MEMBERS ONLY

Putting things into perspective for the FB face-plant

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Facebook has been making headlines recently. Not only in the newspapers and online news services but also in some of the blogs at Stockcharts.com.

With hindsight everything is easy and we can find many “signals” that “would have” given us early warning signals that we “should” have seen and...

READ MORE

MEMBERS ONLY

A view on Asset Class rotation and the difference between open and closed universes.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week I was the guest of Tom and Erin in their Market Watchers Live show on stockcharts.tv.

In that show, I talked about the difference between open and closed universes and what it means for a Relative Rotation Graph and following that discussion we had a look at...

READ MORE

MEMBERS ONLY

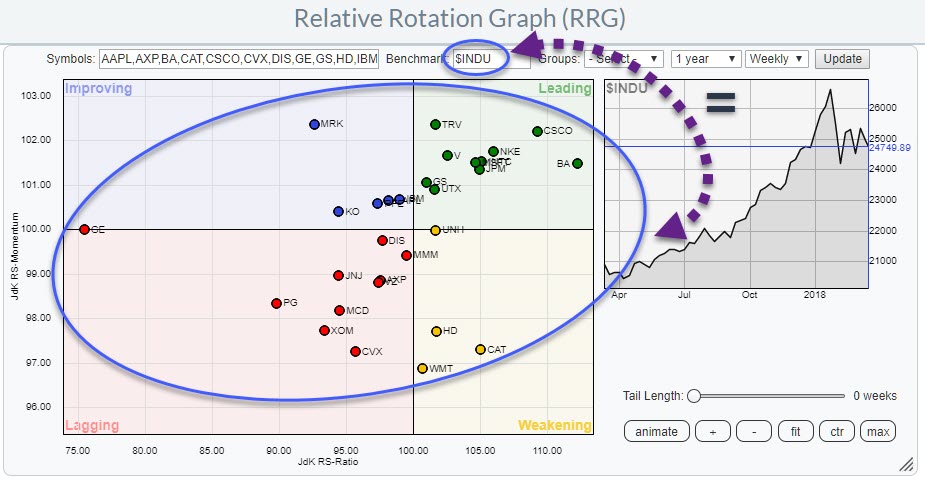

Scanning 30 Dow stocks in two minutes on a Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

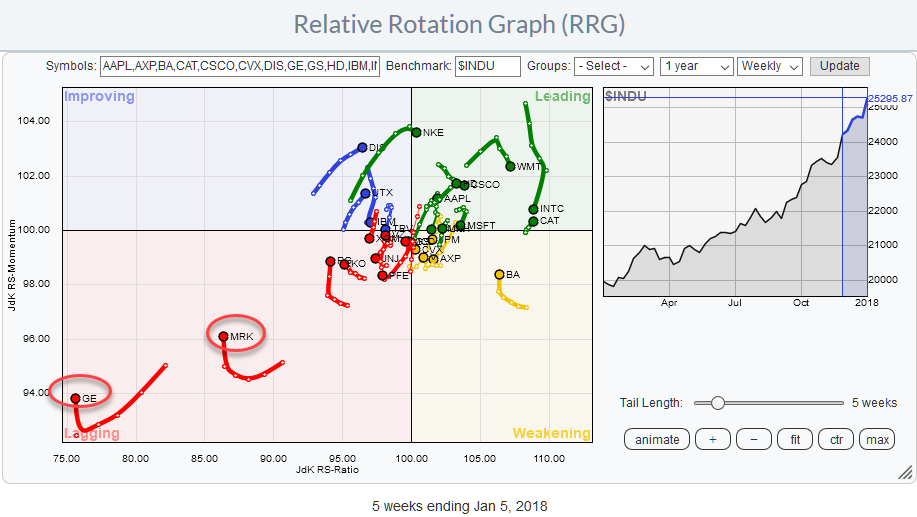

In this blog, I will take another look at the 30 stocks that make up the DJ Industrials index.

A quick look learns that the real outsider in this index is GE which is positioned far to the left on the RRG, moving higher (almost vertical) on the JdK RS-Momentum...

READ MORE

MEMBERS ONLY

Nine tech stocks to watch from an RRG perspective

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

An inspection of the weekly Relative Rotation Graph for US sectors at the beginning of this week (ending 2 March) reveals that we have:

* 3 sectors in leading

* 2 sectors in weakening

* 4 sectors in lagging

* 1 sector in improving

Out of these 10 sectors, we have only 2 at...

READ MORE

MEMBERS ONLY

Painting the US equity landscape using Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are a great tool to visualize sector rotation and that is probably where you will see them applied most. But they can be used for so many more (rotational) variations of different universes or similar universes in a different way.

In this post, I will show you...

READ MORE

MEMBERS ONLY

A few hundred points in the S&P 500.... Who cares?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The rough ride down in the markets last Friday was something that was probably expected by many but still came as a surprise. I am not a big fan of “calling tops”, or troughs for that matter. Mainly because many of these “predictions” have had many failed attempts to “call...

READ MORE

MEMBERS ONLY

Relative Rotation Graphs are sending a clear message for Real-Estate (XLRE) and Utilities (XLU)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

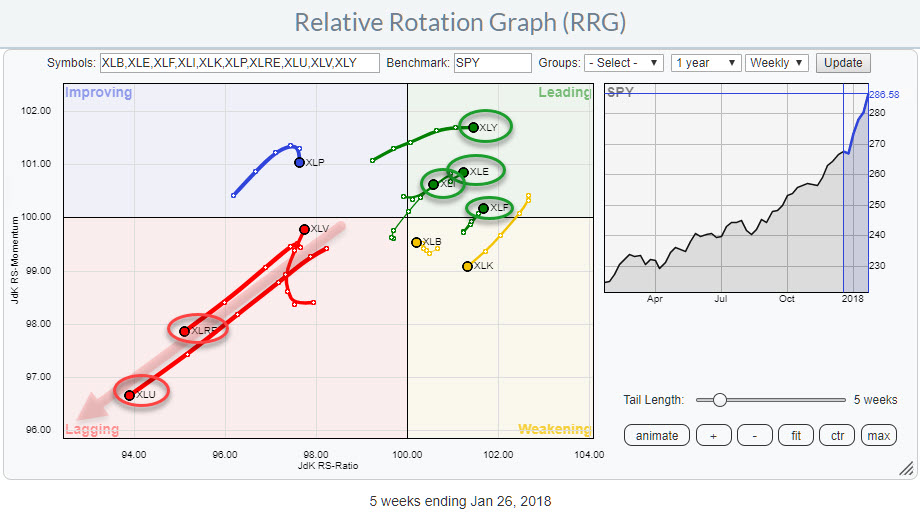

The Relative Rotation Graph shows the positions of US sectors against SPY as of 26 Jan. Sometimes the rotational patterns are not so clear but in this example, there is one observation sending a screaming message:

Avoid Real-Estate and Utilities.

At the other end of the spectrum inside the leading...

READ MORE

MEMBERS ONLY

Using Relative Rotation Graphs(R) to get a handle on both price- and relative rotation in ONE picture

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

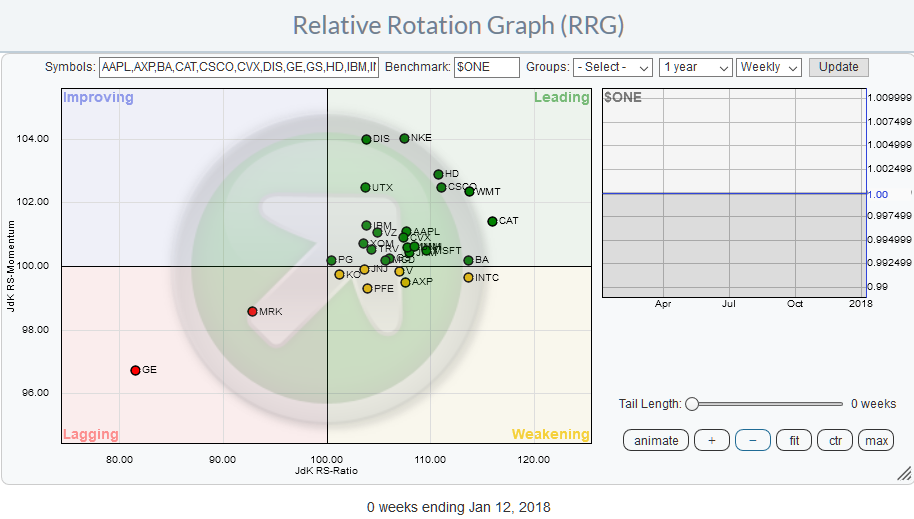

In my last blog, we looked at the 30 components of the Dow Jones Industrials Index and more specifically at the relative positioning and relative rotation of these 30 stocks around their common denominator the DJ Industrials index ($INDU).

And despite the fact that this is valuable information you may...

READ MORE

MEMBERS ONLY

Selecting stocks to watch (and avoid) in the Dow 30 using Relative Rotation Graphs(r)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the members of the DJ Industrials index against $INDU. This is a so-called closed universe which means that all elements that make up the universe are present in the plot. If we would calculate all the distances (vectors) from the center of the chart to...

READ MORE

MEMBERS ONLY

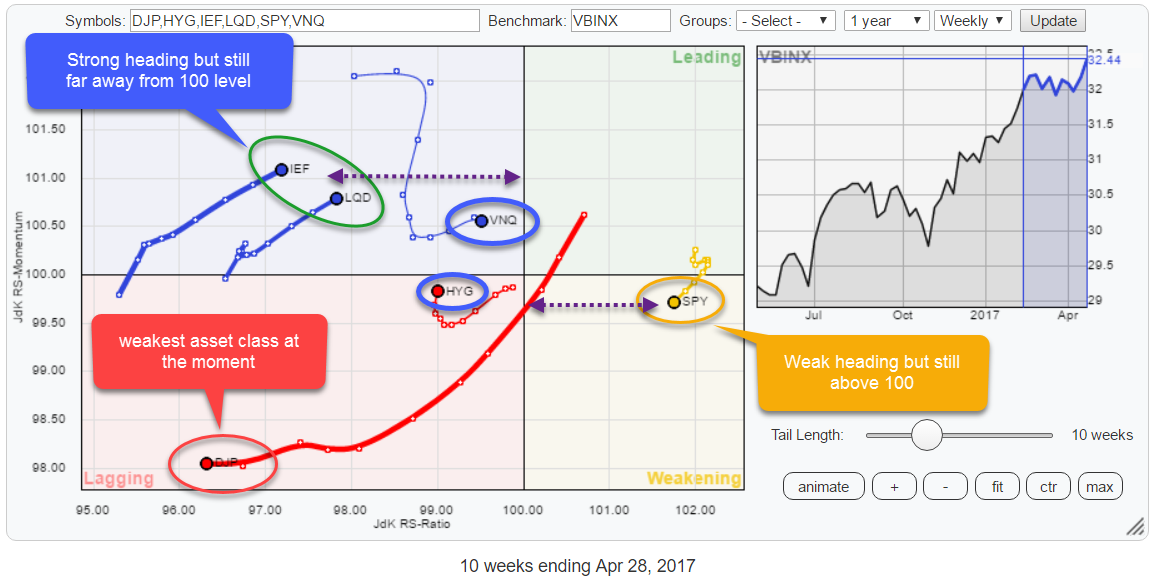

Relative Rotation Graphs suggest to stick with equities (SPY) while keeping an eye on commodities (DJP) going into 2018

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

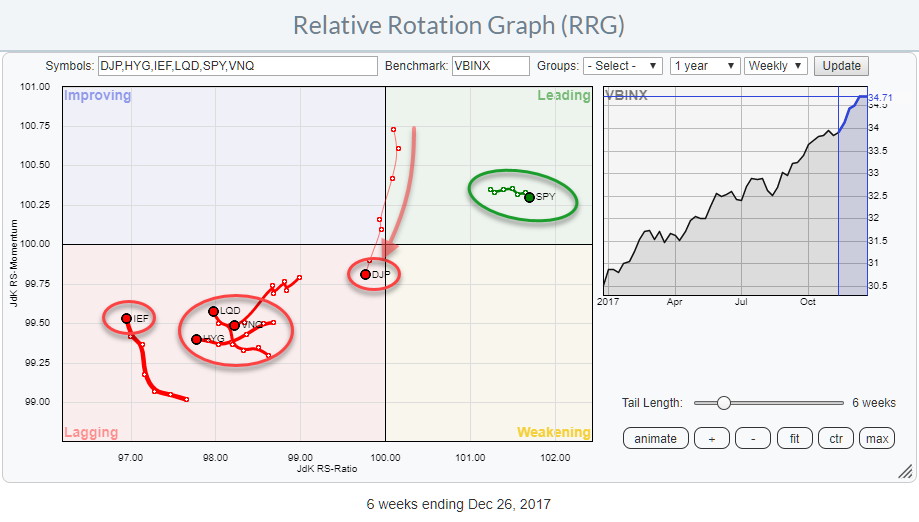

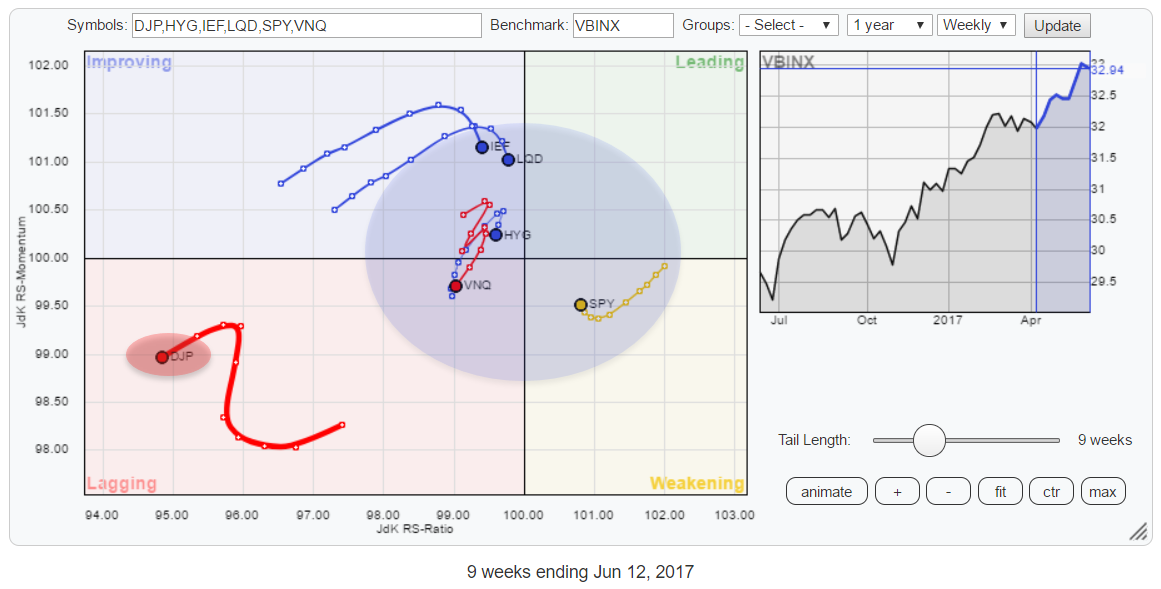

As 2017 draws to an end, the Relative Rotation Graph for asset classes is sending a very clear message!

Equities are leading the way into 2018!

The RRG above shows some ETFs representing various asset classes and uses VBINX, a balanced index fund, as the benchmark.

With only SPY, representing...

READ MORE

MEMBERS ONLY

RRG shows two sectors continuing to carry SPY higher and three sectors to avoid going into the new year

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors is showing us three sectors to avoid but also two which may offer good potential.

Inside the leading quadrant, we find XLK and XLF still being the strongest sector in US equity market based on their JdK RS-Ratio reading.

Energy (XLE) started heading...

READ MORE

MEMBERS ONLY

Responding to comments and answering questions from MWL last week

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week Wednesday (29 November) I was the guest of Tom and Erin in the Market Watchers Live show.

During the show, we talked a lot about RRG, Relative Rotation Graphs, covering some basics and some new(er) techniques and interpretations that I have been working on.

If you missed...

READ MORE

MEMBERS ONLY

GE in freefall while WMT is shooting for the stars on Relative Rotation Graph for $INDU

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

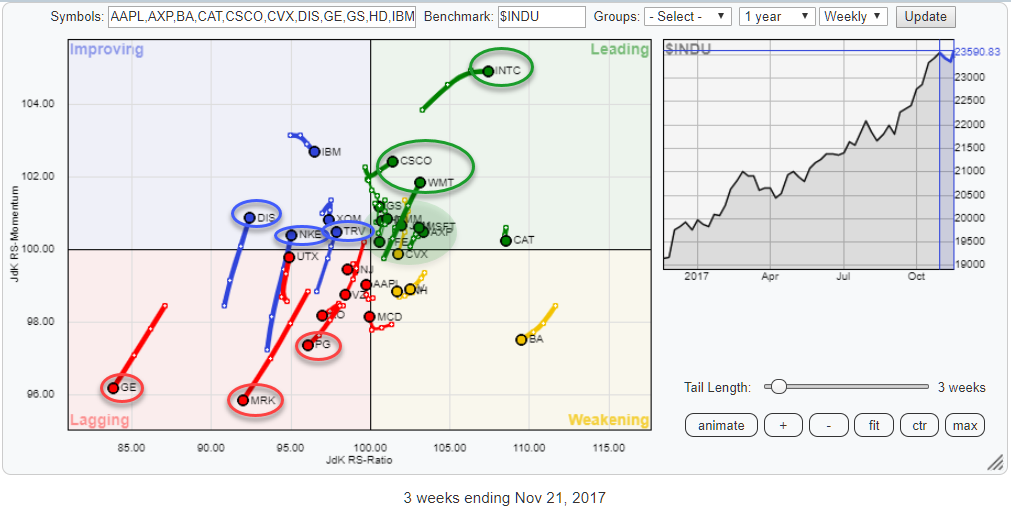

Above is the Relative Rotation Graph for the DJ Industrials index, comparing the relative rotation of all members around $INDU.

On this chart, a few stocks stand out because of their clear directional moves.

Inside the leading quadrant, INTC, CSCO, and WMT are pulling away from the crowd further into...

READ MORE

MEMBERS ONLY

Energy sector bursting into leading quadrant on Relative Rotation Graph, strong potential for EOG and COP

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

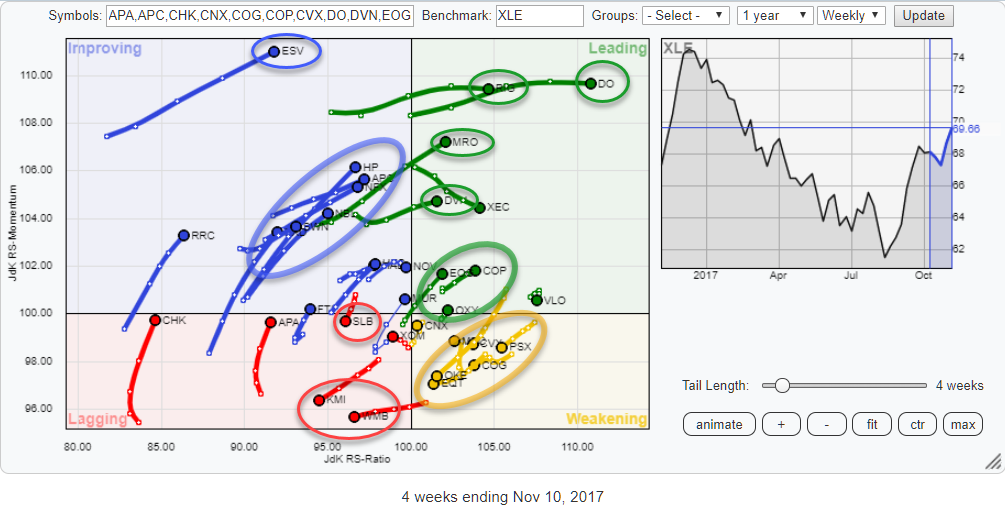

The Relative Rotation Graph above shows all the members of the S&P 500 Energy sector against XLE, the ETF that tracks the Energy sector price index.

The main reason for looking at this universe at the moment is the fact that the sector (XLE) on the RRG for...

READ MORE

MEMBERS ONLY

S&P 500 in nose bleed area? ... Not from this perspective!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above plots a number of world equity markets against the FTSE all-world index and shows their relative rotation around this benchmark.

With all the chatter going around on the S&P 50o index camping in the nose-bleed area this gives a refreshing angle to look...

READ MORE

MEMBERS ONLY

Once again, strong rotation for SPY vs other asset classes on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above holds six ETF that represent various asset classes.

The picture gives you the big picture of what is going on at asset class level on a relative basis against VBINX which is a Vanguard balanced index fund (60% equity / 40% bonds).

This one frame immediately...

READ MORE

MEMBERS ONLY

Using RRG to pick Ford from "most active" table

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the top-right corner of the homepage at StockCharts.com, there is a table that holds "Market Movers". It defaults to the top10 "most active" in the S&P 500 but you can change that using the buttons and drop-downs.

Below the table, you will...

READ MORE

MEMBERS ONLY

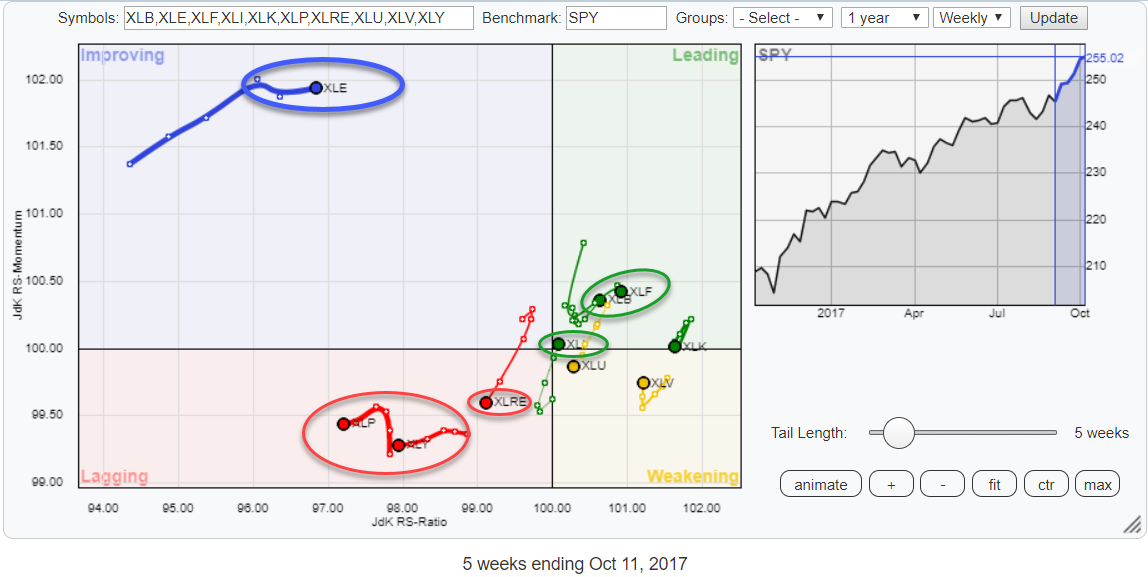

RRG suggests sector rotation out of Real Estate (XLRE) into Industrials (XLI)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

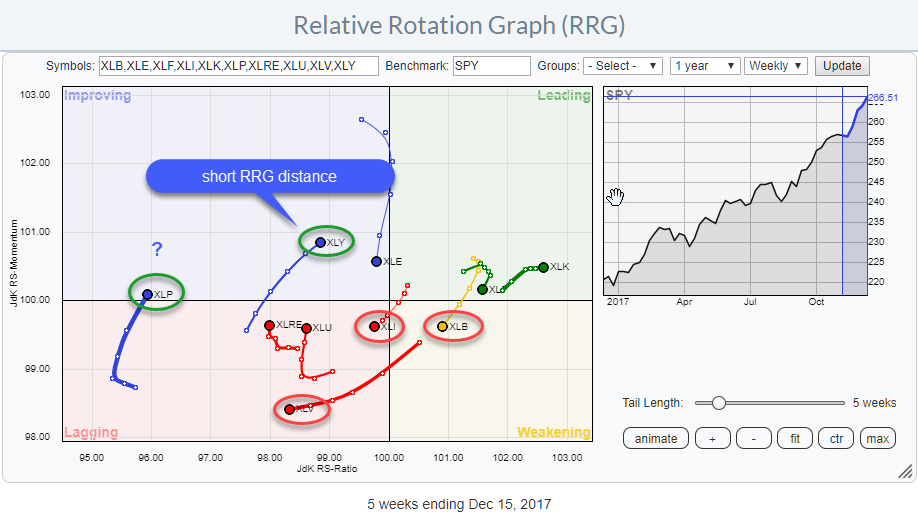

The Relative Rotation Graph for US sectors shows seven sectors clustered around the benchmark in the middle of the graph (SPY) and three of them further away.

XLE is more or less detached from the rest of the universe while XLP and XLY are breaking away together and heading deeper...

READ MORE

MEMBERS ONLY

RRG says you need to keep an eye on Small Caps!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotation of the three size indices that make up the S&P Composite 1500 index.

Although the S&P 500 large cap index ($SPX) is still clearly on the right-hand side of the RRG, making very small rotations close to the...

READ MORE

MEMBERS ONLY

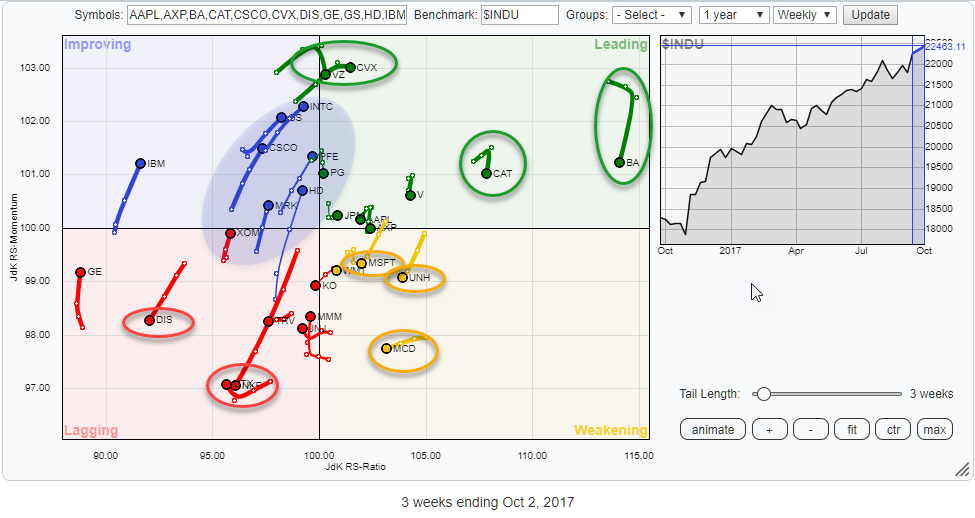

INTC and PFE expected to dominate relative rotation in $INDU while NKE, DIS, and TRV are lagging

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

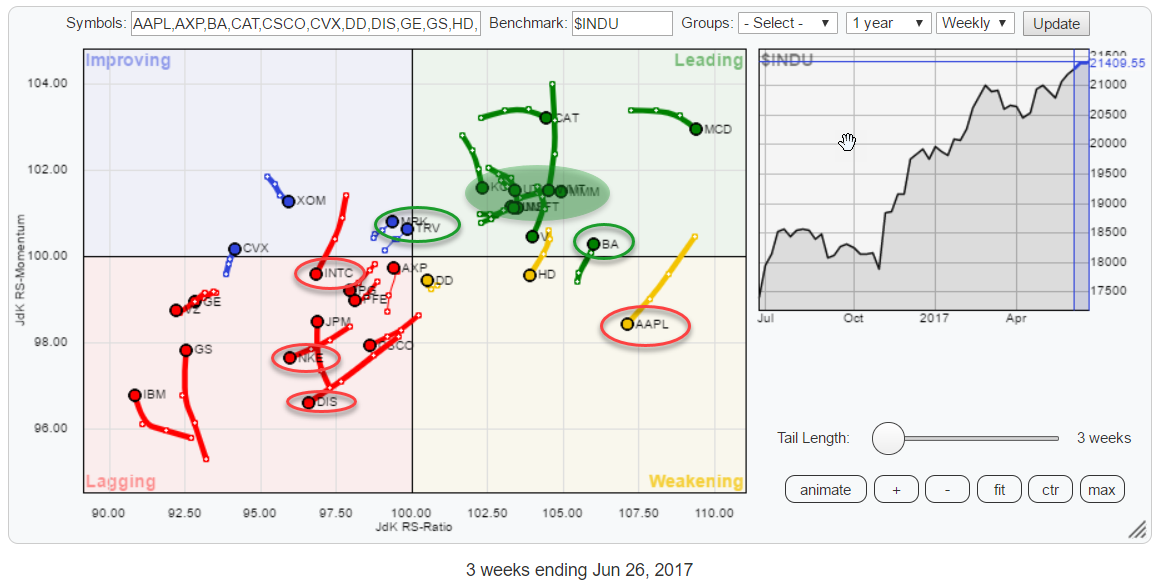

Plenty of actionable rotation towards the edges of the Relative Rotation Graph above. The RRG holds the 30 members of the Dow Jones Industrials index. Scanning around the outside of the chart the following stocks draw the attention.

In the weakening quadrant, MCD is at the lowest JdK RS-Momentum reading...

READ MORE

MEMBERS ONLY

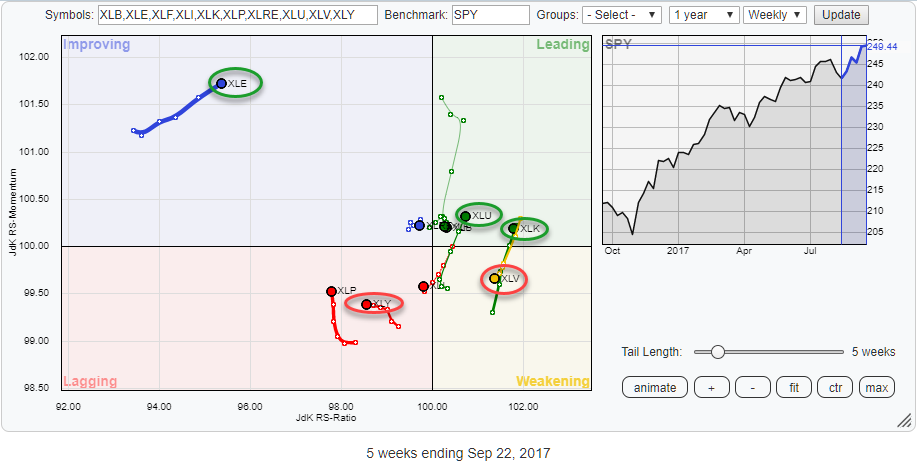

Pair trade opportunity in XLV/XLK and potentially strong (rare) rotational pattern for XLI

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

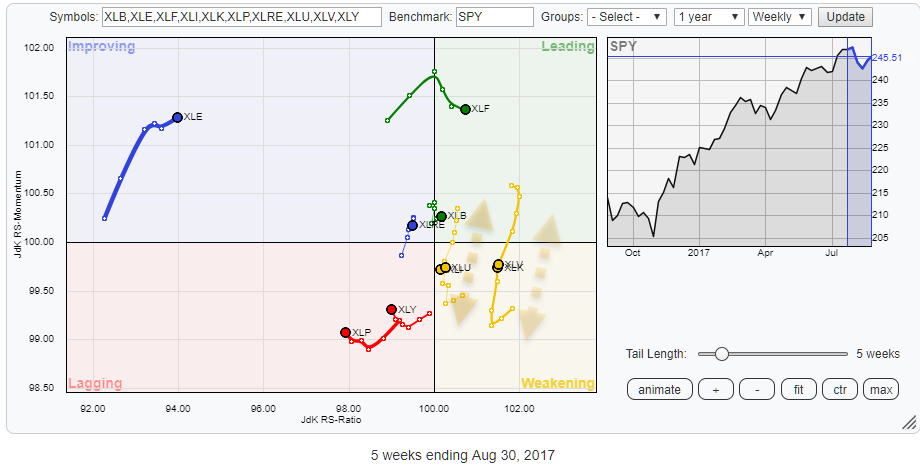

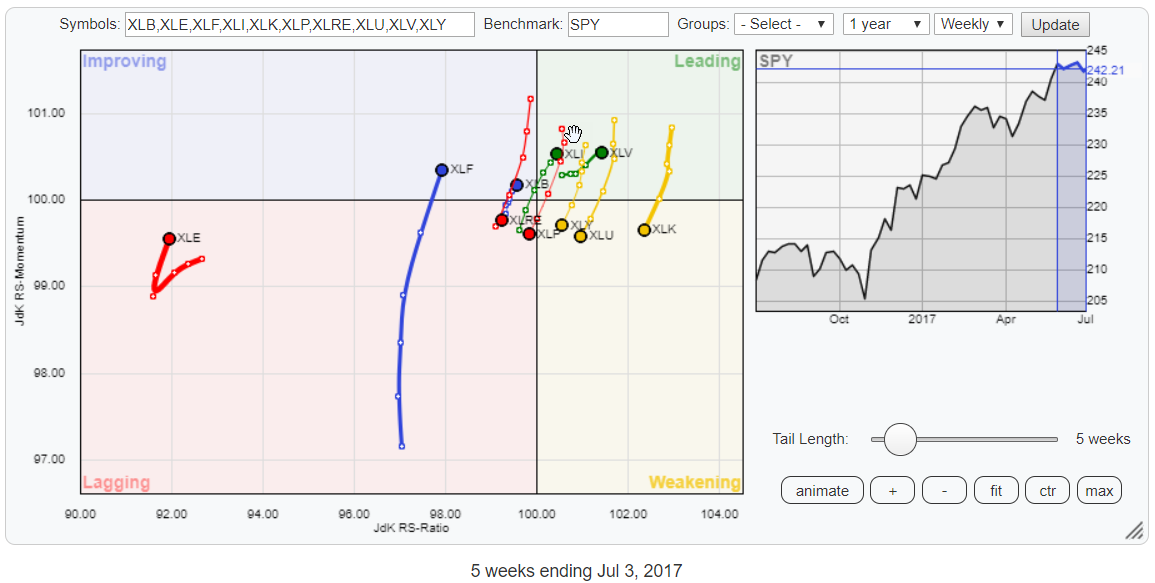

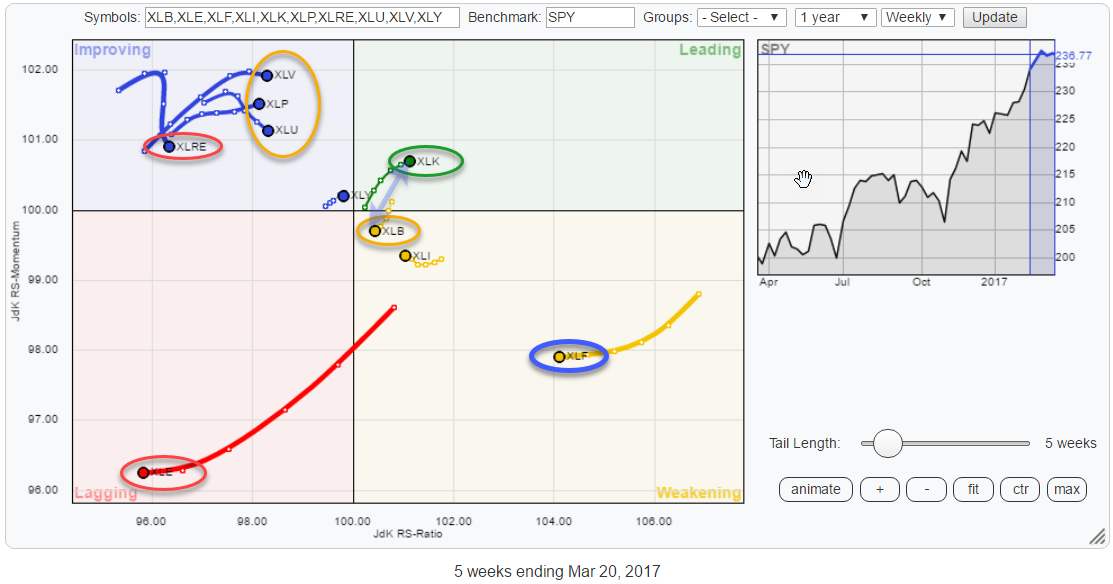

The Relative Rotation Graph above holds the ten sector SPDR ETFs that make up the complete S&P 500 index (SPY).

At the moment the positioning of the various sectors and their rotational patterns are relatively evenly spread over the RRG canvas except for XLE which is far away...

READ MORE

MEMBERS ONLY

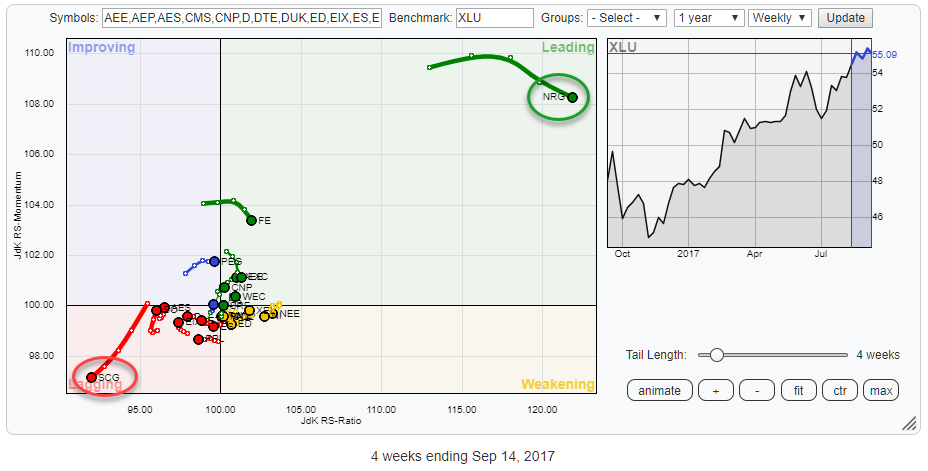

"Boring" Utilities moving up to main stage

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

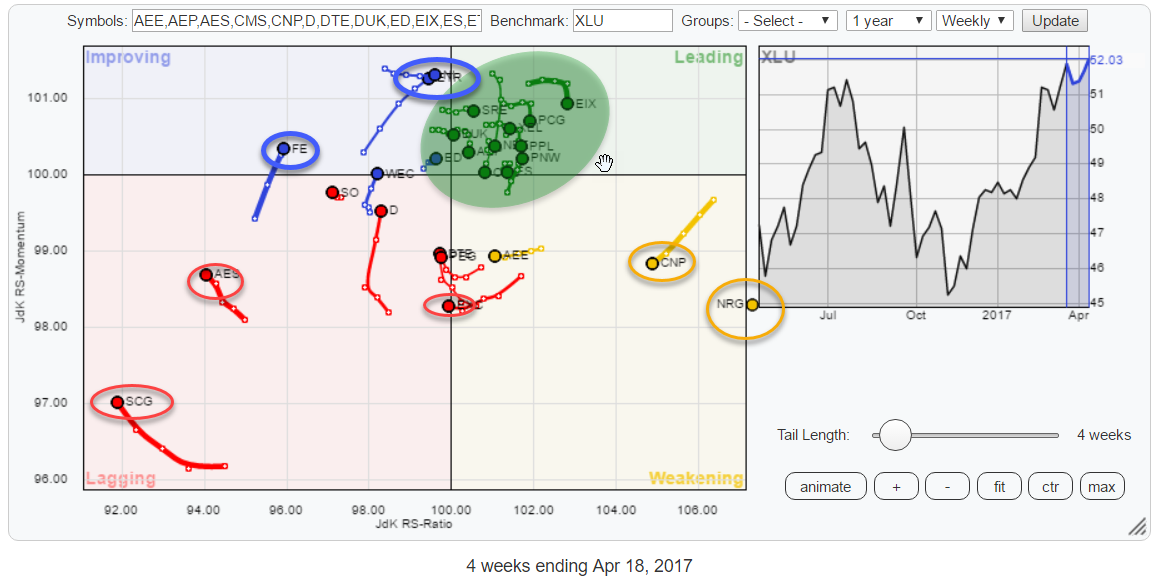

Bringing up the Relative Rotation Graph that holds all members of the Utilities sector (XLU) gives the picture above. With NRG all the way up in the top-right corner of the leading quadrant and SCG in the lower left-hand corner of the lagging quadrant, the remaining stocks in the sector...

READ MORE

MEMBERS ONLY

Is TECHNOLOGY now a defensive sector?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the US sector universe based on S&P 500 indices (ETFs).

Two sectors stand out on this chart. These are Energy (XLE) inside the improving quadrant but at low levels on the JdK RS-Ratio axis, and Financials (XLF) inside the Leading quadrant which...

READ MORE

MEMBERS ONLY

PG and PFE at similar location on RRG but one of them looks much stronger

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

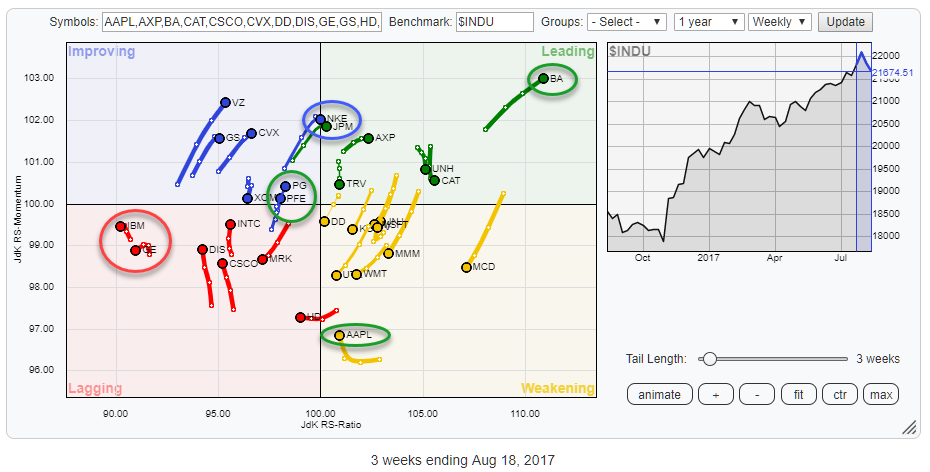

The Relative Rotation Graph above holds the 30 stocks that make up the Dow Jones Industrials Index and compares their relative rotation to $INDU.

From the first observation of this chart, a few tails/stocks catch the eye. First, there is BA in the top-right, leading, quadrant still powering further...

READ MORE

MEMBERS ONLY

SPY returning to leading quadrant on Relative Rotation Graph!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The above Relative Rotation Graph holds some ETFs representing various asset classes and compares the against VBINX, a balanced index fund that holds 60% equities and 40% bonds.

The most striking observation is the fact that there is only one asset class on the right-hand side of the plot AND...

READ MORE

MEMBERS ONLY

What's going on in Materials? (XLB)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

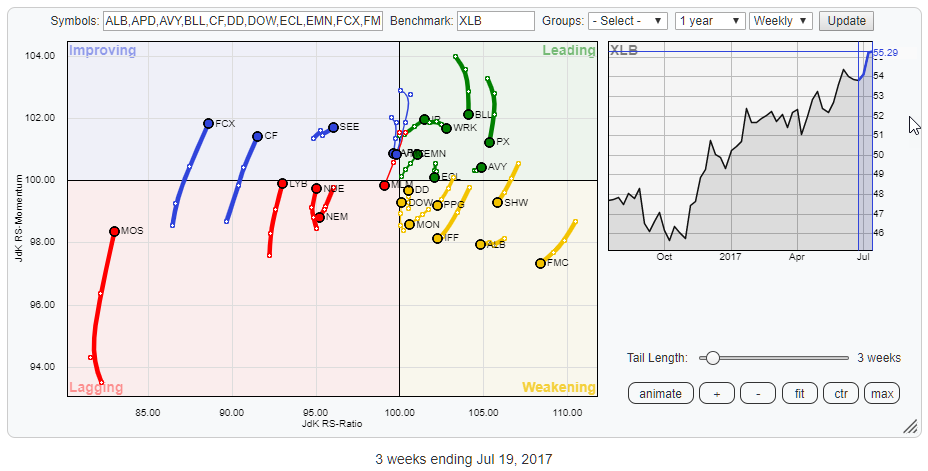

The Relative Rotation Graph above holds the constituents of the Materials sector (XLB). The picture shows a fairly evenly distributed pattern with no real stocks standing out, maybe with the exception of MOS as it has the longest tail of all stocks on the graph while being at the lowest...

READ MORE

MEMBERS ONLY

Which metals hold the most value at the moment?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

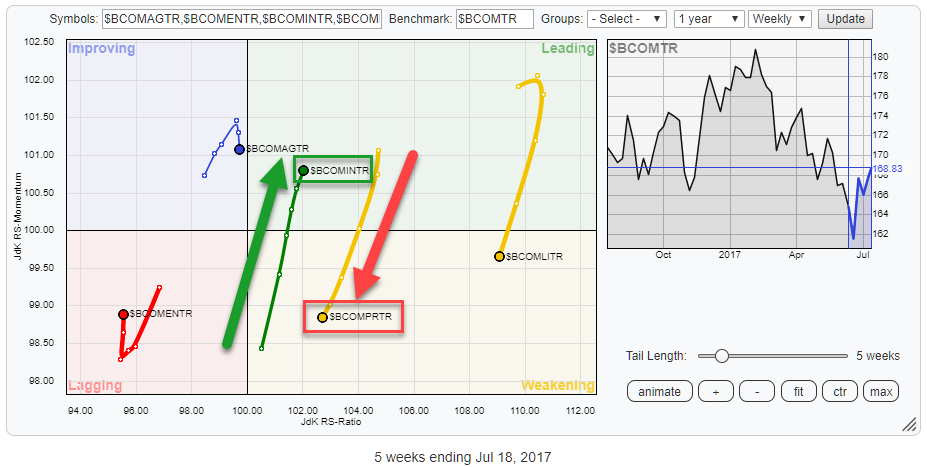

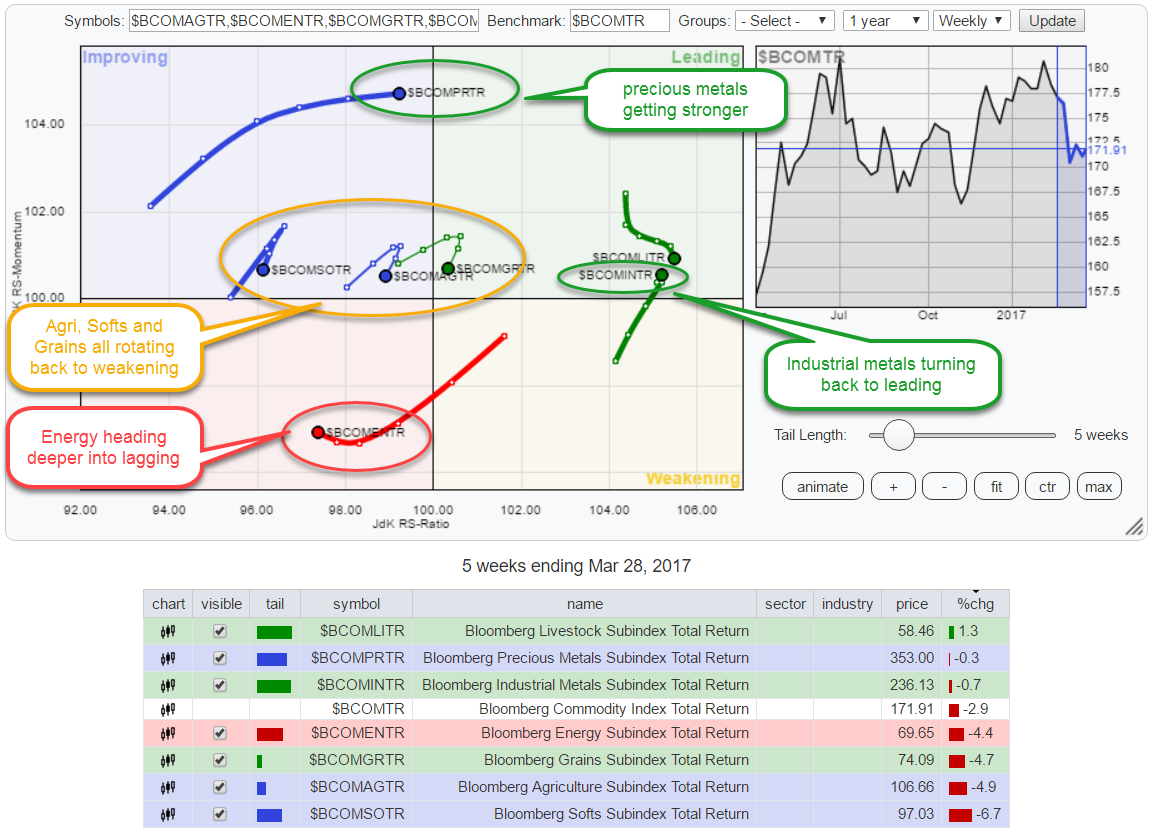

The above Relative Rotation Graph holds the main commodity groups (BCOM family) and uses the Bloomberg Commodity Index as the benchmark.

The opposite directions in the rotations of Industrial metals ($BCOMINTR) and Precious metals ($BCOMPRTR) stand out for me.

As they are both on the right-hand side of the graph...

READ MORE

MEMBERS ONLY

A FOREX pair trade idea from Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

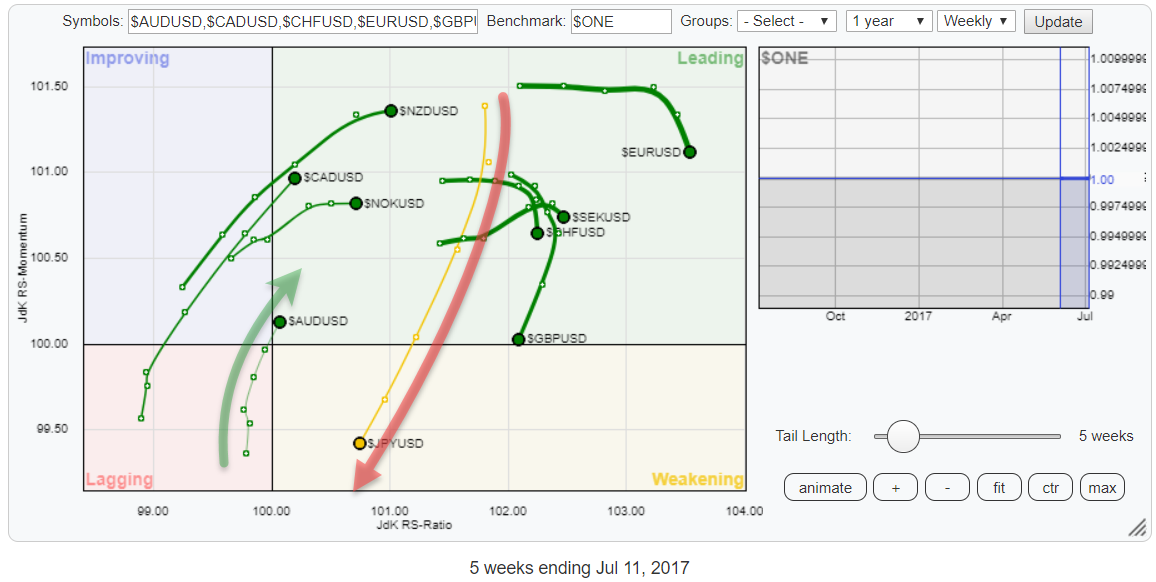

The Relative Rotation Graph above shows the relative rotation, on a weekly basis, for the G10 currencies using the USD as the base.

For a better understanding of how to use RRGs to monitor currency rotation please refer to this blog article on the subject.

Looking at the RRG above...

READ MORE

MEMBERS ONLY

Strong (relative) momentum based rotations among S&P 500 sectors, powerful tail for XLF

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The almost vertical tails on the above Relative Rotation Graph for US sectors indicates a very clear (relative) momentum rotation, sending some sectors from North to South and vice versa.

The two most obvious tails on the RRG are for XLE, far away on the left while sharply hooking upward,...

READ MORE

MEMBERS ONLY

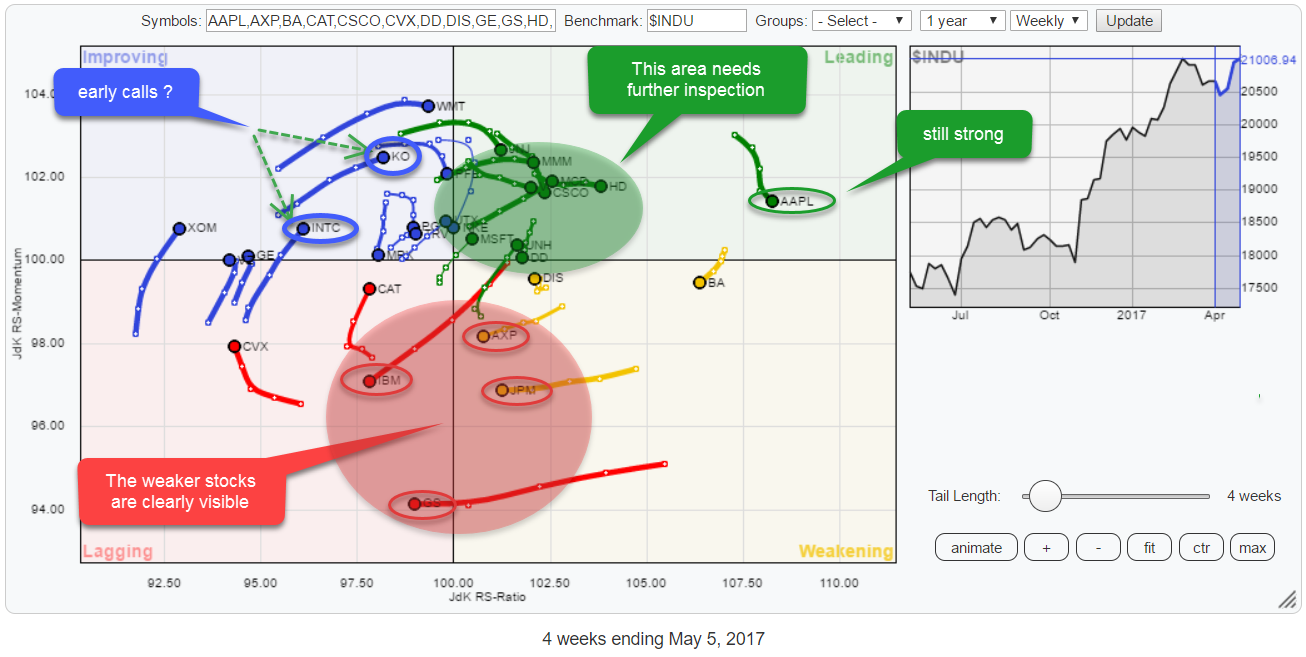

AAPL rotating opposite to BA on Relative Rotation Graph for $INDU

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Watching the 30 members of the Dow Jones Industrials index on a Relative Rotation Graph always provides a great insight into what's going on under the hood of that universe.

The first quick takes from the graph above are a fairly evenly spread universe with no big outliers...

READ MORE

MEMBERS ONLY

Commodities completely detached from other asset classes and equities picking up over bonds again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Relative Rotation Graph for Asset Classes shows Commodities (DJP) far away in the bottom-left corner of the chart, completely detached from the others.

At, by far, the lowest readings on the JdK RS-Ratio axis, DJP moved higher on the JdK RS-Momentum axis for a few weeks but recently turned...

READ MORE

MEMBERS ONLY

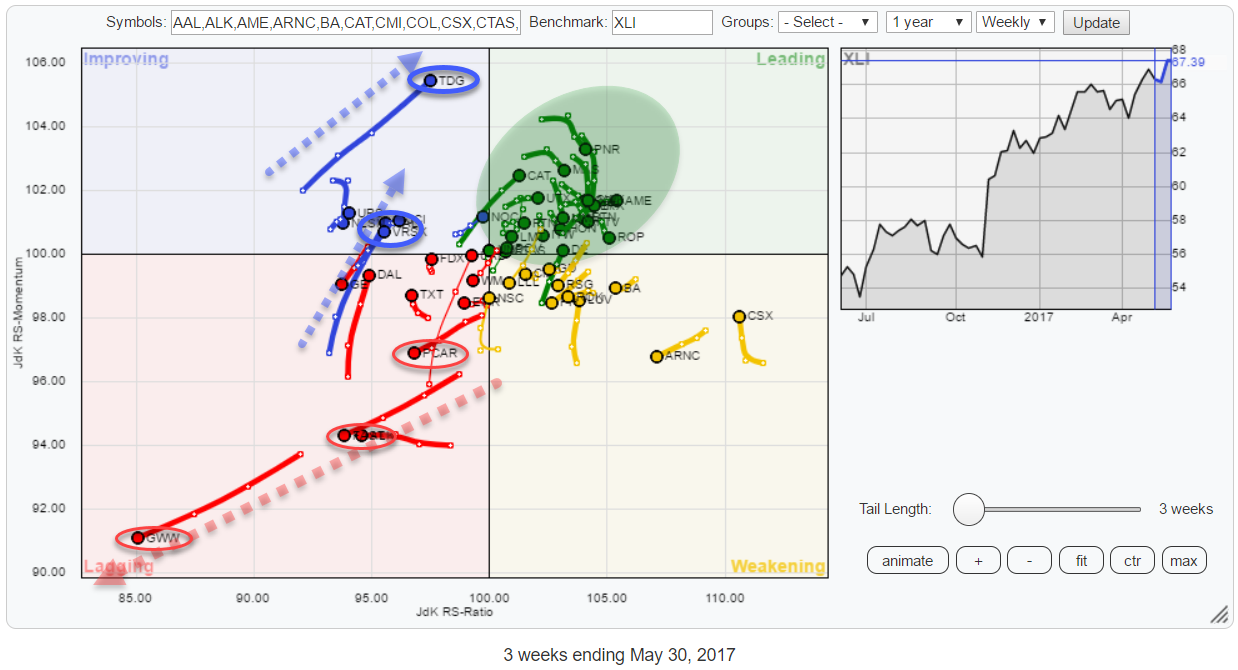

Are you looking at Industrial (XLI) stocks? ..Maybe you should.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Relative Rotation Graph holds the top 50 (based on market cap) members of the S&P 500 Industrials sector index (XLI). This sector accounts for just over 10% of the S&P 500 market cap and is the fifth largest sector in this index. At the moment...

READ MORE

MEMBERS ONLY

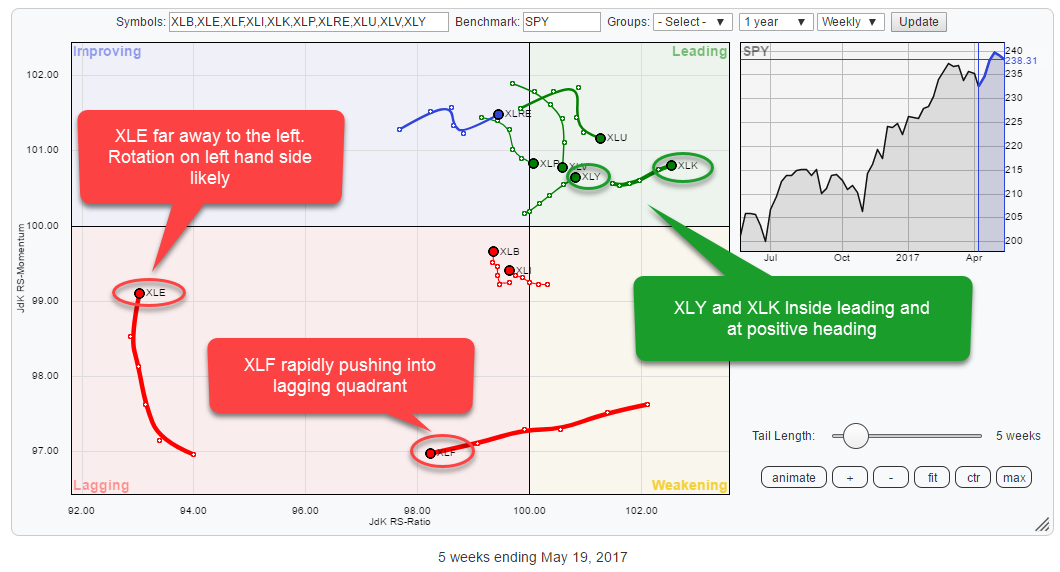

Will Technology (XLK) continue to lead the market higher?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows four sectors with rotational patterns that catch the eye and deserve a further investigation.

Inside the lagging quadrant, these are Energy (XLE) and Financials (XLF) and inside the leading quadrant, I am looking at Technology (XLK) and Consumer Discretionary (XLY).

The balance...

READ MORE

MEMBERS ONLY

Tech stocks inside $INDU looking good on RRG but avoid IBM and financials.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for the 30 DJ Industrials (INDU) stocks once again presents us with some interesting insights.

From the picture above we can read that AAPL is still the strongest stock in this universe with the highest JdK RS-Ratio reading and still inside the leading quadrant. Inside the...

READ MORE

MEMBERS ONLY

No asset class in leading quadrant on RRG but SPY still strongest!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for asset classes shows that not a single category is inside the leading quadrant at the moment and only one asset class, equities (SPY), is on the right-hand side of the plot.

The quick take from this reading is that only SPY, asset class equities, is...

READ MORE

MEMBERS ONLY

Utilities (XLU) moving into leading quadrant, what are the strongest (and the weakest) stocks for this sector?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above holds the stocks that, together, make up the Utilities sector index (XLU).

The keen observer may notice that there is one stock, NRG, positioned in the "gutter" of the chart. This is done on purpose as NRG is so far out to the...

READ MORE

MEMBERS ONLY

RRG suggests favoring Europe over US and Hong Kong over Japan

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

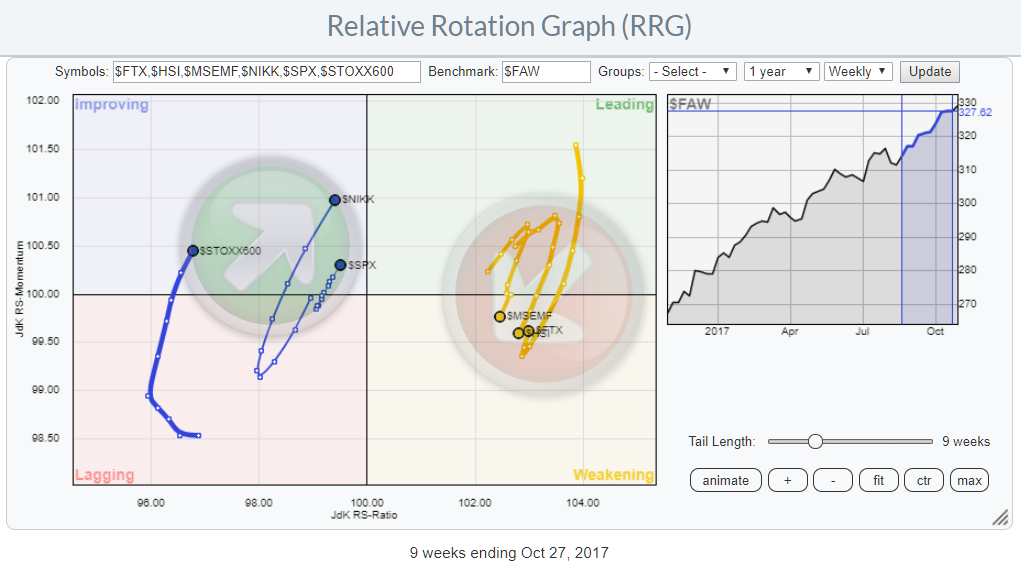

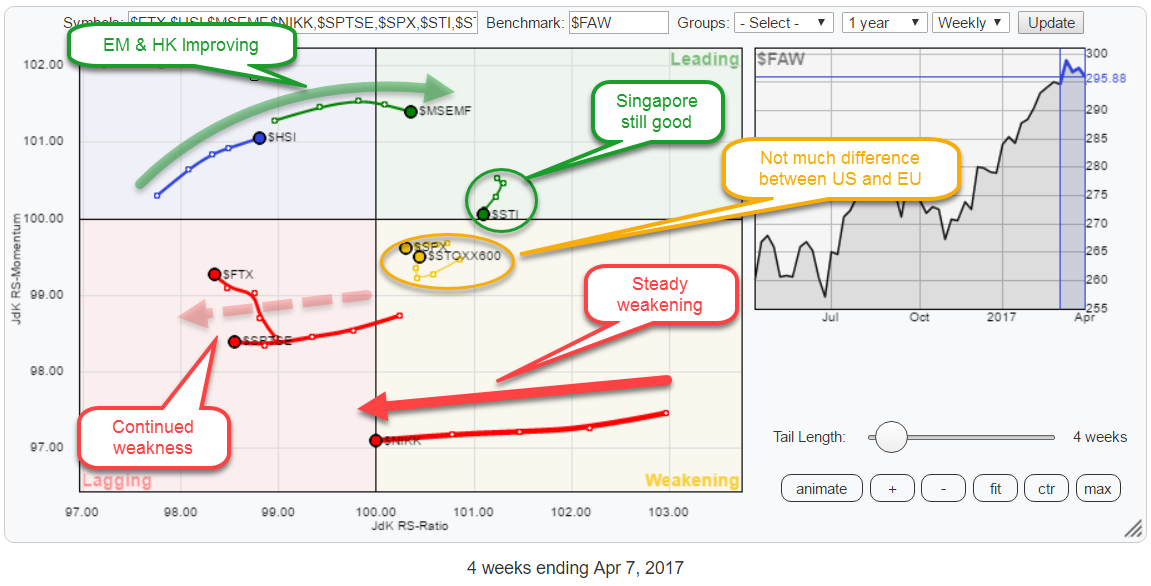

The Relative Rotation Graph above holds some the major world market indices and compares them to the FTSE all world index ($FAW) as the benchmark.

Straight from the RRG above we can make a few interesting observations.

Starting in the lagging quadrant, we find continued weakness for China ($FTX) and...

READ MORE

MEMBERS ONLY

Precious metals shining on Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Most of the time Relative Rotation Graphs are used to visualize stock-related universes but please "Don't Ignore the fact" that RRGs can be used to visualize the rotation of any universe that holds comparable securities.

In the chart above I have plotted the rotations for all...

READ MORE

MEMBERS ONLY

Three breaks and you're out .....

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This post looks at the rotation of US sectors again. The Relative Rotation Graph above holds the ETFs that track the performance of US sectors.

Pretty much immediately the attention goes out to the Energy sector (XLE) and the Financials sector (XLF) as they stand out because of the length...

READ MORE

MEMBERS ONLY

There are two Energy stocks inside $INDU.....

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

... And they both show very weak rotations on the Relative Rotation Graph of the DJ Industrials components.

XOM rotated negatively while inside the lagging quadrant and CVX just crossed over into the lowe-left part coming from weakening. These are the two names to avoid in this universe.

They are closely...

READ MORE