MEMBERS ONLY

The World is Outperforming the US

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs, or RRGs, can help you get a better view of the big picture.

One of the RRGs I often use to get a handle on international developments on stock markets around the world is to pull up the Relative Rotation Graph for international stock market indexes, as...

READ MORE

MEMBERS ONLY

Brazil is Beating the US! (and We're Not Talking About Soccer...)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

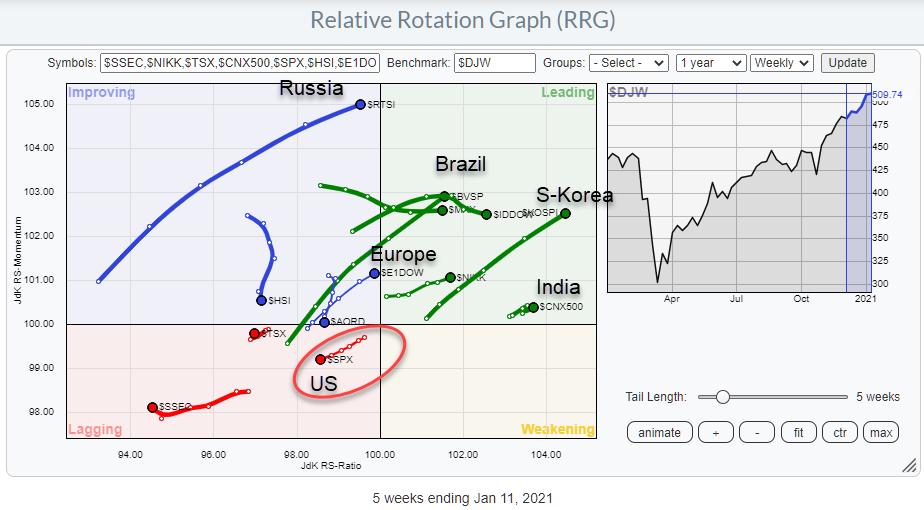

One of the Relative Rotation Graphs that I like to keep an eye, in order to monitor the bigger picture, is the RRG that shows the rotations for international stock market indexes against the DJ Global index, as shown above.

What we see here is a cluster of markets inside...

READ MORE

MEMBERS ONLY

Sector Spotlight: Energy & Financials Beating SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I talk you through the recent rotations in asset classes and US sectors, then look at growth vs value rotation, as well as the rotation of the US vis-a-vis international stock markets. After the break, I dive into the current...

READ MORE

MEMBERS ONLY

Value Starts to Accelerate Away from Growth

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

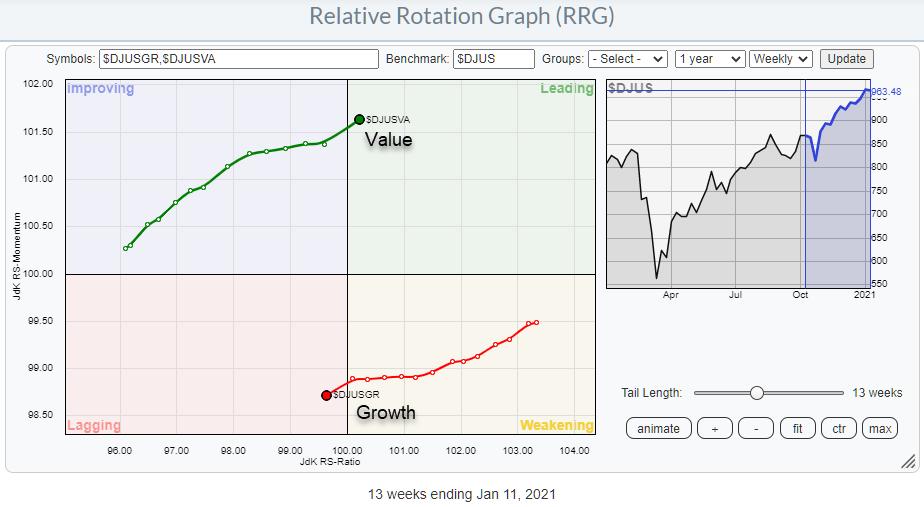

This week, the tails for Growth and Value are crossing over. Value is moving into the leading quadrant while Growth crosses from weakening into lagging.

This rotation has been going on for quite some time already and was picked up by the RRG Lines and the rotation of the tails...

READ MORE

MEMBERS ONLY

CF Industries Confirms Uptrend as it Moves Into Leading Quadrant on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly RRG, XLB is inside weakening but rotating back towards the leading quadrant. On the daily RRG, XLB is pushing rapidly into leading from improving. This alignment makes the sector very interesting to watch in the coming days/weeks.

It is one of the seven sectors that are...

READ MORE

MEMBERS ONLY

Seasonality is Nice but Reality Rules

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Happy New Year!!!

Those of you who watch my weekly show Sector Spotlight on StockCharts TV will know that, towards the end of every month, I look at the seasonality for sectors going into the new month and then try to combine that with the actual rotations that are taking...

READ MORE

MEMBERS ONLY

Sector Spotlight: 7 Sectors in Monthly Uptrends

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I take a look at the rotations that took place in Asset Classes and Sectors during the last two weeks of December. After the break, I dive into the long-term trends for those asset classes and sectors using monthly charts....

READ MORE

MEMBERS ONLY

Financials En-Route For a Strong Start in 2021

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

My first article for the Chartwatchers newsletter going into the new year... 2021!!

First of all, I wish all readers and watchers of Sector Spotlight a very happy and, above all, healthy new year. That "Healthy" part all of a sudden has gotten a whole new meaning after...

READ MORE

MEMBERS ONLY

Sector Spotlight: Using RRG Top-Down

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I work my way down the investment pyramid and show how I use RRG as a tool to get from Asset Allocation all the way down to individual stocks to build a portfolio. You should be able to pick and...

READ MORE

MEMBERS ONLY

Sector Spotlight: How CB3 Uses RRG in Portfolio Management

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I interview Charles Brown of CB3 Financial. Charles is an early adopter and long time user of Relative Rotation Graphs, which he actively promotes and uses in the investment process that he uses to manage his client portfolios.

This video...

READ MORE

MEMBERS ONLY

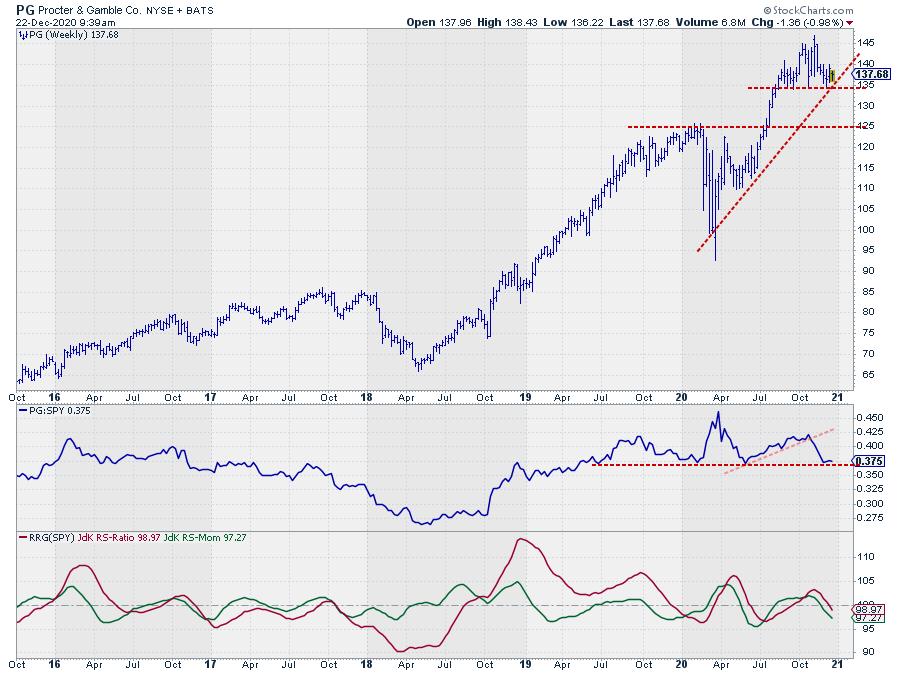

PG is Ready to GO..... !

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Into the lagging quadrant on the RRG and to the short side of the RRG Long/Short baskets.

Before diving into the PG chart, let's go over the current symbols on both lists. At the moment, both the Long and the Short basket have six names in them....

READ MORE

MEMBERS ONLY

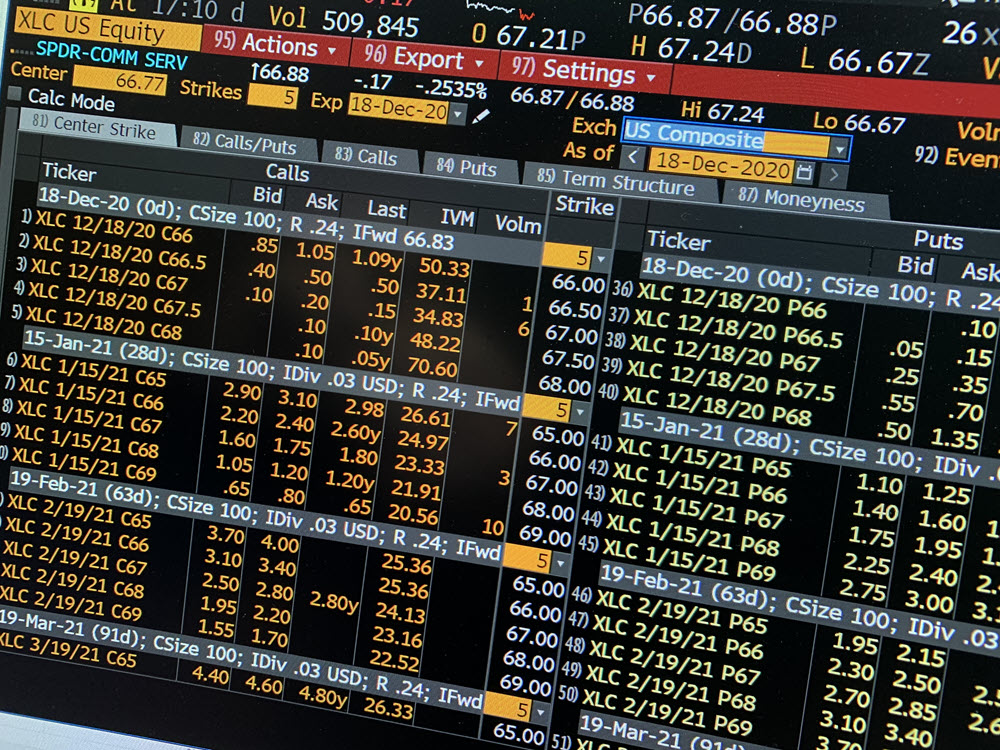

Getting Your Options Right Around Communication Services

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the last weeks, the Communication Services sector continued to improve and recently moved back into the leading quadrant after rotating through weakening and, very briefly, through lagging. This rotation, especially the increase in RRG-Velocity (the distances between the week-to-week observations), make XLC an interesting sector to keep your eyes...

READ MORE

MEMBERS ONLY

It's All About Da Base......

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With Bitcoin up around 10% and breaking beyond $20k, there can only be one chart today that should not be ignored.

BTC moved back to the forefront of financial markets and press recently. Dave Keller recently wrote about it and sent out this tweet (to the right) today. And I...

READ MORE

MEMBERS ONLY

Sector Spotlight: Performance and Trends in Performance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I review last week's rotations for asset classes and sectors, then answer questions from the mailbag. I explain the difference between outright performance and "trends in performance" and discuss potential entry points using Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Four RRGs That Give You a Clear Overview of What is Going On in the Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Asset Classes

Starting at Asset Class level, the first Relative Rotation Graph shows the rotation of various asset classes (ETFs) against VBINX (the benchmark).

The relationship that stands out here is the very clear preference for stocks. It is the only tail that is inside the leading quadrant. As an...

READ MORE

MEMBERS ONLY

MTB is Ready to Break Resistance and Push Into The Leading Quadrant

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph for US sectors, the Financial sector is gradually improving more and more, with the tail having just crossed over into the leading quadrant.

Zooming in on the RRG for the constituents of the Financial sector against XLF, we see a high concentration of banking...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks Massively Beating Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I spend a big part of the show going over the (completed) monthly (bar-) charts for November, in order to get a handle on the long-term trends that are in play for both asset classes and sectors. In particular, the...

READ MORE

MEMBERS ONLY

(When) Will we See $40k in Bitcoin?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Bitcoin and, more broadly, cryptocurrencies, are back to the forefront of financial markets. A lot of new participants are entering the crypto-space and they are all looking to get a piece of the bitcoin-pie.

So what can we learn from the Bitcoin chart when we want to get an idea...

READ MORE

MEMBERS ONLY

What's with Gold?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for Commodities shows the tail for precious metals deep inside the lagging quadrant and recently bending towards the left again after a few weeks of picking up relative momentum. This makes precious metals the weakest group in the universe.

Watching such a rotation on the tail...

READ MORE

MEMBERS ONLY

Sector Spotlight: Strong Performance for XLC in December

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I kick off by walking viewers through last week's performances and rotations on the Relative Rotation Graphs for Asset Classes and US sectors. After the break, I put these rotations in a bigger perspective and bring in seasonality for the month of...

READ MORE

MEMBERS ONLY

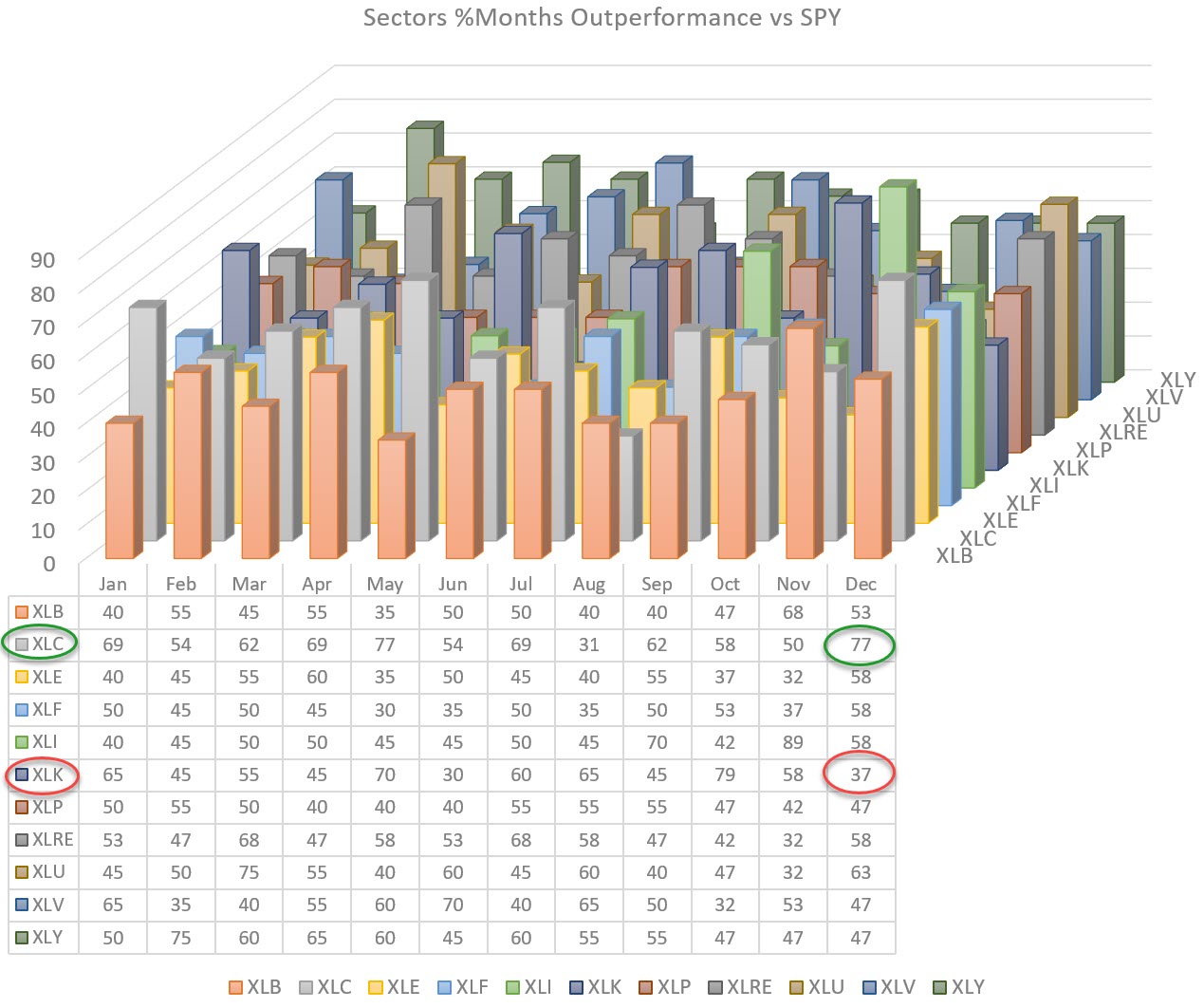

Seasonality Points to a Strong Month of December for XLC

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart above shows the seasonality for all US sectors relative to the S&P 500 index. The numbers in the table are the percentages of time in history (20 years when available) where a sector outperformed the S&P.

For the coming month of December, two sectors...

READ MORE

MEMBERS ONLY

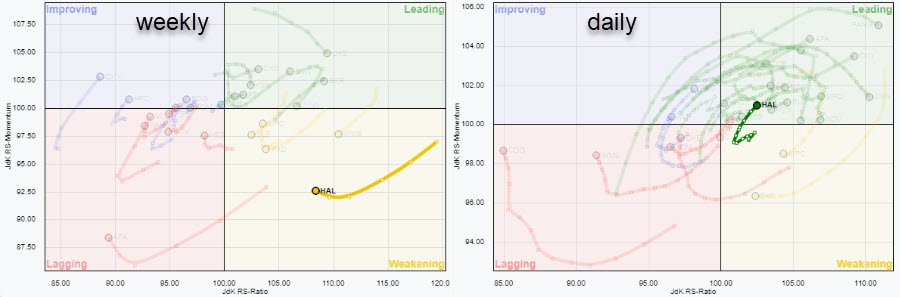

RRG is Picking Up Turnaround in HAL

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With returns in the Energy sector flying off the charts, I want to track developments in individual stocks within the sector closely. This is particularly true because the rotation of the sector on the weekly Relative Rotation Graph is still not very strong.

The weekly tail on XLE is shown...

READ MORE

MEMBERS ONLY

Sector Spotlight: Equal Weight vs. Cap Weight Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I walk viewers through the current state of asset class and sector rotations. After that, I zoom in, using the Relative Rotation Graphs of Equal weight and Cap weighted sectors side by side in order to spot differences or anomalies that can help us...

READ MORE

MEMBERS ONLY

Financial Stocks Showing Strength on Relative Rotation Graph as Dow Hits 30k

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Financial sector has been picking up a lot of relative strength recently.

On the Relative Rotation Graph for US sectors (against SPY), XLF is on a rotation trail through the improving quadrant and closing in on a cross over into the leading quadrant. Where JdK RS-Momentum was slightly lower...

READ MORE

MEMBERS ONLY

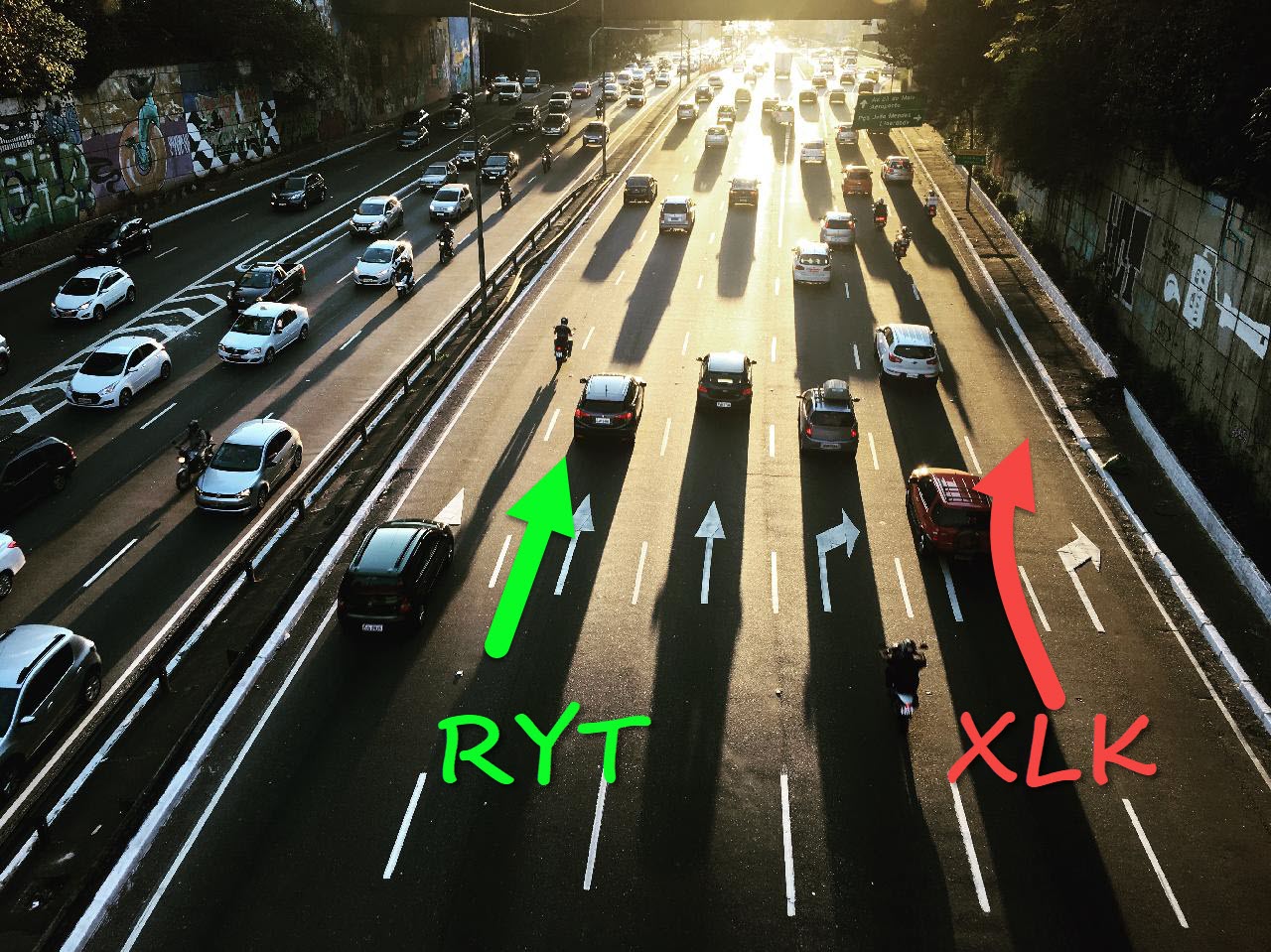

Sometimes You Need to Change Lanes to Stay on the Right Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When I was preparing for last week's episode of Sector Spotlight and writing an article for the RRG Blog on the Growth/Value Rotation, I had to think back to an article that I wrote for this newsletter back in August.

The title for this article was "...

READ MORE

MEMBERS ONLY

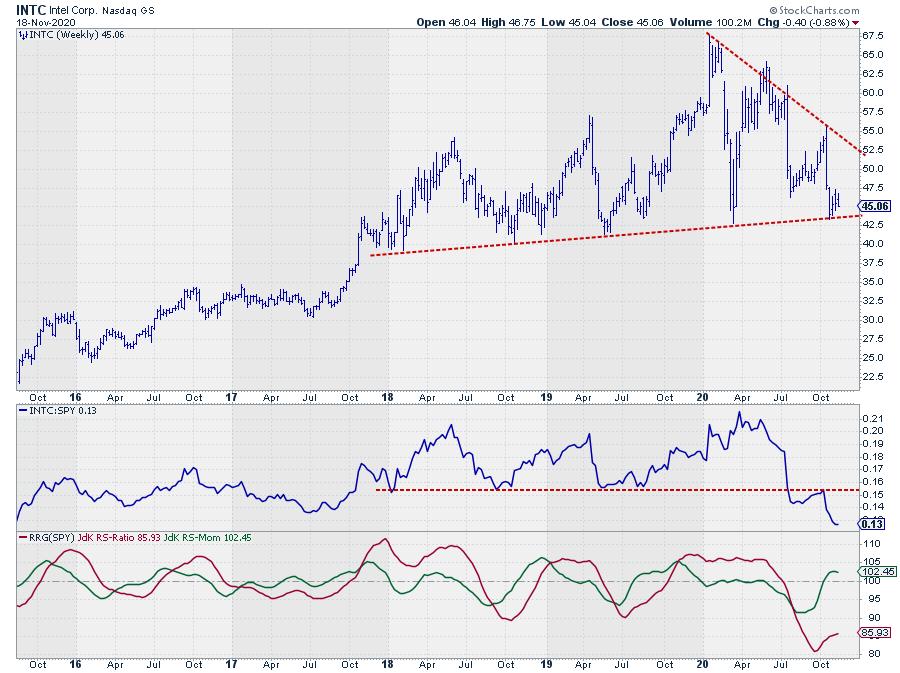

INTC at Risk for a Violent Move Lower

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for Technology stocks (XLK), the tail on INTC stands out - but not in a positive way.

INTC is positioned inside the improving quadrant after a recovery in relative momentum (JdK RS-Momentum), but recently started to roll over again, while still being the technology stock...

READ MORE

MEMBERS ONLY

Adding FB As a Short to RRG Long/Short Basket Trade Ideas

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I discuss possible long or short positions (stocks, ETFs) based on observations on Relative Rotation Graphs or ideas generated from them.

Currently, the baskets contain five positions each. Below, I will review all positions and come up with a few proposed changes to the mix.

Long...

READ MORE

MEMBERS ONLY

Sector Spotlight: Rotation OUT of Large-Caps

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at the performances for asset classes and sectors last week, noticing long tails on those daily RRGs - that indicates some big moves that have taken place. Following the lookback using daily RRGs, I move on to some weekly charts for stocks,...

READ MORE

MEMBERS ONLY

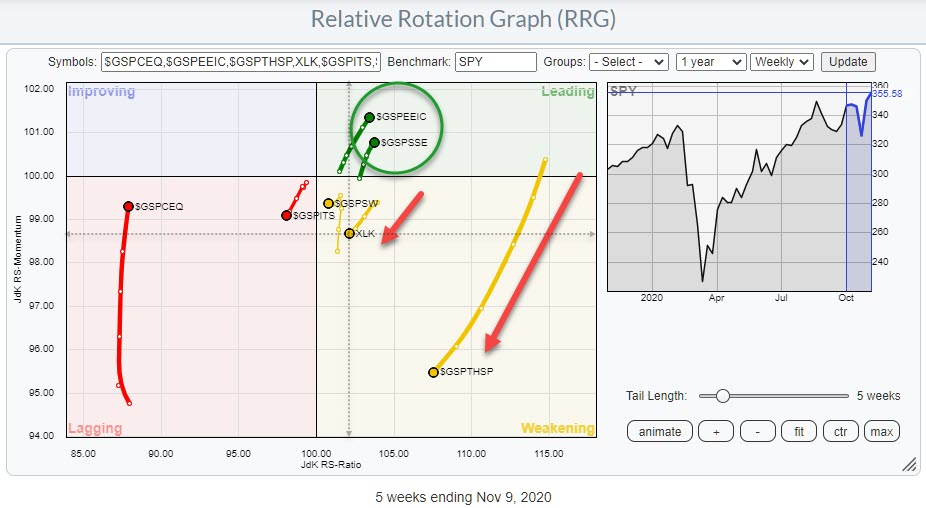

A Closer Look at the Growth to Value Rotation - There is More To It Than Meets the Eye...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

There is a lot of talk lately regarding the Growth to Value rotation that seems to be going on. And if you look at the surface, that is certainly true, but there is more to it than meets the eye...

The Relative Rotation Graph below visualizes this rotation and shows...

READ MORE

MEMBERS ONLY

Forget about AAPL! What is Happening Under the Hood of Rotation Out of Technology?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The flow of money out of the Technology sector is clearly visible on the Relative Rotation Graph for US sectors, and it is an observation that has made by many market commentators recently. What I want to do in this article is look under the hood of the technology sector...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation After the Election

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at asset class and sector rotation after last week's elections and try to digest the impact for various sectors. I analyze both the daily and weekly RRGs and find that, for some sectors, the different timeframes send contradicting messages. After...

READ MORE

MEMBERS ONLY

Sector Rotation Shows Money Flowing Out of Technology, Communications and Discretionary

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows an ongoing rotation out of the three strongest performers in 2020 so far.

Technology is inside the weakening quadrant, following a long rotation through leading, and has started to accelerate towards lagging. Consumer Discretionary is trailing slightly behind the rotation of XLK...

READ MORE

MEMBERS ONLY

Did We Already See "The Dip" or Is There Risk Ahead?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Every first Tuesday of the month in Sector Spotlight, I go over the completed monthly charts for the prior month.

Sometime mid-2019, when there was a lot of discussion on the yield curve being inverted, I started to include a long-term chart of the yield-curve in my monthly overviews. And,...

READ MORE

MEMBERS ONLY

This Energy Stock Has Started to Improve!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Tuesday 11/3, Election Day, I joined Dave Keller on The Final Bar. Most likely because all potential US-based guests were busy doing something else ;)

Dave and I talked about the Stock/Bond rotation going into the elections and how that lined up with the 2016 elections. We also...

READ MORE

MEMBERS ONLY

Sector Spotlight: Yield Curve Steepening Accelerates

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, as it is the first Tuesday of the new month, I take a look at the monthly charts for asset classes and US sectors. Most of the (strong) monthly trends are still intact. The long-term chart of the 10-2 yield curve, in combination with...

READ MORE

MEMBERS ONLY

Monthly Charts, Bars or Lines?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the first Tuesday of every month, I have a segment in Sector Spotlight in which I look at the completed monthly charts for the previous month. It forces me to sit down and look at the market from a longer-term perspective and make up my mind about trends that...

READ MORE

MEMBERS ONLY

Sector Spotlight: Asset Rotation on Same 2016 Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I review asset and sector rotations of the last week, then move on to my monthly segment on seasonality and whether or not it matches with current rotations. Materials, Industrials, Energy and Real Estate seem on track for a performance in line with their...

READ MORE

MEMBERS ONLY

Seasonality is Pointing to Outperformance for Materials and Industrials in November

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

We are approaching the month of November, which, this year, also means election month. In last week's edition of the ChartWatchers Newsletter, I wrote an article. Presidential Rotation, on how the rotations for Stocks vs. Bonds are now looking similar to the rotation seen around the same time...

READ MORE

MEMBERS ONLY

Presidential Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Those of you who follow my blogs and watch Sector Spotlight on StockCharts TV will know that I regularly look at rotations among various asset classes. I talked about that subject in last week's show, focusing on the relationship between stocks and bonds, and I wanted to highlight...

READ MORE

MEMBERS ONLY

AMD is at Risk!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While going over some Relative Rotation Graphs showing the rotations for individual stocks, the tail for AMD in the Technology sector caught my attention.

AMD was one of the leading tech stocks from July to early September, almost doubling in price, but then started to fade in terms of relative...

READ MORE