MEMBERS ONLY

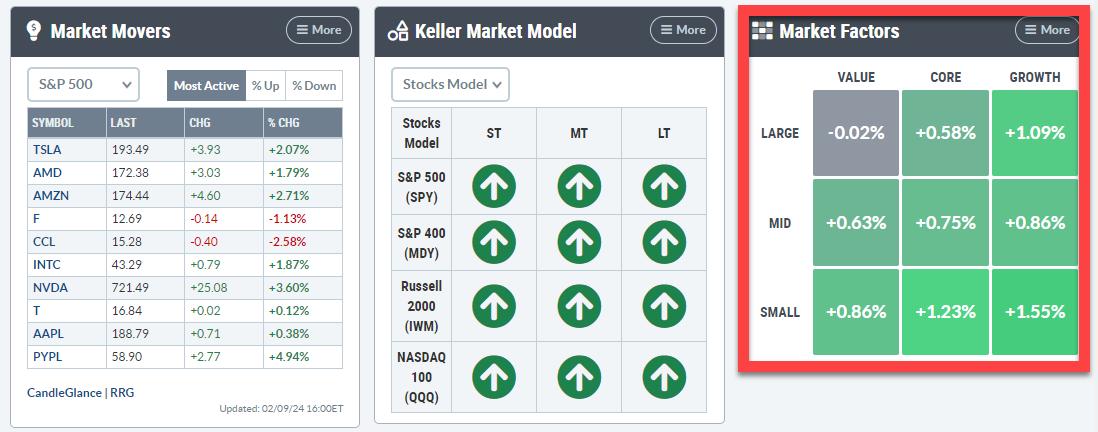

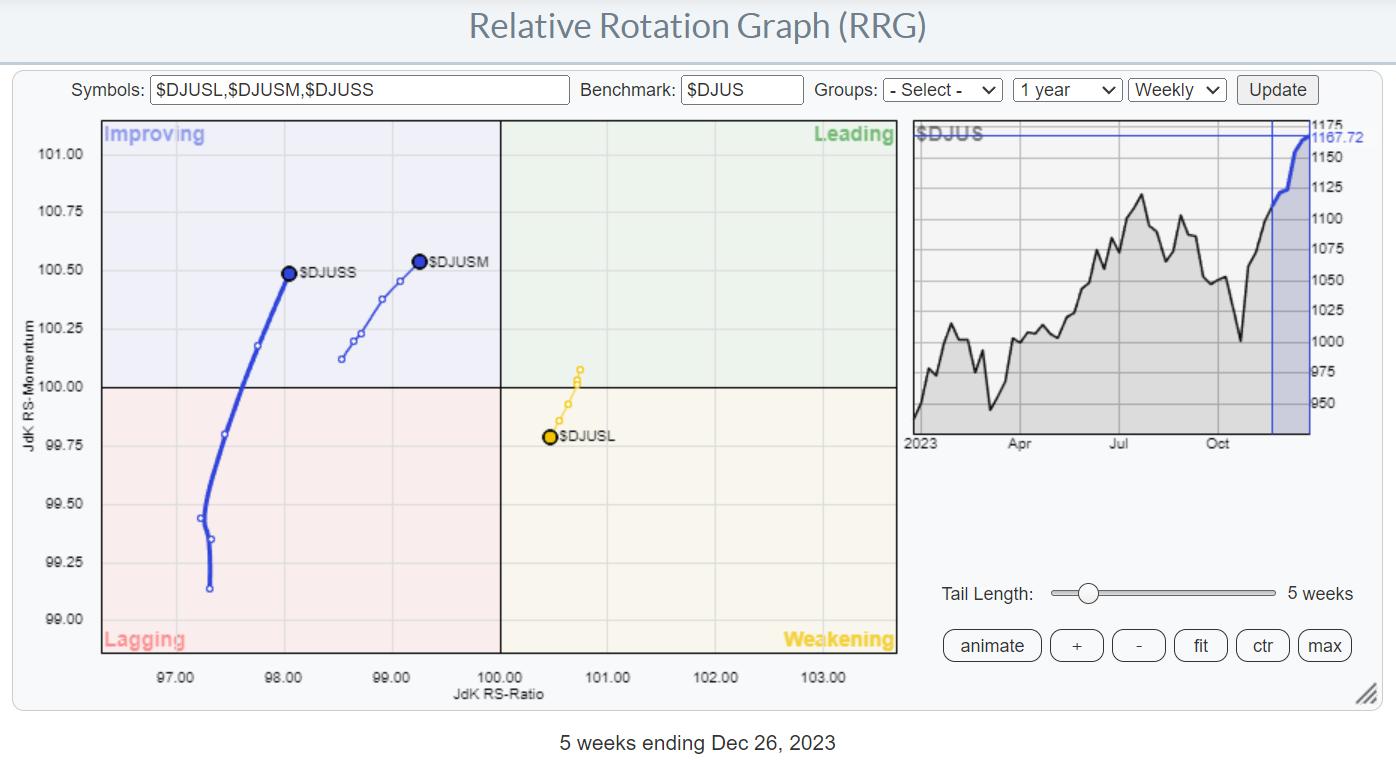

Can Small and Mid-Caps Save the Market?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at the markets through the lens of the "market factors" panel you can find on your StockCharts dashboard. Starting from the RRG, he then moves to the individual charts for these factors and notes a low correlation for...

READ MORE

MEMBERS ONLY

Will This Sector Rotation Be the Start of Something Bigger?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Technology is rotating out of favor

* Market Capitalization is a two-edged sword

* Negative divergences on Technology and S&P 500 charts are executing

Strong Rotations on Daily RRG

This daily RRG shows the sector rotation over the last five days. With only one more trading day to...

READ MORE

MEMBERS ONLY

Why Stocks are STILL the BEST Investment

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the markets from an asset allocation perspective using various RRGs. Stocks are (still) beating bonds, while commodities are rotating out of favor and the USD is losing steam. BTC is jumping higher off support, and the Yield Curve is steepening against...

READ MORE

MEMBERS ONLY

Market Foundation Showing CRACKS!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius continues to look at the narrowing market breadth and puts things into (another) perspective. The conclusion remains the same: it's a Risk-ON market, but the Risk is BIG.

This video was originally broadcast on July 9, 2024. Click anywhere on the...

READ MORE

MEMBERS ONLY

Unmasking Market Moves: Why Focusing on Individual Stocks Beats Indexes in 2024

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Today, we're looking at market breadth from a different perspective

* In this article, we'll plot major US stockmarket indices on a Relative Rotation Graph

* Even inside the NYFANG index, the base is narrow

There's been much chatter and mentions of weak or...

READ MORE

MEMBERS ONLY

Market Breadth is Narrowing - Should You Be Worried?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses the long-term trends as they are playing out on the monthly S&P 500 sector charts. He takes a look into the future using the expected seasonal trends for the month of July. Markets are still going higher, but the path...

READ MORE

MEMBERS ONLY

Large-Cap Growth Threatens the S&P Rally

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at rotation among growth/value and size segments, followed by a look at current sector rotation. He detects an intraday sector rotation he has never seen before, which could be the prelude for a larger move.

This video was originally...

READ MORE

MEMBERS ONLY

Price Pays... But For How Long?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The number of new 52-week highs is declining

* The percentages of stocks trading above 200-,50-, and 20-day Exp Moving Averages are declining

* Despiote narrowing breadth, the S&P continues higher

While the S&P 500 continues to move higher, the number of stocks participating to...

READ MORE

MEMBERS ONLY

Market Stumbles Near The Edge of a CLIFF

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius shares a rare RRG rotational pattern that he's never seen before! He then follows up with a breakdown of the current sector rotation into offensive, defensive, and sensitive, and finds that only one sector is on a positive relative trajectory... which...

READ MORE

MEMBERS ONLY

Sector Rotation Model Flashes WARNING Signals

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius examines the theoretical sector rotation model and aligns it with current state of sector rotation on Relative Rotation Graphs, and the phase of the economy. He makes some interesting observations and highlights some flashing warning signals.

Check out Julius' Macroeconomic Variables/Metrics...

READ MORE

MEMBERS ONLY

Only One Pocket of Strength Left in US Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Only Large-Cap Growth is on a positive RRG-Heading

* No segment, except LC Growth, has managed to take out its late March high

* $DJUSGL setting up for negative divergences

Breaking Down Into Growth / Value

Using Relative Rotation Graphs to help break down the US stock market into various segments...

READ MORE

MEMBERS ONLY

These SURPRISING Sectors are Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius uses the S&P 500 Sector Indexes to assess the long term price trends on the completed monthly charts for May, then discusses the long-term relative trends on a monthly RRG. Julius highlights the continued relative strength for Technology, Communication Services and...

READ MORE

MEMBERS ONLY

What Happens to GOOGL When This Negative Divergence Executes

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at the differences in rotation between cap-weighted and equal-weighted sectors and sees a warning signal for GOOGL. He also examines the Communications Sector vs. the Equal-Weighted ETF.

This video was originally broadcast on May 28, 2024. Click anywhere on the...

READ MORE

MEMBERS ONLY

Surge in TSLA and Strong AMZN Not Enough

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sector rotation remains a concern.

* AMZN & TSLA are both strong, but XLY remains in relative downtrend.

* Large Cap Growth is the only segment on a strong RRG-Heading.

Concerns Remain

My concerns about current market developments, which I voiced in last week's article, are still...

READ MORE

MEMBERS ONLY

S&P 500 Breakout: Here to STAY or Heading for a FALL?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses the quality of the breakout in the S&P 500, using sector rotation on Relative Rotation Graphs, the volume pattern in the S&P 500 and the relationship between stocks and bonds.

This video was originally broadcast on May 20,...

READ MORE

MEMBERS ONLY

Is This the Magic Upward Break Everybody Was Waiting For?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector rotation still pointing to defense

* Upward break in SPY not supported by volume

* Asset class rotation starting to rotate in favor of bonds

No Confirmation In Volume

This week, the S&P 500 is breaking out above its previous high, undeniably a bullish sign. After the...

READ MORE

MEMBERS ONLY

These Three Strong Financial Stocks Look Ready To Surge Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* XLF on strong RRG-Heading, rotating back into leading quadrant

* XLF price approaching overhead resistance after short setback

* Three major financial stocks ready for upward breaks to lead the sector higher

The Relative Rotation Graph for US sectors shows long tails for XLE and XLU. Both are on a...

READ MORE

MEMBERS ONLY

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

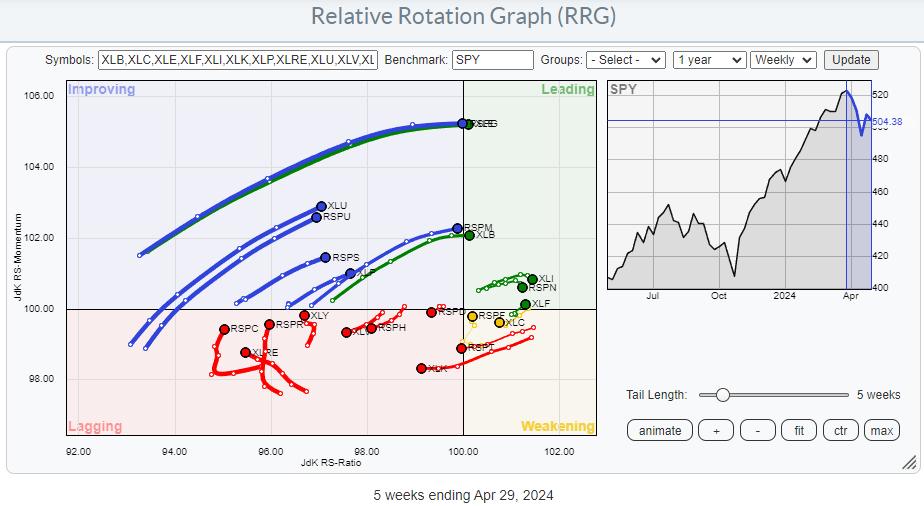

* Comparing equal-weighted and cap-weighted sectors on a Relative Rotation Graph can offer interesting insights

* When the trajectory of the tails and their position on the chart differ significantly, further investigation is warranted

* At the moment, two sectors are showing such divergences

All on the Same Track... or?

The...

READ MORE

MEMBERS ONLY

10% Downside Risk For Stocks as Value Takes The Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

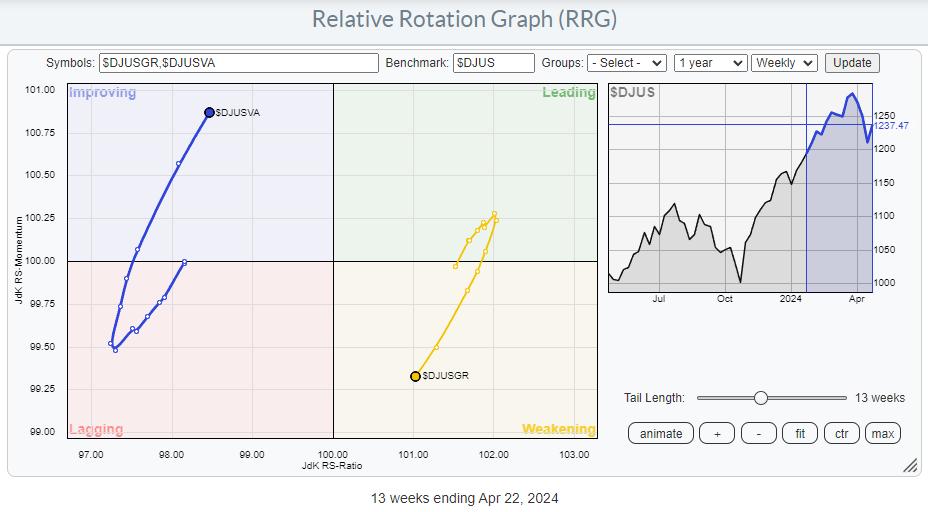

KEY TAKEAWAYS

* Value stocks are taking over the lead from Growth

* When Value beats Growth, the S&P 500 usually does not do too well

* The strength of Value is surfacing across all size segments of the market

* Important support areas for SPY at 480 and 460

Value Taking...

READ MORE

MEMBERS ONLY

RRG Indicates That Non-Mega Cap Technology Stocks are Improving

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

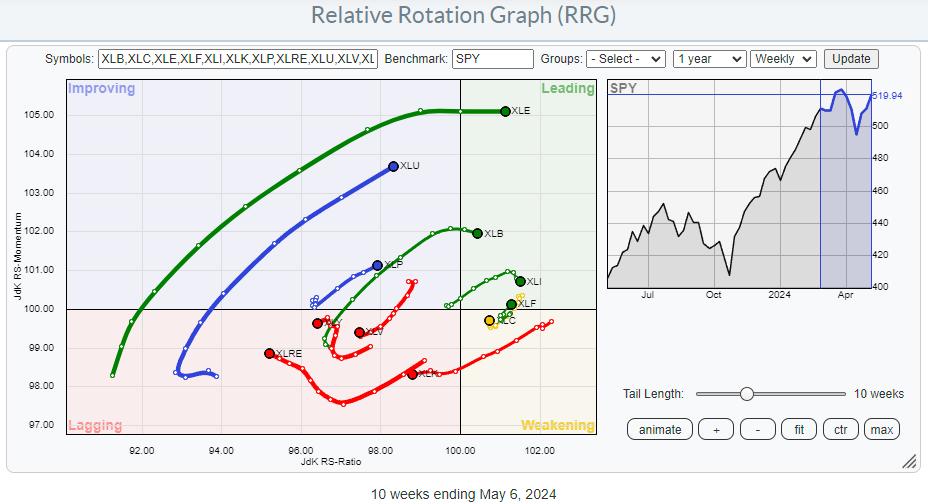

* The energy sector remains on a very strong rotational path

* A completed top formation in Healthcare opens up significant downside risk

* Smaller Technology stocks are taking over from mega-cap names

A Sector Rotation Summary

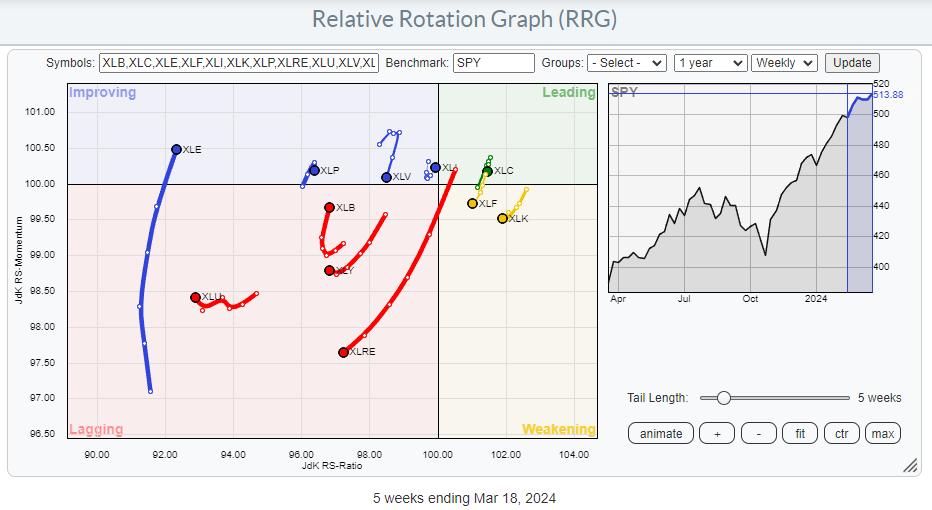

A quick assessment of current sector rotation on the weekly Relative Rotation Graph:

XLB:...

READ MORE

MEMBERS ONLY

Energy is on Fire

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

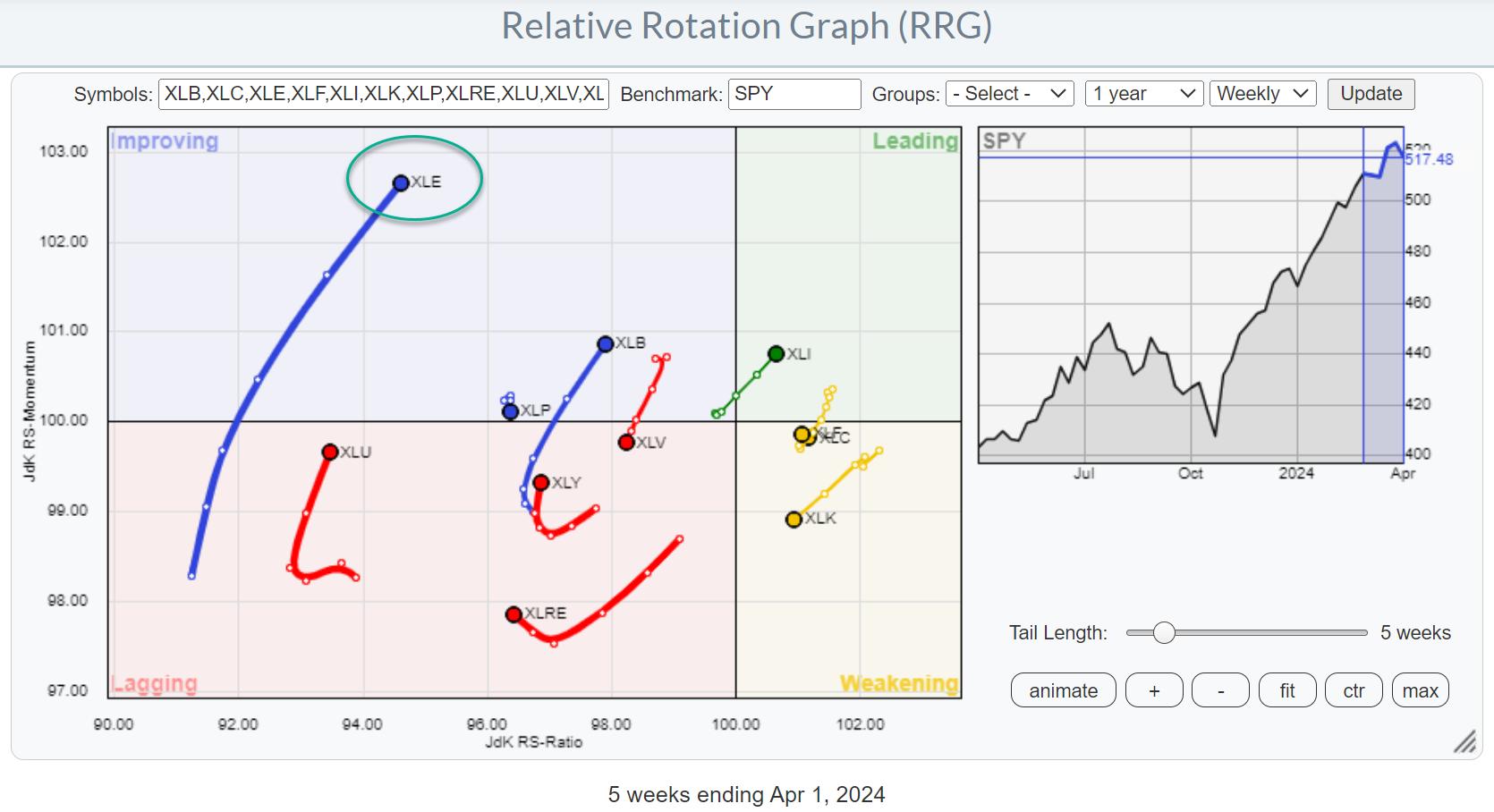

KEY TAKEAWAYS

* Energy sector is breaking higher on price chart

* XLE's RRG tail is continuing to pick up steam

* The exploration & production industry is leading inside the energy sector

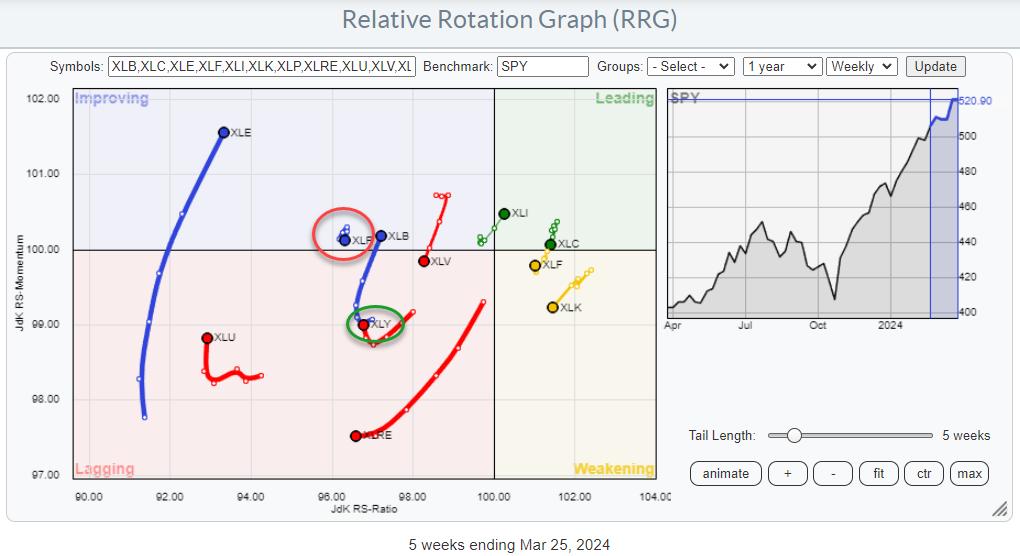

Strong Rotation on the Weekly RRG

For a few weeks now, the improvement in the energy sector (XLE)...

READ MORE

MEMBERS ONLY

When These Levels Break, The S&P 500 is Going to Explode Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Discretionary Beating Staples

* Sectors Pushing Against Major Resistance Levels

Summary

The Relative Rotation Graph for US Sectors for this week mainly shows a continuation of the rotations as they were underway last week.

XLB: This is moving from lagging into improving at a strong RRG-Heading, underscoring the...

READ MORE

MEMBERS ONLY

Energy: A Long-Term Turnaround in Relative Strength is Brewing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

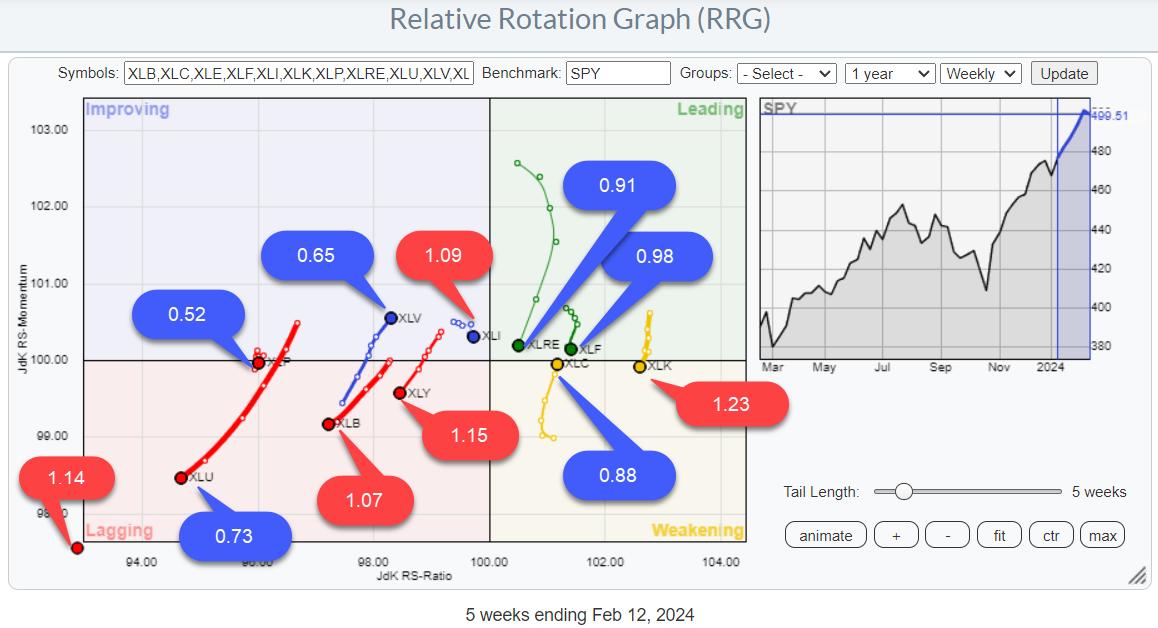

KEY TAKEAWAYS

* Energy sector showing relative strength in three timeframes

* The sector is nearing a heavy resistance area

* A long-term turnaround in relative strength appears to be underway

Energy Improving in Three Time Frames

Watching the sector rotation at the start of this week shows a continued improvement for the...

READ MORE

MEMBERS ONLY

Clear Split in NY FANG+ Universe Offers Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* NYFANG+ Index at elevated levels in strong uptrend.

* New long positions are exposed to high risk.

* I found a pair trading opportunity within the NYFANG universe to avoid directional market risk.

It is no secret that the NYFANG+ Index is still in in incredible up-run after bottoming out...

READ MORE

MEMBERS ONLY

Sector Spotlight: Dominant Trend for Stocks Still UP

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I separate the 11 sectors in the S&P 500 into Offensive, Defensive, and Sensitive, assessing their group rotational patterns to see if there is any alignment with the current technical condition of the S&P 500. After...

READ MORE

MEMBERS ONLY

SPY Uptrend Intact, But Mixed Sector Rotation Signals Hesitation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Looking at Risk ON / OFF through BETA

* RRG shows mixed rotations

* SPY Uptrend intact with limited downside risk

BETA

One of the Risk ON/OFF metrics I like to keep an eye on is BETA.

From Investopedia:

—systematic risk—

I have updated my spreadsheet with last year'...

READ MORE

MEMBERS ONLY

Sector Spotlight: EASY SCAN! Find Growth Names in Small-Caps

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I start with an assessment of the daily and weekly charts for SPY, trying to put recent developments into perspective. Then, I go over various Relative Rotation Graphs slicing the market down into various-size segments, as well as growth and...

READ MORE

MEMBERS ONLY

Visualizing the Market Factors Panel on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Bring the New Market Factors Panel to a Relative Rotation Graph

* Same approach using different index family shows a different image

With the release of the new Panels feature on the StockCharts dashboard, there are a lot of ways that users of RRG charts can take advantage! Let&...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks vs. Bonds -- Monthly Trends Revealed!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I review the monthly charts for January 2024, in combination with the Relative Rotation on the Monthly RRGs for asset classes and sectors. At asset class level, the preference for stocks over bonds remains clearly visible. Looking at the monthly...

READ MORE

MEMBERS ONLY

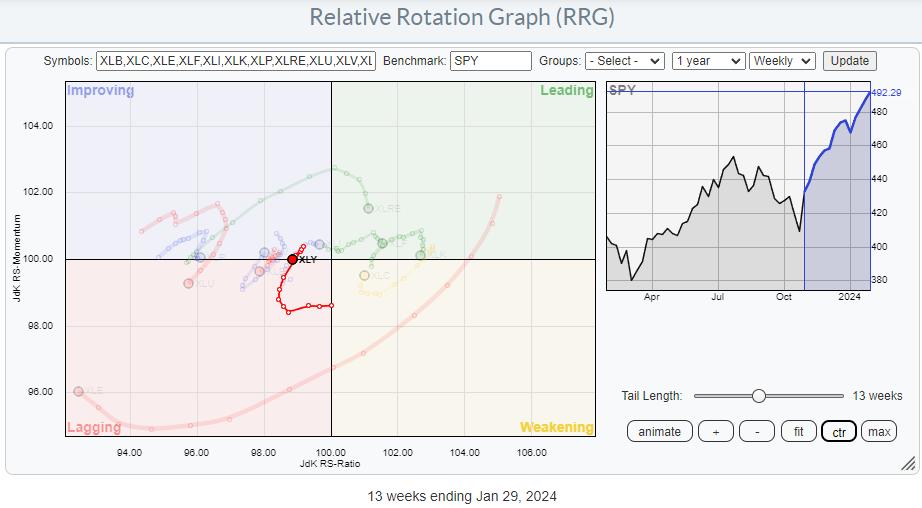

Discretionary vs. Discretionary, a Fierce Battle Under the Hood

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Not all is what it looks like inside the Consumer Discretionary Sector

* Using Cap-weighted vs. Equal-Weighted Sectors on RRG reveals underlying differences

* Mega-cap Stocks are dragging XLY down

* Using a Simple Scan Leads to four interesting charts

Cap-Weighted vs. Equal-Weighted

Sometimes, you need to look a little further....

READ MORE

MEMBERS ONLY

Sector Spotlight: The Market is Moving Higher, BUT Avoid Real Estate in February!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after a quick look at asset class rotation and sector rotation for US stocks, I dive into a comparison of cap-weighted sectors vs. equal-weighted sectors and find a big difference for the Consumer Discretionary sector, which underscores and supports the...

READ MORE

MEMBERS ONLY

Sector Spotlight: US Stocks Once Again Lead the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I highlight the short-term weakness in BTC, the price strength in USD, and the clear strength of stocks over all other asset classes. In sectors, I analyze the continuing rotation out of defensive sectors, which is another positive for stocks...

READ MORE

MEMBERS ONLY

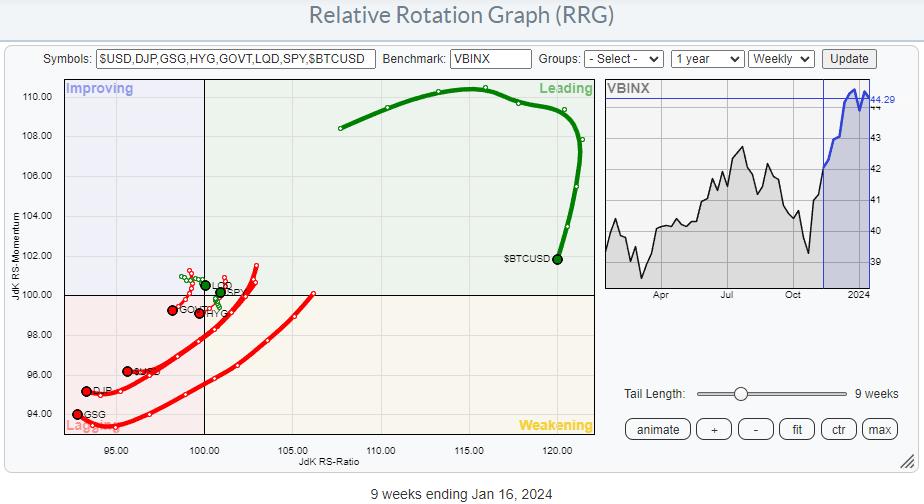

Watch Stocks Triumph in Latest Asset Allocation Battle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Commodities and USD rotating deep inside the lagging quadrant, indicating weak relative strength

* Bitcoin is in a strong relative uptrend vs all other asset classes, but going through a corrective phase

* Stocks are the clear winner in this asset allocation battle

The RRG above shows the rotation of...

READ MORE

MEMBERS ONLY

USD Strength Accelerates After Completing Bearish Flag in EUR/USD

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* EUR/USD executes bearish flag formation

* Leaves rising trend channel by breaking rising support line as a result

After a rally from $1.045 to a high of $1.1140 from October to December 2023, the EUR/USD exchange rate has now executed a bearish flag formation, which...

READ MORE

MEMBERS ONLY

Sector Spotlight: Is the S&P 500 Facing a Double Top?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I look at asset class rotation and examine the continued preference for stocks over bonds. After that, I move on to sector rotation and the Technology sector, breaking it down into industry groups and plotting them on a Relative Rotation...

READ MORE

MEMBERS ONLY

View The Large Cap - Small Cap Debate in a Direct Comparison on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Using RRG to see Large-Cap vs Small-Cap sector rotation

* The current strength for Small-Cap stocks vs Large-Caps is evident

At the end of last year, I wrote a blog article about the relationship between Large-Cap and Equal-Weight sectors. It involved plotting the ratios of the large-cap sector ETFs...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG Showing Strong Rotation For Stocks in All Time Frames

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Stocks Showing Relative Strength in All Time Frames on RRG

On this episode of StockCharts TV's Sector Spotlight, 2024's first episode, I dive into both Asset Class and Sector Rotation to set the stage for 2024. Today, I focus on a synchronized rotation of...

READ MORE

MEMBERS ONLY

SPY Resting at Support, But Financials Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is testing, maybe breaking, short-term support

* Next support in 455 area

* Financials sector tails on daily and weekly RRG moving back in sync

* All banks inside the leading quadrant

HAPPY NEW YEAR!!! (I guess that is still allowed on day 5...)

Let's kick off the...

READ MORE

MEMBERS ONLY

Which Sectors Benefit Most From the Large- to Mid- & Small-Cap Rotation?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Money rotating away from large-cap stocks

* Re-distribution and new inflow to mid- and small-caps

* Majority of sectors show preference for equal weight ETFs over Cap-Weighted counterparts

I have used this Relative Rotation Graph regularly in the past few weeks to indicate the ongoing rotation out of large-cap stocks...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks vs. Bonds --The Clear Preference

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, the last one of the year 2023, I assess current rotations in asset classes, as well as US sectors. This big picture calls for a continued/renewed strength for stocks over bonds. As I observe, money is rotating out of...

READ MORE