MEMBERS ONLY

Size (Matters) Over Style!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth and Value are moving together in an unusual rotation

* Money from large-cap stocks being distributed into mid- and small-cap segments

* Even all Mag7 names dropping in price is not enough to pull down benchmark indices

Something Strange is Going On

Or, at least, something unusual.

On the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Timeless Knowledge and Insights into Sector Rotation & Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For the 200th episode of StockCharts TV's Sector Spotlight, I inviteWall Street legend Sam Stovall for an entertaining discussion. Before that, I starts the show with a short look at current market rotations, highlighting the increasing relative weakness for the Energy Sector. I also note money rotating out...

READ MORE

MEMBERS ONLY

45% of Market Capitalization In S&P 500 Showing Strong Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG showing very distinct opposite rotations

* Once Sector Inside Leading and Two Sectors Inside Improving and Pushing toward Leading

* Energy Sector At Risk of Completing a Massive Double Top Formation

Usually, I would do this week's Sector Spotlight on the completed monthly charts for November. But...

READ MORE

MEMBERS ONLY

Sector Spotlight: Decoding The S&P's Monthly Behavior With Sector Rotation and Insights!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's the end of the month, which means it's time for me to take a look at the seasonal behavior for the S&P 500 and its sectors on this episode of StockCharts TV's Sector Spotlight. Is there is any alignment between historical...

READ MORE

MEMBERS ONLY

How RRG Helps Us Find Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* DJ Industrials closing in on overhead resistance

* Weekly RRG showing some strong opposite rotations

* Identifying two potential pair trading setups (MSFT-MRK & NKE-CAT)

The Dow Jones Industrial Index ($INDU) is reaching overhead resistance between 35.5k and 35.7k, which means that upside potential is now limited. Even...

READ MORE

MEMBERS ONLY

Sector Spotlight: S&P 500 - Consumer Discretionary Sector Holds the Key

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I dive deep into rotations for asset classes and sectors. Bitcoin, as a proxy for crypto currencies as an asset class, is shooting off into the leading quadrant, while commodities are losing strength and stocks are back in the lead....

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation and Macro Insights for the Economic Cycle!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I update the current rotation in sectors and the positioning of macroeconomic variables to make an assessment of the positioning of the stock market within the economic cycle.

This video was originally broadcast on November 14, 2023. Click anywhere on...

READ MORE

MEMBERS ONLY

Find Great Trading Ideas By Combining SCTR Rankings and RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Combing Top SCTR rankings with Relative Rotation Graphs provides a powerful combination

* Confirmation between weekly and daily RRG tails sends strong signals

* PLTR, DKNG, COIN, ADBE, NVDA showing strong set-ups

One of the several widgets/panels I have on my dashboard is SCTR Reports. To visualize the group...

READ MORE

MEMBERS ONLY

Sector Spotlight: Unleash The Power of Sector Analysis by Plotting Ratio Symbols on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I take a look at current sector rotation while comparing cap-weighted sectors with equal weight sectors, trying to find areas of the market where either one of these is dominating. I then demonstrate how to use ratio symbols on Relative...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts Suggest Downside Risk is Limited

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the completed monthly charts for October and assess the condition of the long term trends, along with whether they are still in play or have shifted. As usual, I start with the long-term rotation and trends in asset...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality is Dropping Big Bomb on Real Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the seasonality patterns that are likely to affect stock market and sector performance in the coming month. November is one of the strongest months in the year based on seasonality, but the Real Estate Sector looks to be...

READ MORE

MEMBERS ONLY

Bonds Now Beating Stocks While NVDA Goes into Tailspin

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The Stock/Bond ratio is changing course

* SPY:IEF complets top formation

* NVDA completes large H&S formation unlocking 20% downside risk

SPY:IEF completes top formation

One of the metrics I keep a close eye on is the ratio between stocks and bonds. Most of the...

READ MORE

MEMBERS ONLY

RRG is Sending a Clear Message And Finds Two Stocks With Good Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG is sending a strong message to prefer Growth over Value

* Putting the growth stocks from IVW through a scan and some thorough RRG analyses finds a handful of interesting names

* Two unexpected stocks are showing up as having good upside potential

* Especially growth stocks from Defensive sectors...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sensitive Sectors Continue to Prop Up the S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after two weeks of absence, Julius de Kempenaer is back with an in-depth look at the current state of asset class rotation and sector rotation. By slicing sectors into Offensive, Defensive, and Sensitive groups, he paints a picture with an...

READ MORE

MEMBERS ONLY

Sector Rotation Makes Technology Line Up With Strong Seasonality Pattern

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Market is entering strongest period of the year

* Positive seasonal expectations for Technology and Financials

* Weaker outlook for Healthcare and Energy

* Current rotations for Tech and Healthcare are in line with seasonality

We are already in October .... How did that happen?

Also, I am writing this article while...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Sends Mixed Signals

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after two weeks of non-regular market updates, I'm back with a regular episode. Here, I dive deep into the current state of rotation in asset classes, highlighting the strength of commodities and the opposing rotations for stocks and...

READ MORE

MEMBERS ONLY

Sector Rotation Signals an Important Week Ahead for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Short Term, Risk-Off Sector Rotation While Heading into new week

* Did The Market Complete a H&S Top, or Is SPY Looking For Support?

* 430 Is The Crucial Level To Watch in SPY

First of all, my apologies for everybody who has been waiting for a Sector...

READ MORE

MEMBERS ONLY

This Is The Only Segment Of The Market Worth Paying Attention To Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth-Value Rotating Back in Favor of Growth

* Large-Cap stocks picking up Strength Over Mid- and Small-cap segments

* Hence, Large-Cap Growth Stands out Positively

RRG sending a clear message

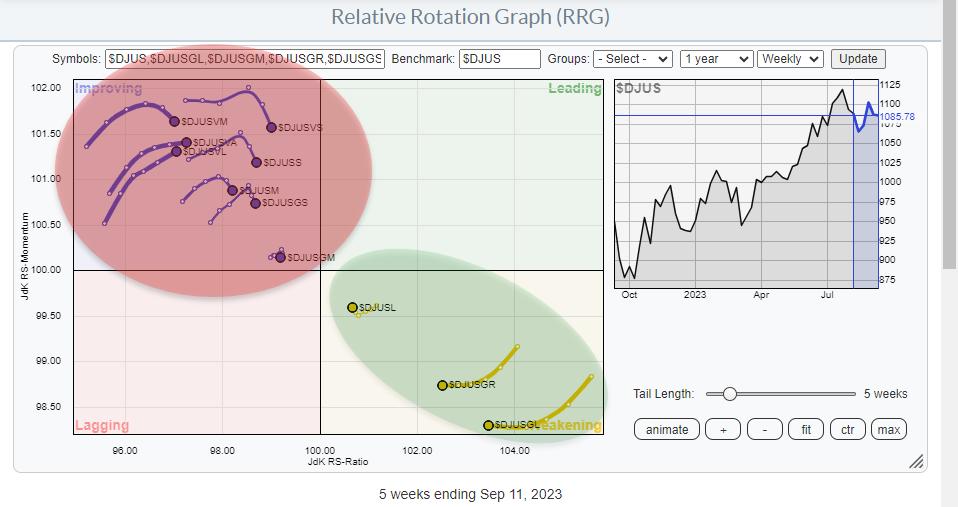

The Relative Rotation Graph above shows the rotation for the combined Size and Growth/Value segments in the market.

And...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Current State of ARGoN -- Applying the Concept to 30 DOW Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I continue my chat with Ralph Acampora in the StockCharts.com studio.

After recording our previous video (see here!), I put Ralph on the spot, and together we flip through the 30 Dow stocks, calling the current price and relative...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Story of ARGoN (Acampora's Relative Grid of Nine)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I chat with guest Ralph Acampora in the StockCharts.com studio in Redmond, WA. We discuss the birth of ARGoN, a special way of looking at markets from both a price and a relative perspective.

Once upon a time, Ralph...

READ MORE

MEMBERS ONLY

Looks Like a Strong Rotation to The Leading RRG Quadrant is Around the Corner for Three Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

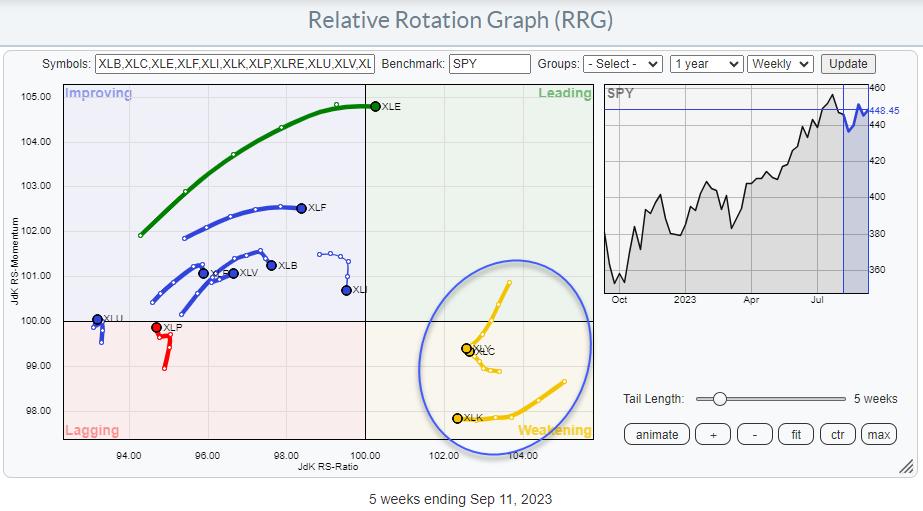

KEY TAKEAWAYS

* Three Sectors Are Ready to Rotate Back Towards the Leading Quadrant

* Technology, Discretionary, and Communication Services Together Are Almost Half Of Total Market Cap

* Daily Tails for these sectors are supporting the looming positive rotation for their weekly counterparts

First of all, for those who are awaiting a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly RRG Shows Preference for Stocks Over Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The month of August has come to an end, and that means a focus on long-term trends, using monthly Relative Rotation Graphs in combination with the finalized price (bar-)charts for August, on this episode of StockCharts TV's Sector Spotlight. Julius de Kempenaer assesses the rotations of asset...

READ MORE

MEMBERS ONLY

Sector Spotlight: Three Takeaways from Seasonal Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In August's last regular episode of StockCharts TV's Sector Spotlight, I address the seasonal patterns in sector rotation and looks to find alignment with the current rotations as they are playing out on the Relative Rotation Graph. September is not the strongest month in terms of...

READ MORE

MEMBERS ONLY

Watch These Four Horrible Charts in the Dow Jones Industrials Index

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* $INDU chart resting at double support and likely to bounce higher

* Outperform the index by avoiding four stocks

The Relative Rotation Graph above, which shows the rotations inside the DJ Industrials index, exhibits an evenly-spread-out universe of stocks. This is primarily the result of $INDU being a price-weighted...

READ MORE

MEMBERS ONLY

Sector Spotlight: This Powerful Use of RRG Will Make Your Head Spin

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look at the Relative Rotation Graphs for cap-weighted and equal-weighted sectors side by side, then make an assessment regarding his preference for each of them. I then zoom in on the chart technical comparisons for four sectors. Finally, I...

READ MORE

MEMBERS ONLY

US Stocks Are Lagging The World For Now, But This Alternative Could Skyrocket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* US stocks are lagging the world on RRG

* The Indonesian stock market looks ready to jump

* The iShares EIDO (MSCI Indonesia) ETF can be used to play that market

Let's take a look at the rotation of stock markets around the world. The Relative Rotation Graph...

READ MORE

MEMBERS ONLY

Sector Spotlight: Money Rotating Out of Large-Cap Growth Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, after an assessment of weekly rotations on Relative Rotation Graphs for US sectors, I address the shorter rotations this week, trying to find whether some of these daily rotations managed to get in sync with their weekly counterparts (spoiler alert:...

READ MORE

MEMBERS ONLY

Sector Spotlight: Risk to S&P as Technology Under Pressure

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I take a look at the rotations for asset classes and sectors. The current state of the rotations in asset classes shows Bitcoin and Commodities far away from the benchmark, which could provide ample opportunities to benefit from larger moves...

READ MORE

MEMBERS ONLY

RRG Finds Three Strong Stocks in Materials Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Materials Sector Steering Towards Leading Quadrant at Strong RRG Heading

* Twelve Stocks In the Materials Sector are at a North Eastern Trajectory

* PKG, WRK, and NUE look particularly interesting

Looking at the Relative Rotation Graph for US sectors, we can see the Materials sector pops up as potentially...

READ MORE

MEMBERS ONLY

Sector Spotlight: Industrials & Tech Headed to Uncharted Territory

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, on this first day of of August, I go over the completed monthly sector charts for July, looking for trends and support/resistance levels. I then wrap all of this up in a table, and finally talks the monthly Relative...

READ MORE

MEMBERS ONLY

Sector Spotlight: Energy & Tech's Opposite Seasonal Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, on this last day of July, I look at the expected seasonal patterns for the coming month of August and examine whether the current sector rotation, as seen on the Relative Rotation Graphs for any of the sectors, lines up...

READ MORE

MEMBERS ONLY

Surging Trucks Are Driving The Industrials Sector Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Industrials sector XLI broke to new highs and is on a strong rotational path on the Relative Rotation Graph

* Within the sector the groups "Commercial Vehicles & Trucks" and "Trucking" stand out

* These groups are taking over from Airlines and Construction which have been...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Says Bull Market in Full Swing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, using the sector rotation model, I make an assessment of the current economic phase and how that aligns with the current sector rotation and alignment of four macroeconomic indicators. Along the way, I also show you where you can find...

READ MORE

MEMBERS ONLY

Sector Spotlight: Latest Drop in US Dollar Sending Markets Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I address the recent drop in the US dollar and its effect on the US stock market. The asset class segment is then followed by a look at current sector rotation and the increasing number of stocks in the S&...

READ MORE

MEMBERS ONLY

Sector Spotlight Special: The Impact of Using Different Benchmarks for RRG!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this special episode of StockCharts TV's Sector Spotlight, I address the impact of using different benchmarks on Relative Rotation Graphs and the opportunities for investors to adapt the use of RRGs in different circumstances.

This video was originally broadcast on July 15, 2023. Click anywhere on the...

READ MORE

MEMBERS ONLY

Low Vol-to-High Beta Stock Rotation is Surging

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* High BETA vs Low Vol Comparison as an alternative Risk ON/OFF metric

* SPHB:SPLV showing strength for High BETA stocks in all three time frames (M,W,D)

* Preference for High BETA confirms current sector rotation out of defensive sectors

In this week's episode of...

READ MORE

MEMBERS ONLY

What The HECK?! Can an Inverted Yield Curve Really Be Bullish?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV'sThe Final Bar, guest host Julius de Kempenaer talks to Todd Gordon of TradingAnalysis.com. They cover a broad spectrum of topics, ranging from the big macro picture, to growth value rotation, to the current strength in the consumer discretionary. In the 3-in-3...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Out of Defensive into Offensive

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I go over the current status of asset class rotation, noting the ongoing strength for stocks vis-a-vis other asset classes. After that, he moves to sector rotation and uses the breakdown of the sector universe into offensive, defensive, and sensitive...

READ MORE

MEMBERS ONLY

Sector Spotlight: Two Sectors Hitting New All-Time Closing High

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I assess the monthly charts following the end of June. Bond-related asset classes remain vulnerable, while commodities are struggling to remain afloat. The stock/bond ratio is now sending a very clear signal. In US sectors, all eyes are on...

READ MORE

MEMBERS ONLY

Small-Cap Value Stocks Unexpected Driver for Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Rotation continues in favor of growth

* Large Cap Segments Generally Beating Value

* Small-Cap Value Stocks Stand Out

Growth, Value, Size

It has been a while since I addressed the rotations of Growth vs. Value and their different size variations. The RRG above shows these rotations on the weekly...

READ MORE