MEMBERS ONLY

SEASONAL PATTERNS FAVOR THE BULLS - DOW HITS CHANNEL RESISTANCE - SHORT-TERM RATES REMAIN WAY DOWN - LONG-TERM RATES RECOVER - A STEEPER YIELD CURVE - REGIONAL BANKS LAGGING BIG BANKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEASONAL PATTERNS FAVOR THE BULLS ... Link for todays video. According to the Stock Traders Almanac, the best six months of the year are from November 1st to April 30th. The Almanac provides a performance table going back to 1950. Being long stock indices for these six months and switching to...

READ MORE

MEMBERS ONLY

STOCKS AND COMMODITIES JUMP AS DOLLAR DROPS -- LARGE CAP INDEXES HIT NEW HIGHS FIRST -- SILVER, PLATINUM, AND COPPER BREAKOUT -- COAL STOCKS LEAD ENERGY COMPLEX HIGHER -- BRISTOL MYERS SQUIBB BREAKS OUT -- CHINA LEADS EMERGING MARKETS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

LARGE CAPS HIT NEW HIGHS FIRST... My Friday message wrote about a new recovery high by the Dow Industrials reflecting investor preference for large cap stocks. A buying spree on Monday has pushed several large cap index to new highs as well. Charts 1 and 2 show the S&...

READ MORE

MEMBERS ONLY

INVESTORS SWITCH TO LARGE CAPS -- THAT EXPLAINS WHY THE DOW HAS BEEN THE FIRST INDEX TO HIT A NEW HIGH -- RECENT DOW BREAKOUTS INCLUDE DISNEY, UNITED TECHNOLOGIES, AND WAL-MART

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHIFT TOWARD LARGE STOCKS... One of the more obvious discrepancies of late has been between the performance of the Dow Industrials and the Russell 2000 Small Cap Index. While the Dow (blue line) has been the first of the major stock indexes to hit a new recovery high, the RUT...

READ MORE

MEMBERS ONLY

WATCHING MONDAYS GAPS (QQQQ,RSP), SMALL-CAPS AND FINANCE SHOW RELATIVE WEAKNESS ($RUT,XLF), XLB STALLS NEAR PRIOR HIGHS, USING THE STOCHASTIC OSCILLATOR IN A TRADING RANGE (XLI), BONDS FIRM AT SUPPORT (TLT,IEF)

by John Murphy,

Chief Technical Analyst, StockCharts.com

WATCHING THE GAPS... Link for todays video. The major index ETFs gapped higher and closed strong on Monday. Even though trading since the gap has been subdued, the gaps are holding and remain bullish until proven otherwise. Chart 1 shows the Nasdaq 100 ETF (QQQQ) gapping up and closing above...

READ MORE

MEMBERS ONLY

DOW NEARS CHANNEL TRENDLINE - S&P 500 CHALLENGES OCTOBER HIGH - AIRLINES LEAD TRANSPORTS HIGHER - SOUTHWEST AIRLINES AND UNITED BOUNCE OFF SUPPORT - DOW THEORY REMAINS BULLISH - GOLD BENEFITS FROM WEAK DOLLAR AND INFLATIONARY EXPECTATIONS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW CHANNELS HIGHER... Video Link (click here) The medium-term trends are clearly up for the major indices - but a few are approaching potential resistance levels after sharp advances the last two weeks. Chart 1 shows the Dow Industrials with a rising price channel over the last few months. Notice...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR HITS 52-WEEK HIGH -- LEADERS INCLUDE ALLERGAN, MEDCO HEALTH, AND ZIMMER HOLDINGS -- BRISTOL MYERS SQUIBB ACHIEVES BULLISH BREAKOUT -- PHARM HOLDERS SHOW NEW RELATIVE STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SPDR HITS NEW HIGH ... With the market pausing after yesterday's strong rally, defensive stocks like consumer staples and healthcare are gaining some ground today. Of those two, healthcare is the stronger. Chart 1 shows the Healthcare SPDR (XLV) breaking out to a new 52-week high today. Also...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS AND COMMODITIES SURGE ON G-20 DECISION TO KEEP MONEY CHEAP AND STIMULUS PROGRAMS IN PLACE -- DOLLAR PLUNGE SPURS FOREIGN CURRENCY BUYING

by John Murphy,

Chief Technical Analyst, StockCharts.com

KEEPING MONEY CHEAP ... The weekend decision from G-20 nations to maintain current global stimulus programs pushed the U.S. dollar sharply lower and global stocks and commodities higher. Foreign currencies surged as well. Chart 1 shows the Euro gapping higher after bouncing off its 50-day average last week. With all...

READ MORE

MEMBERS ONLY

BARRICK AND NEWMONT MINING TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

With gold hitting new record highs each day, gold stocks are starting to play catch-up. Two of the biggest are at or very close to hitting new 52-week highs. Chart 1 shows Barrick Gold closing at a new 52-week high today. The gray line is the ABX/SPX ratio which...

READ MORE

MEMBERS ONLY

BARRICK GOLD AND NEWMONT MINING HIT 52-WEEK HIGHS -- GOLD IS SOARING VERSUS THE CHINESE YUAN WHICH MAY PROMPT CHINESE BUYING -- GOLD AND GOLD STOCKS ARE STILL CHEAP RELATIVE TO S&P 500 -- GOLD IS OVERBOUGHT BUT STILL THE STRONGEST MARKET IN THE WORLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

BARRICK AND NEWMONT MINING TURN UP ... With gold hitting new record highs each day, gold stocks are starting to play catch-up. Two of the biggest are at or very close to hitting new 52-week highs. Chart 1 shows Barrick Gold closing at a new 52-week high today. The gray line...

READ MORE

MEMBERS ONLY

TECHNOLOGY AND CONSUMER DISCRETIONARY LEAD REBOUND - SEMICONDUCTOR ETF GETS OVERSOLD BOUNCE - NETWORKING ETF RECOVERS AFTER SUPPORT BREAK - QUALCOM AND CISCO LEAD NETWORKERS - SHANGHAI COMPOSITE RISING WITHIN WEDGE - KOSPI SHOWS RELATIVE WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ECONOMIC REPORTS STOKE THE BULLS... Video Link (click here)

Selling pressure hit after the Feds policy statement yesterday, but the bulls were back in business on Thursday. It appears that a drop in initial jobless claims and a sharp increase in productivity sparked the bulls. Jobless claims decreased by 20,...

READ MORE

MEMBERS ONLY

STOCKS FAIL TO HOLD EARLY GAINS - THE BATTLE FOR SUPPORT - FINANCE SPDR CLOSES WEAK - UTILITIES SPDR TESTS SUPPORT - DOLLAR MOMENTUM REMAINS BEARISH - EURO ETF HOLDS 50-DAY LINE - INFLATION PROTECTED BONDS SHOW STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS ERASE EARLY GAINS... Video Link (click here) The Fed left rates and its policy statement unchanged. Stocks were up heading into the announcement and just after the announcement, but selling pressure drove the major indices lower in the final hour. Chart 1 shows the Major Indices Market Carpet without...

READ MORE

MEMBERS ONLY

INDIAN CENTRAL BANK BUYS GOLD -- MORE MAY FOLLOW -- GOLD IS RISING FASTER THAN ALL GLOBAL CURRENCIES -- CENTRAL BANKERS MAY START TREATING GOLD LIKE NEW RESERVE CURRENCY

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD SURGES TO NEW RECORD IN HEAVY TRADING... Gold prices surged today to the highest level in its long history. Chart 1 shows the streetTrack Gold ETF (GLD) surging the equivalent of $25 dollars to a new record high. The volume bars show that recent trading activity (including today'...

READ MORE

MEMBERS ONLY

MARKET INDEXES STILL TESTING OCTOBER LOW -- SO ARE FOREIGN ETFS -- CHIP DOWNGRADE WEIGHS ON MARKET AND OFFSETS BNI BOUNCE -- GOLD HITS RECORD HIGH AS DOLLAR TESTS 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD HITS NEW RECORD HIGH... Gold prices have erupted to new record highs today. Chart 1 shows the streetTracks Gold ETF (GLD) breaking through its October highs today on rising volume. Chart 2 shows Silver iShares (SLV) bouncing off chart support at their late-September low and 50-day average. Precious metal...

READ MORE

MEMBERS ONLY

DOLLAR RISE HURTS STOCKS AND COMMODITIES -- STOCK VOLUME PATTERN TURNS NEGATIVE -- NASDAQ AND S&P 500 NEAR POINT & FIGURE SELL SIGNALS -- BEAR FUND TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR BOUNCE HURTS COMMODITIES ... I wrote a week ago about the U.S. Dollar Index starting to bounce from major support formed in the spring of 2008 near 22 and an oversold condition. I warned that a dollar rally could unsettle stocks and commodities. Chart 1 shows this week'...

READ MORE

MEMBERS ONLY

FRIDAY'S STOCK PLUNGE WIPES OUT THURSDAY BOUNCE -- SEVERAL GROUPS HAVE COMPLETED DOUBLE TOPS -- AN IMPORTANT BREADTH INDICATOR WEAKENS -- WEEKLY CHART SHOWS S&P 500 UP STALLING NEAR MAJOR RESIS TANCE -- S&P 500 ENDS WEEK BELOW 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NO FRIDAY FOLLOW-THROUGH... Heading into Thursday, we had been warning about a downside correction in stocks and commodities (partially owing to a rebound in the oversold dollar). Thursday's stock rally muddied the water a bit. Friday's sharp price drop, however, erased all of the Thursday'...

READ MORE

MEMBERS ONLY

NY COMPOSITE AND NASDAQ REBOUND - FINANCE SECTOR LEADS - DOW THEORY REMAINS BULLISH - USING PRICE AND TIME FILTERS - PERCENT OF STOCKS ABOVE 50-DAY AVERAGE PLUNGES - BONDS TEST KEY SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

NYSE LEADS REBOUND... Video Link (click here) The harder the fall, the bigger the rebound. After plunging below the 50-day moving average on Wednesday, the NY Composite managed to hold above its early October low with a sharp rebound on Thursday. As chart 1 shows, the string of higher lows...

READ MORE

MEMBERS ONLY

BROAD DECLINE ROCKS WALL STREET - SPY TESTS 50-DAY - SMALL-CAPS LEAD LOWER - RUSSELL 2000 ETF FORMS DOUBLE TOP - XLB, XLI AND IYT ALSO FORM DOUBLE TOPS - EURO AND STOCKS FALL TOGETHER - DOLLAR ETF SURGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS DECLINE ON INCREASED VOLUME... Video Link (click here) Selling pressure picked up significantly on Wednesday. All of the major indices were down over 1% with the Russell 2000 leading the way lower (-3.51%). All sectors were lower with energy, finance and materials down over 3%. Declining stocks outnumbered...

READ MORE

MEMBERS ONLY

BANKS AND MATERIALS LEAD STOCKS LOWER -- BANK OF AMERICA IS ONE OF THE BIGGEST LOSERS -- OVERSOLD DOLLAR BOUNCES FROM 2008 LOWS -- THAT'S CAUSING NERVOUS PROFIT-TAKING IN STOCKS AND COMMODITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANK INDEX DROPS 3% ... A big drop in bank shares is pulling the financial sector lower today and the rest of the market with it. Chart 1 shows the PHLX Bank Index dropping well below its 50-day moving average. If those losses hold through the balance of the day, this...

READ MORE

MEMBERS ONLY

PLUNGE IN RAILROADS THREATENS DOW THEORY UPTREND -- FALLING CHIP STOCKS FORM ANOTHER NEGATIVE DIVERGENCE AS SOX WEAKENS -- NASDAQ COMPOSITE IS UP AGAINST MAJOR RESISTANCE NEAR 2200

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS FAIL TEST OF SEPEMBER PEAK ... On Monday, I wrote a brief update on the Dow Theory which holds that the Dow Industrials and Transports need to both hit new highs to keep the current uptrend intact. Although the Industrials had already done so, I showed the Dow Transports still...

READ MORE

MEMBERS ONLY

SETTING A SHORT-TERM BEAR TRAP - REGIONAL BANK ETF RECOVERS BIG TIME - XLF LEADS SECTORS HIGHER - THE PANIC PHASE OF A BEAR MARKET - SPY NEARS 62% RETRACEMENT MARK - MAJOR INDEX ETFS REMAIN IN MEDIUM-TERM UPTRENDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPRINGING THE BEAR TRAP... Video Link (click here) Fighting the bigger trend is a dangerous game. With a sharp sell-off in the final hour on Wednesday, the S&P 500 ETF (SPY) broke below its prior low to reverse the short-term uptrend. This support break did not last long....

READ MORE

MEMBERS ONLY

SMALL-CAPS LEAD LATE SELL-OFF - SPY BREAKS SHORT-TERM SUPPORT - FINANCE LEADS SECTORS LOWER - REGIONAL BANKS SHOW RELATIVE WEAKNESS - OCTOBER HAS BEEN GOOD FOR COMMODITIES - AGRICULTURE AND BASE METALS ETFS BREAK RESISTANCE - DOLLAR HITS ANOTHER NEW LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS FAIL HOLD GAINS... Video Link (click here) Stocks opened strong with positive reactions to earnings from Morgan Stanley, US Bancorp and Yahoo!. However, these gains proved fleeting as selling pressure hit hard in the final hour of trading. Small-caps led the way lower with the Russell 2000 ETF (IWM)...

READ MORE

MEMBERS ONLY

APPLE TESTS OLD HIGH -- MARKET IS LOSING HOUSING AND REIT SUPPORT -- CONSUMER DISCRETIONARY/STAPLES RATIO IS STARTING TO WEAKEN WHICH SHOWS MORE CAUTION -- HERSHEY FOODS RISES WHILE SHERWIN WILLIAMS TUMBLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPLE GAINS 5% BUT REACHES RESISTANCE... Apple shares have gapped 5% higher today. Upside volume over the last two days has been exceptional. That's given a boost to the technology sector. There is one caveat, however, that you should at least be are of. Apple is testing its...

READ MORE

MEMBERS ONLY

STOCKS AND COMMODITIES CONTINUE RALLY AS DOLLAR DROPS -- COPPER JUMPS 4% AS CHINESE ETFS HIT NEW HIGHS -- DOW NEARS 50% RETRACEMENT POINT NEAR 10,500

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES CONTINUE BULL RUN ... The dollar is dropping again and commodities are rising. Chart 1 shows the DB Commodities Tracking Index (DBC) exceeding its early August high after completing a bullish symmetrical triangle. Most commodities are joining the rally. Chart 2 shows the United States Oil Fund (USO) having also...

READ MORE

MEMBERS ONLY

DOW THEORY UPDATE -- DOW TRANSPORTS ARE TESTING SEPTEMBER HIGHS -- UPSIDE LEADERS ARE RYDER AND OVERSEAS SHIPBUILDING -- UTILITIES ARE ALSO CLOSE TO BREAKING OUT -- UTILITY LEADERS ARE PG&E AND SOUTHERN COMPANY -- ELY LILLY BREAKS RESISTANCE LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW THEORY UPDATE ... One of our readers asked for an update on Dow Theory. Just to refresh your memory, Dow Theory holds that the Dow Industrials and Transports must both hit new highs to confirm an ongoing uptrend. Chart 1 shows the Dow Industrials having already done so. Chart 2...

READ MORE

MEMBERS ONLY

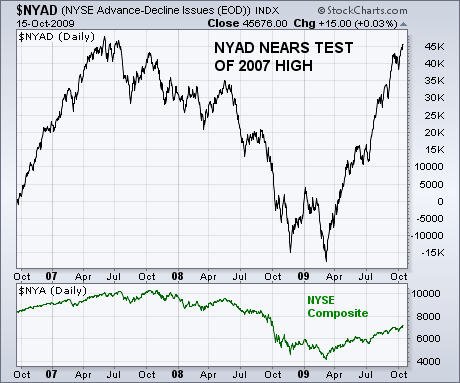

NYSE AD LINE NEARS 2007 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

NYSE ADVANCE-DECLINE LINE NEARS OLD HIGH ... One of our readers asked for a look at the NYSE Advance-Decline line, and this may be a good time to start keeping an eye on it. Chart 7 shows the NYAD nearing a test of its 2007 peak. What's surprising is...

READ MORE

MEMBERS ONLY

CONSUMER STAPLES START TO ATTRACT NEW MONEY -- THAT SUGGESTS INVESTORS ARE LOOKING FOR DEFENSE OR VALUE -- WEEKLY LEADERS INCLUDE SUPERVALU, KROGER, SAFEWAY, AND SYSCO -- NYSE AD LINE NEARS 2007 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER STAPLES SHOW SOME STRENGTH ... For the first time since March, consumer staples are starting to show some market leadership. They were the strongest group on Friday, the third strongest on the week, and second strongest of the last month (behind energy). Chart 1 shows the Consumer Staples SPDR (XLP)...

READ MORE

MEMBERS ONLY

OIL ETF BREAKS TRIANGLE - GASOLINE SURGES TO RESISTANCE - AGRICULTURE ETF BREAKS OUT - INDUSTRIAL METALS ETF CHALLENGES RESISTANCE - COMPARING ETFS AND THE UNDERLYING - HEALTHCARE SPDR AFFIRMS UPTREND - STOCKS TO WATCH (LLY, PFE, AMGN, MDT)

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL ETF BREAKS TRIANGLE... Video Link (click here) John Murphy showed a symmetrical triangle pattern in the US Oil Fund ETF (USO) on Monday. John also said, an eventual upside breakout is likely. Chart 1 shows USO breaking above triangle resistance with a big move today. A report showing a...

READ MORE

MEMBERS ONLY

SMALL-CAPS LEAD BROAD RALLY - JP MORGAN POWERS THE FINANCE SECTOR - XLF BREAKS SEPTEMBER HIGH - JPM-BAC-WFC-USB LEAD FINANCE SECTOR - INTEL LIFTS THE SEMIS - SMH BREAKS RESISTANCE - RISK-ON TRADE REMAINS AS DOW HITS 10K AND DOLLAR HITS NEW LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS LEAD BROAD RALLY... Video Link (click here) The Russell 2000 and the NY Composite led the major indices on Wednesday. All of the major indices were up on the day, but the Russell 2000 and NY Composite were the only two to gain 2%. Chalk it up to the...

READ MORE

MEMBERS ONLY

ANSWERS TO P&F QUESTIONS -- THE FIRST SIGNAL IS ALWAYS THE BEST ONE -- TRY PERCENTAGE SCALES WHEN THERE ARE DISCREPANCIES -- THE DOLLAR HAS NO LONG-TERM LINK TO STOCKS -- CORPORATE BONDS DO

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE FIRST SIGNAL IS ALWAYS THE BEST ONE... Chart 1 is the point & figure chart of the S&P 500 that I posted on Friday to show that its trend is still upward, and made mention of the buy signal given at 935 during July. One of our...

READ MORE

MEMBERS ONLY

OIL SERVICE STOCKS LEAD STRONG ENERGY COMPLEX TO 52-WEEK HIGHS -- CHEVRON BREAKS OUT -- CRUDE OIL AND NATURAL GAS ARE TESTING IMPORTANT RESISTANCE LINES AND APPEAR TO BE HEADED HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL SERVICE BREAKOUTS ... With energy prices on the rise, stocks in the energy patch have become market leaders. That's certainly the case today. While energy is the day's top sector, oil service is the top energy industry group. Chart 1 shows Oil Service Holders rising to...

READ MORE

MEMBERS ONLY

A POINT & FIGURE VIEW OF CURRENT MARKETS SHOW UPTREND STILL INTACT -- GOLD STOCKS ARE RISING FASTER THAN BULLION -- DOLLAR AND VIX STILL IN DOWNTRENDS -- RISING TIPS MATCH JUMP IN COMMODITIES -- CORPORATE BONDS SELLOFF

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK TREND IS STILL UPWARD ... A rebound in global stock markets this week has kept the seven-month uptrend intact. On Monday, I showed major stock indexes bouncing off their 50-day moving averages. The only potential negative is that trading activity on the way up was less than it was on...

READ MORE

MEMBERS ONLY

ENERGY SECTOR LEADS HIGHER - ALCOA POWER MATERIALS SECTOR - FILLED VERSUS HOLLOW CANDLESTICKS - PRECIOUS METALS LEAD COMMODITY GROUPS - INDUSTRIAL METALS AND ENERGY INDICES REMAIN RANGE BOUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY STOCKS SURGE... Video Link (click here) With oil moving back above $70, energy stocks advanced sharply and led all sectors on Thursday. Chart 1 shows the Energy SPDR (XLE) challenging its September high. After a pullback in late September, XLE found support near the early September gap and surged...

READ MORE

MEMBERS ONLY

STOCKS STALL WITH MIXED TRADING - FINANCE SECTOR LEADS - REGIONAL BANKS LAG - HOMEBUILDERS CONTINUE TO SHOW RELATIVE WEAKNESS - REIT ISHARES RETURN TO BREAKOUT - SHORT-TERM RATES POSITIVELY CORRELATED TO THE DOLLAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS STALL IN MIXED ACTION... Video Link (click here) Trading was mixed on Wednesday as the major indices meandered on either side of unchanged. Chart 1 shows the Dow finishing virtually unchanged with an indecisive candlestick. After two sharp gains on Monday and Tuesday, a little indecision is understandable. Overall,...

READ MORE

MEMBERS ONLY

HIKE IN AUSSIE RATES GIVES BIG BOOST TO GLOBAL STOCKS AND COMMODITIES -- GOLD HITS RECORD HIGH -- COAL STOCKS HELP LEAD ENERGY RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUSSIE DOLLAR HITS 52-WEEK HIGH ... The Australian central bank lifted its short-term interest rate 25 basis points to 3.25% from the lowest level in nearly half a century. It was the first G-20 country to do so. Global stocks and commodities rallied sharply on the view that the hike...

READ MORE

MEMBERS ONLY

PRECIOUS METAL AND ENERGY STOCKS LEAD MONDAY RALLY -- SO DO NATURAL GAS STOCKS -- STOCK INDEXES BOUNCE OFF 50-DAY LINES BUT ON LIGHTER VOLUME

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING DOLLAR HELPS... A falling dollar is giving boost to stocks and commodities on Monday. Gold stocks are the one of the day's top groups. The reason is a jump in gold and silver prices. Chart 1 shows the streetTrack Gold Trust ETF (GLD) climbing the equivalent of...

READ MORE

MEMBERS ONLY

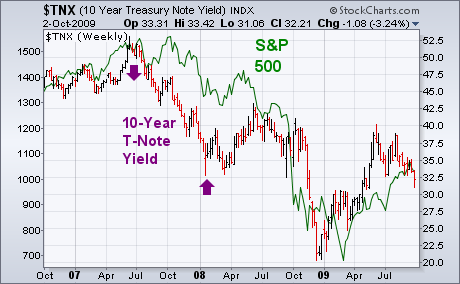

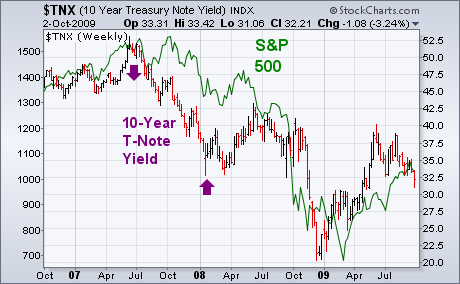

BREAKDOWN IN BOND YIELD MAY BE BAD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

One of the catalysts behind Thursdays heavy stock selling was the breakdown in Treasury bond yields. The 10-Year T-note yield fell below its July low to the lowest level in more than four months. Bond yields are an indicator of confidence in the economy. When investors are optimistic, they buy...

READ MORE

MEMBERS ONLY

BREAKDOWN IN BOND YIELD MAY BE BAD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

One of the catalysts behind Thursdays heavy stock selling was the breakdown in Treasury bond yields. The 10-Year T-note yield fell below its July low to the lowest level in more than four months. Bond yields are an indicator of confidence in the economy. When investors are optimistic, they buy...

READ MORE

MEMBERS ONLY

TREASURY BONDS SIGNAL MORE CAUTION ON THE ECONOMY -- INVESTORS MAY START FAVORING SAFER TREASURIES OVER RISKIER JUNK BONDS -- MORE ON MACD LINES -- % NYSE STOCKS OVER 50-DAY AVG WEAKENS -- ABBOTT LABS TOP HEALTH CARE GAINER

by John Murphy,

Chief Technical Analyst, StockCharts.com

BREAKDOWN IN BOND YIELD MAY BE BAD FOR STOCKS ... One of the catalysts behind Thursdays heavy stock selling was the breakdown in Treasury bond yields. The 10-Year T-note yield fell below its July low to the lowest level in more than four months. Bond yields are an indicator of confidence...

READ MORE

MEMBERS ONLY

STOCKS FALL SHARPLY ON INCREASING VOLUME - FINANCIALS LEAD LOWER - RETRACEMENT CLUSTERS MARK RESISTANCE FOR KEY SECTORS - DOLLAR SURGES AS STOCKS DECLINE - GOLD FOLLOWS EURO LOWER - BONDS BENEFIT FROM WEAKNESS IN STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SELLING PRESSURE INTENSIFIES... Video Link (click here) Wall Street was hit with heavy selling pressure ahead of Fridays employment report. All major indices were down over 2%. Small-caps led the way with the Russell 2000 lost over 3%. All nine sectors were down with the Materials SPDR losing almost 4%...

READ MORE

MEMBERS ONLY

DOW CHOPS LOWER - VIX SURGES AND STAYS ELEVATED - VOLATILITY AND STOCK MARKET REMAIN INVERSELY CORRELATED - DEFENSIVE SECTORS PERKING UP - OIL SURGES AS GAS INVENTORIES CONTRACT - GOLD AND METALS ALSO BOUNCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

VOLATILITY REIGNS SUPREME... Video Link (click here) For the second time in six days, the stock market plunged and recovered - though todays plunge-recovery was much quicker than the previous. Chart 1 shows the Dow Industrials plunging after the FOMC policy statement last Wednesday afternoon. The Dow stalled for a...

READ MORE