MEMBERS ONLY

Earnings Season Favors the Bulls

by John Hopkins,

President and Co-founder, EarningsBeats.com

Recent headlines have focused on tax reform, health care reform, partisan bickering, the president's first 100 days. But in the background many companies have been coming up big when reporting earnings which is why the market has been so strong of late.

While the bears have been hoping...

READ MORE

MEMBERS ONLY

Earnings Take Center Stage

by John Hopkins,

President and Co-founder, EarningsBeats.com

It's that time of the year, a time when all attention is turned to the bottom line of corporate America. It happens every quarter and it always has a major impact on the direction of the market. And the bottom line almost always trumps everything else.

Of course...

READ MORE

MEMBERS ONLY

Trust Your Good Work

by John Hopkins,

President and Co-founder, EarningsBeats.com

If you trade stocks you're going to run into situations where you question whether or not you are making good decisions. This could include identifying entry levels and setting price targets and stop losses. It could also include pulling the trigger on a trade, taking a loss or...

READ MORE

MEMBERS ONLY

Reward to Risk Calculation a Must

by John Hopkins,

President and Co-founder, EarningsBeats.com

As part of our service at EarningsBeats.com we send trade alerts to our members on stocks that beat earnings expectations. But before we notify members of any trade candidates we look closely at the "Reward to Risk' ratio as we want to make sure it is favorable...

READ MORE

MEMBERS ONLY

Patience in an Overbought Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

The rise in the major indexes since the election has been stunning. The S&P alone is up over 15% in just over 3 months. That would be a terrific year by any measure. The Dow was up 18% since the election at its all time high on Wednesday,...

READ MORE

MEMBERS ONLY

Trading Stocks in a Stretched Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

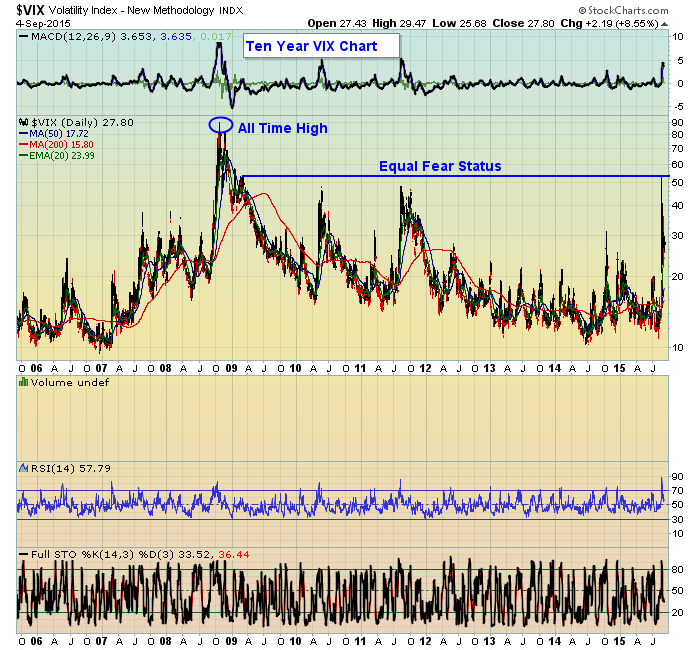

I made my case to EarningsBeats members this past Wednesday just before we started to see a bit of selling. Here are the highlights:

1-The VIX is up by almost 9% today as it tests its 50 day moving average from the downside even though the market is higher. This...

READ MORE

MEMBERS ONLY

No Chasing Allowed

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats we are steadfast in avoiding being involved in stocks into a company's earning's report because one can never tell how the market will respond to a company's numbers. Case in point is Amazon who reported their numbers last week.

Just look at...

READ MORE

MEMBERS ONLY

A Sure Recipe for Success - or Not!

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings Season is now in high gear with thousands of companies getting ready to report their numbers over the next several weeks. Whenever earnings season comes around there are clear winners and clear losers with the sole evidence of success or failure being the performance of a stock. For example,...

READ MORE

MEMBERS ONLY

Guess What? "Official" Earnings Season is About to Begin

by John Hopkins,

President and Co-founder, EarningsBeats.com

No one can argue with the fact that the market has been fascinating to watch since the election with all of the major indexes substantially higher since the most recent bottom on November 4. There's been a few minor pullbacks along the way, but not many as traders...

READ MORE

MEMBERS ONLY

Taking Advantage of Good Luck

by John Hopkins,

President and Co-founder, EarningsBeats.com

p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 13.0px Georgia; -webkit-text-stroke: #000000} p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; font: 13.0px Georgia; -webkit-text-stroke: #000000; min-height: 15.0px} span.s1 {font-kerning: none} span.s2 {text-decoration: underline ; font-kerning: none; color: #4787ff; -webkit-text-stroke:...

READ MORE

MEMBERS ONLY

When Market is Stretched Patience is Required

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has been in non-stop higher mode ever since the election. The NASDAQ is up over 6%. The Dow rose 1000 points in four trading days. The small cap Russell 2000 rose over 13%. At the same time, bond yields have soared with the ten year US Treasury Note...

READ MORE

MEMBERS ONLY

Examining Market Response to Earnings Reports

by John Hopkins,

President and Co-founder, EarningsBeats.com

When the market is under fire like it has been for the past few weeks it becomes harder to trade successfully. This is particularly true if your focus is on the long side.

One way we've tried to combat a difficult trading environment at EarningsBeats is to focus...

READ MORE

MEMBERS ONLY

Holding Stocks into Earnings can be Costly

by John Hopkins,

President and Co-founder, EarningsBeats.com

We're now in the thick of Q3 earnings season when thousands of companies will report their numbers over the next several weeks. Earning season kicked off when Alcoa reported its numbers early last week and served as the poster child of why it's a crap shoot...

READ MORE

MEMBERS ONLY

Tis the Season - Earnings Season

by John Hopkins,

President and Co-founder, EarningsBeats.com

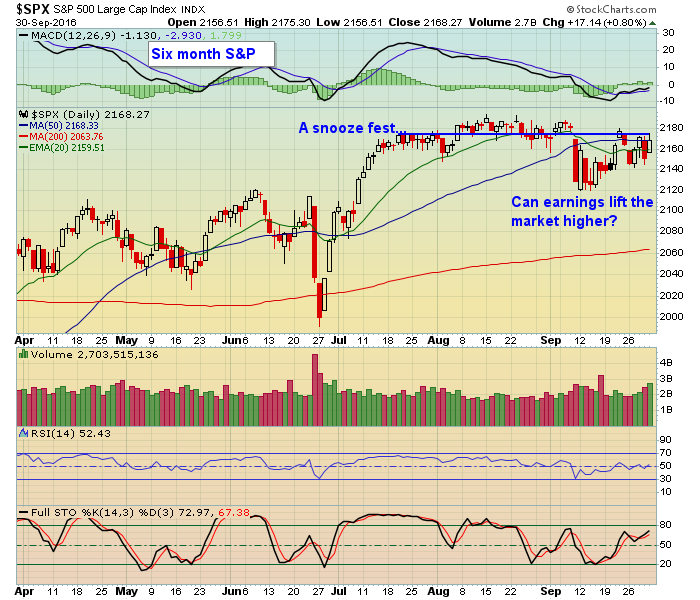

The third quarter has come to an end. It ended on a high note with the S&P gaining 3.3% from the June 30 close to Friday's close. Interestingly, the S&P got to 2168 two weeks into the third quarter which is exactly where...

READ MORE

MEMBERS ONLY

Sitting on the Edge

by John Hopkins,

President and Co-founder, EarningsBeats.com

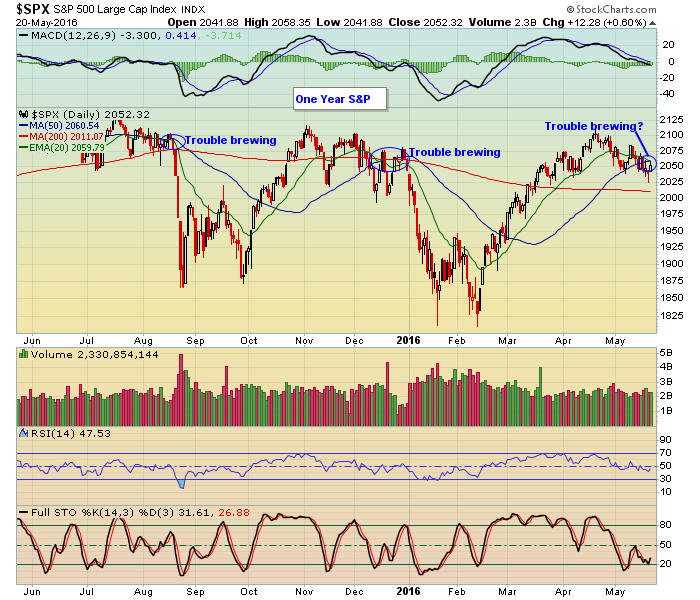

September has a reputation of being a difficult month for traders. So far it is living up to its reputation.

The S&P started out the month pretty much like it had the prior many weeks; going nowhere. And on September 8 the S&P remained within easy...

READ MORE

MEMBERS ONLY

Finding Trading Opportunities in a Flat Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has been in consolidation mode for over six weeks now. The S&P closed at 2173 on July 20. It closed at 2179 on Friday. During that period of time any pullbacks have been shallow and short-lived with the S&P topping twice at 2193 and...

READ MORE

MEMBERS ONLY

With Earnings Season Over, What's Next?

by John Hopkins,

President and Co-founder, EarningsBeats.com

The latest earnings season has come and gone. Now what?

It's a good question, especially with the market in stall mode, with the S&P barely budging in over a month. This stagnation comes after investors seemed to have applauded the majority of earnings reports telling me...

READ MORE

MEMBERS ONLY

Earnings Power Market Higher

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has seen both the Dow and S&P hit record highs recently and now the NASDAQ wants to join the party. In fact the NASDAQ got to within just a few points of its all time high Friday, fueled by a very positive response to earnings in...

READ MORE

MEMBERS ONLY

Earnings Season Shifts into High Gear

by John Hopkins,

President and Co-founder, EarningsBeats.com

The "official" start to earnings season began when Alcoa reported its numbers after the bell last Monday. The market liked what it saw and heard with AA up close to 10% by the time the week ended. We also saw some major banks report their numbers with mixed...

READ MORE

MEMBERS ONLY

Bizarre to the Max

by John Hopkins,

President and Co-founder, EarningsBeats.com

Exactly how bizarre has the market action been over the last six trading days? Let me count the ways.

First, the British voted to leave the European Union which put the market in a tailspin with the S&P losing almost 6% in just two days. But by Friday&...

READ MORE

MEMBERS ONLY

Can Earnings Save the Market?

by John Hopkins,

President and Co-founder, EarningsBeats.com

Last week was rough on stocks as fear engulfed the market. All of the major indexes remain below key technical levels with the NASDAQ in particular very weak. And the fear was evident as the VIX rose sharply, hitting levels not seen since February of this year when the market...

READ MORE

MEMBERS ONLY

When Bad News is...Bad News

by John Hopkins,

President and Co-founder, EarningsBeats.com

The stock market can be quite mystifying. Depending on the mood of the market, good news can be interpreted as bad news, bad news can be seen as good news and every once in a while good news and bad news are seen just as described. It's one...

READ MORE

MEMBERS ONLY

Trading Tune Up Part Two

by John Hopkins,

President and Co-founder, EarningsBeats.com

In my last ChartWatchers article I pointed to the importance of taking a time out now and then to analyze trading habits. I referred to it as a "Trading Tune Up".

The article served as a reminder to me that you need to be on your toes at...

READ MORE

MEMBERS ONLY

Trading Tune Up - Lessons Learned

by John Hopkins,

President and Co-founder, EarningsBeats.com

If you've been trading for a decent period of time you know how quickly things can turn against you. Sometimes with no warning, all of the good work you've done seems to disappear and before you know it, profits quickly disappear as well.

As a trader...

READ MORE

MEMBERS ONLY

Earnings Season off and Running

by John Hopkins,

President and Co-founder, EarningsBeats.com

Alcoa reported its numbers after the bell last Monday which served as the kick off for first quarter earnings season. This was followed by a few big banks and then next week we'll get hundreds of more companies reporting their numbers.

Earnings season is important because when everything...

READ MORE

MEMBERS ONLY

Another Earnings Season Ready to Kick Off

by John Hopkins,

President and Co-founder, EarningsBeats.com

The first quarter has come and gone and now we are about to embark upon another earnings season that will officially kick off when Alcoa reports its numbers after the bell on Monday, April 11. Alcoa rarely sets the tone for earnings season but when they do report it'...

READ MORE

MEMBERS ONLY

A Set up for Shorts?

by John Hopkins,

President and Co-founder, EarningsBeats.com

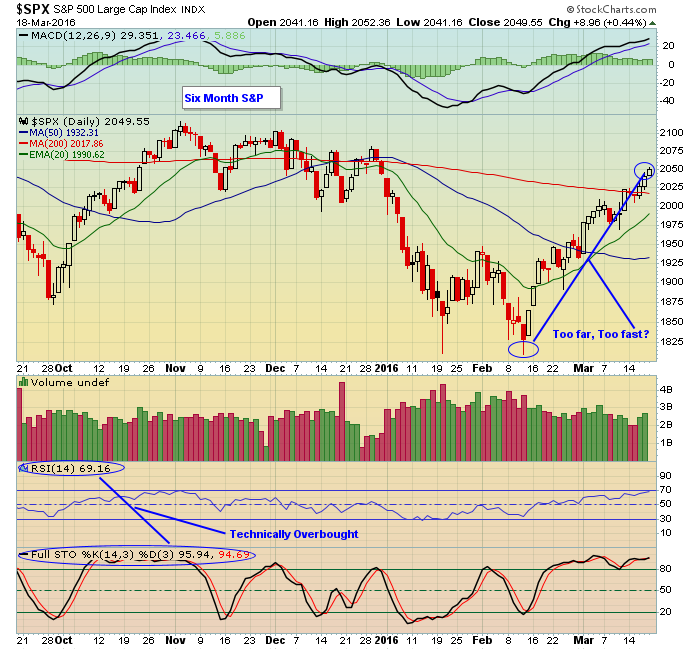

The market has been pretty much straight up since the February 11 bottom of 1810. Since that day the S&P has climbed 13%. That's a very impressive move by any measurement. In fact, I would argue that it has been too much too quick.

Look at...

READ MORE

MEMBERS ONLY

It's as Easy to Get Burned Up as it is Down

by John Hopkins,

President and Co-founder, EarningsBeats.com

If the market this year has taught us one thing it's that it's as easy losing money when the market is going up as when it is going down. Consider this.

After the first trading day of the year was over, the S&P closed...

READ MORE

MEMBERS ONLY

Profit from Earnings Misses

by John Hopkins,

President and Co-founder, EarningsBeats.com

Our primary focus for a long time at EarningsBeats.com has been on those companies that beat earnings expectations and have strong charts. The reason being that companies with strong numbers and strong charts provide superior reward to risk trading opportunities. But we've learned lately that companies that...

READ MORE

MEMBERS ONLY

In Rocky Times Earnings REALLY Matter

by John Hopkins,

President and Co-founder, EarningsBeats.com

In the best of times companies see their stock prices rewarded or punished based on earnings results. Even when a company misses its earnings per share or revenue forecasts by just a small amount it can have a meaningful, negative impact on its stock price. But when the market is...

READ MORE

MEMBERS ONLY

Will Earnings Matter?

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earning's season will kick into high gear this week and trader's are wondering how much they will matter after the market slaughter already experienced this year. Since this is the worst start to a year for stocks it's a legitimate question.

Let's...

READ MORE

MEMBERS ONLY

Preparing for Potential Shifts

by John Hopkins,

President and Co-founder, EarningsBeats.com

The S&P ended 2015 down slightly from the close in 2014. But to many traders, it sure felt like a downer of a year.

At EarningsBeats.com we combine strong fundamentals with strong technicals to try to find the best reward to risk trading candidates for our members,...

READ MORE

MEMBERS ONLY

Trading in a Sideways Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

On 12-3-14 the S&P closed at 2074. On 12-3-15 (Friday) the S&P closed at 2091. That's about as flat as you can get over a 12 month period and it helps explain why many traders have had a difficult time scoring big gains over...

READ MORE

MEMBERS ONLY

Strong Earnings = Strong Performance

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats.com we focus squarely on stocks that beat earnings expectations and also have strong charts. We do this as we have found that companies who report strong numbers get a lot of attention which makes sense given the single most important attribute investors look for in a company...

READ MORE

MEMBERS ONLY

Another Painful Reminder - Hold Stocks into Earnings at Your own Peril

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season has been in high gear the past few weeks with thousands of companies reporting their numbers. So far the results have been mixed but maybe better than most expected with the S&P now back to within striking range of its all time high.

One of the...

READ MORE

MEMBERS ONLY

When it Comes to Earnings, Patience is Required

by John Hopkins,

President and Co-founder, EarningsBeats.com

The earnings season is in high gear now with some very visible companies already reporting their numbers and thousands more about to report over the course of the next several weeks. Already we've seen example of stocks that have performed well after reporting and others that have taken...

READ MORE

MEMBERS ONLY

Now that the Fed is out of the way, let Earning's Season begin!

by John Hopkins,

President and Co-founder, EarningsBeats.com

The much weaker than expected jobs report this past Friday put a kibosh on any intention the Fed might have had to raise interest rates during the month of October. In fact, barring a major improvement in the economic outlook, it's doubtful the Fed will be raising rates...

READ MORE

MEMBERS ONLY

Strong Earnings Matter in Volatile Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

To say the past three weeks have been wild would be a major understatement.

For example, the S&P lost 11% of its value in just 4 trading days ending in the most recent low of 1867 on August 24. Then it gained over 8% from that August 24...

READ MORE

MEMBERS ONLY

It's True...The Only Thing We Have to Fear is Fear Itself

by John Hopkins,

President and Co-founder, EarningsBeats.com

We've all heard that famous quote from Franklin D. Roosevelt in his first inaugural address. It's a saying that has had staying power for over 80 years. And it's something that rings true today in the current and volatile market environment.

It starts with...

READ MORE

MEMBERS ONLY

How to Avoid Getting Slaughtered

by John Hopkins,

President and Co-founder, EarningsBeats.com

There are differing opinions on whether or not it makes sense to hold stocks into earnings reports. One camp argues that you stand to make a big score if a company beats its numbers. Another camp - the one I'm in - says it's way too...

READ MORE