Co-founder, EarningsBeats.com

Some promising news on a drug from Gilead Sciences (GILD) to help those with the coronavirus came out on Thursday after the market closed, which resulted in a big move in futures and a solid end to the week as traders got excited about the prospects of making progress on...

READ MORE

MEMBERS ONLY

Get Ready to be Shocked - To the Upside

by John Hopkins,

President and Co-founder, EarningsBeats.com

If there ever was a time to be worried about where the market could be headed, this is it. We've seen the weekly jobless claims go from a boring week-to-week reading of just over 200,000 all the way to now 6 million over the course of a...

READ MORE

MEMBERS ONLY

The Times They Are A-Changin'

by John Hopkins,

President and Co-founder, EarningsBeats.com

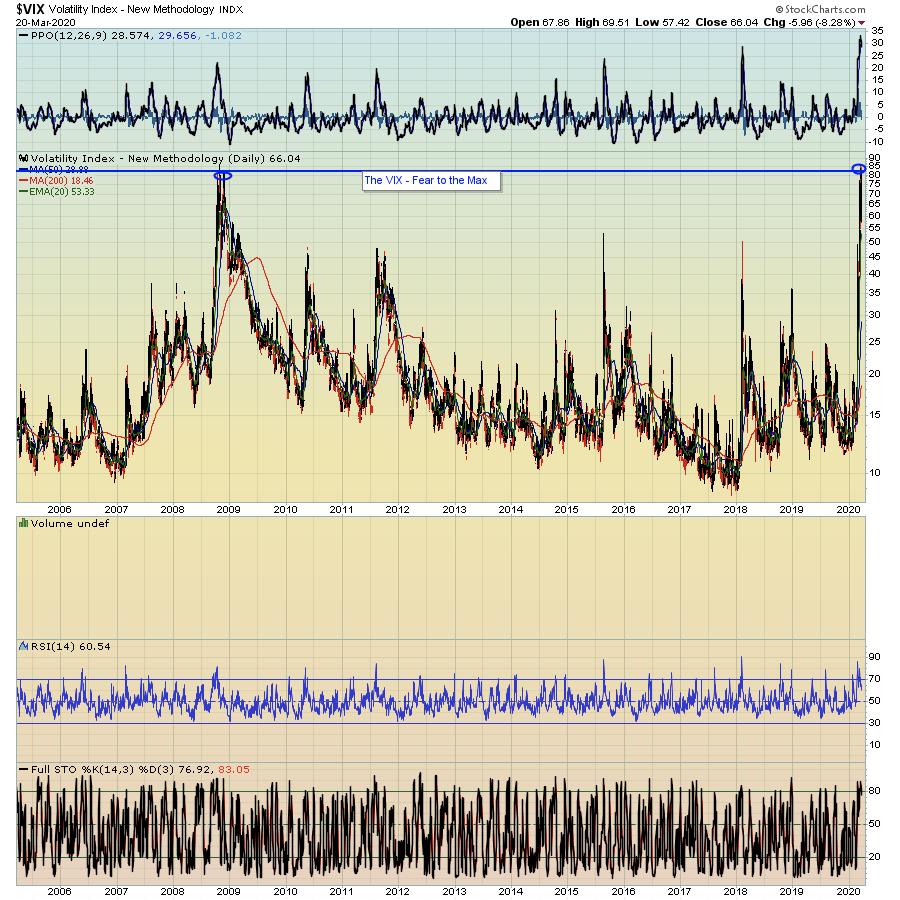

Generally, my articles focus on corporate earnings. But let's face it - earnings have taken a back seat these days, with traders more in survival mode. How volatile has it gotten out there and how worried are investors? Well, just take a look at the chart on the...

READ MORE

MEMBERS ONLY

Earnings Still Matter

by John Hopkins,

President and Co-founder, EarningsBeats.com

With the market in turmoil, many traders are in survival mode, never mind looking for new opportunities. Yet there are still companies reporting earnings that show the bottom line is still king.

As an example, take a look at the chart below on Zoom (ZM), a stock that reported its...

READ MORE

MEMBERS ONLY

Don't Buy a Stock Like This Heading into Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season has come and (mostly) gone, with all of the major companies reporting Q4 numbers. The consensus is that, overall, earnings were strong, as witnessed by record levels in the market. But there were also companies that came up short that had charts showing warning signs, one of them...

READ MORE

MEMBERS ONLY

Earnings Shine, Helping to Power Market Higher

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has shown incredible resiliency lately, shaking off the coronavirus epidemic, any negative economic reports, an impeachment trial and other developments that one would think could derail stocks. Yet here we are, with the market near record highs with traders seeming to "care less" about anything but...

READ MORE

MEMBERS ONLY

In a Volatile Market, Focus on the Best of the Best

by John Hopkins,

President and Co-founder, EarningsBeats.com

It's no secret that the market has reached frothy levels with virtually no relief since the beginning of October 2019. Thus, it makes sense that the VIX spiked on Friday, as it moved above all key technical intraday levels and many traders moved to the sidelines.

While the...

READ MORE

MEMBERS ONLY

Get Ready - Earnings Season Ready to Kick into High Gear

by John Hopkins,

President and Co-founder, EarningsBeats.com

Most of the talking heads on TV have gone out of their way to indicate that analysts have lowered their expectations for Q4 earnings. Given the way the market has powered forward with a new year underway, one can only imagine what the S&P might look like if...

READ MORE

MEMBERS ONLY

What's in a Forecast? See for Yourself and Be Amazed!

by John Hopkins,

President and Co-founder, EarningsBeats.com

On September 23, our Chief Market Strategist Tom Bowley, who had just returned to EarningsBeats.comafter 4.5 years as Senior Technical Analyst at StockCharts, made a bold call. Right as the market was in danger of rolling over, Tom saw something that caught his attention, which he shared with...

READ MORE

MEMBERS ONLY

How Commission-Free Trading Stacks the Odds in our Favor

by John Hopkins,

President and Co-founder, EarningsBeats.com

When Charles Schwab recently announced they were cutting their online brokerage commissions to zero, the other major brokerage houses fell in line. Then, shortly after, Schwab announced they would be buying Ameritrade. Game on!

The most amazing part of this major development is it gives traders a tremendous amount of...

READ MORE

MEMBERS ONLY

This Impressive Market Could Require Patience

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has mostly been straight up since the October 3 bottom, when the S&P touched 2855 before heading north. Since then, the S&P has climbed more than 10%, with buyers ready and willing to buy on any dips.

If you are a bull, and especially...

READ MORE

MEMBERS ONLY

How is YOUR Market Vision?

by John Hopkins,

President and Co-founder, EarningsBeats.com

First off, it gives me GREAT pleasure to announce our first ever online Financial Conference, Market Vision 2020,which will take place just as the new year begins. EarningsBeats.comChief Market Strategist Tom Bowley and I will be joined by some of the biggest names in the industry (we'...

READ MORE

MEMBERS ONLY

Do Not Ignore the Most Important Signal Heading Into an Earnings Report

by John Hopkins,

President and Co-founder, EarningsBeats.com

We are now deep into earnings season and, as we can see by the record highs in the NASDAQ and S&P, traders are mostly liking what they are hearing and seeing from companies who are reporting their numbers. We've seen some phenomenal moves in stocks -...

READ MORE

MEMBERS ONLY

Earnings Season Presents TONS of Profit Opportunities

by John Hopkins,

President and Co-founder, EarningsBeats.com

On Friday morning, Tom Bowley, Chief Market Strategist of EarningsBeats.com, and Mary Ellen McGonagle, president of MEM Investment Research, conducted a webinar that included identifying stocks reporting earnings next week that could make significant moves. It was fascinating listening to these two seasoned pros as they displayed charts on...

READ MORE

MEMBERS ONLY

Q4 and Earnings Season Kick into High Gear. Get Ready!

by John Hopkins,

President and Co-founder, EarningsBeats.com

In just over a week, some of the largest banks will report their earnings including Citigroup, JP Morgan and Wells Fargo. When these financial behemoths report, I consider that the kickoff of Q3 earnings season. And when I think about the beginning of earnings season, my blood gets flowing thinking...

READ MORE

MEMBERS ONLY

Cash Is King Right Now; Join Us TODAY For A Big Event

by John Hopkins,

President and Co-founder, EarningsBeats.com

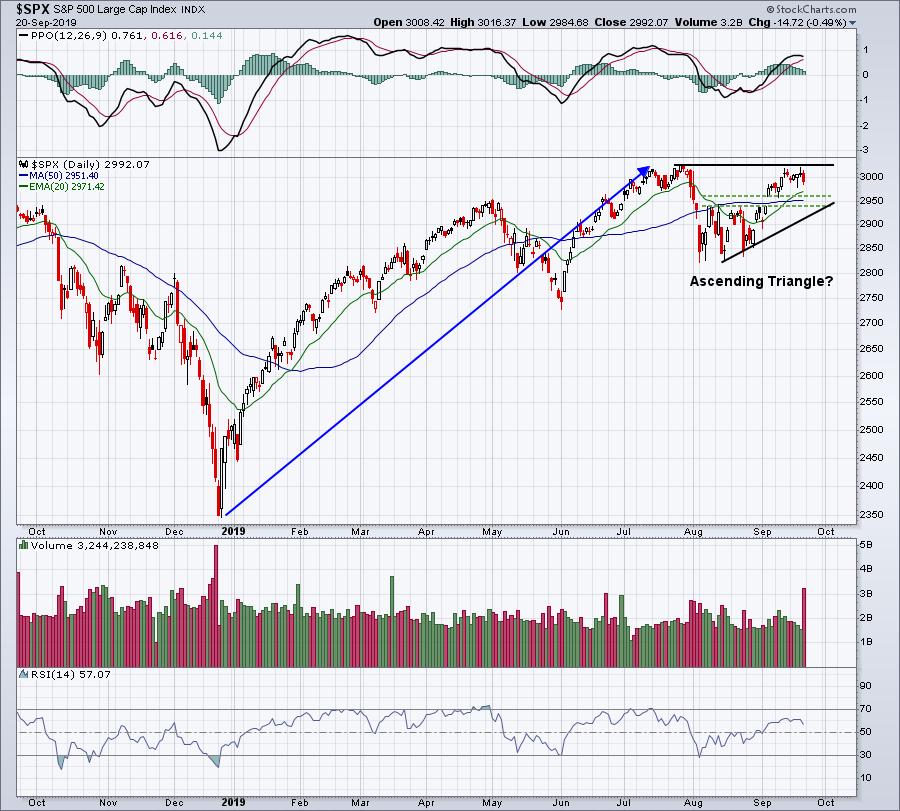

Technically, it makes sense to lessen stock exposure any time a major price resistance level is challenged. The all-time high close on the S&P 500 is 3025.86, set on July 26, 2019. On Thursday, the S&P 500 hit 3021.99, less than 4 points from...

READ MORE

MEMBERS ONLY

Drum Roll, Please!! A New Era Begins

by John Hopkins,

President and Co-founder, EarningsBeats.com

The excitement is building as Tom Bowley gets ready to rejoin the EarningsBeats.comteam as Chief Market Strategist. Why the excitement? Because Tom's experience as Senior Technical Analyst at StockCharts.com, along with being one of the original founders of and contributors to EarningsBeats.com, gives him a...

READ MORE

MEMBERS ONLY

Here's to the Future!

by John Hopkins,

President and Co-founder, EarningsBeats.com

Recently, Tom Bowley announced to the StockChartscommunity that he will soon bereturning to his "roots"atEarningsBeats.com. When Tom first approached me with the idea, I let out a big "Woohoo!". In all seriousness, it was a joyful day for me, as Tom and I go...

READ MORE

MEMBERS ONLY

5 Best Industry Groups Not Named Software (And Stocks To Trade In Each)

by John Hopkins,

President and Co-founder, EarningsBeats.com

I know it's summer, and we generally think defensively during this time of year, but there are still very strong areas with tremendous momentum that you should be considering. I'll give you my top five industry groups with a stellar individual stock performer within each group....

READ MORE

MEMBERS ONLY

Emerging Leadership From Two Key Groups - On Your Mark, Get Set, TRADE!!!

by John Hopkins,

President and Co-founder, EarningsBeats.com

With a new earnings season comes new leadership, and I'm already beginning to see a shifting of industry winds. Sure, some of the prior leaders continue to show leadership - software ($DJUSSW), financial administration ($DJUSFA), renewable energy ($DWCREE), and restaurants & bars ($DJUSRU) - but, as the current...

READ MORE

MEMBERS ONLY

Two Stocks Setting Up To Report Blowout Earnings Next Week

by John Hopkins,

President and Co-founder, EarningsBeats.com

On Thursday morning, Delta Airlines (DAL) blew past revenue and EPS estimates, despite a challenging environment for airline stocks ($DJUSAR) in 2019. While DAL's results may have surprised quite a few people, they didn't surprise me. The best way to follow where Wall Street is placing...

READ MORE

MEMBERS ONLY

Building Portfolio Power: Start With Stocks Like These!

by John Hopkins,

President and Co-founder, EarningsBeats.com

Let me start by saying that we track a "Best of the Best" list at EarningsBeats.com. Technically, it's actually 3 "Best of the Best" lists - a Model Portfolio, an Aggressive Portfolio and an Income Portfolio. They each include 10 stocks that are...

READ MORE

MEMBERS ONLY

I've Never Seen An Earnings Signal This Bullish

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats.com, we track the best U.S. companies in a "Strong Earnings ChartList." In order for a company to be included in our ChartList, they must do 3 things:

(1) Beat quarterly revenue estimates

(2) Beat quarterly EPS estimates

(3) Look solid technically

If a company...

READ MORE

MEMBERS ONLY

Strong Earnings can Fuel a Portfolio

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has been under fire for some time now as uncertainty abounds. Even a lot of stocks that had earlier reported strong earnings haven't been able to escape the recent market turmoil. However, there are also many stocks that have held up quite well, outperforming the market...

READ MORE

MEMBERS ONLY

Here's What a Double Looks Like

by John Hopkins,

President and Co-founder, EarningsBeats.com

Every trader dreams of owning a stock that doubles. If it can happen in just six months, even better. This has been the case for Twilio (TWLO), a stock featured during our Top 10 Stock Picks webinar in November of 2018 that has doubled in price since the November 20...

READ MORE

MEMBERS ONLY

Profiting from Pullbacks

by John Hopkins,

President and Co-founder, EarningsBeats.com

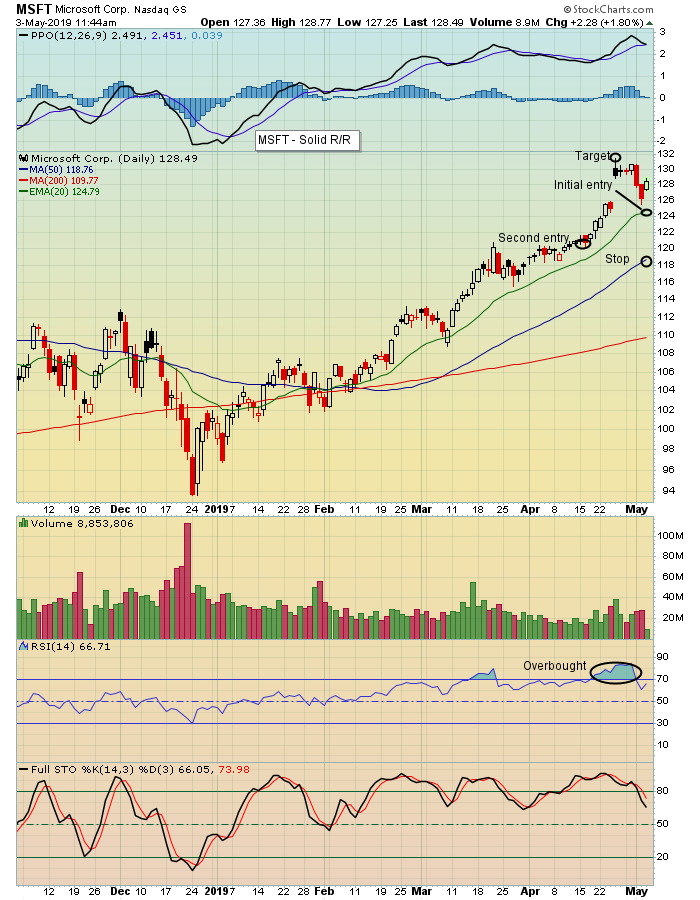

When you're a bull, the last thing you want to see is a pullback in stocks you own. This is understandable - who wants to see something they own lose value? But, at some point, the market and individual stocks will get overheated, so instead of worrying about...

READ MORE

MEMBERS ONLY

Profiting from Companies that Beat Earnings Expectations

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season is off and running and already some companies that beat expectations could set up as high reward-to-risk trades. JP Morgan (JPM) is a perfect example of a company that reported stronger than expected numbers; you can see below the positive response from the market below.

In the week...

READ MORE

MEMBERS ONLY

Earnings Season Can Produce Real Sizzle

by John Hopkins,

President and Co-founder, EarningsBeats.com

As earnings season gets ready to kick off this week once JPM, PNC and WFC report their results on Friday, here's a reminder that those stocks that come up big on the top and bottom line could ultimately become high reward-to-risk trading candidates, possibly multiple times. There are...

READ MORE

MEMBERS ONLY

The Strong Continue to Thrive

by John Hopkins,

President and Co-founder, EarningsBeats.com

The S&P is pretty much at the same level it was back in October of last year. However, it still remains well below its all-time high of 2939, which was also achieved in October of last year. Yet there are a number of stocks at their all-time highs,...

READ MORE

MEMBERS ONLY

A Treasure Chest Awaits You

by John Hopkins,

President and Co-founder, EarningsBeats.com

SO MANY stocks that recently reported earnings beat expectations and gapped up sharply on very strong volume after their results were released. Those stocks include OLED, TTD, W and PANW, among others. In fact, take a look at the chart below on TTD, which reported its earnings before the bell...

READ MORE

MEMBERS ONLY

The Secret Combination For Solid Reward To Risk Trades

by John Hopkins,

President and Co-founder, EarningsBeats.com

Well, it's really not a secret, but it's our secret at EarningsBeats.com. Our mantra is "Better Timing. Better Trades." and, for us, that means finding the best stocks, identifying key price and moving average support and then adding.....an extra helping of patience....

READ MORE

MEMBERS ONLY

Earnings Season Brings with it Lots of Trading Candidates

by John Hopkins,

President and Co-founder, EarningsBeats.com

We're now deep into earnings season, with hundreds of companies reporting last week alone. The reaction to earnings so far has been mostly positive - witness the nice move higher in the market. But we've also seen some earnings misses, with those companies taking it on...

READ MORE