MEMBERS ONLY

BANKS LEAD FINANCIALS AND THE MARKET HIGHER -- FINANCIAL SPDR HITS NEW 2019 HIGH -- WHILE S&P BANK ISHARES CLEAR THEIR 200-DAY LINE -- BANK LEADERS INCLUDE JPM, BAC, AND PNC -- S&P 500 NEARS TEST OF LAST SEPTEMBER HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS LEAD FINANCIALS HIGHER ... Strong earnings from three banks this morning have helped push that group sharply higher; and they're leading the financial sector and the market higher. Chart 1 shows the Financial Sector SPDR (XLF) gapping up to the highest level of the year (after regaining its...

READ MORE

MEMBERS ONLY

RUSSELL 2000 IS TRYING TO CLEAR ITS 200-DAY AVERAGE -- SO ARE AIRLINES AND ENERGY STOCKS -- BANKS ARE HOLDING FINANCIALS BACK -- WHILE MORTGAGE FINANCE STOCKS ARE LEADING THEM HIGHER -- MEXICO AND SOUTH KOREA ETFS CLEAR THEIR 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 SMALL CAP INDEX IS TRYING TO CLEAR ITS 200-DAY AVERAGE... Last Wednesday's message showed the S&P 400 Mid Cap Index clearing its 200-day average; and suggested that left only the small caps to join the market rally. That may be about to happen. Chart...

READ MORE

MEMBERS ONLY

RISING CHINESE STOCK MARKET IS BOOSTING INDUSTRIAL METALS AND STOCKS TIED TO THEM - THE GLOBAL METALS AND MINING PRODUCERS ISHARES HAVE TURNED UP -- RISING COMMODITY PRICES HELPED MAKE MATERIALS THE WEEK'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

POSITIVE IMPLICATIONS FROM A STRONGER CHINA... My Thursday message showed an index of foreign stocks turning higher, which relieved concerns that weaker foreign stocks could start to weigh on U.S. stocks (as they did near the end of last year). To the contrary, rising foreign stocks are now supporting...

READ MORE

MEMBERS ONLY

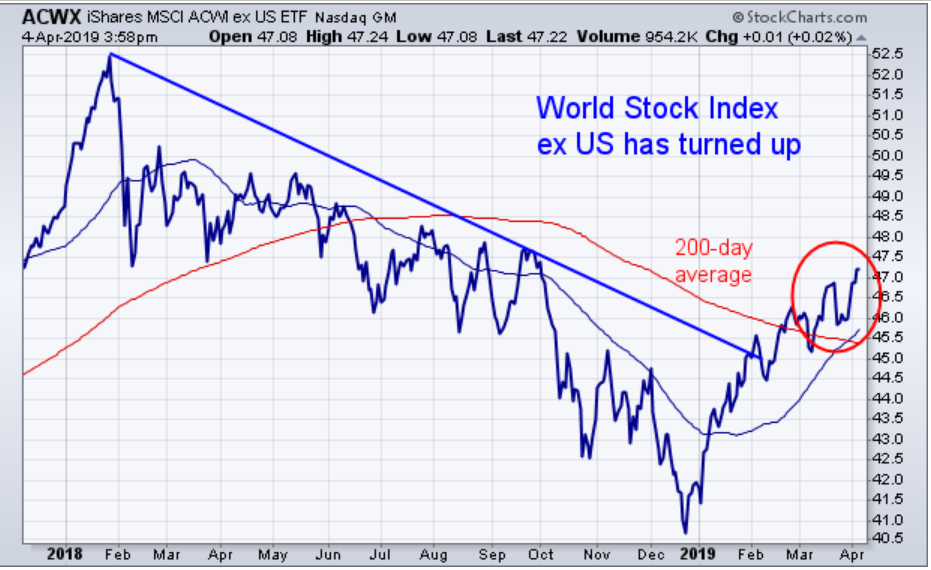

Foreign Stocks are Now Rising

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, April 4th at 4:16pm ET.

Much of the concerns over the past year have centered around weakness in foreign stocks, and whether that would eventually pull U.S. stocks lower. The...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS ARE NOW RISING -- CHINESE STOCKS HAVE RISEN TWICE AS FAST AS THE U.S. THIS YEAR -- THAT'S BOOSTING STOCKS IN ASIA AND AUSTRALIA -- ALONG WITH COPPER PRICES AND SEMICONDUCTORS -- EUROZONE STOCKS ARE ALSO LOOKING STRONGER

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCKS ARE RISING ... Much of the concerns over the past year have centered around weakness in foreign stocks, and whether that would eventually pull U.S. stocks lower. The general feeling seemed to be that sooner or later the discrepancy between strong U.S. stocks and weak foreign stocks...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES NEAR TEST OF 2018 HIGHS -- TRANSPORTS CLEAR THEIR 200-DAY AVERAGE -- DELTA AIR LINES TURNS UP -- THE TRANSPORTS ARE STARTING TO GAIN GROUND ON THE DOW INDUSTRIALS AND UTILITIES -- S&P 400 MID CAP INDEX CLEARS ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES HEADING TOWARD TEST OF LAST YEAR'S HIGH... Major stock indexes in the U.S. appear on track to test their all-time highs reached during the second half of 2018. Chart 1 shows the Nasdaq Composite Index trading today at the highest level since early...

READ MORE

MEMBERS ONLY

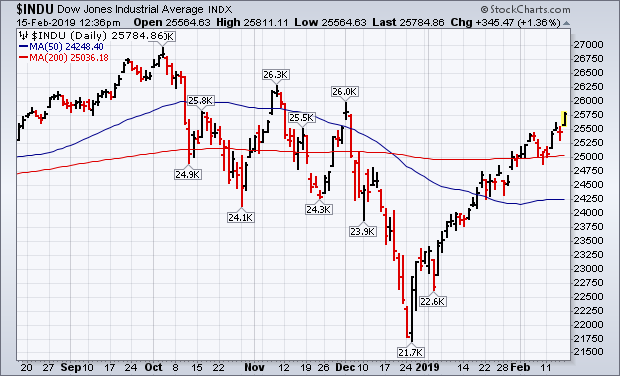

STOCKS ARE ENDING WEEK AND QUARTER ON A FIRM NOTE -- ALL THREE MAJOR STOCK INDEXES HAVE KEPT THEIR 2019 UPTRENDS INTACT -- THE DOW TRANSPORTS MAY MAKE ANOTHER RUN AT THEIR 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES MAINTAIN THEIR 2019 UPTRENDS ... Major U.S. stock indexes appear on track to end the week and quarter with their 2019 uptrends intact. Chart 1 shows the Dow Industrials in a sideways trading pattern over the last month. This week's pullback bounced off its (blue)...

READ MORE

MEMBERS ONLY

DROP IN BOND YIELDS HERE AND IN GERMANY WEIGH ON STOCKS -- MAJOR STOCK INDEXES MAY RETEST THEIR 200-DAY AVERAGES -- THE BOND/STOCK RATIO IS RISING AGAIN WHICH SUGGESTS THAT INVESTORS ARE HEDGING THEIR BETS ON A STRONGER ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS FOLLOW BUNDS LOWER ... German 10-year bunds were sold below zero at today's auction which is keeping downside pressure on Treasury yields. The daily bars in Chart 1 show the 10-Year Treasury yield falling today to the lowest level since the end of 2017. That's...

READ MORE

MEMBERS ONLY

PLUNGE IN GLOBAL BOND YIELDS AND INVERTED YIELD CURVE PUSHES BOND PRICES HIGHER AND STOCKS LOWER -- FALLING BOND YIELDS REWARD UTILITIES WHILE HURTING BANKS -- WEAKNESS IN SMALL CAPS AND TRANSPORTS MAY BE WARNING OF MORE PROFIT-TAKING TO COME

by John Murphy,

Chief Technical Analyst, StockCharts.com

PLUNGE IN BOND YIELDS CAUSES YIELD CURVE TO INVERT ... Weak economic numbers from the eurozone and the U.S. on Friday pushed bond yields here and in Europe sharply lower and caused heavy profit-taking in global stocks. The 10-Year German bond yield fell into negative territory (below zero) for the...

READ MORE

MEMBERS ONLY

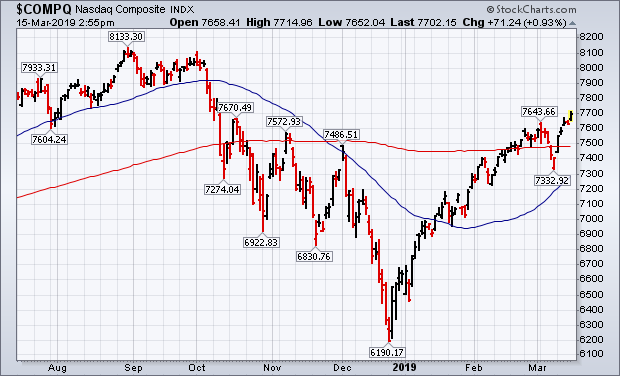

Tech-Dominated Nasdaq Leads Market Higher -- The Nasdaq and S&P 500 are Clearing Their November Highs

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, March 15th at 2:58pm ET.

Just a week after slipping below their 200-day averages, the Nasdaq Composite Index in Chart 1 and the S&P 500 in Chart 2 appear...

READ MORE

MEMBERS ONLY

TECH-DOMINATED NASDAQ LEADS MARKET HIGHER -- THE NASDAQ AND S&P 500 ARE CLEARING THEIR NOVEMBER HIGHS -- FALLING BOND YIELDS HAVE HELPED BOOST STOCK AND BOND PRICES -- HIGH YIELD AND INVESTMENT GRADE BONDS ARE OUTPACING TREASURIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND S&P 500 HAVE CLEARED THEIR NOVEMBER HIGH... Just a week after slipping below their 200-day averages, the Nasdaq Composite Index in Chart 1 and the S&P 500 in Chart 2 appear to be ending the week above their November highs. That's the...

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR LEADS TODAY'S REBOUND AND HOLDS ITS 200-DAY LINE -- SEMICONDUCTORS ARE HAVING AN EVEN STRONGER DAY -- THE NASDAQ AND S&P 500 REGAIN THEIR 200-DAY LINES -- THE DOW SHRUGS OFF BIG BOEING LOSS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR HOLDS ITS 200-DAY LINE ... Stocks are off to a strong start for the week. All stock sectors are in the green today led by technology, energy, communications, financials, and cyclicals. All stocks sectors are also in the green with the technology-dominated Nasdaq in the lead. The Dow Industrials...

READ MORE

MEMBERS ONLY

BULL MARKET IN STOCKS REACHES ITS TENTH ANNIVERSARY TODAY -- AND IS THE LONGEST IN HISTORY -- THE ECONOMIC EXPANSION WILL HIT ITS TENTH ANNIVERSARY IN JUNE -- AND IS NEARING A NEW RECORD AS WELL

by John Murphy,

Chief Technical Analyst, StockCharts.com

HAPPY TENTH ANNIVERSARY... Today marks the tenth anniversary of the bull market in stocks that started on March 9, 2009. It's already the longest in history, and the first bull market to last ten years. According to the Wall Street Journal, the S&P 500 has gained...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SPDR FALLS BACK BELOW 200-DAY AVERAGE -- APPAREL RETAILERS ARE LEADING THE S&P 500 RETAIL SPDR LOWER -- AMAZON.COM ISN'T DOING MUCH BETTER -- CONSUMER CYCLICALS/STAPLES RATIO IS ALSO WEAKENING

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR IS BACK BELOW ITS 200-DAY AVERAGE... As of today, the Nasdaq Composite Index and the S&P 500 are trading back below their 200-day averages. That leaves only the Dow Industrials still above that long-term support line. A number of sector ETFs have either failed a...

READ MORE

MEMBERS ONLY

SMALL CAPS AND TRANSPORTS CONTINUE TO LEAD STOCKS LOWER -- STOCK INDEXES UNDERCUT 20-DAY AVERAGES -- AND ARE THREATENING 200-DAY LINES -- BOND PRICES RALLY -- EUROZONE BOND PRICES RISE ON MORE DOVISH ECB -- A PLUNGING EURO PUSHES DOLLAR TO TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS TURN DOWN FROM OVERBOUGHT TERRITORY... Several of the writers on this site have been pointing out that the strong 2019 stock rally had become over-extended, and was up against formidable chart resistance at their November high. So it's not a big surprise to see some profit-taking...

READ MORE

MEMBERS ONLY

KOHLS AND TARGET LEAD RETAILERS HIGHER -- RETAIL SPDR REMAINS BELOW 200-DAY LINE -- HOME CONSTRUCTION ISHARES FALL BELOW ITS 200-DAY LINE -- SO DO LENNAR AND DR HORTON -- STOCK INDEXES HOLD STEADY AFTER MODEST PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

KOHLS AND TARGET LEAD RETAILERS HIGHER ... Chart 1 shows Kohls (KSS) surging 7% to clear its 200-day average and trade at the highest level since November. Chart 2 shows Target (TGT) up nearly 5% and also trading at the highest level in three months. The broadline retailer is also trading...

READ MORE

MEMBERS ONLY

Major Stock Indexes Continue to Test Overhead Resistance Near Their November Highs

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, March 1st at 11:55am ET.

After having one of the strongest starts to a new year in history, major stock indexes find themselves testing yet another potential overhead resistance barrier. And...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES CONTINUE TO TEST OVERHEAD RESISTANCE NEAR THEIR NOVEMBER HIGHS -- AND CONTINUE TO LOOK OVER-EXTENDED -- THE S&P 600 SMALL CAP INDEX AND THE DOW TRANSPORTS ARE MEETING SOME SELLING AT THEIR 200-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

NOVEMBER HIGH IS BEING TESTED ... After having one of the strongest starts to a new year in history, major stock indexes find themselves testing yet another potential overhead resistance barrier. And they're doing so while in an over-extended technical condition. But they've been looking over-extended for...

READ MORE

MEMBERS ONLY

BOND PRICES ARE UP AGAINST CHART RESISTANCE -- AND MAY BE SUBJECT TO PROFIT-TAKING -- RISING OIL PRICE MIGHT ALSO WEAKEN BOND PRICES -- SO COULD A STRONGER COPPER MARKET -- TODAY'S YIELD BOUNCE MIGHT BE CAUSING SOME PROFIT-TAKING IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY BOND ETFS ARE UP AGAINST CHART RESISTANCE... Last Thursday's message suggested that an overbought Treasury bond market was looking vulnerable to some profit-taking. That's still the case. The weekly bars in Chart 1 show the 7-10 Year Treasury Bond IShares (IEF) just below potential overhead...

READ MORE

MEMBERS ONLY

CISCO, INTEL, AND MICROSOFT LEAD DOW HIGHER -- TECHNOLOGY SECTOR SHOWS NEW LEADERSHIP -- FINANCIAL SPDR IS TRADING OVER ITS 200-DAY AVERAGE -- CHINA LEADS EMERGING MARKET STOCKS HIGHER -- CHINESE STOCKS ARE NOW DOING BETTER THAN THE U.S.

by John Murphy,

Chief Technical Analyst, StockCharts.com

CISCO, INTEL, AND MICROSOFT ARE DOW LEADERS ... A glance at today's most actives list for the Dow shows three stocks attracting a lot of the buying. Chart 1 shows Cisco (CSCO) surging to an all-time high. Its rising relative strength line (upper box) shows it leading the Dow...

READ MORE

MEMBERS ONLY

STOCK INDEXES TEST OVERHEAD RESISTANCE WHILE LOOKING OVEREXTENDED -- FINANCIALS AND MATERIALS TEST 200-DAY LINES -- UTILITIES NEAR A NEW RECORD HIGH -- COPPER ACHIEVES BULLISH BREAKOUT AS COMMODITIES STRENGTHEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES TEST OVERHEAD RESISTANCE ... All three major U.S stocks are testing overhead resistance barriers. Chart 1 shows the Dow Industrials right up against their early December peak at 26000. That's the Dow's first test of a previous peak formed during the fourth quarter...

READ MORE

MEMBERS ONLY

DOVISH FED HAS CONTRIBUTED TO FALLING BOND YIELDS -- FALLING GERMAN YIELDS ARE ALSO HOLDING TREASURY YIELDS DOWN -- FALLING GLOBAL BOND YIELDS MAY ALSO EXPLAIN RECENT BUYING OF GOLD AND MINERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD REMAINS WEAK ... Despite renewed optimism in the stock market which has had a spectacular start to the new year, Treasury yields remain surprisingly low. Chart 1 shows the 10-Year Treasury Yield ($TNX) still trading close to its lowest level in a year. The TNX also remains below...

READ MORE

MEMBERS ONLY

Nasdaq May Be the Third Major Stock Index to Cross Its Red Line

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, February 15th at 12:40pm ET.

Charts 1 and 2 show the Dow Industrials and S&P 500 building on their gains after rising above their 200-day averages (red lines). Both...

READ MORE

MEMBERS ONLY

MARKET RALLY CONTINUES AS NASDAQ TESTS ITS 200-DAY AVERAGE -- FINANCIALS LEAD TODAY'S GAINS -- DRUGS HELP BOOST HEALTHCARE SECTOR -- HOME DEPOT, UNITED TECHNOLOGIES, AND TRAVELERS ARE DOW LEADERS -- SEMICONDUCTORS SHOW NEW LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ MAY BE THE THIRD MAJOR STOCK INDEX TO CROSS ITS RED LINE ... Charts 1 and 2 show the Dow Industrials and S&P 500 building on their gains after rising above their 200-day averages (red lines). Both now appear headed for a test of their early December peaks....

READ MORE

MEMBERS ONLY

THE S&P 500 JOINS THE DOW ABOVE ITS 200-DAY AVERAGE -- CONSUMER DISCRETIONARY AND INDUSTRIAL SPDRS HAVE CROSSED THEIR THEIR RED LINES -- THE XLI HAS ALSO CLEARED ITS DECEMBER HIGH -- RAILS ARE BOOSTING THE XLI -- NYSE AD LINES NEAR TEST OF 2018 HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 CROSSES ABOVE ITS 200-DAY AVERAGE... Up to last night, the Dow Industrials were the only major stock index to trade above their 200-day average. The S&P 500 closed marginally above its 200-day line yesterday. Chart 2 shows the SPX extending that gain over its...

READ MORE

MEMBERS ONLY

DOLLAR INDEX MAY BE NEARING AN UPSIDE BREAKOUT -- SEVERAL FOREIGN CURRENCIES HAVE FAILED TESTS OF 200-DAY AVERAGES -- THE EURO MAY RETEST NOVEMBER LOW -- THE RISING DOLLAR WEAKENS COMMODITY PRICES -- ESPECIALLY BASE METALS AND ENERGY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX NEARS NEW HIGH... The recent upturn in the dollar is continuing today. The daily bars in Chart 1 show the Invesco U.S. Dollar Index Fund (UUP) jumping to the highest level in two months and nearing a challenge of its December high. A close above that chart...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE FAILING TEST OF 200-DAY MOVING AVERAGES -- THE DOW MAY ALSO SLIP BACK BELOW ITS RED LINE -- FALLING BOND YIELDS ARE BOOSTING UTILITIES AND OTHER DEFENSIVE SECTORS -- WHILE A RISING DOLLAR IS HURTING ENERGY AND MATERIAL STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

200-DAY MOVING AVERAGES CONTAIN THE RECENT RALLY... With stocks losing ground over the past two days, it looks like the 200-day averages that we've all been watching have managed to contain the 2019 rally. Chart 1 shows the S&P 500 pulling back from that red overhead...

READ MORE

MEMBERS ONLY

TESTING OF 200-DAY AVERAGES CONTINUES -- THE SPX AND QQQ ARE TESTING IT NOW -- XLI AND XLY ARE ALREADY ABOVE -- WHILE THE XLC IS STALLING AT ITS RED LINE -- TREASURY YIELDS AREN'T FOLLOWING STOCKS HIGHER WHICH GIVES MIXED MESSAGE ON INVESTOR CONFIDENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 AND NASDAQ ARE TESTING 200-DAY AVERAGES ... It seems that everyone is watching 200-day moving averages. That's because the strong rebound since the end of December has pushed major U.S. stock indexes back to that overhead resistance line. What they do there should help...

READ MORE

MEMBERS ONLY

WHAT TO MAKE OF THE 2019 REBOUND -- BEAR MARKET RALLY OR START OF A NEW UPLEG? -- OR PART OF A TOPPING PROCESS -- S&P 500 NEARS TEST OF 200-DAY AVERAGE AND MAYBE ITS DECEMBER HIGH -- WEEKLY CHARTS ALSO SHOW IMPROVEMENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 NEARS TEST OF 200-DAY MOVING AVERAGE... The daily bars in Chart 1 show the S&P 500 nearing a test of its 200-day moving average (red line). That's an important test for it and rest of the stock market. A strong stock market...

READ MORE

MEMBERS ONLY

Cyclicals and Biotechs are Trading Above Their 200-Day Lines

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, January 31st at 12:34pm ET.

Chart 4 shows the Consumer Discretionary SPDR (XLY) trading above its 200-day line in today's trading. That a positive sign for the economically-sensitive sector...

READ MORE

MEMBERS ONLY

STOCK RALLY CONTINUES -- DOW IS THE FIRST INDEX TO REACH ITS 200-DAY AVERAGE -- CYCLICALS AND BIOTECHS ARE TRADING ABOVE THEIR 200-DAY LINES -- BIG DROP IN BOND YIELDS BOOSTS STAPLES, UTILITIES, AND REITS -- LOWER YIELDS ARE HURTING BANK STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW IS THE FIRST TO REACH ITS 200-DAY AVERAGE... The stock rally that began right after Christmas is continuing today. Major stock indexes have been heading up to challenge potential overhead resistance at their 200-day moving averages. Chart 1 shows the Dow Industrials being the first major stock index...

READ MORE

MEMBERS ONLY

GOLD IS STARTING TO GAIN SOME UPSIDE ATTENTION -- SO ARE GOLD MINERS -- THAT MAY REFLECT EXPECTATIONS FOR A MORE DOVISH FED, A WEAKER DOLLAR, AND LOWER INTEREST RATES -- WEAKER GLOBAL STOCKS ALSO MAKE GOLD ASSETS A MORE ATTRACTIVE ALTERNATIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD ETFS ARE IN RALLY MODE ... Today is Fed day which could have an impact on several markets. The Fed isn't expected to raise its short-term rate today. But what it says after the meeting could have an impact. Two things are being watched very closely. The first...

READ MORE

MEMBERS ONLY

STOCK ADVANCE CONTINUES AS 50-DAY AVERAGES HOLD -- 200-DAY AVERAGES ARE NOW IN SIGHT -- EMERGING MARKETS ISHARES REACH SEVEN-MONTH HIGH AND ARE CHALLENGING 200-DAY AVERAGE -- CONSUMER DISCRETIONARY SPDR IS ALSO CHALLENGING ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR U.S. STOCK INDEXES HEAD TOWARD 200-DAY AVERAGES ... My Wednesday message expressed concern that several stock indexes were in danger of falling back below their 50-day averages, which would have put their January rebound in jeopardy. As today's first three charts show, however, the blue 50-day lines...

READ MORE

MEMBERS ONLY

XILINX LEADS SEMICONDUCTOR ISHARES TO THE HIGHEST LEVEL IN NEARLY TWO MONTHS -- LAM RESEARCH IS ALSO HAVING A VERY STRONG DAY -- INTEL CLEARS 200-DAY AVERAGE TO LEAD DOW HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR ISHARES TURN UP... My message from yesterday showed semiconductor stocks under selling pressure. In today's trading, however, semis are having a very strong day and are the day's strongest stock group. Chart 1 shows the PHLX Semiconductor iShares (SOXX) jumping 5% to reach the highest...

READ MORE

MEMBERS ONLY

SEVERAL STOCK INDEXES ARE TRYING TO STAY ABOVE MOVING AVERAGE LINES -- CYCLICALS AND BIOTECHS ARE STRUGGLING WITH 200-DAY LINES -- SO ARE EMERGING MARKET ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LOT OF MOVING AVERAGES ARE BEING TESTED... Recent messages have focused on major U.S stock indexes reaching overhead resistance barriers which could slow their January advance; or maybe even end it. All of those major stock indexes remain below their 200-day averages; while their 50-day lines remain below...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS DROP SHARPLY -- OVERBOUGHT S&P 500 BACKS OFF FROM TRENDLINE RESISTANCE -- WHILE AN OVERSOLD VIX INDEX BOUNCES OFF CHART SUPPORT -- TRADE AND ECONOMICALLY SENSITIVE STOCKS LEAD THE SELLING -- BIG DROP IN BOND YIELD BOOSTS BOND PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS SELL OFF WHILE BONDS RALLY... Stocks all over the world turned lower today. And they're doing it at a bad time. That's because the recent rebound has taken major U.S. stock indexes up to some formidable overhead resistance barriers. And they may be...

READ MORE

MEMBERS ONLY

January Stock Rebound Continues

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, January 18th at 11:01am ET.

All major U.S. stock indexes have exceeded their 50-day averages (blue lines). That still leaves their 200-day averages to contain the rally. But there are...

READ MORE

MEMBERS ONLY

JANUARY STOCK REBOUND CONTINUES -- STOCK INDEXES HAVE CLEARED THEIR 50-DAY MOVING AVERAGES -- OVERHEAD RESISTANCE LINES STILL HAVE TO BE TESTED -- INCLUDING THEIR 200-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR U.S. STOCK INDEXES NEAR TEST OF OVERHEAD RESISTANCE ... All major U.S. stock indexes have exceeded their 50-day averages (blue lines). That still leaves their 200-day averages to contain the rally. But there are a couple of other resistance lines that still need to be tested. Chart 1...

READ MORE

MEMBERS ONLY

FINANCIAL STOCKS LEAD MARKET HIGHER -- OVERSOLD READINGS SUPPORT A RALLY -- BUT THEIR MAJOR TREND IS STILL DOWN -- THE S&P 500 NEARS OVERHEAD RESISTANCE WHILE THE VIX TESTS SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR CLEARS 50-DAY AVERAGE ... After months of poor absolute and relative performance, financial stocks are starting to show some upside leadership. The daily bars in Chart 1 show the Financial Sector SPDR (XLF) gapping higher today and trading above its 50-day moving average (blue circle). That would be enough...

READ MORE

MEMBERS ONLY

RATIO ANALYSIS SHOWS A MAJOR SHIFT OUT OF STOCKS AND INTO BONDS -- ALL BOND CATEGORIES OUTPERFORMED STOCKS SINCE OCTOBER -- TREASURIES ARE DOING BETTER THAN INVESTMENT GRADE CORPORATES -- WHILE HIGH YIELD JUNK BONDS ARE THE WEAKEST BOND CATEGORY

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMPARISON OF TWO VANGUARD FUNDS SHOWS BONDS IN THE LEAD ... In good times when investors are confident about the economy, they usually favor stocks over bonds. One of the ways we can tell when investors are starting to lose confidence is when they start favoring bond holdings over stocks. And...

READ MORE