MEMBERS ONLY

Asset Class Rotation on RRGs Sends Clear RISK-OFF Message

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

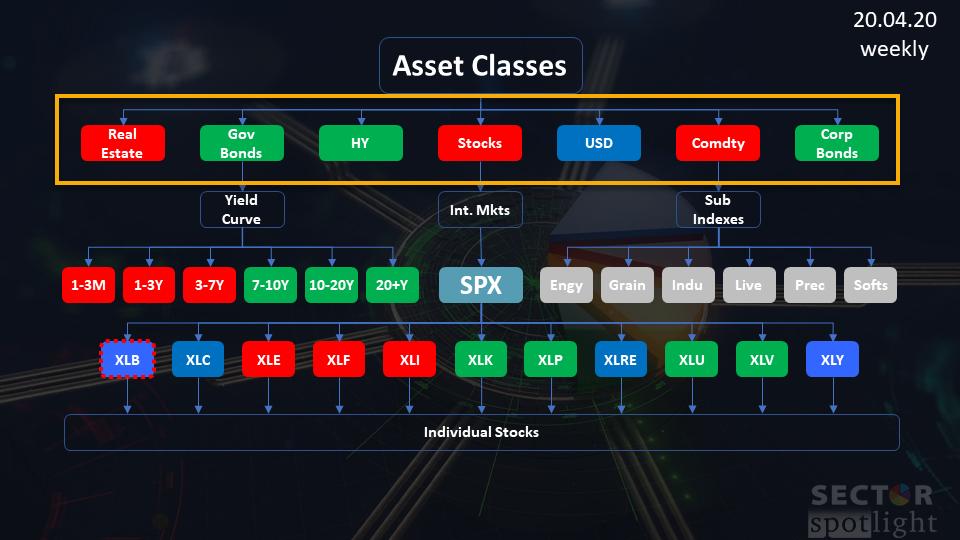

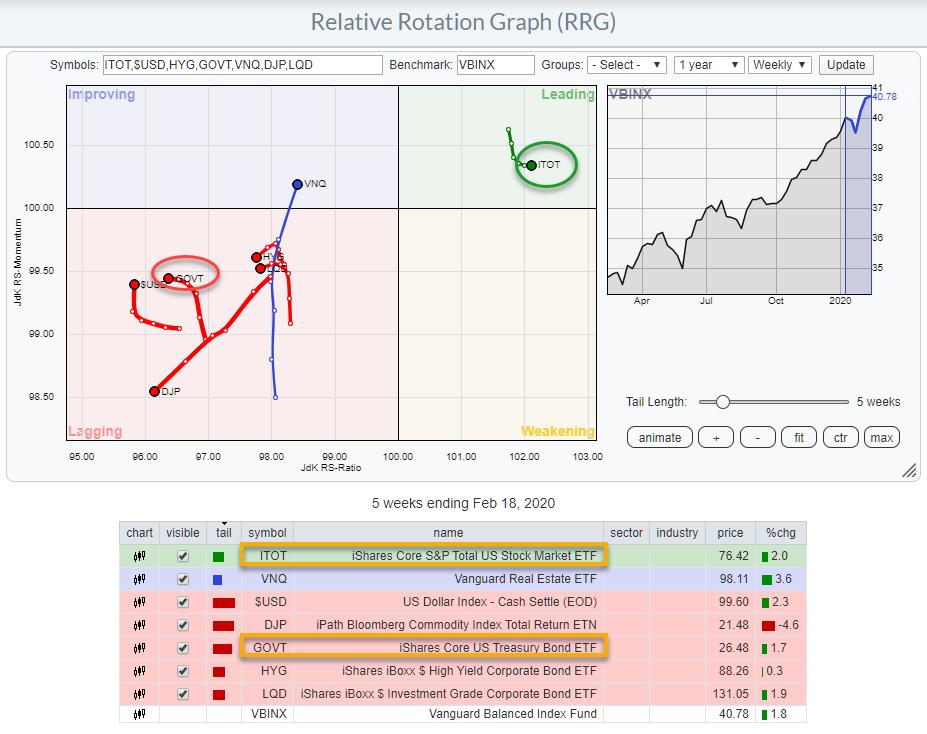

In the latest episode of my StockCharts TV series Sector Spotlight, I took an in-depth look at the relative rotation of asset classes vs. VBINX, the Vanguard Balanced Index fund, which represents a 60/40 stocks/bond portfolio. The image above shows the investment pyramid that I use to show...

READ MORE

MEMBERS ONLY

Is the Energy Sector Preparing for a Turnaround?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

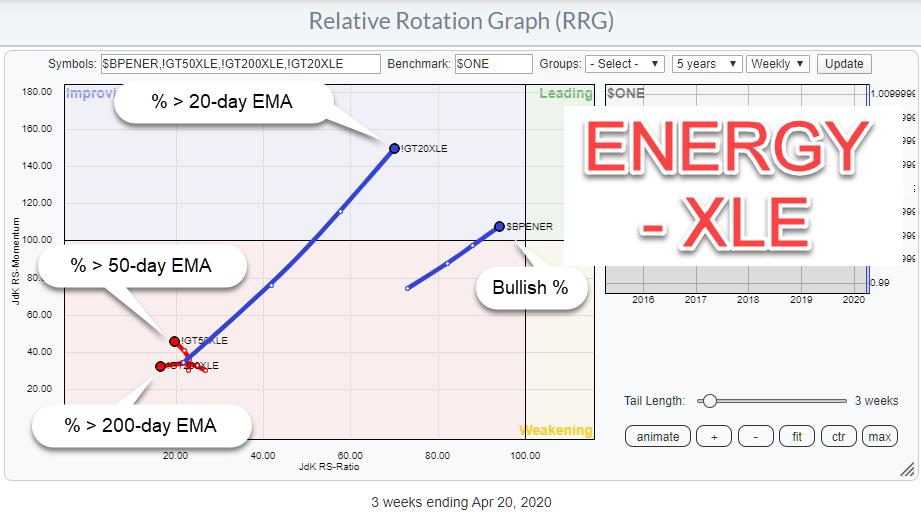

Recently I have been picking up some work that I had done in the past with regard to plotting (sector) breadth data on Relative Rotation Graphs.

You can review the segment in this episode of Sector Spotlight and read more about possibilities with breadth on RRGs in this article "...

READ MORE

MEMBERS ONLY

Following Up With Breadth Data On a Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the 4/14/20 episode of my show Sector Spotlight, which airs every Tuesday at 10:30am ET on StockCharts TV, I talked about plotting breadth data on a Relative Rotation Graph.

The link below starts at that segment.

In this article, I will add another option to take...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG Signals Risk OFF, Pointing to Lower Yields

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I perform an in-depth overview of asset class rotations, finding that RRG still suggests a cautious approach for stocks; meanwhile, (long) bonds are on the verge of breaking higher, sending yields to even lower levels.

This video was originally broadcast on April 21st, 2020....

READ MORE

MEMBERS ONLY

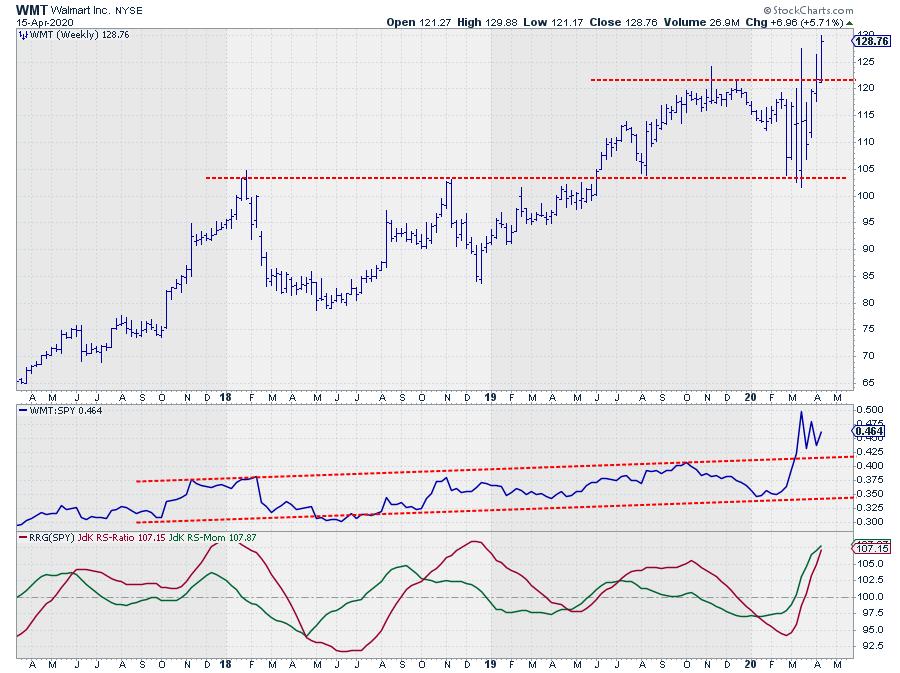

No Crisis For WMT as It Pushes To New Highs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

No matter what sort of general market regime we are in, there are always a few that go the other direction.

From 2017 to 2019, when the S&P surged, GE went completely the other way and more than halved. At the moment, we have a market that is...

READ MORE

MEMBERS ONLY

UDIs (User Defined Indexes) + RRG (Relative Rotation Graph) Opens Up New Possibilities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can show many different relationships. They do not necessarily have to come from regular price data-series like stocks or indexes.

In my weekly show on Stockcharts TV, Sector Spotlight, which airs every Tuesday from 10.30-11.00 am ET I spent time on pair trades on a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Plotting Sector Breadth on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I demonstrate how you can create UDIs to plot pairs, as well as how to use breadth data for sectors on RRG. In addition, I also showcase a new idea for a pair trade.

This video was originally broadcast on April 14th, 2020. Please...

READ MORE

MEMBERS ONLY

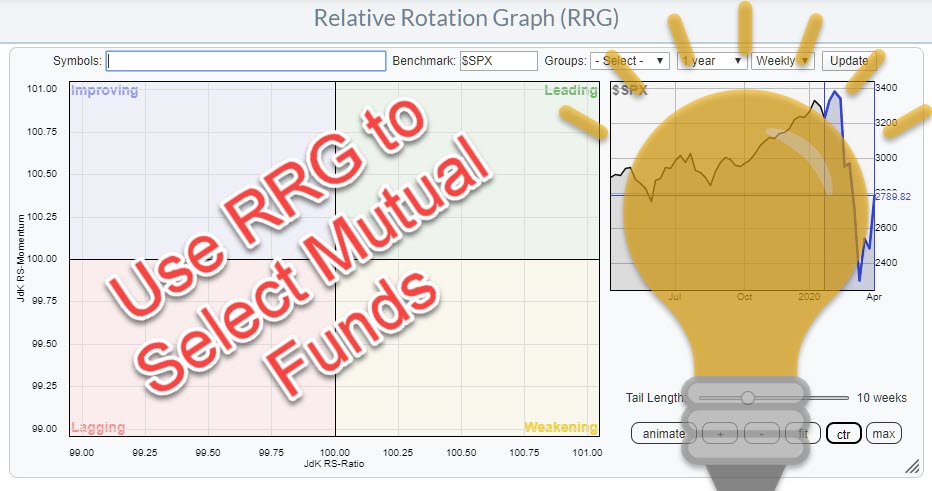

Using Relative Rotation Graphs as a Selection or Evaluation Tool for Mutual Funds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week on Wednesday (4/8) I wrote an article in the RRG blog on how you can use ChartLists, in combination with Relative Rotation Graphs to monitor your mutual fund portfolio. The article was inspired by a question which I received in the mailbag of my weekly show Sector...

READ MORE

MEMBERS ONLY

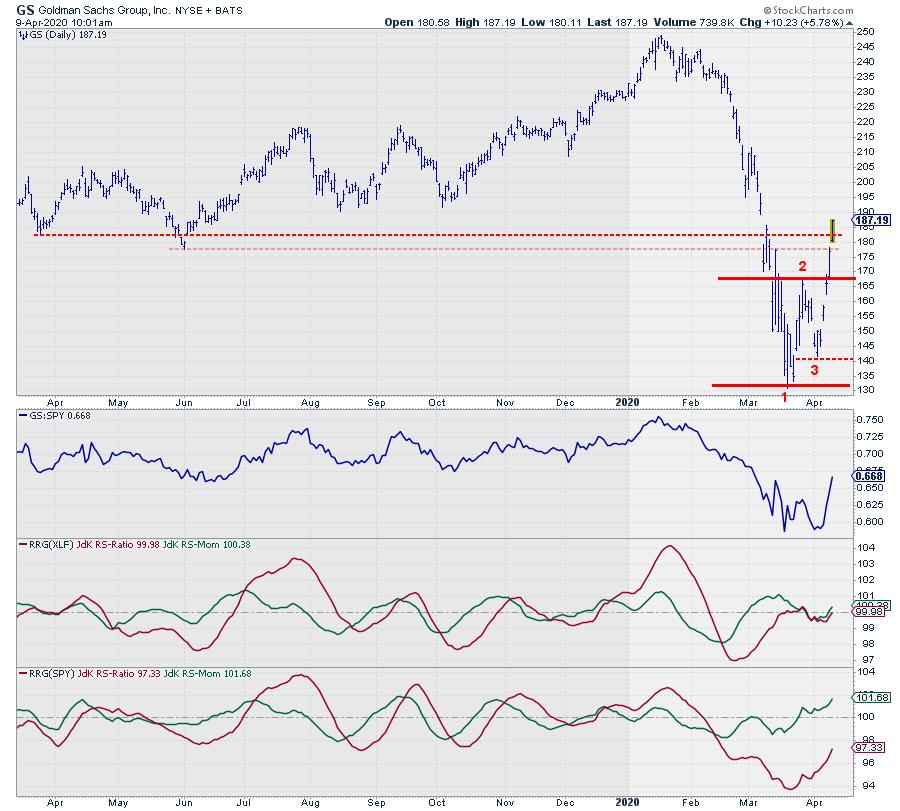

Did GS Just Come Back to Life Again?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

$248.94... That was the high for GS, set on Jan 17/2020. Two months later, on Mar 19/2020, a low was reached at $130.85. The stock is almost halved... so now what?

On the (weekly) RRG for US sectors, Financials is traveling well inside the lagging quadrant...

READ MORE

MEMBERS ONLY

Use ChartLists and RRG to Monitor your Mutual Fund Portfolio

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Recently I received a message asking if Relative Rotation Graphs would be useful for tracking Mutual Funds. My answer: Of course they are!

Pricing of Mutual Funds

In essence, the prices of mutual funds are also the result of people buying and selling on financial (stock) markets. The difference between...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation, Monthly Charts using RRG and Mutual Funds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I take a look at sector rotation on monthly charts (since it is the first Tuesday of the month). In addition, I answer a question whether RRG can be used to monitor mutual funds.

This video was originally recorded on April 7th, 2020. Please...

READ MORE

MEMBERS ONLY

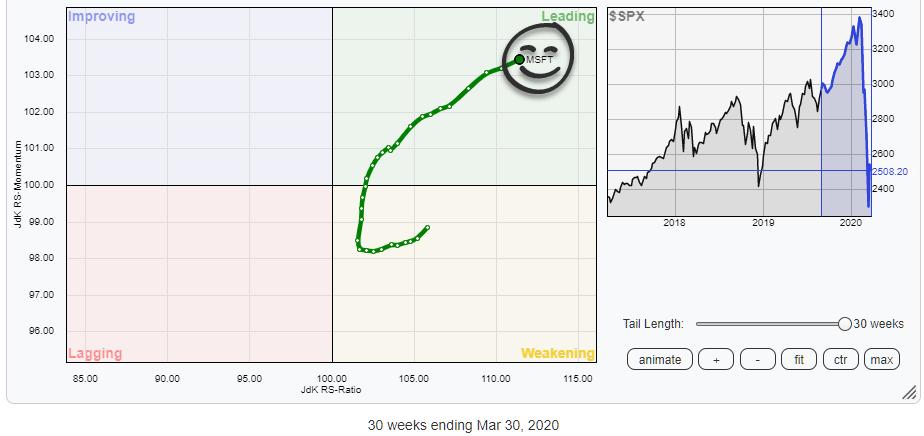

+10% in the Last 30 Weeks, Outperforming SPY by 26% and Still Moving Further Into Leading Quadrant.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

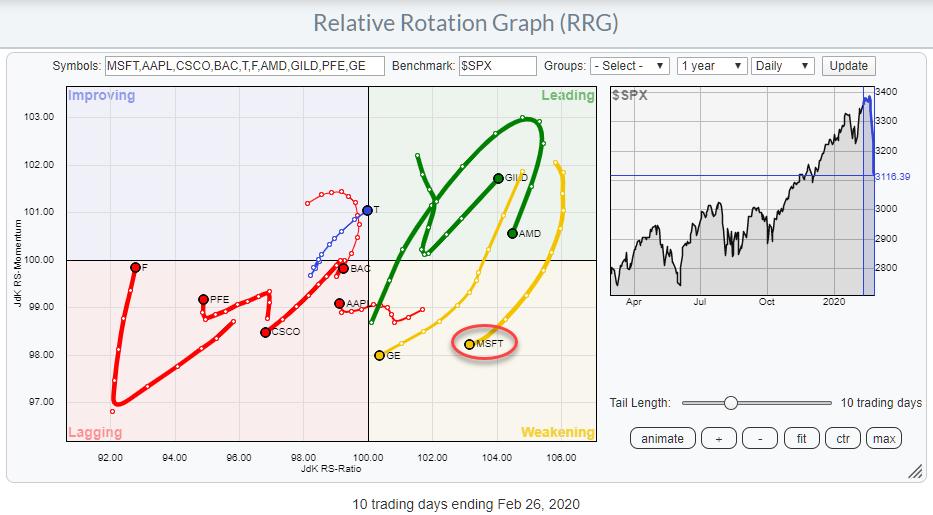

Tails that rotate from the leading quadrant into weakening and then back into leading always have my attention. The reason for that is that securities that rotate along such a path are already in a relative uptrend and the rotation from leading, through weakening, back into leading ,eams that another...

READ MORE

MEMBERS ONLY

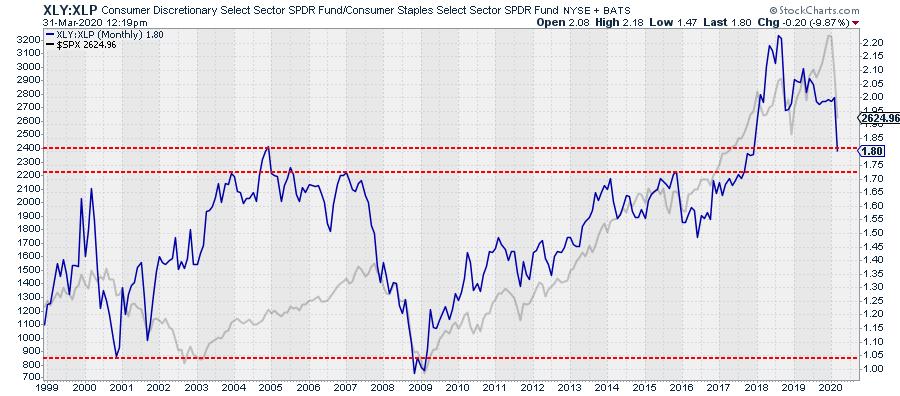

How One Stock is Holding Up an Entire Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The ratio between XLY:XLP, Consumer Staples vs. Consumer Discretionary, has traditionally been a pretty good gauge to get an idea about being in a risk-on or risk-off environment.

The chart above shows the XLY:XLP ratio, with the S&P 500 plotted behind it. Around the big turns,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Strong Seasonality for Utilities Going Into April

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I take a closer look at what's happening in the various Asset Classes. Afterwards, I examine the Utilities sector, as it has a strong seasonality going into April which is now backed by a strong tail/rotation on the RRG.

This video...

READ MORE

MEMBERS ONLY

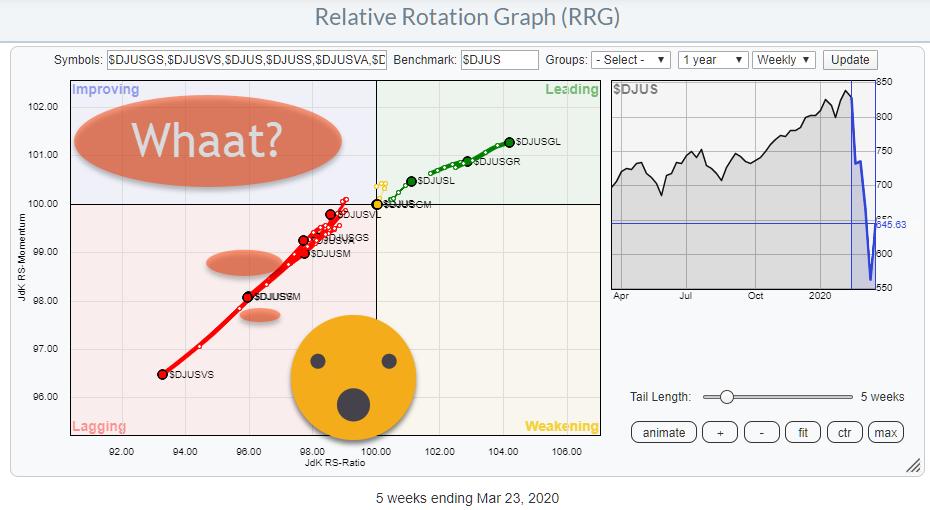

And the Worst Section of the US Stock Market Is.......

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Instead of simply looking at sectors, it also makes sense to keep an eye on segments of the stock market based on different criteria.

The Size Factor

One example is to group stocks based on Market Capitalization, i.e. Large-, Mid- and Small-Cap stocks.

A Relative Rotation Graph of that...

READ MORE

MEMBERS ONLY

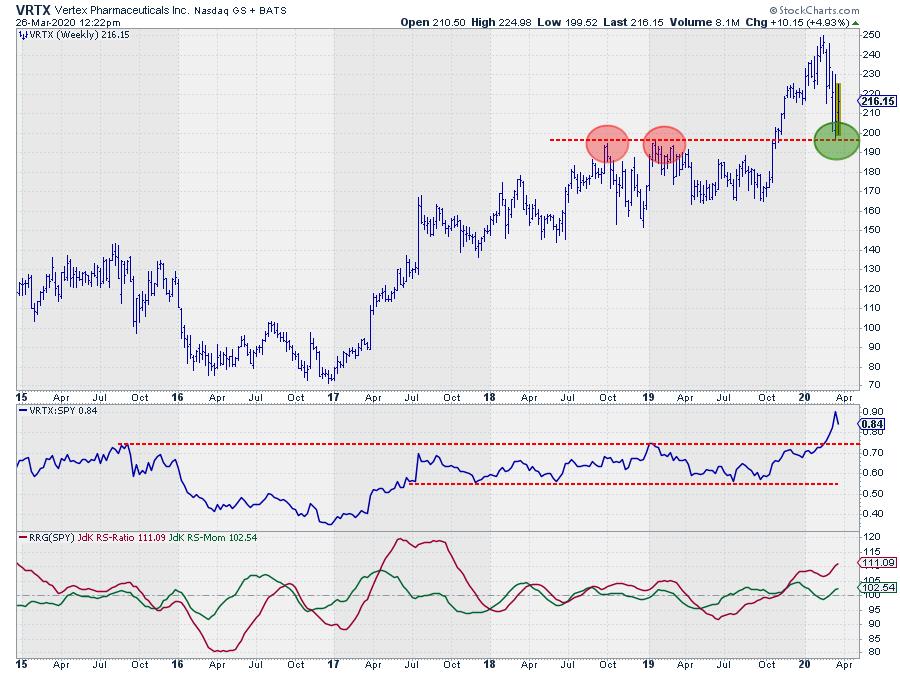

Resistance is Turning Into Support for This Biotech Stock

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

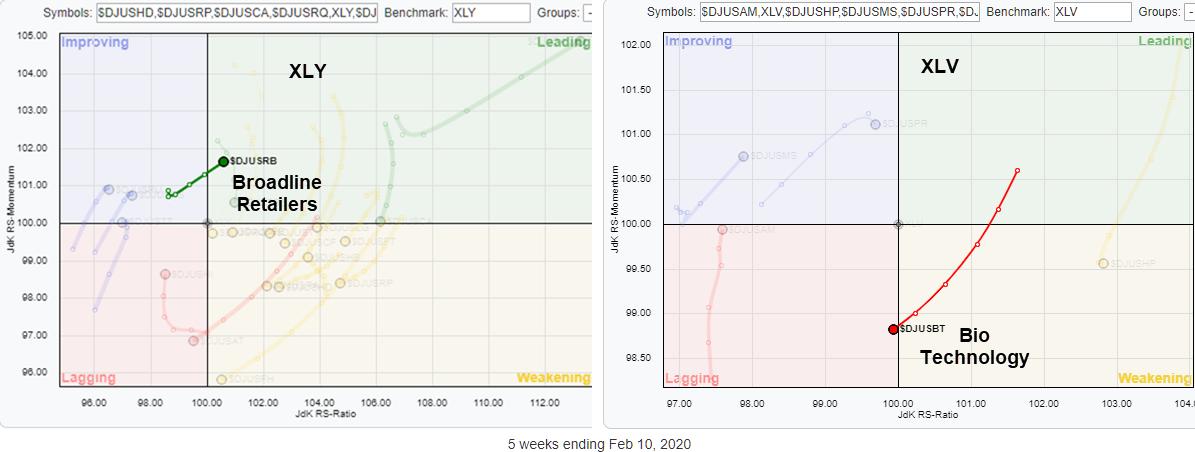

A lot of eye balls on the health care sector these days, and for good reasons. Traditionally, this has been one of the more defensive sectors, and it seems to be picking up that role at the moment.

On the weekly RRG for US sectors, XLF hooked sharply upward, moving...

READ MORE

MEMBERS ONLY

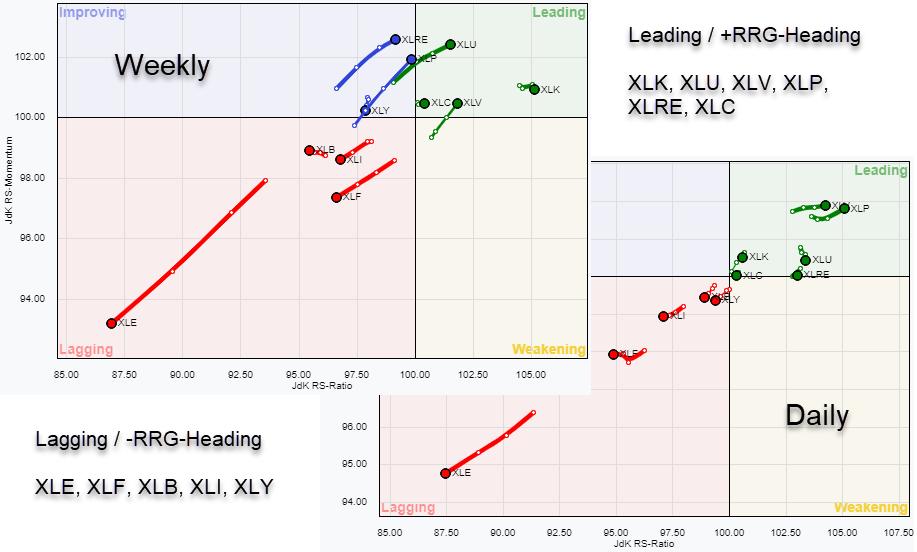

Sector Spotlight: Cap-Weighted vs. Equal-Weight Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I discuss the subtle differences between cap-weighted and equal weight sector ETFs on RRG. I also take some time to show how you can plot pairs/ratios on a Relative Rotation Graph.

This video was originally recorded on March 24th, 2020. Please note the...

READ MORE

MEMBERS ONLY

What About the US Dollar.....? and Other Currencies

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Everybody's looking at the stock market these days, but, in other areas of the market, big shifts seem to be underway as well. One of the areas that I like to keep an eye on is currencies, and Relative Rotation Graphs can help you keep an eye on...

READ MORE

MEMBERS ONLY

Subtle Differences Between Equal Weight and Regular Sector RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The image above shows two Relative Rotation Graphs for US sectors, side by side. The one on the left is the RRG (as I usually use it in my blogs and the Sector Spotlight show) holding 11 US sector ETFs, the SPDR ETFs offered by State Street. The one on...

READ MORE

MEMBERS ONLY

Sector Spotlight: Looking at US Sectors Through the Mayhem

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I try to see through the mayhem and get an angle on US sector rotations on weekly Relative Rotation Graphs. In addition, I go a bit more in-depth answering some questions from the Mailbag.

This video was originally recorded on March 17th, 2020. Please...

READ MORE

MEMBERS ONLY

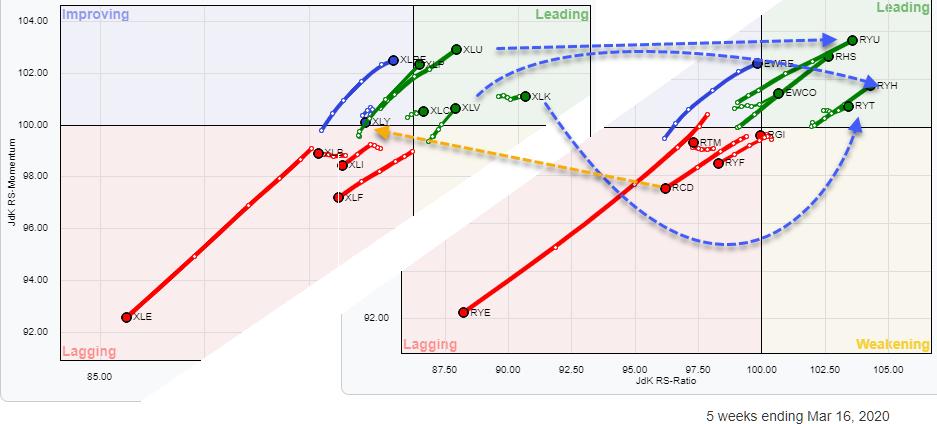

Sector Rotation in Sync On Daily and Weekly RRGs - What Does it Tell Us?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

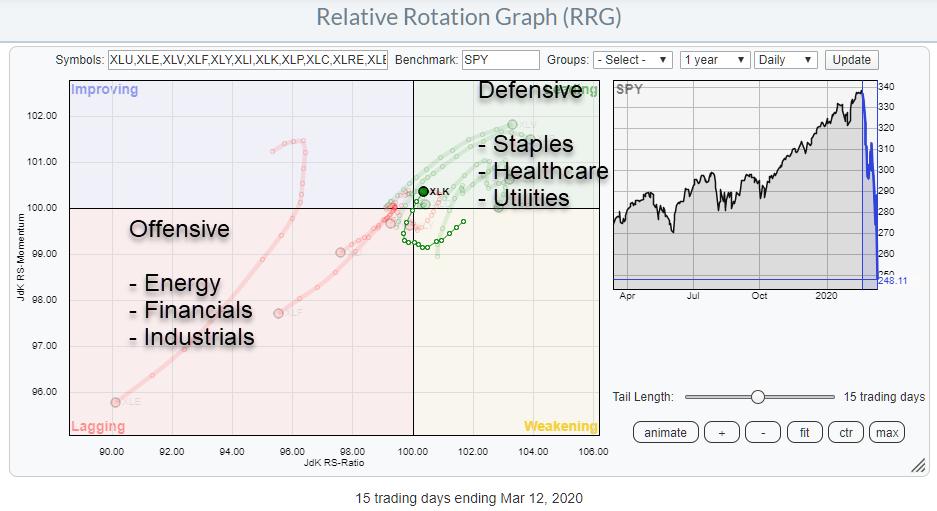

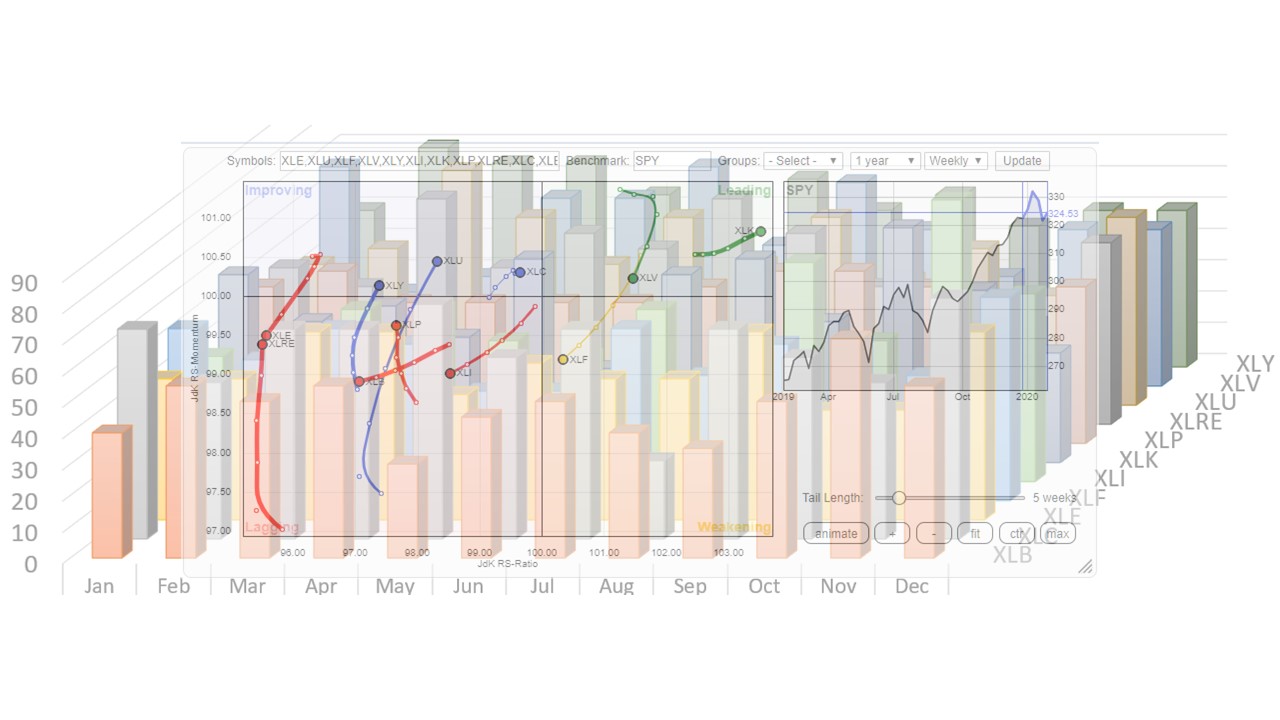

The US sector universe is split pretty much evenly around the benchmark SPY. That is normal. It is also split pretty distinctively in sectors that are inside the leading quadrant and/or traveling at a positive RRG-Heading, which means that they are in a relative uptrend vs. the market. Under...

READ MORE

MEMBERS ONLY

Technology Emerging as a Defensive Sector? Here are a Few Stocks to Watch

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The mayhem in the markets over the past three weeks has clearly caused a rotation out of the more offensive sectors towards defensive ones. The sectors with the clearest rotations are mentioned on the chart above.

One sector that I would have expected inside the lagging quadrant, or at least...

READ MORE

MEMBERS ONLY

How's That for a Split Universe...?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

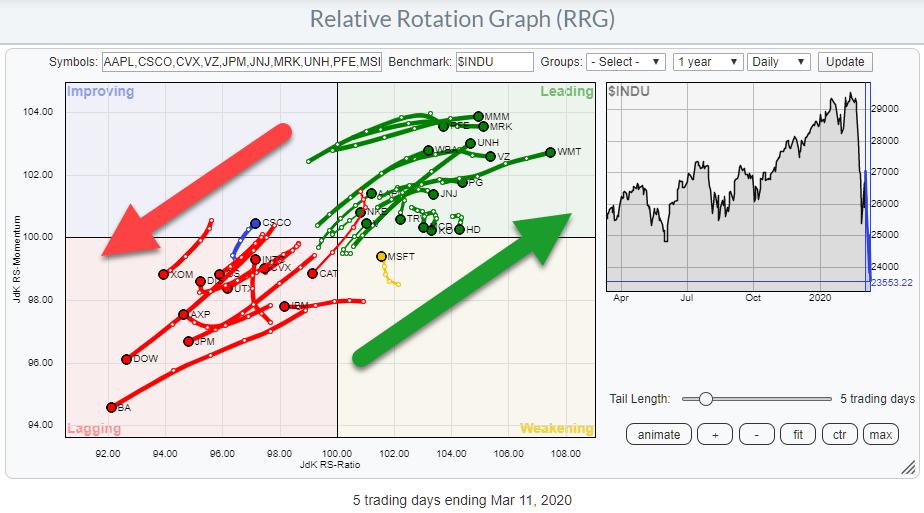

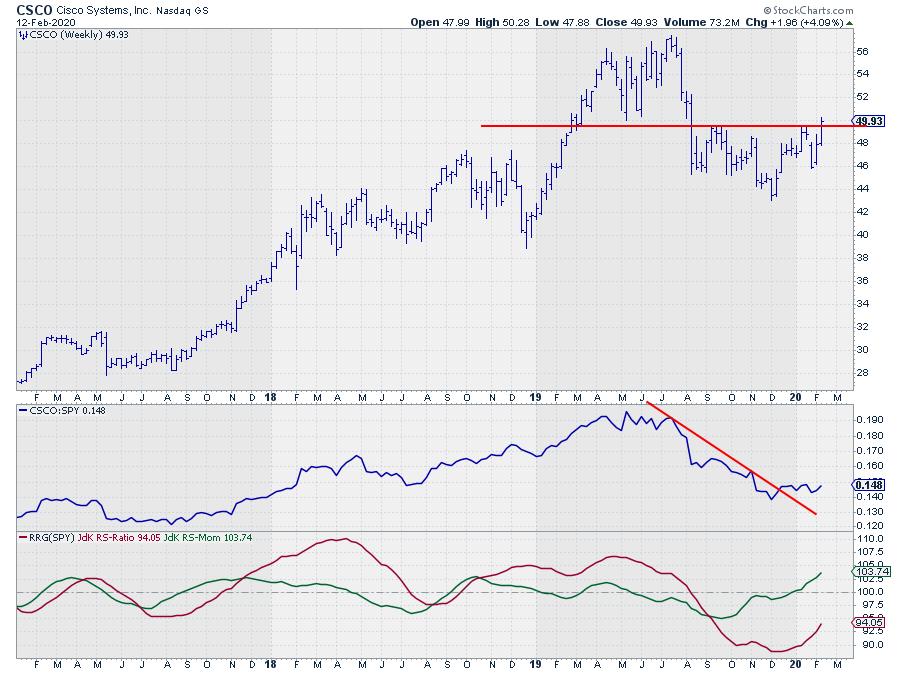

The Relative Rotation Graph for the DJ Industrial constituents shows a clear split between stocks in the leading quadrant vs. stocks inside the lagging quadrant, with only one inside weakening (MSFT) and one inside improving (CSCO).

A few stocks inside the leading quadrant are starting to roll over and a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Markets Are All Over the Place

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

RRG can help you put things into an international perspective. In this edition of StockCharts TV'sSector Spotlight, I look at international stock markets through the RRG lens and comes up with two new pair trade ideas.

This video was originally recorded on March 10th, 2020. Please note the...

READ MORE

MEMBERS ONLY

Use RRG to Help You Put Recent Developments into International Perspective

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What a week ....

With stock markets flying all over the place, I always find it an enlightening exercise to take a step back and put things into a broader perspective. This can be done in multiple ways, including taking a longer-term approach, looking at different segments of the market via...

READ MORE

MEMBERS ONLY

It's a Crucial Time for SPY and These Are Crucial Levels to Watch!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

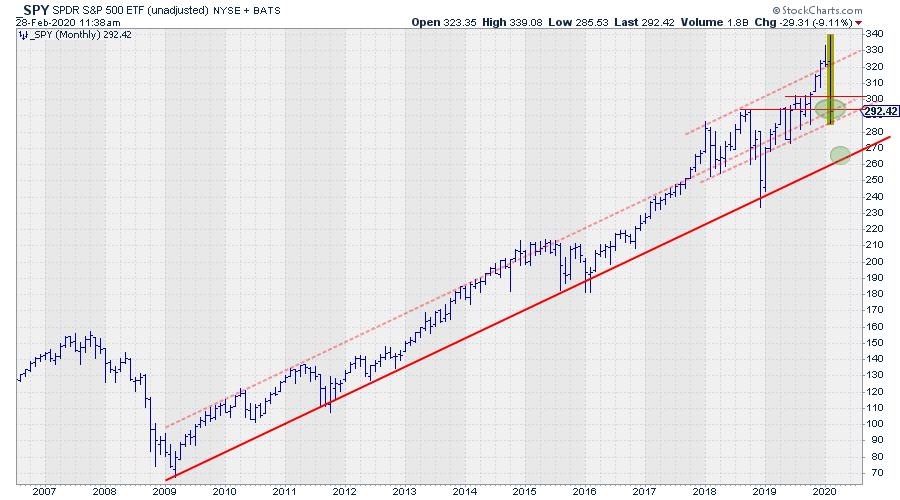

When the market tanks, like it did from 24 February onwards, there is not much you can do anymore. You basically have to sit and wait and see which level(s) support or resistance are respected by the market. And the problem is, you will not know until a few...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Look at Monthly Charts for Asset Classes and Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I look at the monthly charts for asset classes and sectors in combination with their rotations on RRG. In addition, I also answer a question from the mailbag on using leveraged ETFs on Relative Rotation Graphs

This video was originally recorded...

READ MORE

MEMBERS ONLY

This is My Trendline, Which One is Yours?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What a week...

Where do I start???

Let's just say that this was not a boring week for the markets...... at all!

When markets go crazy and swings get out of control, I have learned to step back and look at the bigger picture - and keep it...

READ MORE

MEMBERS ONLY

Use RRG to Get a Grip on Where the Action is - Throw in Symbol Summary to Be Prepared

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Days with wild swings, as we are seeing at the moment, are either heaven or hell, depending on what kind of trader or investor you are. Those looking for action will have a field day.

But how do you easily find tradable securities? And how do you get a handle...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stock/Bond Relationship Rolling Over on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I analyze the impact of current market movements on sector- and asset-class rotations. After the break, I answer a question from the mailbag and introduce a new pair trade idea.

This video was originally recorded on February 25th, 2020. Click anywhere...

READ MORE

MEMBERS ONLY

Roundup of Pair Trade Ideas from Sector Spotlight

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Since November, I've had a recurring segment in each episode of Sector Spotlight on Pair Trading Ideas. Every show, I try to come up with a pair trade idea using Relative Rotation Graphs on various universes and on various timeframes.

These ideas were, and still are, practical examples...

READ MORE

MEMBERS ONLY

Two Changes to the Asset Allocation RRG Universe

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

People who follow the RRG Charts blog and my other articles in the ChartWatchers newsletter, as well as this Don't Ignore This Chart blog, will know that I like a top-down, structured approach to markets. The starting point for this approach is always the Asset Allocation universe, which...

READ MORE

MEMBERS ONLY

Sector Spotlight: (Re-)structuring the Asset Allocation Process

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I cover a few questions that came in via the mailbag and used one of the questions to (re-)structure my asset allocation approach and visualize the investment pyramid.

This video was originally recorded on February 18th, 2020. Click anywhere on...

READ MORE

MEMBERS ONLY

Picking Industries from Sectors with RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Two weeks ago, I wrote a ChartWatchers article titled "RRG Suggests Aggressive Trade Setup for XLY vs. XLV." In this article, I want to show you how you can take that idea one step further and, at the same time, answer a question on how you can easily...

READ MORE

MEMBERS ONLY

Opposite Rotations Suggest an Outperformance for CSCO over WMT in Coming Weeks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

CSCO peaked in the first half of 2019. The first time at $ 56.30 in April and then again in July at $ 57.40. A typical failure to convincingly break above a previous high. From July onward CSCO moved lower to a low around $ 43 at the start of December....

READ MORE

MEMBERS ONLY

Sector Spotlight: Adding an Extra Benchmark to Your RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I discuss the current rotations for US sectors, then explain how to add a second(ary) benchmark to the RRG chart as a way of getting a more detailed analysis.

This video was originally recorded on February 11th, 2020. Click anywhere...

READ MORE

MEMBERS ONLY

RRG + Seasonality is a Very Powerful Combination!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's a Puzzle

Regular readers of the RRG blog and my contributions to DITC and the ChartWatchers newsletter, as well as watchers of Sector Spotlight, will probably be aware of my recent research exercises to combine RRG with seasonality.

The reason for doing that lies in my belief...

READ MORE

MEMBERS ONLY

A Sharp "Hook" on the RRG and a Completed Wedge Suggest This Stock is Ready to Rally

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While browsing through some RRGs, my eye fell on a rare rotation in the Financial sector.

AIG, on the daily RRG, was coming from leading through weakening and just hit the lagging quadrant a few days ago. Then, just yesterday, the stock "hooked" back aggressively, taking it from...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Difference Between Price Ratios and RRG-Lines

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I cover Asset Classes and Sectors using monthly charts, as usual given the start of the new month. After the break, I answer a question on the difference between a simple price ratio and the RRG-Lines.

This video was originally recorded...

READ MORE

MEMBERS ONLY

Is This Bullish or Bearish?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Earlier today, I was preparing for my weekly Sector Spotlight show on StockCharts TV (airing every Tuesday at 10:30am ET), and, as today is the first Tuesday of the month, that meant looking at monthly charts for Asset Classes and US sectors. This routine gives me a good (forced)...

READ MORE