MEMBERS ONLY

LIFE INSURERS AND INVESTMENT SERVICE STOCKS BENEFIT FROM RISING BOND YIELDS -- PRUDENTIAL AND GOLDMAN SACHS ACHIEVE UPSIDE BREAKOUTS -- THE WISDOM TREE JAPAN HEDGED ETF ACHIEVES NEW RECOVERY HIGH ON PLUNGING YEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING RATES HELP INSURANCE PORTFOLIOS... Financial stocks are starting to show upside leadership at the same time that bond yields are starting to rise. Banks usually benefit from rising bond yields because they can charge higher rates for their loans. Two other financial groups have actually done better than banks...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS HIT NEW HIGHS -- BANKS LEAD FINANCIALS HIGHER -- LENNAR LEADS BIG BOUNCE IN HOMEBUILDERS -- RATE BOUNCE AFTER FED MEETING PUSHES DOLLAR HIGHER AND GOLD LOWER -- RISING SHORT-TERM RATES CAN BE GOOD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW INDUSTRIALS JOIN TRANSPORTS IN NEW HIGHS... Chart 1 shows the Dow Transports hitting another record high today, and remaining the strongest of the three Dow averages. Today's rally was led by rails and delivery services. Fedex gained 3.5% to lead the latter group higher. Chart 2...

READ MORE

MEMBERS ONLY

DOW AND S&P 100 HOLD UP THE BEST -- INDUSTRIAL SECTOR SHOWS RELATIVE STRENGTH -- BANDWIDTH INDICATOR HITS NEW LOW FOR XLI -- 3M AND GENERAL ELECTRIC -- AEROSPACE & DEFENSE ETF PACES INDUSTRIALS -- ALLIANT TECH AND ROCKWELL COLLINS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 100 HOLD UP THE BEST... Link for today's video. After a big advance in August, stocks succumbed to some selling pressure in September. This selling pressure, however, has not been uniformly spread throughout the stock market. As noted in Monday's Market...

READ MORE

MEMBERS ONLY

SMALL-CAPS LEAD THE MARKET LOWER -- INTERNET ETF LEADS TECH SECTOR LOWER -- GOOGLE AND AMAZON SHOW RELATIVE WEAKNESS -- BIOTECHS AND SOLAR STOCKS LEAD MOMENTUM NAMES LOWER -- FINANCE SECTOR MOVES INTO SCTR TOP THREE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS LEAD THE MARKET LOWER ... Link for today's video. The Russell 2000 iShares (IWM) and the S&P SmallCap iShares (IJR) are showing relative weakness in September and leading the current correction. There may be some debate on the term "correction" though. The S&...

READ MORE

MEMBERS ONLY

SWEDISH KRONA IS EUROPE'S WEAKEST CURRENCY -- FALLING COMMODITIES ALSO HURT AUSSIE AND CANADIAN DOLLARS -- TREASURY YIELDS ARE HIGHLY CORRELATED TO LOWER GERMAN YIELDS -- TREASURY YIELD JUMPS TO TWO-MONTH HIGH -- BOND ETFS HAVE WORST WEEK IN A YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE CURRENCY WEAKNESS... My mid-week message on the broadbased nature of the U.S. dollar rally showed a number of falling currencies, including the Euro, the Swiss franc, the British Pound, the Japanese yen, and the Canadian Dollar. Chart 1 adds two more. The blue line shows the Swedish Krona...

READ MORE

MEMBERS ONLY

MAJOR INDICES STILL CONSOLIDATING WITHIN UPTRENDS -- FINANCE AND TECH SECTORS HOLD NEAR HIGHS -- BANK OF AMERICA AND TYCO BREAK OUT -- RISING 10-YR BOOSTS BANKS AND HURTS REITS -- COPPER ETF REVERSES UPSWING

by John Murphy,

Chief Technical Analyst, StockCharts.com

NIKKEI HITS SEVEN MONTH HIGH... Link for today's video. Despite some stalling over the last few weeks, the major stock indices remain in long-term uptrends. The S&P 500, S&P 500 Equal-Weight Index and the S&P 1500 all hit new highs in early...

READ MORE

MEMBERS ONLY

SHORT-TERM RATES REMAIN BELOW LONG-TERM RATES -- BUT THE GAP IS NARROWING -- THAT'S BEEN GOOD FOR STOCKS IN THE PAST -- RISING SHORT-TERM RATES ARE HELPING THE DOLLAR -- BUT ARE BEARISH FOR GOLD -- FALLING BULLION IS WEIGHING ON GOLD MINERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ANOTHER WAY TO LOOK AT YIELD CURVE... My Wednesday message included a paragraph on the yield curve. One of the charts, however, overlaid the 2-year and 10-year Treasury yields on the same chart. I was trying to show that short-term rates were rising, while long-term yields were dropping. That chart,...

READ MORE

MEMBERS ONLY

DOLLAR RALLY IS BROADBASED -- SCOTTISH INDEPENDENCE VOTE WEIGHS ON THE POUND -- DOLLAR INDEX APPEARS TO BE FORMING MAJOR BOTTOM -- THAT WOULD BE BAD FOR COMMODITIES, BUT GOOD FOR U.S. STOCKS -- DOW/GOLD RATIO HAS TURNED UP IN FAVOR OF STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR RALLY IS VERY BROADBASED... The U.S. Dollar has become the strongest currency in the world. Although a lot of the attention has focused on the plunge in the Euro, the fact is that all major currencies are falling against the dollar, as shown in Chart 1. Two of...

READ MORE

MEMBERS ONLY

A MOMENT OF TRUTH FOR SMALL-CAPS -- REGIONAL BANKS AND SMALL-CAPS FINANCIALS SWING HIGHER -- CYBER SECURITY STOCKS SHOW RELATIVE STRENGTH -- CHECK POINT SURGES TO NEW HIGHS -- PALO ALTO AND FORTINET LEAD SECURITY GROUP

by John Murphy,

Chief Technical Analyst, StockCharts.com

A MOMENT OF TRUTH FOR SMALL-CAPS... Link for today's video. Small-caps have been lagging large-caps for some time now, but the S&P SmallCap iShares (IJR) and the Russell 2000 iShares (IWM) have yet to break down and actually weigh on the stock market. Chart 1 shows...

READ MORE

MEMBERS ONLY

METALS & MINING SPDR FAILS TO HOLD BREAKOUT -- STEEL ETF TESTS CONSOLIDATION SUPPORT -- RETAIL SPDR STALLS AHEAD OF BIG REPORT -- SOLAR ETF, FIRST SOLAR AND SOLAR CITY HEAT UP -- OIL BREAKS TO NEW LOWS AND TAKES GASOLINE WITH IT

by John Murphy,

Chief Technical Analyst, StockCharts.com

METALS & MININGS SPDR FAILS TO HOLD BREAKOUT... Link for today's video. Metals and mining stocks are getting hit hard on Monday. Gold, silver and platinum were down around 1% in afternoon trading. Elsewhere, iron-ore prices hit five year lows this month. Overall, gold is trading some $600...

READ MORE

MEMBERS ONLY

All Three Dow Averages Are Rising Together

by John Murphy,

Chief Technical Analyst, StockCharts.com

My Wednesday message showed the Dow Industrials and Transports testing their summer highs. The bars on top of Chart 7 show that the Dow Transports have hit new highs (led by rails and truckers). The Dow Industrials, however, are still testing their July peak. The Industrials need to hit a...

READ MORE

MEMBERS ONLY

UKRAINE CEASEFIRE BOOSTS RUSSIAN STOCKS -- AGGRESSIVE ECB ACTION ALSO BOOSTS EUROZONE STOCKS -- FALLING EURO UNDERMINES STOCK ETFS -- ALL THREE CHINESE INDEXES ARE NOW IN UPTRENDS -- DOW INDUSTRIALS ARE STILL TESTING SUMMER HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSIAN RALLY HELPS EUROPEAN STOCKS... Expectations for a cease-fire in Ukraine gave a big boost to Russian stocks as well as European stocks closely tied to Russia. Chart 1 shows the Market Vectors Russia ETF (RSX) climbing 6% during the week to close just above its 200-day moving average average....

READ MORE

MEMBERS ONLY

SPY EXTENDS LONG-TERM UPTREND -- SMALL-CAPS ARE DOWN, BUT NOT OUT -- XLF, XLK AND XLY STALL AFTER NEW HIGHS -- XLI FORMS BULLISH CONTINUATION PATTERN -- KEY BREADTH INDICATORS HIT NEW HIGHS -- ECONOMIC INDICATORS SHOW SERIOUS STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPY CONTINUES TO LEAD AND TREND HIGHER... Link for today's video. Stocks stalled over the last two weeks, but the overall trends are up for the major index ETFs. Keep in mind that stocks were short-term overbought at the end of August because the S&P 500...

READ MORE

MEMBERS ONLY

POSSIBLE UKRAINE CEASEFIRE LIFTS GLOBAL STOCKS -- RUSSIAN AND EUROPEAN STOCKS JUMP -- CHINA LEADS EMERGING MARKETS -- DOW INDUSTRIALS AND TRANSPORTS TEST OLD HIGHS -- RISING DOLLAR HURTS COMMODITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSIAN STOCKS JUMP 5% ... News of a possible ceasefire in Ukraine has given a big boost to global stock markets. Nowhere is that more evident than in Russia. Chart 1 shows the Market Vectors Russia ETF (RSX) jumping more than 5%. The Russian ETF needs to clear its mid-August peak...

READ MORE

MEMBERS ONLY

REGIONAL BANKS AND RUSSELL 2000 LEAD -- HOME CONSTRUCTION ISHARES FORMS A HIGH-TIGHT FLAG -- TOLL BROTHERS AND USG GO FOR BREAKOUTS -- GOLD HOLDS LONG-TERM BEARISH PATTERN -- YEN FOLLOWS EURO WITH A BREAK DOWN

by John Murphy,

Chief Technical Analyst, StockCharts.com

REGIONAL BANKS AND RUSSELL 2000 LEAD... Link for today's video. September trading has started with a bang for the Russell 2000 iShares (IWM) and the Regional Bank SPDR (KRE). I am mentioning these two in the same sentence because financial services accounts for 24.19% of IWM and...

READ MORE

MEMBERS ONLY

RISING DOLLAR AND PLUNGING EURO REFLECT WEAKER ECONOMIC CONDITIONS IN EUROPE -- FALLING EUROZONE BOND YIELDS PULL HIGHER-YIELDING TREASURY YIELDS LOWER AS DEFLATION THREAT WORSENS-- EUROZONE STOCKS ALSO WEAKEN ON UKRAINE TENSIONS AND LOWER RUSSIAN STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX REACHES 12-MONTH HIGH ... The U.S. dollar continues to strengthen. The daily bars in Chart 1 show the U.S. Dollar Index now trading at the highest level in a year. Its upturn started in May and was followed by upside breakouts during July and August. The fact...

READ MORE

MEMBERS ONLY

SPY AND QQQ STALL ABOVE THEIR JULY HIGHS -- AMAZON, GOOGLE, QUALCOMM AND EBAY LAG -- GOOGLE DOES SHOW SOME IMPROVEMENT THOUGH -- RUSSIAN INDEX REVERSES AT SUPPORT BREAK -- 20+ YR T-BOND ETF WHIPS UP ON SPY -- ONLY ONE COMMODITY GROUP SHOWS STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPY AND QQQ STALL ABOVE THEIR JULY HIGHS... Link for today's video. Stocks took a breather this week as the S&P 500 SPDR (SPY) and the Nasdaq 100 ETF (QQQ) moved sideways after a strong open on Monday morning. Considering the negative geopolitical news this week,...

READ MORE

MEMBERS ONLY

TALE OF TWO INDUSTRY GROUPS TODAY -- BIOTECHNOLOGY IS THE WILD WEST -- MID CAP AND SMALL CAP BIOTECHS ARE PERFORMING OK AS WELL -- CONDITIONS AROUND $GOLD ARE CHANGING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TALE OF TWO INDUSTRY GROUPS TODAY... Health Care continues to be a leading sector. Within healthcare, the Biotechnology sector is a rapidly changing field with huge medical advancements being made. There are currently 6 SCTR ranked large cap stocks that have really strong SCTR rankings and strong weekly charts in...

READ MORE

MEMBERS ONLY

EMERGING MARKETS ISHARES HIT THREE-YEAR HIGH TO EXTEND BULLISH BREAKOUT -- EMERGING MARKET CURRENCIES ARE ALSO HAVING A GOOD YEAR, ESPECIALLY AGAINST THE EURO -- HIGHER YIELDING EMERGING MARKET BONDS ARE ALSO RISING -- CHINA BREAKOUT IS A BULLISH SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKET ISHARES REACH THREE-YEAR HIGH ... The weekly bars in Chart 1 show Emerging Markets iShares (EEM) now trading at the highest level in three years. Just over a month ago, the EEM broke above its late 2012 high near 44.00. That bullish breakout bodes well for emerging market...

READ MORE

MEMBERS ONLY

RUSSELL 2000 ETF LAGS, BUT MAINTAINS BULLISH EDGE -- EQUAL-WEIGHT S&P 500 ETF HITS NEW HIGH -- OIL NEARS SUPPORT ZONE AND REMAINS OVERSOLD -- OIL & GAS EQUIP & SERVICES SPDR FIRMS NEAR KEY RETRACEMENT -- MERCK LEADS HEALTHCARE SPDR TO NEW HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ETF LAGS, BUT MAINTAINS BULLISH EDGE... There has been some concern that the Russell 2000 (small-caps) is lagging the Russell 1000 (large-caps). Relative weakness in small-caps detracts from a broad market advance because these stocks represent the appetite for risk and the high-beta end of the stock market....

READ MORE

MEMBERS ONLY

INDUSTRIALS, TECH AND DISCRETIONARY SECTORS HIT NEW HIGHS -- SHANGHAI COMPOSITE HOLDS BREAKOUT -- BOVESPA CONFIRMS MAJOR BULLISH REVERSAL PATTERN -- YEN BREAKDOWN IS POSITIVE FOR NIKKEI 225 -- JO PULLS BACK AFTER BIG SURGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIALS, TECH AND DISCRETIONARY SECTORS HIT NEW HIGHS... Link for today's video. Stocks were broadly higher around midday on Monday with several major index ETFs hitting new highs. The Dow Diamonds, Nasdaq 100 ETF, S&P 500 SPDR and Equal-Weight S&P 500 ETF hit new...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD AS XLF AND REM HIT NEW HIGHS -- FOUR FINANCIAL STOCKS TO WATCH -- BASE METALS ETF EXTENDS UPTREND -- ALUMINUM LEADS BASE METALS -- COPPER MINERS ETF CORRECTS WITHIN UPTREND -- 2-YEAR YIELD ENDS PULLBACK AND RESUMES UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS LEAD AS XLF AND REM HIT NEW HIGHS... Link for today's video. The Finance SPDR (XLF) and the Equal-weight Finance ETF (RYF) moved to new highs this week to affirm their long-term uptrends. Things can't be all that bad when these two sector ETFs record...

READ MORE

MEMBERS ONLY

$SPX SPENDS THE DAY BREAKING THROUGH TO NEW ALL TIME HIGHS -- $INDU ONLY 75 POINTS FROM PREVIOUS HIGHS -- THE RUSSELL 2000 ($RUT) STALLS AT 50 DMA -- THE NYSE ADVANCE DECLINE LINE HIT NEW HIGHS TODAY AS WELL

by John Murphy,

Chief Technical Analyst, StockCharts.com

$SPX SPENDS THE DAY BREAKING THROUGH TO NEW ALL TIME HIGHS... While the S&P500 ($SPX) worked through to all time highs today as shown on Chart 1, there was a continuous drumbeat towards the 2000 level for the $SPX. The market peaked out at 1994, which was 3...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SPDR HITS A NEW HIGH -- HOME IMPROVEMENT AND APPAREL RETAILERS PUSH MARKET VECTORS RETAIL ETF TO A NEW HIGH -- BIG JUMP IN HOUSING STARTS LIFTS HOMEBUILDERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR HITS NEW HIGH... A positive sign for the stock market and the economy is the ability of the Consumer Discretionary SPDR (XLY) to hit a new high this week, as shown in Chart 1. The relative strength line (above chart) had fallen during the first half of...

READ MORE

MEMBERS ONLY

SMALL-CAP FINANCIALS ETF RECAPTURES KEY MOVING AVERAGE -- REGIONAL BANK SPDR ATTEMPTS ANOTHER UPSWING -- STEEL ETF SURGES OFF CONSOLIDATION SUPPORT -- WORTHINGTON AND VALE REVERSE NEAR KEY RETRACEMENTS -- RETAIL SPDR CATCHES FIRE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAP FINANCIALS ETF RECAPTURES KEY MOVING AVERAGE... Link for today's video. Yesterday I noted that the Consumer Discretionary SPDR moved back above its short-term support break. The Finance SPDR (XLF) also joined with a surge back above 22.50 over the last few days. As with XLY, the...

READ MORE

MEMBERS ONLY

BIG TECH SHOWS RELATIVE STRENGTH AS SMALL TECH ATTEMPTS BREAKOUT -- INTERNET ETF BREAKS OUT AS CLOUD COMPUTING ETF CHALLENGES RESISTANCE -- YAHOO! CHALLENGES RESISTANCE AS VM WARE BREAKS PENNANT

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIG TECH SHOWS RELATIVE STRENGTH AS SMALL TECH ATTEMPTS BREAKOUT ... Link for today's video. The Nasdaq 100 ETF (QQQ) continues to lead the major index ETFs with another new high. Not many ETFs are trading at or above their July highs right now. QQQ shows both chart strength...

READ MORE

MEMBERS ONLY

Europe is Helping Drive the Treasury Yields Lower

by John Murphy,

Chief Technical Analyst, StockCharts.com

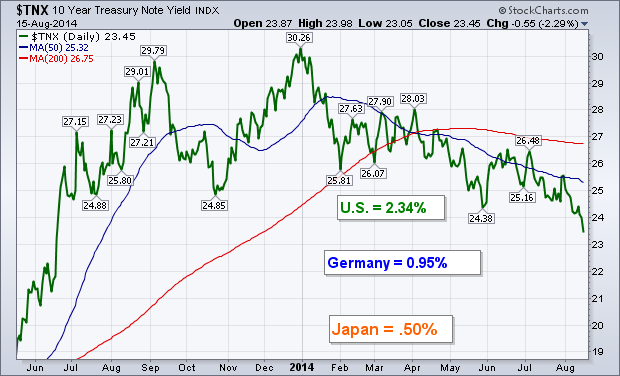

The yield on the 10-Year Treasury Note fell to 2.34% this week which is the lowest level in fourteen months. Heavy buying of Treasury bonds in an apparent flight to safety was a big reason for the yield plunge. A bigger reason may have signs of economic weakness overseas,...

READ MORE

MEMBERS ONLY

UKRAINE TENSION ON FRIDAY STALLS MARKET RALLY -- NASDAQ IS ONLY INDEX TO CLEAR 50-DAY AVERAGE -- DAILY MACD LINES FOR S&P 500 IMPROVE -- BUT WEEKLIES HAVEN'T -- BOND YIELD PLUNGE HAS MORE TO DO WITH WEAKNESS IN EUROPE THAN U.S.

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ LEADS MARKET HIGHER... The Nasdaq market led this week's stock market rebound (gaining 2.15%). Chart 1 shows the Nasdaq Composite Index ending the week well above its 50-day average, and within striking distance of its July peak. So far, the Nasdaq is the only major U....

READ MORE

MEMBERS ONLY

SETTING FIRST SUPPORT FOR SPY BOUNCE -- TREASURIES SURGE ON TAME PPI -- GOLD REVERSES COURSE ON GEOPOLITICAL TENSIONS -- URANIUM ETF SURGES OFF SUPPORT -- CAMECO LEADS URANIUM ETF HIGHER -- AD LINE AND AD VOLUME LINE REVERSE SHORT-TERM DOWNTRENDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SETTING FIRST SUPPORT FOR SPY BOUNCE... Link for today's video. Stocks opened strong and then sold off on reports suggesting an escalation of tensions in Ukraine - at least that was reasoning in the financial media. As of noon, the S&P 500 SPDR (SPY) was trading...

READ MORE

MEMBERS ONLY

$SPX BOUNCES OFF THE PRIMARY TREND ON THE MONTHLY CHARTS -- $SPX 30 WEEK MA HAS BEEN SOLID SUPPORT FOR 20 MONTHS -- CHANGE IN $SPX SLOPE DEFINES THE NEXT TEST -- $SPX TESTS BOTH THE 20 DMA AND 50 DMA FROM BELOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

$SPX BOUNCES OFF THE PRIMARY TREND ON THE MONTHLY CHARTS... With the bounce off last weeks lows, we have moved back above the monthly trend off the 2011-2012 lows on the S&P 500 ($SPX). This level also coincides with some moving averages on shorter time frames. The confluence...

READ MORE

MEMBERS ONLY

FINANCE SECTOR BOUNCES OFF KEY RETRACEMENT -- GOLD MINERS ETF GETS A BULLISH MOMENTUM SIGNAL -- SMALL-CAP BREADTH IMPROVES -- HIGH-LOW LINE LINES REMAIN NEGATIVE -- USING THE VIX TO TIME A MARKET BOUNCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCE SECTOR BOUNCES OFF KEY RETRACEMENT... Link for today's video. The Finance SPDR (XLF) is showing some relative strength early Tuesday with a modest advance. Chart 1 shows XLF hitting the 50% retracement in late July and firming for seven days. This firmness turned to buying pressure the...

READ MORE

MEMBERS ONLY

SMALL-CAPS START SHOWING RELATIVE STRENGTH -- TREND, SETUP AND TRIGGER FOR IWM -- XRT BREAKS RESISTANCE ZONE -- SOCIAL MEDIA ETF FORMS BULLISH CONTINUATION PATTERN -- COAL STOCKS TURN INTO MARKET LEADERS -- XME BREAKS RIM RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS SHOW A LITTLE RELATIVE STRENGTH ... Video note: I am on the road today and there is no video for Monday. Video will return on Tuesday when I get back to the office. Even though it is just one week, small-caps are starting to show relative strength by outperforming. Note...

READ MORE

MEMBERS ONLY

QQQ REMAINS THE LONE HOLD OUT -- IGN AND XSD HOLD SUPPORT BREAKS -- MARKETVECTORS RETAIL ETF BREAKS DOWN, BUT XRT HOLDS FIRM -- MEDIA AND LEISURE ETFS WEIGH ON CONSUMER DISCRETIONARY -- GOLD IGNORES DOLLAR WITH SURGE ABOVE 1300

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ REMAINS THE LONE HOLD OUT... Link for today's video. The Russell 2000 iShares (IWM) peaked in early July and fell the last five weeks. The S&P 500 SPDR (SPY) held out, but succumbed to selling pressure in late July and broke first support. The Nasdaq...

READ MORE

MEMBERS ONLY

CONSUMER STAPLES (XLP) BECOMES THE STRONGEST SECTORS ON THE WEEK -- UTILITIES (XLU) CONTINUE TO UNDER PERFORM -- COMPLIMENTING SECTOR PERF CHARTS WITH RELATIVE ROTATION GRAPHS -- THE ENERGY SECTOR MOVES INTO THE WEAKENING QUADRANT

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER STAPLES (XLP) BECOMES THE STRONGEST SECTOR OF THE WEEK... Since August 1, the Sector SPDR Consumer Staples (XLP) has really surged. It has become the top sector on the week. Notice the box in the bottom right of Chart 1 says 6 days.

On Chart 2, XLP is now...

READ MORE

MEMBERS ONLY

THE DOW AND S&P 500 ARE TESTING THEIR 200 AND 100-DAY MOVING AVERAGES RESPECTIVELY -- RUSSELL 2000 AND EUROZONE ISHARES NEAR SUPPORT AT SPRING LOWS -- OVERSOLD HIGH YIELD BOND ETF IS ALSO TESTING 200-DAY AVERAGE -- SEE YOU IN SEATTLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW IS TESTING 200-DAY LINE ... The Dow Industrials have already reached their 200-day moving average. At the same time, the 14-day RSI line (above chart) has reached a short-term oversold reading at 30. This is an important test for the Dow and the rest of the market. Chart 2 shows...

READ MORE

MEMBERS ONLY

INTERNET ETF CONSOLIDATES AT MOMENT-OF-TRUTH -- GOOGLE TESTS SUPPORT AS YAHOO STALLS AT RESISTANCE -- A SHIFT IN SENTIMENT TOWARDS UTILITIES -- THREE UTILITIES ETFS BREAK SUPPORT -- OIL BREAKS LONG-TERM SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

INTERNET ETF CONSOLIDATES AT MOMENT-OF-TRUTH ... Chart 1 shows the Internet ETF (FDN) advancing to the 62% retracement and consolidating with a triangle. This is a make-or-break level for the ETF. A triangle after an advance is typically a bullish continuation pattern. As such, a break above the upper trend line...

READ MORE

MEMBERS ONLY

FINANCE SPDR TESTS THE MAY BREAKOUT -- MORGAN STANLEY AND JP MORGAN TESTS KEY SUPPORTS -- THREE IMPROVING INDUSTRY GROUPS ON RRG -- REGIONAL BANK SPDR HEADS FOR MAJOR SUPPORT TEST -- METALS & MINERS SPDR FORMS BIG BULLISH CONTINUATION PATTERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCE SPDR TESTS THE MAY BREAKOUT... Link for today's video. The Finance SPDR (XLF) got slammed last week and broke first support in the 22.50 area. Will it continue lower and drag the market down? Or, will XLF firm and resume the bigger uptrend. Here's...

READ MORE

MEMBERS ONLY

VIX Jumps to Four-Month High

by John Murphy,

Chief Technical Analyst, StockCharts.com

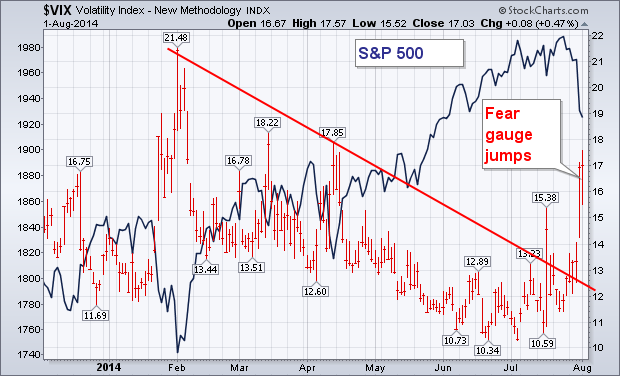

As usually happens when stocks weaken, the CBOE Volatility (VIX) Index jumped sharply this week to the highest level since April. The VIX (also called the "fear gauge") has climbed 47% since the start of July. That means that traders are buying "option" insurance against a...

READ MORE

MEMBERS ONLY

GERMANY LEADS REST OF THE WORLD INTO DOWNSIDE CORRECTION -- A LOT OF MOVING AVERAGES HAVE BEEN BROKEN -- BOND YIELDS FALL AT WEEK'S END -- RISING DOLLAR HAS CONTRIBUTED TO COMMODITY SELLOFF -- % NYSE STOCKS ABOVE 50 AND 200-DAY AVERAGES PLUNGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

GERMAN DAX FALLS BELOW 200-DAY AVERAGE... My last two messages warned that weakness in the Eurozone threatened the global rally in stocks, including the U.S. Not surprisingly, this week's plunge in Europe finally had a negative impact on most other developed markets. Chart 1 shows EMU iShares...

READ MORE

MEMBERS ONLY

USING RSI TO TIME A BOUNCE IN THE S&P 500 -- KEY LEVELS FOR SMALL AND MID-CAP ETFS -- AUGUST SEASONAL PATTERNS ARE NEGATIVE FOR STOCKS -- SEASONAL PATTERNS DO FAVOR A STOCK ALTERNATIVE THOUGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

USING RSI TO TIME A BOUNCE IN THE S&P 500... Link for today's video. The S&P 500 finally came under selling pressure to join small-caps and mid-caps with a pullback. The S&P 500 was down 2% on Thursday, which was the sharpest...

READ MORE