MEMBERS ONLY

HOMEBUILDERS ARE HAVING A STRONG DAY -- USING RATIO ANALYSIS TO CHOOSE THE STRONGEST HOUSING ETF -- AMAZON, HOME DEPOT, AND WAL-MART LEAD VANECK RETAIL ETF HIGHER -- S&P 500 VALUE/GROWTH RATIO MAY BE JUST PAUSING IN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. HOME CONSTRUCTION ISHARES HIT NEW HIGHS... Add housing stocks to parts of the stock market that still offer value and are attracting new money. Chart 1 shows the U.S. Home Construction iShares (ITB) climbing today to the highest level in nearly a decade. That's following...

READ MORE

MEMBERS ONLY

Healthcare SPDR Turns Up, Biotechs and Pharmaceutical ETFS Show Improvement

by John Murphy,

Chief Technical Analyst, StockCharts.com

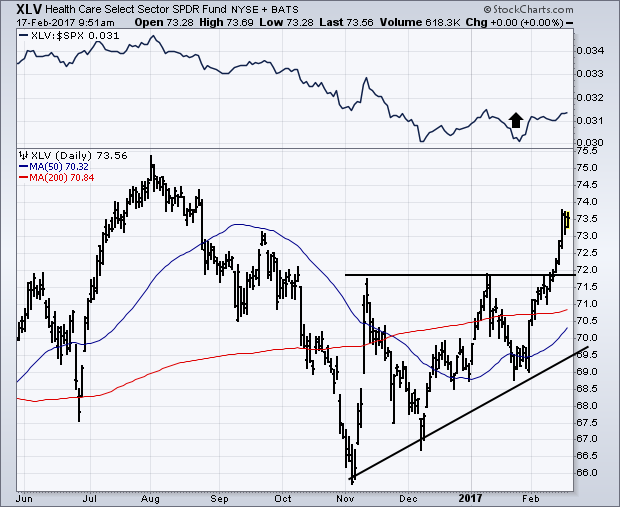

In case you haven't noticed, the Health Care SPDR (XLV) has taken a bullish turn. Chart 1 shows the XLV breaking out of a bullish "ascending triangle" that I described in my February 4 message. At the same time, the XLV/SPX ratio (top of chart)...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR TURNS UP -- HEALTH CARE EQUIPMENT AND MEDICAL DEVICE ETFS HIT NEW RECORDS -- HEALTHCARE PROVIDERS ETF TOUCHES 52-WEEK HIGH -- BIOTECHS AND PHARMACEUTAL ETFS SHOW IMPROVEMENT BUT ARE HEALTHCARE LAGGARDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR TURNS UP... In case you haven't noticed, the Health Care SPDR (XLV) has taken a bullish turn. Chart 1 shows the XLV breaking out of a bullish "ascending triangle" that I described in my February 4 message. At the same time, the XLV/...

READ MORE

MEMBERS ONLY

BOND YIELDS CLEAR 50-DAY LINE ON YELLEN TESTIMONY -- THAT HELPS FINANCIALS AND HURTS UTILITIES -- FINANCIALS/UTILITIES RATIO TURNS BACK UP -- RISING YIELDS BOOST DOLLAR AND WHICH HURTS GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CLEAR 50-DAY LINE... Previous messages have described Treasury bond yields as consolidating within a major uptrend since mid-December . Today's jump in yields supports that view. In testimomy before Congress today, Janet Yellen warned about the danger of the Fed falling behind the inflation curve. That more...

READ MORE

MEMBERS ONLY

COPPER AND STEEL STOCKS RESUME UPTRENDS -- CRUDE OIL BOUNCE BOOSTS ENERGY SECTOR -- OIL SERVICE STOCKS ARE ENERGY LEADERS -- CANADIAN STOCKS HIT NEW RECORD ON COMMODITY RALLY -- AUSSIE AND CANADIAN DOLLARS ALSO TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER AND STEEL STOCKS RESUME UPTRENDS... Economically-sensitive industrial metals are rising again, along with stocks tied to them. The price of copper is up 3.5% today to the highest level in nearly two years. So are copper shares. Chart 1 shows the Global X Copper Miners ETF (COPX) resuming...

READ MORE

MEMBERS ONLY

GOLD CONTINUES RALLY BUT NEARS RESISTANCE -- SO DO GOLD MINERS -- EURO STAYS FLAT -- PULLBACK IN BOND YIELDS ARE HELPING GOLD BUT MAYBE NOT FOR LONG -- REBOUND IN SAFE HAVEN BONDS AND THE YEN NOT THAT IMPRESSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD REACHES THREE-MONTH HIGH... The price of gold continues to rise. Chart 1 shows the Gold Shares SPDR (GLD) trading at the highest level in three months. It has reached a point, however, where some overhead resistance may appear. For one thing, it has retraced 62% of its November/December...

READ MORE

MEMBERS ONLY

Dow and S&P 500 End Week On a Strong Note

by John Murphy,

Chief Technical Analyst, StockCharts.com

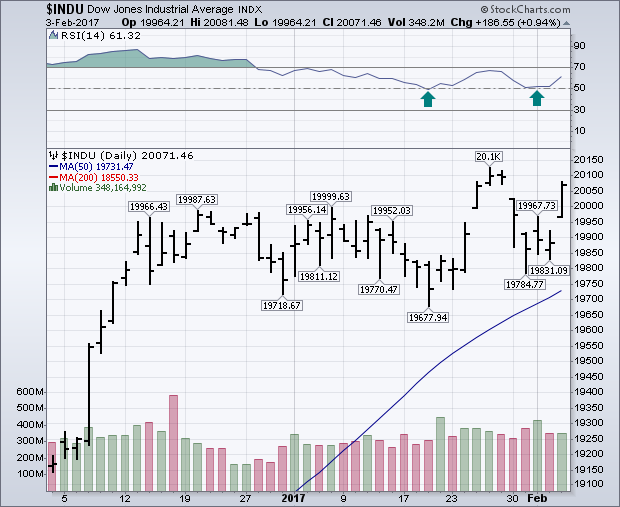

What started off as a soft week for stocks ended on a strong note. Friday's gain was enough to keep stock indexes basically flat for the entire week. But there was some improvement on the charts. The daily bars in Chart 1 show the Dow Industrials jumping 186...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD FRIDAY'S STOCK BOUNCE -- SO DO SMALL CAPS AND TRANSPORTS -- HEALTCHARE IS WEEK'S STRONGEST SECTOR -- HCA HOLDINGS ACHIEVES BULLISH BREAKOUT -- AMGEN SURGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 END WEEK ON A STRONG NOTE ... What started off as a soft week for stocks ended on a strong note. Friday's gain was enough to keep stock indexes basically flat for the entire week. But there was some improvement on the charts....

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR REACHES OVERBOUGHT TERRITORY -- BIG TECH STOCKS ARE UP AGAINST RESISTANCE OR PULLING BACK -- HEALTHCARE WINNERS INCUDE IDEXX LABS, BOSTON SCIENTIFIC, AND MERCK -- HCA HOLDINGS MAY BE NEAR BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR FINALLY REACHES OVERBOUGHT TERRITORY ... One of the trends supporting the stock market rally has been a strong technology sector. That group, however, has reached overbought territory for the first time in six months and is starting to weaken. Chart 1 shows the 14-day RSI for the Technology SPDR...

READ MORE

MEMBERS ONLY

DOLLAR STILL UNDER PRESSURE -- BUT EURO AND YEN ARE STILL IN DOWNTRENDS -- GOLD'S TREND MAY DEPEND ON THE EURO -- DOW MAY RETEST 50-DAY LINE -- TRANSPORTS FAIL TO REACH NEW HIGHS -- UTILITIES WEAKEN AT 200-DAY LINE -- APPLE NEARS RECORD HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR BREAKS SHORT-TERM SUPPORT... I keep writing about prospects for a bounce in the U.S. Dollar, and it keeps dropping. My last message showed the PowerShares Dollar Index Fund (UUP) testing chart support at its early December low. The red circle in Chart 1 shows the UUP slipping below...

READ MORE

MEMBERS ONLY

STOXX EUROPE 600 STOCK INDEX REACHES HIGHEST LEVEL IN A YEAR -- EUROPEAN BOND YIELDS ARE ALSO RISING -- A WEAK EURO MAKES EURO COMMODITY INFLATION EVEN HIGHER -- DOLLAR IS TRYING TO BOUNCE OFF CHART SUPPORT -- GOLD STRUGGLES WITH RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOXX EUROPE 600 HITS 52-WEEK HIGH... My last message focused on the idea that foreign stocks were also turning up which has strengthened the global rally. My main focus was on Europe which I'm returning to today. First, the rally the stocks. Chart 1 shows the STOXX Europe...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS RALLY AS DOW CROSSES 20K -- ALL COUNTRY WORLD STOCK INDEX HITS NEW RECORD -- FOREIGN STOCK INDEX ACHIEVES BULLISH BREAKOUT -- DO DOES EUROPE -- RISING BOND YIELDS DRIVE MONEY OUT OF BONDS AND INTO STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALL COUNTRY WORLD INDEX HITS NEW RECORD ... The Dow Industrials finally exceeded the 20K threshold that everyone in the media has been focused on. That's puts all major U.S. stock indexes in record highs. What's also impressive is that the current stock rally is global...

READ MORE

MEMBERS ONLY

MATERIALS SPDR HITS NEW HIGH -- LEADERS ARE CENTURY ALUMINUM, FREEPORT MCMORAN, INTERNATIONAL PAPER, AND DOW CHEMICAL -- DR HORTON LEADS HOMEBUILDERS HIGHER -- CONSUMER DISCRETIONARY SPDR REACHES NEW HIGH -- S&P 500 IS CLOSE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS SPDR HITS NEW RECORD ... Chart 1 shows the Materials Sector SPDR (XLB) surging to a record high. Equally impressive is that the fact that the XLB/SPX ratio (top of chart) has turned up as well. The XLB/SPX ratio has risen to the highest level in eighteen months...

READ MORE

MEMBERS ONLY

10-Year Treasury Yield Is Bouncing Off It's 50-Day Average, As is The Dollar

by John Murphy,

Chief Technical Analyst, StockCharts.com

The pullback in Treasury yields (coinciding with an oversold bounce in Treasury prices) may have run its course. Chart 1 shows the 10-Year Treasury Yield ($TNX) bouncing sharply off its 50-day moving average. The two momentum indicators above Chart 1 are also supportive. The 14-day RSI (green) line is back...

READ MORE

MEMBERS ONLY

10-YEAR TREASURY YIELD IS BOUNCING OFF ITS 50-DAY AVERAGE -- DOLLAR INDEX ALSO BOUNCES OFF SUPPORT -- GOLD MARKET MEETS RESISTANCE -- DOW REMAINS FLAT -- STOCK/ BOND RATIO STILL FAVORS STOCKS -- UPTREND IN JUNK BONDS IS ALSO STRETCHED

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD BOUNCES OFF 50-DAY AVERAGE ... The pullback in Treasury yields (coinciding with an oversold bounce in Treasury prices) may have run its course. Chart 1 shows the 10-Year Treasury Yield ($TNX) bouncing sharply off its 50-day moving average. The two momentum indicators above Chart 1 are also supportive....

READ MORE

MEMBERS ONLY

ALUMINUM, COPPER, AND STEEL STOCKS HAVE A STRONG DAY -- LEADERS ARE CENTURY ALUMINUM, SOUTHERN COPPER, NUCOR AND US STEEL -- THAT'S A POSITIVE SIGN FOR STOCKS AND NEGATIVE FOR BONDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CENTURY ALUMINUM LEADS THAT GROUP HIGHER... Aluminum stocks are leading a rally in the materials group. Chart 1 shows the Dow Jones US Aluminum Index surging to the highest level in eighteen months. Chart 2 shows Century Aluminum (CENX) looking pretty much the same. Alcoa (AA) is also having a...

READ MORE

MEMBERS ONLY

SMALL CAPS RECOVER FROM THURSDAY SELLOFF TO KEEP SIDEWAYS TRADING RANGE INTACT -- NASDAQ RISES TO NEW RECORDS -- AN HOURLY LOOK AT FOUR SECTORS THAT SHOW IMPROVEMENT -- BOND YIELDS PULL BACK TO SUPPORT AND ARE STILL IN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS SURVIVE TEST OF SUPPORT... The stock market continues to trade sideways within the context of an overall uptrend. The fact that small caps stabilized at week's end is an encouraging sign (because they often lead larger stocks). At one point Thursday morning, the Russell 2000 iShares...

READ MORE

MEMBERS ONLY

SMALL CAPS LEAD MARKET LOWER -- S&P SHOWS NEGATIVE DIVERGENCE -- THAT INCREASES THE ODDS THAT THE DOW WON'T REACH 20K ON THIS ATTEMPT -- HEALTHCARE SPDR SELLS OFF ON TRUMP DRUG COMMENTS -- BUT HEALTH CARE PROVIDERS ANTHEM AND CIGNA LOOK STRONG

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM MARKET TREND WEAKENS... It looks like the Dow probably won't reach the 20K on this attempt. That's because of weaker market action in other stock indexes. Chart 1 shows the S&P 500 SPDR (SPY) starting to roll over to the downside after touching...

READ MORE

MEMBERS ONLY

FINDING THE RIGHT LONG-TERM TRENDLINE FOR THE 10-YEAR TREASURY YIELD -- NEXT UPSIDE TARGET FOR THE 10-YEAR YIELD IS 3% -- 10-YEAR BOND PRICE IS BOUNCING FROM SHORT-TERM OVERSOLD CONDITION -- RELATIVE STRENGTH TREND STILL FAVORS TRANSPORTS OVER UTILITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHICH TRENDLINE IS BILL GROSS REFERRING TO... I've heard a lot this week about Bill Gross' prediction that a move by the 10-Year Treasury yield above 2.6% would end the secular bull market in bonds. Part of his reasoning is that a rise above 2.6%...

READ MORE

MEMBERS ONLY

Dow Flirts With 20K, While NASDAQ Closes At Record High

by John Murphy,

Chief Technical Analyst, StockCharts.com

Let's get this out of the way first. If you've been watching business TV, all they've been talking about is the Dow nearing the 20,000 level. Much to their dismay, it came close on Friday but couldn't make it. The Dow...

READ MORE

MEMBERS ONLY

DOW CONTINUES TO FLIRT WITH 20K -- WHILE NASDAY CLOSES AT RECORD HIGH -- INTERNET INDEX TURNS UP WITH FANG STOCKS BACK IN FAVOR -- FACEBOOK, AMAZON, AND GOOGLE IMPROVE -- NETFLIX HITS NEW RECORD -- BIOTECHS HELP MAKE HEALTHCARE WEEK'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW FLIRTS WITH 20K... Let's get this out of the way first. If you've been watching business TV, all they've been talking about is the Dow nearing the 20,000 level. Much to their dismay, it came close on Friday but couldn't...

READ MORE

MEMBERS ONLY

OVER-EXTENDED TREASURY YIELDS PULL BACK -- DO DOES THE DOLLAR -- THAT'S BOOSTING GOLD AND GOLD MINERS -- WEAKER DOLLAR AND STRONG YUAN ALSO BOOST EMERGING MARKETS -- UPTREND IN FINANCIALS IS STALLING -- WHILE UTILITIES STRENGTHEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD PULLS BACK ... After the steep ascent in Treasury bond yields since the November 8 election, it's not too surprising to them pulling back a bit. There are a couple of technical reasons for that. The daily bars in Chart 1 show the 10-Year Treasury Yield...

READ MORE

MEMBERS ONLY

AUTOS LEAD CYCLICALS HIGHER -- AUTO LEADERS ARE GM, FORD, AND TESLA -- GENERAL MOTORS NEARS NEW RECORD -- CARMAX COMPLETES MAJOR BASING PATTERN -- TENNECO AUTOMOTIVE LEADS AUTO PARTS STOCKS HIGHER AFTER REACHING TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES AUTO INDEX IS BREAKING OUT... For the first time in a long time, auto stocks are showing market leadership. I first wrote about the group in a December 1 message about autos leading consumer cyclicals higher. They're doing that again today. Chart 1 shows the Dow...

READ MORE

MEMBERS ONLY

STOCK RALLY REMAINS STRETCHED -- AVERAGE DIRECTIONAL INDEX FOR THE DOW SIGNALS THAT RALLY IS VULNERABLE TO A SETBACK -- THE SAME IS TRUE FOR OTHER MARKET LEADERS -- THE 20,000 MILESTONE FOR THE DOW MAY BE PROMPTING SOME PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

ADX AND RSI LINES ISSUE WARNINGS... My last couple of messages have repeated the idea that the post-election stock rally looks stretched. Last Friday's message showed the stock/bond ratio, the value/growth ratio, and the transportation/utilities ratio also in overbought territory. Momentum and seasonal factors are...

READ MORE

MEMBERS ONLY

Stock/Bond Ratio Still Favors Stocks But Has Become Overbought

by John Murphy,

Chief Technical Analyst, StockCharts.com

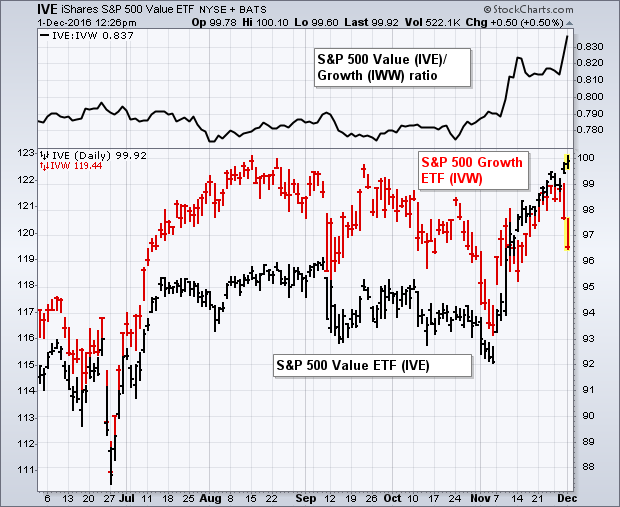

Several market messages over the past couple of months used relative strength ratios to paint a more bullish picture of the stock market, and a more bearish picture for bonds. While those ratios have strengthened considerably, especially since the election, I'm a little concerned that they're...

READ MORE

MEMBERS ONLY

STOCK/BOND RATIO STILL FAVORS STOCKS BUT HAS GOTTEN OVERBOUGHT -- SO HAS THE VALUE/GROWTH RATIO -- AND THE TRANSPORTATION/UTILITY RATIO -- ALL OF WHICH SUGGESTS THAT THE RECENT SURGE INTO STOCKS AND OUT OF BONDS MAY BE GETTING OVERDONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK/BOND RATIO IS OVERBOUGHT... Several market messages over the past couple of months used relative strength ratios to paint a more bullish picture of the stock market, and a more bearish picture for bonds. While those ratios have strengthened considerably, especially since the election, I'm a little...

READ MORE

MEMBERS ONLY

FED HIKES AS EXPECTED BUT SUGGESTS MORE TO COME IN 2017 -- BOND YIELDS CLIMB ALONG WITH THE DOLLAR -- GOLD AND RATE SENSITIVE STOCKS LOSE GROUND -- SO DO EMERGING MARKETS -- STOCK RALLY STALLS WHILE IN SHORT-TERM OVERBOUGHT CONDITION

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED OFFERS SLIGHTLY STEEPER PATH FOR 2017... The Fed surprised no one today one by raising short-term rates by a quarter of a point. It did, however, offer a steeper path for rate hikes in 2017. That may have caught more attention. Bond yields climbed which boosted bank stocks initially....

READ MORE

MEMBERS ONLY

NASDAQ 100 NEARS NEW RECORD -- IT'S BEING HELPED BY REBOUNDS IN APPLE, GOOGLE, AND INTEL -- ALL COUNTRY WORLD INDEX HITS 18-MONTH HIGH -- VANGUARD FOREIGN STOCK INDEX IS ALSO REBOUNDING -- TEN-YEAR YIELD NEARS CHALLENGE OF MID-2015 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWERSHARES QQQ NEARS NEW RECORD... A lot has been made recently about domestic-oriented American businesses leading the market rally (like small caps, retailers, and transports to name a few). And how large tech stocks have gone from market leaders to market laggards. Technology companies derive nearly two-thirds of their earnings...

READ MORE

MEMBERS ONLY

EURO IS IN DANGER OF DROPPING TO 14-YEAR LOW -- THE FALLING EURO, HOWEVER, IS PUSHING EUROZONE STOCKS HIGHER -- THE WISDOMTREE EUROPE HEDGED EQUITY ETF OFFERS A WAY TO BUY EUROZONE STOCKS WITHOUT LOSING MONEY ON THE EURO

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO FALLS ON ECB... The ECB had some good and bad news for the Euro today. The ECB offered to extend its bond buying program for an additional nine months after next March. But it also announced that it was reducing the amount of bond purchases. The market interpreted the...

READ MORE

MEMBERS ONLY

AUTO PARTS LEAD CYCLICALS HIGHER -- LEADERS INCLUDE BORGWARNER, MAGNA INTL, AND TENNOCO AUTOMOTIVE -- USED CAR DEALER CARMAX ALSO COMPLETES BASING PATTERN -- IT MIGHT NOT BE A BAD IDEA TO BUY SOME AUTO STOCKS FOR CHRISTMAS

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUTO PARTS INDEX TURNS UP... My message from last Thursday was headlined: "Autos Drive Cyclicals Higher". It showed an index of auto stocks achieving a bullish breakout led by GM and Ford. Auto parts are today's cyclical leaders. That shouldn't be surprising since they&...

READ MORE

MEMBERS ONLY

Rotation Continues Into Value Stocks, Financials and Energy Still Look Cheap

by John Murphy,

Chief Technical Analyst, StockCharts.com

Two days after the election (November 10), I wrote a message entitled: "Rotation Out of Growth Stocks into Value Stocks Causes Profit-taking in Technology". We're seeing a replay of that rotation again this week as technology stocks are underperforming the market while financials, energy, and industrials...

READ MORE

MEMBERS ONLY

AUTOS DRIVE CYCLICALS HIGHER -- GENERAL MOTORS HAS THE STRONGER PATTERN -- BUT FORD TURNS UP -- INDUSTRIAL LEADERS INCLUDE FLOWSERVE, DOVER, AND WW GRAINGER -- MONEY CONTINUES TO ROTATE OUT OF TECHNOLOGY INTO CHEAPER VALUE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR SHOWS RELATIVE STRENGTH ... One of the signs of growing strength behind the post-election stock market rally is that it's being led higher by economically-sensitive stocks like cyclicals and industrials. [We'll deal with industrials shortly]. Chart 1 shows the Consumer Discretionary SPDR (XLY) finding...

READ MORE

MEMBERS ONLY

OPEC PRODUCTION CUT PUSHES OIL SHARPLY HIGHER -- ENERGY STOCKS LEAD MARKET HIGHER -- OIL SERVICES ETF ACHIEVES BULLISH BREAKOUT -- ENERGY LEADERS INCLUDE DEVON, MARATHON, AND MURPHY OIL -- RISING BOND YIELDS BOOST FINANCIALS WHILE UTILITIES FALL

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL SPIKES ON OPEC CUT... The agreement by OPEC to cut oil production by 1.2 million barrels a day has pushed the price of crude $3 (7%) higher in today's trading. The spike in oil is giving a huge boost to energy stocks which are leading the...

READ MORE

MEMBERS ONLY

BASE METALS INDEX HITS ANOTHER HIGH FOR THE YEAR -- SO DOES THE S&P 500 METALS & MINING SPDR -- STEEL LEADERS ARE AKSTEEL, CLIFFS NATURAL RESOURCES, AND US STEEL -- RISING DOLLAR, RISING RATES, AND A STRONG STOCK MARKET ARE PUSHING GOLD LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL METALS CONTINUE TO CLIMB... The huge rally in industrial (base) metals continues. Chart 1 shows the PowerShares DB Base Metals Fund (DBB) climbing to the highest level since mid-2015. The DBB reflects rising aluminum, copper, and zinc prices. Iron ore and steel prices are also surging in Chinese trading....

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SPDR HITS NEW RECORD -- S&P 500 RETAIL SPDR ACHIEVES BULLISH BREAKOUT-- MATERIAL SPDR NEARS UPSIDE BREAKOUT -- COPPER AND STEEL STOCKS LEAD XLB HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAILERS LEAD CYCLICALS TO NEW HIGHS... My message from last Monday wrote about apparel retailers leading retail stocks higher which were leading the cyclical sector higher. The same headline could be written again today. Chart 1 shows the Consumer Discretionary SPDR (XLY) rising above its August high to a new...

READ MORE

MEMBERS ONLY

CRUDE OIL JUMPS 4% ON HOPES FOR OPEC CUT -- ENERGY SPDR HITS NEW HIGH -- OIL SERVICES ETF MAY BE NEXT -- ENERGY AND MINERS LEAD CANADIAN STOCKS HIGHER -- HUDBAY MINERALS ACHIEVES BULLISH BREAKOUT -- SO DOES FREEPORT MCMORAN

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL CLIMBS ABOVE 50-DAY AVERAGE... Renewed optimism for an OPEC output cut has pushed crude oil 4% higher in today's trading and has given a big boost to energy shares and the rest of the stock market. Chart 1 shows WTIC Light Crude oil rising above its...

READ MORE

MEMBERS ONLY

Falling Yen Boosts Nikkei Index

by John Murphy,

Chief Technical Analyst, StockCharts.com

My October 6 market message suggested that the Japanese yen was peaking which would give a boost to export-oriented Japanese stocks which appeared to be bottoming. Since then, the yen has fallen to the lowest level in six months against the dollar, and has fallen below its 200-day average (Chart...

READ MORE

MEMBERS ONLY

THE 2-YEAR TREASURY YIELD IS ALSO RISING, BUT NOT AS FAST AS 10-YEAR YIELD -- TREASURY YIELDS ARE ALSO RISING FASTER THAN FOREIGN YIELDS -- THAT'S HELPING PUSH THE US DOLLAR INDEX TO THE HIGHEST LEVEL IN THIRTEEN YEARS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TWO-YEAR TREASURY YIELD ALSO HITS NEW 2016 HIGH... Most recent attention has been focused on the surge in the 10-Year Treasury yield to the highest level since last December (middle line in Chart 1). That's based on expectations for stronger economic growth and higher inflation. It's...

READ MORE

MEMBERS ONLY

SOME MONEY FLOWING INTO FINANCIALS HAS COME OUT OF TECHNOLOGY -- INTERNET STOCKS MAY HAVE FOUND A BOTTOM -- TECHNOLOGY SPDR HOLDS CHART SUPPORT -- APPLE AND MICROSOFT ARE HOLDING UP -- ADVANCED MICRO DEVICES LEADS SEMICONDUCTORS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SOME TECHNOLOGY WINNINGS WENT INTO FINANCIALS... A lot is being made of the fact that technology stocks have underperformed the broader market since last Tuesday's election. I suggested last week that technology selling was most likely a rotation out of some expensive technology stocks (mainly in the Internet)...

READ MORE

MEMBERS ONLY

APPAREL RETAILERS LEAD CYCLICALS HIGHER -- RETAIL LEADERS ARE KOHLS, NORDSTOM, AND URBAN OUTFITTERS -- RAILS LEAD INDUSTRIAL SPDR HIGHER -- UNION PACIFIC AND NORTHERN SOUTHERN IN UPTRENDS -- TRANSPORTATION/INDUSTRIAL RATIO TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P RETAIL SPDR SURGES ... My last message on Thursday mentioned a rotation into discretionary sectors like retailers and out of defensive consumer staples. That rotation is looking even more impressive today as retail stocks are strong. Chart 1 shows the S&P Retail SPDR (XRT) surging nearly...

READ MORE