MEMBERS ONLY

WHY I'VE AVOIDED INVERSE ETFS

by John Murphy,

Chief Technical Analyst, StockCharts.com

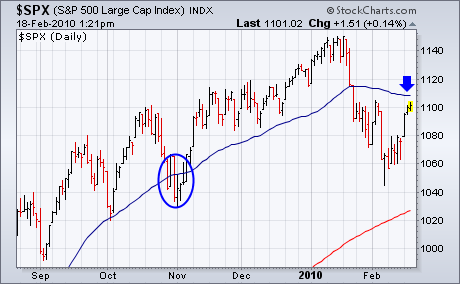

A number of readers have asked why I haven't said much about inverse (or bear) ETFs. The main reason is that I wasn't convinced that the recent market dip was serious enough to warrant bearish positions. So far, that view has been justified. Chart 1 shows...

READ MORE

MEMBERS ONLY

BONDS ROCKED BY PAYROLLS - BACK TO BASICS WITH HIGHER HIGHS AND HIGHER LOWS FOR SPY - EQUAL-WEIGHT QQQQ VERSUS QQQQ - NET NEW HIGHS EXPAND TO JANUARY LEVELS - OIL CHALLENGES RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BONDS ROCKED BY BETTER-THAN-EXPECTED PAYROLLS... The Labor Department reported that non-farm payrolls declined 36,000 for the month of February, which was much better than the consensus estimate for a decline of 68,000 jobs. Positive news on the jobs front sent bonds sharply lower and yields sharply higher. Bonds...

READ MORE

MEMBERS ONLY

WEEKLY EMA LINES ARE STILL POSITIVE -- DAILIES TURN POSITIVE -- STRENGTH IN RETAIL STOCKS IS A POSITIVE SIGN FOR THE MARKET -- RETAIL BREAKOUTS ARE OCCURRING IN BIG LOTS, FAMILY DOLLAR STORES, AND TARGET -- AVOID INVERSE ETFS WHILE MARKET IS RISING

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEEKLY EMA COMBINATION IS STILL UP ... Several recent messages have dealt with the use of "daily" exponentially smoothed average (EMA) crossovers (in particular the 13-34 day EMA combination ) to generate buy and sell signals . One reader suggested that I take a longer-range view of things. Another suggested looking...

READ MORE

MEMBERS ONLY

DOW LAGS SMALL-CAPS AND MID-CAPS - SURGING EURO WEIGHS ON THE GREENBACK - FALLING DOLLAR BOOSTS MATERIALS SECTOR - STEEL ETF FORMS GRAVESTONE DOJI - YIELDS HIT SUPPORT AS BONDS HIT RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW SPDR LAGS OTHER INDICES... Link for todays video. It is a tale of two markets. Small-caps and mid-caps show relative strength, but large-caps show relative weakness. Chart 1 shows the Russell 2000 ETF (IWM) hitting a new 52-week high intraday on Wednesday. IWM exceeded the 50-day moving average and...

READ MORE

MEMBERS ONLY

STOCK INDEXES EXCEED 50-DAY LINES -- THAT IMPROVES THE MARKET'S SHORT-TERM TREND -- SO DOES THE NYSE ADVANCE-DECLINE LINE HITTING A RECORD HIGH -- NEWMONT MINING LEADS GOLD MINERS HIGHER AS GOLD RALLIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

50 DAY AVERAGES ARE EXCEEDED ... The ability of major U.S. stock indexes to rally back above their 50-day moving averages has improved the market's short-term trend picture. Chart 1 shows the S&P 500 closing above its 50-day average for two consecutive days although the line...

READ MORE

MEMBERS ONLY

SMALL-CAPS AND TECHS LEAD FEBRUARY BOUNCE - IWM OUTPERFORMS SPY ON THE CHART - S&P 500 EQUAL WEIGHT OUTPERFORMS - CONSUMER DISCRETIONARY AND STAPLES LEADING - KEY LEVELS FOR XLY AND XLF

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS AND TECHS LEAD THE BOUNCE... Link for todays video. Small-caps and tech stocks are showing relative strength over the last few weeks. There are many ways to measure relative strength or relative weakness. Comparing percentage gains is perhaps the easiest and most straight forward. Perfchart 1 shows the Major...

READ MORE

MEMBERS ONLY

EURO DECLINE SLOWS - PICKING THE RIGHT RETRACEMENT - GOLD AND THE EURO STILL POSITIVELY CORRELATED - GOLD BATTLES WEDGE TRENDLINE - OIL, STOCKS AND THE DOLLAR - OIL REMAINS STUCK IN A RUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO DECLINE SLOWS... Link for todays video. The decline in the Euro is slowing over the last few weeks, but we have yet to see a bounce last more than two days since late December. Chart 1 shows weekly candlesticks for the Euro ETF (FXE) Should the ETF close down...

READ MORE

MEMBERS ONLY

MORE WAYS TO USE MOVING AVERAGES -- 20-50 AND 13-34 EMA COMBINATIONS ARE STILL NEGATIVE -- SIMPLIFY MOVING AVERAGE SIGNALS -- YEN RALLIES IN FLIGHT TO SAFETY AS GLOBAL STOCKS SELLOFF

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE SENSITIVE EMA CROSSINGS ... I got such an overwhelming response on Tuesday's message on using exponentially smoothed moving averages (EMAs) in conjunction with simple averages that I'd like to expand even further on the subject. One reader asked if shorter-term EMAs could be employed in a...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SPDR CHALLENGES RESISTANCE - A BEAR TRAP OR OVERSOLD BOUNCE? - WATCHING THE VOLATILITY INDICES - ACCUMULATION DISTRIBUTION LINE VERSUS ON BALANCE VOLUME

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR CHALLENGES RESISTANCE... Link for todays video. While the S&P 500 and the Dow remain well below their January highs, the Consumer Discretionary SPDR (XLY) is challenging its January highs after a sharp advance the last few weeks. Chart 1 shows XLY within a rising price...

READ MORE

MEMBERS ONLY

A LOT OF MARKETS ARE MEETING RESISTANCE AT THEIR 50-DAY AVERAGES -- COMBINING SIMPLE AND EMA AVERAGES -- WHY 50-DAY LINES ARE LIKELY TO KEEP FALLING

by John Murphy,

Chief Technical Analyst, StockCharts.com

RALLY STALLS AT 50-DAY LINES ... Two Tuesdays ago (February 9), I wrote a message about the number of markets (domestic and foreign) that were starting to bounce off their 200-day moving averages and the likelihood for a short-term rally. The last part of that headline, however read: 'Expect Resistance...

READ MORE

MEMBERS ONLY

ELLIOTT WAVE COUNT FOR S&P 500 - REVIEWING LONG-TERM RETRACEMENTS FOR SPY AND DIA - INTERNATIONAL INDICES ALSO NEAR KEY RETRACEMENTS - XHB CHALLENGES RESISTANCE AS XLF TESTS SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

ELLIOTT WAVE COUNT FOR S&P 500 ... Link for todays video. Chart 1 shows an Elliott Wave interpretation for the S&P 500 over the last three years. There are currently four waves with a potential fifth wave coming. Wave 1 extends down from October 2007 to March...

READ MORE

MEMBERS ONLY

DOES FALLING 50-DAY LINE MEAN ANYTHING?

by John Murphy,

Chief Technical Analyst, StockCharts.com

One of our readers recently pointed out that the blue 50-day moving average is declining for the first time since last March, and asked if that makes it more of a resistance barrier. The short answer is probably. Although most attention is paid to "crossings" above and below...

READ MORE

MEMBERS ONLY

RETRACEMENTS REINFORCE MOVING AVERAGES - SHORT-TERM RATES MOVE AHEAD OF FED - RATES STILL LOW BY HISTORICAL STANDARDS - DOLLAR BENEFITS FROM RISING RATES - SWINGS WITHIN THE 2004 CORRECTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETRACEMENTS REINFORCE MOVING AVERAGES... This week John Murphy featured the S&P 500 and other global indices with the falling 50-day moving averages coming into play. Key Fibonacci retracements and short-term overbought readings are also coming into play. The Fibonacci Retracements Tool shows potential reversal/resistance levels based on...

READ MORE

MEMBERS ONLY

FALLING 50-DAY AVERAGE USUALLY PROVIDES MORE RESISTANCE ON MARKET BOUNCES -- TIME TO SHORT THE YEN? -- ANALYSIS VERSUS REPORTING

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOES FALLING 50-DAY LINE MEAN ANYTHING? ... One of our readers correctly points out that the blue 50-day moving average is declining for the first time since last March, and asks if that makes it more of a resistance barrier. The short answer is probably. Although most attention is paid to...

READ MORE

MEMBERS ONLY

BONDS FALL AS FED CONSIDERS ASSET SALES - EURO GETS HIT AGAIN - XLF TESTS SUPPORT AROUND 14 - GOLD AND EURO DECOUPLE FOR A FEW DAYS - LOOK AT 2003-2004 SPX FOR CLUES TO CURRENT SITUATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

BONDS FALL AS FED CONSIDERS ASSET SALES... Link for todays video. The Fed released the minutes of its January meeting this afternoon. Shrinking the balance sheet proved a top priority among Fed officials. Among other things, this would involve sales of Treasury bonds the Fed bought during its quantitative easing...

READ MORE

MEMBERS ONLY

STOCK AND COMMODITY REBOUND CONTINUES AS EURO BOUNCES AND DOLLAR WEAKENS -- COMMODITY STOCKS LEAD REBOUND -- GLOBAL STOCK INDEXES RALLY TOWARD THEIR 50-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO BOUNCES OFF 62% RETRACEMENT LINE ... Most of the U.S. Dollar strength since December has come from a falling Euro. Therefore, any bounce in the Euro has a big influence on the direction of global stocks and commodities. Chart 1 shows the Euro trading well below its 200-day moving...

READ MORE

MEMBERS ONLY

TECHS AND SMALL-CAPS SHOW RESILIENCE - SPX HITS LONG TERM REVERSAL ZONE - CHANNEL STILL FALLING FOR SPX - OIL BATTLES SUPPORT - XLE AND OIH ALSO BATTLING SUPPORT - SHANGHAI COMPOSITE BREAKS SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHS AND SMALL-CAPS SHOW RESILIENCE... Link for todays video. The Nasdaq 100 ETF (QQQQ) and the Russell 2000 ETF (IWM) are showing relative strength this week. Concerns with Greek debt and monetary tightening in China weighed on stocks in early trading, but buyers stepped in after the morning gap and...

READ MORE

MEMBERS ONLY

GREEK SUPPORT PLAN BOOSTS STOCKS AND COMMODITIES -- DAILY AND WEEKLY BOLLINGER BANDS SHOW SUPPORT -- MORE MARKETS BOUNCE OFF 200-DAY AVERAGE -- % NYSE STOCKS ABOVE 200-DAY AVERAGE HAS FALLEN TO SEVEN-MONTH LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

BLENDING DAILY AND WEEKLY BANDS... One of the reasons I thought last Friday's upside reversal day signalled a short-term rally attempt was because it occurred right at its lower Bollinger band as shown in Chart 1. Another reason is that the two bands have started to contract as...

READ MORE

MEMBERS ONLY

STOCKS EXTEND STALL - BONDS DECLINE ON BERNANKE REMARKS - HIGH YIELD BOND ETF HIT HARD - CORPORATE BOND ETF FORMS LOWER HIGH - JUNK VERSUS INVESTMENT GRADE - PERCENT OF STOCKS ABOVE 50-DAY PLUMMETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS EXTEND STALL... Link for todays video. Stocks stalled again on Wednesday with the major indices finishing mixed. Actually, most indices were down slightly with fractional gains coming from the Russell 2000 ($RUT) and the S&P 600 SmallCap Index ($SML). Small-caps showed a little relative strength today. Eight...

READ MORE

MEMBERS ONLY

BIG DROP IN GREEK BOND YIELDS ENCOURAGES STOCK AND COMMODITY REBOUND AS DOLLAR DROPS -- MATERIALS ARE DAY'S STOCK LEADERS -- A LOT OF 200-DAY AVERAGES ARE HOLDING FOR NOW -- THAT SUGGESTS A SHORT-TERM BOTTOM

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS LEAD GLOBAL REBOUND... A 40 basis point plunge in Greek bond yields, which is the biggest drop in more than a decade, has increased hopes for some type of aid to that endangered economy. That has eased downside pressure on the Euro and caused some profit-taking in an overbought...

READ MORE

MEMBERS ONLY

DOLLAR BECOMES OVERBOUGHT AGAIN - GOLD REMAINS TIED TO THE DOLLAR - AN ABC CORRECTION FOR GLD - OIL FLIRTS WITH SUPPORT - LONG-TERM RATES RISING

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR BECOMES OVERBOUGHT AGAIN... Link for todays video. For the second time in two weeks, the US Dollar Index ($USD) surged and became overbought. Chart 1 shows the index with 14-day RSI moving back above 70. This is also the third overbought reading since December 21st. While overbought readings increase...

READ MORE

MEMBERS ONLY

MATERIALS AND FINANCIALS BOUNCE OFF 200-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

The stock market remains in a downside correction as evidenced by the breaking of initial support levels and negative turns in several longer-term technical indicators (more on that later). Friday's heavy-volume upside reversal, however, suggests that a short-term bottom may have formed from an oversold condition. That'...

READ MORE

MEMBERS ONLY

FRIDAY UPSIDE REVERSAL MAY GIVE WAY TO OVERSOLD BOUNCE AS NYSE INDEX BOUNCES OFF NOVEMBER LOW -- MATERIAL AND FINANCIAL SPDRS BOUNCE OFF 200-DAY LINES -- SELL SIGNAL IN NYSE BULLISH PERCENT INDEX, HOWEVER, ARGUES AGAINST QUICK RECOVERY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS AND FINANCIALS BOUNCE OFF 200-DAY LINES ... The stock market remains in a downside correction as evidenced by the breaking of initial support levels and negative turns in several longer-term technical indicators (more on that later). Friday's heavy-volume upside reversal, however, suggests that a short-term bottom may have...

READ MORE

MEMBERS ONLY

STOCKS AND DOLLAR CONTINUE INVERSE CORRELATION - CHINA LEADS LOWER WITH BREAKDOWN - GLOBAL INDICES HIT HARD - COMMODITIES AFFECTED BY DOLLAR AND STOCKS - NATURAL GAS FORMS FALLING FLAG

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS AND THE DOLLAR CONTINUE INVERSE CORRELATION... Link for todays video. Maybe this time its different, but the sharp rise in the Dollar could be a big negative for the stock market. The Dollar and the stock market have had an inverse relationship for most of the last two years....

READ MORE

MEMBERS ONLY

SECTOR AND GLOBAL ROTATION VIEWS ARE PART OF MARKET ANALYSIS -- RECENT ROTATIONS AND MARKET SIGNALS HAVE WARNED OF GLOBAL CORRECTION -- DURING AN INTERMEDIATE DOWNSIDE CORRECTION, SHORT-TERM TRADERS SHOULD BE SELLING BOUNCES NOT BUYING THEM

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR ROTATION STRATEGIES ARE PART OF MARKET ANALYSIS... Given all of the warnings sounded by Arthur Hill and myself since mid-January, I was somewhat surprised at some e-mail messages I received today. One reader accused me of focusing too much on sector rotation strategies and ignoring the broader market. A...

READ MORE

MEMBERS ONLY

SPAIN LEADS GLOBAL SELLOFF AS DEFAULT FEARS GROW IN EUROPE -- COMMODITIES ARE SELLING OFF HARD AS DOLLAR RALLIES -- SO ARE COMMODITY-RELATED STOCKS -- THE ONLY OTHER SAFE HAVENS ARE TREASURIES AND THE YEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPAIN SHARES LEAD GLOBAL RETREAT IN STOCKS AND COMMODITIES... Growing fears that some European countries may have trouble financing their deficits is rattling global stock and commodity markets. Those fears started in Greece and have now spread to Spain and Portugal. Chart 1 shows Spain iShares (EWP) tumbling 7% to...

READ MORE

MEMBERS ONLY

BOND ETF HITS RESISTANCE - DOLLAR CONTINUES ITS RISE - LESSONS FROM PRIOR BEAR MARKET - A QUICK TOP ON 2001 - A DRAWN OUT TOP IN 2002 - TECHNICAL ANALYSIS IS FRACTAL - S&P 500 HITS IMPORTANT RESISTANCE ZONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND ETF HITS RESISTANCE... Link for todays video. After a pretty good rally in January, the 20+ Year Treasury ETF (TLT) hit resistance last week and fell back over the last three days. Chart 1 shows TLT breaking support the 91.5-93 support zone with a sharp decline in December....

READ MORE

MEMBERS ONLY

DOLLAR PULLS BACK FROM 200-DAY AVERAGE AS COMMODITIES BOUNCE OFF CHART SUPPORT -- SURGING LUMBER PRICES MAY CARRY GOOD NEWS FOR HOMEBUILDERS AS DR HORTON LEADS A STRONG HOUSING RALLY -- MARKET REBOUNDS AGAIN ON LIGHT VOLUME

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR PULLBACK BOOSTS COMMODITIES... Chart 1 shows the DB Bullish Dollar Fund (UUP) meeting some resistance near it 200-day moving average. That's giving a nice boost to commodity markets which is coming at a good time since several commodities are testing support levels. Chart 2, for example, shows...

READ MORE

MEMBERS ONLY

BIOTECHS SHOW NEW HEALTHCARE LEADERSHIP -- BIOTECH HOLDERS NEAR RECORD HIGH -- BIOGEN NEARS BULLISH BREAKOUT AS AMGEN TURNS UP -- GILEAD HITS SIX-MONTH HIGH WHILE GENZYME EXCEEDS 200-DAY LINE -- FIDELITY BIOTECH FUND IS WEEK'S TOP GAINER

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIOTECH HOLDERS TEST OLD HIGHS ... We've been writing for several months about the new upside leadership in the healthcare sector, and have taken that as a sign that investors were turning a bit more defensive. [The same is true of consumer staple stocks]. Chart 1 shows the Health...

READ MORE

MEMBERS ONLY

DOLLAR INDEX HITS FIVE MONTH HIGH ($USD,$XEU) - GOLD FINDS SUPPORT ($GOLD,GLD) - OIL HITS POTENTIAL SUPPORT ($WTIC) - BONDS HIT RESISTANCE ZONE ($USB)

by John Murphy,

Chief Technical Analyst, StockCharts.com

US DOLLAR INDEX HITS FIVE MONTH HIGH... Link for todays video. The US Dollar Index ($USD) reversed course in December and continued strong in January. Weakness in the Euro is the main catalyst for this move. Currencies, and other securities for that matter, can decline simply from a lack of...

READ MORE

MEMBERS ONLY

SUPPORT COMING INTO PLAY FOR IWM AND SPY - AD VOLUME LINES DECLINE FROM 52-WEEK HIGHS - NET NEW HIGHS HIT MOMENT-OF-TRUTH - BULLISH PERCENT INDICES REMAIN ABOVE 50% - TECHNOLOGY MATTERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SUPPORT COMING INTO PLAY FOR IWM AND SPY... Link for todays video. With the January decline, the Russell 2000 ETF (IWM) has retraced around 50% of the November-January advance and returned to its triangle breakout. Chart 1 shows IWM breaking triangle resistance way back in early December. This broken resistance...

READ MORE

MEMBERS ONLY

THE US DOLLAR ISN'T THE ONLY SAFE HAVEN CURRENCY -- THE JAPANESE YEN HAS BEEN EVEN STRONGER DURING JANUARY -- THE YEN IS ALSO TURNING UP RELATIVE TO OTHER GLOBAL CURRENCIES IN UNWINDING OF CARRY TRADE AND MOVE TO SAFETY

by John Murphy,

Chief Technical Analyst, StockCharts.com

YEN IS ALSO A SAFE HAVEN CURRENCY ... Most currency focus has been on the rise in the U.S. Dollar since December. That has not only undermined the commodity rally, but is also siphoning money out of global stocks that had been trending in the opposite direction of the greenback....

READ MORE

MEMBERS ONLY

JANUARY ROTATION OUT OF EMERGING MARKETS AND BASIC MATERIALS INTO CONSUMER STAPLES AND HEALTCHARE SHOWS MOVE AWAY FROM RISK AND TOWARD SAFETY -- TECHNOLOGY IS FALLING HARD TODAY AND IS PULLING REST OF MARKET LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS TURN RISK AVERSE... Arthur Hill has been showing the recent rotation out of former market leaders and into defensive market sectors that are considered to be risk averse. It's an important point that bears repeating. While it's important to look at the technical condition of...

READ MORE

MEMBERS ONLY

DOW ETF FIRMS NEAR SUPPORT (DIA) - PULLBACK HITS FIRST TEST ($COMPQ,$NYA) - LESS THAN 50% OF STOCKS ABOVE THEIR 50-DAY SMAS - COMMODITIES REMAIN UNDER PRESSURE (DBC,DBA,DBB) - AMGEN AND GILEAD LIFT BIOTECHS (BBH,AMGN,GILD)

by John Murphy,

Chief Technical Analyst, StockCharts.com

DIA FIRMS NEAR SUPPORT ... Link for todays video. After becoming oversold with last weeks decline, stocks firmed over the last three days. Important support levels are coming into play for a number of key indices and ETFs. Chart 1 shows the Dow Diamonds (DIA) hitting support around 101-102. This support...

READ MORE

MEMBERS ONLY

CHINA LEADS GLOBAL RETREAT -- INTERMARKET REVERSALS RAISE WARNING FLAGS -- MARKET IS OVERSOLD SHORT-TERM -- BUT WEEKLY MACD LINES HAVE TURNED NEGATIVE -- THAT INCREASES ODDS FOR A 10% CORRECTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINA ISHARES LEAD GLOBAL RETREAT... I wrote a message on January 12 about Chinese central bankers starting to tighten credit, and the fact that Chinese stocks were no longer showing relative strength. In fact, China had lagged the global rally for several months. The biggest negative divergence took place in...

READ MORE

MEMBERS ONLY

ELLIOTT WAVE COUNT FOR THE S&P 500 - RELATIVE STRENGTH IN DEFENSIVE SECTORS - MEDIUM-TERM UPTRENDS REMAIN IN FORCE - LONG-TERM WEAKNESS IN FINANCE - COMMODITIES LIKELY TO FOLLOW STOCKS - XLE HITS LONG-TERM RESISTANCE ZONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

ELLIOTT WAVE COUNT FOR THE S&P 500 ... Link for todays video. At the risk of opening Pandoras box, I am going to offer some long-term Elliott Wave analysis for the S&P 500. Like much of technical analysis, Elliott Wave is subjective and open to interpretation. Chart...

READ MORE

MEMBERS ONLY

ON HIATUS THIS WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

John Murphy is on hiatus this week. His article will return in the next issue....

READ MORE

MEMBERS ONLY

TECHS LEAD THE MARKET LOWER - A ROUGH MONTH FOR TECHNOLOGY - FROM BIG BANKS TO BIG TECHS - VOLATILITY SPIKES - MAJORITY OF STOCKS STILL ABOVE THEIR 200-DAY SMA - PERCENT ABOVE THEIR 50-DAY SMA PLUMMETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHS LEAD THE MARKET LOWER ... Link for todays video. John Murphy is away this week and will return next week. Stocks came under pressure again on Friday with the technology sector leading the way lower. Chart 1 shows the Nasdaq 100 ETF (QQQQ) breaking below consolidation support on Thursday and...

READ MORE

MEMBERS ONLY

DOW DROPS OVER 200 ($INDU,$TRAN) - MATERIALS SECTOR LEADS MARKET LOWER (XLB) - STEEL, METALS AND MINING PACE MATERIALS LOWER (SLX,XME) - BIG BANKS HIT HARD (XLF) - KEY INVESTMENT BANKS GIVE UP JANUARY GAINS (JPM,GS,MS)

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW DROPS OVER 200... Link for todays video. Stocks moved broadly lower on Thursday with the Dow loosing over 200 points. All major indices and sectors finished lower on the day. Chart 1 shows the Dow Industrials closing above 10700 on Tuesday and 10400 today. This two day decline was...

READ MORE

MEMBERS ONLY

STOCKS GIVE UP TUESDAYS GAINS (QQQQ, IWM) - FINANCE SECTOR HOLDS UP RELATIVELY WELL (XLF, BAC, STT) -DOLLAR SURGES AS EURO PLUNGES (UUP) - EURO BREAKS 200-DAY SMA (FXE) - GLD ETF BREAKS BELOW 110 (GLD) - CHINESE STOCKS FALL SHARPLY ($SSEC)

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS GIVE UP TUESDAYS GAINS... Link for todays video. Stocks came under pressure in early trading and closed lower. All major indices were down with small-caps and large techs leading the way lower. These two groups led the major indices higher on Tuesday, but the tables were turned on Wednesday....

READ MORE