MEMBERS ONLY

STOCK INDEXES ARE RETESTING INTRA-DAY SUPPORT LEVELS FORMED ON TUESDAY -- THE REBOUND IN THE VIX IS MUCH WEAKER THAN ON TUESDAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ARE RETESTING TUESDAY'S INTRA-DAY LOWS... Stocks are falling sharply again today and are in the process of retesting intra-day support levels formed on Tuesday. That's an important test. The 10-minute bars in Chart 1 shows the Dow Industrials testing lows formed Tuesday between...

READ MORE

MEMBERS ONLY

BOND YIELDS CLIMB BACK NEAR RECENT HIGH -- A BOUNCING DOLLAR IS PUSHING COMMODITIES LOWER -- THE RUSSELL 2000 SMALL CAP INDEX IS BOUNCING OFF ITS 200-DAY MOVING AVERAGE -- THE S&P 500 SLIPS INTO THE RED NEAR THE CLOSE IN HEAVIER TRADING

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD NEARS ANOTHER FOUR-YEAR HIGH ... A plunging stock market earlier in the week caused some safe-haven bond buying which caused bond yields to weaken. Chart 1, however, shows the 10-Year Treasury yield climbing 7 basis points today and very close to another four-year high. The recent upside breakout...

READ MORE

MEMBERS ONLY

STOCKS ACHIEVE UPSIDE REVERSAL -- S&P 500 BOUNCES OFF TRENDLINE SUPPORT AND 100-DAY AVERAGE -- THE VIX REVERSES LOWER AFTER FAILING TO STAY OVER 40 LEVEL -- APPLE AND DOWDUPONT BOUNCE SHARPLY OFF 200-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 REBOUNDS OFF CHART SUPPORT... After opening sharply lower, stocks achieved an upside reversal on heavier volume than yesterday. And stocks bounced off a couple of important support levels. Yesterday's message showed a rising trendline extending back to late 2016 near the 2600 level. The...

READ MORE

MEMBERS ONLY

STOCKS HAVE WORST DAY IN YEARS -- 50-DAY AVERAGES HAVE BEEN BROKEN -- S&P 500 APPEARS HEADED FOR RETEST OF RISING TRENDLINE EXTENDING BACK TO 2016 -- VIX DOUBLES TO HIGHEST LEVEL IN MORE THAN TWO YEARS -- LATE RALLY IN MAJOR STOCK INDEXES FADES

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 FALLS BELOW 50-DAY AVERAGE... Stocks had a terrible day today. Major stock indexes in the U.S. lost about 4% in one day. And some chart damage was done. The daily bars in Chart 1 show the S&P 500 falling well below its 50-day...

READ MORE

MEMBERS ONLY

Bond Yields Climbing, Gaining on Stocks

by John Murphy,

Chief Technical Analyst, StockCharts.com

Bond yields are rising a lot faster than a lot of people expected. And that's starting to worry stock holders. The weekly bars in Chart 1 show the 30-Year Treasury Yield rising over 3.00% for the first time since last March and heading up for a challenge...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS ARE RATTLING STOCK HOLDERS -- TEN YEAR YIELD REACHES FOUR-YEAR HIGH -- BOND YIELDS ARE RISING FASTER THAN STOCKS FOR THE FIRST TIME SINCE THE BULL MARKET STARTED -- THE VIX INDEX SURGES TO FIFTEEN-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS ARE CLIMBING ... Bond yields are rising a lot faster than a lot of people expected. And that's starting to worry stock holders. The weekly bars in Chart 1 show the 30-Year Treasury Yield rising over 3.00% for the first time since last March and heading...

READ MORE

MEMBERS ONLY

AVERAGE DIRECTIONAL INDEX SHOWS AN OVERBOUGHT MARKET IN NEED OF A BREATHER -- THE LAST 5% PULLBACK IN STOCKS WAS FIFTEEN MONTHS AGO -- CONTRACTING BOLLINGER BANDS ALSO HINT AT SOME WEAKENING IN THE MARKET'S SHORT-TERM UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

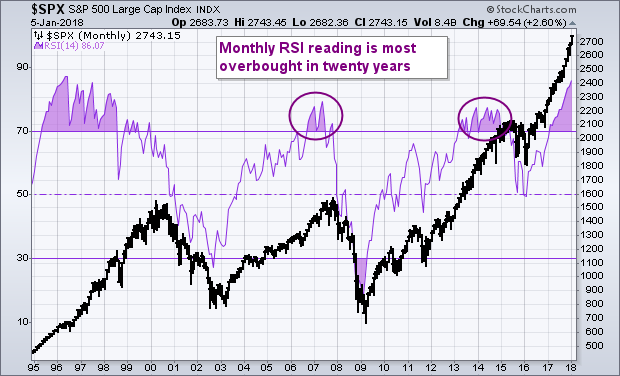

S&P 500 IS DUE FOR A PAUSE ... There are a number of ways to tell when a market is stretched too far. My January 6 message pointed out that the 14-month RSI for the S&P 500 was the most overbought since the late 1990s (twenty years...

READ MORE

MEMBERS ONLY

CRB COMMODITY INDEX ACHIEVES A BULLISH BREAKOUT BY REACHING A TWO-YEAR HIGH -- THAT HELPED PUSH THE TEN-YEAR TREASURY YIELD TO THE HIGHEST LEVEL IN THREE YEARS -- SO DID THE FACT THAT GERMAN AND AND BRITISH YIELDS TURNED UP THIS WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRB INDEX ACHIEVES BULLISH BREAKOUT ... A couple of messages during the week showed the Bloomberg Commodity Index nearing a two-year high. It broke through those highs during the week. Today's message shows the more widely-followed Reuters/Jefferies CRB Index accomplishing a bullish breakout of its own by rising...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR HITS NEW RECORD AND IS PLAYING CATCH-UP TO THE REST OF THE MARKET -- AMGEN AND BIOGEN LEAD BIOTECH ISHARES HIGHER -- ABBVIE EXPLODES TO NEW RECORD AND HELPS BOOST PHARMACEUTICAL ETF TO HIGHEST LEVEL IN TWO YEARS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SECTOR IS PLAYING CATCH-UP ... Healthcare stocks are off to a good start for the new year, and are one of the market's strongest sectors. That's a big change from the past three years when healthcare was one of the markets weakest laggards. That's...

READ MORE

MEMBERS ONLY

TREASURY SECRETARY TALKS DOWN THE DOLLAR WHICH DROPS SHARPLY -- BRITISH POUND SURGES AGAINST THE DOLLAR -- WHILE BRITISH BOND YIELD RISES TO HIGHEST LEVEL IN A YEAR -- BIG DROP IN DOLLAR PUSHES BLOOMBERG COMMODITY INDEX NEAR A TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BRITISH POUND RISES WITH UK BOND YIELDS ... It's now official that the U.S. government wants a weaker dollar. Speaking in Switzerland, Treasury Secretary Mnuchin stated that a weak dollar is good for the U.S. economy, and would help reduce the U.S. trade deficit. That'...

READ MORE

MEMBERS ONLY

FALLING DOLLAR PUSHES BLOOMBERG COMMODITY INDEX TO ELEVEN MONTH HIGH -- GOLD NEARS ANOTHER FOUR-MONTH HIGH -- A WEAK DOLLAR ALSO FAVORS LARGE CAPS OVER SMALLER STOCKS -- S&P BIOTECH SPDR REACHES NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

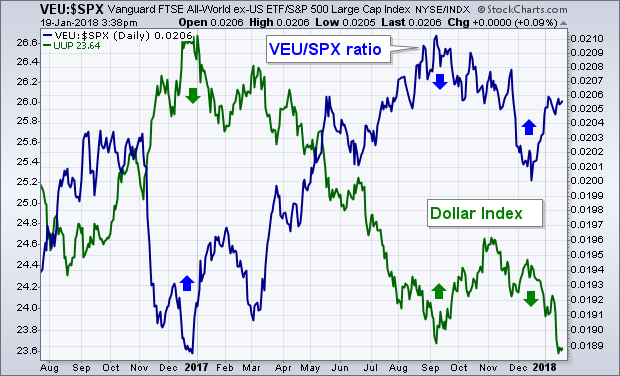

DOLLAR CONTINUES TO WEAKEN AS FOREIGN CURRENCIES RISE... Chart 1 shows the PowerShares Dollar Index (UUP) falling today to the lowest level in three years. The dollar is losing ground against virtually all major foreign currencies. Most of the upward movement in the UUP is coming from buying of the...

READ MORE

MEMBERS ONLY

Falling Dollar Favors Foreign Stocks, EU Stock ETFs Benefit From Stronger Currencies

by John Murphy,

Chief Technical Analyst, StockCharts.com

The direction of currency markets tells us a lot about the relative strength (or weakness) of global markets. As a rule, stronger economies have stronger currencies, while weaker economies have weaker currencies. As a result, the direction of the U.S. dollar tells us whether to favor U.S. stocks...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD TOUCHES THREE-YEAR HIGH -- STRONG CHINESE ECONOMY PUSHES MAINLAND STOCKS HIGHER -- HONG KONG HITS A NEW RECORD -- A WEAKER DOLLAR FAVORS FOREIGN STOCKS -- FOREIGN STOCK ETFS GET A BOOST FROM RISING LOCAL CURRENCIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR BOND YIELD TOUCHES THREE-YEAR HIGH ... The weekly bars in Chart 1 show the 10-Year Treasury Yield touching the highest level in three years today. A decisive close above its late 2016 peak (2.62%) would signal even higher rates. That's a lot better for stocks than it...

READ MORE

MEMBERS ONLY

STOCK BUYING RESUMES AFTER YESTERDAY'S PULLBACK -- DOW REGAINS 26K -- YESTERDAY'S INTRA-DAY LOW PROVIDES A SHORT-TERM SUPPORT LEVEL -- SEMICONDUCTORS LEAD TECHNOLOGY SECTOR TO NEW HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET INDEXES NEAR YESTERDAY'S INTRA-DAY HIGH ... Stocks are making a strong comeback after yesterday afternoon's pullback. The charts below show 30-minute price bars for the three major stock indexes. All three are approaching the intra-day highs reached yesterday. Chart 1 also shows the Dow Industrials back...

READ MORE

MEMBERS ONLY

EURO REACHES THREE-YEAR HIGH AGAINST DOLLAR -- THAT'S GOOD FOR COMMODITIES -- ENERGY SPDR BREAKS OUT TO THE UPSIDE -- DECEMBER CPI ABOVE 2% SECOND MONTH IN A ROW -- CORE CPI HAS BIGGEST JUMP IN 11 MONTHS -- WHAT ENERGY DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO REACHES THREE-YEAR HIGH ... Yesterday's message showed the euro on the verge of a new three-year high. The weekly bars in Chart 1 show the eurozone currency achieving that bullish breakout in today's trading. I also mentioned yesterday that a move above 1.20 would push...

READ MORE

MEMBERS ONLY

A TEN-YEAR TREASURY YIELD MOVE ABOVE 2.62% WOULD PAVE THE WAY FOR 3% YIELD LATER THIS YEAR -- THAT WOULD PUT THE THIRTY-FIVE YEAR DECLINE IN BOND YIELDS IN JEOPARDY -- GERMAN YIELD NEARS TWO-YEAR HIGH ON HAWKISH ECB HINT

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LONGER TERM LOOK AT RISING BOND YIELDS... Chart evidence of a major upturn in Treasury bond yields continues to grow. The weekly bars in Chart 1 show the 10-Year Treasury yield ($TNX) nearing a test of its late 2016 intra-day peak at 2.62%. A decisive move above that...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD JUMPS TO NINE MONTH HIGH -- BANK OF JAPAN CUTS BOND PURCHASES -- THAT'S BOOSTING BANKS WHILE HURTING UTILITIES -- A DRAMATIC ROTATION OUT OF UTILITIES INTO TRANSPORTS POINTS TO A STRONGER ECONOMY AND HIGHER RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD REACHES HIGHEST LEVEL SINCE MARCH ... Chart 1 shows the 10-Year Treasury Yield ($TNX) climbing 5 basis points to 2.53% which is the highest level since last March. That leaves little doubt that the trend for Treasury yields is upward. Part of the reason for today'...

READ MORE

MEMBERS ONLY

Global Stocks Start Year With a Bang, S&P 500 is Well Into a Five-Wave Advance

by John Murphy,

Chief Technical Analyst, StockCharts.com

Global stock markets started off the new year with a bang. U.S. stock indexes exploded to record highs for the best start in years. Foreign stock benchmarks did the same, including the FTSE All World Stock Index which also hit a new record. New records were set in North...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS START YEAR WITH A BANG WITH STOCKS AROUND THE WORLD HITTING NEW RECORDS -- BUT THE S&P 500 INDEX IS THE MOST OVERBOUGHT IN TWENTY YEARS -- AND IS WELL INTO A FIVE-WAVE ADVANCE -- THE CRB INDEX MAY BE NEARING AN UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS MOST OVERBOUGHT SINCE LATE 1990S... Global stock markets started off the new year with a bang. U.S. stock indexes exploded to record highs for the best start in years. Foreign stock benchmarks did the same, including the FTSE All World Stock Index which also...

READ MORE

MEMBERS ONLY

CRUDE OIL HITS ANOTHER HIGH AND NEARS TEST OF $62 -- UNITED STATES OIL FUND NEARS TEST OF SPRING 2016 HIGH -- ENERGY SPDR MAY ON THE VERGE OF A BULLISH BREAKOUT -- ENERGY/SPX RELATIVE STRENGTH RATIO REACHES HIGHEST LEVEL IN EIGHT MONTHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

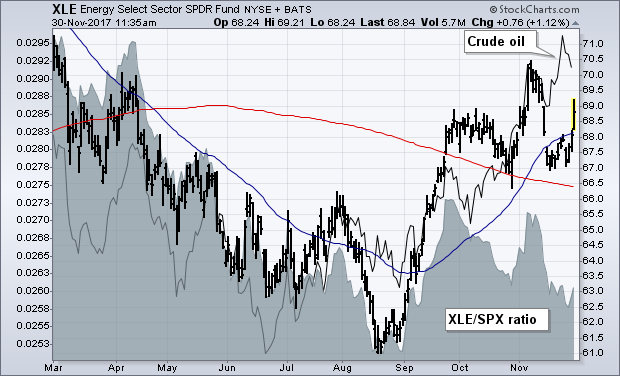

UNITED STATES OIL FUND NEARS UPSIDE BREAKOUT ... Energy prices continue to rise. WTIC Light Crude Oil is trading over $61 today for the first time more than two years and is nearing a test of its spring 2015 high just over $62. Chart 1 shows the United States Oil Fund...

READ MORE

MEMBERS ONLY

COMMODITIES ARE AT LOWEST LEVEL RELATIVE TO STOCKS IN HISTORY -- COMMODITIES HAVE A LOT OF CATCHING UP TO DO -- THAT PROCESS MAY BE BEGINNING -- CRB INDEX MAY BE NEARING UPSIDE BREAKOUT -- GLOBAL METALS AND MINING PRODUCERS ETF REACHES THREE-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES ARE HISTORICALLY VERY CHEAP VERSUS STOCKS... I suggested yesterday that commodity prices (and stocks tied to them) usually do better in the later stages of a business cycle as inflation pressures start to build. We may be entering that stage. One of the reasons why investors may be turning...

READ MORE

MEMBERS ONLY

WEAKER DOLLAR PUSHES COMMODITY PRICES HIGHER -- GOLD AND ITS MINERS CLIMB -- RISING ALUMINUM AND COPPER PRICES PUSH THEIR SHARES TO NEW HIGHS -- SOUTHERN COPPER HITS ALL-TIME HIGH -- RISING COMMODITIES MAY GIVE A BOOST TO CANADIAN STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. DOLLAR INDEX WEAKENS ... The U.S. dollar continues to weaken. Chart 1 shows the PowerShares US Dollar Index (UUP) falling today to the lowest level in a month. The dollar is down against all foreign developed currencies except the yen which is marginally lower. The biggest influence on...

READ MORE

MEMBERS ONLY

STOCKS HAVE ANOTHER UP WEEK BUT END QUIETLY -- - SURGE IN BOND YIELDS WAS WEEK'S BIGGEST STORY -- INFLATION-SENSITIVE STOCKS SURGED WHILE RATE-SENSITIVE STOCKS TUMBLED -- THAT SUGGESTS THERE MAY BE SOME HEDGING AGAINST FUTURE INFLATION GOING ON

by John Murphy,

Chief Technical Analyst, StockCharts.com

SANTA CLAUS RALLY STILL LIES AHEAD... The stock market experienced the second slowest trading day of the year on Friday as traders headed home for Christmas. All major stock indexes, however, hit new records during the week. The Russell 2000 Small Cap Index had the week's biggest percentage...

READ MORE

MEMBERS ONLY

DOW JONES HOME CONSTRUCTION INDEX REACHES ELEVEN YEAR HIGH BUT STILL LOOKS CHEAP ON A RELATIVE STRENGTH BASIS -- US HOME CONSTRUCTION ISHARES ARE HAVING A STRONGER YEAR THAN THE S&P HOMEBUILDER SPDR -- ENERGY SPDR HITS ELEVEN MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES HOME CONSTRUCTION INDEX REACHES ELEVEN-YEAR HIGH... Recent reports of strong home sales and home construction have boosted stocks tied to the housing sector. The low inventory of existing homes available for sale argues for even more homebuilding in the year ahead. All of which bodes well for the...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD CLIMBS TO NINE-MONTH HIGH -- LONG-TERM TREASURY BOND CHART LOOKS BEARISH -- RELATIVE STRENGTH ANALYSIS SHOWS RISING RATES HURTING UTILITIES AND REITS -- BUT BOOSTING FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD HITS NINE-MONTH HIGH ... Chart 1 shows the 10-Year Treasury yield climbing another 3 basis points today to the highest level since March (2.49%). That's most likely tied to the impending passage of the tax bill before Congress with expectations for faster economic growth and...

READ MORE

MEMBERS ONLY

10-YEAR BOND YIELD SURGES TO TWO-MONTH HIGH AND MAY BE ON VERGE OF UPSIDE BREAKOUT -- FOREIGN YIELDS ARE ALSO JUMPING -- THAT'S PUSHING BOND PRICES SHARPLY LOWER -- UTILITIES AND REITS ARE STARTING TO SHOW SERIOUS UNDERPERMANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD SURGES... The daily bars in Chart 1 show the 10-Year Treasury yield ($TNX) jumping 7 basis points today to the highest level in two months in one of the biggest daily gains this year. That puts the yield within striking distance of its late October intra-day peak...

READ MORE

MEMBERS ONLY

STEEL STOCKS LEAD MATERIALS TO NEW RECORD -- STEEL ETF NEARS FIVE-YEAR HIGH -- STEEL LEADERS INCLUDE NUCOR AND STEEL DYNAMICS -- S&P METALS AND MINING SPDR ACHIEVES BULLISH BREAKOUT -- STOCKS HAVE ANOTHER STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS SPDR HITS NEW RECORD ... In a strong market day, materials led stocks higher. Chart 1 shows the Materials Select SPDR (XLB) breaking out to a new record. The XLB has been finding support along its 50-day average. The XLB/SPX ratio (top of chart) has been lagging behing the...

READ MORE

MEMBERS ONLY

NASDAQ and Microsoft Hit New Records, Russell 2000 Ishares Bounce

by John Murphy,

Chief Technical Analyst, StockCharts.com

The Nasdaq finally joined the Dow and S&P 500 in record territory on Friday. Chart 1 shows the PowerShares QQQ exceeding its November peak at week's end, and in heavy trading. The QQQ is based on the Nasdaq 100 index which includes the 100 largest non-financial...

READ MORE

MEMBERS ONLY

TECHNOLOGY IS WEEK'S STRONGEST SECTOR AND HITS NEW HIGH -- SO DOES THE NASDAQ 100 -- MICROSOFT WAS ONE OF THE BIG REASONS WHY -- RUSSELL 2000 ISHARES BOUNCE OFF 50-DAY AVERAGE -- SMALL CAPS SHOULD BENEFIT FROM TAX CUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY HAS A STRONG WEEK... After leading the market higher for most of the year, technology stocks saw some profit-taking near the end of November, and have lagged behind the rest of the market since then. This week, however, technology was the market's strongest sector. And that was...

READ MORE

MEMBERS ONLY

DISNEY AND FOX SURGE TOGETHER -- TIFFANY BREAKS OUT WHILE NIKE CONTINUES TO RUN -- DELTA AND SOUTHWEST CLIMB TO NEW HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DISNEY AND FOX SURGE ... The announcement that Walt Disney was buying $66 billion worth of assets from Fox sent both stocks surging today. And they helped make cyclical stocks the day's biggest gainer. Chart 1 shows Disney (DIS) surging more than 3% to the highest closing level since...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS BOOSTS FINANCIAL STOCKS -- FINANCIAL SPDR LEADS MARKET HIGHER -- GOLDMAN SACHS SETS A NEW RECORD -- VERIZON SURGE LEADS TELECOM HIGHER -- AT&T CLEARS ITS 200-DAY AVERAGE -- EDISON INTL WEIGHS ON UTILITY SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELD IS CLIMBING... The daily bars in Chart 1 show the 10-Year Treasury Yield climbing 2 basis points to 2.40%. The 5-year Treasury Yield (not shown) has climbed to the highest level in six years. Today's strong PPI report may have something to do with that....

READ MORE

MEMBERS ONLY

INDUSTRIAL SECTOR CONTINUES TO SHOW NEW LEADERSHIP -- DOW JONES HEAVY CONSTRUCTION INDEX MAY BE NEARING UPSIDE BREAKOUT -- QUANTA SERVICES AND JACOBS ENGINEERING HAVE ALREADY BROKEN OUT -- AMONG RETAILERS, BEST BUY HITS A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SECTOR CONTINUES NEW LEADERSHIP ROLE... Industrial stocks assumed a new market leadership role during November and remained in that role again this week. Chart 1 shows the Industrial Sector SPDR (XLI) gaining 1.4% during the week which made it second only to the financial sector's gain...

READ MORE

MEMBERS ONLY

EMERGING MARKETS ISHARES FALL TO TWO-MONTH LOW -- MOST OF THE SELLING IS COMING FROM ASIA, AND TAIWAN IN PARTICULAR -- SELLING IN TAIWAN SEMICONDUCTOR IS THE MAIN REASON WHY -- SEMICONDUCTOR ETFS HAVE SLIPPED BELOW THEIR 50-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKETS ISHARES FALL TO TWO-MONTH LOW... The recent rotation out of technology stocks may be taking a toll on emerging markets which are heavily exposed to that sector. Chart 1 shows Emerging Markets iShares (EEM) falling below its 50-day average to the lowest level in two months. And it&...

READ MORE

MEMBERS ONLY

MONEY CONTINUES TO ROTATE OUT OF TECHNOLOGY AND INTO BANKS, RETAILERS, ENERGY AND TRANSPORTS -- FAANG STOCKS AND SEMICONDUCTORS WEIGH ON TECHNOLOGY SECTOR -- S&P 500 VALUE ISHARES ARE OUTPERFORMING GROWTH ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHEAPER STOCKS ARE GAINING ... The rotation into cheaper undervalued stocks that started last week is continuing today on the back of the weekend passage of the tax reform package. The relative strength lines in Chart 1 show the past week's leaders to be banks (blue line), retailers (red...

READ MORE

MEMBERS ONLY

Energy Shares Are Bouncing on Optimism Over OPEC Agreement

by John Murphy,

Chief Technical Analyst, StockCharts.com

Energy shares are finally showing some bounce. The daily bars in the chart below shows the Energy Sector SPDR (XLE) climbing above its 50-day average today. The XLE is bouncing off chart support along its late October low and its 200-day moving average. Those are logical chart points for the...

READ MORE

MEMBERS ONLY

ENERGY SHARES ARE BOUNCING ON OPTIMISM OVER OPEC AGREEMENT -- EXXON MOBIL MAY BE ON THE VERGE OF A BULLISH BREAKOUT -- CHEVRON IS NEARING A NEW RECORD HIGH -- ENERGY SHARES MAY START TO BENEFIT FROM RECENT BUYING OF CHEAP STOCK GROUPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY SHARES REBOUND ... Energy shares are finally showing some bounce. The daily bars in Chart 1 shows the Energy Sector SPDR (XLE) climbing above its 50-day average today. The XLE is bouncing off chart support along its late October low and its 200-day moving average. Those are logical chart points...

READ MORE

MEMBERS ONLY

RETAIL SPDR ACHIEVES BULLISH BREAKOUT -- TODAY'S RETAIL LEADERS INCLUDE NORDSTROM, KOHLS, AND TJX -- TRANSPORTATION AVERAGE RISES SHARPLY -- AIRLINES AND DELIVERY SERVICE STOCKS ARE HAVING A STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P RETAIL SPDR BREAKS OUT TO THE UPSIDE... My Monday message showed the S&P Retail SPDR (XRT) attempting an upside breakout above its October high. Chart 1 shows the XRT accomplishing that in pretty decisive fashion over the last two days. In fact, retailers have been...

READ MORE

MEMBERS ONLY

FINANCIAL SPDR IS FINDING SUPPORT AT 50-DAY AVERAGE -- S&P BANK SPDR IS ALSO TRADING ABOVE ITS 50-DAY LINE -- BANK LEADERS INCLUDE J.P. MORGAN CHASE, REGIONS FINANCIAL, AND ZIONS BANCORP -- INSURERS ARE ALSO HAVING A STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR CONTINUES TO BOUNCE OFF 50-DAY AVERAGE... My message from last Wednesday showed the Financial Sector SPDR (XLF) starting to bounce off its 50-day moving average. Chart 1 shows that the XLF continues to find support at its 50-day line. That's an encouraging sign. The gray area...

READ MORE

MEMBERS ONLY

RETAIL SPDR CHALLENGES OCTOBER HIGH -- ITS LONGER RANGE CHART SUGGESTS BASING ACTIVITY -- APPAREL RETAILERS HAVE TURNED UP -- LEADERS INCLUDE BURLINGTON STORES, GAP, AND URBAN OUTFITTERS -- INVESTORS ARE BUYING TIPS AS A HEDGE AGAINST RISING INFLATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 RETAIL SPDR ATTEMPTS UPSIDE BREAKOUT ... Retail stocks may have a strong holiday season after all. Chart 1 shows the S&P 500 Retail SPDR (XRT) trying to clear its early October high near 42. That would put it at the highest level in six months....

READ MORE

MEMBERS ONLY

SEVERAL UNUSUAL FACTORS ARE CONTRIBUTING TO THE FLATTENING YIELD CURVE -- LOW INFLATION IS HELPING KEEP BOND YIELDS DOWN -- SO IS THE FACT THAT FOREIGN BOND YIELDS ARE MUCH LOWER THAN TREASURIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

YIELD CURVE FALLS TO LOWEST LEVEL IN A DECADE ... I've been reading a lot about the yield curve falling to the lowest level since 2007 and the potential warning that carries. The green bars in Chart 1 plot the spread between 10-year and 2-year Treasury yields (the yield...

READ MORE