MEMBERS ONLY

A Review of the RRG L/S Baskets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Earlier today in Sector Spotlight, I discussed the various stocks inside the Long/Short baskets as I show them from time to time. The two RRGs above show both baskets as they currently are after the updates in Sector Spotlight.

Long

On the Long side, I removed EBAY and replaced...

READ MORE

MEMBERS ONLY

A Battle for Breadth on Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This past Thursday, I was one of the guest hosts to fill in for David Keller on The Final Bar, as Dave was enjoying a week off. Of course I brought RRG to the show, but I also wanted to add a bit of educational content on how to use...

READ MORE

MEMBERS ONLY

Sector Spotlight: 8 Sectors at New Closing Highs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It is the last Tuesday of the month, and that means looking at seasonality!

In this edition of StockCharts TV's Sector Spotlight, it's time to go over some monthly charts! As usual, Julius brings two batches of monthly charts to the show: one for Asset Classes,...

READ MORE

MEMBERS ONLY

Over 90% of "The Market" is in an Uptrend

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Every first Tuesday of the month, I look at Asset Classes and Sectors' developments using monthly charts. This start-of-the-month routine keeps me on track of the longer-term developments in terms of price trends.

Yes, Relative Rotation Graphs are all about relative trends and relative strength. And I consider that...

READ MORE

MEMBERS ONLY

US Moving Towards Leading Quadrant vs. the World..... oh, and Canada Too

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

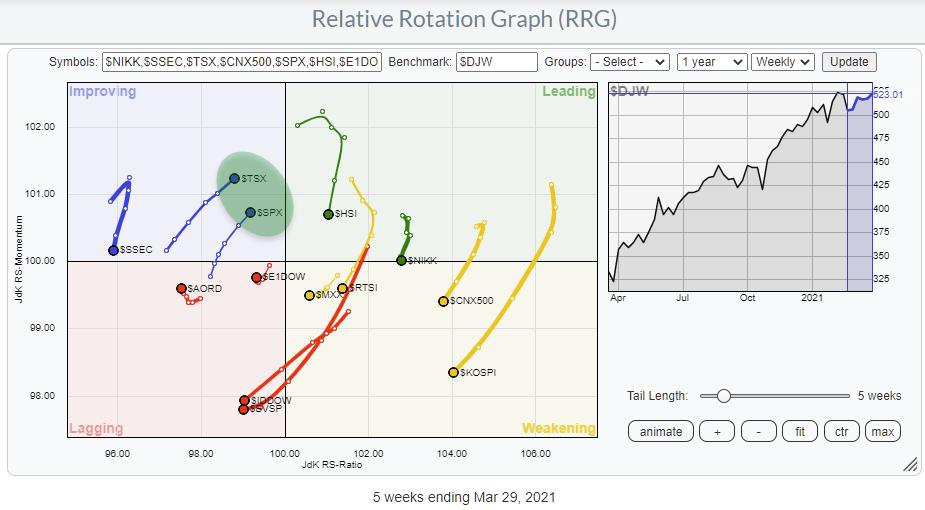

With the S&P 500 jumping to new highs, it's interesting to see how that impacts the position and the rotation of the US vs. the rest of the world.

The RRG above visualizes that. The highlighted area shows both the S&P and the Candian...

READ MORE

MEMBERS ONLY

Sector Spotlight: Tech is a Drag

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It is the last Tuesday of the month, and that means looking at seasonality!

In this edition of StockCharts TV's Sector Spotlight, after an overview of last week's rotations and performances for asset classes and sectors, I bring up his 3-D visualization for sector seasonality and...

READ MORE

MEMBERS ONLY

Comm is Da Bomb

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

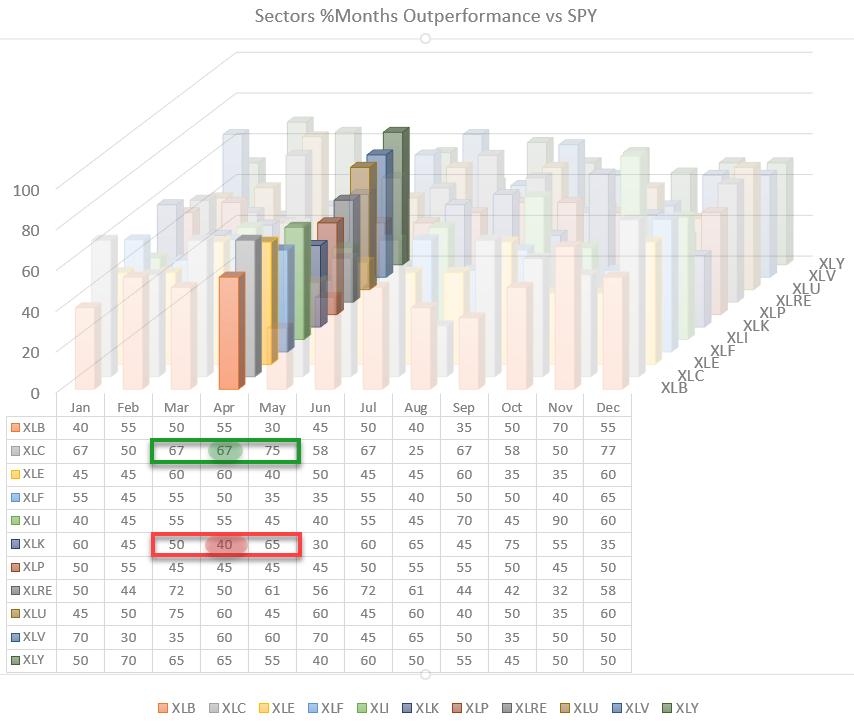

The seasonal trends for sectors vs. the S&P 500 going into April show many 50/50 odds for out- or underperformance. But the two sectors that stand out are interesting and important ones.

Seasonality for Communication services shows that this sector outperformed 67% of the time in April...

READ MORE

MEMBERS ONLY

Tech Is a Drag

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

There is no doubt about it; Tech(nology) is an important sector. As a matter of fact, it is a crucial sector. At 26% weight inside the S&P 500 index, technology is twice as big as the next biggest sector -- Health Care at 13% -- and number...

READ MORE

MEMBERS ONLY

Is the Dow Theory Sending Us a Message?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Dow theory is more than 100 years old, but still holds value today. Sometimes simple things can help you paint a clearer picture for yourself.

One of the principles of the Dow Theory is that "Indices Must Confirm Each Other." Basically, this means that signals or trends...

READ MORE

MEMBERS ONLY

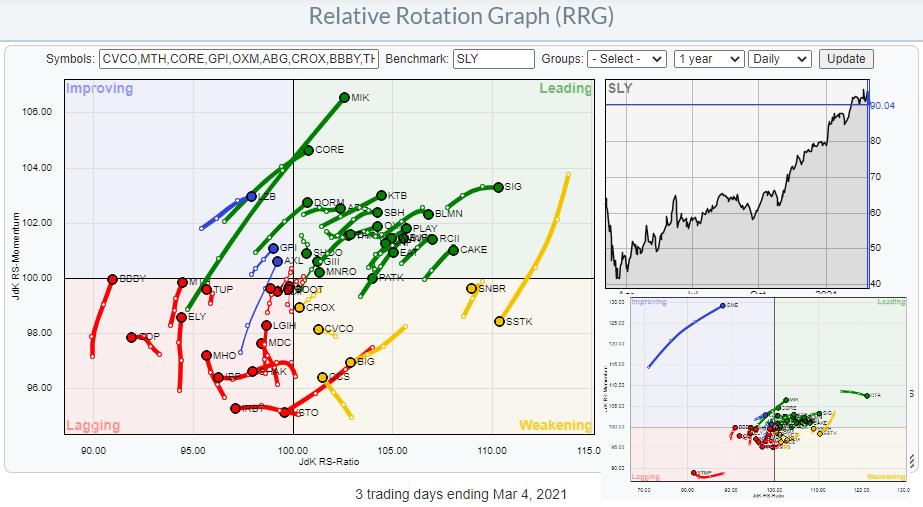

Taking FB and FCX from The RRG L/S Basket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

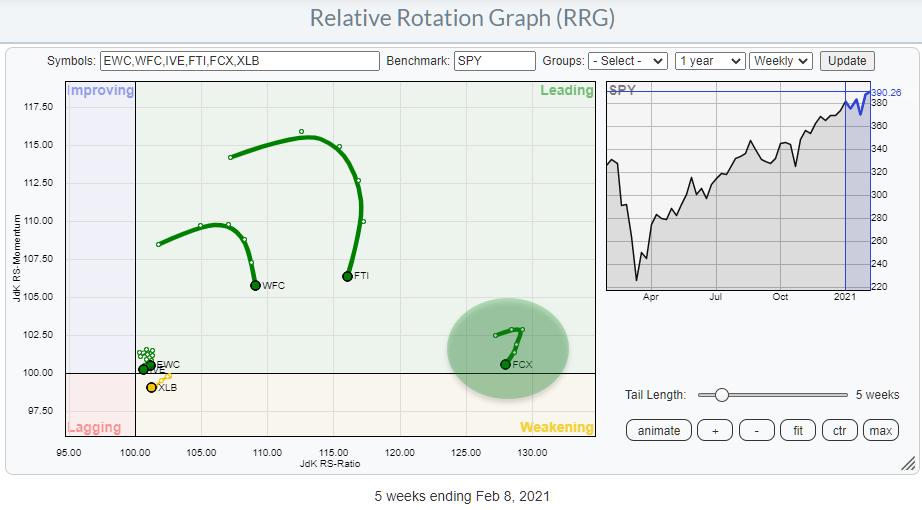

The two RRGs above show the long positions in the RRG L/S basket on the left and the short positions on the right. Going over these rotations, combined with the recent performance (dropping around 4% in a few days), two tails stood out.

On the long side, we have...

READ MORE

MEMBERS ONLY

Sector Spotlight: Rising Real Estate

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week, I spent a lot of time on answering a question from the mailbag. This week is all about charts!

In this edition of StockCharts TV's Sector Spotlight, I starting with a look back at the rotations as they unfolded in various asset classes and US sectors....

READ MORE

MEMBERS ONLY

Real Nice Stocks in the Real Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

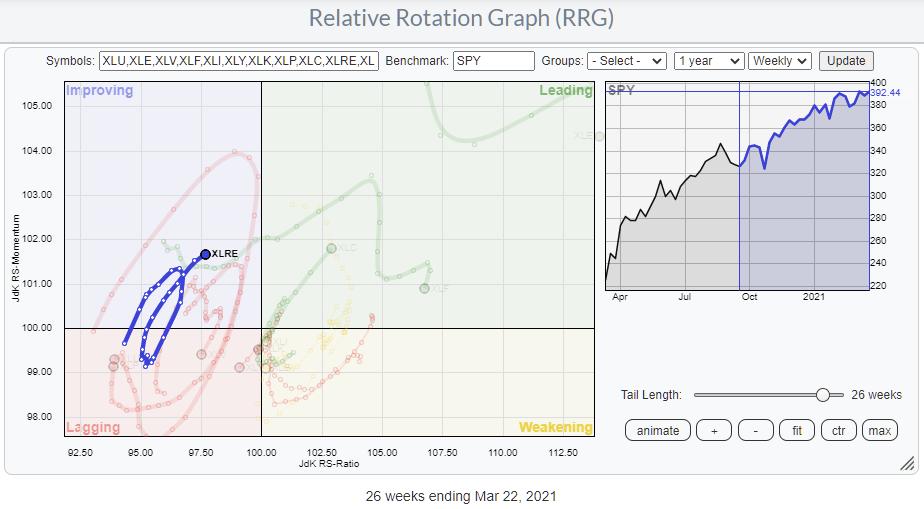

Every last Tuesday of the month in Sector Spotlight, I review the seasonality for US sectors and try to match the historical performance with the current performance as it is playing out on the Relative Rotation Graph.

For March (see episode 68, "Seasonal Surprise for XLRE"), the Real...

READ MORE

MEMBERS ONLY

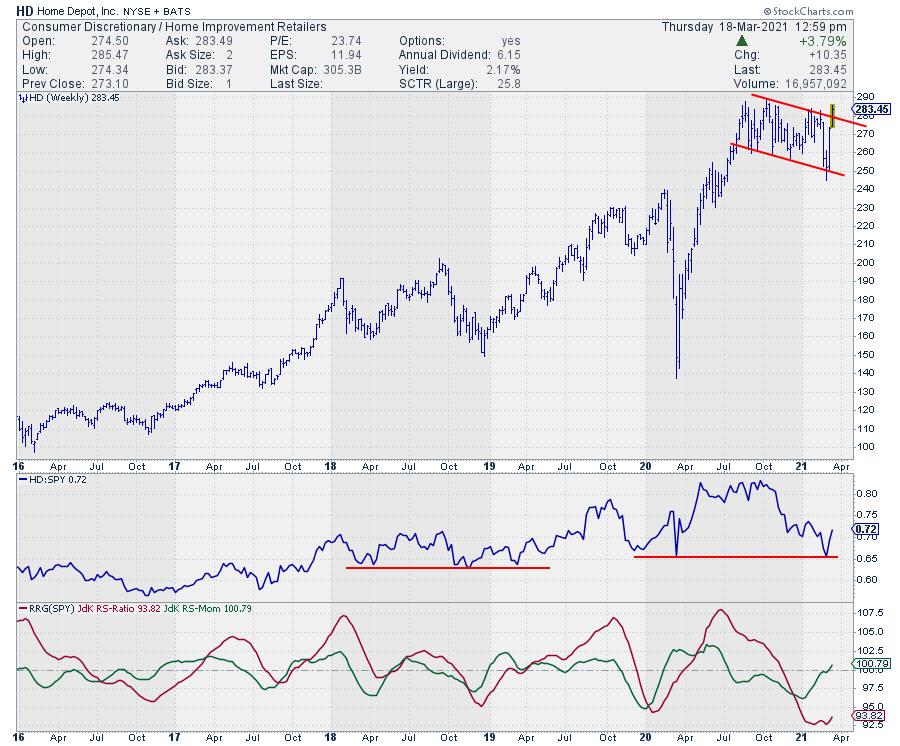

HD Popping From Consolidation and TRV Pushing to New High

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I started at the Market movers (%up) widget for Dow Jones stocks on my dashboard for today's chart(s). When I requested the RRG for these ten stocks, the RRG below showed up.

These then stocks are all moving higher today, but their relative trends differ significantly, as...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Scan and a Trading Plan

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I begin with a quick look at last week's rotations in asset classes and sectors. Then, I look into the RRG mailbag and present in-depth discussion of a recent 3-part question that came in. All three elements that...

READ MORE

MEMBERS ONLY

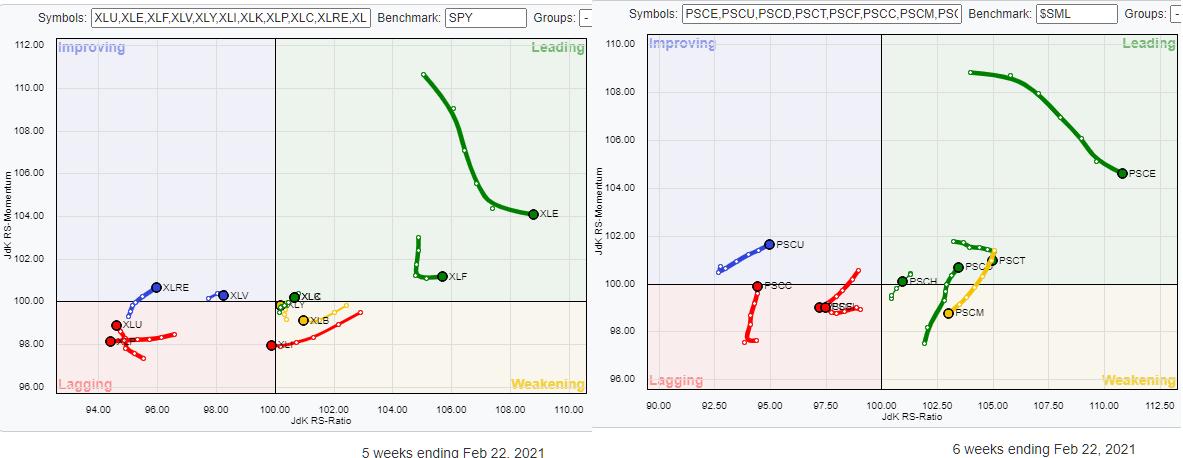

Consumer Discretionary Sector Rotating Back Towards Leading; the Equal Weight Sector, That Is...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Equal Weight version of the Relative Rotation Graph for US sectors shows an interesting divergence in rotation for the Consumer Discretionary sector.

Two weeks ago, 3/2, I showed the RRG for small-cap sectors and analyzed the discrepancies between the small-cap and the large-cap sector rotations. Here also, the...

READ MORE

MEMBERS ONLY

The Name is Value, Growth to Value....

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Growth/Value relationship is always interesting to keep an eye on -- but even more so recently.

For a long period of time, roughly from late 2018 until Q3 2020, Growth stocks were beating Value hands down.

The chart above shows the Growth/Value relationship in the big pane...

READ MORE

MEMBERS ONLY

Sector Spotlight: USD Strength and Tech Weakness

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I start with a look at what happened last week in terms of rotation for asset classes and sectors. After that, I put these rotations in longer-term perspective using weekly charts and Relative Rotation Graphs while overlaying the 12-month rolling...

READ MORE

MEMBERS ONLY

KTB Holds while SLY, SPY and PSCD Drop

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Recently, I have been talking and writing about small-cap sectors and especially how the small cap segment in the consumer discretionary sector, the PSCD ETF, is currently diverging from its large cap counterpart, XLY. For this article I have collected the top 50 members in PSCD (Invesco), and there are...

READ MORE

MEMBERS ONLY

Sector Spotlight: Small Caps Secret Message

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I go over the rotations for asset classes and sectors as they were traced out last week. While talking about the short-term rotations, I bring in the weekly RRGs and charts to find matching and therefore more reliable trends. After...

READ MORE

MEMBERS ONLY

Playing Consumer Discretionary Through PSCD

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my article for last weekend's ChartWatchers newsletter, I wrote about a set of ETFs representing small-cap sectors and how they can be used in a Relative Rotation Graph. I also talk about it in this week's episode of Sector Spotlight. The crux is that looking...

READ MORE

MEMBERS ONLY

When the Tails are Diverging, Opportunities Arise

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week, Friday 2/19, Tom Bowley invited me to be his guest in a webinar he did with EarningsBeats.com.

Of course, I talked about RRG in general and we applied it to international markets, crypto-currencies and US sectors. All good fun. After I presented my bit on sectors...

READ MORE

MEMBERS ONLY

Value Small Caps Are Breaking to New Highs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the predefined RRGs allows you to bring up a universe of growth, value and size indexes, and this can help you to spot how the various parts of the market are positioned against each other and how they are rotating.

Ths small RRG shows the tail of the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonal Surprise for XLRE

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, since it's the last Tuesday of the month, I dive into the seasonal outlook for the month(s) ahead. Communication Services seems on track with its current rotation on the Relative Rotation Graph. But a surprise could be...

READ MORE

MEMBERS ONLY

Communication Services on Seasonal Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Looking at the 3-D seasonality chart above, most of the sectors have a 50/50 history of outperforming SPY in the coming month of March.

Both Communication Services and Consumer Discretionary are showing an upcoming string of months that are historically strong for them. XLC starts with 62% in March,...

READ MORE

MEMBERS ONLY

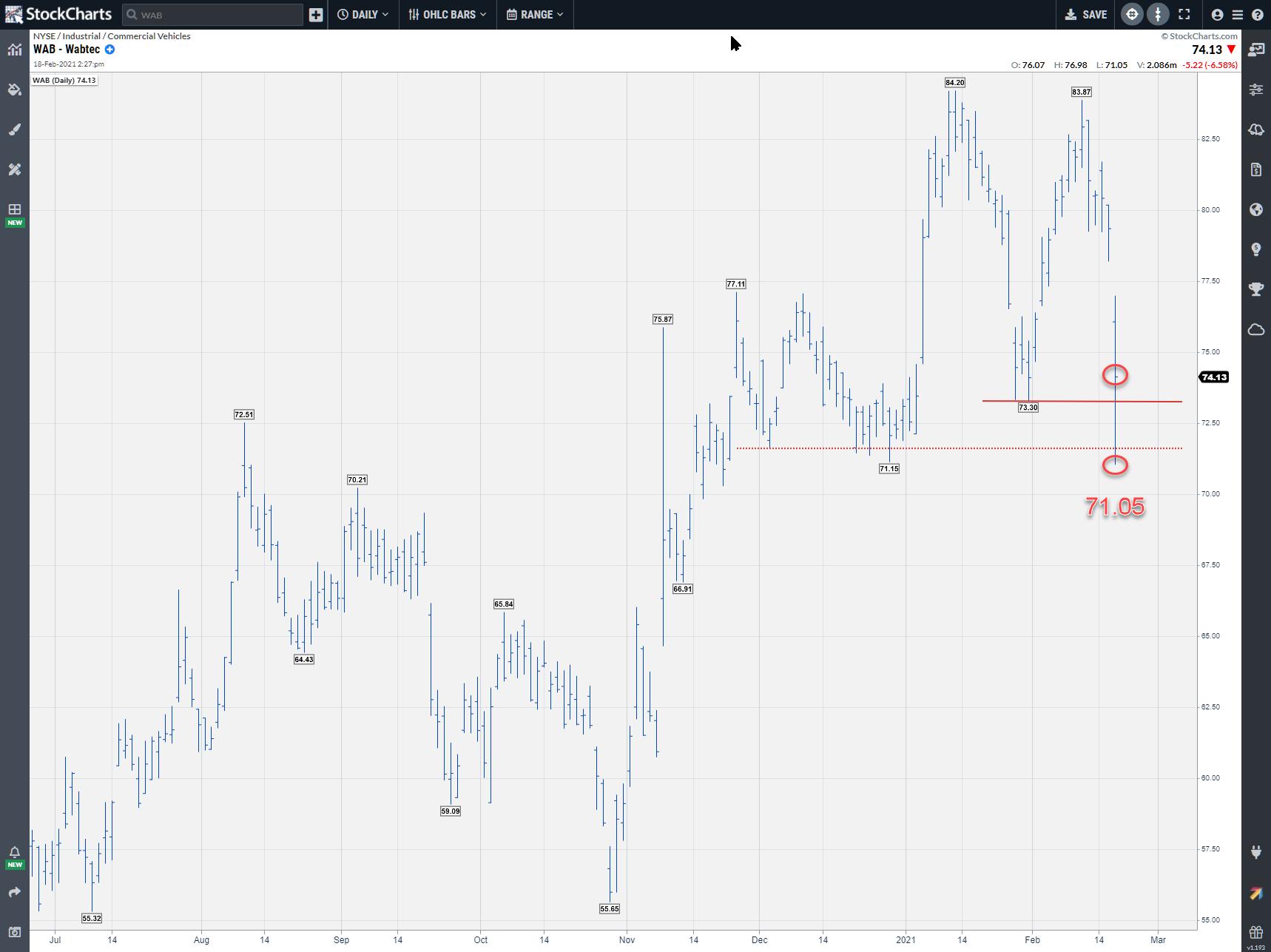

WAB Triggers Turtle Soup Buy Setup

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the BIG improvements or advantages in ACP is the fact that I can run a scan in the side-bar, then immediately click on the symbol to bring up the chart.

One of the scans that I use frequently is the 'Turtle Soup" scan on intraday data....

READ MORE

MEMBERS ONLY

Sector Spotlight: This Bull Has Legs to Run

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

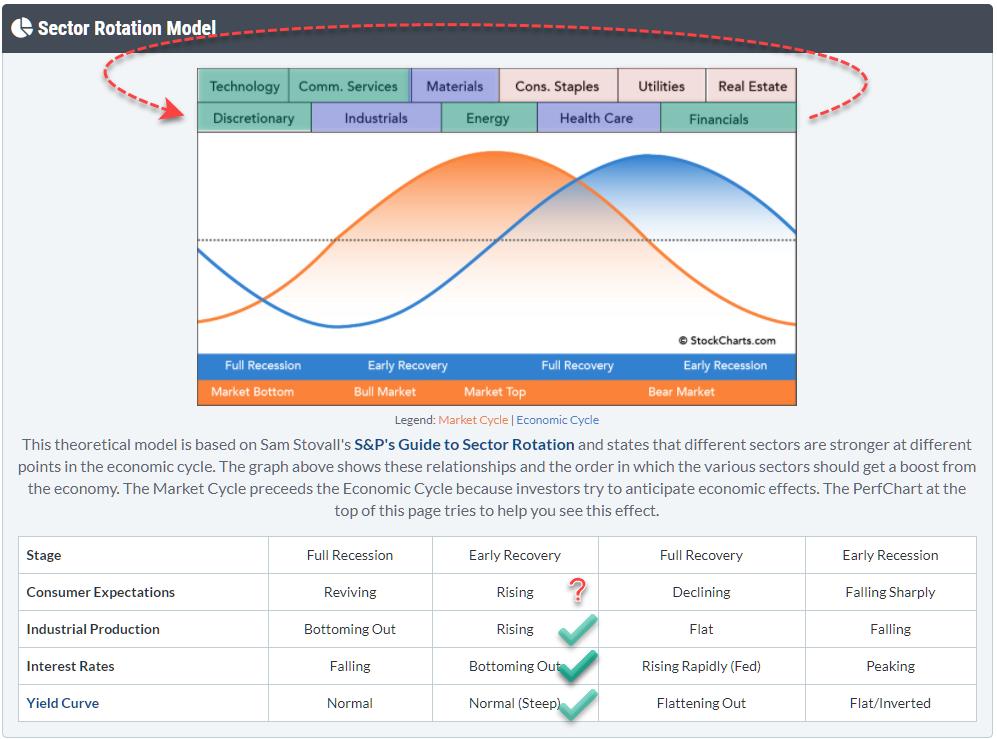

In this edition of StockCharts TV's Sector Spotlight, after a review of last week's rotations in asset classes and sectors, I take a deep dive into the Sector Rotation Model, bringing together all different elements of the Sector Rotation Model using Relative Rotation Graphs to gauge...

READ MORE

MEMBERS ONLY

Using RRG to Find a Match Between Theory and Reality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article appeared in last weekend's ChartWatchers newsletter with the title "Sector Rotation Model Suggests Bull Market in Stocks Ongoing". As I feel that it is one of the more important/better articles showing how to use Relative Rotation Graphs in combination with other analysis techniques,...

READ MORE

MEMBERS ONLY

Sector Rotation Model Suggests Bull Market in Stocks Ongoing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I like to check the macro environment and try to see if I can find meaningful clues to draw conclusions from generally accepted theories/models. The Sector Rotation Model (From Sam Stovall's guide to sector rotation) is one of those models that I like...

READ MORE

MEMBERS ONLY

These Two Relationships Point to Ongoing Strength for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The RRG above shows the rotations for two relationships that can help you get a handle for the market as a whole:

* Growth vs Value: Generally, when growth stocks are doing well and outperforming value, that is good for the market - whereas, vice versa, when value stocks are outperforming...

READ MORE

MEMBERS ONLY

Sector Spotlight: Three Sectors That Will Drive SPY Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I walk you through the current rotations in asset classes and US sectors using Relative Rotation Graphs. On the weekly RRG for sectors, I note three that are rotating back into the leading quadrant. And when these sectors are outperforming,...

READ MORE

MEMBERS ONLY

Rebalancing a Portfolio is Important

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Good money management can help you a great deal in managing portfolios. Rebalancing is a very important part of that discipline. In this article, I am reviewing the current RRG Long/Short basket, replacing XLB and FTI with EBAY and MSFT while at the same time bringing all positions back...

READ MORE

MEMBERS ONLY

EBAY Popping to New High and Unlocking More Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of my routines to gauge the current market action is to start at the StockCharts.com Dashboard and take a look at the Market Movers - Most Active for the S&P 500. The link at the bottom left of that widget allows me to open up the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stealth Rotation for Healthcare

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I attack the monthly charts to monitor the long-term trends that are in play. With this knowledge, I then build this into a "view" using the investment pyramid that covers the market from asset classes all the way...

READ MORE

MEMBERS ONLY

US Stocks are Lagging the World, and a Clear Preference for Short-Dated Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In today's episode of Sector Spotlight, I cover, or at least try to, the complete investment landscape from asset allocation, all the way down to stocks at sector level.

With the monthly bars for January just completed, I stuck to my guns, looking at the long-term trends on...

READ MORE

MEMBERS ONLY

Finding Winners in a Pool of Mud

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At the start of this week in my weekly StockCharts TV show Sector Spotlight, I discussed the re-emerging strength of Consumer Discretionary and Technology stocks.

In the second half of the week, markets started to shift a bit and, as usual, the question is whether this down move, which we...

READ MORE

MEMBERS ONLY

Sector Spotlight: AMZN Ready to Lead Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I look at current rotations in asset classes and sectors and highlight some changes in relative movements against the S&P 500 index. After the break, I bring up my 3-D visualization of (sector) seasonality and see if any...

READ MORE

MEMBERS ONLY

(Big) Tech is Back on Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows an interesting clustering of sectors close to the benchmark at the start of this week. I have highlighted this cluster in the RRG above.

The chart below zooms in on those three sectors that are more or less overlaid on each other...

READ MORE

MEMBERS ONLY

Breaking the Dow(n)... in Theory

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

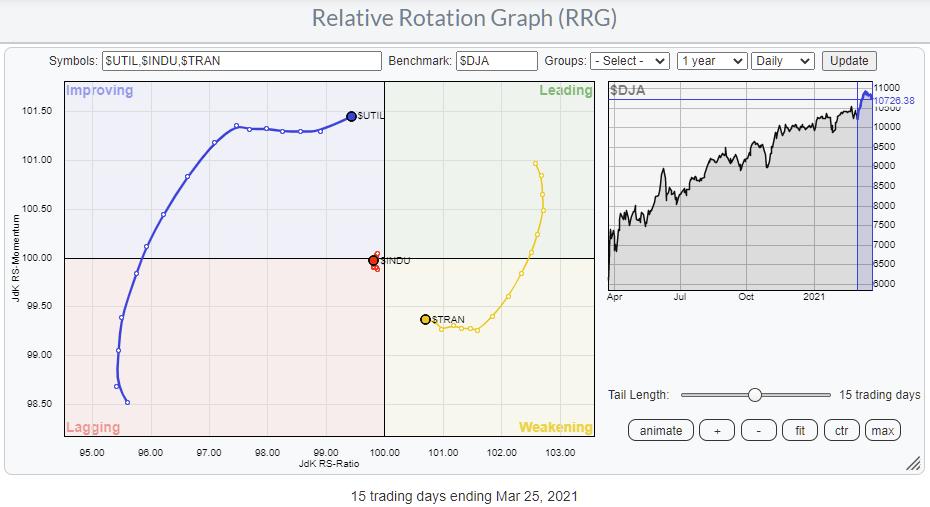

The most widely followed Dow Jones index is the Dow Jones Industrials Average. But, in reality, this is only one of three averages that make up the Dow Jones Composite average.

The other two are the Dow Jones Transportation and the Dow Jones Utility averages.

The RRG above shows the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Core Satellite Approach with RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I highlight the rotations of last week and zoom in on a few sectors to put things in a slightly longer perspective. After the break, I answer two questions from the mailbag, explaining how you can find the symbols covering...

READ MORE

MEMBERS ONLY

RRG Basket Update: Swapping SEE & INTC for EWC & COST

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In today's episode of Sector Spotlight, I promised, time permitting, to have at least one change in the RRG L/S basket that I am maintaining in the show and my blogs. Obviously, time did not permit me to cover it during the show, so I am writing...

READ MORE