MEMBERS ONLY

Will China Be Able To Complete Its Current Rotation Inside Positive Territory And Start A New Period Of Outperformance??

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

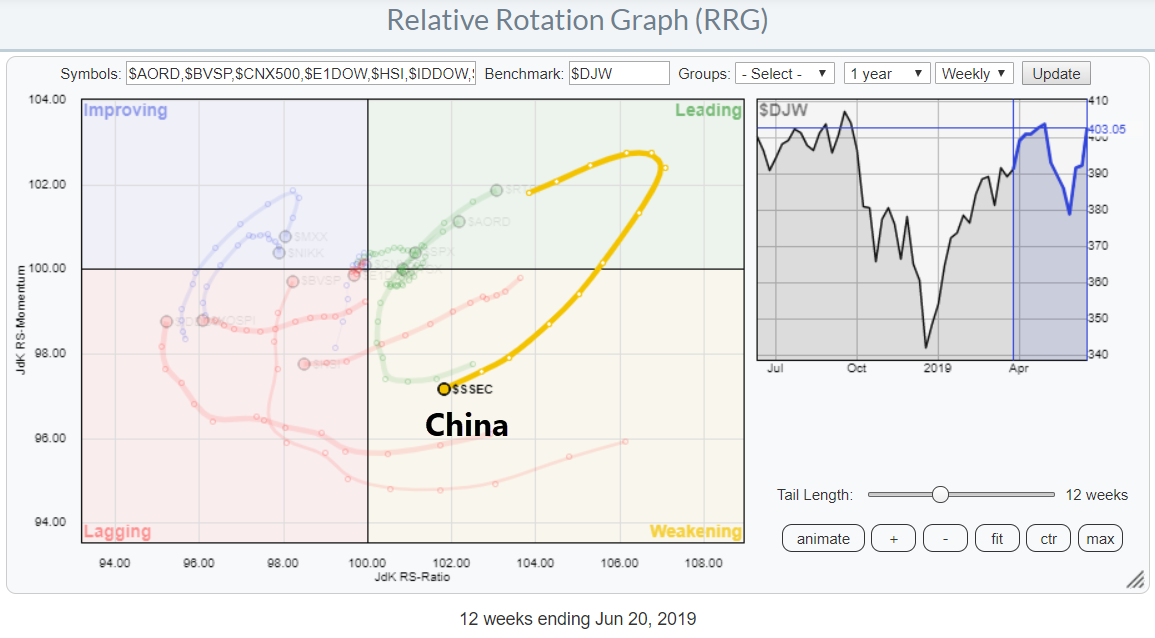

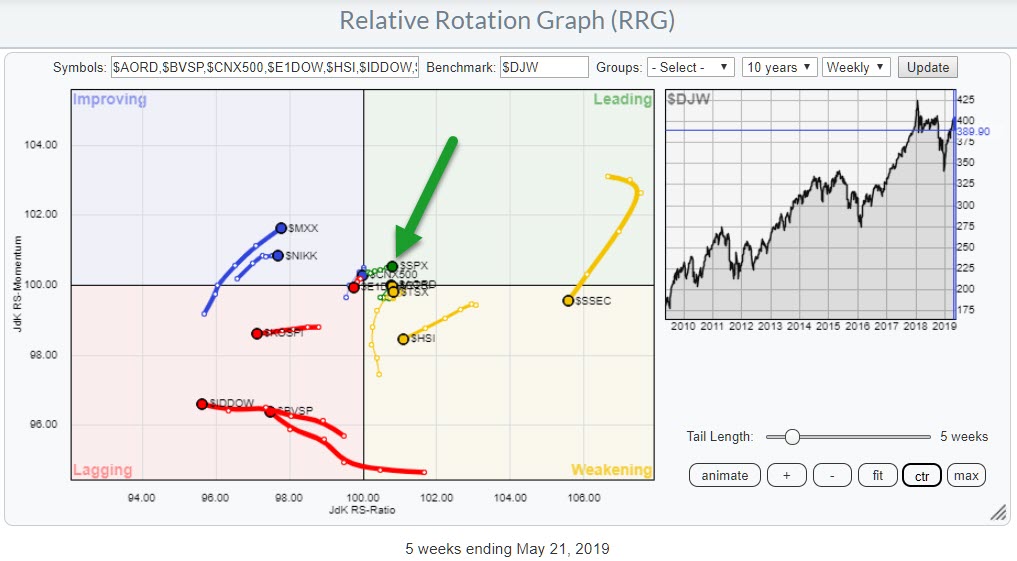

On the above Relative Rotation Graph, which shows the rotation for international stock indexes against the Dow Jones World index, we really ought to pay attention to the long tail inside the weakening quadrant for the Chinese market.

This rotation follows a strong performance of the Chinese market during the...

READ MORE

MEMBERS ONLY

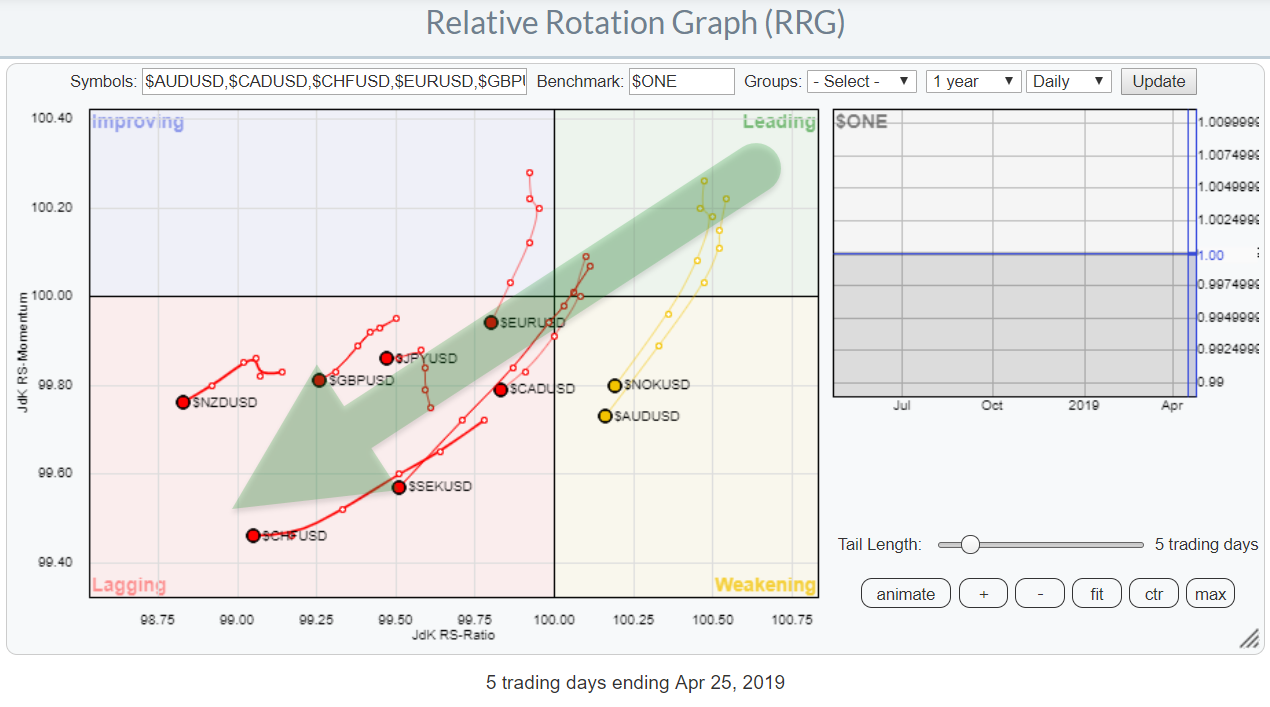

The Dollar Beats All Currencies In The G10 Except For The Japanese Yen

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be used to visualize the relative movement of much more than just stocks and sectors.

In the example below, the RRGshows the relative rotation for the G10 currency universe usingUSD as the base currency.In this case, you will see nine currencies, all expressed in USD...

READ MORE

MEMBERS ONLY

(Technical) Market Analysis And Portfolio Construction Are Two Completely Different Animals In The Same Zoo.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

First of all, let me say that I really appreciate any feedback and comments I get on any of my articles, either via DISQUS below each blog post, via email or in SCAN. I do read all of them and I try to answer most of them, I think my...

READ MORE

MEMBERS ONLY

Real Estate Is Getting Back In Shape!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

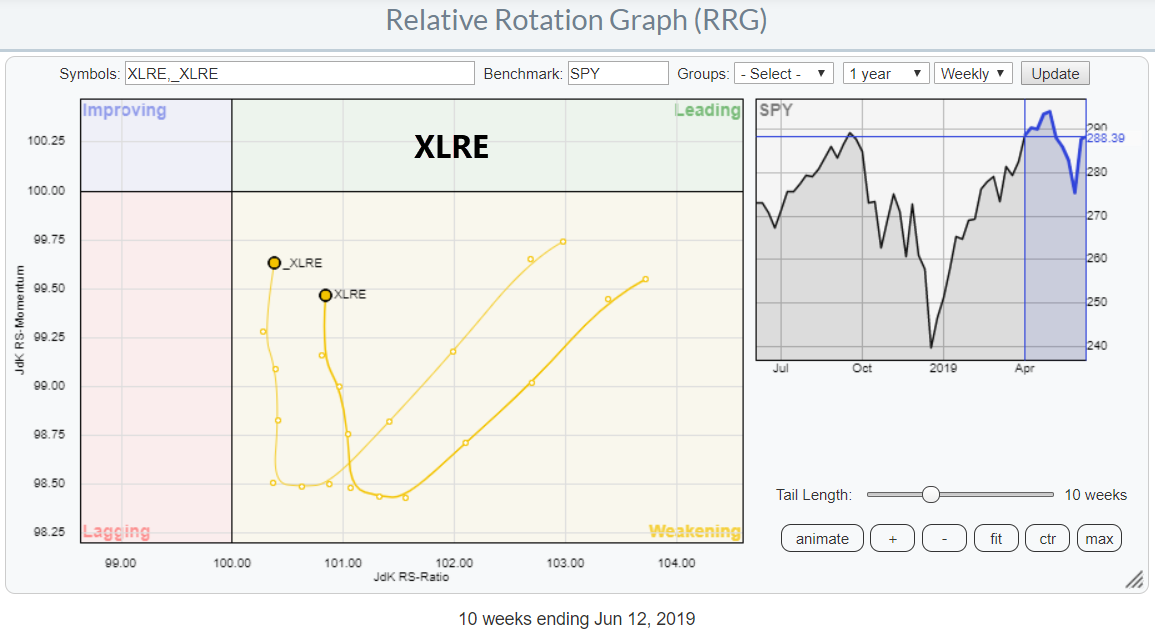

The Relative Rotation Graph for US sectors shows the sector Real Estate (XLRE) inside the weakening quadrant, but that sector moving upward (almost vertically) on the JdK RS-Momentum scale. This type of rotation usually indicates that a second (or third, etc.) leg of a relative uptrend is about to get...

READ MORE

MEMBERS ONLY

Can I Have A Coke (KO) With My Big Mac (MCD) Please?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

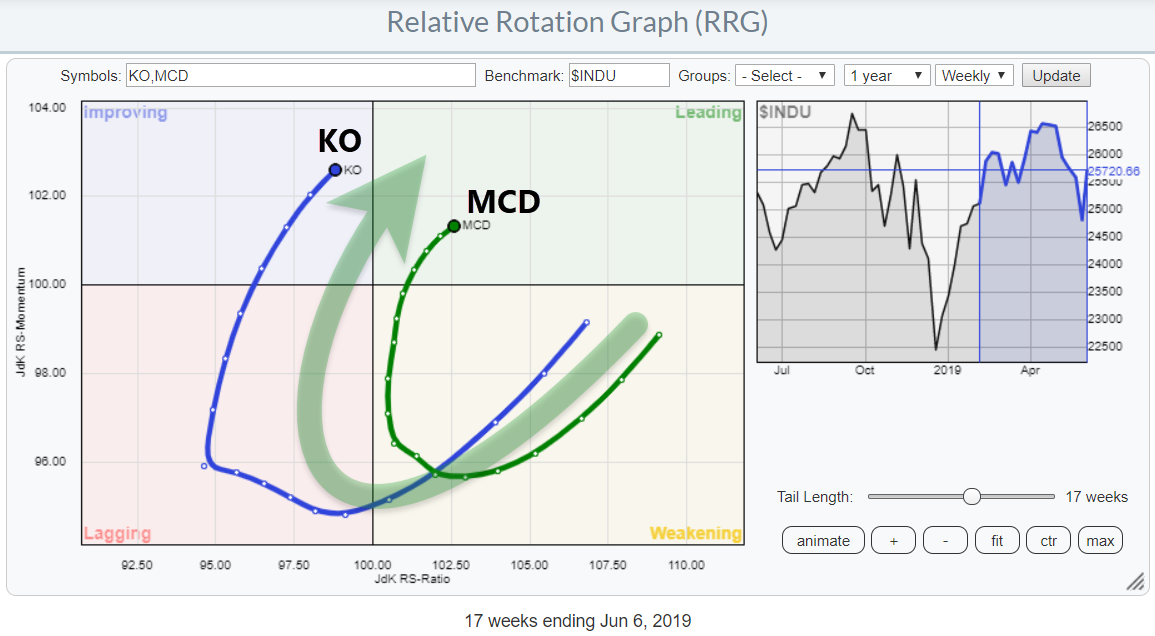

While browsing through the stocks in the DJ Industrials index, my attention was grabbed by the tails on KO and MCD, both in a positive way.

KO is making a wide rotation through lagging into improving and is now very close to crossing over into the leading quadrant. MCD, meanwhile,...

READ MORE

MEMBERS ONLY

Value Is Taking Over From Growth And Shows Positive Rotation On RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

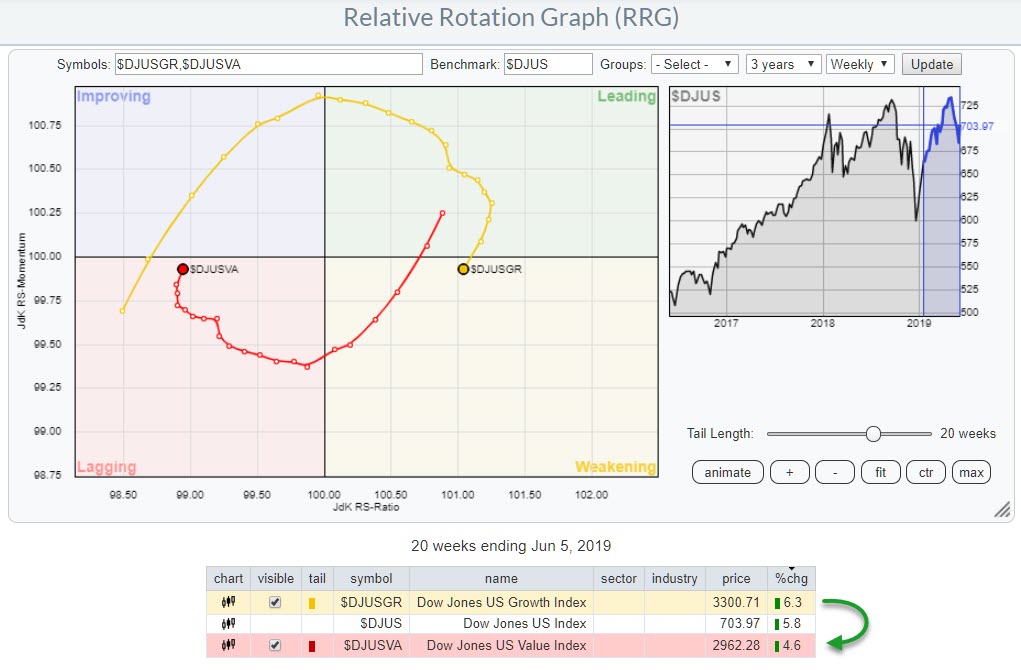

One of the Relative Rotation Graphs that I like to follow, as a way of keeping a handle on the bigger picture, is the one that shows the rotation of growth- versus value stocks.

This RRG is predefined in the dropdown box under the header "US MARKETS" and...

READ MORE

MEMBERS ONLY

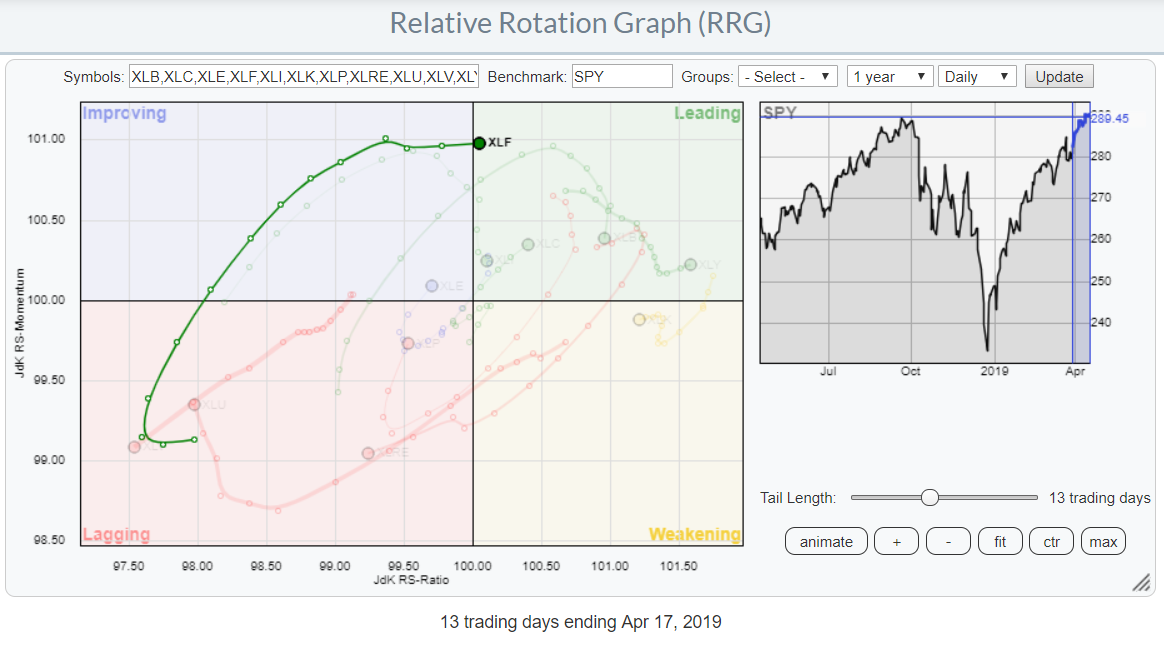

Staples and Financials Head Towards the Leading Quadrant While Energy Rolls Back into Lagging

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

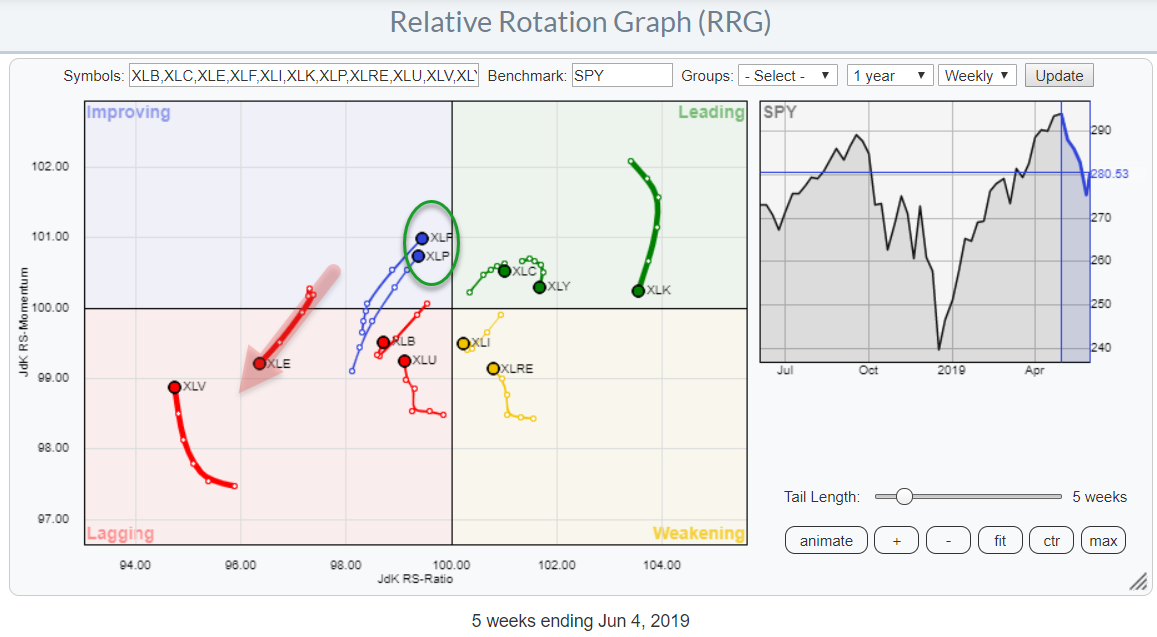

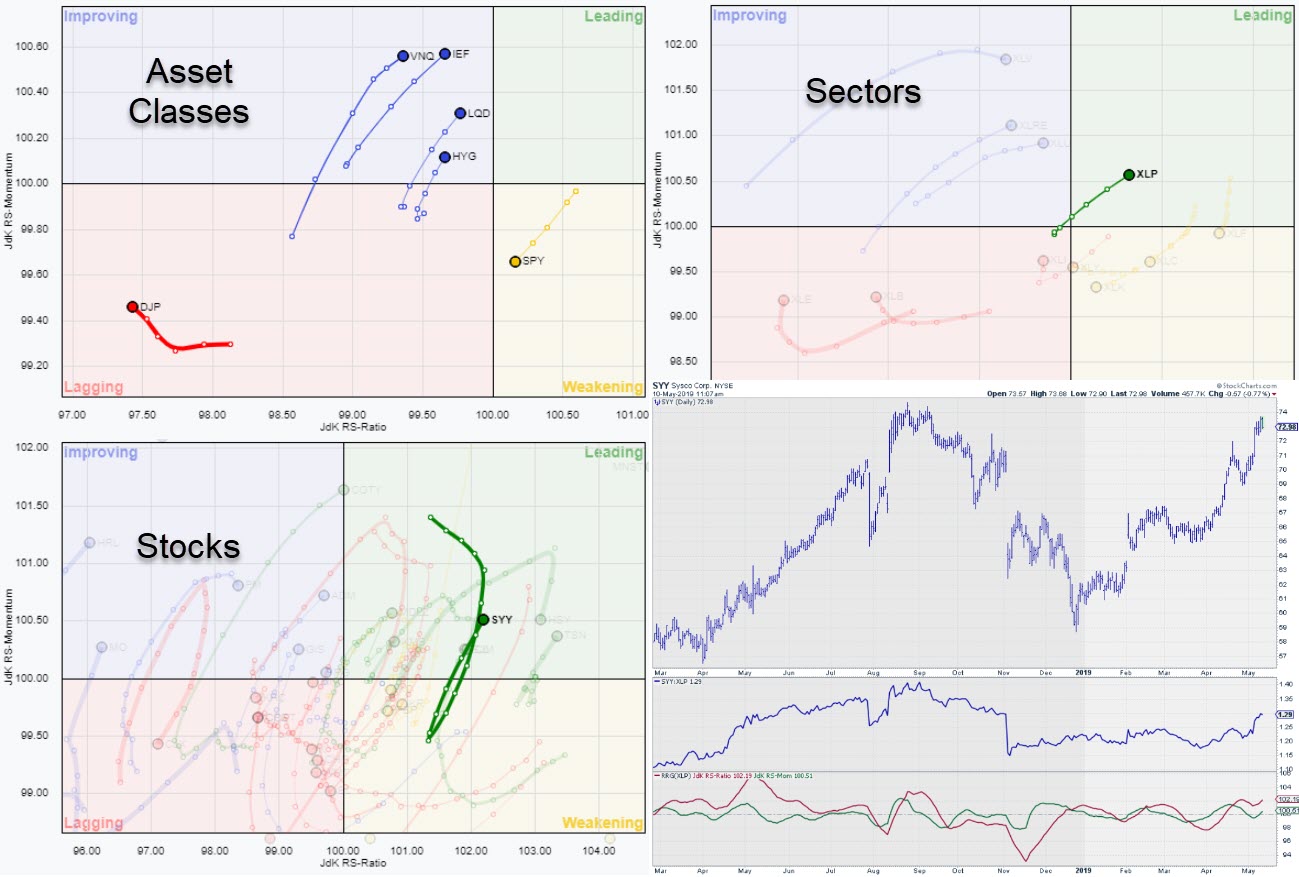

The chart above shows the relative rotation for US sectors against the benchmark S&P 500. Over the last five weeks, the tails for Consumer Staples (XLP) and Financials (XLF) started to move in a similar fashion. Both are heading towards the leading quadrant.

The Energy sector, on the...

READ MORE

MEMBERS ONLY

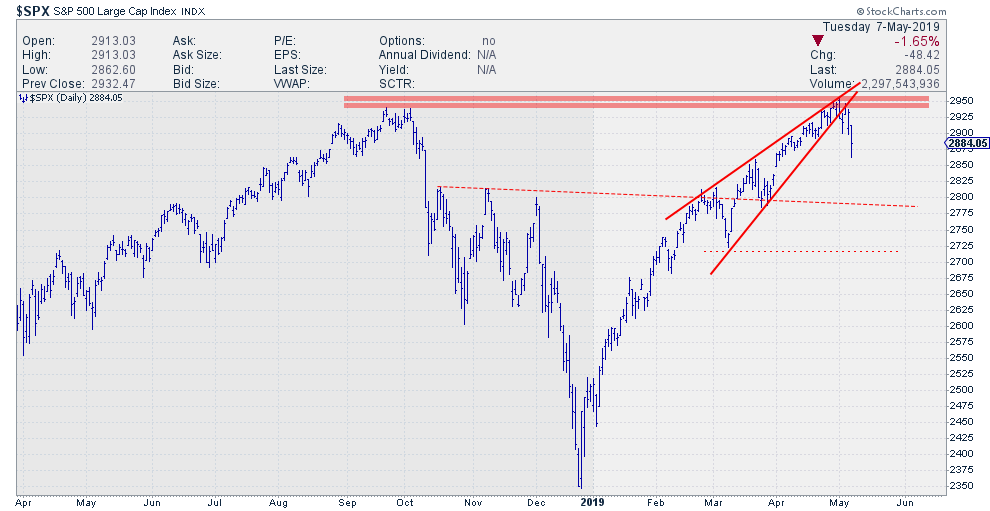

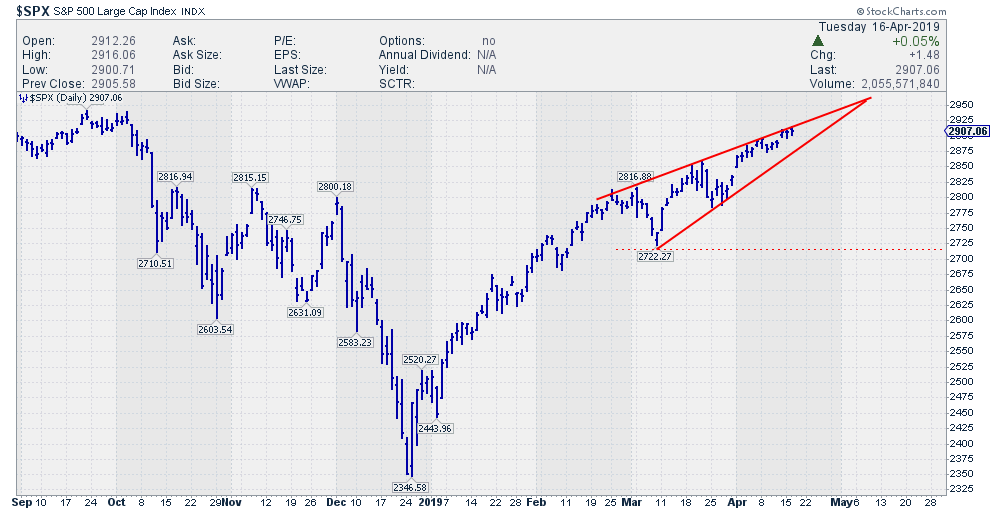

Did We Just Complete a H&S Top In $SPX?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It seems I did not have to look very far to find today's DITC entry...

The S&P 500 ($SPX) provides enough ammunition to get excited - or maybe worried is a better word - and not ignore the price action that is unfolding at the moment....

READ MORE

MEMBERS ONLY

Spotting Strength And Weakness Inside The Financial Sector (XLF)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

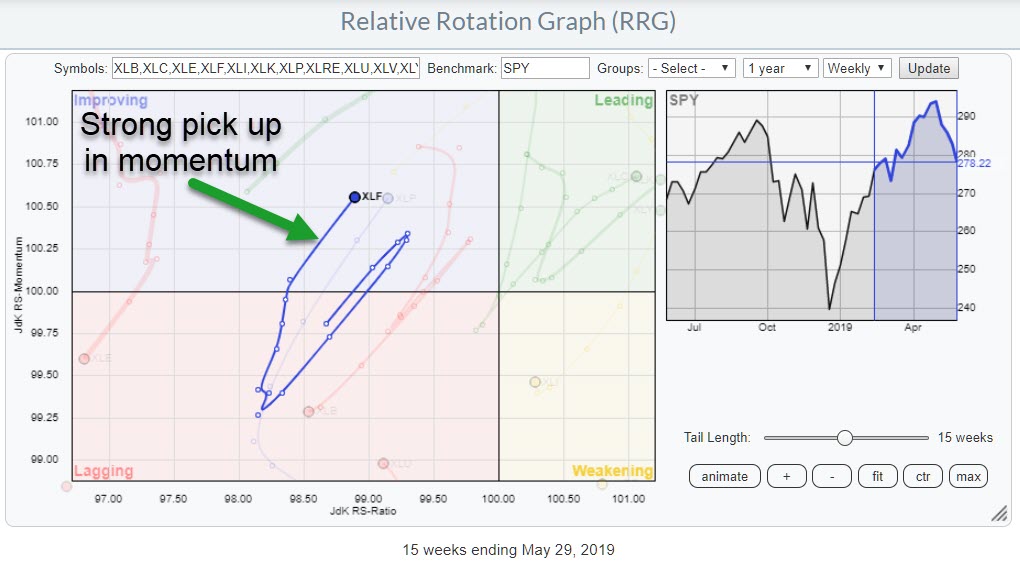

Looking at the Relative Rotation Graph showing the sectors of the S&P 500, we can see that the tail on the Financials sector stands out, having seen a big increase since last Friday.

Over the last 12-13 weeks, Financials rotated from the lagging into weakening quadrant, then moved...

READ MORE

MEMBERS ONLY

Communication Services Shows a Strong Rotation, But GOOG Is Not Participating

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

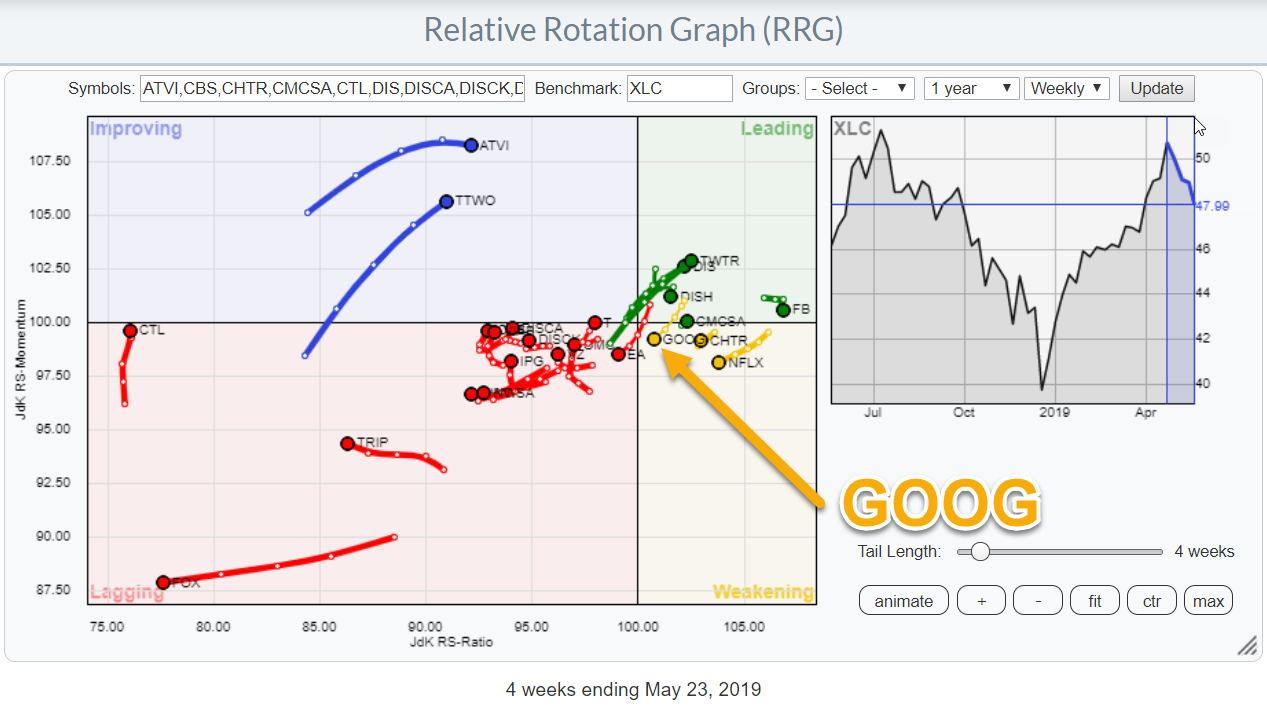

Relative Rotation Graphs can help to identify threats and opportunities within groups of securities. In this article, I will be looking at the position and rotation of the Communication Services Sector against the S&P 500 and other sectors, followed by a closer look at the rotation of various...

READ MORE

MEMBERS ONLY

Is China About To Pick Up The Pace Again?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

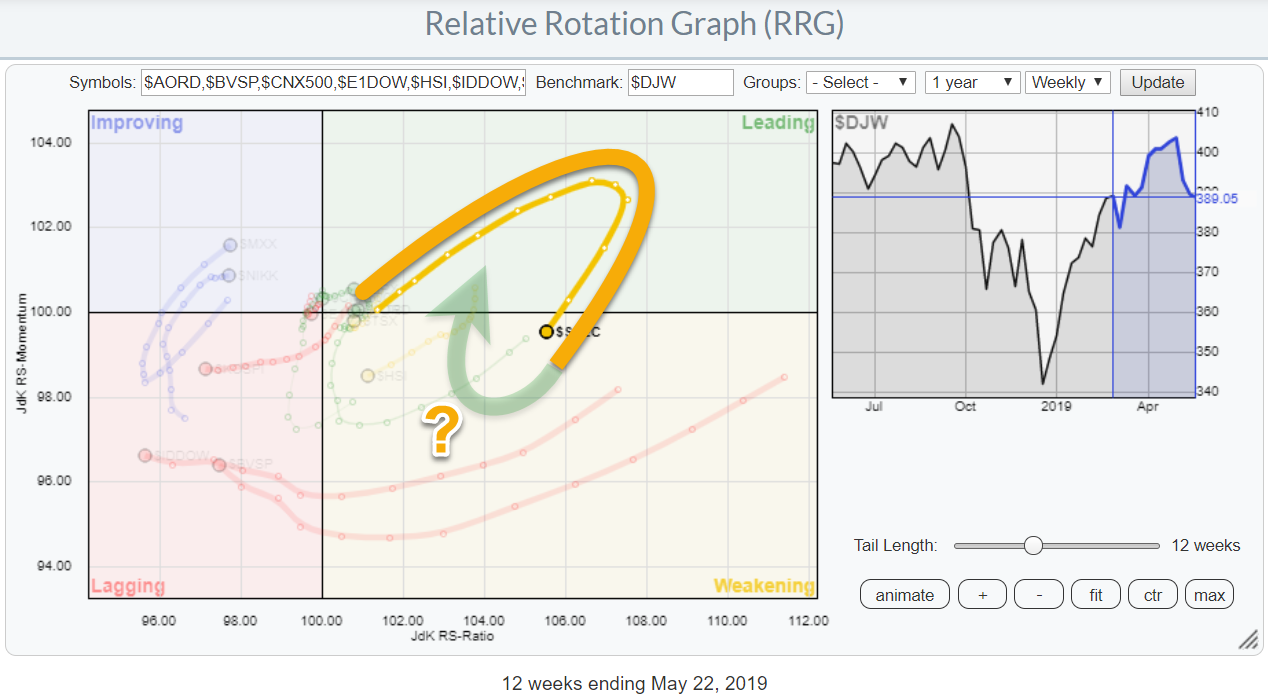

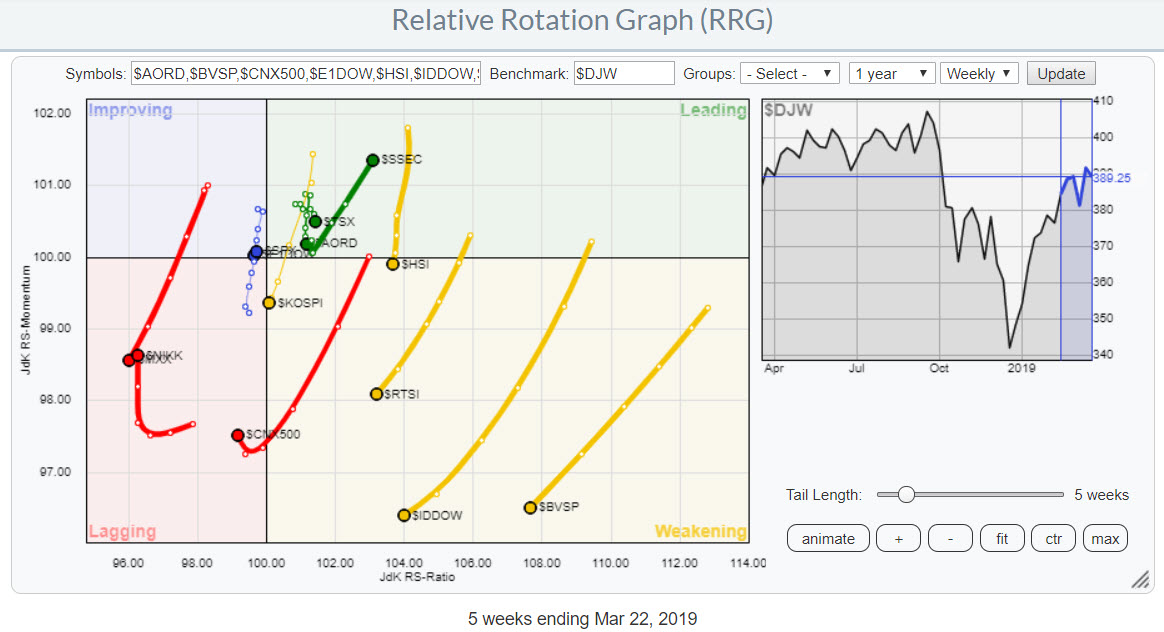

Yesterday, I wrote about the relationship of US stocks against other international stock markets in my regular RRG Charts article.

The Relative Rotation Graph that I use for these analyses is one of the pre-defined groups and is shown above.

While working on that article, I noted the long tail...

READ MORE

MEMBERS ONLY

What Does It Mean When The US Starts Outperforming Other International Stock Markets?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stock markets around the world are giving mixed signals. Returns over the last 5 weeks have varied from +4% in Australia to -10% in China. The Relative Rotation Graph above shows the relative trends that are currently in play among the various international stock market indexes.

For a pure, and...

READ MORE

MEMBERS ONLY

Will this break in IEF be able to hold up?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

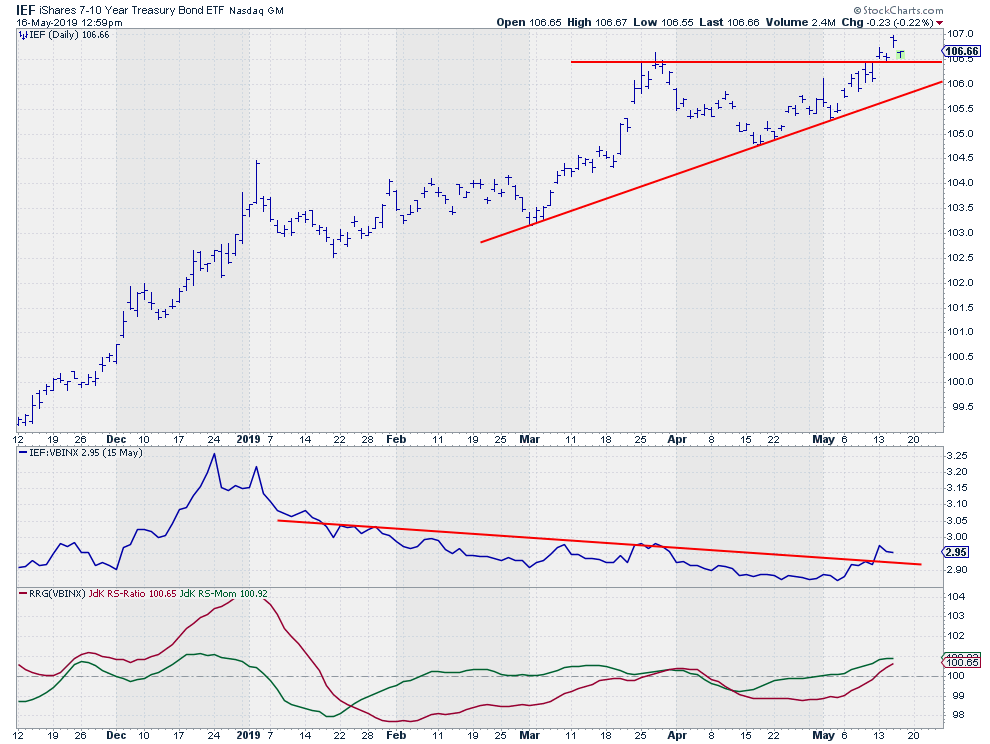

Browsing some Relative Rotation Graphs, the relationship between Stocks and Bonds once again drew my attention.

When I shifted to their respective charts, I decided that the current price action of IEF, as shown in the graph above, deserves our (or, at least, my) attention.

This ETF, which tracks the...

READ MORE

MEMBERS ONLY

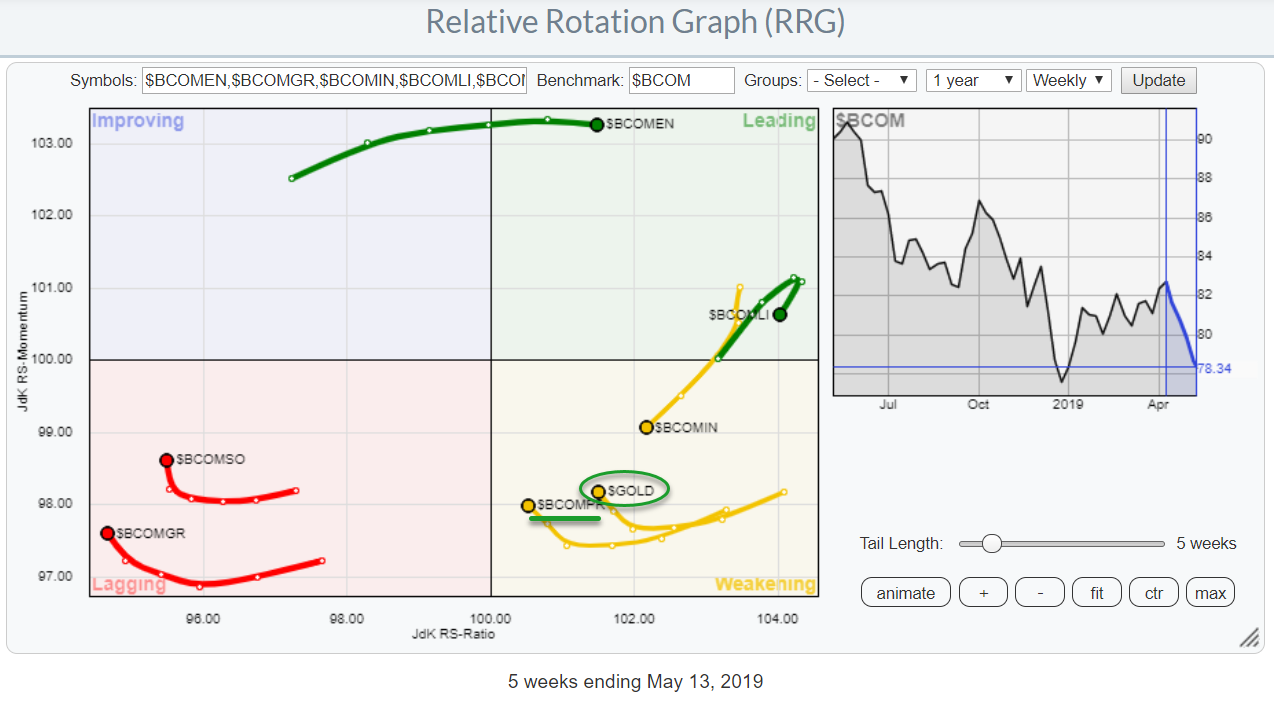

Gold Pops As The Stock Market Drops

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After a struggle with resistance around its previous high of 2940, the S&P 500 index failed to break and started to come down off of its highs.

A lot of political and fundamental issues and news are influencing the behavior of market participants at the moment; this uncertainty...

READ MORE

MEMBERS ONLY

Building A Case For SYY In The Staples Sector Using Three Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be a great asset in getting a high-level overview of what is going on in the markets and keeping an eye on the big picture. Beyond that, though, they can also help you to drill down to find new individual investment possibilities and trading ideas.

For...

READ MORE

MEMBERS ONLY

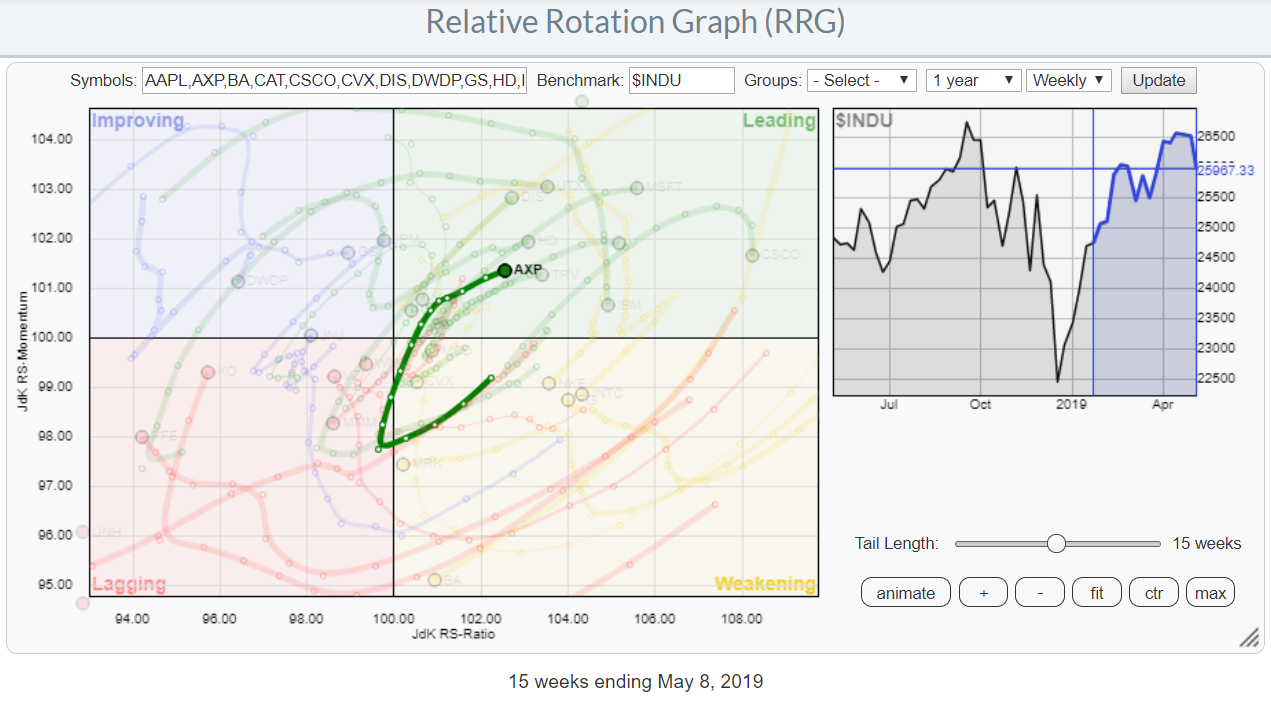

Strong Rotation For AXP on RRG vs DJ Industrials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Watching the Relative Rotation Graph for the DJ-Industrials universe, you can see a few stocks, like AAPL, BA and WBA, that stand out immediately. Despite the current setback in the market, there are still some stocks that are worth approaching from a buyer's perspective.

Inside The Leading Quadrant...

READ MORE

MEMBERS ONLY

S&P Executes Wedge And Rotation To Defensive Sectors Accelerates

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Since printing its high on 1 May, the S&P 500 has struggled to keep up and make its final push through resistance. Over the last three to four days, the bulls have capitulated, putting a reinforcement of the 2940-2950 resistance zone into place. The rising wedge formation that...

READ MORE

MEMBERS ONLY

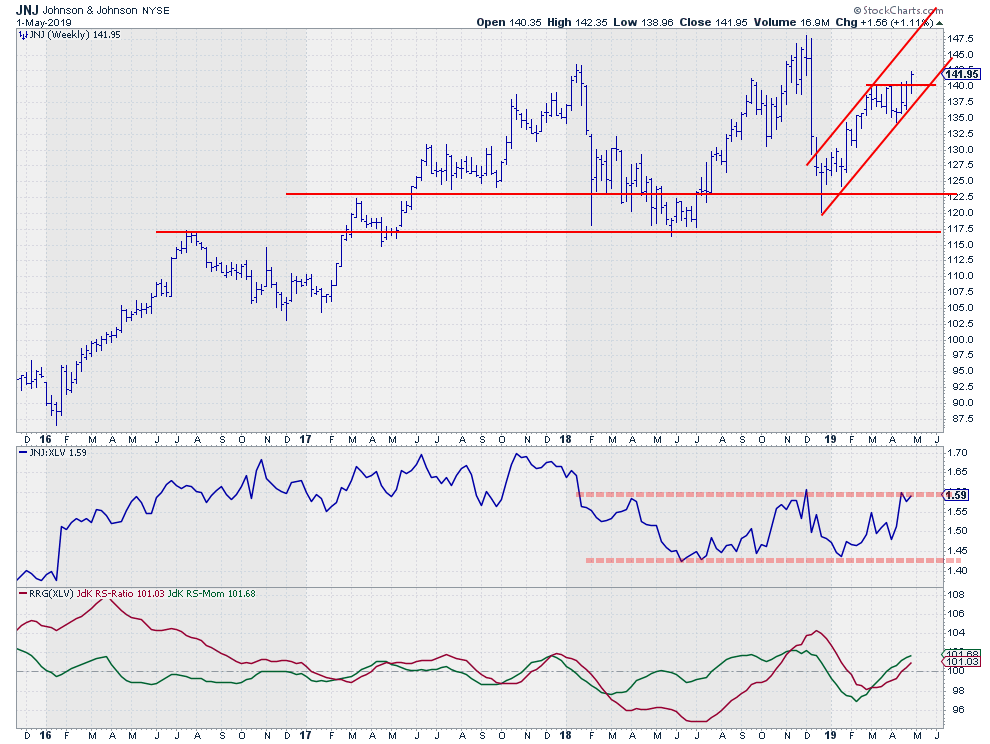

Will JNJ Be Able To Pull The Sector Back On Its Feet?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Healthcare sector is not in its best shape. On the Relative Rotation Graph for US sectors, XLV is deep down inside the lagging quadrant against SPY, without any signs of improvement at the moment. However, if you feel that this situation will not last forever and are gutsy enough...

READ MORE

MEMBERS ONLY

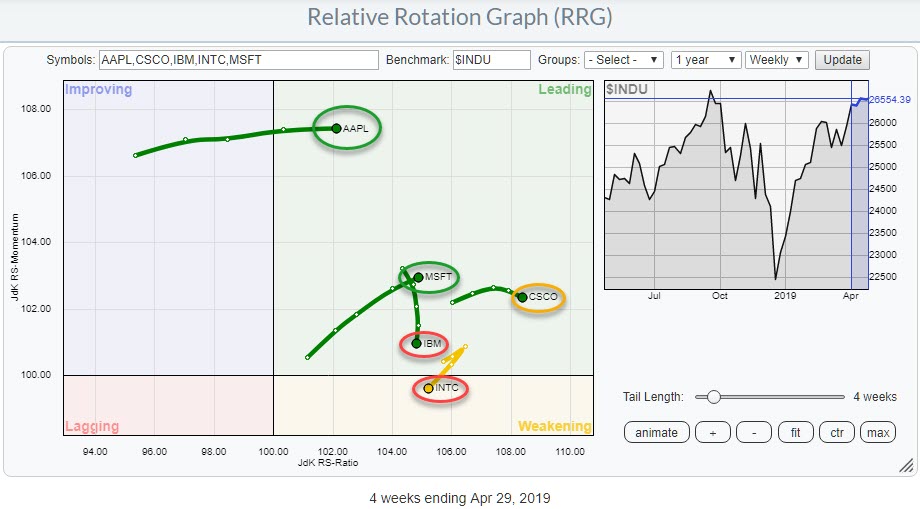

Mixed Rotations For Technology Stocks Inside The Dow - MSFT Comes Out On Top!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the five technology stocks inside the DJ Industrials index, all of which are at the right-hand side of the RRG. This is not surprising, considering the strong rotation of the sector as a whole against the S&P 500 index.

Despite the strength of...

READ MORE

MEMBERS ONLY

All Eyes On The Mighty Greenback! This Is How It Looks On A Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A lot of eyeballs are watching the USD these days. Not surprisingly, as a lot (or most) people pay attention to the chart of the USD index ($USD), which compares the USD to a basket of other currencies. That chart now seems to be breaking out - to the UPside,...

READ MORE

MEMBERS ONLY

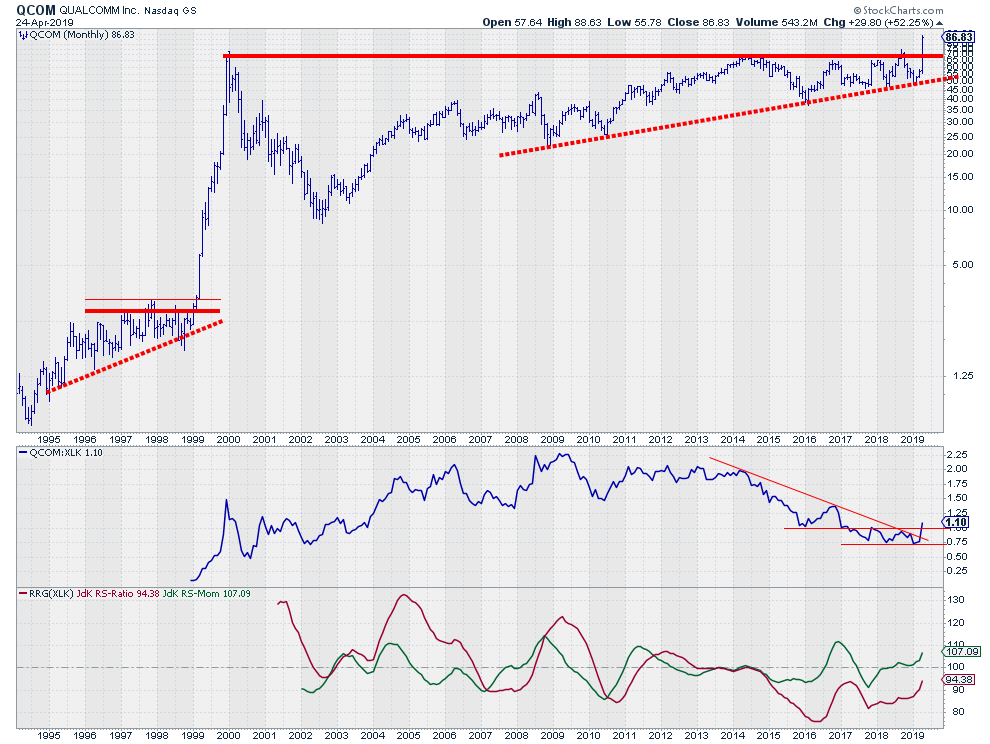

Party Like It's 1999 for QCOM

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Technology is doing very well on the Relative Rotation Graph for US sectors, with a rotation that is well inside the leading quadrant and pushing further into it. If we shift gears and look specifically at the RRG for the technology sector (against XLK), we can see there is one...

READ MORE

MEMBERS ONLY

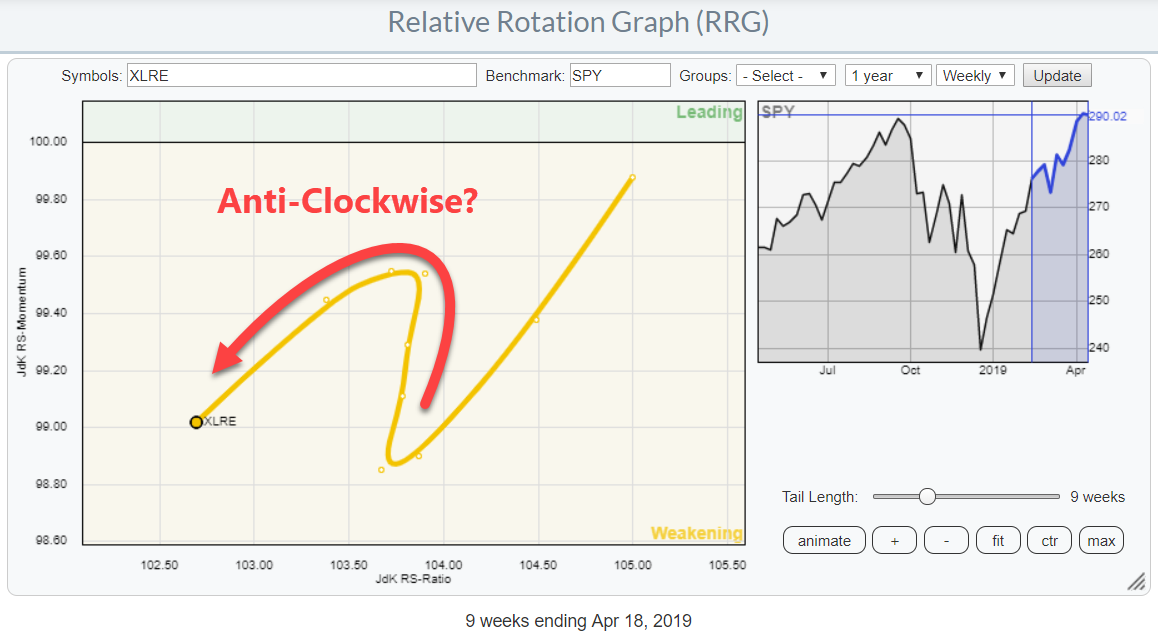

"Hooks" And One Sided Rotations On Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Thursday, 18 April, was the third Thursday of the month, my regularly scheduled guest appearance on MarketWatchers LIVE. As Tom Bowley was enjoying a well-deserved day off, it was just me and Erin on duty.

It wasn't my first time co-hosting, but every time I fill in...

READ MORE

MEMBERS ONLY

Financials Made It Into The Leading Quadrant, Now What?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At yesterday's close, the Financials sector (XLF) crossed over into the leading quadrant on the daily Relative Rotation Graph.

The tail of the sector started to curl upward inside the lagging quadrant roughly two weeks ago, before then proceeding to travel higher on both the Jdk RS-Ratio and...

READ MORE

MEMBERS ONLY

Are We Looking At A Wedge In The Making?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When acting in an environment of uncertainty (of which financial markets are a prime example) it is a good habit to double-check any findings. Think of it as an extra pair of eyes to confirm or deny what you (think you) are seeing.

In this process, please keep an open...

READ MORE

MEMBERS ONLY

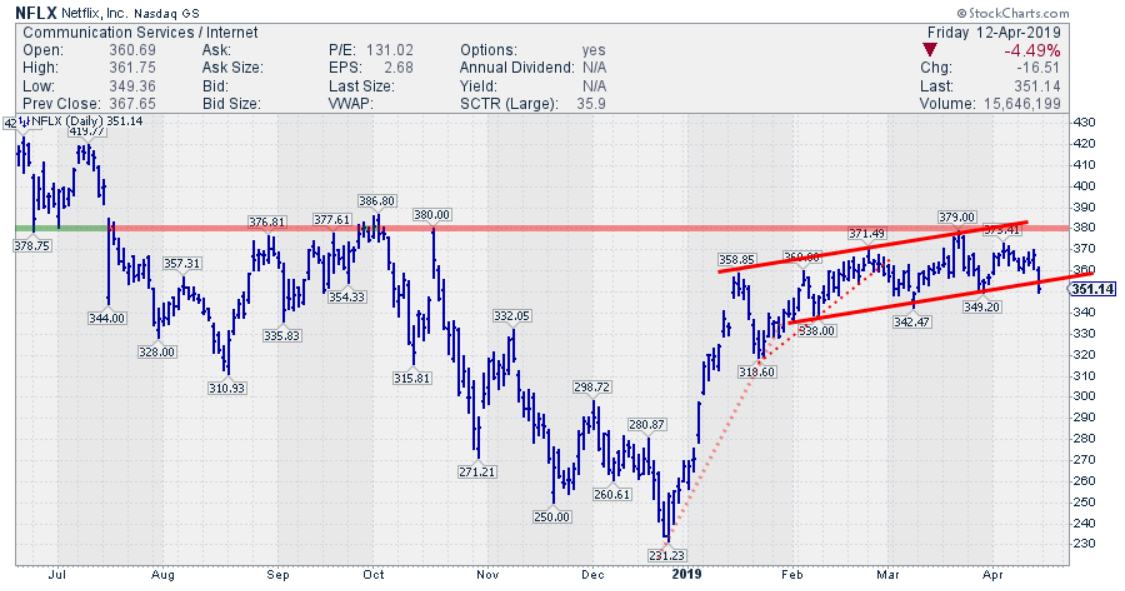

Three Breaks And You're Out For NFLX?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Since the beginning of the month, NFLX is lagging the S&P 500 index by more than 5%.

This is following the relative weakness that entered this stock after a strong start of 2019, where NFLX initially ran from $230 to $370 but started to move sideways, facing heavy...

READ MORE

MEMBERS ONLY

When Tails Remain On One Side Of A Relative Rotation Graph, What Does That Mean?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are a great tool to use to visualize sector rotation, along with other asset rotations in various universes.

If you have used RRGs regularly and have monitored multiple rotational patterns, you may have noticed that the rotations do not always travel through all four quadrants in sequential...

READ MORE

MEMBERS ONLY

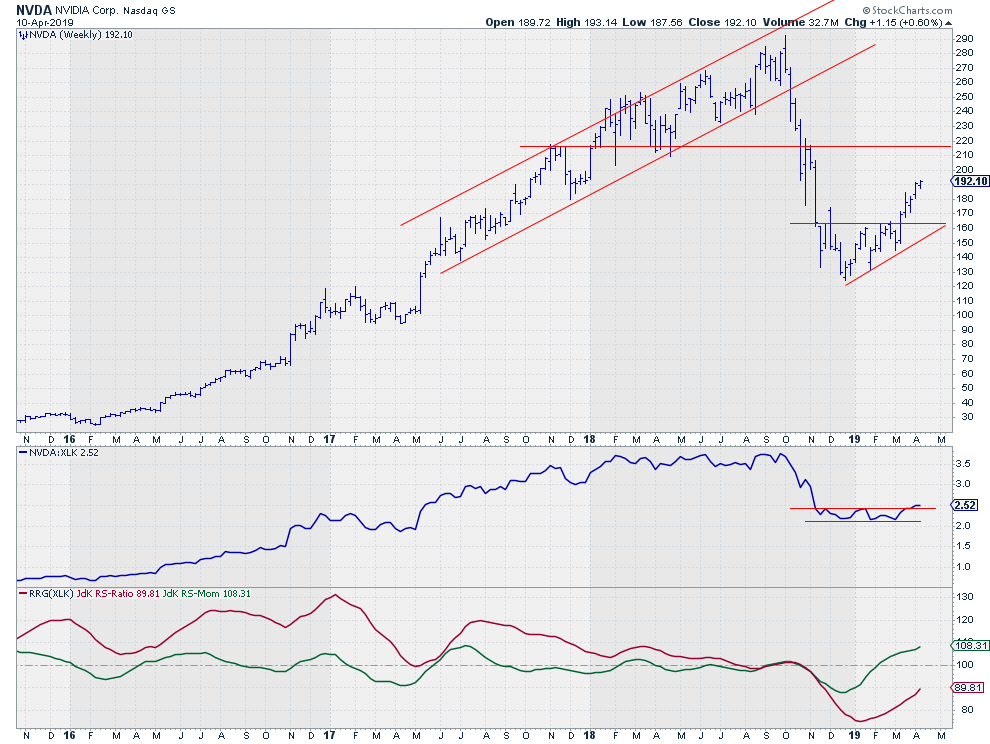

Is NVDA The Strongest Stock In The Strongest Sector?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Looking over some Relative Rotation Graphs this morning showed me that the Information Technology sector is currently the strongest sector in the S&P 500 universe.

XLK is positioned well inside the leading quadrant and is being powered further into that space by a long tail. It is difficult...

READ MORE

MEMBERS ONLY

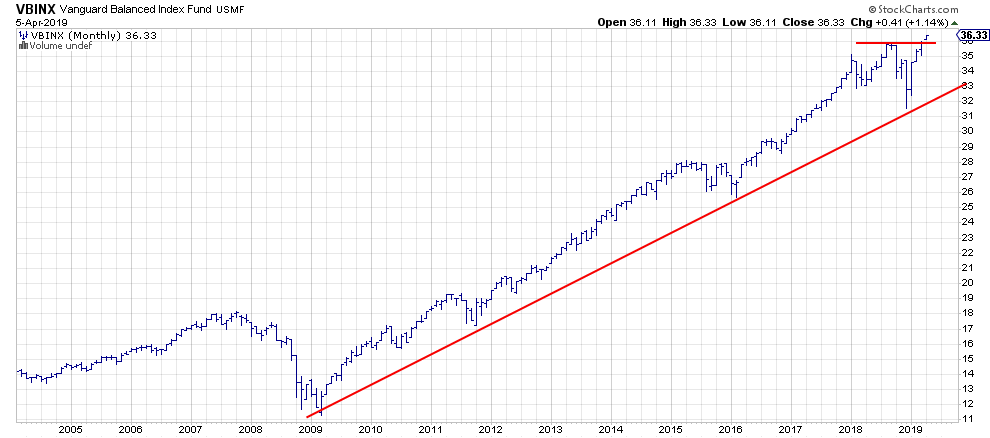

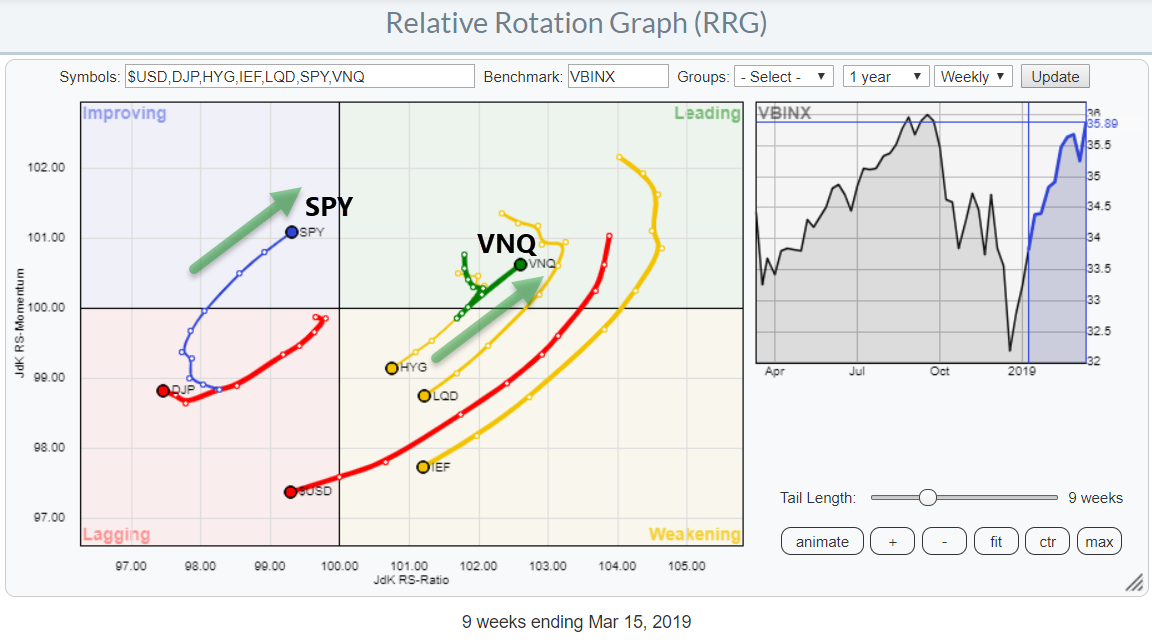

The 60/40 Balanced Portfolio Just Broke To New Highs - What About Stocks vs Bonds?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For asset allocation analysis, I generally use VBINX, a balanced index fund by Vanguard that holds 60% in stocks and 40% in a mix of different bonds.

This balanced portfolio (total return basis) just broke to new highs this week. Meanwhile, neither stocks (SPY) or bonds (IEF) have accomplished that,...

READ MORE

MEMBERS ONLY

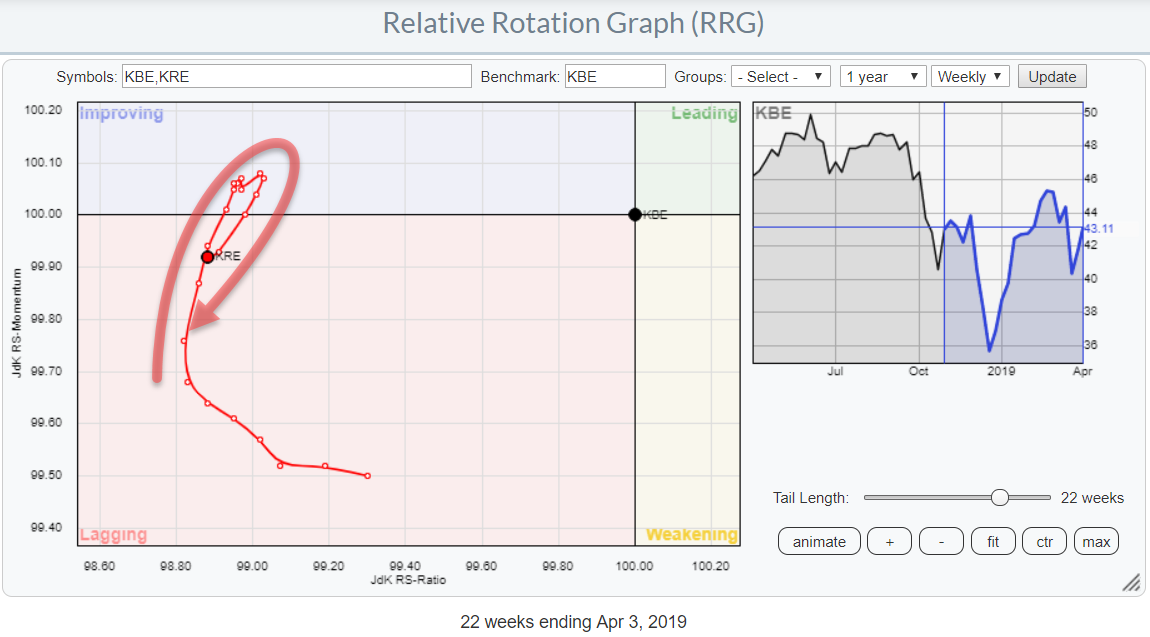

Financials Are Not Looking Very Strong But In That Sector Regional Banks Should Really Be Watched

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, the Financials sector (XLF) is not in the best shape at the moment. It is positioned inside the lagging quadrant and heading lower on both axes. So, not much good there.

At the moment I am in New York City to attend...

READ MORE

MEMBERS ONLY

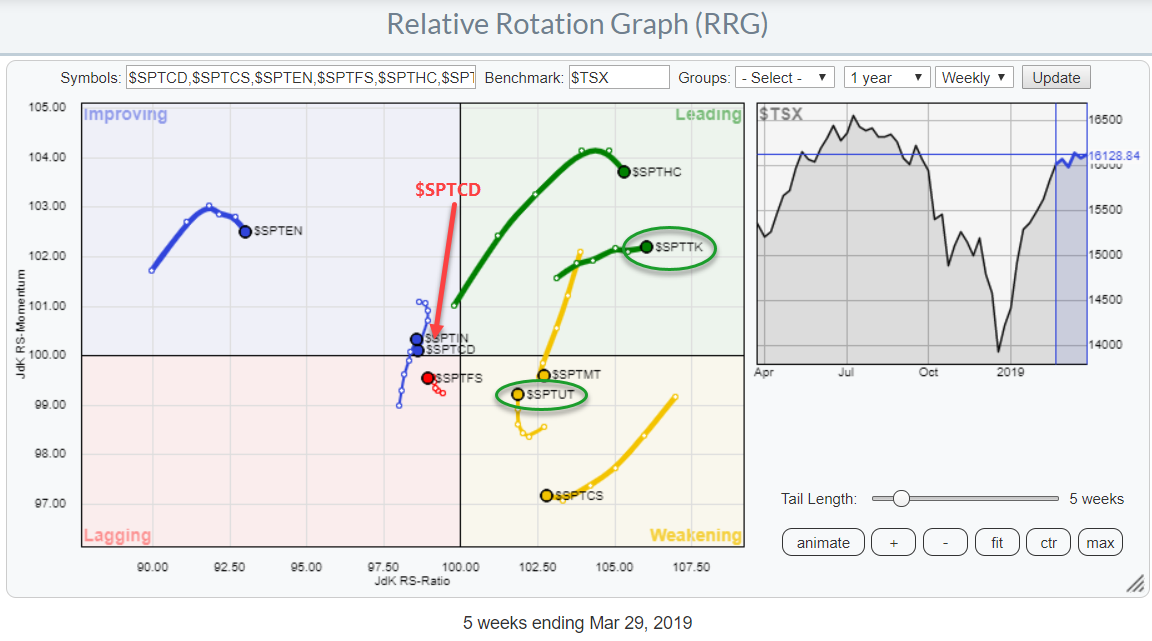

When In Canada.. Do As The Canadians, And Avoid The Consumer Discretionary Sector..

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last night I arrived in Toronto for a weekend with my son and his family, before heading towards New York to attend the CMTA symposium next week.

So for this article, it only seems appropriate to have a look at the Canadian sector landscape from an RRG perspective.

The Relative...

READ MORE

MEMBERS ONLY

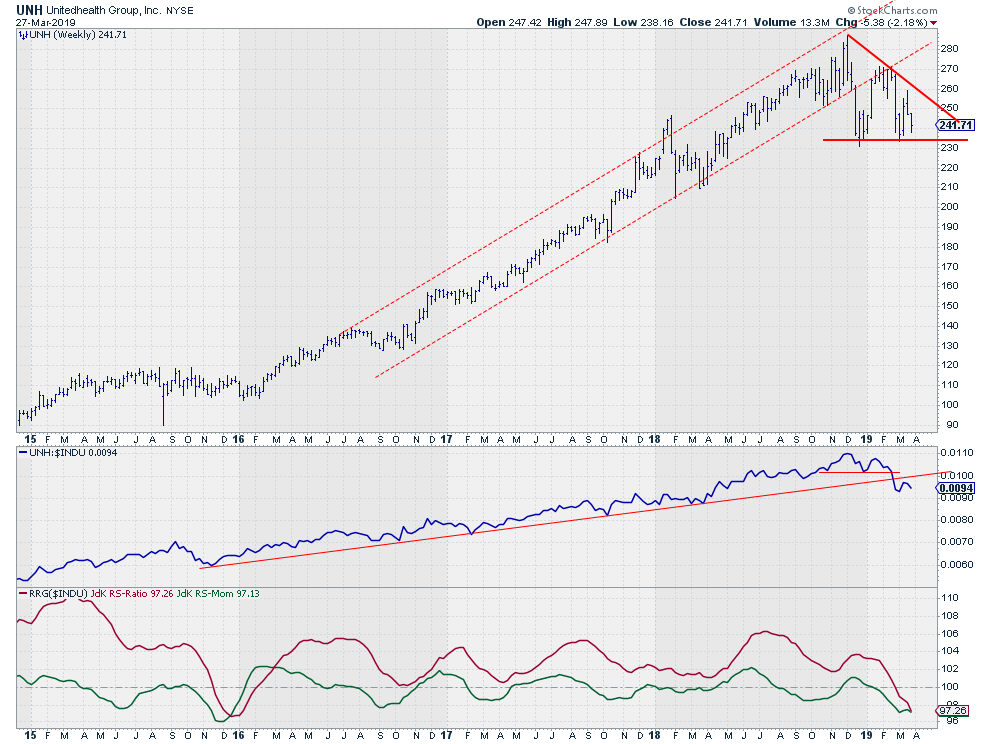

Triple whammy for UNH suggests more weakness ahead!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The weekly chart for UnitedHealth (UNH) shows a steady uptrend in both price and relative (vs $INDU) since the start of 2016.

That three-year move just came to an end.

The uptrend in relative strength emerged out of the low that was set in late 2015. Since then, UNH is...

READ MORE

MEMBERS ONLY

Europe vs The USA... And The Winner Is ....

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I like to keep an eye on what's going on in the world around us. That means also monitoring what's happening in markets that are maybe not directly of interest when it comes to trading or investing.

For stock markets around the world I like to...

READ MORE

MEMBERS ONLY

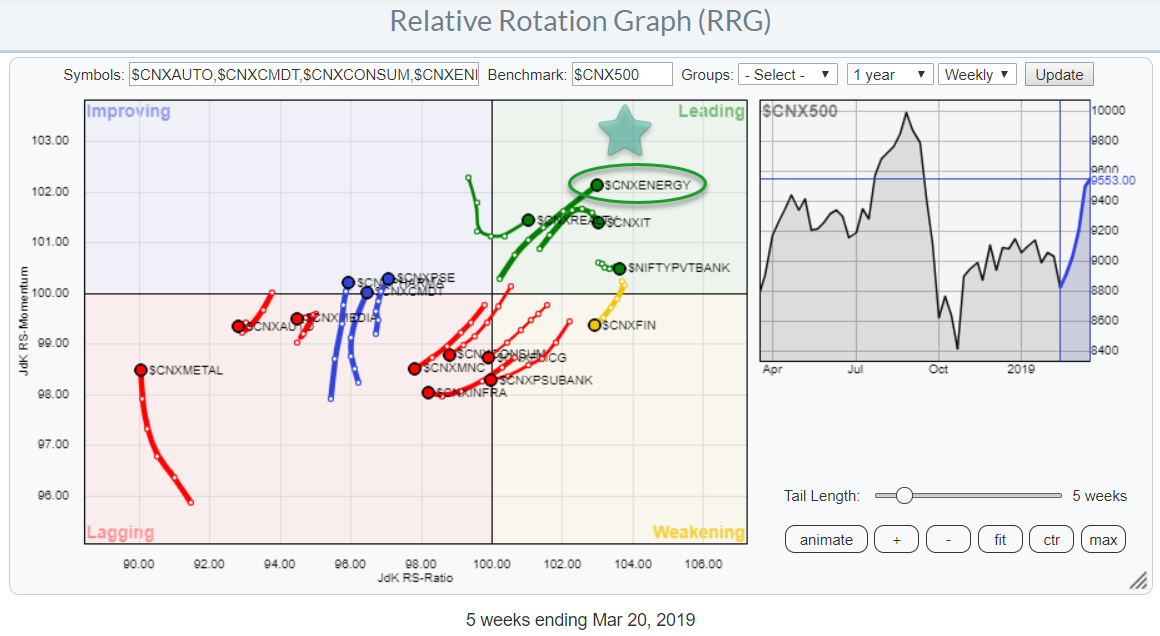

Energy Stands Out on Relative Rotation Graph For Indian Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The list of pre-defined groups in the RRG-menu has been expanded with the universe covering Indian sectors against the Nifty 500 index as the benchmark. Very recently also the universe of individual stocks making up the Sensex 30 index was added. With the Nifty 50 group already on the list,...

READ MORE

MEMBERS ONLY

Real Estate Now Leading On Asset Class- And Sector RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Relative Rotation Graph shows the rotation for asset classes over the past 9 weeks. The main observation is that fixed income related asset classes are all inside weakening and heading, rapidly, towards lagging.

SPY (stocks) is close to returning into the leading quadrant. The strongest rotation at the moment,...

READ MORE

MEMBERS ONLY

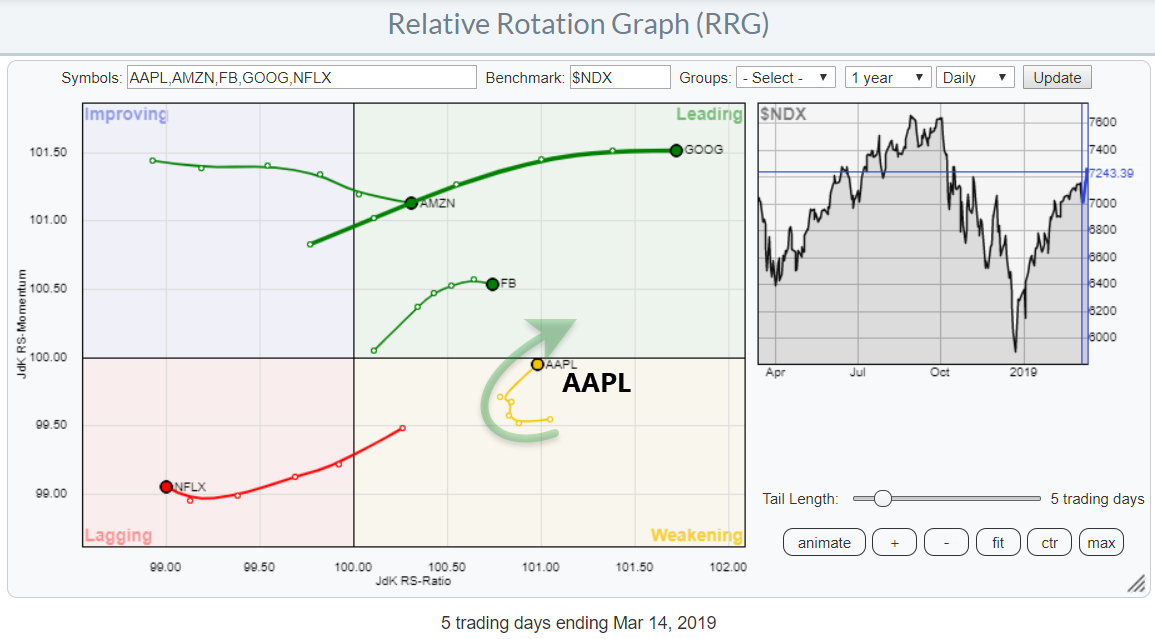

One A In FAANG Just Turned Back towards the Leading Quadrant

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the FAANG stocks against $NDX on a daily basis. The strong move of GOOG is evident and tracks the recent break of resistance.

Out of these five stocks, four are at the right-hand side of the graph, indicating a relative uptrend against the Nasdaq 100...

READ MORE

MEMBERS ONLY

Spotting A Pair Trade On Relative Rotation Graph Of US Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

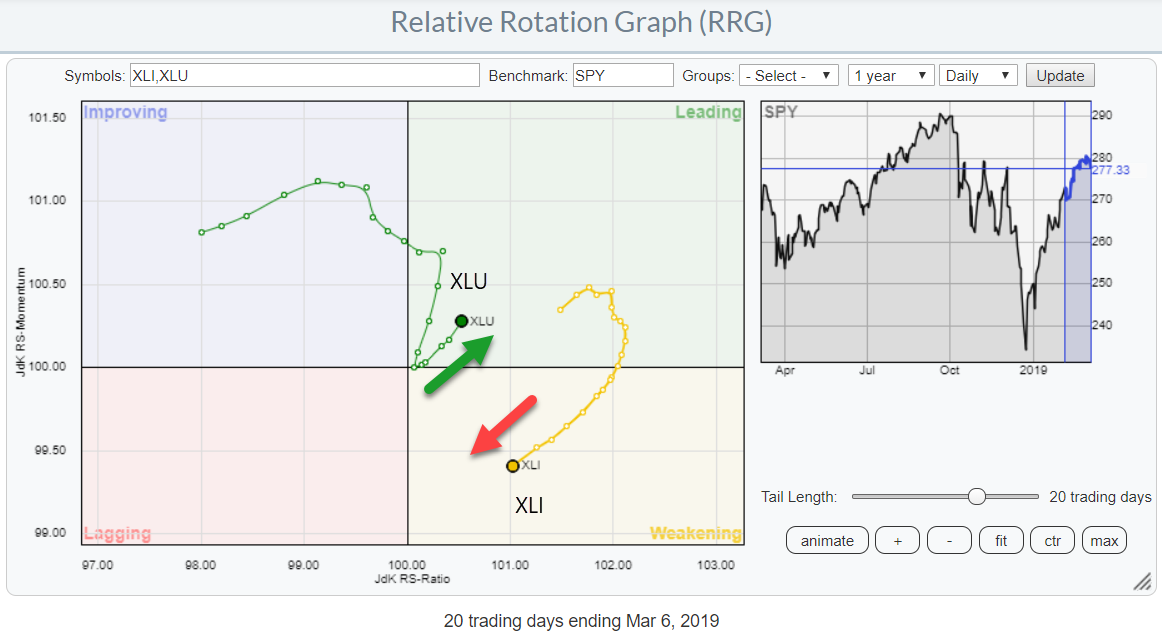

The above Relative Rotation Graph shows the daily rotation over the past 20-days for the Utilities and Industrials sectors.

I have isolated the tails of these two sectors to be able to show them in more detail and highlight the opposite directions that they started moving in.

When you bring...

READ MORE

MEMBERS ONLY

Something that makes me go ...Hmmmmmmm?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

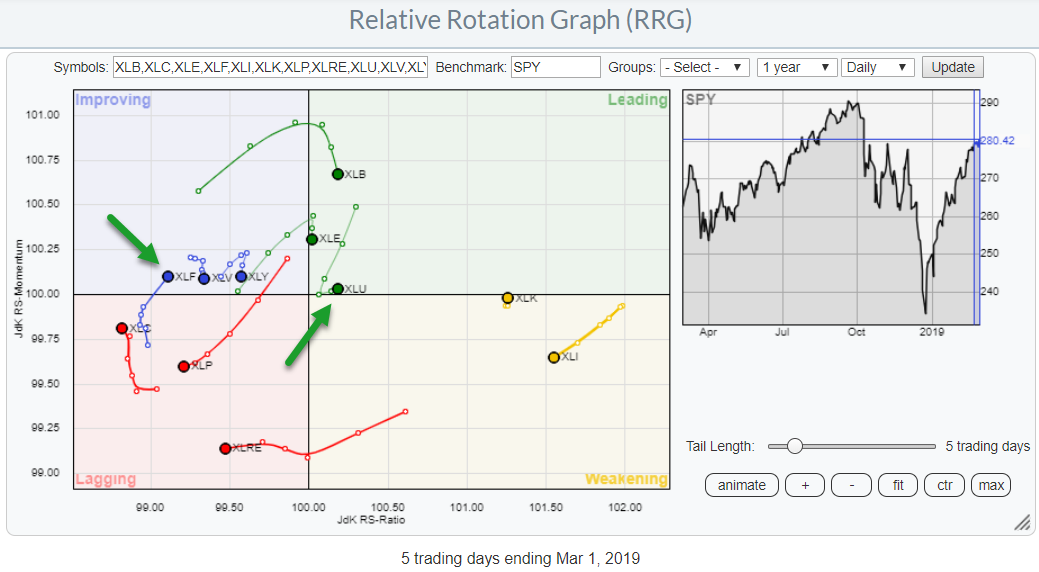

The daily RRG for US sectors shows a lot of sectors "hooking" lower and only two sectors that are, still, at a positive RRG-Heading, ie rising on both axes.

The chart above is showing a 5-day tail on every sector. if we look at the lengths and trajectories...

READ MORE

MEMBERS ONLY

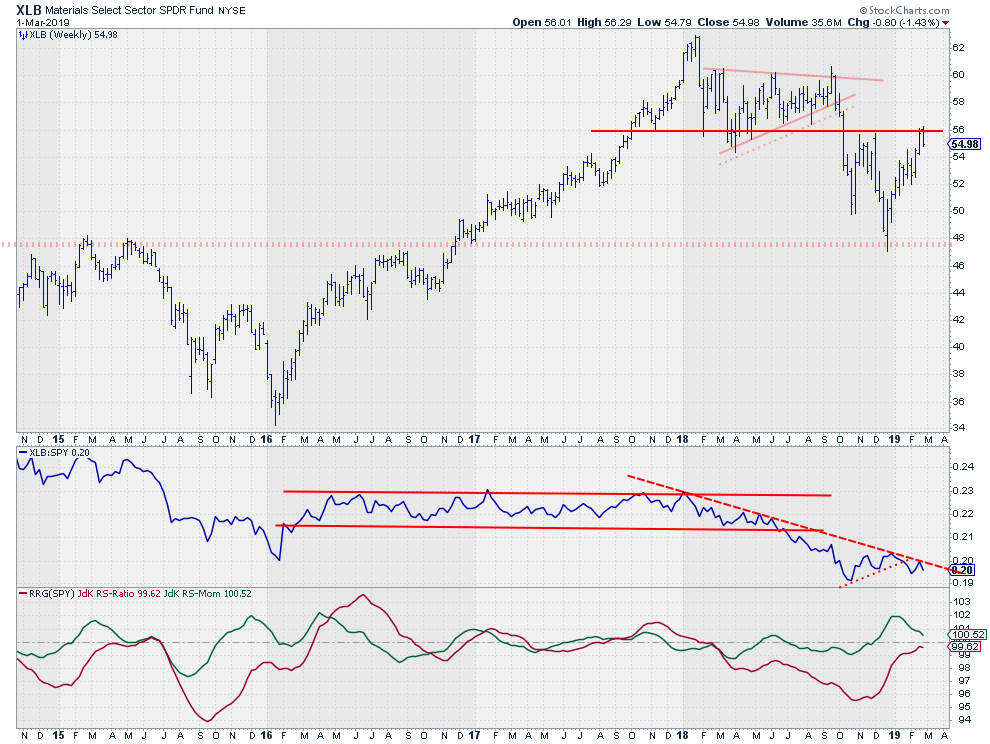

Materials (XLB) Are Failing To Break Resistance And Lose Relative Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Materials sector, XLB, is testing overhead resistance around $56. This is the level where lows have been formed in 2017 and 2018 as well as two important highs at the end of 2018. For the time being, the attempt to break is failing, and this is visible on both...

READ MORE

MEMBERS ONLY

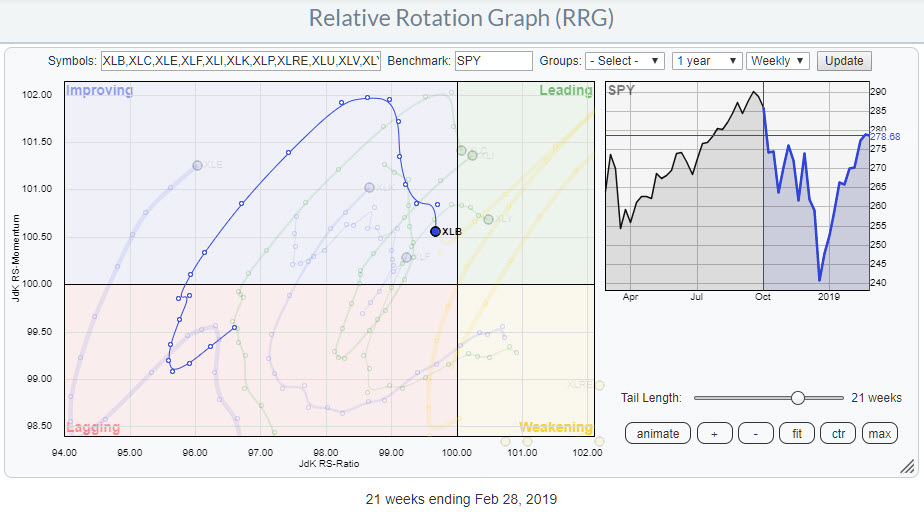

Materials Sector Rolling over On Both The Weekly And The Daily RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart above shows the weekly rotation for the Materials sector, XLB, within the universe of US sectors against SPY. After the tail turned upward inside the lagging quadrant, XLB kept up with the performance of SPY and moderately outperformed the market until the sector started to lose relative momentum...

READ MORE

MEMBERS ONLY

Is This Stock Breaking Out Or Building A Major Top-Formation?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

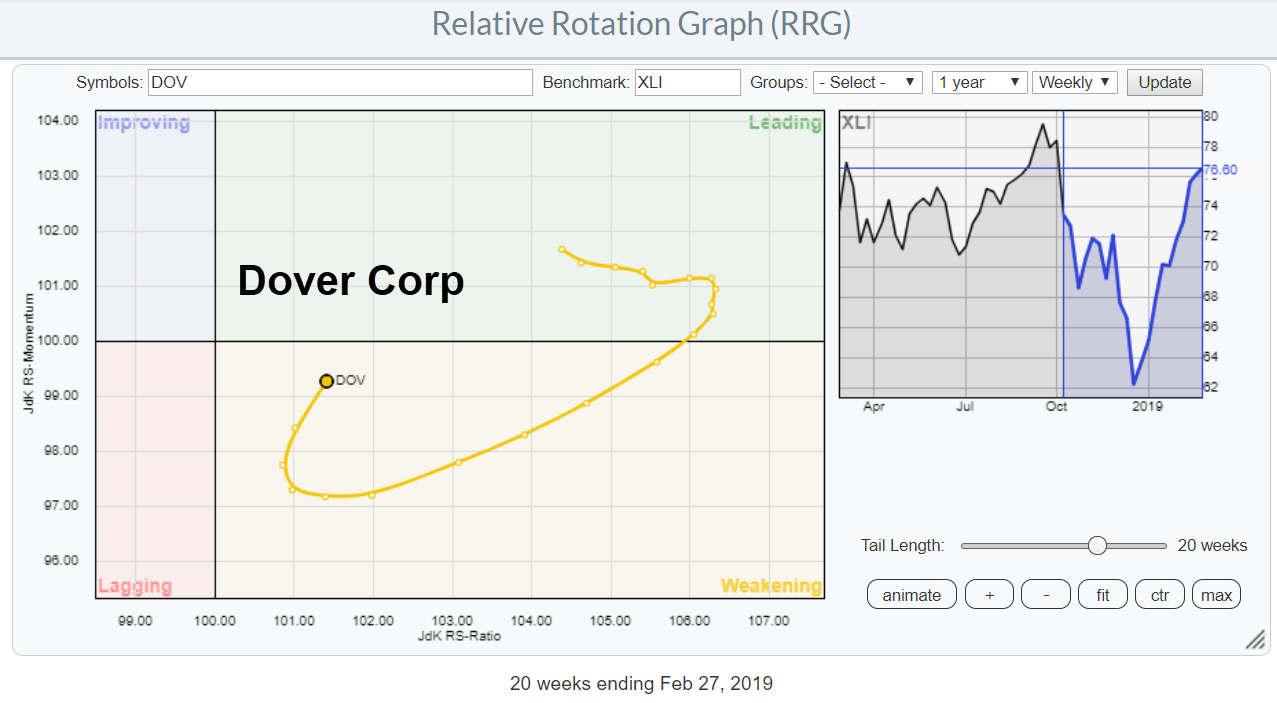

On the weekly Relative Rotation Graph for US sectors, XLI, the Industrials sector is crossing over into the leading quadrant from improving. This indicates further improvement for Industrial stocks compared to other segments of the market.

While zooming in on the RRG for Industrial stocks against XLI I noted the...

READ MORE