MEMBERS ONLY

Join Me At The Traders EXPO in New York

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Here's some shameless self-promotion!

On Monday 11 March I will be doing an RRG presentation at the TradersEXPO in New York and you are invited. For FREE ;)

Julius presenting RRG at TradersEXPO New York

I have never attended one of the TradersEXPO events let alone presented at them...

READ MORE

MEMBERS ONLY

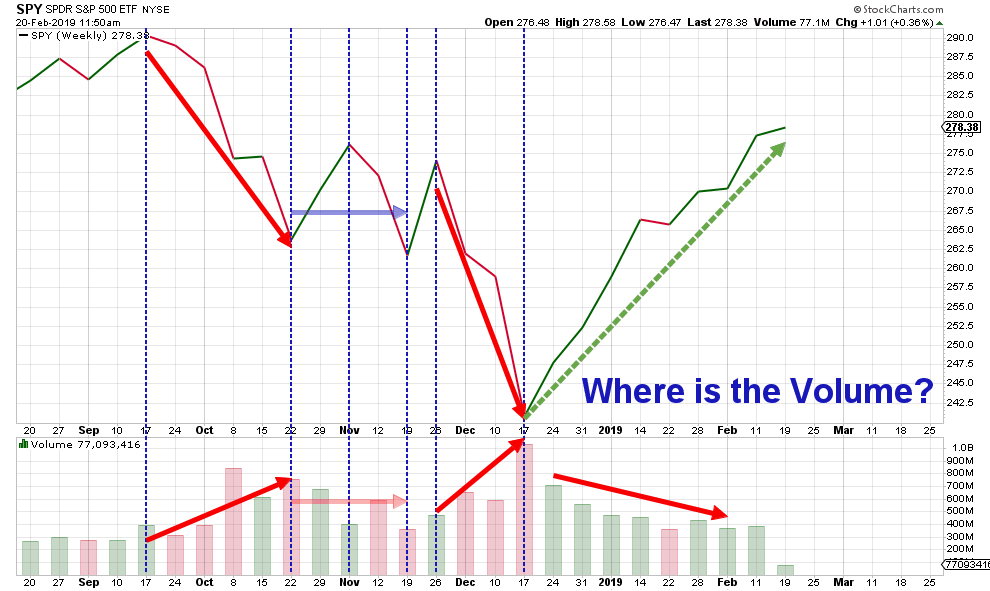

Where Is The Volume?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

My last article in the RRG blog looks at sector rotation for US sectors and how there are some disconnects between groups of sectors on both the daily and the weekly time frames.

My conclusion from that article was that the current rotational patterns are sending mixed signals which makes...

READ MORE

MEMBERS ONLY

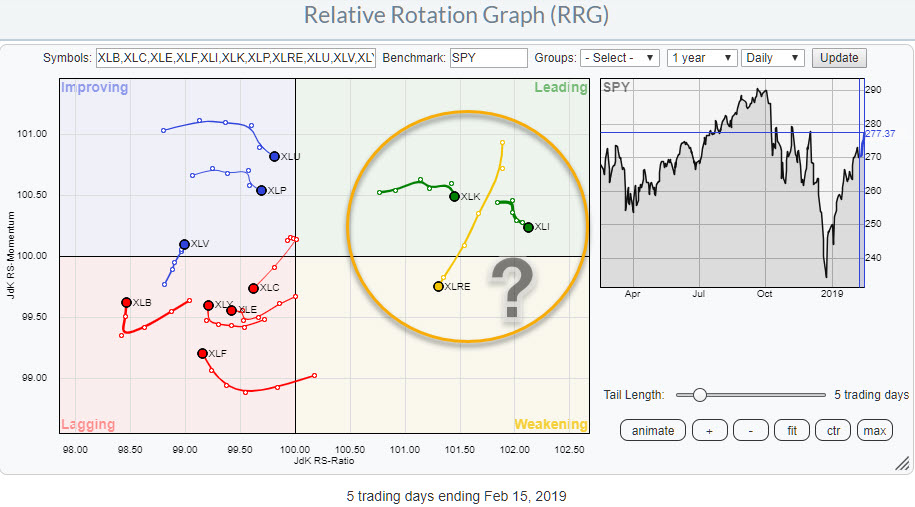

Two Sectors Are Rolling Over Inside The Leading Quadrant On The Daily RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

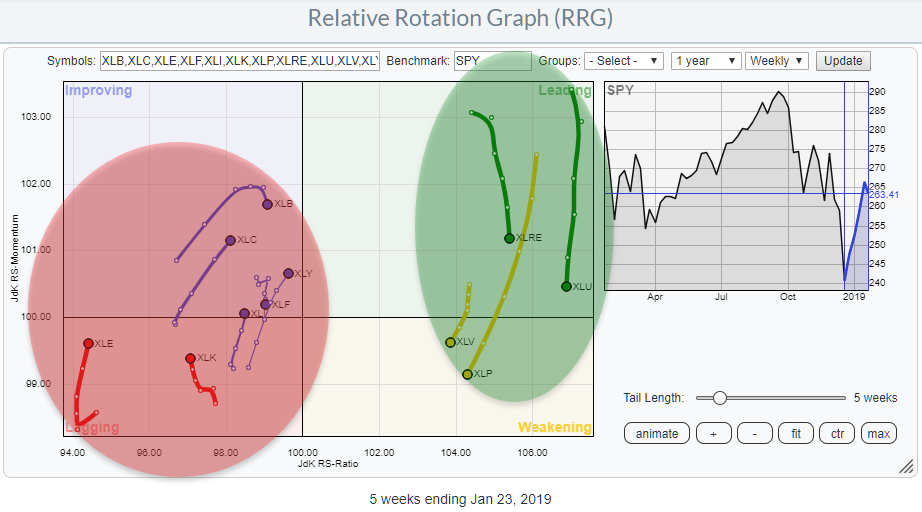

The Relative Rotation Graphs, both daily and weekly, for US sectors are showing big disconnects between sectors.

The image above holds the US sectors and shows daily rotations.

It is immediately obvious that there is a big gap/disconnect between the right (=positive) side and the left (=negative)side of...

READ MORE

MEMBERS ONLY

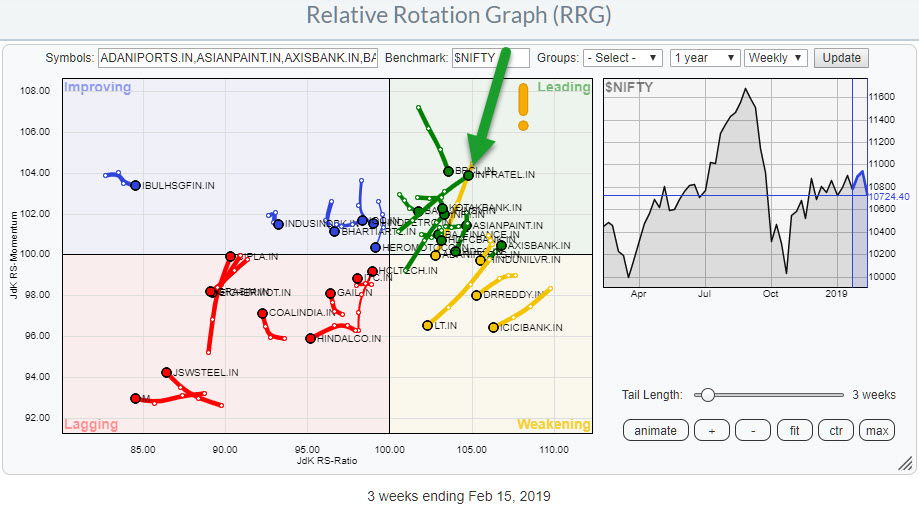

Checking The NIFTY 50 Universe On RRG Results In A Nice Setup For INFRATEL.IN

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With more and more eyeballs looking at the Indian stock market and data for individual stocks and sectors becoming available on Stockcharts.com I started to keep an eye on developments in that market via Relative Rotation Graphs.

To make it easier (for you but also myself), the NIFTY 50...

READ MORE

MEMBERS ONLY

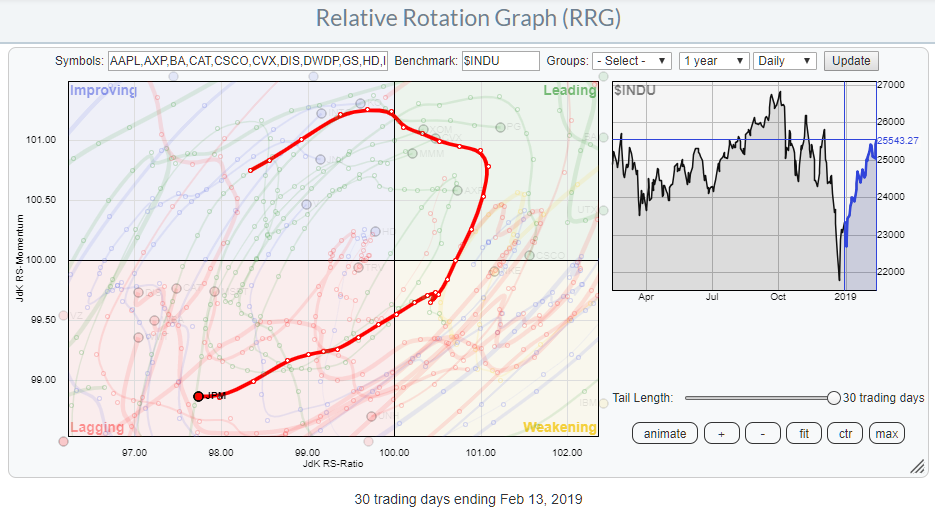

JP Morgan deteriorates further on Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the choices in the drop-down selection on the Relative Rotation Graphs page is the DJ-industrials (Dow 30 Industrials). This RRG shows the rotation of all 30 Dow stocks against the $INDU.

The RRG above shows the daily rotation and highlights the rotation of JP Morgan Chase & Co....

READ MORE

MEMBERS ONLY

Watch Out For More Weakness In Financials This Week!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

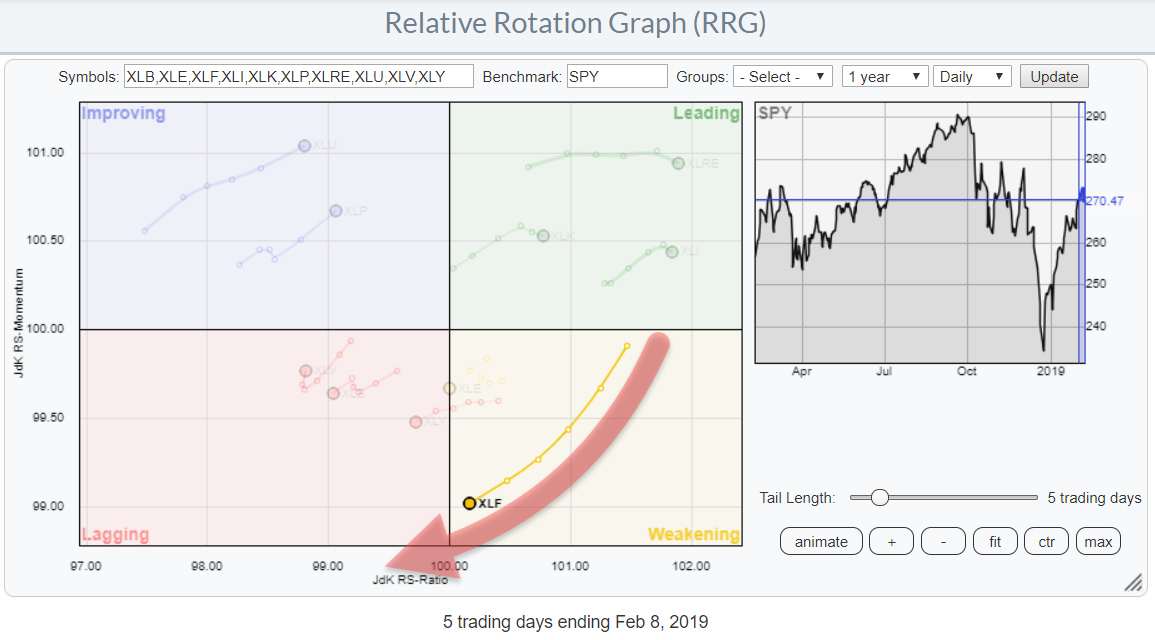

On the daily Relative Rotation Graph for US sectors, the rotation of Financials stands out. The tail is relatively long, indicating that there is good momentum behind this move,

The bad news is that the rotation is taking place inside the weakening quadrant and has almost reached the lagging quadrant....

READ MORE

MEMBERS ONLY

The Staples Sector Is Improving, But Which Stocks Deserve Attention?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

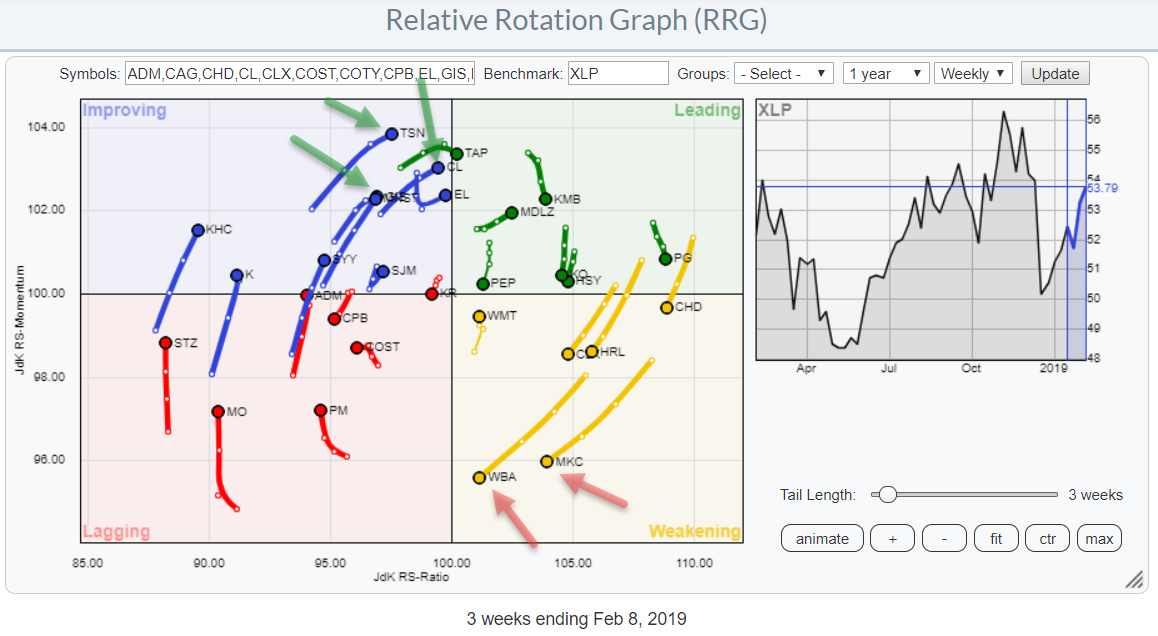

The Relative Rotation Graph shows the rotation of the stocks in the Consumer Staples sector against XLP, the Consumer Staples sector index.

Keen observers may notice that I have left out COTY and CAG because they are very disconnected and distorting the picture. If you click on the image and...

READ MORE

MEMBERS ONLY

Save This Chart To Keep Track Of The Yield Curve Interaction With The Economic Cycle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

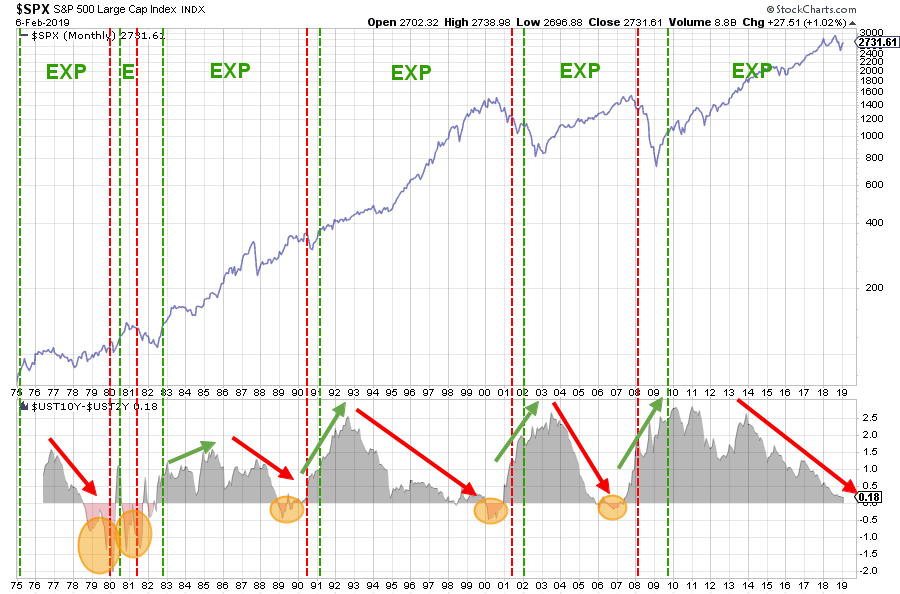

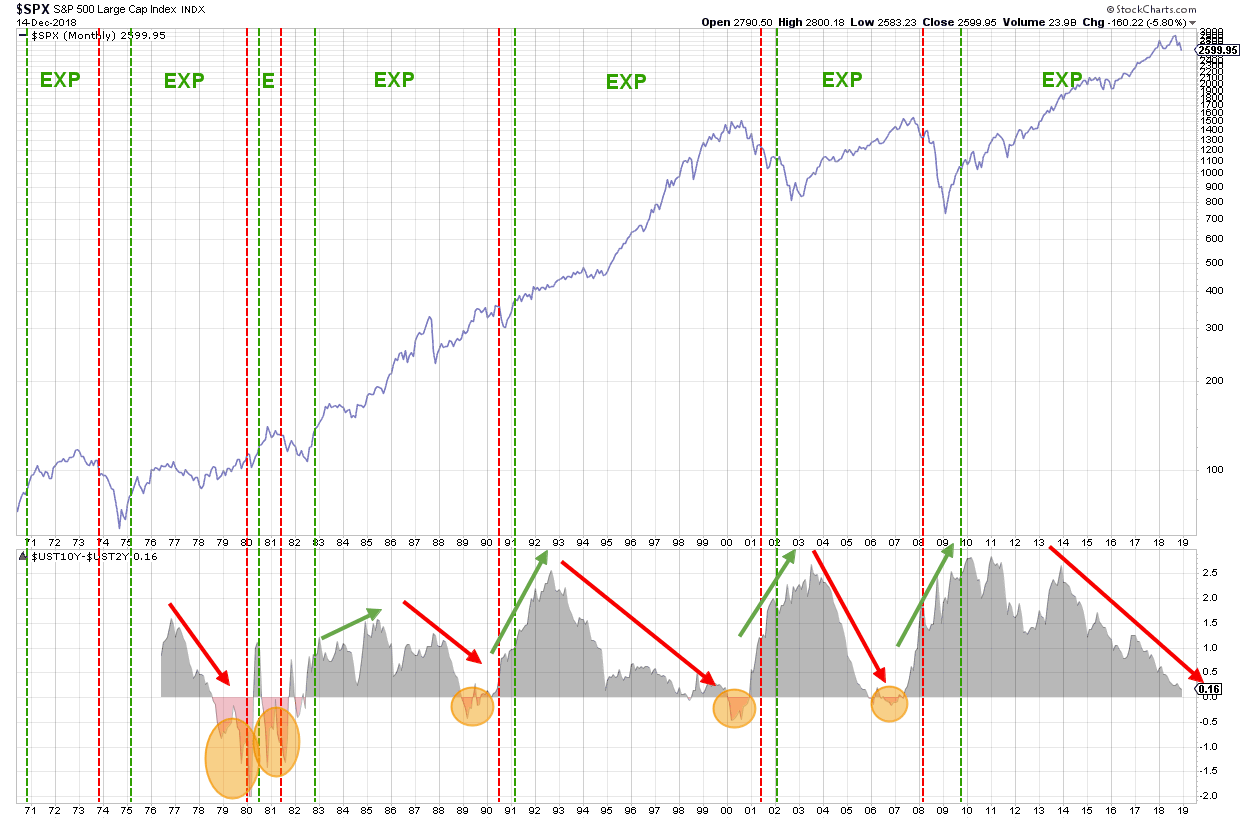

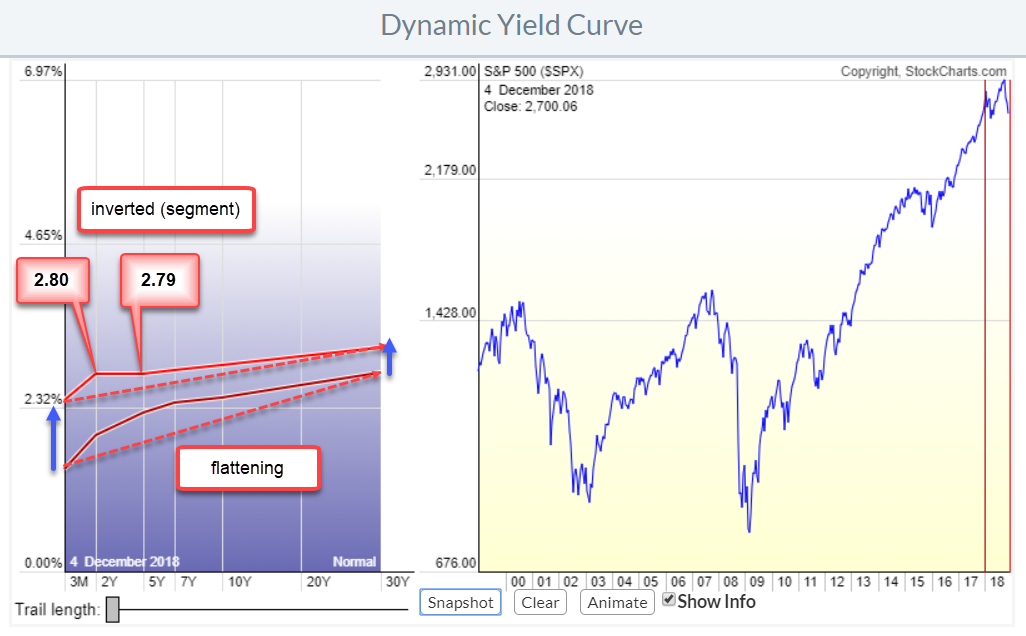

The chart that I want to share with you today is part of a (bigger) research project that I am doing with regard to the various phases in economic cycles and their relation to the (shape of) yield curve.

The chart above shows the S&P Index in the...

READ MORE

MEMBERS ONLY

Using Relative Rotation Graphs To Break Down The Bloomberg Commodity Index Family

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

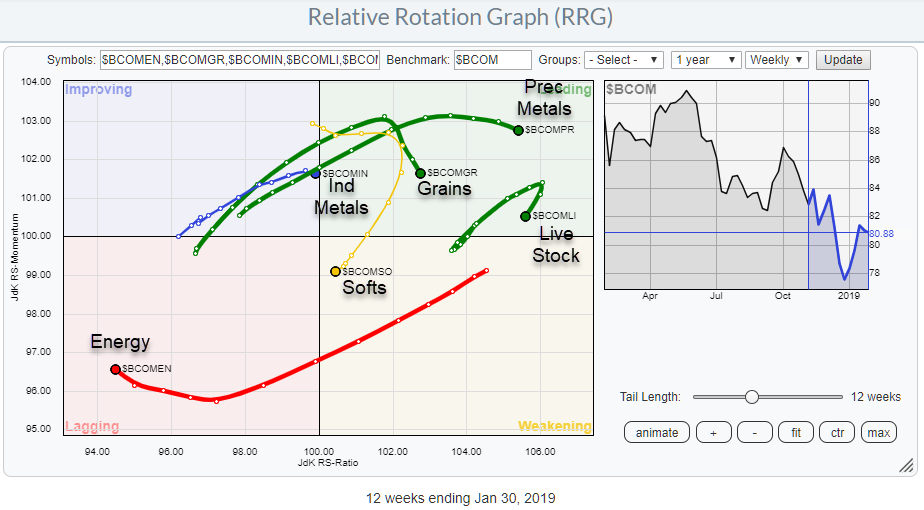

This article was published in the RRG blog on 31 January and takes a look at the Bloomberg Commodity Index Groups through the lens of a Relative Rotation Graph.

When possible, I prefer to use data-sets that come from the same family and creating a "closed universe." This...

READ MORE

MEMBERS ONLY

Breaking Down The Bloomberg Commodity Index Family On RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this article, we are going to take a look at commodities using Relative Rotation Graphs and the Bloomberg commodity index family.

When possible, I prefer to use data-sets that come from the same family and creating a "closed universe." This is a universe where all securities on...

READ MORE

MEMBERS ONLY

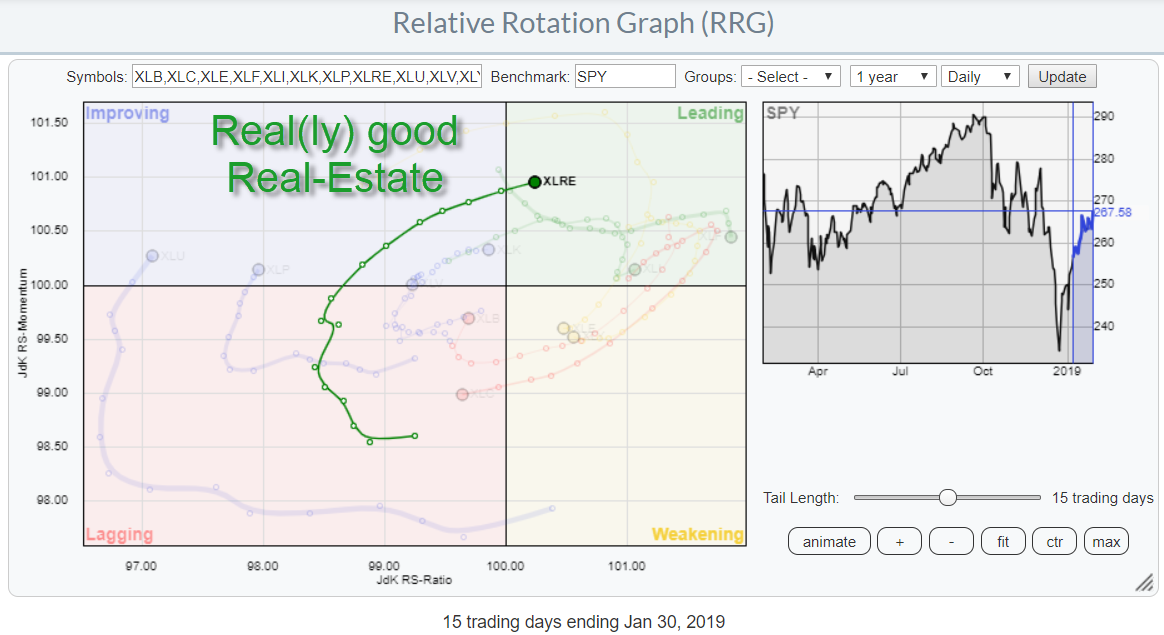

Real(ly) Good Real-Estate (XLRE) But It Needs To Break Resistance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows a remarkably steady rotation for the Real-Estate sector. This is a daily RRG showing a 15 day tail, or three weeks. Yesterday XLRE crossed over into the leading quadrant and is now the only sector inside the leading quadrant at a solidly...

READ MORE

MEMBERS ONLY

Defensive Sectors Starting Positive Rotations Again On Daily Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors is showing a split picture. On the right, we have Utilities, Real-Estate, Consumer Staples and Healthcare. With the exception of Real-Estate maybe, these are generally accepted as "defensive" sectors.

All other sectors (7) are positioned to the left of the benchmark...

READ MORE

MEMBERS ONLY

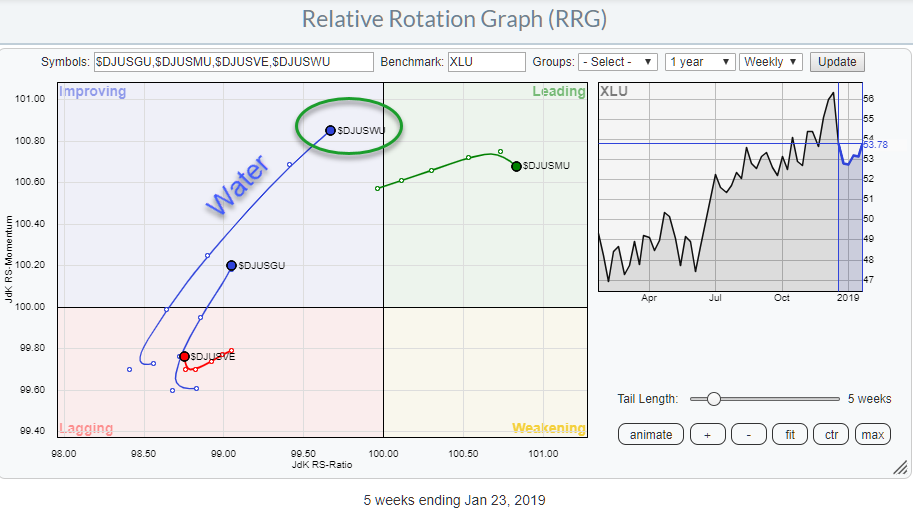

Water ($DJUSWU) Is The Leading Group Inside The Utilities Sector (XLU)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the pages that I often visit on Stockcharts.com is the sector summary. It gives a tabular overview of the price changes that occurred over a certain period (you can choose).

From that page, it is possible to open a Relative Rotation Graph that breaks the sector down...

READ MORE

MEMBERS ONLY

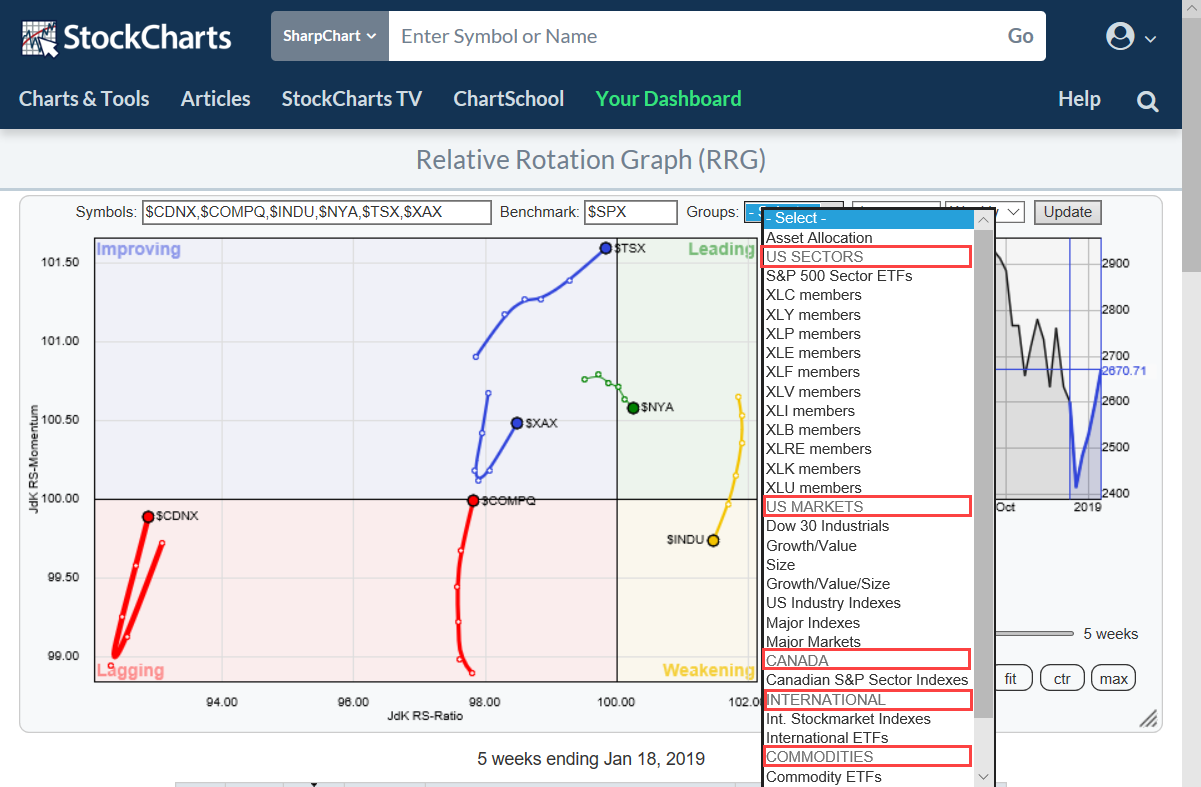

New Pre-Defined Groups And A Look At FAANG Stocks On Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

If you are a regular user of Relative Rotation Graphs you are probably aware of the pre-defined groups (universes) that you can choose from when you open the drop-down box at the top op the chart.

In order to make life easier (for our users) and provide structure, I am...

READ MORE

MEMBERS ONLY

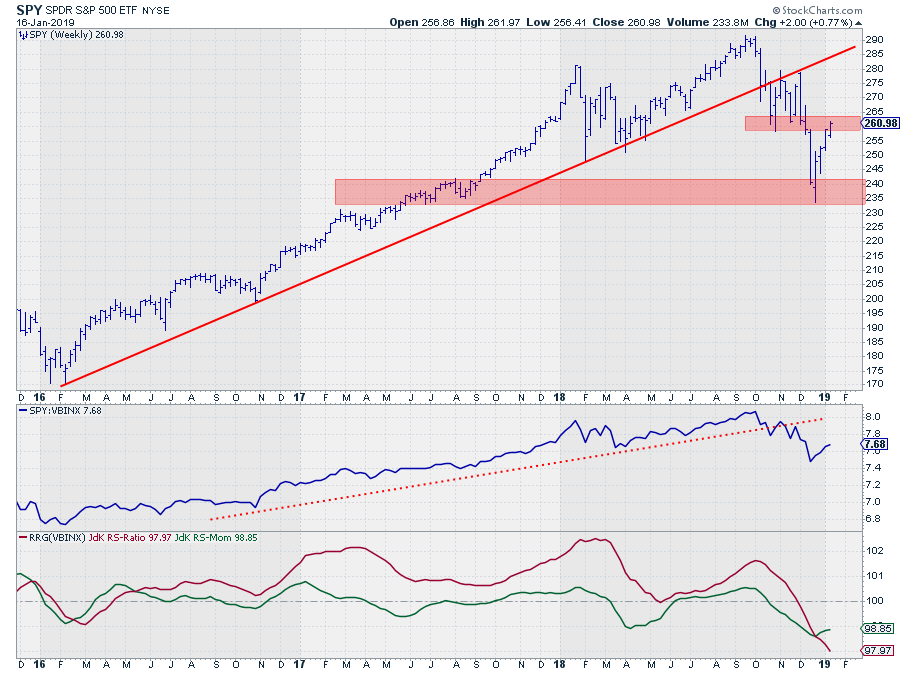

SPY Arrived In "Trouble Territory"

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After the sharp sell-off in Q4 of last year, the market (SPY) started to recover from its lows near 235. And IMHO it is still a "recovery" before turning down again as opposed to a "turnaround" back up.

This weekly chart above clearly shows that the...

READ MORE

MEMBERS ONLY

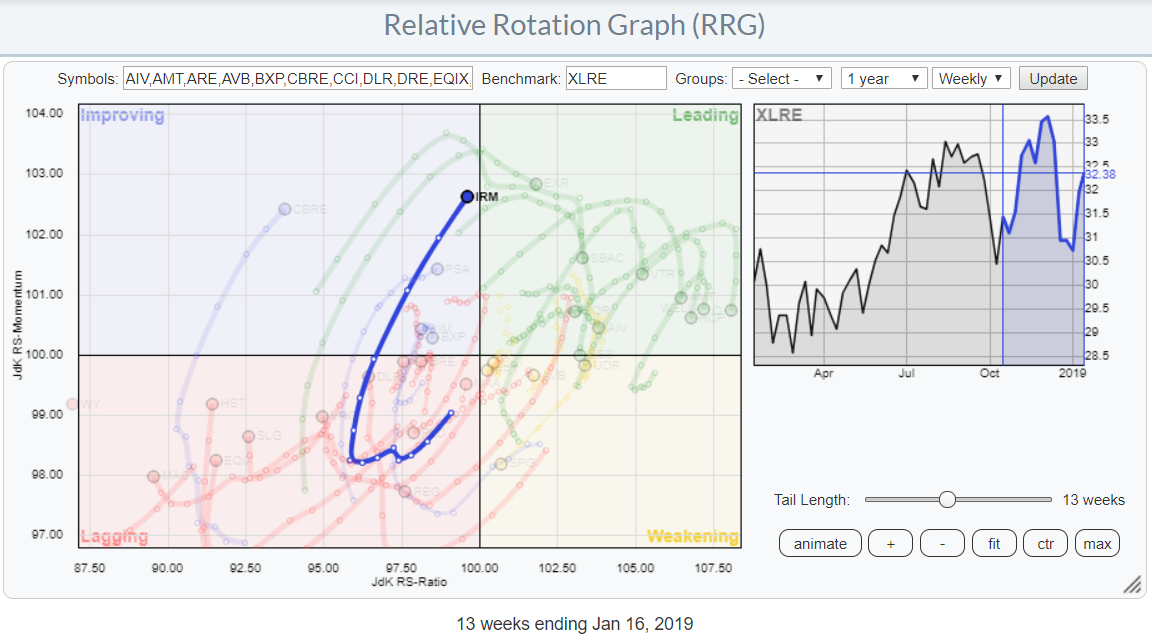

Long Tail And Strong RRG-Heading For IRM

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above highlights the rotation of IRM (Iron Mountain Inc.) in comparison to the other stocks in the S&P Real-Estate sector (XLRE).

The sector itself is interesting to keep an eye on as it is positioned well inside the leading quadrant but rolling over, at...

READ MORE

MEMBERS ONLY

Relative Rotation Graphs And Factor ETFs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's Friday morning in Amsterdam and I just dropped my daughter off at school. On the way to my office, I usually stop at the local Coffee Company for a cappuccino and reading some, market-related, news, blogs etc.

For some reason, I noticed a lot of talk and...

READ MORE

MEMBERS ONLY

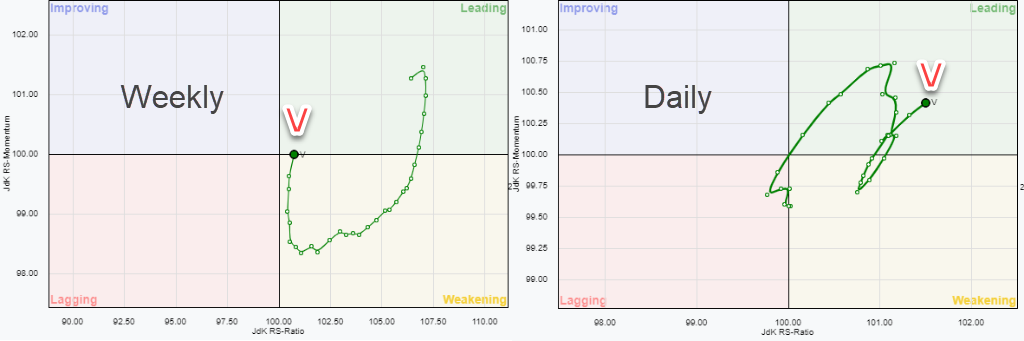

This DOW stock is pushing to new relative highs and rotates back into the leading quadrant on the Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Visa is showing up, just, inside the leading quadrant on the Relative Rotation Graph vs $INDU above. These images are zoomed in from the RRG holding all the 30 DJ Industrials stocks (benchmark $INDU).

The tail in the chart on the left above shows 30 weeks of rotation and as...

READ MORE

MEMBERS ONLY

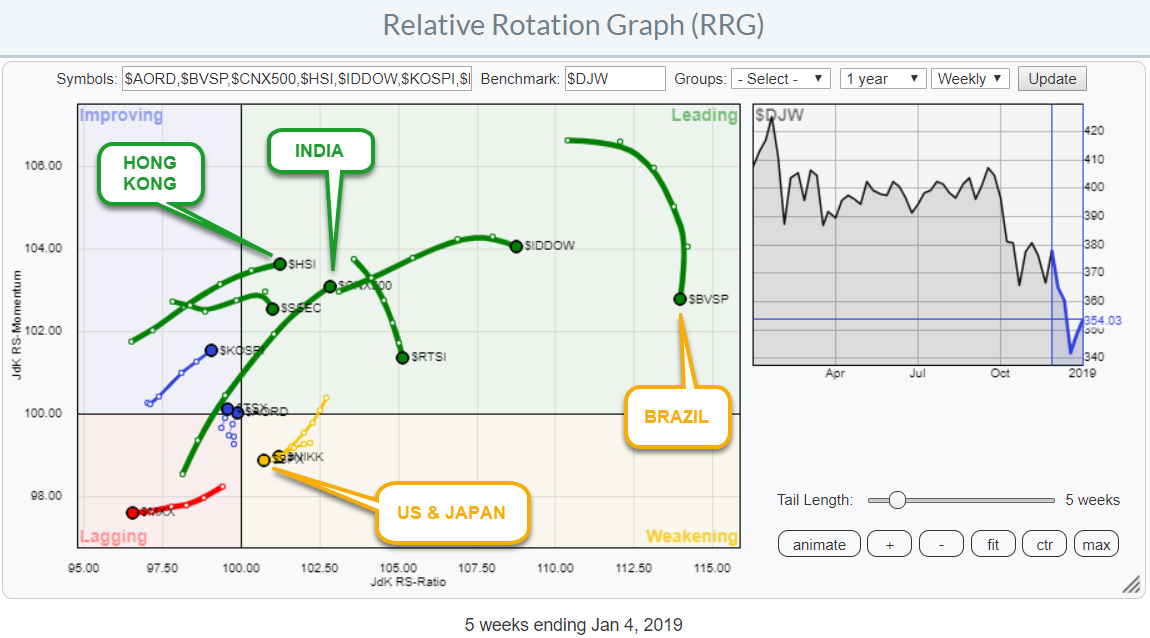

Use Relative Rotation Graphs To Get A Handle On International Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the US stock market declining investors (may) need to look for alternatives in order to preserve capital. Sure enough, there are good opportunities in the US with bonds, IEF is doing very well, and cash is a very viable alternative if you do not "need" to be...

READ MORE

MEMBERS ONLY

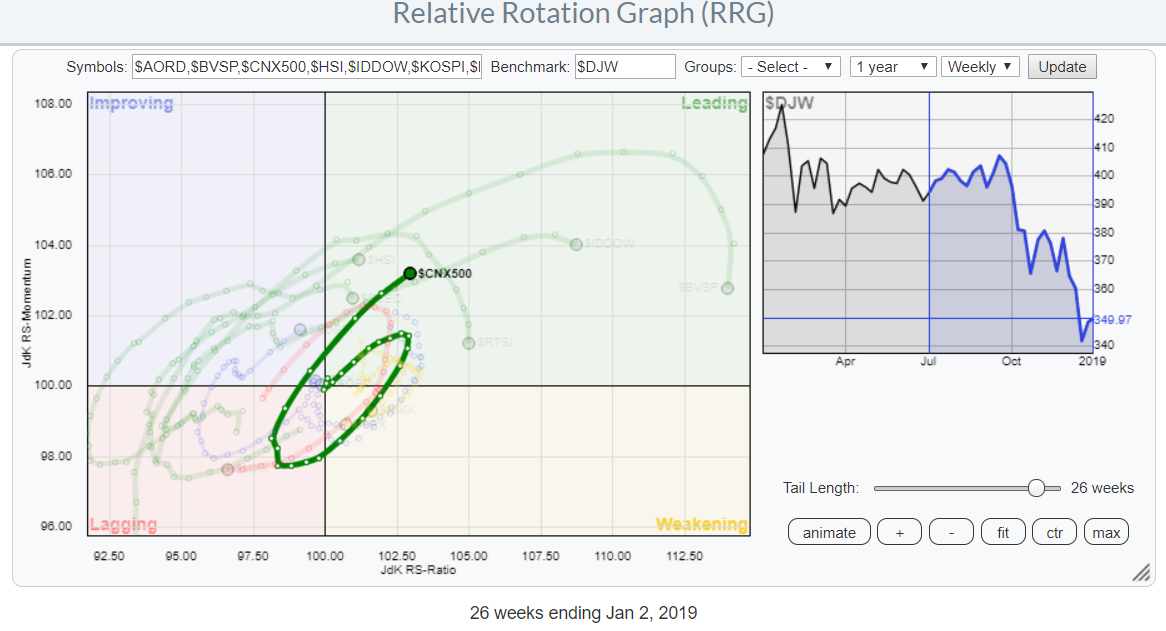

NIFTY (India) As An Alternative For SPY (US Stocks)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the US stock market declining investors (may) need to look for alternatives in order to preserve capital. Sure enough, there are good opportunities in the US with bonds, IEF is doing very well, and cash is a very viable alternative if you do not "need" to be...

READ MORE

MEMBERS ONLY

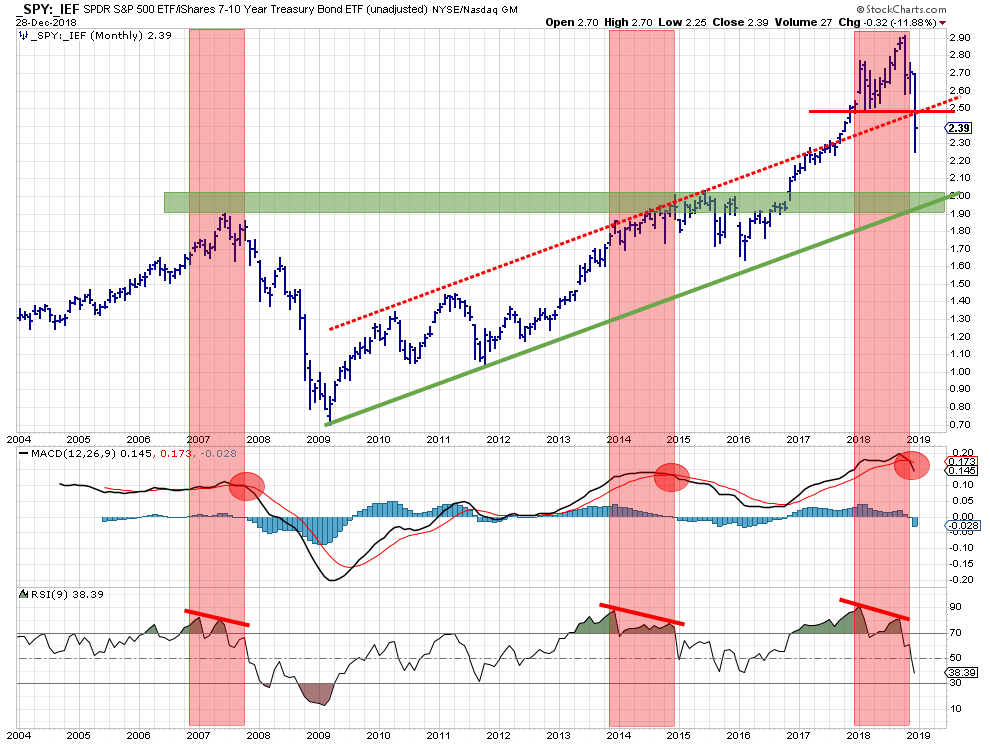

If the SPY:IEF ratio is going to test its support at the 2015 peaks where do SPY and IEF prices need to go?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The above chart shows the stocks/bonds ratio using monthly bars since 2004. IMHO this is one of the most useful charts to decide on an important portion of the asset allocation in your portfolio. Should you invest in stocks or in bonds. In other words, "Risk ON"...

READ MORE

MEMBERS ONLY

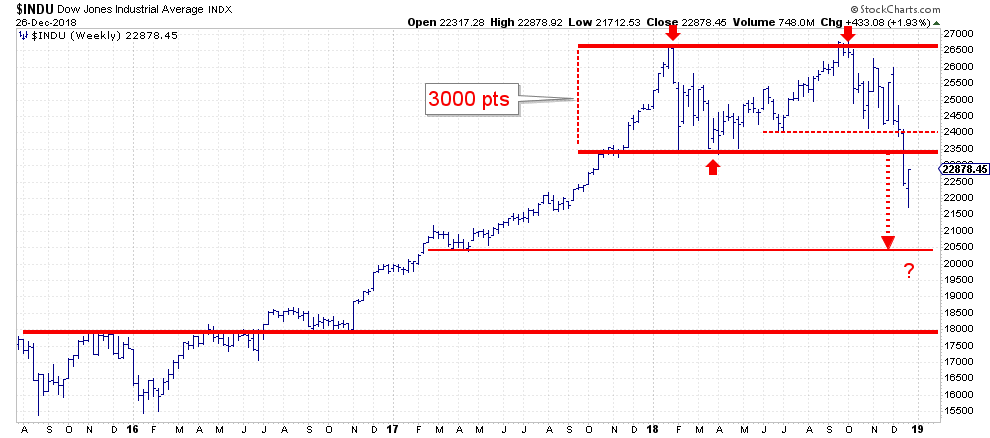

Okay, So You Rallied 1000 Points...? That Don't Impress Me Much.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Yesterday, on boxing day, the Dow jumped 1000 points from its 52-week low which, coincidentally, was also set yesterday. Never a dull moment. But, what does it mean?

Looking at the weekly chart above, at least IMHO, it means only a (small) recovery of the damage that has been done...

READ MORE

MEMBERS ONLY

Relative Rotation Graph Shows BOB (EXC & WELL) vs WOW (NBL & FTV) Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my previous post, I highlighted both the Real-Estate and the Utilities sectors as (strong) outperformers during this weak period for stocks in general. This "Double + for Utilities and Real Estate on Relative Rotation Graph" pointed to the position inside the leading quadrant for both sectors on both...

READ MORE

MEMBERS ONLY

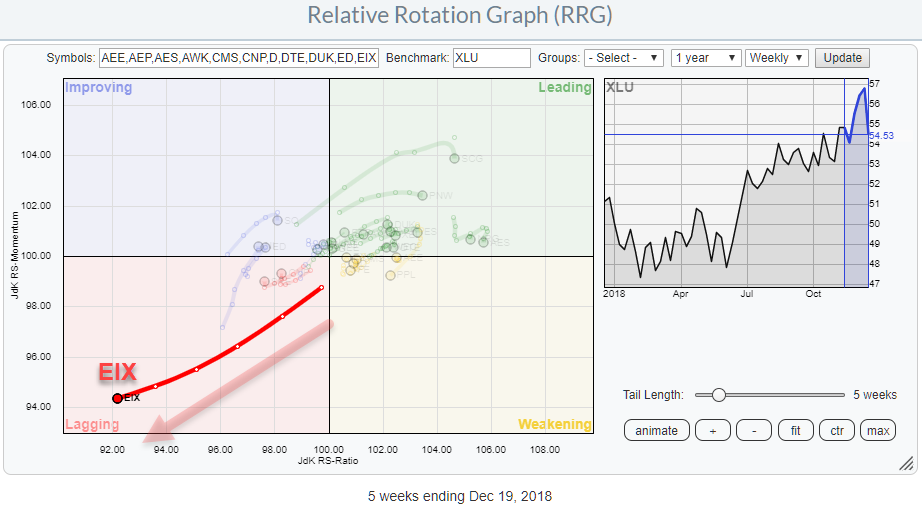

Utilities are OK but it's better to avoid EIX

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Utilities sector is acting as a safe haven for a lot of investors that need to park their money in the stock market because they cannot, or are not allowed to, hold all or significant amounts of cash when markets are going down.

These are the periods when relative...

READ MORE

MEMBERS ONLY

The Yield Curve And The Business Cycle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The "Yield Curve" is a term often used in finance and refers to the relationship between (government) bonds with various maturities.

The "Normal" relationship between the yield on various maturities is that the longer you lend money to someone. In this case the US government, the...

READ MORE

MEMBERS ONLY

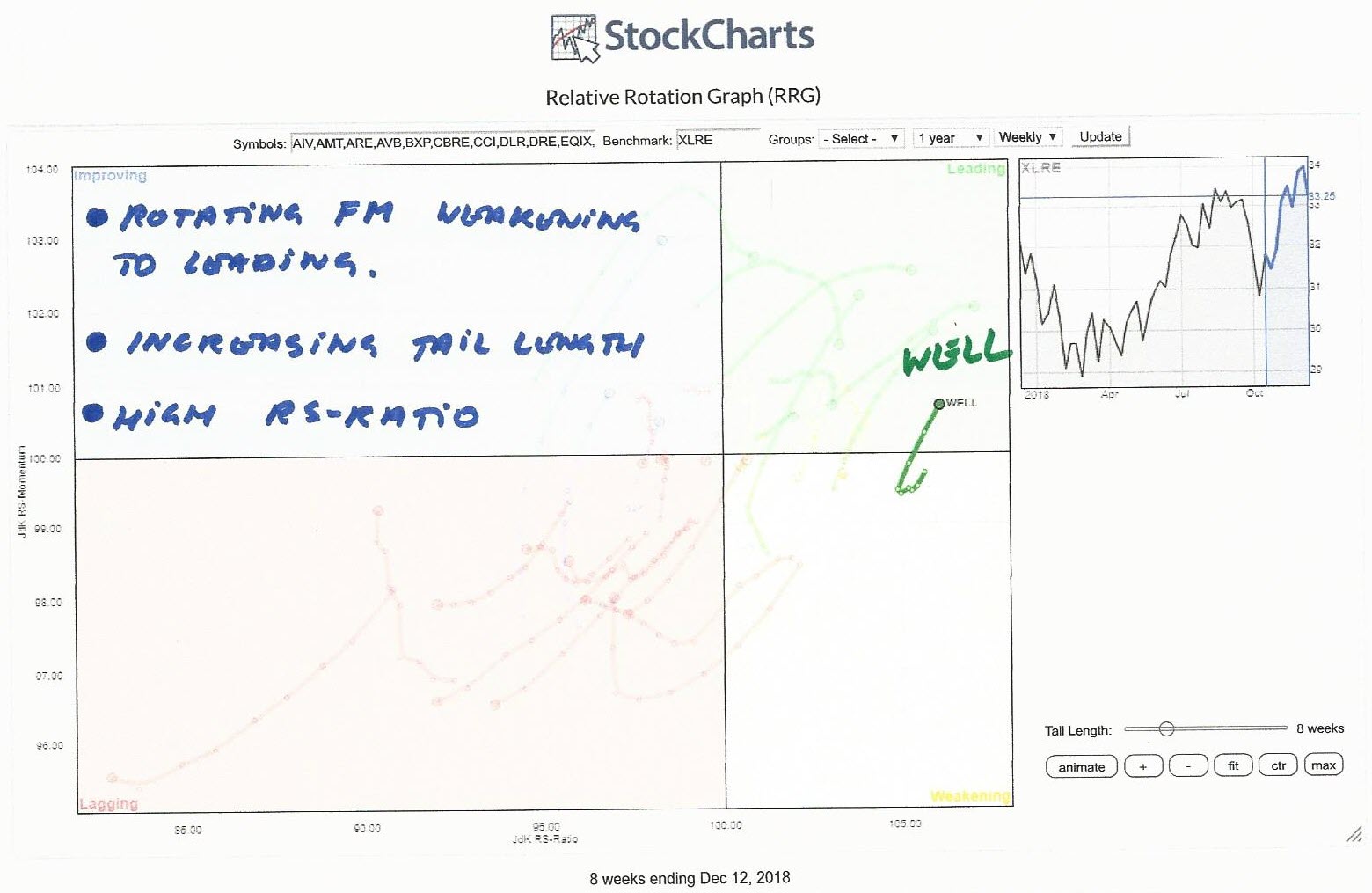

Oh WELL... What Can I Say?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph, the Real-estate sector is one of the better performing sectors vis-a-vis the S&P 500 index.

The RRG above shows the rotation of all the stocks in XLRE against XLRE. This gives us a picture of the relative positions for all these stocks against...

READ MORE

MEMBERS ONLY

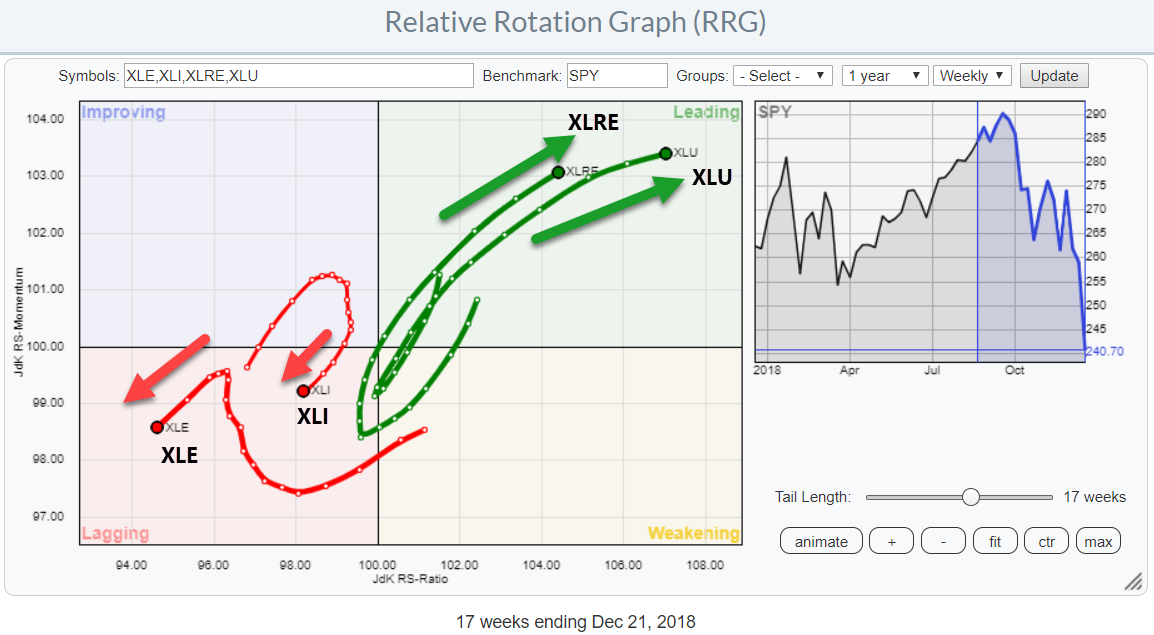

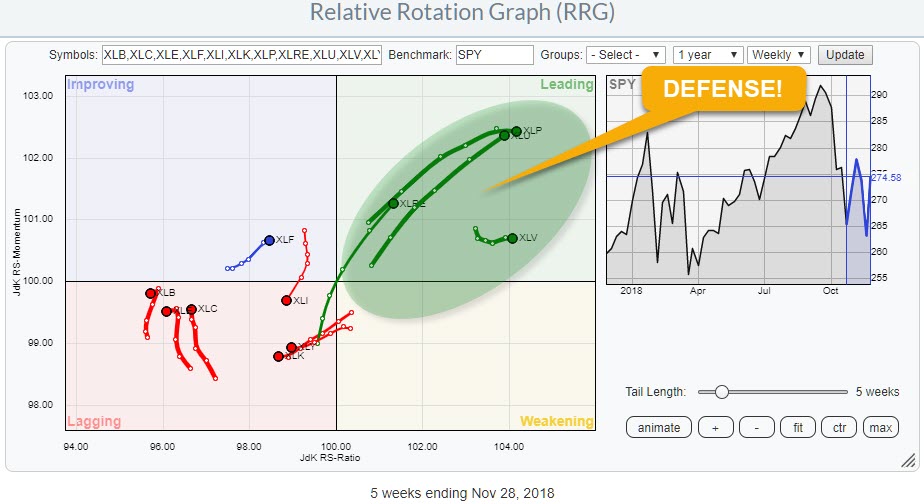

Double + For Utilities And Real Estate On Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The market keeps throwing us curve balls on a daily basis. The Relative Rotation Graph above translates these curve balls into (sector-) rotational patterns.

The weekly chart above shows continuing strength for Utilities and Real Estate as they continue to move higher on both axes of the RRG.

Staples and...

READ MORE

MEMBERS ONLY

Why Is Everybody Talking About The Yield Curve? What Is All The Fuss About?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The yield curve has become a popular subject recently. Also, a few commentators on the site have mentioned the yield curve and its recent movements in their blogs recently. Read articles by Chief John, Greg Schnell, and Arthur Hill.

In my DITC contribution of 18 October, I showed how Relative...

READ MORE

MEMBERS ONLY

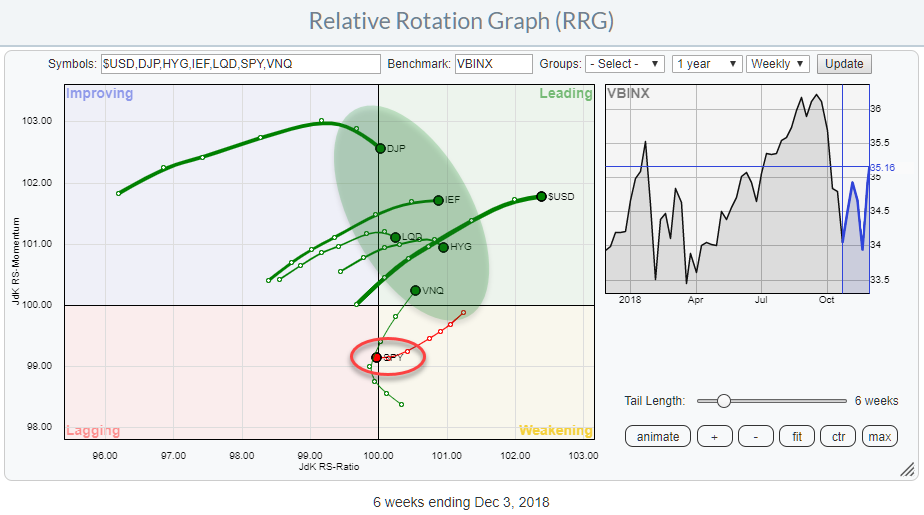

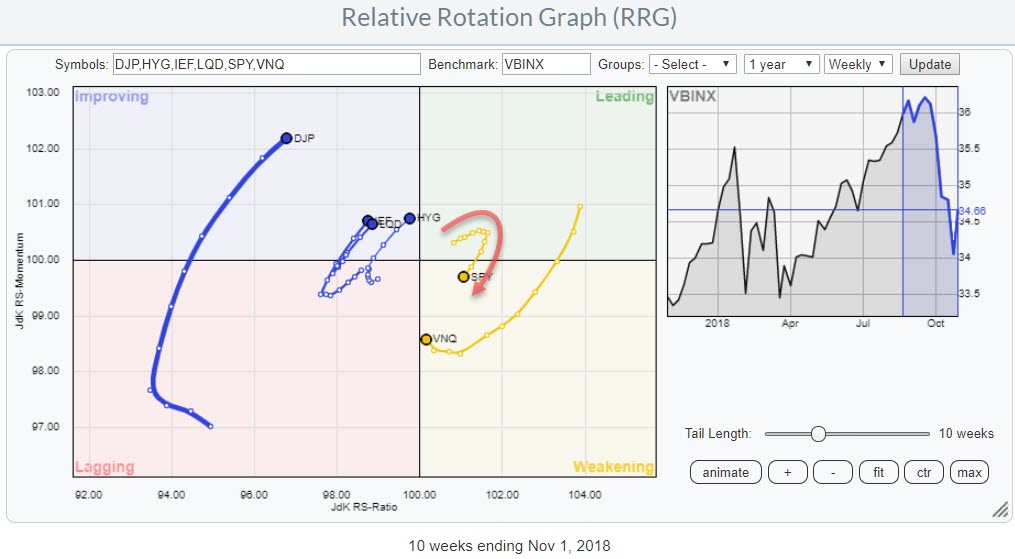

RRG Says Stocks Are The Weakest Asset Class

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graphs shows the rotation of various asset classes around a balance benchmark portfolio (VBINX).

The message could not be more clear. Stocks (SPY) just crossed over from weakening into the lagging quadrant while ALL other asset classes are inside the leading quadrant.

This is a pretty clear...

READ MORE

MEMBERS ONLY

Plotting breadth indicators on Relative Rotation Graphs - Part II

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After finishing the previous article on plotting breadth indicators on Relative Rotation Graphs I have spent hours and hours on studying probably a couple of thousand different RRGs holding various groups of sectors in combination with their breadth equivalents.

And although I did not find the perfect prediction tool or...

READ MORE

MEMBERS ONLY

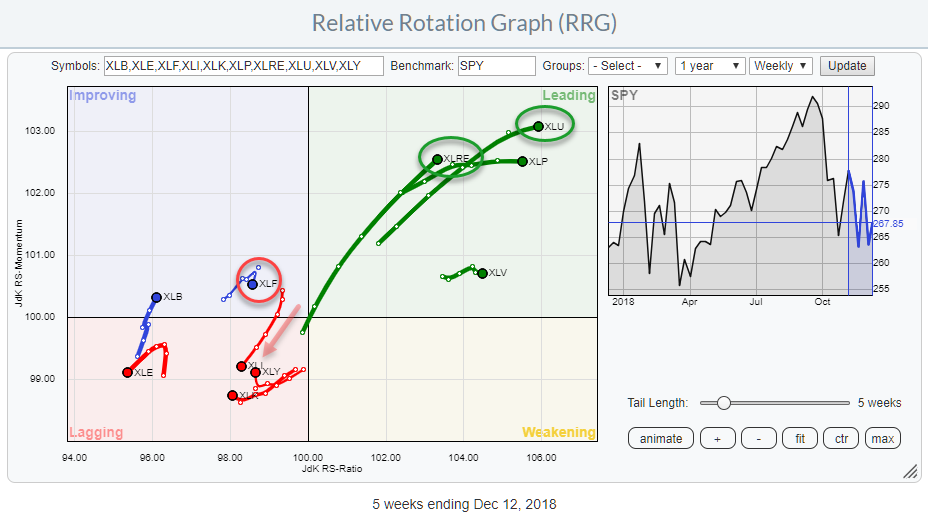

Market is still playing defense!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The recent rally of the S&P 500 index off the lows near 2600-2625 is nice but is it sustainable?

The Relative Rotation Graph above shows the rotation of the 11 SPDR sector ETFs against SPY and the message is very clear!

There is a clear split between the...

READ MORE

MEMBERS ONLY

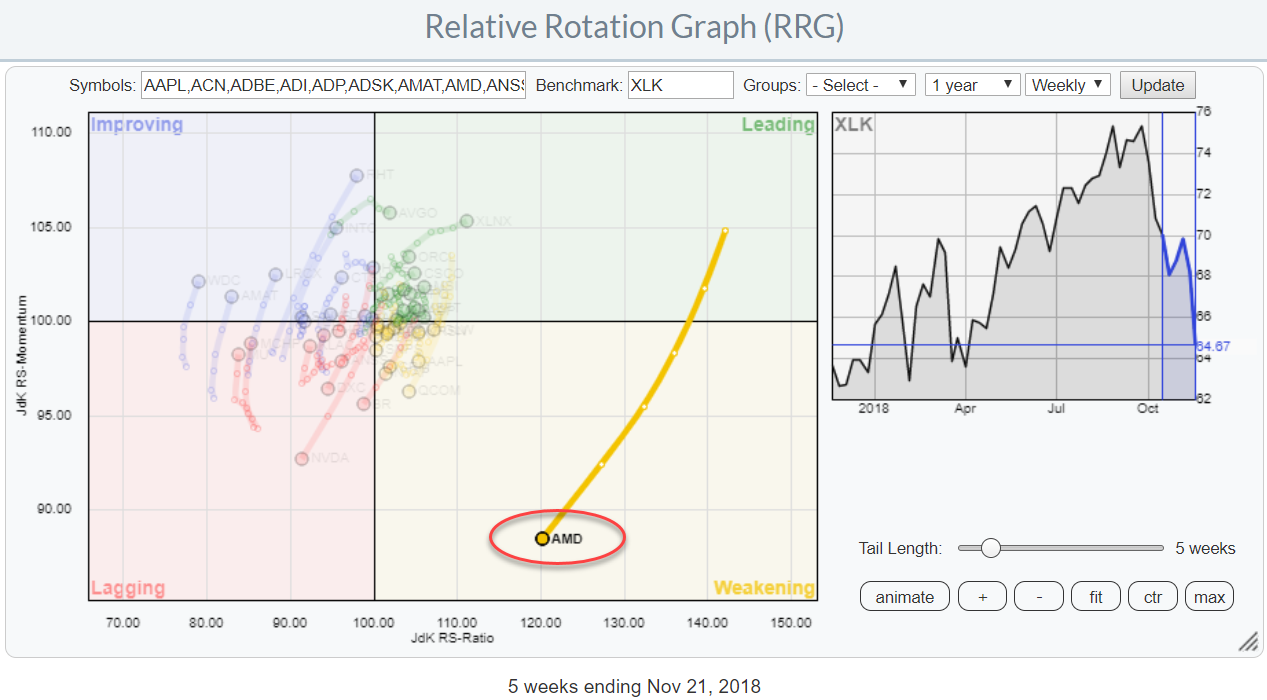

This Technology stock lost 50% of its value but is now hitting support levels.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for the technology stocks in XLK (Technology select sector SPDR) shows one big outlier that recently went through a big rotation. It crossed from improving to leading in June then pushed to a JdK RS-Ratio value over 140 before rolling over. Three weeks ago the rotation...

READ MORE

MEMBERS ONLY

Plotting breadth indicators on Relative Rotation Graphs - Part I

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my contribution to last week's Chartwatchers newsletter, I mentioned my current experiment on using breadth indicators on a Relative Rotation Graph.

In this article, I want to take a look at a few of these setups side by side and see if there is indeed a leading...

READ MORE

MEMBERS ONLY

Experimenting with breadth on Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Various breadth indicators are used to analyze the underlying strength or weakness of a broad market index like the S&P 500 index or NYSE. Over the years a number of different breadth indicators have been developed and/or used in their work by well known technical analysts.

A...

READ MORE

MEMBERS ONLY

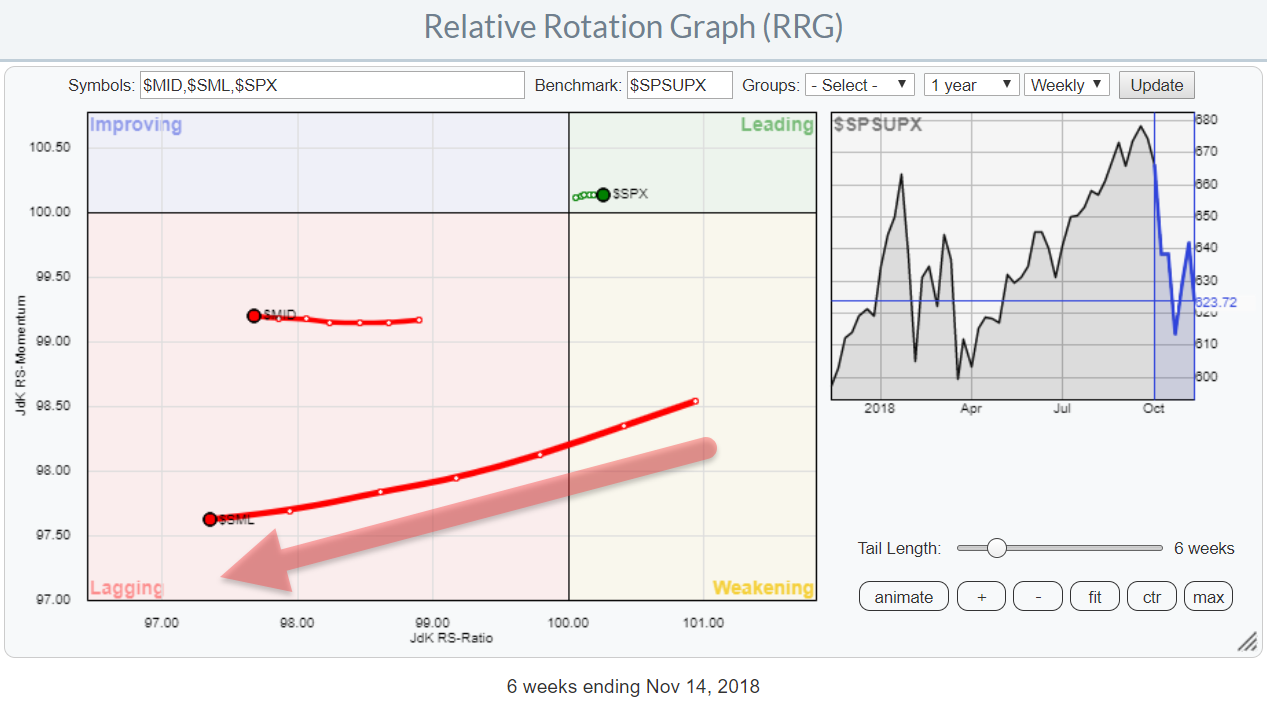

Small cap stocks are leading the market lower.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

There are many indexes available to monitor and analyze the stock market. The S&P500, together with Daddy "Dow" being among the more popular ones.

But the S&P 500, although covering 500 stocks, is only looking at one segment of the total market. Only large-cap...

READ MORE

MEMBERS ONLY

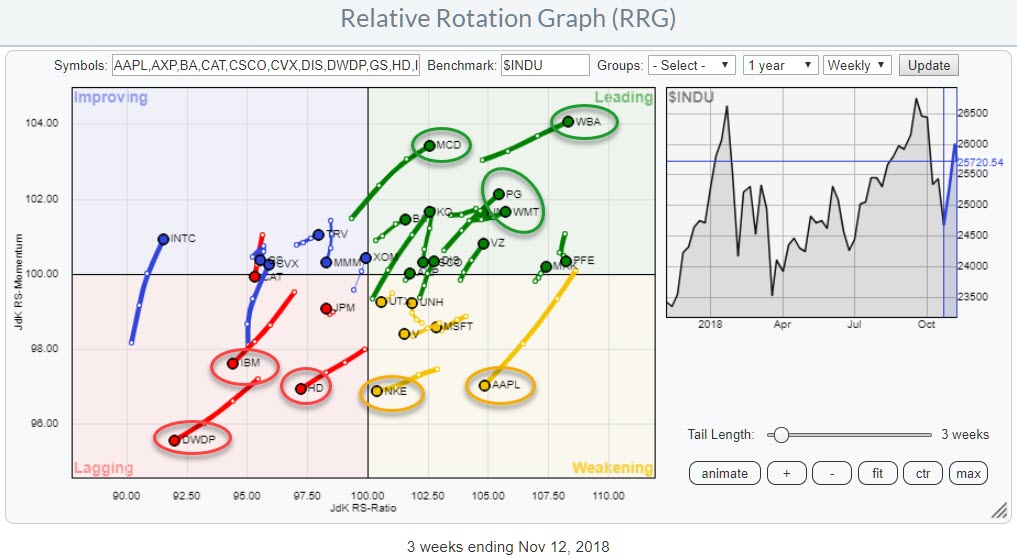

Using RRG to find some good and some not so good names inside the DJ Industrials index.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The relative rotation graph above shows the rotation of the 30 DJ Industrials stocks. Watching the interaction on the canvas, a few rotations catch the eye.

Inside the lagging quadrant IBM, HD, and DWDP are clearly moving deeper into negative territory. On the opposite side inside the leading quadrant, we...

READ MORE

MEMBERS ONLY

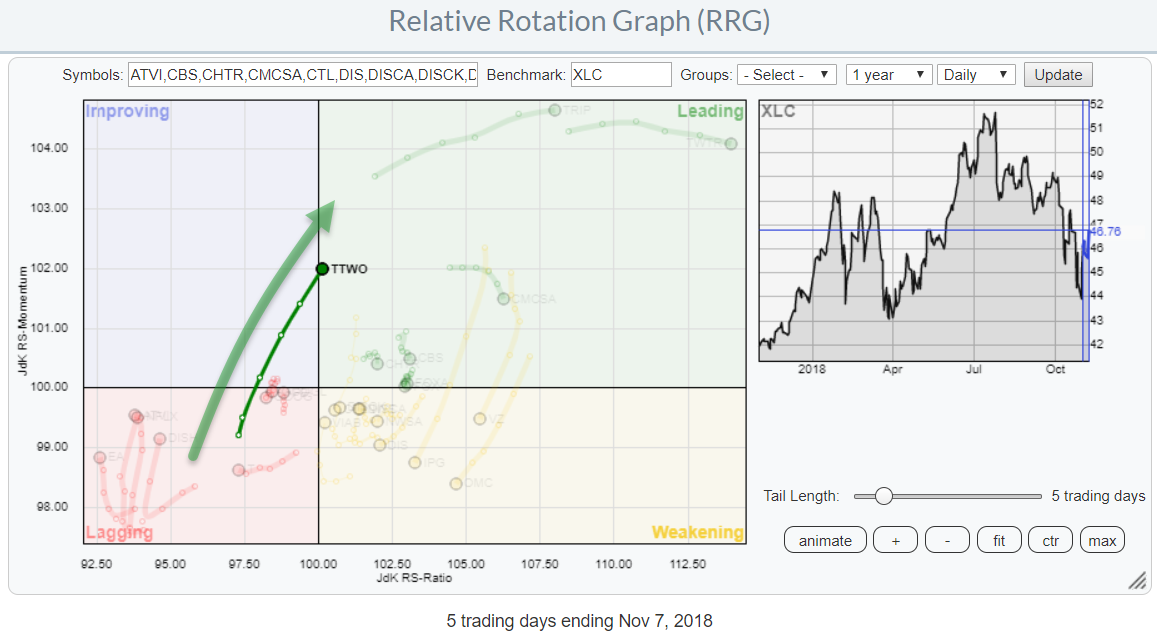

It takes two to tango for TTWO

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While browsing through some Relative Rotation Graphs, looking for DITC candidates, my eye fell on TTWO inside the Communications Services sector.

XLC itself is inside the weakening quadrant vs SPY but very close to the benchmark, meaning that the performance of the sector is very close to that of SPY....

READ MORE

MEMBERS ONLY

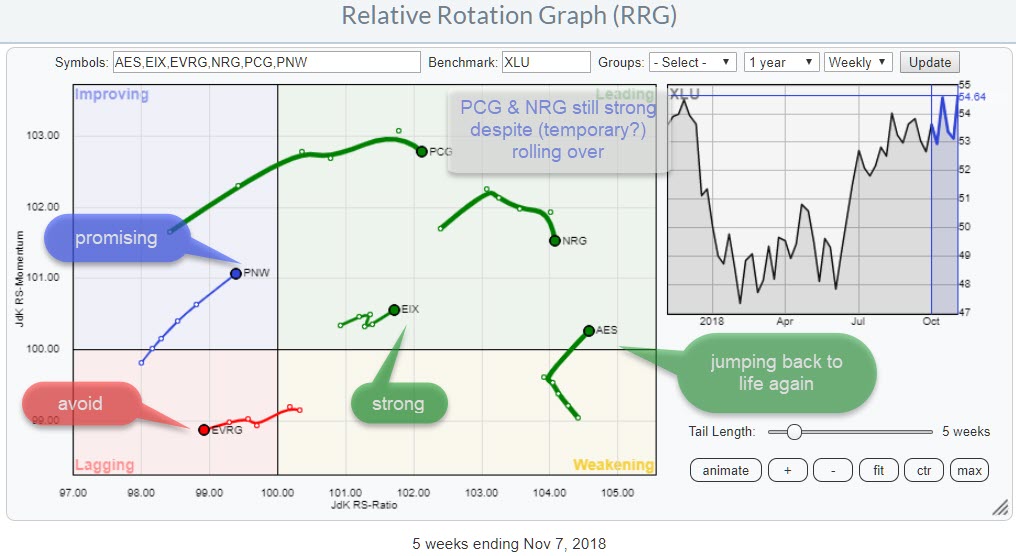

Some utility stocks worth paying attention to

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The relative rotation graph above shows a selection of stocks in the utilities sector. I have created this zoomed in version for better visibility. The fully populated RRG can be found here.

In this post, I will highlight a few of the stocks shown in the picture. As XLU is...

READ MORE

MEMBERS ONLY

Two stocks in the Consumer Staples sector that could offer shelter when needed.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this blog post, I want to do a quick top-down analysis to arrive at a few stocks that could help investors to provide shelter in case the current hiccup in the market is ..... well a "hiccup."

The Relative Rotation Graph above shows the rotation of various asset...

READ MORE

MEMBERS ONLY

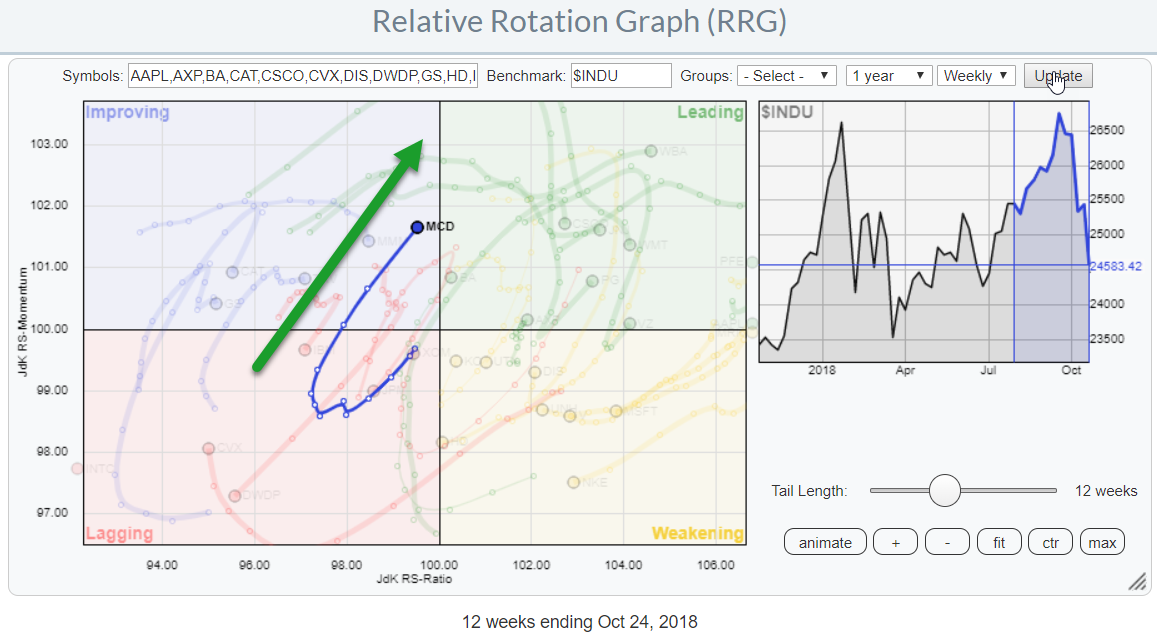

Can I have some fries with that please?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph holding the 30 stocks in the DJ Industrials index, McDonald's (MCD) is one of the names that pop up as potentially interesting. The stock is positioned inside the improving quadrant for a few weeks now and moving towards the leading quadrant at a...

READ MORE