MEMBERS ONLY

DOW INDUSTRIALS AND TRANSPORTS ARE FINALLY IN SYNC -- TRANSPORTATION RALLY INCLUDES AIR FREIGHT, RAILS, AND TRUCKERS -- COPPER UPTREND ACCELERATES AS FREEPORT MCMORAN NEARS BULLISH BREAKOUT -- CYCLICAL STOCKS OUTPACE STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW THEORY LOOKS STRONG... Chart 1 shows the Dow Industrials trading at a new record high today. That's a positive sign. But so is the fact that the Dow Transports achieved a bullish breakout on Monday. That puts both Dow Averages in sync on the upside for the...

READ MORE

MEMBERS ONLY

STOCKS RALLY ON TRUMP VICTORY -- FINANCIALS, HEALTHCARE, INDUSTRIALS, MATERIALS, AND ENERGY HAVE BIG GAINS -- STOCKS TIED TO ALUMINUM, COPPER, STEEL, AND COAL SURGE -- 10-YEAR TREASURY YIELD SURGES ABOVE 2%

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS SURGE AFTER WEAK NIGHT... Today's strong stock market builds one surprise on top of another. The first surprise was a Trump victory. The second is today's sizable stock market gain. It was widely expected that a Trump victory would push stocks sharply lower. And it...

READ MORE

MEMBERS ONLY

STOCKS SURGE ON PRE-ELECTION FBI ANNOUNCEMENT AS SAFE HAVEN ASSETS SLIDE -- RISING DOLLAR HURTS GOLD -- MEXICO LEADS EMERGING MARKETS HIGHER -- RISING BASE METALS BOOST AUSSIE DOLLAR -- AIRLINES LEAD TRANSPORTS IN BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

FBI ANNOUNCEMENT CAUSES BIG RISK-ON DAY... The Sunday afternoon FBI announcement that it was ending its Hillary Clinton email investigation with no charges caused a huge risk- on trade the day before the presidential election. Stocks have surged as much as 2% around the world. A stronger dollar, and surging...

READ MORE

MEMBERS ONLY

Rising Bond Yields Boost Insurers, Have Negative Impact on Stock Indexes

by John Murphy,

Chief Technical Analyst, StockCharts.com

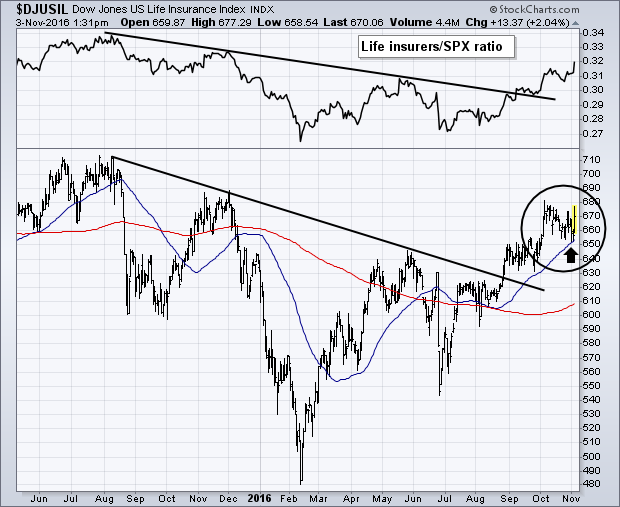

LIFE INSURERS LEAD FINANCIALS HIGHER ... Rising bond yields continue to give a boost to financial stocks like life insurers. Bear in mind that premium income in insurance stocks is invested mostly in fixed income markets. Higher bond yields mean higher income. Life insurers are leading the financial sector higher today....

READ MORE

MEMBERS ONLY

RISING BOND YIELDS BOOST INSURERS WHILE HURTING REITS AND OTHER DIVIDEND PAYERS -- LINCOLN NATIONAL, METLIFE, AND PRUDENTIAL RISE ON STRONG EARNNGS -- RISING BOND YIELDS ARE HAVING A NEGATIVE IMPACT ON STOCK INDEXES WITH MOST SECTORS IN THE RED

by John Murphy,

Chief Technical Analyst, StockCharts.com

LIFE INSURERS LEAD FINANCIALS HIGHER ... Rising bond yields continue to give a boost to financial stocks like life insurers. Bear in mind that premium income in insurance stocks is invested mostly in fixed income markets. Higher bond yields mean higher income. Life insurers are leading the financial sector higher today....

READ MORE

MEMBERS ONLY

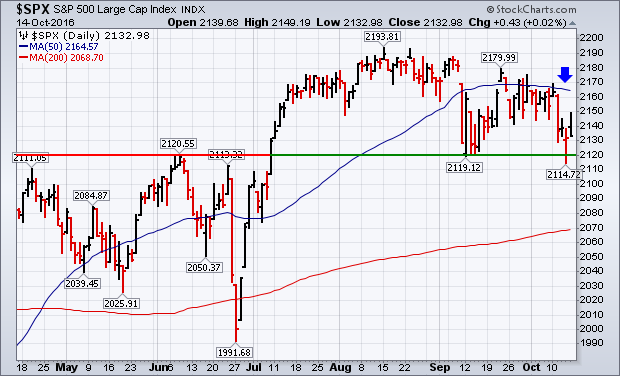

S&P 500 BREAKS CHART SUPPORT AS THE VIX SURGES -- FALLING DOLLAR PUSHES GOLD HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 BREAKS SUPPORT AS VIX SURGES... Election jitters are taking a toll on stocks. Chart 1 shows the S&P 500 falling below its September/October lows to a four month low. All other major stock indexes are falling as well. That leaves the SPX in...

READ MORE

MEMBERS ONLY

LONGER-DATED TREASURY BONDS LEAD FIXED INCOME MARKETS LOWER -- HIGH YIELD BONDS ARE MORE CLOSELY TIED TO STOCKS -- MONEY IS FLOWING INTO TIPS FOR INFLATION PROTECTION -- RISING COAL SHARES ARE ANOTHER SIGN OF A COMMODITY REVIVAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE BOND CHARTS ... I've been writing about how the recent upturn in bond yields has been pushing bond prices lower (primarily due to rising commodity prices). Not all bond categories are falling at the same rate however. When inflationary pressures are starting to pull bond yields higher, longer...

READ MORE

MEMBERS ONLY

RISING COMMODITY PRICES ARE PULLING BOND YIELDS HIGHER -- BASE METALS ETF HITS NEW HIGH FOR THE YEAR -- S&P METALS AND MINING ETF OUTPERFORMS -- STRONG GDP FAVORS ECONOMICALLY-SENSITIVE STOCKS OVER BONDS -- SO DOES RISING STOCK/BOND RATIO

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING COMMODITY PRICES ARE BOOSTING GLOBAL BOND YIELDS... I find it amusing listening to TV talking heads trying to explain why global bond yields have started to rise (pushing bond prices sharply lower). They don't seem to have noticed that commodity prices have risen more than 20% since...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS CONTINUE TO BOOST BANKS AND INSURERS -- BANK ETF HITS NEW HIGH -- BANK LEADERS INCLUDE KEYCORP, HUNTINGTON BANKCORP, AND PNC -- INSURANCE LEADERS INCLUDE CHUBB AND HARTFORD FINANCIAL -- RISING RATES HURT REITS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CONTINUE TO CLIMB... Chart 1 shows the 10-Year Treasury Yield climbing again today after finding support along its 200-day moving average. Rising yields are giving the usual lift to financial shares, banks and insurers in particular. Chart 2 shows the S&P Bank SPDR (KBE) trading at...

READ MORE

MEMBERS ONLY

RISING BASE METALS BOOST MINERS -- COPPER AND STEEL ETFS HAVE STRONG CHART PATTERNS -- MINING LEADERS INCLUDE BHP BILLITON, RIO TINTO, AND VALE -- SHANGHAI INDEX NEARS 2016 HIGH -- EMERGING MARKETS OUTPERFORM -- RISING DOLLAR LOOKS OVERBOUGHT

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWERSHARES BASE METALS FUND JUMPS 2%... Base metal prices like iron ore and steel are seeing big gains in China. That strength is spilling over into aluminum, copper, nickel, and zinc. That's giving a big boost to global stocks tied to those commodities. Chart 1 shows the PowerShares...

READ MORE

MEMBERS ONLY

STOCKS ARE BEING LED HIGHER BY ENERGY AND FINANCIALS -- OIL SERVICES ETF NEARS SUMMER HIGH -- HALLIBURTON AND SCHLUMBERGER ACHIEVE BULLISH BREAKOUTS -- SO DO COMERICA AND REGIONS FINANCIAL WHICH ARE LEADING BANKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL HITS FOUR-MONTH HIGH... The price of oil continues to rise. Chart 1 shows the United Stated Oil Fund (USO) climbing nearly 3% to reach the highest level in nearly four months. That's giving a big boost to energy shares which are leading the rest of the...

READ MORE

MEMBERS ONLY

TREASURY BOND ETFS ARE TRYING TO BOUNCE OFF 200-DAY AVERAGE -- SO ARE RATE-SENSITIVE UTILITIES AND REITS -- CONSUMER CYCLICALS TRADE SIDEWAYS BUT UNDERPERFORM S&P 500 -- UNITEDHEALTH KEEPS XLV ABOVE 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

20+YEAR TREASURY BOND ISHARES TEST 200-DAY AVERAGE... Before getting to rate-sensitive stocks ETFs that are testing their 200-day averages, it's necessary to first look at what Treasury ETFs are doing. That's because they've all been falling together. Chart 1 shows the 20-Year Treasury...

READ MORE

MEMBERS ONLY

Stock Bounce Fades as Yields and the Dollar Keep Climbing

by John Murphy,

Chief Technical Analyst, StockCharts.com

A morning bounce in stocks faded by the end of the day. Chart 1 shows the S&P 500 ending the day at its low. That keeps stocks in a short-term downside correction and well below a falling 50-day average (blue arrow). It also leaves open the possibility that...

READ MORE

MEMBERS ONLY

EARLY STOCK BOUNCE FADES --BOND YIELD CONTINUES TO CLIMB -- SO DOES THE DOLLAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK BOUNCE FADES AS YIELD CONTINUE TO RISE... A morning bounce in stocks faded by the end of the day. Chart 1 shows the S&P 500 ending the day at its low. That keeps stocks in a short-term downside correction and well below a falling 50-day average (blue...

READ MORE

MEMBERS ONLY

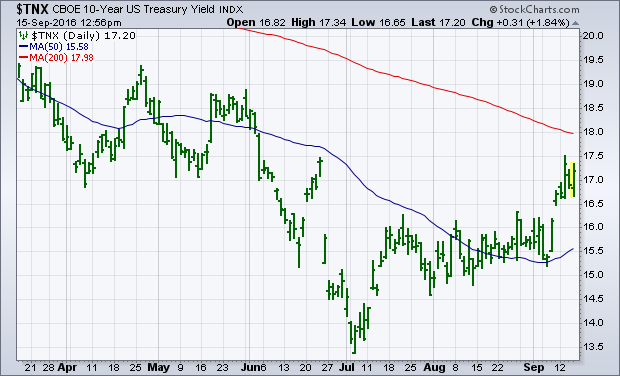

TEN-YEAR TREASURY YIELD HITS FOUR-MONTH HIGH -- RISING TWO-YEAR YIELD SUGGESTS RATE HIKE THIS YEAR -- HIGHER RATES PUSH DOLLAR TO SEVEN-MONTH HIGH -- THE COMBINATION OF HIGHER RATES AND STRONGER DOLLAR ARE PUSHING GLOBAL STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD CLEARS 200-DAY LINE... Bond yields around the world continue to climb, led by U.S. Treasuries. Chart 1 shows the 10-Year Treasury Yield ($TNX) climbing 4 basis points to 1.76% which is the highest level in four months. The TNX has also moved above its 200-day...

READ MORE

MEMBERS ONLY

WTI CRUDE NEARS TEST OF NECKLINE -- BRENT TOUCHES ONE-YEAR HIGH -- ENERGY SPDR HITS NEW RECOVERY HIGH -- LED BY PIONEER NATURAL RESOURCES AND HALLIBURTON -- OIL SERVICES ETF ALSO NEARS NECKLINE -- LEADERS INCLUDE NABORS AND HELMERICH & PAYNE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BRENT HITS ONE-YEAR HIGH -- WTIC IS CLOSE... The pledge of a joint Russian and Saudi agreement to limit oil output has pushed the commodity even higher, and has increased the odds of a major bottom being completed. Chart 1 shows the price of Light Crude Oil ($WTIC) gaining 3%...

READ MORE

MEMBERS ONLY

THE JAPANESE YEN MAY BE PEAKING -- THAT WOULD BE GOOD FOR JAPANESE STOCKS WHICH MAY BE BOTTOMING -- THE WISDOM TREE JAPAN HEDGED EQUITY ETF OFFERS A WAY TO BUY JAPANESE STOCKS WITHOUT CURRENCY RISK

by John Murphy,

Chief Technical Analyst, StockCharts.com

CURRENCY DIRECTION REALLY MATTERS IN JAPAN... My Tuesday message explained why foreign currency direction is important when investing in foreign stocks. That message showed why a falling British pound hurts American investors investing in U.K. stocks. Currency direction is also important when investing in Japanese stocks. Chart 1 is...

READ MORE

MEMBERS ONLY

FINANCIAL SPDR CLEARS 50-DAY AVERAGE -- S&P BANK SPDR HITS NEW 2016 HIGH -- BANK BREAKOUTS ARE ACHIEVED BY COMERICA, SUNTRUST BANKS, AND REGIONS FINANCIAL -- FINANCIALS/ UTILITIES RATIO SCORES BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR CLEARS 50-DAY AVERAGE... With bond yields on the rise, financial stocks are starting to show market leadership. Chart 1 shows the Financial Sector SPDR (XLF) rising above its 50-day average in today's trading. It's only the fourth sector SPDR to do that (after technology,...

READ MORE

MEMBERS ONLY

TREASURY YIELDS CONTINUE TO RISE -- THAT'S HURTING UTILITIES AND OTHER DIVIDEND PAYERS -- WHILE GIVING FINANCIALS A BOOST -- RISING DOLLAR PUSHES GOLD AND MINERS SHARPLY LOWER -- BRITISH STOCKS HIT RECORD HIGHS -- BUT NOT IN DOLLAR TERMS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS CONTINUE TO REBOUND... The continuing rebound in Treasury yields is helping some stock groups while hurting others. It's hurting dividend-paying stocks like staples, telecom, utilities, and REITs which continue to sell off. Rising rates are also boosting the dollar which is pushing gold and miners sharply...

READ MORE

MEMBERS ONLY

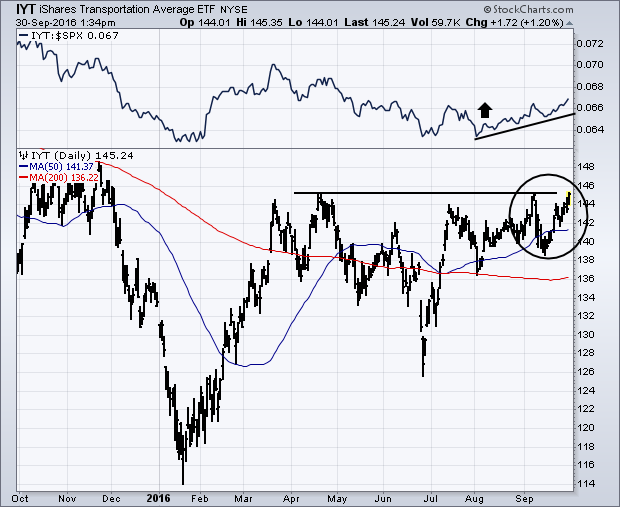

Transports Are on the Verge of Bullish Breakout -- Rails Have Already Turned Up

by John Murphy,

Chief Technical Analyst, StockCharts.com

Once again, transportation stocks appear to be on the verge of a bullish breakout. Chart 1 shows Transportation Average iShares (IYT) on the verge of breaking through their April/September highs. Their relative strength ratio (top of chart) also appears to have bottomed. I recently showed buying in airlines and...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD FRIDAY STOCK BOUNCE -- DEUTSCHE BANK LEADS EUROPEAN BANKS HIGHER -- BANK OF AMERICA AND CITIGROUP LEAD US BANKS -- TRANSPORTS ARE ON THE VERGE OF BULLISH BREAKOUT -- RAILS LIKE UNION PACIFIC AND CSX HAVE ALREADY TURNED UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

DEUTCHE BANK BOUNCE SUPPORTS BANK STOCKS... In a reversal from yesterday, financial stocks are leading a Friday bounce in global stock markets. And, like yesterday, European banks are a big reason why. Concerns about contagion from Deutche Bank weakened bank shares yesterday. The daily bars in Chart 1, however, show...

READ MORE

MEMBERS ONLY

ENERGY STOCKS RISE WITH OIL -- RISING OIL MAY BE HURTING UTILITIES -- CYCLICALS CONTINUE TO GAIN ON STAPLES -- TRANSPORT/ UTILITY RATIO IS ALSO RISING -- EUROPEAN FINANCIALS ARE HOLDING EUROPE BACK -- FOOD PRICES REMAIN WEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

PROPOSED OPEC CUTS BOOST OIL AND ENERGY STOCKS... Yesterday's announcement of proposed production cuts by OPEC this November pushed the price of crude oil sharply higher along with energy shares. The daily bars in Chart 1 show WTIC Light Crude Oil (plotted through yesterday) trading above its 50-...

READ MORE

MEMBERS ONLY

ANOTHER LOOK AT TRANSPORTATION STOCKS -- FEDEX TURNS UP -- UPS MAY BE NEXT -- MEXICO ISHARES BOUNCE OFF CHART SUPPORT -- CONSUMER DISCRETIONARY SPDR BOUNCES OFF 200-DAY LINE -- CYCLICALS/STAPLES RATIO APPEARS TO BE BOTTOMING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTATION ISHARES STILL LOOK POSITIVE... My market message from three weeks ago (Wednesday, September 7) showed Transportation iShares climbing to a five-month high. I took that as a sign that transportation stocks were on the verge of an upside breakout. A pullback in the transportation group since then has prevented...

READ MORE

MEMBERS ONLY

Treasury Yields Continue to Climb, Investment Service Stocks Show New Leadership

by John Murphy,

Chief Technical Analyst, StockCharts.com

I've been writing about the upturn in global bond yields, which has boosted Treasury bond yields. Chart 1 shows the 10-Year Treasury Yield trading above 1.70% in today's trading. Foreign yields are bouncing as well. One of the side-effects of rising bond yields is the...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS BOOST INVESTMENT SERVICE STOCKS AND LIFE INSURERS -- E*TRADE ACHIEVES BULLISH BREAKOUT -- AMERITRADE MAY BE NEXT -- PRUDENTIAL ALSO BREAKS OUT AS METLIFE CLEARS 200-DAY LINE -- STAPLES AND UTILITIES ARE OVERSOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS CONTINUE TO CLIMB... I've been writing about the upturn in global bond yields, which has boosted Treasury bond yields. Chart 1 shows the 10-Year Treasury Yield trading above 1.70% in today's trading. Foreign yields are bouncing as well. One of the side-effects of...

READ MORE

MEMBERS ONLY

ANOTHER JUMP IN TREASURY YIELD PUSHES GLOBAL BOND AND STOCK PRICES LOWER -- EMERGING MARKETS ARE TAKING THE BIGGEST FOREIGN HIT -- BOUNCING DOLLAR PUSHES COMMODITIES LOWER -- ENERGY IS BIGGEST SECTOR LOSER

by John Murphy,

Chief Technical Analyst, StockCharts.com

ANOTHER JUMP IN BOND YIELD PUSHES BOND PRICES LOWER... Treasury yields continue to bounce which is pushing bond prices and stocks sharply lower. Chart 1 show the 10-Year Treasury Yield jumping another six basis points to 1.73%. That's pushing bond prices lower. Chart 2 shows the 20+...

READ MORE

MEMBERS ONLY

JUMP IN GLOBAL BOND YIELDS SENDS BOND AND STOCK PRICES SHARPLY LOWER -- LONG-TERM CHARTS CONTINUE TO SUGGEST A BOTTOM IN TEN-YEAR TREASURY YIELD AND A BOND TOP -- S&P 500 FALLS BELOW 50-DAY AVERAGE IN HEAVY TRADING -- VIX JUMPS 40% TO TWO -MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

JUMP IN BOND YIELDS WASN'T A BIG SURPRISE... This week's jump in bond yields started on Thursday when the ECB failed to extend its bond buying program. That helped push the 10-Year German bund yield into positive territory for the first time since July. UK bond...

READ MORE

MEMBERS ONLY

JUMP IN GLOBAL BOND YIELDS PUSHES STOCKS INTO DOWNSIDE CORRECTION -- TEN-YEAR TREASURY YIELD HITS TWO-MONTH HIGH -- STOCKS ARE FALLING WITH BOND PRICES -- THE DOW AND S&P 500 SPDRS ARE BREAKING 50-DAY LINE IN HEAVY TRADING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD CLIMBS TO TWO-MONTH HIGH... The upturn in global bond yields that started Thursday on ECB inaction continues today. Bond yields are rising sharply around the globe (after hawkish comments from another Fed governor). Ten year yields in Germany and the UK are up 7 and 10 basis...

READ MORE

MEMBERS ONLY

TREASURY BOND YIELDS JUMP ALONG WITH EUROPE ON ECB INACTION -- CRUDE OIL AND ENERGY SHARES JUMP ON PLUNGE IN OIL INVENTORIES -- RISING YIELDS SUPPORT FINANCIALS -- LEADERS ARE BANK OF AMERICA, PNC, MORGAN STANLEY, GOLDMAN SACHS, AND LINCOLN NATIONAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS FOLLOW EUROPE HIGHER... Chart 1 shows the 10-Year Treasury Yield ($TNX) climbing six basis points to 1.60%. That followed a jump in European bond yields following the ECB failure to announce any additional monetary stimulus. That caused selling in European sovereign bonds, which led to selling here....

READ MORE

MEMBERS ONLY

TRANSPORTATION ISHARES HIT FIVE MONTH HIGH -- AIRLINES STOCKS ARE MAIN REASON WHY -- AMERICAN AIRLINES AND UAL CLEAR 200-DAY AVERAGES -- WEEKLY TRANSPORTATION CHART LOOKS PROMISING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTATION ISHARES TURN UP... My message from last Wednesday expressed concern about the inability of the Dow Transports to keep pace with the Dow Industrials. According to Dow Theory, both Dow Averages should be rising together. A jump in transportation stocks is relieving those concerns. The daily bars in Chart...

READ MORE

MEMBERS ONLY

S&P 600 Hits New Record, Hong Kong IShares Reach Two-Year High

by John Murphy,

Chief Technical Analyst, StockCharts.com

While most of the media focus is on sideways action in large cap stocks, smaller stocks have been rising. The weekly bars in Chart 1 show the S&P 600 Small Cap Index ($SML) ending the week at a new record high. The solid matter is a relative strength...

READ MORE

MEMBERS ONLY

STOCKS BOUNCE ON WEAK JOB REPORT -- BUT TREASURY YIELDS BOUNCE -- 10-YEAR JAPANESE YIELD HITS FIVE-MONTH HIGH -- S&P 600 SMALL CAP INDEX HITS NEW RECORD -- HONG KONG ISHARES REACH TWO-YEAR HIGH -- EAFE ISHARES END AT 2016 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P BOUNCES BUT ON LOW VOLUME... The stock market climbed on Friday on the weak August job figure on lower expectations for a September Fed hike. Friday's intermarket action, however, was somewhat muted. It's true that stocks jumped, but on lower volume. Chart 1...

READ MORE

MEMBERS ONLY

WEAK JOBS REPORT LOWERS ODDS FOR SEPTEMBER RATE HIKE -- STOCKS LIKE THE NEWS -- TWO-YEAR TREASURY YIELD DROPS -- WEAKER DOLLARS LIFTS COMMODITY PRICES AND STOCKS TIED TO THEM -- EMERGING MARKETS LEAD FOREIGN BOUNCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DISAPPOINTING JOBS REPORT... This morning's August jobs report saw a gain of 151,000 jobs versus estimates for a gain of 180,000. That low number is giving a boost to stocks, and helping to unwind some of the recent hedges against a possible September rate hike. Most...

READ MORE

MEMBERS ONLY

DOLLAR RISES ON POSSIBLE RATE HIKE -- THAT'S PUSHING COMMODITY PRICES LOWER -- TWO-YEAR TREASURY YIELD HITS THREE-MONTH HIGH -- PROSPECT FOR HIGHER RATES BOOSTS BANKS BUT HURTS UTILITIES -- DOW TRANSPORTS ARE DIVERGING FROM INDUSTRIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR CONTINUES TO FIRM ... The rally in the dollar that started late last week is still intact. The rally started on Friday following statements from the Fed that seemed to suggest a rate hike sooner rather than later. The daily bars in Chart 1 show the PowerShares US Dollar Index...

READ MORE

MEMBERS ONLY

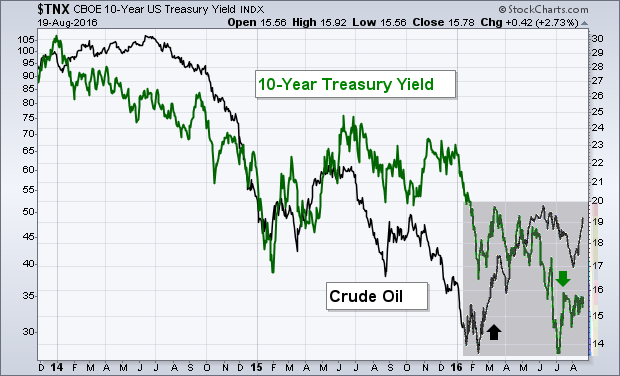

Rising Crude Oil Prices May Start Putting Upward Pressure on Bond Yields

by John Murphy,

Chief Technical Analyst, StockCharts.com

In more normal times, the direction of commodity prices, and oil in particular, had an impact of the direction of bond yields. That because oil is viewed as an early barometer of inflationary trends. A falling oil price (along with other commodities) was disinflationary which boosted bond prices and lowered...

READ MORE

MEMBERS ONLY

CHINA A-SHARES REACH EIGHT-MONTH HIGH ON STRONG VOLUME -- SHANGHAI STOCK INDEX ALSO ACHIEVES BULLISH BREAKOUT -- ANNOUNCEMENT OF SHENZHEN-HONG KONG STOCK CONNECT SHOULD BOOST INTEREST IN MAINLAND CHINESE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CSI 300 CHINA A-SHARES COMPLETE CHART BOTTOM ... Last Friday's market message showed a big rise in the Hong Kong stock market, and suggested that mainland A-Shares might be starting to turn up as well. They did that this week. Chart 1 shows the Deutsche X-trackers CSI 300 China...

READ MORE

MEMBERS ONLY

FALLING GREENBACK BOOSTS CANADIAN DOLLAR -- IT'S ALSO PUSHING COMMODITY PRICES HIGHER -- ENERGY SPDR ACHIEVES BULLISH BREAKOUT -- OIL SERVICE ETF IS ALSO TURNING UP -- ENERGY LEADERS ARE SCHLUMBERGER, BAKER HUGHES, AND MARATHON OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING DOLLAR BOOSTS COMMODITY CURRENCIES... The falling U.S. dollar continues to support commodity prices and currencies tied to commodities. Chart 1 shows the PowerShares Dollar Index (UUP) falling to the lowest level in two months. A falling dollar is positive for foreign currencies, especially those of commodity producing countries....

READ MORE

MEMBERS ONLY

COMMODITY CURRENCIES CONTINUE TO STRENGTHEN -- CANADIAN DOLLAR MAY BE TURNING UP -- EMERGING MARKET CURRENCIES RISE WITH STOCKS -- HONG KONG STOCKS HAVE BEEN CHINESE LEADERS -- BUT A-SHARES MAY BE BOTTOMING AS YUAN STABILIZES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CANADIAN DOLLAR STRENGTENS ... My Tuesday message wrote about the fact that stock ETFs in Canada and Mexico were looking stronger. I also mentioned their stronger currencies resulting from the rebound in crude oil and other commodity prices. With oil rebounding some more this week, commodity currencies in Australia, Canada, Mexico,...

READ MORE

MEMBERS ONLY

MSCI ALL WORLD STOCK INDEX HITS 12-MONTH HIGH -- VANGUARD ALL-WORLD EX US ETF ACHIEVES BULLISH BREAKOUT -- CANADIAN STOCKS CONTINUE TO CLIMB -- BRAZIL ISHARES HAVE STRONG YEAR -- MEXICO ISHARES MAY BE TURNING UP -- GERMAN STOCKS LEAD EUROPE HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MSCI ALL COUNTRY WORLD INDEX HITS 12-MONTH HIGH ... Chart 1 shows the MSCI All Country World Index iShares (ACWI) trading at the highest level since last July. The index of world stocks recently broke through a "neckline" drawn over its November/May highs. The ACWI includes stocks in...

READ MORE

MEMBERS ONLY

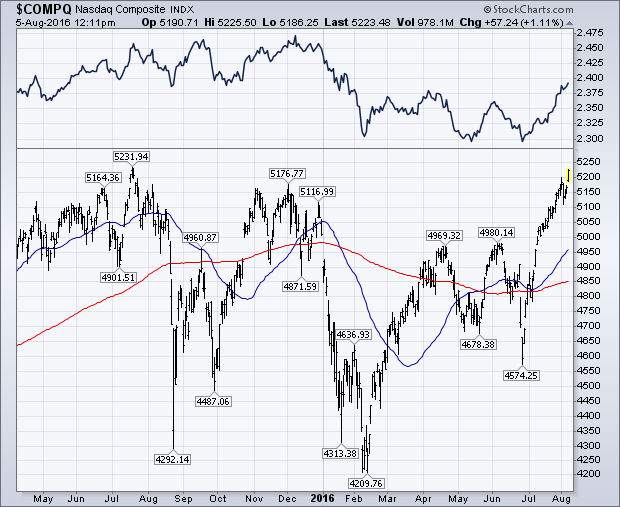

Nasdaq Nears Record - Microsoft is Already There

by John Murphy,

Chief Technical Analyst, StockCharts.com

The Nasdaq Composite Index is on the verge of joining the Dow and S&P 500 in record territory. The first chart below shows the $COMPQ trading at the highest level in a year, and on the verge of clearing last July intra-day peak at 5232. The Nasdaq 100...

READ MORE