MEMBERS ONLY

Sector Spotlight: Tech is Back, But...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I highlight interesting seasonal patterns for various sectors and explore if they are aligning with the current rotations on the Relative Rotation Graph. It looks like August has some interesting seasonal anomalies that are worth exploring. 7 out of the...

READ MORE

MEMBERS ONLY

Technology Rotating Into Leading Quadrant on RRG, But Will It Be Enough?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

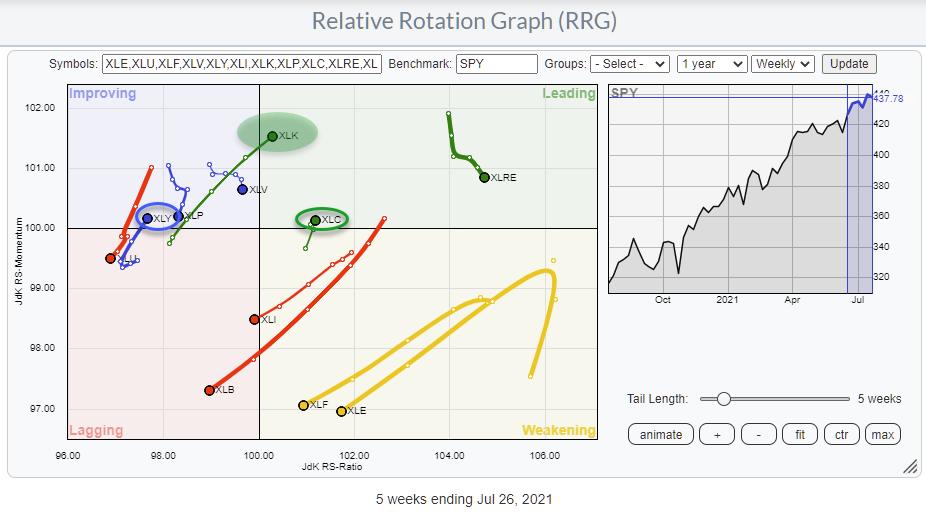

At the start of this week, the technology sector is rotating into the leading quadrant on the weekly RRG. Clearly, the endpoint of the tail is not fixed until Friday's close. Still, the improvement is visible and follows the improvement that was already visible for a few weeks...

READ MORE

MEMBERS ONLY

Long Overdue RRG Basket Update

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

First of all, I'm sorry I had to cancel today's episode of Sector Spotlight. I've been battling a nasty cough/cold and a sore throat with not much voice left for a week now, and things did not improve enough to do a decent...

READ MORE

MEMBERS ONLY

Thinking Outside the US Box

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

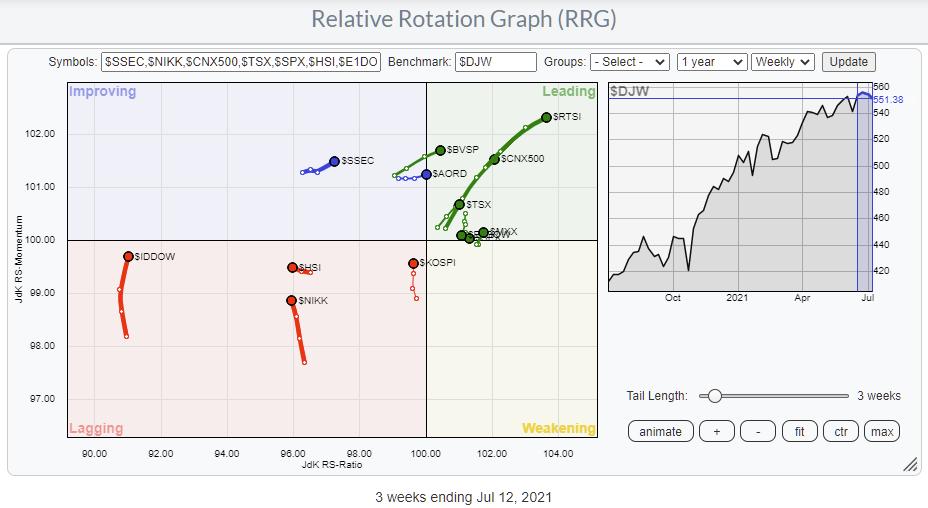

The Relative Rotation Graph above shows the rotation for major stock market indexes against the Dow Jones Global Index.

First of all, this is a so-called "open universe" which means that not all constituents of the benchmark are plotted on the graph. As a result, the universe is...

READ MORE

MEMBERS ONLY

Sector Spotlight: Answering Viewer Questions (+ Charting the Second Half!)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I seize the opportunity to answer questions from the mailbag. Why is this stock showing a negative performance while it is inside the leading quadrant? Can you give some guidelines on where to buy or sell? These are the major...

READ MORE

MEMBERS ONLY

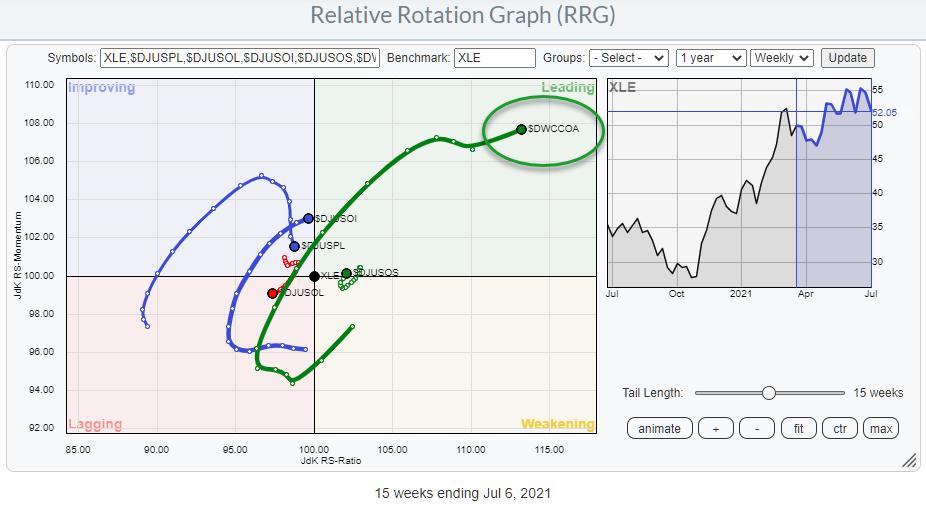

This Energy Group is Moving on the RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Relative Rotation Graph shows the industries that make up the Energy sector. One tail that especially stands out is for $DWCCOA. I have looked at this RRG, and the sector before, but always excluded Coal as none of the stocks in that index are in the S&P....

READ MORE

MEMBERS ONLY

Sector Spotlight: Risk for SPX Increasing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I go over the completed monthly charts for June. Starting with Asset Classes, I note the stretched levels for the stock market and revives the concept of "Reversed Relative Strength" that I first introduced in a blog article...

READ MORE

MEMBERS ONLY

Elevated Risk for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

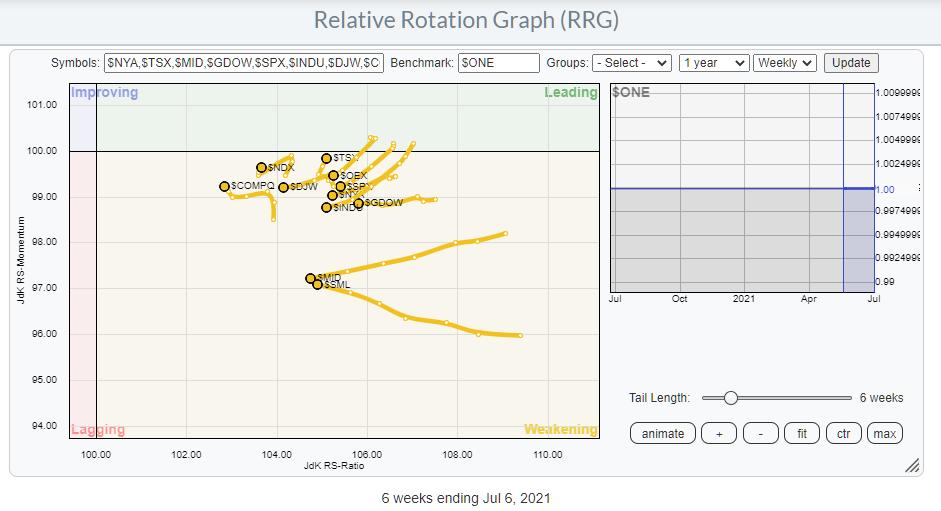

The RRG above shows the ABSOLUTE rotations for a selection of major indexes. Instead of plotting them against a global or otherwise encompassing index, I have plotted them against $ONE to get a handle on their underlying absolute trends. What is noticeable is that they are all inside the weakening...

READ MORE

MEMBERS ONLY

Energy vs. Utilities: 2 Sectors, 8 Groups, 28 Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

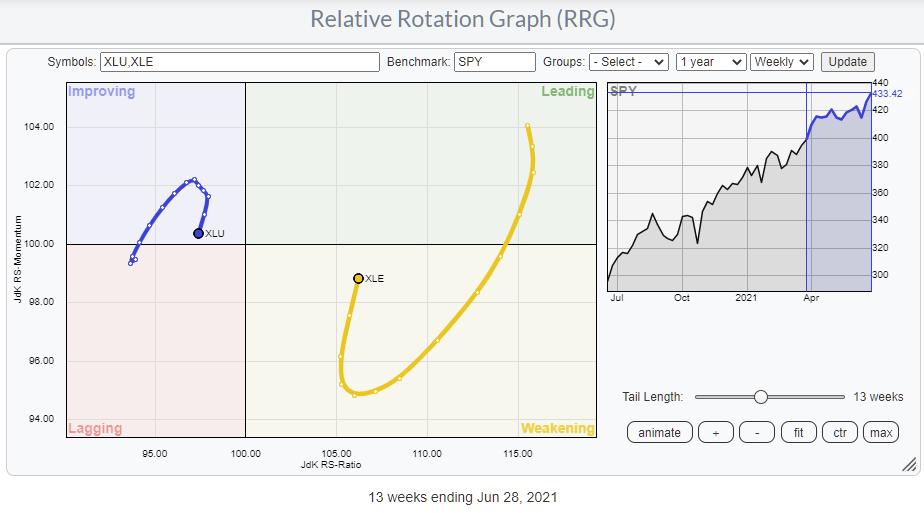

On the Sector RRG, the tails for Energy and Utilities stand out. The Utilities sector is positioned inside the improving quadrant, but started rolling over a few weeks ago and is now heading towards the lagging quadrant again. On the opposite side, Energy is inside the weakening quadrant, but is...

READ MORE

MEMBERS ONLY

Sector Spotlight: Will Seasonality Save SPX?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, as per usual on the last Tuesday of the month, I dive into seasonality for sectors. This time, I present a sneak preview of some work that expands on the 3D visualizations that I usually use for this segment. At...

READ MORE

MEMBERS ONLY

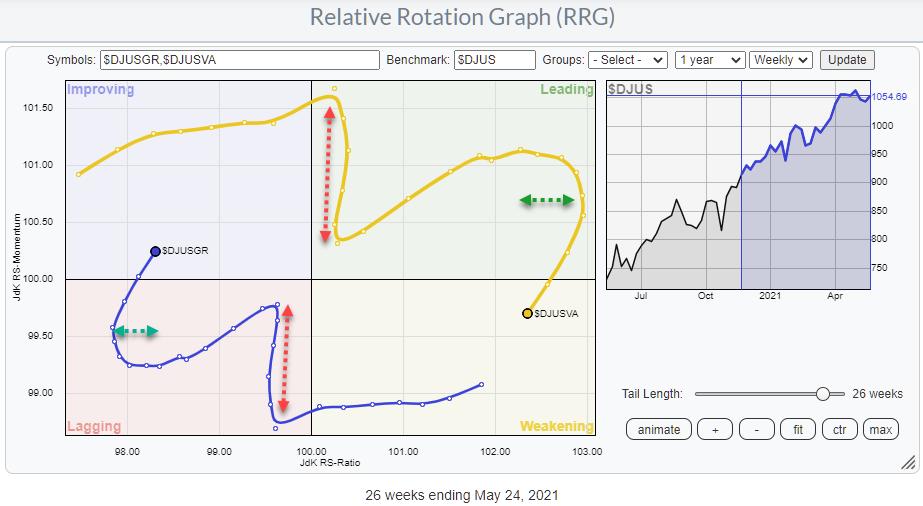

Growth / Value... A (Fake) Break?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows growth vs. value stocks rotations over the last six months (two quarters). After the initial cross into the leading/lagging quadrant, the relationship almost immediately started to move back in favor of Growth. Until both tails hooked in the week of 22 Feb, from...

READ MORE

MEMBERS ONLY

Sector Spotlight: SPX on the Edge

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, after spending almost an entire show on a question from the mailbag last week, I shift gears again and highlight the most important rotations in asset classes and sectors. In the asset class segment, I look closely at the stock/...

READ MORE

MEMBERS ONLY

Is The Bond Market Sending Us Warning Signals?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

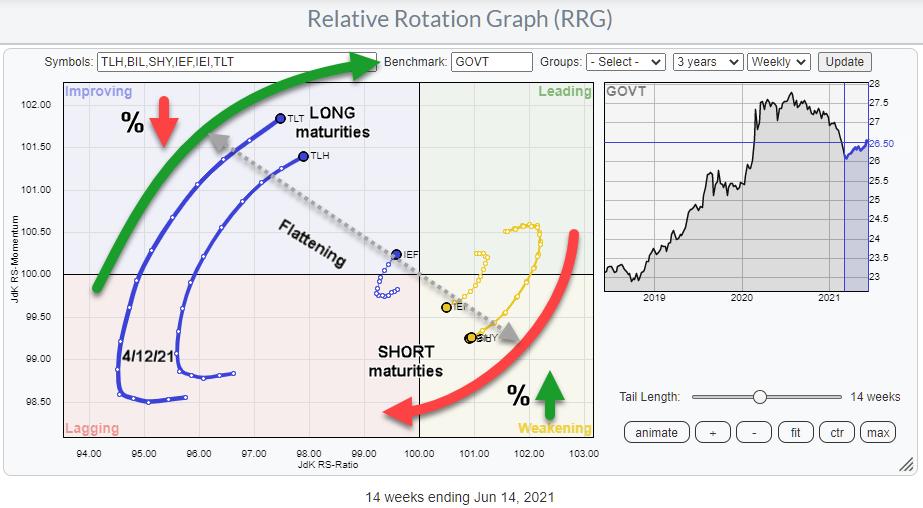

There's been a lot of talk and articles on rates, rising yields, and rate hikes lately. That seems like a good moment for a reminder of the fact that Relative Rotation Graphs can also be very well used to visualize the (relative) movement of yields for various maturities....

READ MORE

MEMBERS ONLY

Cactus, Not The Plant, Is Breaking Out.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In yesterday's article in the RRG blog, I highlighted the Oil&Equipment Services industry as potentially interesting.

Using the scan-manager to find the members of this industry gives 78 matching results.

[group is OilEquipmentServices]

One thing that we need to take into account when using the scan-manager...

READ MORE

MEMBERS ONLY

Financials and Energy Sectors Are (Re-)Gaining Strength -- Which Industries to Watch?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows interesting rotations on the tails of the Financials and the Energy sectors. These two sectors are inside the weakening quadrant on the RRG, but ranking highest on the JdK RS-Ratio scale.

Both sectors completed a first stint through the leading quadrant, entering...

READ MORE

MEMBERS ONLY

Sector Spotlight: Does RRG Really Matter?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I address an email I received from a user with the subject line "Does RRG Really Matter?" At first glance, one could think a lot of things about such a subject line. However, it appeared to be a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Putting Rotation into Perspective

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I make up for last week's brief coverage of recent rotations in asset classes and sectors by spending half of today's show examining recent rotations on the daily Relative Rotation Graphs. I put things into longer-term...

READ MORE

MEMBERS ONLY

Recap of Long/Short Baskets, adding CRM (+) and SWKS (-)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In today's episode of Sector Spotlight, I did a full review of all stocks that we are monitoring in the RRG L/S baskets. Both baskets (Long and Short) with the stocks on watch are shown in the RRGs above; the members of the Long basket are on...

READ MORE

MEMBERS ONLY

The Big Turnaround in Commodities Continues, Favoring Energy and Agricultural

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The improvement of commodities started already back in early 2020. Looking at long-term (monthly) charts, that rally seems like one straight move higher.

This chart shows $GNX and GSG stacked on top of each other. ($GNX is the S&P GSCI Commodity Index and GSG is the iShares S&...

READ MORE

MEMBERS ONLY

This Health Care Provider is Ready to Pop

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

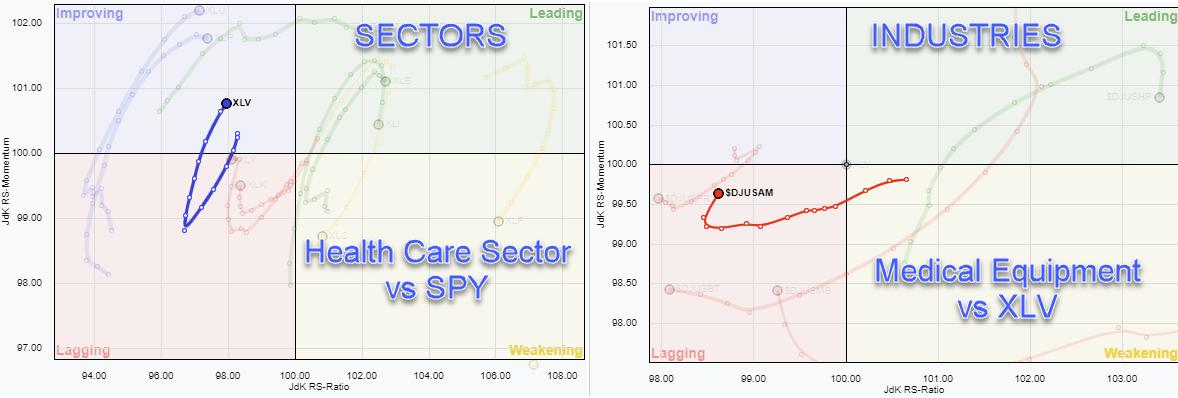

In this week's episode of Sector Spotlight, I discussed the outlook for the Health Care sector based on the current alignment of the rotation on the Relative Rotation Graph and the seasonal expectation for the sector. Over the last 20 years, the Health Care sector outperformed the S&...

READ MORE

MEMBERS ONLY

Sector Spotlight: It's Healthcare Season

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, for the first Tuesday of the month, I combine the usual look at long-term trends on the monthly charts with the seasonal expectations along with current rotations as they are visible on the Relative Rotation Graph for US sectors. For...

READ MORE

MEMBERS ONLY

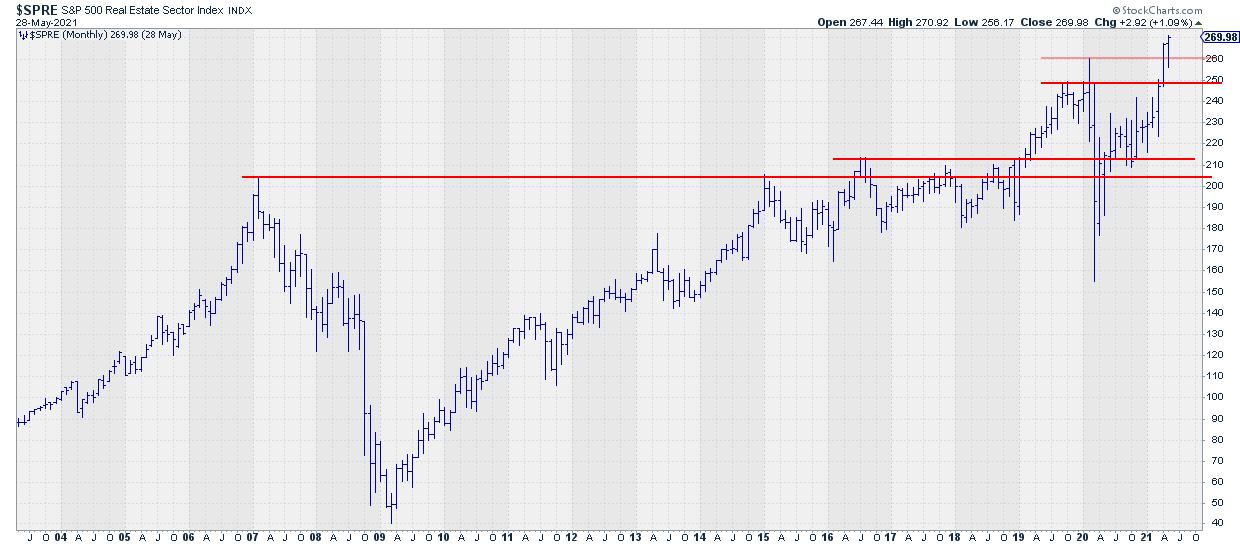

Specialty REITs are Surfacing Inside a Strong Real-Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Going over the monthly charts, I noticed the confirmation of the upward break visible at the end of April. During May, that upward break managed to hold up above the breakout level, record a new high during the month and close the month at a new closing high.

These are...

READ MORE

MEMBERS ONLY

From Sector to Industry to Agilent Technologies

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Health Care sector is one of the defensive sectors in the S&P 500 which is on a positive trajectory inside the improving quadrant and heading towards leading. The RRG for sectors, highlighting XLV, is on the left above.

The RRG on the right shows the industries inside...

READ MORE

MEMBERS ONLY

Sector Spotlight: Rotation to Defense Continues

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I highlight the rotations in asset classes and US sectors as they played out last week and then put things into a longer-term perspective. The warning signals that already popped up over the last few weeks are persisting. In today&...

READ MORE

MEMBERS ONLY

Value to Growth Rotation is Slowing Down

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Big Growth to Value Rotation, which has been going on for months, seems to be slowing down. NOT REVERSING, yet, but slowing down!

In the RRG Long/Short baskets, we have IVE on the Long side and IVW on the Short side since September 2020. Looking at the RRG...

READ MORE

MEMBERS ONLY

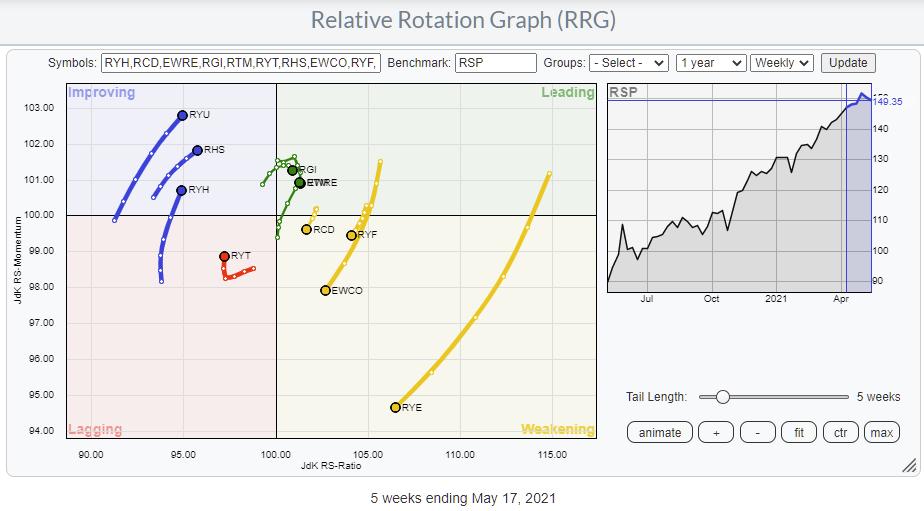

Is Equal-Weight Really Equal Weight When it Comes to Sectors?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the rotation of the Invesco family of equal-weight ETFs. These sector ETFs are often used to eliminate the dominating weight of some individual stocks in specific sectors. Think AAPL and MSFT in Technology, AMZN and (to a lesser extent) TSLA in Consumer Discretionary and FB...

READ MORE

MEMBERS ONLY

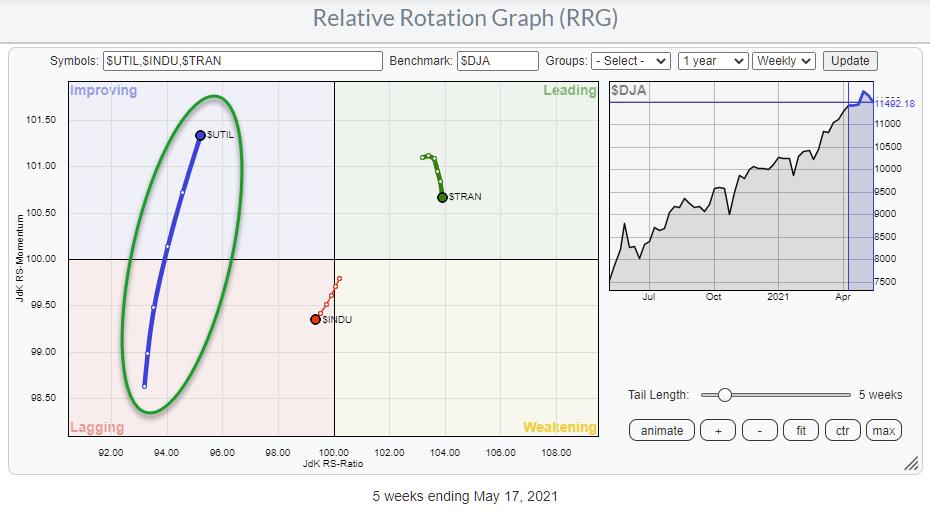

A Long Tail on Utilities Signals Power for Defense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A great way to keep an eye on offense vs. defense is using the Relative Rotation Graph above, which shows the three main Dow indexes against the Dow Jones Composite Average.

This RRG is available from the drop-down on the RRG page under <DJ Composite 65>. As the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Discretionary Danger

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I start with the usual overview of last week's rotations in asset classes and sectors, blending those observations in with a look at the weekly Relative Rotation Graphs to identify meaningful relative trends. On the Asset Class side,...

READ MORE

MEMBERS ONLY

Sector Spotlight: It's Not Good Under the Hood

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I kicksoff the show with an overview of last week's rotation in asset classes, immediately blending them with a longer term picture using the weekly RRGs and price charts. After that, the focus is on stock sectors, starting...

READ MORE

MEMBERS ONLY

RRG Tails Have a Story to Tell

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the main characteristics of a Relative Rotation Graph is the "tail," which shows us the sector's trajectory through recent history.

Tails illustrate how the security ended up in the position where it currently is, helping us to view current rotations and create a big...

READ MORE

MEMBERS ONLY

While Everything is Going Digital, This Stock is Breaking Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

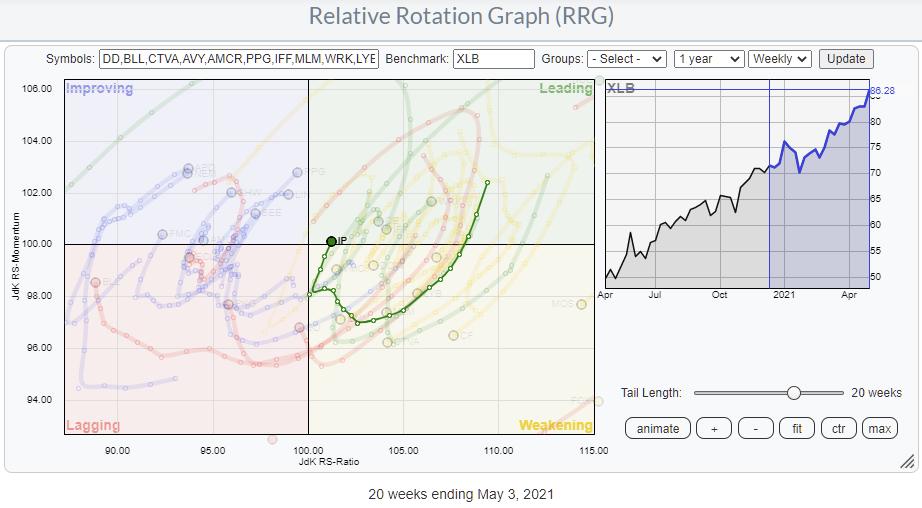

The Relative Rotation Graph for sectors shows XLB, the Materials sector, powering into the leading quadrant.

The RRG at the top of the article shows the rotations of the individual stocks in the Industrials sector, with the tail for IP highlighted. After entering the leading quadrant in October, IP traveled...

READ MORE

MEMBERS ONLY

Europe is Ready to Turn Around a Long Period of Underperformance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I keep an eye on the Relative Rotation Graph showing the rotations of various world markets against the DJ Global Index. The tail on Europe ($E1DOW) has just crossed into the leading quadrant after a quick improving-lagging-improving rotation, setting it up for a powerful rotation into...

READ MORE

MEMBERS ONLY

Sector Spotlight: Short-Term Weakness Ahead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I start the month with an overview of rotations in asset classes and sectors last week using Relative Rotation Graphs. The main theme remains intact; the stock market is in a long-term uptrend and stocks continue to outperform bonds. However,...

READ MORE

MEMBERS ONLY

Seasonality Shows Weakness Ahead For Financials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

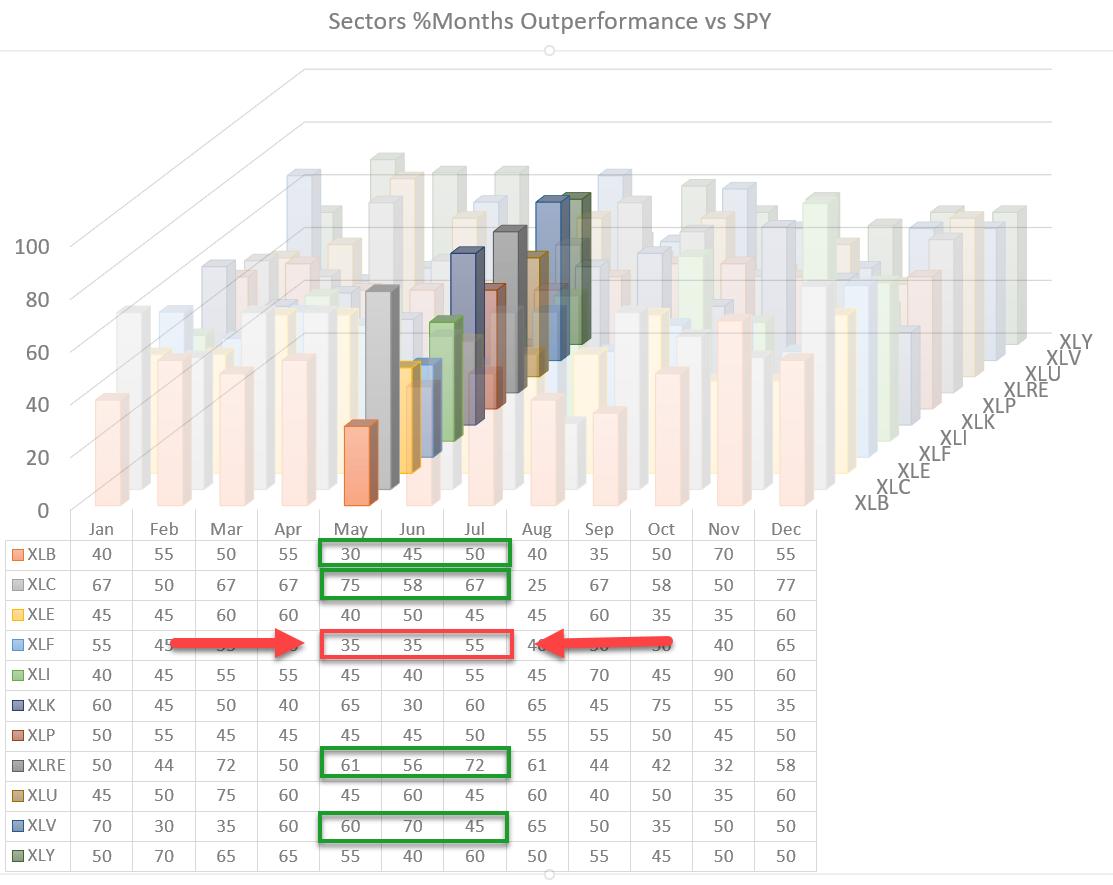

Looking at the 3D visualization for US sectors going into May, one sector stands out negatively. That sector is Financials, the fourth largest sector at ~11% of market cap.

For May and June, the historical record is that the Financial sector outperforms the S&P 500 only 35% of...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonal Stars Aligning

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's all about tails on this edition of StockCharts TV's Sector Spotlight. For the last Tuesday of the month, I examine the seasonal patterns for sectors and compare them to the current rotations on Relative Rotation Graphs. Five sectors are worth a further investigation based on...

READ MORE

MEMBERS ONLY

Forget Bitcoin, There is a New Kid on The Block(chain)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

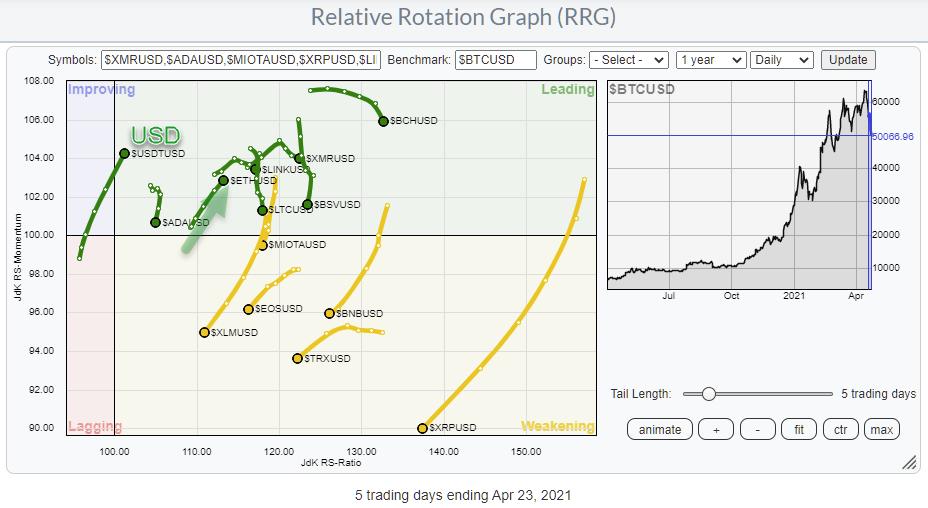

Another wild ride in crypto space this week. Bitcoin dropped almost 10% in value against the US Dollar in the past five days, while market darling DOGE lost a whopping 27%, as did TRON, Bitcoin SV, EOS and a few other major coins.

If you are ever looking for action,...

READ MORE

MEMBERS ONLY

XLB and XLI Show Strong Rotations, But What About the Industries Inside?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Currently, two sectors stand out on the Relative Rotation Graph for sectors -- Industrials and Materials. Both tails are pushing further into the leading quadrant after a rotation through weakening and back into leading. Such a rotation usually signals a new up-leg in an already established rising relative trend. If...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Tale of the Tails

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's all about tails on this edition of StockCharts TV's Sector Spotlight. After a short look at last week's rotations for asset classes and sectors, I dive into the meaning of the tails on the Relative Rotation Graphs. What do they represent? How to...

READ MORE

MEMBERS ONLY

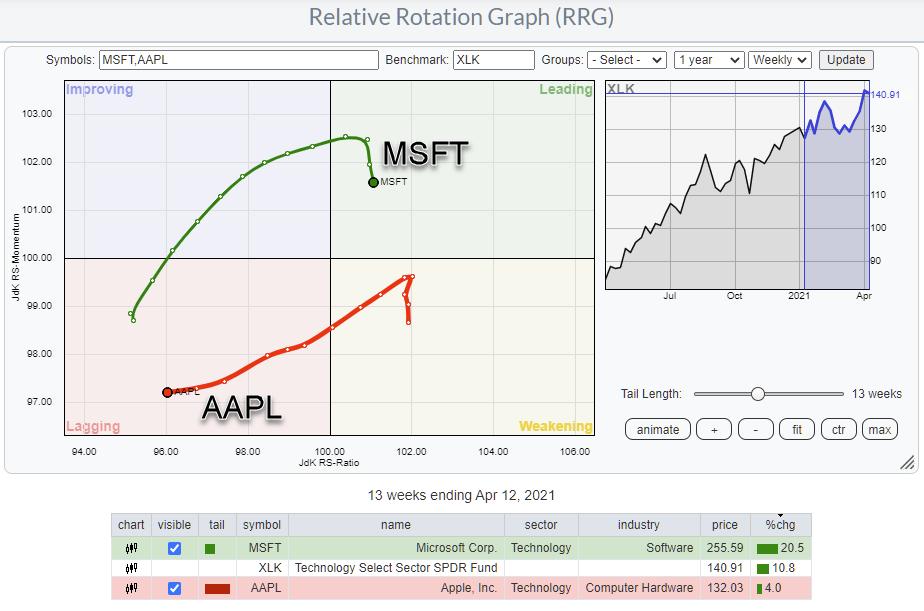

Can XLK hold without participation of AAPL & MSFT?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Developments in the technology sector keep me busy, but above all alert.

First of all it's the biggest sector in the S&P 500 and therefore by default an important one to watch. Primarily because you need a lot of power to push the S&P...

READ MORE

MEMBERS ONLY

Sector Spotlight: Strong Rotation for Industrials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I look at last week's rotations for asset classes and sectors and review the daily rotations on the Relative Rotation Graph in combination with the weekly picture, aligning these with the current trends on the price charts. Caution...

READ MORE