MEMBERS ONLY

RUSSELL 2000 FINDS SUPPORT AT 200-DAY AVERAGE -- SO HAVE THE DOW TRANSPORTS -- TWO-YEAR COPPER HIGH BOOSTS COPPER MINER ETF -- FREEPORT MCMORAN IS BIGGEST PERCENTAGE GAINER IN THE S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHY IT'S IMPORTANT TO TRACK THE PERFORMANCE OF SMALLER STOCKS... One of the concerns expressed recently by several technical analysts (including myself) has been the relatively weak performance by small stocks. That's because they often tell us more about the true state of the stock market...

READ MORE

MEMBERS ONLY

HOME IMPROVEMENT STOCKS LEAD CYCLICALS LOWER -- AMAZON HAS ALSO WEAKENED -- CONSUMER DISCRETIONARY SPDR IS UNDERPERFORMING THE MARKET -- IT'S ALSO UNDERPERFORMING CONSUMER STAPLES WHICH ARE GAINING GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOME DEPOT AND LOWES TUMBLE... Heavy selling in retail stocks is weighing on cyclical stocks which are the one of the day's weakest sectors. Home improvement stocks are the day's weakest group in that sector. Chart 1 shows Home Depot (HD) losing nearly -3% and falling...

READ MORE

MEMBERS ONLY

VOLATILITY SPIKES AS MARKET SELLOFF CONTINUES -- VIX INDEX CLIMBS TO THREE-MONTH HIGH AND PLAYS CATCH-UP TO RISING NASDAQ 100 VOLATILITY INDEX -- MAJOR AVERAGES LOSE MORE GROUND -- THE S&P 500 AND NASDAQ 100 DROP TOWARD 50-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL AND MID SIZE STOCK INDEXES BREAK SUPPORT... Yesterday's message showed small and midcap stock indexes testing support at their July lows, and warned that any further weakness would be bad for them and the rest of the market. Both indexes have broken support levels and are now...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS TRADE LOWER ON HEIGHTENED TENSIONS -- MACD LINES FOR S&P 500 TURN NEGATIVE -- SMALL AND MIDSIZE STOCKS ARE DAY'S BIGGEST LOSERS -- VIX INDEX GAINS 8% -- RECENT GAINS IN THE NASDAQ 100 VOLATILITY INDEX ARE OF MORE CONCERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 PULLS BACK ... Global stocks are in the red today, which continues the profit-taking that started yesterday afternoon. Yesterday's downside reversal day in U.S. stock indexes on rising volume signaled the likelihood of more profit-taking. Foreign stocks in Europe and Asia are falling more...

READ MORE

MEMBERS ONLY

Friday's Strong Job Report May Not Be As Strong As It Looks

by John Murphy,

Chief Technical Analyst, StockCharts.com

IS THIS THE REAL UNEMPLOYMENT RATE? ... Friday's job report saw 209,000 new jobs added during July which was well above expectations. Hourly earnings also saw a July again of 0.3% which attracted the most attention. That, however, leaves the year over year rise in wages at...

READ MORE

MEMBERS ONLY

STOCKS END THE WEEK ON A STRONG NOTE WITH THE DOW STILL IN THE LEAD -- SMALL CAPS REBOUND AS TRANSPORTS HOLD 200-DAY LINE -- JUMP IN BOND YIELDS KEEPS FINANCIALS IN THE LEAD -- OVERSOLD DOLLAR BOUNCES OFF MAJOR CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW HITS NEW RECORD WHILE NASDAQ HOLDS BACK ... The Dow Industrials continue to lead the market higher. Chart 1 shows the Dow ending the week at a new record. Its weekly gain of 1.2% led all other market indexes. Its 14-day RSI line, however, shows the Dow now in...

READ MORE

MEMBERS ONLY

AFTER FALLING DURING THE FIRST HALF OF THE YEAR, CRUDE OIL AND GASOLINE PRICES ROSE DURING JULY -- THAT SHOULD BOOST INFLATION NUMBERS FOR THAT MONTH -- THE FED SHOULD LIKE THAT

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY PRICES ROSE DURING JULY... A report on Tuesday covered economic conditions during the second quarter. One of the things it showed was continuing low inflation, which remains well below the Fed's target of 2%. One of the factors mentioned was falling energy prices. Naturally, the media reported...

READ MORE

MEMBERS ONLY

A FEW CRACKS ARE SHOWING IN THE STOCK UPTREND -- THE FIRST ONE IS DOW OUTPERFORMANCE -- THE SECOND IS TRANSPORTATION SELLING -- A THIRD IS SMALL CAP WEAKNESS -- AND STOCKS HAVE ENTERED A SEASONALLY A WEAK PERIOD BEWEEN AUGUST AND SEPTEMBER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW OUTPERFORMANCE MAY NOT BE A SIGN OF MARKET STRENGTH... It seems everyone in the media has been transfixed on the Dow Industrials hitting 22K this week. And they cite that as proof that the stock rally is alive and well. That recent Dow strength, however, is coming from a...

READ MORE

MEMBERS ONLY

FALLING DOLLAR IS BOOSTING COMMODITIES -- THAT'S POTENTIALLY INFLATIONARY -- WHILE A RISING EURO IS HOLDING EUROZONE INFLATION DOWN -- A STRONGER EURO IS STARTING TO WEIGH ON EUROPEAN STOCKS -- A LOOK AT GOLD IN DIFFERENT CURRENCIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CURRENCIES HAVE AN IMPACT ON INFLATION RATES... Persistently low inflation is worrying central bankers around the globe. Even the Fed has expressed more concern of late. Central bankers in Australia, Canada, Europe, and Japan have also mentioned low inflation as restraining them from abandoning their ultra-loose monetary policies. So far,...

READ MORE

MEMBERS ONLY

TRANSPORTS AND TECHS ARE HAVING A BAD DAY -- AIRLINES ARE DOWN 4% -- UPS IS ALSO HAVE A BAD DAY -- NASDAQ 100 IS SUFFERING DOWNSIDE REVERSAL ON SELLING OF BIG TECH STOCKS -- THAT INCLUDES APPLE AND GOOGLE -- SEMICONDUCTORS ARE ALSO TURNING SHARPLY LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTATION ISHARES FALL BELOW 50-DAY LINE... After hitting a new record earlier in the month, transportation stocks are being sold pretty hard today . Chart 1 shows the Transportation Average iShares (IYT) plunging 3% to the lowest level in nearly two months. The IYT has also fallen back below its 50-day...

READ MORE

MEMBERS ONLY

U.S. DOLLAR INDEX IS NEARING POTENTIAL MAJOR SUPPORT NEAR 2016 LOWS -- ELLIOTT WAVE ANALYSIS SUGGESTS DOLLAR UPTREND IS INCOMPLETE AND MAY HAVE FURTHER TO RUN -- THAT WOULD CALL INTO QUESTION A LOT OF CURRENT INTERMARKET TRENDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LOT IS RIDING ON DOLLAR DIRECTION... After hitting a 14-year high at the end of 2016, the U.S. Dollar Index has lost 8% during 2017. A lot of that slide came from disappointment in the so-called Trump reflation trade which was supposed to boost the U.S. economy,...

READ MORE

MEMBERS ONLY

BOND YIELDS MAY BE BOTTOMING -- RISING OIL AND METAL PRICES MAY ALSO BE BOOSTING YIELDS -- COPPER STOCKS LEAD RALLY IN MINERS -- RISING BOND YIELDS ARE BOOSTING BANKS AND OTHER FINANCIAL STOCKS -- RISING YIELDS MAY BE HURTING TECHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS MAY BE BOTTOMING... Bond yields are jumping today. Their chart patterns also suggest that yields may be bottoming. Chart 1 shows the 10-Year US Treasury YIeld ($TNX) jumping 6 basis points today to push it back above its (red) 200-day average. The trendline drawn over its May/July...

READ MORE

MEMBERS ONLY

WEAK DOLLAR HELPS BOOST EMERGING MARKETS -- EM CURRENCIES AND STOCKS ARE RISING TOGETHER -- THIS ISN'T A COMMODITY STORY -- IT'S A TECHNOLOGY ONE -- TECHNOLOGY STOCKS IN ASIA ARE DRIVING THE EM RALLY -- FALLING TREASURY YIELDS ARE ALSO HELPING

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING DOLLAR BOOSTS EMERGING MARKET CURRENCIES... One of my recent messages explained that a weak dollar was contributing to money flows into foreign markets. That's because American investors get the dual benefit of rising foreign currencies as well as stocks. That's been especially true in emerging...

READ MORE

MEMBERS ONLY

STRONG ECONONIC NEWS IN CHINA BOOSTS BASE METALS -- MINING ETFS ARE HAVING A STRONG DAY -- SO ARE IRON ORE MINERS BHP BILLITON AND RIO TINTO -- CHINA MAY IMPORT MORE AGRICULTURAL COMMODITIES TO OFFSET SHORTAGES -- HIGHER FOOD PRICES MAY BE IN THE PIPELINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE ECONOMY EXCEEDS EXPECTATIONS... China's economy grew by 6.9% during the second quarter which exceeded market expectations. That's one of the explanations behind today's jump in industrial metals like copper, iron ore, and zinc. Mining stocks that produce those commodities are also having...

READ MORE

MEMBERS ONLY

Bond Yields Drop, Falling Rates Boost Technology Stocks

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS DROP ON LACK OF INFLATION ... June's CPI report showed no change from the previous month, reflecting the absence of inflation. Its annual gain of 1.6% was the smallest since last October. Excluding food and energy, the core CPI saw a modest monthly bounce of 0....

READ MORE

MEMBERS ONLY

ANOTHER WEAK CPI REPORT BOOSTS BONDS AND STOCKS -- BOND YIELDS DROP ON EXPECTATIONS FOR LESS AGGRESSIVE FED -- RISING BOND YIELDS CAN BE BAD FOR TECHNOLOGY STOCKS -- FALLING DOLLAR REDUCES NEED TO HEDGE FOREIGN CURRENCY RISKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS DROP ON LACK OF INFLATION ... June's CPI report showed no change from the previous month, reflecting the absence of inflation. Its annual gain of 1.6% was the smallest since last October. Excluding food and energy, the core CPI saw a modest monthly bounce of 0....

READ MORE

MEMBERS ONLY

CANADA RATE HIKE BOOSTS CURRENCY BUT WEAKENS STOCKS WHICH ARE WEAKEST IN G7 -- HIGHER COMMODITIES PRICES COULD HELP -- LIVESTOCK PRICES ARE RISING -- DROUGHT IN THE MIDWEST AND RAIN IN GERMANY BOOST GLOBAL WHEAT PRICES -- FOOD AND SERVICES BOOST JUNE PPI

by John Murphy,

Chief Technical Analyst, StockCharts.com

CANADA RATE HIKE BOOSTS THE LOONIE... Canada warned that it was about to hike rates, and did it yesterday for the first time in seven years. The Bank of Canada raised its short-term policy rate 25 basis points to 0.75%. That's still below the rate of 1....

READ MORE

MEMBERS ONLY

BONDS AND STOCKS LIKE DOVISH SOUNDING FED -- LOW INFLATION IS KEEPING THE FED CAUTIOUS -- A WEAKER DOLLAR MAY BE HELPING COMMODITIES -- LONG-TERM CHARTS SUGGEST THAT COMMODITIES MAY BE BOTTOMING -- DROUGHT CONDITIONS BOOST GRAIN PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING DOLLAR MAY GIVE FED A HAND... Bonds and stocks are reacting very positively to written comments by Janet Yellen before Congress today. Her comments are being interpreted as being more dovish than anticipated, owing mainly to Fed concerns about persistently low inflation. It's hard for the Fed...

READ MORE

MEMBERS ONLY

DESPITE FRIDAY'S STOCK BOUNCE, TECHNICAL INDICATORS SIGNAL CAUTION -- THE S&P 500 HASN'T HAD A 5% CORRECTION IN MORE THAN A YEAR AND APPEARS OVERDUE FOR ONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUGUST AND SEPTEMBER ARE USUALLY WEAKER MONTHS... I've made references to seasonal patterns in some recent messages. I'm referring mainly to monthly seasonal patterns. Chart 1 plots the percent of months the S&P 500 closed higher over the last ten years. Average percentage gains...

READ MORE

MEMBERS ONLY

BOND YIELDS JUMP AGAIN IN EUROPE WHICH IS PRESSURING BONDS AND STOCKS -- TECHNOLOGY SECTOR REMAINS BELOW 50-DAY AVERAGE -- S&P 500 IS IN DANGER OF SLIPPING BELOW ITS 50-DAY LNE -- NASDAQ VOLATILITY REACHES EIGHT-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

GERMAN 10-YEAR BUND YIELD REACHES 18-MONTH HIGH ... The jump in European bond yields that started last Tuesday is continuing. A weak French auction of 30-year bonds caused bond prices in Europe to fall sharply which pushed yields higher. Ten-Year French and German yields jumped 10 and 9 basis points respectively....

READ MORE

MEMBERS ONLY

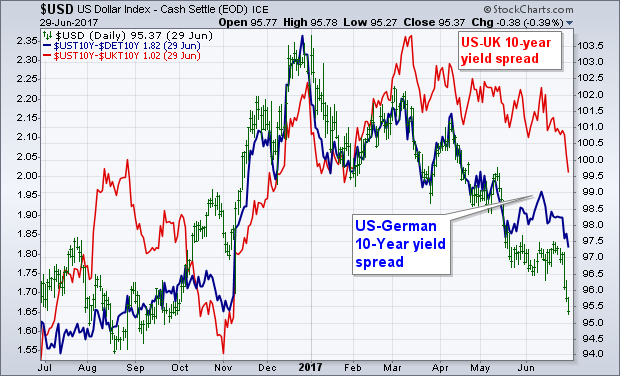

Narrowing Spread Between Treasuries and Foreign Yields Are Bad For the Dollar

by John Murphy,

Chief Technical Analyst, StockCharts.com

The U.S. Dollar has had a bad six months. And things got even worse this week. The driving force between currencies is the relationship between global interest rates. The 10-Year Treasury yield remains higher than foreign developed yields. The problem is that the difference between them is narrowing. The...

READ MORE

MEMBERS ONLY

NARROWING SPREAD BETWEEN TREASURIES AND FOREIGN YIELDS ARE BAD FOR THE DOLLAR -- A STUDY OF QE IMPACT ON DOLLAR DIRECTION -- FALLING DOLLAR MAY HELP STABILIZE COMMODITY PRICES -- BASE METALS HAD A STRONG WEEK -- OIL SERVICE STOCKS ALSO BOUNCED

by John Murphy,

Chief Technical Analyst, StockCharts.com

NARROWING SPREAD BETWEEN GLOBAL YIELDS HURTS THE DOLLAR... The U.S. Dollar has had a bad six months. And things got even worse this week. The driving force between currencies is the relationship between global interest rates. The 10-Year Treasury yield remains higher than foreign developed yields. The problem is...

READ MORE

MEMBERS ONLY

TECH SELLOFF RESUMES WHILE FINANCIALS GAIN -- THAT CONTINUES THE ROTATION OUT OF GROWTH AND INTO VALUE STOCKS THAT STARTED ON JUNE 9 -- TECH SPDR UNDERCUTS 50-DAY AVERAGE -- BANKS GAINED ON STRESS TEST RESULTS AND RISING BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECH SECTOR UNDERCUTS 50-DAY AVERAGE...STRESS TEST BOOSTS BANKS... Everyone in the media is suddenly talking about a rotation out of technology-dominated growth stocks into value stocks led by financials, healthcare, and (to a lesser extent) energy shares. We wrote about that on the day it started (June 9): "...

READ MORE

MEMBERS ONLY

GERMAN AND UK BOND YIELDS ARE JUMPING -- THAT'S BOOSTING FOREIGN CURRENCIES AND WEAKENING THE DOLLAR -- DOLLAR WEAKNESS SUPPORTS ROTATION INTO FOREIGN STOCKS -- RISING CANADIAN DOLLAR FAVORS CANADA ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TODAY IT'S THE BRITS TURNING HAWKISH... Yesterday it was hawkish comments from Mario Draghi that pushed eurozone bond yields sharply higher, and the rest of the world with them. Today it's hawkish comments by Mark Carney that the Brits may have to raise rates soon. Rising...

READ MORE

MEMBERS ONLY

TREASURY YIELDS FOLLOW EUROPE HIGHER -- THAT'S HELPING FINANCIAL STOCKS -- LEADERS INCLUDE JP MORGAN, SCHWAB, AND METLIFE -- TECHNOLOGY SELLING RESUMES -- SEMIS ARE ALSO FALLING -- THAT'S STARTING TO TAKE A TOLL ON THE S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD HAS A STRONG DAY ... For the first time in weeks, bond yields are climbing. Chart 1 shows the 10-Year Treasury Yield climbing 7 basis points to the highest level in two weeks. A lot of that is following even bigger gains in Europe. French and German 10-year...

READ MORE

MEMBERS ONLY

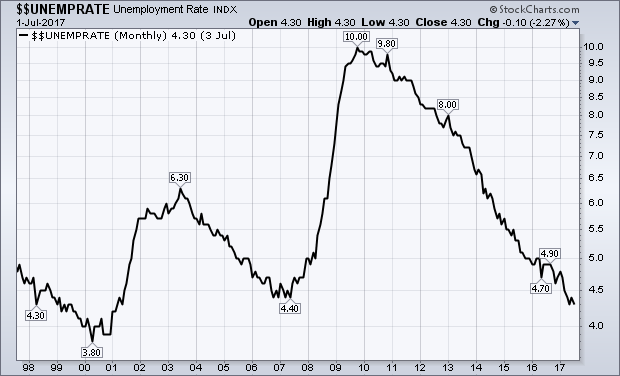

AN EVEN LONGER-TERM COMPARISON OF THE LINK BETWEEN CRB INDEX AND CPI -- THE PAST TWO EXPERIENCES OF FULL EMPLOYMENT ALSO SAW RISING RISING OIL PRICES -- THIS TIME MAY BE DIFFERENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG TERM COMPARISON OF CPI AND COMMODITIES... I wrote a message over the weekend examining the impact that full employment and commodity prices have had on CPI inflation. At the risk of overdoing it, I'd like to finish that article with two more charts. I made the bold...

READ MORE

MEMBERS ONLY

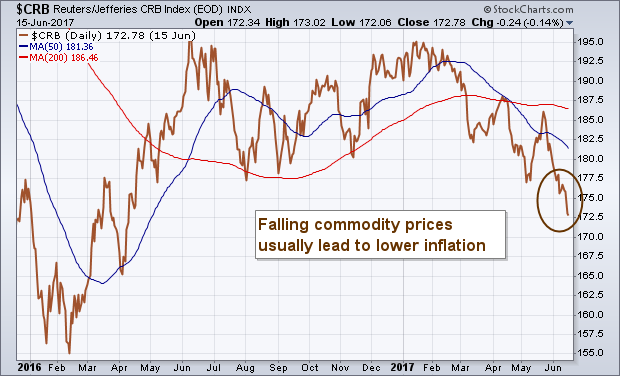

STUDYING HISTORY TO MEASURE THE IMPACT OF FULL EMPLOYMENT AND COMMODITY PRICES ON CPI INFLATION -- THE FED IS BANKING ON FULL EMPLOYMENT TO BOOST INFLATION -- BUT THAT'S UNLIKELY AS LONG AS COMMODITY PRICES ARE FALLING

by John Murphy,

Chief Technical Analyst, StockCharts.com

A HISTORICAL COMPARISON... A big debate is going on regarding the path of inflation. Inflation figures have slipped during the second quarter. So have commodity prices. Normally, falling commodity prices signal lower inflation. Fed economists argue that the current low unemployment rate should boost inflation. The Fed generally defines "...

READ MORE

MEMBERS ONLY

FALLING ENERGY PRICES ARE AFFECTING BOND RELATIONSHIPS -- LONGER MATURITIES ARE RISING FASTER -- AND INFLATION PROTECTED BONDS ARE LAGGING BEHIND -- ENERGY RELATED HIGH YIELD BONDS ARE ALSO WEIGHING ON THAT SECTOR -- CRUDE OIL IS TESTING NOVEMBER LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONGER MATURITY BONDS ARE RISING FASTER ... We can often get clues about market sentiment by comparing different parts of the fixed income universe. A lot has been written about the falling yield curve, which plots the difference between 10-Year and 2-Year Treasury yields. That usually signals expectations for lower inflation....

READ MORE

MEMBERS ONLY

HEALTHCARE IS YEAR'S SECOND STRONGEST SECTOR -- IT ALSO OFFERS GREAT VALUE -- THE BEST HEALTHCARE VALUE NOW LIES WITH BIOTECHS AND PHARMA -- BIOTECH ISHARES ARE BREAKING OUT TO UPSIDE -- PHARMACEUTICAL ISHARES SHOULD BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE IS GETTING A LOT STRONGER ... I continue to believe that healthcare is one of the best values in the stock market. And it's attracting a lot of investor attention. Chart 1 shows the Health Care SPDR (XLV) trading at a new record high after clearing its mid-2015...

READ MORE

MEMBERS ONLY

WHILE TECHNOLOGY HAS SLIPPED, FINANCIALS AND HEALTHCARE HAVE BECOME MARKET LEADERS -- HEALTHCARE SPDR HITS RECORD HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY IS NOT THE STRONGEST SECTOR ... Although a rebound in technology is getting the most attention, it's not the main reason that stock indexes are hitting new highs. Most of that credit goes to financials and healthcare. The daily bars in Chart 1 show the Technology SPDR (XLK)...

READ MORE

MEMBERS ONLY

Falling Commodity Prices Are a Big Reason Why Inflation Is So Low

by John Murphy,

Chief Technical Analyst, StockCharts.com

Ever since Wednesday's Fed rate hike, and the press conference by Janet Yellen, I've been thinking a lot about inflation. I believe the Fed is underestimating how weak inflation really is. I also believe that's because it's looking in the wrong places....

READ MORE

MEMBERS ONLY

FALLING COMMODITY PRICES ARE A BIG REASON WHY INFLATION IS SO LOW -- CRB INDEX FALLS TO LOWEST LEVEL IN MORE THAN A YEAR -- FALLING COMMODITY PRICES ARE HELPING PULL YIELD CURVE LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRB INDEX IS TRADING AT LOWEST LEVEL IN MORE THAN A YEAR... Ever since Wednesday's Fed rate hike, and the press conference by Janet Yellen, I've been thinking a lot about inflation. I believe the Fed is underestimating how weak inflation really is. I also believe...

READ MORE

MEMBERS ONLY

TREASURY YIELDS FALL BELOW 200-DAY AVERAGE ON WEAK INFLATION NUMBERS -- CRUDE OIL FALLS TO LOWEST LEVEL IN A YEAR -- LOWER FOREIGN BOND YIELDS ARE ALSO WEIGHING ON TREASURY YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD FALLS BELOW 200-DAY AVERAGE... Expectations are for another Fed rate hike this afternoon. Bond yields, however, are falling sharply. Chart 1 shows the 10-Year Treasury Yield ($TNX) falling 9 basis points to the lowest level since last November. The yield has also slipped below its 200-day average...

READ MORE

MEMBERS ONLY

INVESTORS ARE SELLING TECHNOLOGY AND BUYING FINANCIALS -- THAT SUGGESTS A ROTATION OUT OF GROWTH AND INTO VALUE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEAVY PROFIT-TAKING IN TECHNOLOGY... An overbought technology sector is being sold heavily today. Chart 1 shows the PowerShares Nasdaq 100 (QQQ) tumbling in heavy trading. That's mainly big technology stocks. Chart 2 shows the Technology SPDR (XLK) looking just as bad. The FANG stocks are a big part...

READ MORE

MEMBERS ONLY

FINANCIALS HAVE A STRONG DAY -- BANK AND BROKER ETFS TURN UP -- ASSET MANAGERS INDEX HITS NEW RECORD -- LEADERS INCLUDE BLACKROCK, STATE STREET, AND BANK OF NEW YORK MELLON -- FINANCIAL RALLY MAY ALSO EXPLAIN SMALL CAP BUYING

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR TURNS SHARPLY HIGHER... Financial stocks are having a very strong day. Chart 1 shows the Financial Sector SPDR (XLF) surging to the highest level in a month and, in the process, clearing its 50-day average. That puts the XLF in position to challenge its spring highs. A decisive...

READ MORE

MEMBERS ONLY

AIRLINES ARE LEADING TRANSPORTATION STOCKS HIGHER -- AIRLINE INDEX HITS RECORD HIGH -- DAY'S LEADERS ARE ALASKA AIR, DELTA, AMERICAN AIRLINES, AND JETBLUE -- FEDEX ACHIEVES BULLISH BREAKOUT -- KANSAS CITY SOUTHERN MAY BE CLOSE TO ONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS CONTINUE TO GAIN... The daily bars in Chart 1 show the Dow Jones Transportation Average reversing higher today to continue its recent upturn. After finding support at its 200-day average during May, the TRAN rose above a three-month resistance line last week to signal its takeoff. It now appears...

READ MORE

MEMBERS ONLY

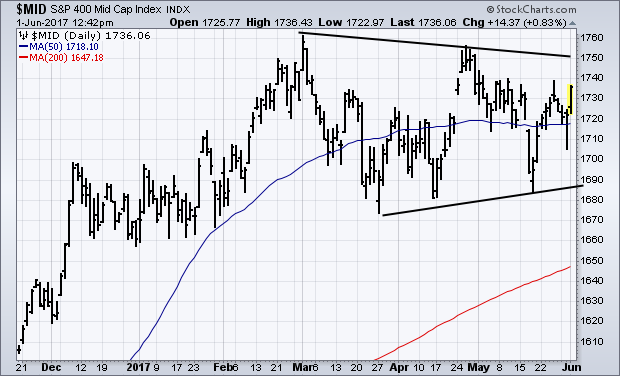

Midcaps May Show Truer Picture of US Stocks

by John Murphy,

Chief Technical Analyst, StockCharts.com

Several of my recent messages have focused on the divergence between large and small cap stocks. Wednesday's message suggested that part of that divergence was due to stronger foreign markets. Large cap multinationals do better when foreign markets are strong, which is the case at the moment. Small...

READ MORE

MEMBERS ONLY

STAPLES AND CYCLICALS HIT NEW HIGHS TOGETHER -- BUT CYCLICALS STILL HAVE THE EDGE -- HEALTHCARE SPDR HITS NEW RECORD HIGH -- MIDCAPS MAY GIVE TRUER PICTURE OF STOCK MARKET --S&P 400 MID CAP INDEX IS CONSOLIDATING IN BULLISH TRIANGLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STAPLES AND CYLICALS BOTH HIT NEW HIGHS... We can often get clues about stock market direction by watching shifting rotations among market sectors. In a strong market, stocks tied to the economy usually lead. In a correction, defensive stocks lead. But what are we to make of a situation where...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD MARKET LOWER -- FALLING YIELD CURVE HURTS BANKS -- FALLING YIELDS, HOWEVER, PUSH UTILITIES TO NEW HIGHS -- SMALL CAPS CONTINUE TO UNDERFORM -- U.S. LARGE CAP STRENGTH MAY HAVE MORE TO DO WITH STRONGER FOREIGN MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING BOND YIELD PUSHES YIELD CURVE LOWER... The divergence between falling Treasury bond yields and rising stock indexes may be starting to take its toll on the stock market. Major stock indexes are in the red today. The biggest selling, however, is coming from small caps and financials. At the...

READ MORE

MEMBERS ONLY

GROWTH STOCKS ARE CARRYING MARKET HIGHER -- THAT'S MAINLY BIG TECHS -- VALUE STOCKS ARE LAGGING BEHIND -- THAT'S MAINLY FINANCIALS AND ENERGY -- % OF STOCKS ABOVE 50- AND 200-DAY AVERAGES NEED TO START CLIMBING

by John Murphy,

Chief Technical Analyst, StockCharts.com

GROWTH STOCKS ARE LEADING THIS YEAR'S STOCK RALLY... The S&P 500 and the Nasdaq hit new record highs yesterday, and the Dow isn't far behind. Large parts of the stock market, however, are lagging behind. That's not necessarily a good thing. The...

READ MORE