MEMBERS ONLY

The Best Five Sectors, #5

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

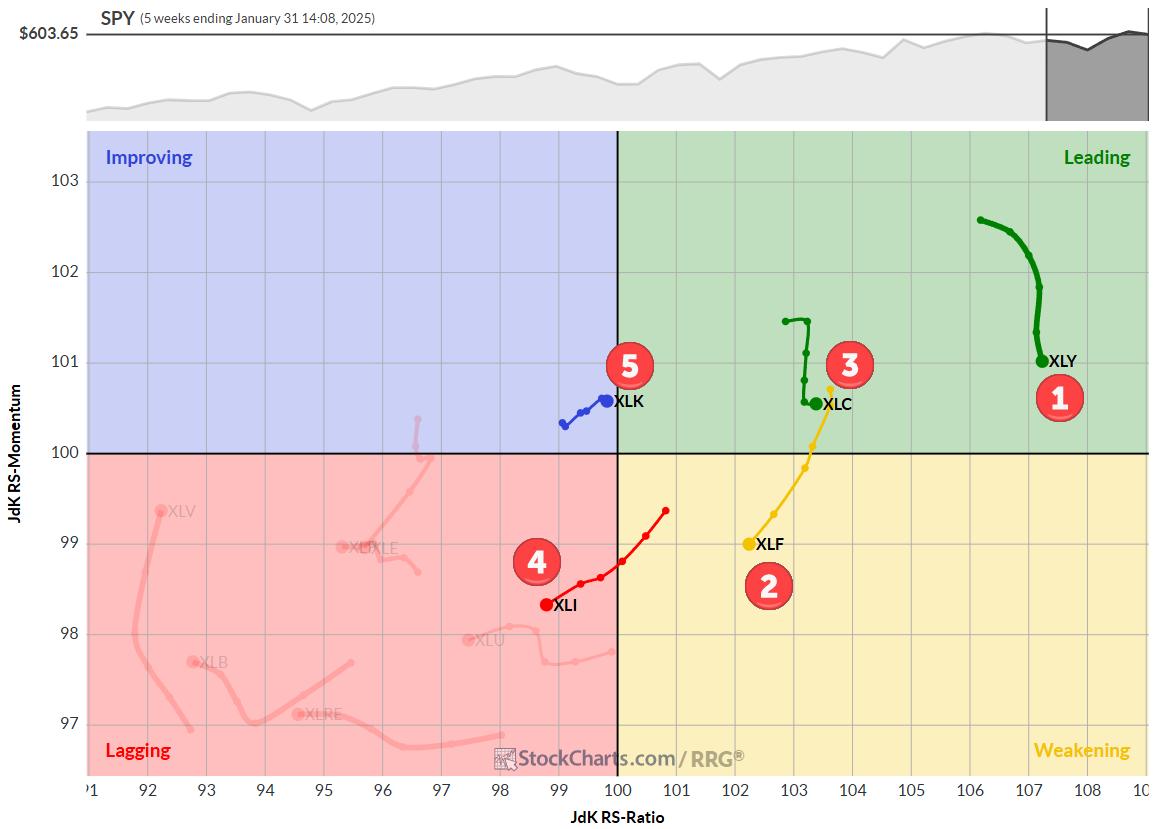

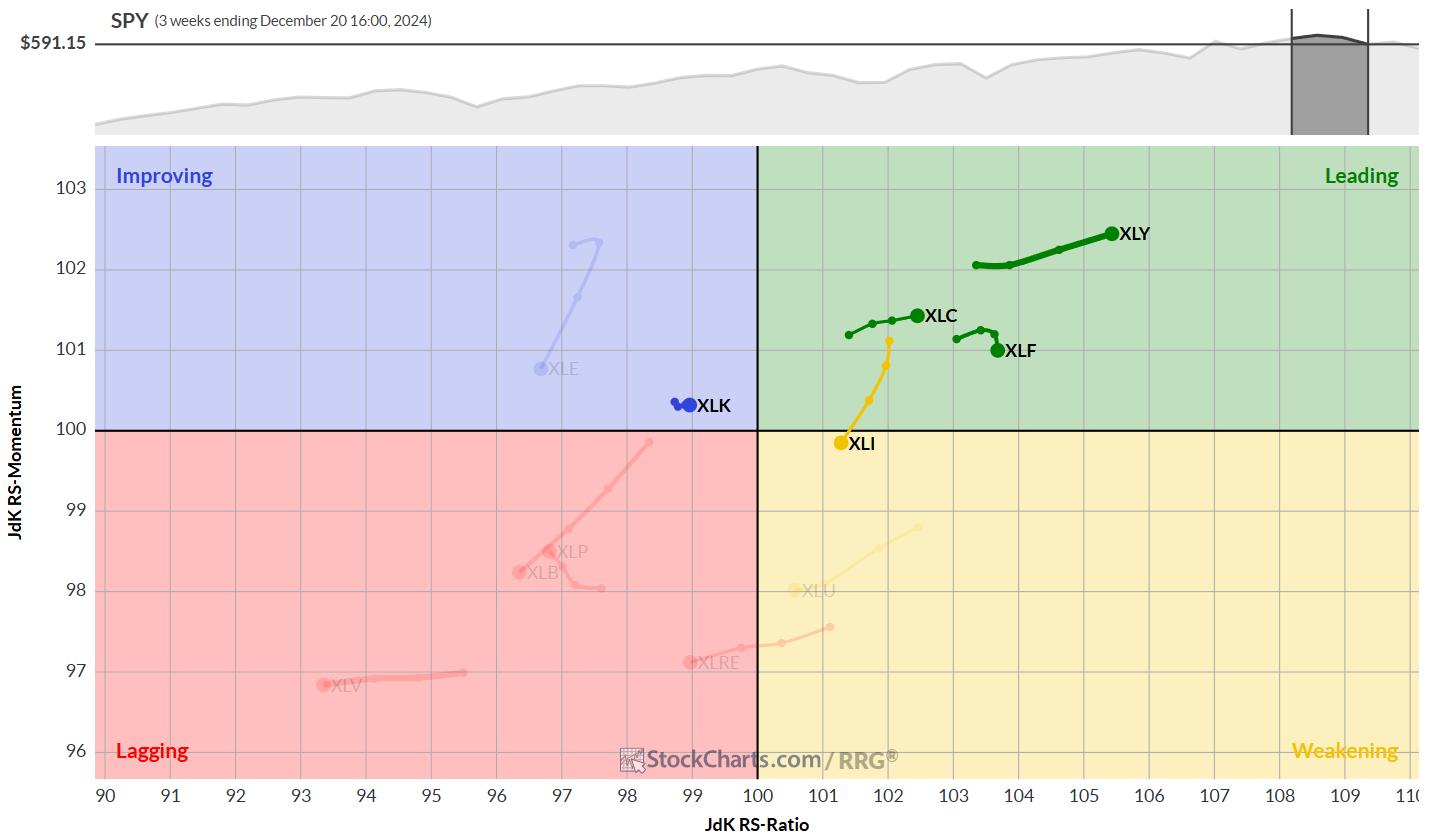

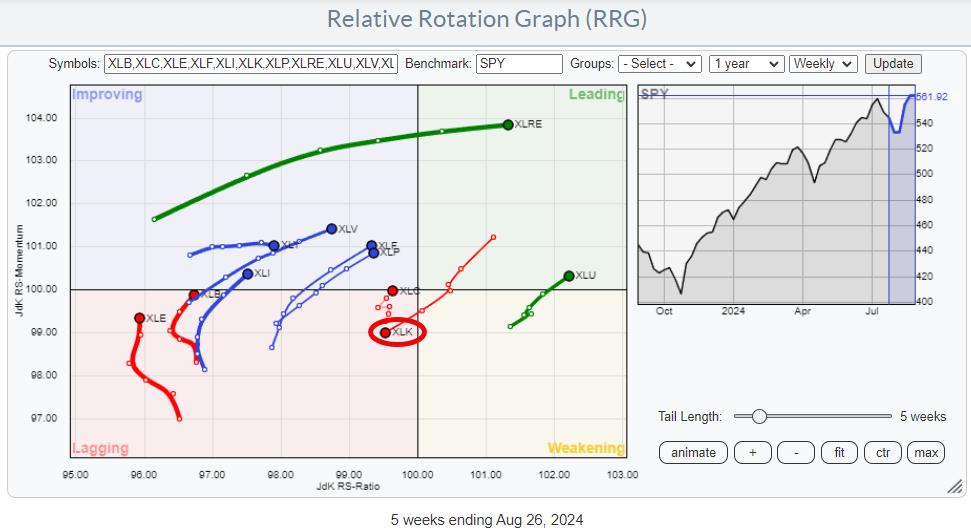

* Technology (XLK) re-enters top 5 sectors, displacing Energy (XLE)

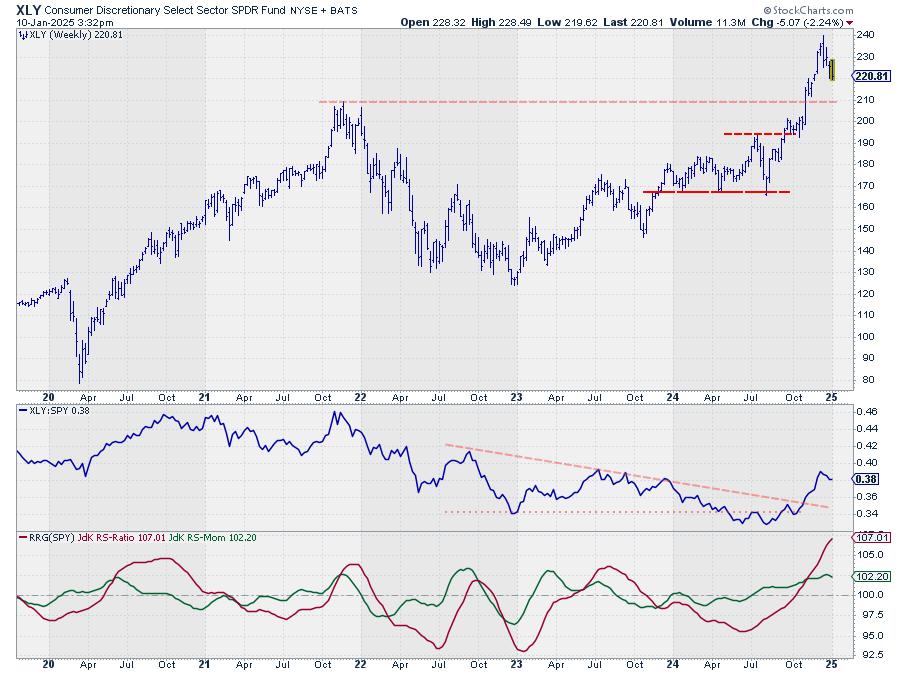

* Consumer Discretionary (XLY) maintains #1 position

* Weekly and daily RRGs show supportive trends for leading sectors XLY and XLC

* Top-5 portfolio outperforms S&P 500 by nearly 50 basis points

Technology Moves Back into Top-5

As we wrap...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #4

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

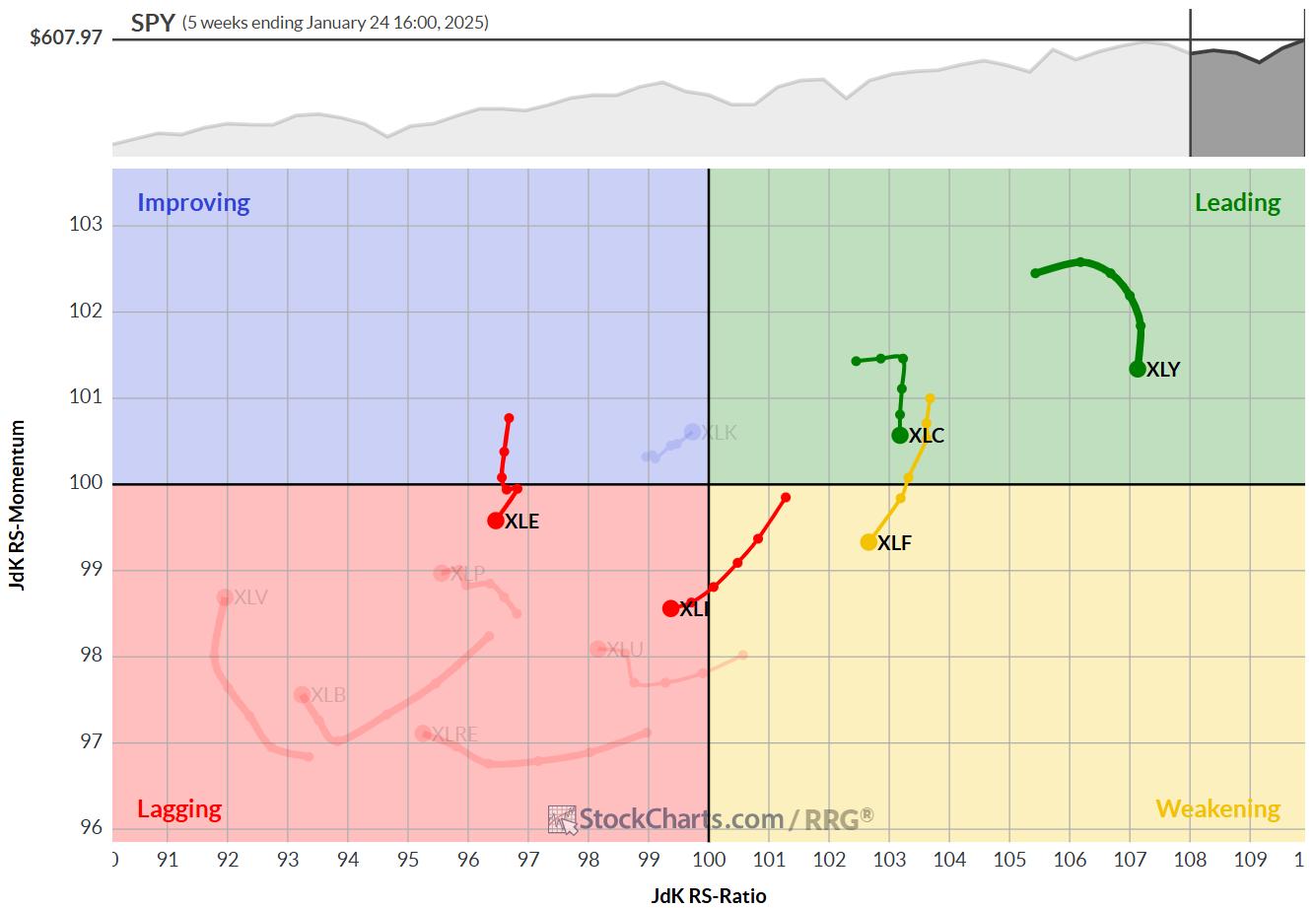

* No changes in top-5 sectors

* XLC showing strong break from consolidation flag

* XLE remains just barely above XLK as a result of strong daily RRG

No changes in the top-5

At the end of this week, there were no changes in the ranking of the top-5 sectors.

1....

READ MORE

MEMBERS ONLY

Energy Picks Up and Consumer Discretionary Continues to Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

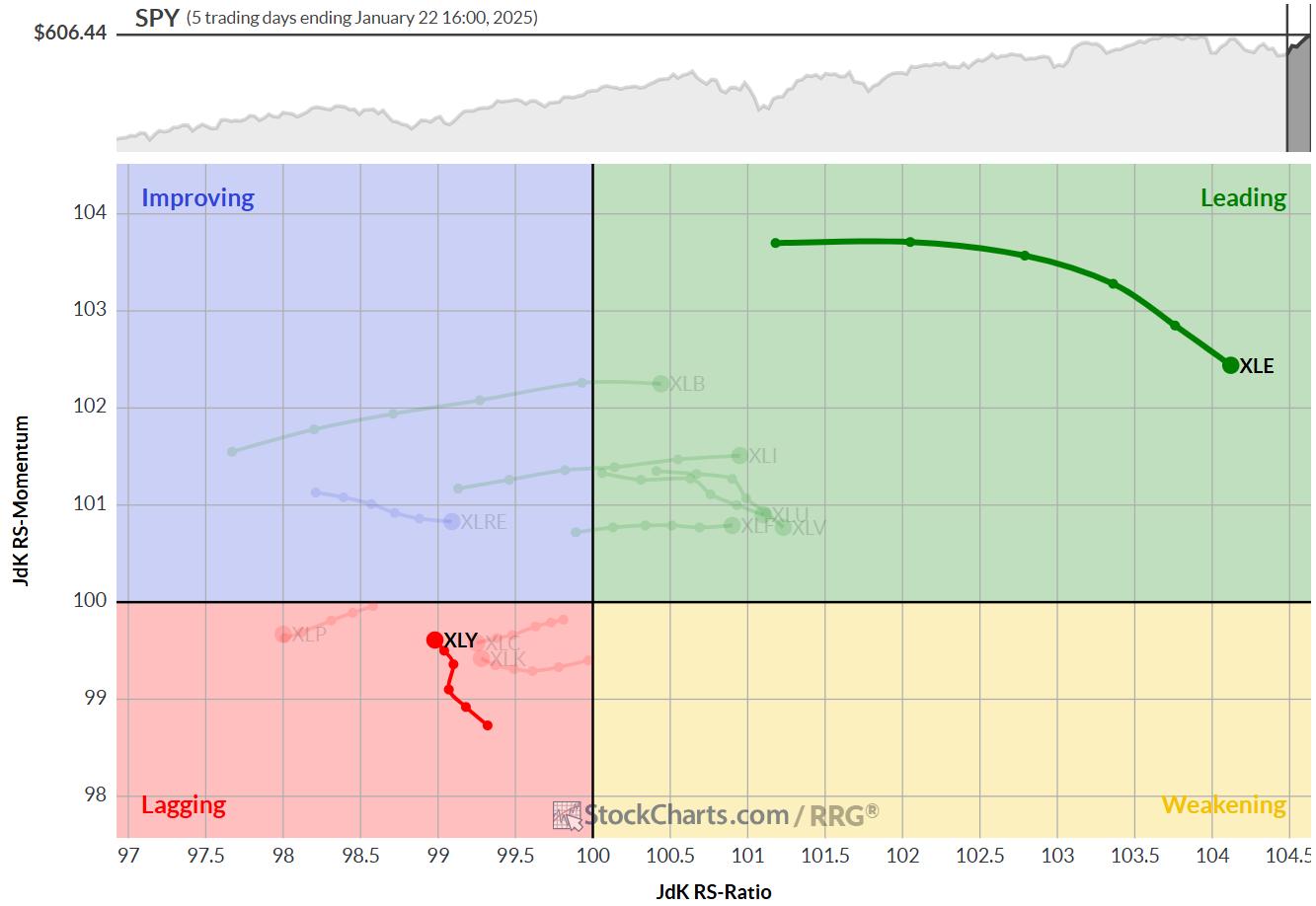

* Short term strength drags enery sector up

* Long term strength keeps consumer discretionary on top

* Massive upside potential ready to get unlocked in EOG

I have been traveling in the US since 1/15 and attended the CMTA Mid-Winter retreat in Tampa, FL 1/16-1/17 and then...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #3

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy replaces Technology in top-5

* Financials rise to #2 position pushing XLC down to #3

* Top-5 portfolio out-performs SPY 0.52%

* A closer look at the (equal) weighting scheme

Energy Replaces Technology

At the end of this week, 1/17/2024, the Technology sector dropped out of the...

READ MORE

MEMBERS ONLY

Stocks UNDER PRESSURE! Which Sector is Leading Now?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius takes a look at asset class rotation on Relative Rotation Graphs. He then addresses the 6 sectors that are NOT in the "best five sectors" for this week. To conclude, he dives into the Technology sector to find some of the best...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #2

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The best five sectors remain unchanged.

* XLC and XLF are both starting to show weakness.

* XLI is holding above support, while XLK remains within rising channel.

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop...

READ MORE

MEMBERS ONLY

THIS is the BEST Market Sector Right Now!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius takes a look at what he recently called "The Best Five Sectors" on a relative rotation graph side-by-side with their price charts. He then takes an in-depth at Consumer Discretionary, and shares some interesting stocks within, including AMZN, ULTA, and more.

This...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #1

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

HAPPY NEW YEAR!!!

Ever since the introduction of RRG back in 2011, many people have asked me questions like: "What is the track record for RRG" or "What are the trading rules for RRG"?

My answers have always been, and will continue to be, "There...

READ MORE

MEMBERS ONLY

Three RRGs to Keep You on Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

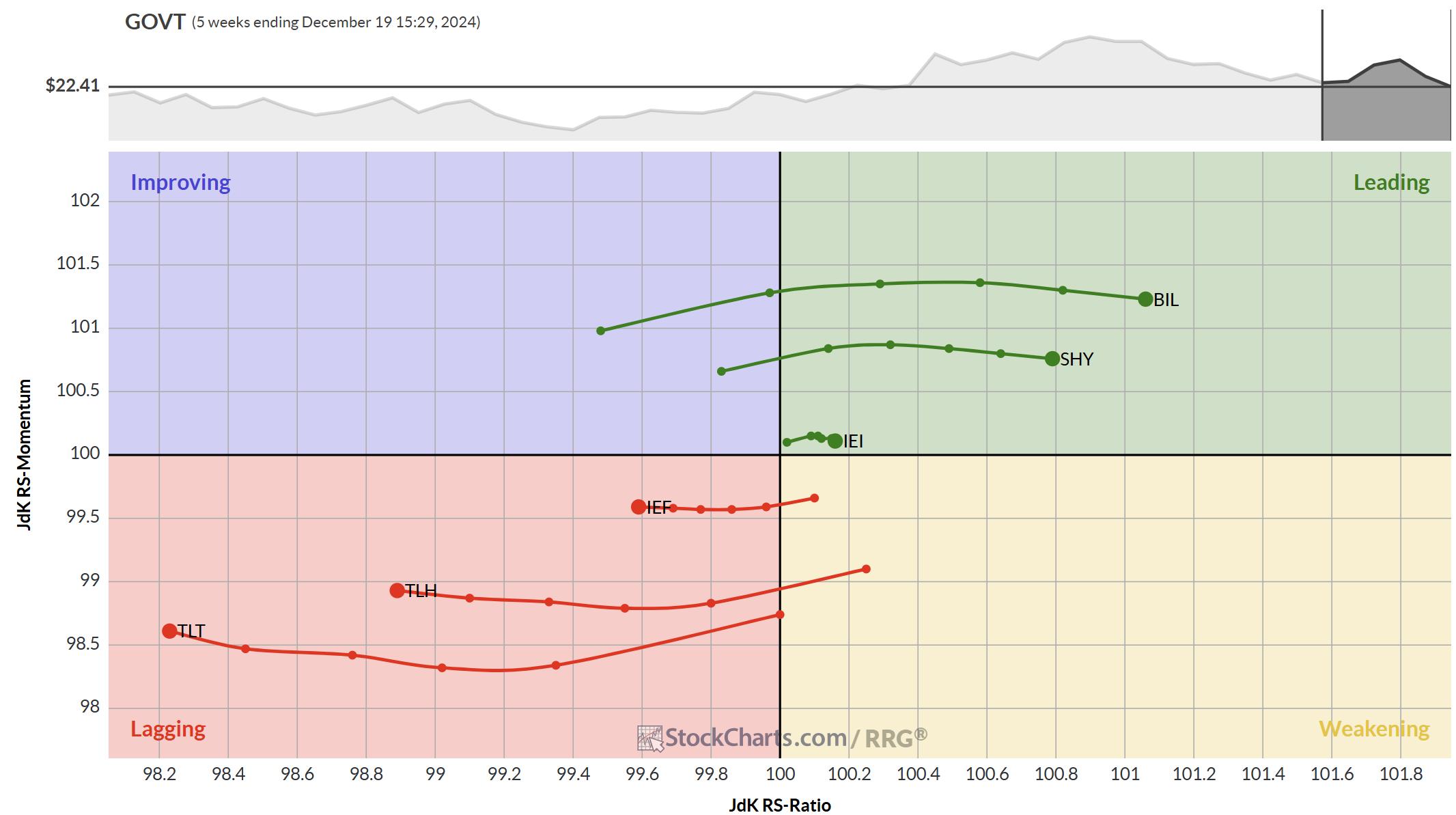

* Track the Yield curve moving back to normal on RRG

* USD showing massive strength against all currencies

* Stock market drop not affecting sector rotation (yet)

The Yield Curve

The RRG above shows the rotations of the various maturities on the US-Yield Curve.

What we see at the moment...

READ MORE

MEMBERS ONLY

Top Techniques for Finding Strength in Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius gives a quick update on sector rotation, then examines the strength uncovered in Consumer Discretionary. He analyzes names like TSLA, AMZN, and LULU; some are in full swing uptrends, but there are also a few names that are on the verge of turning around...

READ MORE

MEMBERS ONLY

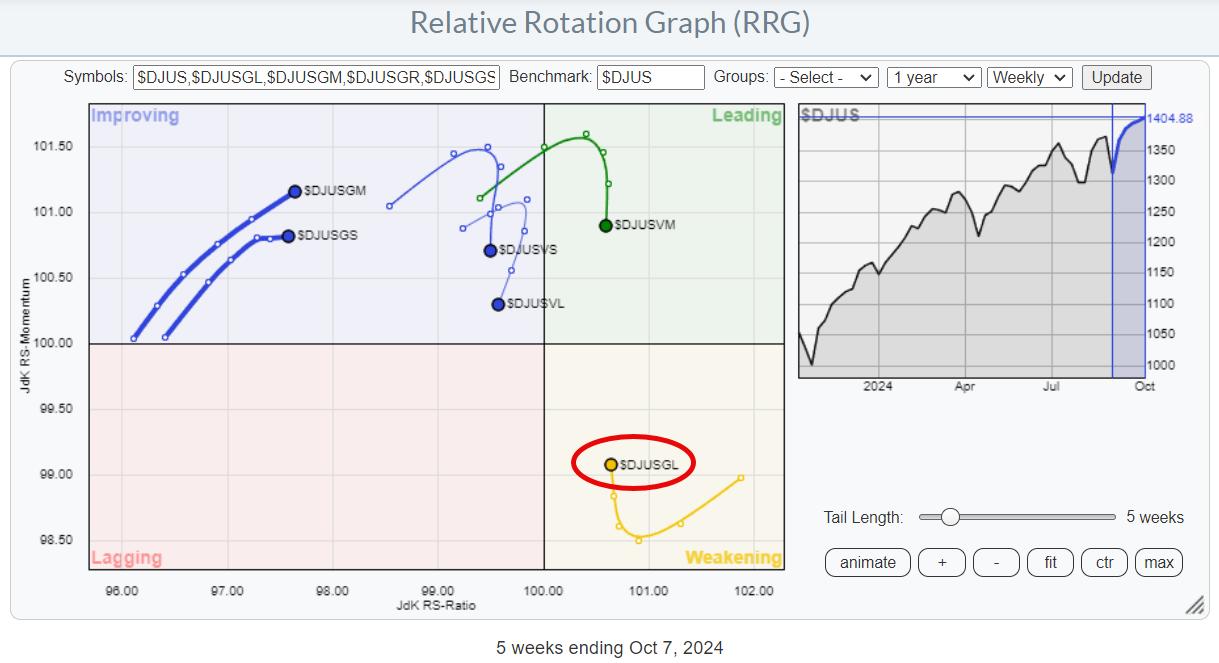

Stay Away from Large-Cap Value Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

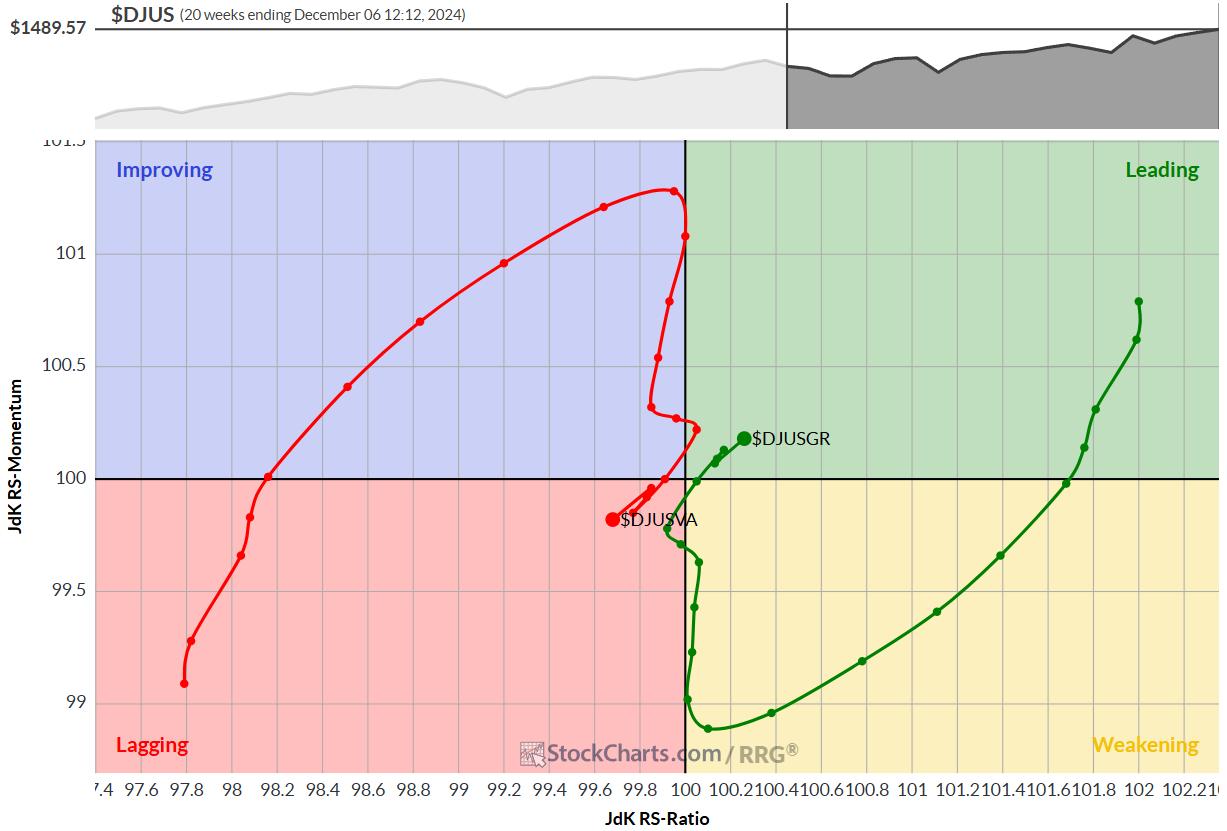

KEY TAKEAWAYS

* Growth stocks are regaining leadership over value.

* Small and mid-cap growth sectors are leading the charge.

* Large-cap value is currently the weakest market segment.

Growth vs. Value Rotation: The Pendulum Swings Again

Relative Rotation Graphs (RRG) are not just good tools to use in analyzing sector rotation; they&...

READ MORE

MEMBERS ONLY

Financials Primed to Beat Tech in December!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive video,Julius analyzes the completed monthly charts for November and assesses the long-term trends for all sectors. What we can expect for the coming month of December based on seasonality? With the technology sector under pressure, an interesting opportunity appears to be arising in Financials.

This video...

READ MORE

MEMBERS ONLY

Can the S&P 500 Rally Without Tech?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a deep dive into US sector rotation, breaking it down into offensive, defensive and cyclical sectors. He first looks at the relative rotations that are shaping up inside the group, assessing each sector's price chart in combination with the rotation...

READ MORE

MEMBERS ONLY

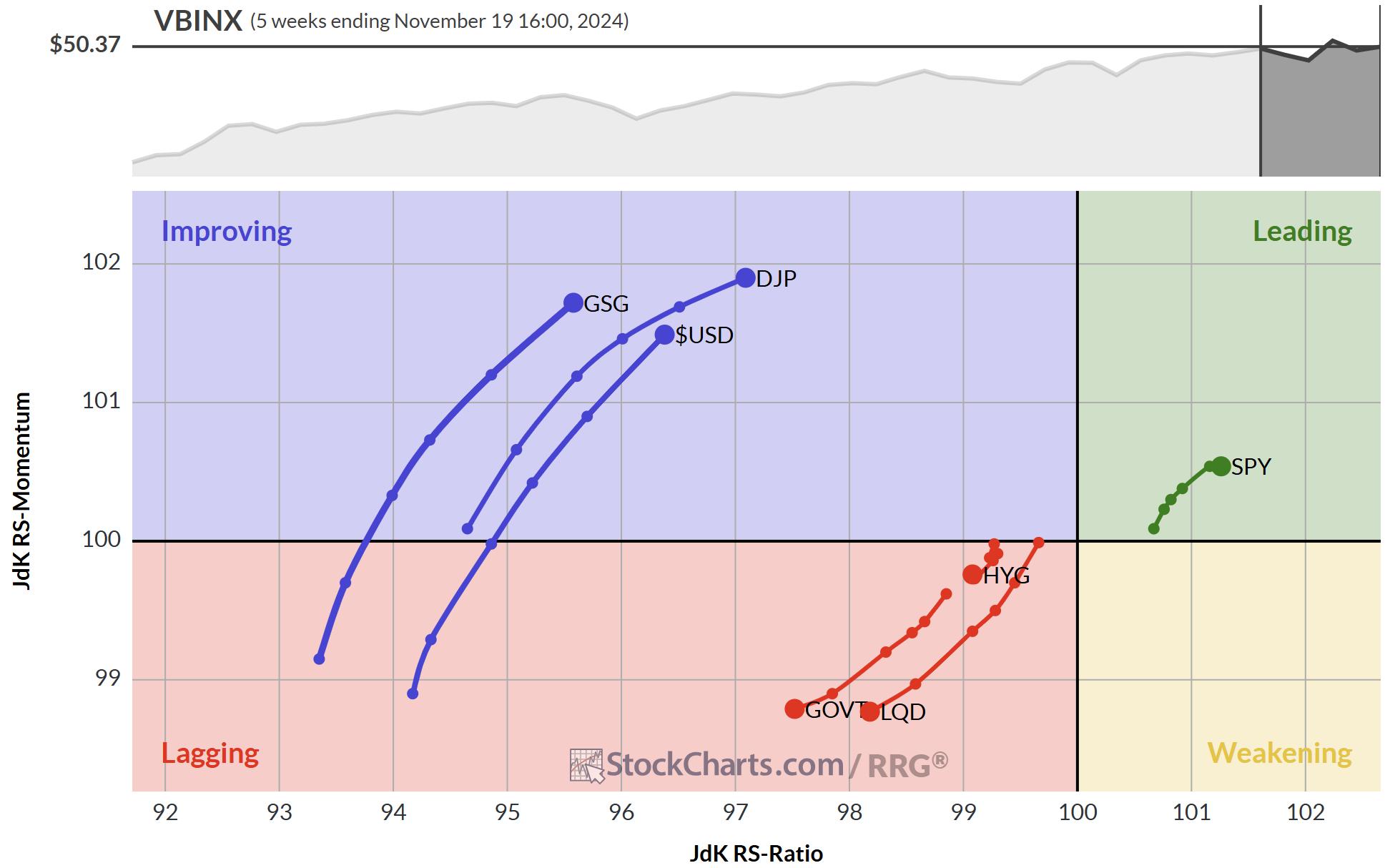

Is the USD Setting Up for a Perfect Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

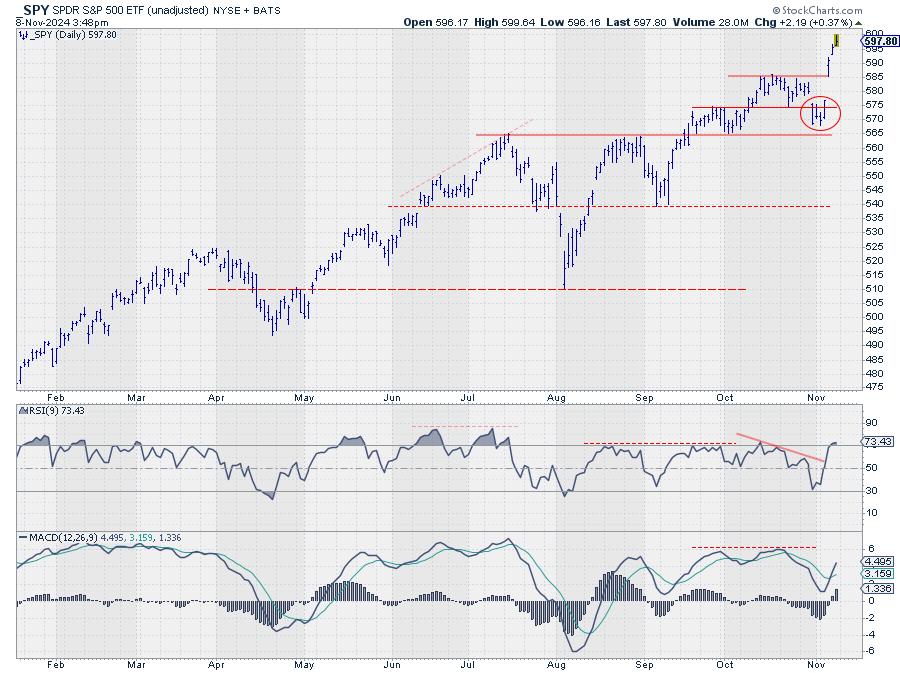

* Despite a lot of turmoil, SPY continues to show strong rotations on both weekly and daily RRGs.

* Rising yields have not damaged the stock rally yet.

* Stock/Bond ratio remains strongly in favor of stocks.

After the election, things have hardly settled in the world. New developments in...

READ MORE

MEMBERS ONLY

MUST SEE Updates to RRG Charts on StockCharts!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius pulls the curtain back on the updated Relative Rotation Graphs that are now available on the StockCharts website. He demonstrates a myriad of new features, including alignment of the intraday time frames with SharpCharts/ACP, zoom and position control with your mouse, and...

READ MORE

MEMBERS ONLY

Three Sectors Leading SPY Back to Offense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The market came out of defensive mode after the election.

* Old resistance at 585 is now support for SPY.

* XLC, XLY, and XLF are all showing strength.

First of all, for those of you looking for a new video this week, I have intentionally skipped it because I...

READ MORE

MEMBERS ONLY

S&P 500 Under Pressure, Can Strong Seasonality Save It?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius begins by looking back at the completed monthly bars for October to assess the long term trends in the 11 S&P sectors. He follows that up with an updated view for SPY in coming weeks. After that, Julius looks forward using...

READ MORE

MEMBERS ONLY

Market Rotation Fueled by Large-Cap Growth (Again)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large-cap stocks are pushing the market higher.

* Large-cap growth is the only segment driving the market.

* AAPL, TSLA, NVDA, and AMD are having trouble pushing higher.

Following the recent market fluctuations, with a sharp decline and a subsequent rally, it's crucial to examine these movements'...

READ MORE

MEMBERS ONLY

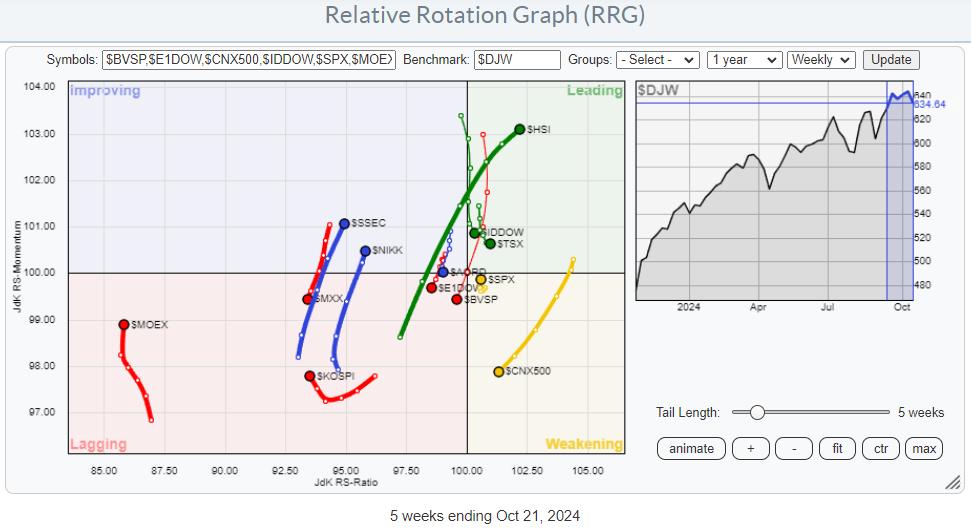

The US is Not the Only Stock Market in the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Asian stock markets showing strong relative trends.

* Meanwhile, India, Mexico, and Brazil are nosediving.

* Overall, the US is stull beating Europe.

The global stock market is a big place, and it extends far beyond the borders of the United States. While the US market is undeniably the largest...

READ MORE

MEMBERS ONLY

DISCOVER the Top Consumer Discretionary Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius begins by looking back at the completed monthly bars for October to assess the long term trends in the 11 S&P sectors. He follows that up with an updated view for SPY in coming weeks. After that, Julius looks forward using...

READ MORE

MEMBERS ONLY

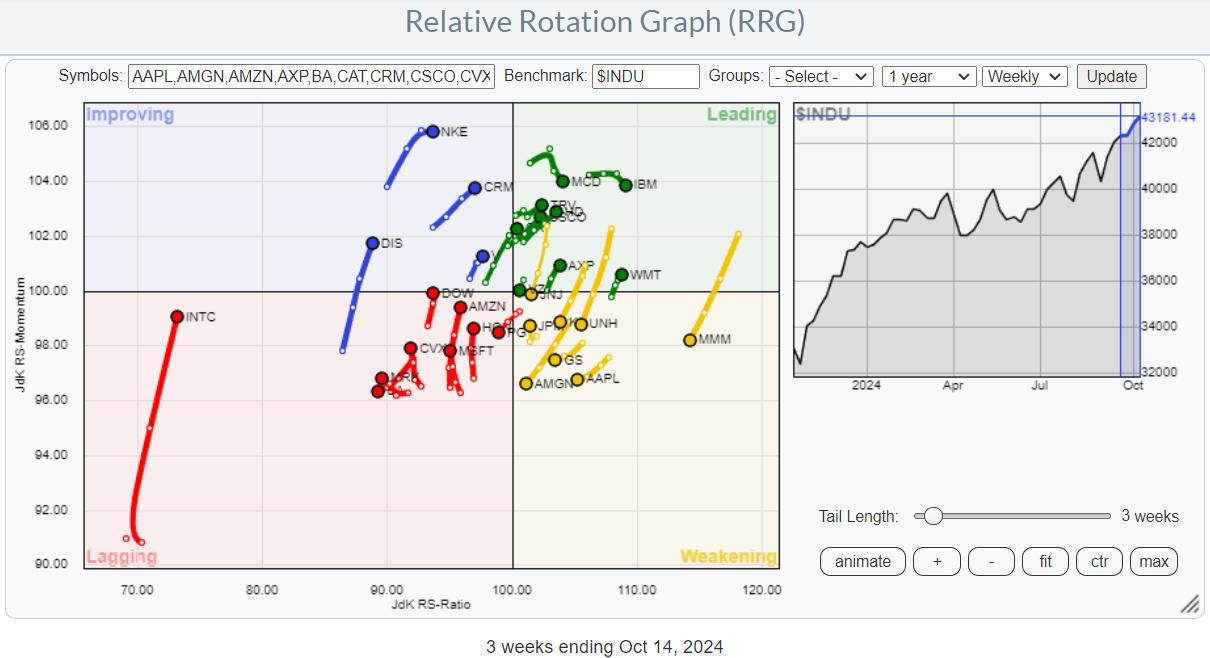

Using RRG To Find Best Three Stocks inside the DJ Industrials Index

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector Rotation Model and current sector rotation are not supporting broad market strength.

* Plotting the members of $INDU on a Relative Rotation Graph helps find the best names in that universe.

* TRV, WMT, and AXP are still strong, but now have too much risk for new positions.

* CAT,...

READ MORE

MEMBERS ONLY

Sector Rotation is Giving Conflicting Stories!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius dives in to the sector rotation model, trying to find any alignment between theoretical and real-life rotations of sectors in combination with the economic cycle. The positions of the various sectors and the economic indicators that are part of this model are not...

READ MORE

MEMBERS ONLY

It's Large-Cap Growth Stocks (Mag 7) Once Again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is starting to resolve its negative divergence with RSI.

* Large-cap growth is coming back into favor.

* Magnificent 7 stocks provided 2.9% of the S&P 50's 6.8% performance over the past five weeks.

Where is the Recent Performance in the S&...

READ MORE

MEMBERS ONLY

Why This S&P Support Level is SO IMPORTANT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius presents a few conflicting rotations and signals that continue to warrant caution while the S&P 500 keeps hovering just above support. With the negative divergences between price and MACD/RSI remaining intact, SPY should not break 565. Julius looks at rotations...

READ MORE

MEMBERS ONLY

Will Technology Drive S&P Higher in October?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius explores the October seasonal outlook for the S&P 500 and various sectors. Seasonality suggests a potential rise in the S&P 500, fueled by strength in technology, but there are still concerns about the ongoing negative divergence between price and...

READ MORE

MEMBERS ONLY

US Sectors Soar to New Highs!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a detailed look at the monthly charts for all US sectors and the S&P 500. With many sectors breaking to new highs, he highlights how the long-term uptrend for the S&P 500 remains intact. Julius also examines the...

READ MORE

MEMBERS ONLY

Opportunities in Industrials and Materials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Negative divergence remains a distracting factor

* Defensive rotation still present

* Industrials and Materials on positive track toward leading RRG quadrant

Despite a backdrop of conflicting market signals, there are still sectors within the S&P 500 that are showing promising movements and potential opportunities for investors. Today,...

READ MORE

MEMBERS ONLY

Why the Stock Market is SO Confusing Right Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses current rotations in asset classes and US sectors using Relative Rotation Graphs, finding a lot of contradictory behavior. Taking a step back, he focuses on the weekly timeframe to find some more meaningful trends and shy away from day-to-day noise. He then...

READ MORE

MEMBERS ONLY

A Sector Rotation Dilemma ...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector Rotation remains defensive

* S&P chart showing resemblence to late 2021

* Negative divergences still in play

First of all, I apologize for my absence this week. I caught something that looked like Covid, and felt like Covid, but it did not identify (pun intended) as Covid....

READ MORE

MEMBERS ONLY

A Déjà Vu in The Consumer Staples Sector Sends a Strong Warning Signal

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Tech bounce is judged as recovery within downtrend.

* XLP, XLF, and XLV are positioned for outperformance in coming weeks.

* The XLP chart is showing interesting characteristics which we have seen before

Tech Rallies, But Remains Inside the Lagging Quadrant

A quick look at the Relative Rotation Graph for...

READ MORE

MEMBERS ONLY

Why Stock Outperformance Might be ENDING!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at rotations in an asset allocation RRG. He compares fixed-income-related asset classes, commodities, the US dollar, Bitcoin and stocks to a balanced portfolio of 60% stocks/40% bonds. The long-lasting outperformance of stocks seems to be coming to an end....

READ MORE

MEMBERS ONLY

Why the S&P 500 Going Sideways is the Best Case Scenario

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius evaluates the completed monthly charts for August, noting the strength of defensive sectors. He then analyzes a monthly RRG and seeks alignment for the observations from the price charts. Could "sideways" be the most positive scenario for the S&P...

READ MORE

MEMBERS ONLY

NVDA is Not the Only Semiconductor Stock Out There

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is pushing against resistance.

* The technology sector is out of favor, and semiconductors are a drag for it.

* NVDA is big, but it is not the only semiconductor stock.

It's All Still Relative

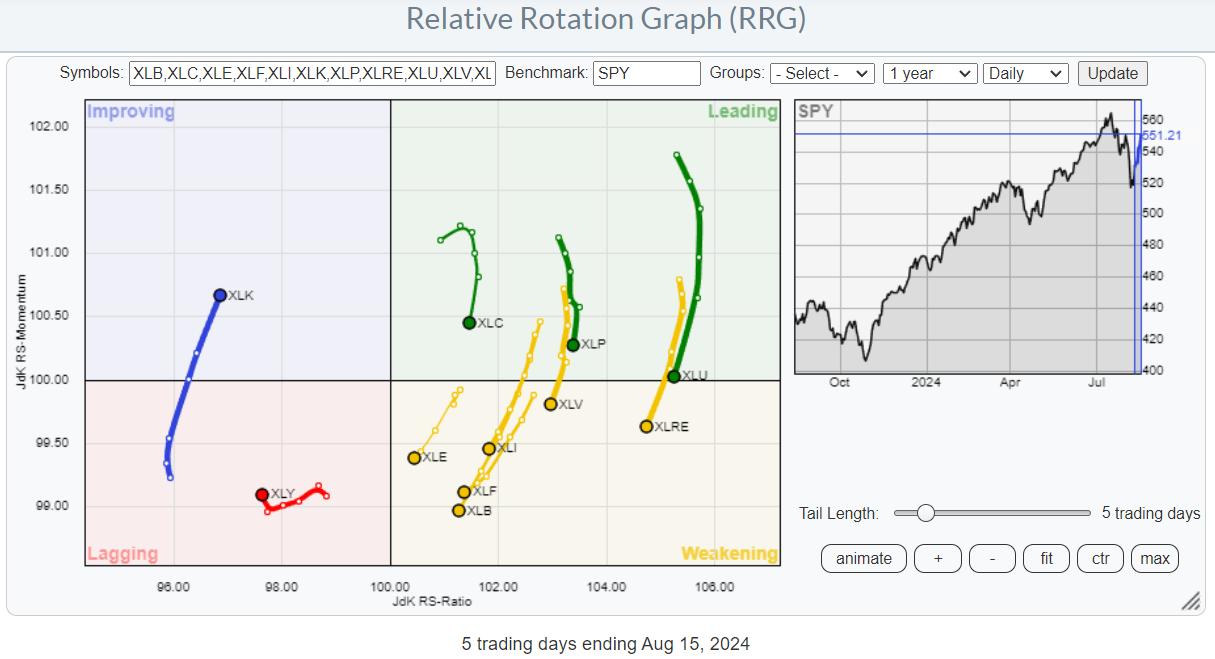

The weekly Relative Rotation Graph, as it looks toward the close of...

READ MORE

MEMBERS ONLY

Weak September Rotation - What Does it Mean for Sectors?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius addresses the expected sector rotation for the upcoming month of September which is traditionally the weakest month of the year. But what does it mean for sectors and how are current sector rotations shaping up on the Relative Rotation Graphs? Breaking down the...

READ MORE

MEMBERS ONLY

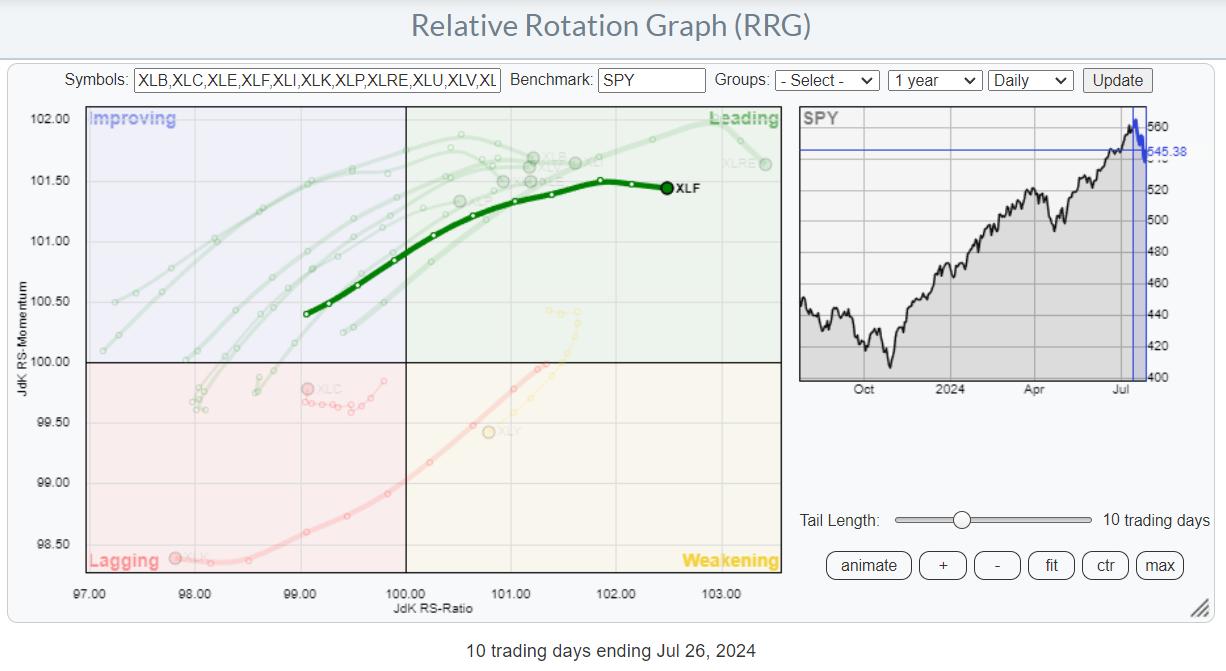

RRG-Velocity Jumping on XLF Tail

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

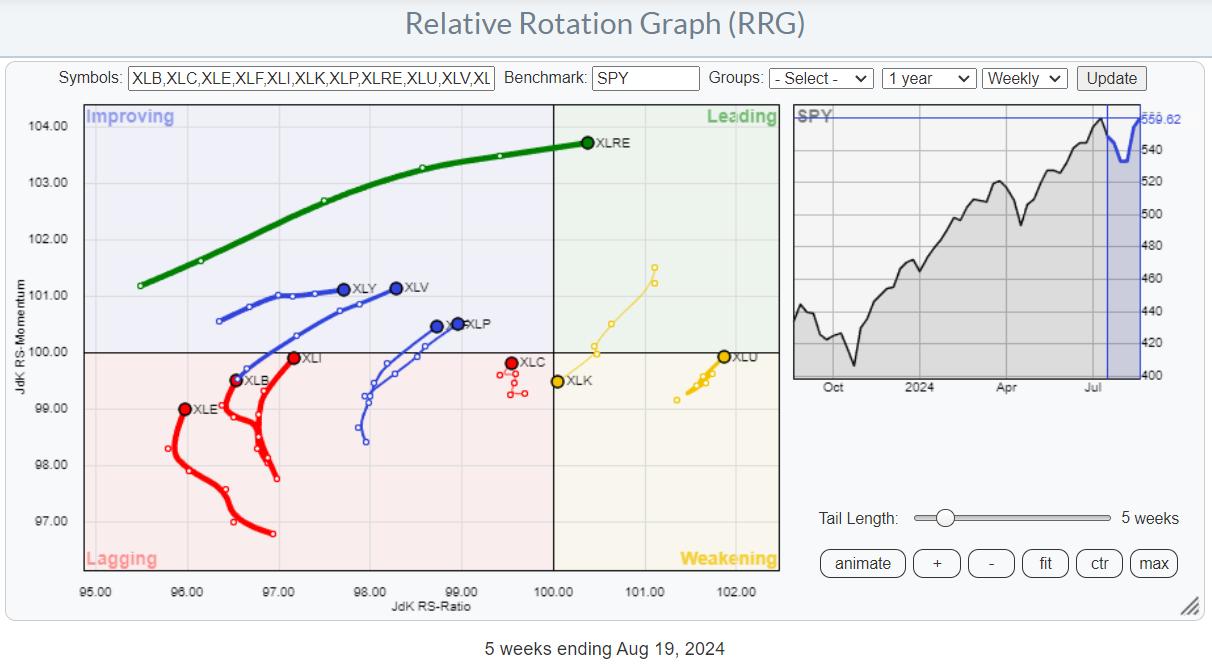

* Sector rotation out of technology

* All other sectors are picking up relative strength

* Real-Estate, Utilities, and Financials showing strong rotations

On the weekly Relative Rotation Graph, the rotation still favors almost every sector over Technology. I discussed the opposite rotations between weekly and daily RRGs in last week&...

READ MORE

MEMBERS ONLY

What Does This Mean for the S&P 500 Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the conflicting rotations in both asset classes and equity sectors. The weekly rotations differ significantly from their daily counterparts. What does it mean for the current rally in the S&P 500, and what does it mean for the relationship...

READ MORE

MEMBERS ONLY

Strength Off the Lows, But Concerns Remain

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Rotation to large-cap growth is back

* And so is the narrow foundation/breadth supporting this rally

* Weekly and daily $SPX charts need to get in line

Stronger than Expected

The recent rally out of the August 5th low is definitely stronger than I had anticipated. I was watching...

READ MORE

MEMBERS ONLY

CRITICAL Week Ahead for S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses various rotations using Relative Rotation Graphs, starting at asset class level and then moving to sectors. Julius zooms in on the industries of two sectors to get an idea of where pockets of out-performance may exist in the current market. He then...

READ MORE

MEMBERS ONLY

It's Been a Long Time Mr Bear, Where Have You Been?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Some real damage for the markets

* Equal weight sector rotation paints a more realistic picture

* The BIG ROTATION into small caps has come to a halt

And then ..... all of a sudden..... things are heating up. Lots of (downside) market action in the past week.

Let's...

READ MORE

MEMBERS ONLY

Flying Financials. Will It Be Enough?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Strong Sector Rotation Out Of Technology

* Financials and Real Estate Lead

* Stock/Bond Ratio Triggers Sell Signal

Flying Financials

In the recent sector rotation, basically OUT of technology and INTO anything else, Financials and Real-Estate led the relative move.

On the RRG above, I have highlighted the (daily)...

READ MORE