MEMBERS ONLY

Sector Spotlight: Stocks Lining Up for a Strong July

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look ahead to the month of July and what we can expect based on 20 years of seasonal performance. I then align that information with the current rotations for the various sectors in order to find interesting opportunities on...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds Surrender to Strong US Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I take a look at Asset Class rotations, highlighting the current strength of US stocks in comparison to Bonds. In the Sector Rotation segment, I address the differences between cap-weighted and equal-weighted sectors and find some interesting stocks inside the...

READ MORE

MEMBERS ONLY

Is There Big Tech Trouble in FANG(sta's) Paradise?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Near-Term Rotations

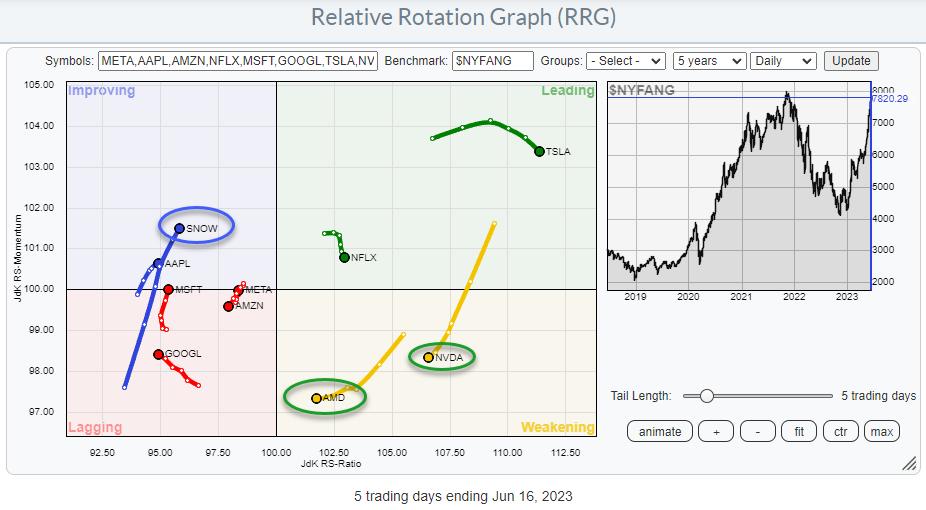

The Relative Rotation Graph above shows the stock rotation inside the NYFANG index.

Semiconductor stocks AMD and NVDA have been the leaders over the past weeks/months, but they are now rolling over into weakening and heading toward the lagging quadrant. TSLA and NFLX are still inside the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Remarkably Strong Sector Rotation Out of Defense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I present an in-depth assessment of the current state of rotation in asset classes and sectors, and also share some background on where the split into three groups -- offensive, defensive, and sensitive -- is coming from. Spoiler alert: The...

READ MORE

MEMBERS ONLY

Sector Spotlight: May Was NOT a Good Month for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, wrapping up the month of May, I look back at developments in May for Asset Classes and Sectors. Using Monthly Relative Rotation Graphs and monthly charts, I talk you through the good and the not-so-good parts of the markets, starting...

READ MORE

MEMBERS ONLY

How To Benefit From a Big Rotation in Asian Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's been a while since we discussed international stock markets.

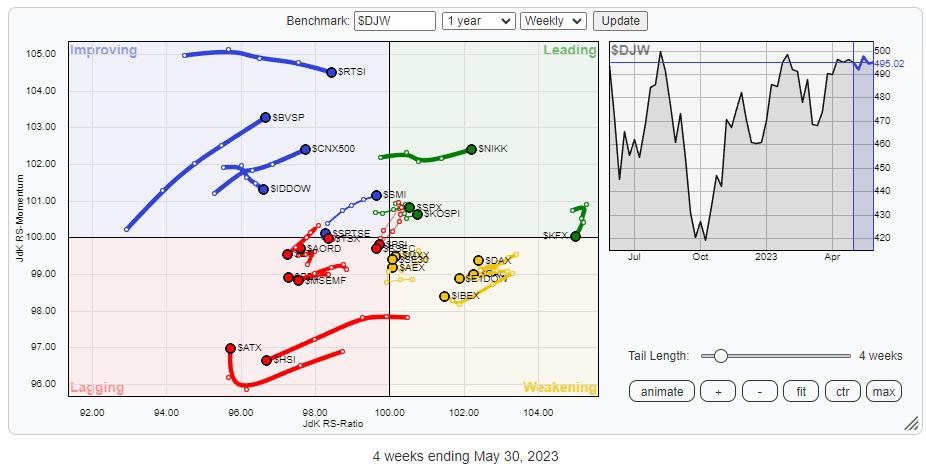

Above is the Relative Rotation Graph that shows the rotation for a group of international stock market indices against $DJW, The Dow Jones Global Index. Looking at this, chart I see two big(ger) rotations that are probably...

READ MORE

MEMBERS ONLY

Sector Spotlight: Will Tech Take a Seasonal Break in June?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, wrapping up the month of May, I dive into the seasonal characteristics of the markets. I start with a quick look back at seasonal rotation during the current month, then assess the seasonal expectation for the S&P 500...

READ MORE

MEMBERS ONLY

Sector Spotlight: Big Bases in Technology Support SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look at sector rotation while breaking down the universe into offensive, defensive, and sensitive sectors. I then zoom in on the groups that make up the technology sector and some of the stocks in them, where I find a...

READ MORE

MEMBERS ONLY

Superior NYFANG+ Performance Leaves S&P 500 in the dust

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

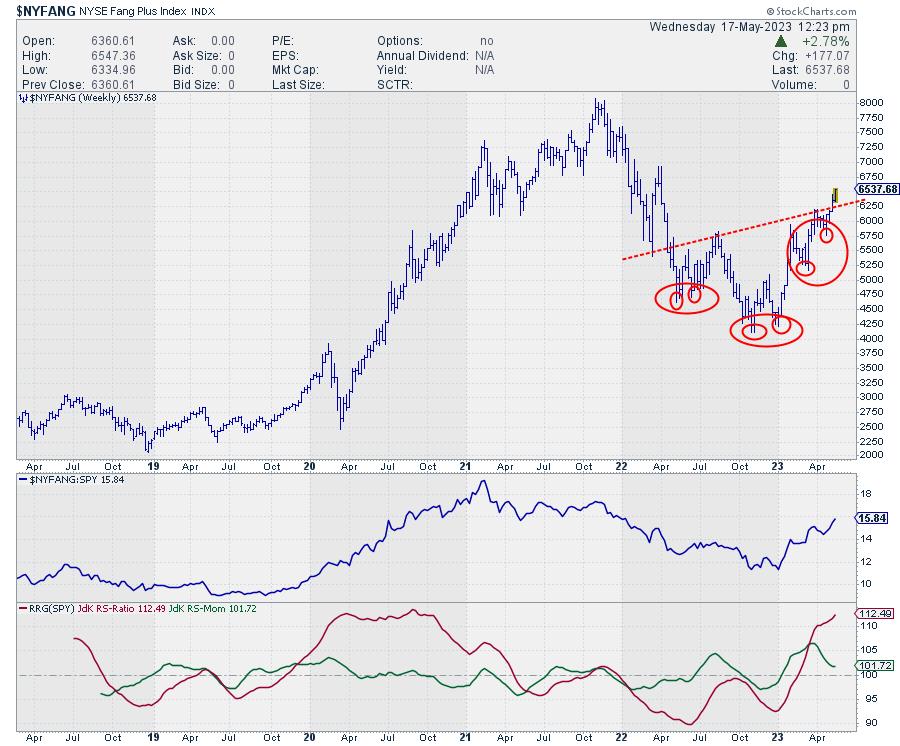

The NYSE FANG+ index $NYFANG holds ten of the largest stocks in the US.

1. Alphabet - GOOGL

2. Snowflake - SNOW

3. META Platforms - META

4. NVIDIA Corp - NVDA

5. Amazon - AMZN

6. Microsoft - MSFT

7. Advanced Micro Devices - AMD

8. Apple - AAPL...

READ MORE

MEMBERS ONLY

Sector Spotlight: GOOGL and Double Benchmark RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I take a look at developments on asset class level and more specifically, the USD and BTC. I then compare current cap-weighted sector rotation with its equal-weight equivalent to find some interesting differences. Finally, I re-introduce the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sensitive Sectors Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After looking at the Sector Rotation Model, Seasonality, and Monthly charts in recent episodes, it is time for an assessment of current market rotation again. In this week's edition of StockCharts TV's Sector Spotlight, I take a look at the rotations for asset classes on weekly...

READ MORE

MEMBERS ONLY

Market Holds Up Well as Money Rotates Out of Offensive Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

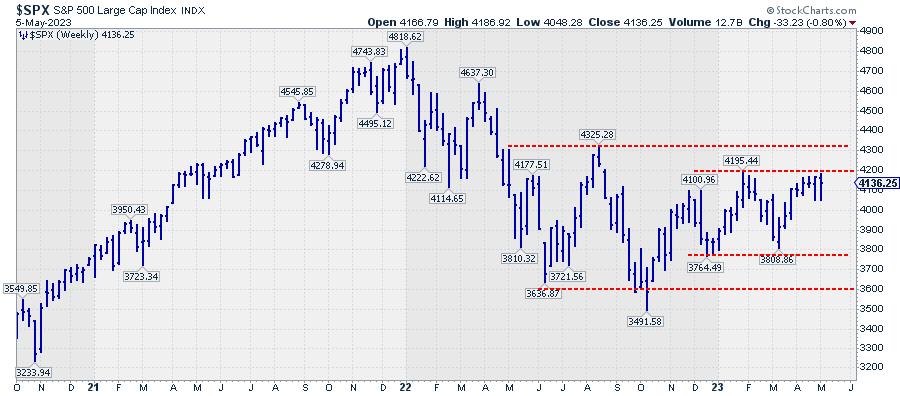

While the S&P 500 struggles to push beyond its overhead resistance in the area around 4200, money is rotating out of offensive sectors into defensive AND sensitive.

On the weekly chart, two trading ranges are starting to emerge. The first one is the more narrow one, between roughly...

READ MORE

MEMBERS ONLY

Sector Spotlight: Strong Seasonal Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This a packed episode of StockCharts TV's Sector Spotlight; as you'll notice from the different setup, Julius recorded IN the studio at the StockCharts.com headquarters! With the show on hiatus last and this week being the first Tuesday of the month, Julius covers both the...

READ MORE

MEMBERS ONLY

The Birth of Ralph Acampora's Brainchild; ARGoN

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This journey started back in October 2022. After three years of no traveling and four years not having been to the US, it was finally possible to have an in-person event again, or at least partially.

StockCharts.com has been hosting its bi-annual conference, "ChartCon," since 2011. My...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Suggests Market Ready to Move

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I evaluate the current state of the Sector Rotation Model. Each quarter, I take the elements of the Model, as described by Sam Stovall, and use the charts of four macroeconomic indicators and the monthly RRG to determine where the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Surge in Oil Revives Rotation to Energy Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I put the spotlight on Energy, starting off with a look at the rotation of various commodity groups and a focus on the group of Energy-related commodities. Following this assessment, I move to the Energy sector and the stocks inside...

READ MORE

MEMBERS ONLY

Sensitive Sectors are Holding the Keys to Unlock Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The daily RRG for US sectors is showing an interesting picture. Out of all eleven sectors, only four are on a negative trajectory.

Industrials is inside the lagging quadrant at a very short tail, and more or less in a static position, which means that the sector is in a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds & Financials Crucial for Promising S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The first Tuesday of the month means monthly charts in this episode of StockCharts TV's Sector Spotlight. I start with an overview of long-term trends in asset classes, including a look at the USD and BTC and the relationship between stocks and bonds. I then move on to...

READ MORE

MEMBERS ONLY

When You See Amazon Turning Around, Beautiful Things Start to Happen

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

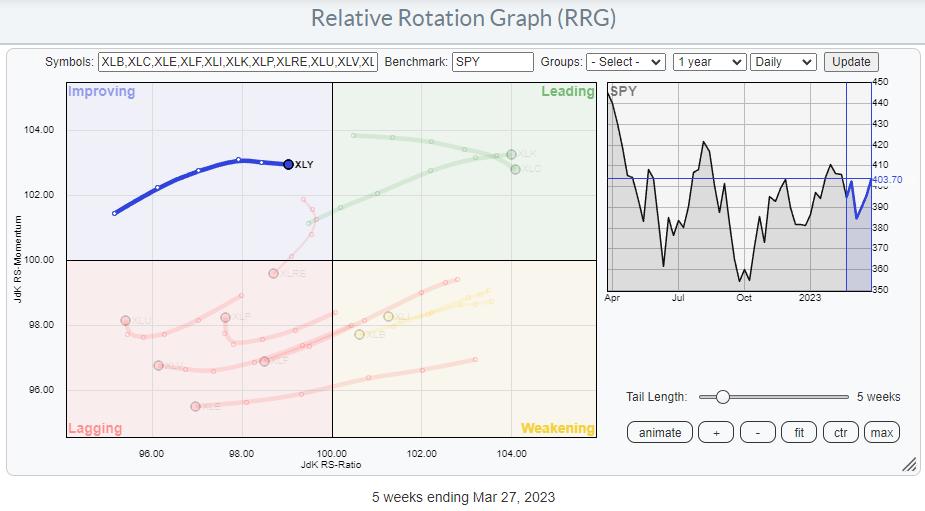

On the weekly RRG, the tail for XLY, Consumer Discretionary, is inside the improving quadrant and heading at an RRG-Heading of roughly 90 degrees. Not ideal; somewhere between 0-90 is stronger, as it indicates that the trend is still picking up speed, but not wrong either.

With only two sectors...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks Entering Year's Strongest Month

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, for this last Tuesday of the month, I take a look at seasonality as the S&P 500 enters the (historically speaking) strongest month of the year. Two sectors are showing meaningful odds for out-performance in April, and one...

READ MORE

MEMBERS ONLY

Sector Spotlight: When Stocks are Not Marked Down on Bad News

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I talk you through my assessment of what's going on in terms of sector rotation and how that connects with my observations of the S&P 500 chart. Following that assessment of current market behavior, I then...

READ MORE

MEMBERS ONLY

Fearless Rotation Back to Growth Stocks Unfolding Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

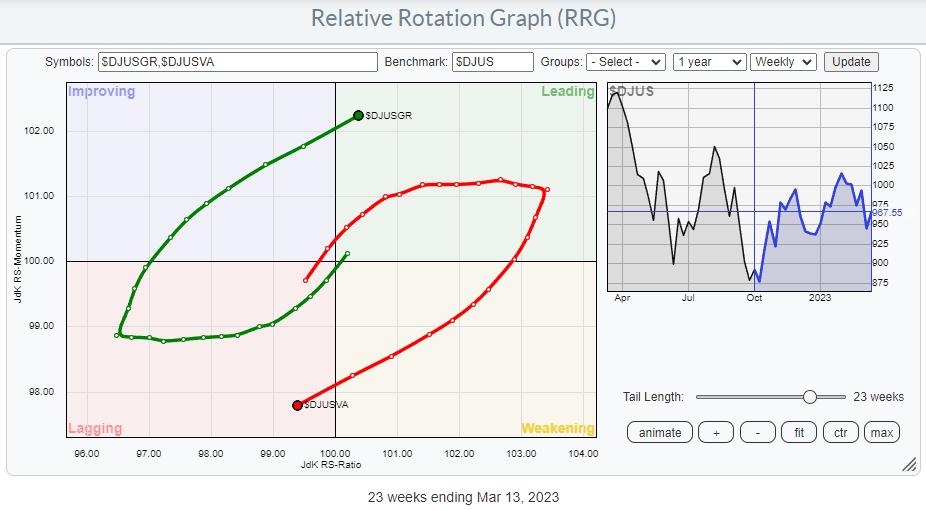

Since late 2021, value stocks have been dominating Growth. The $DJUSGR:$SJUSVA ratio rode the way down together with $SPX. I highlighted this development in a few articles back in 2022.

At the moment, that situation seems to be reversing. The Relative Rotation Graph above shows the Growth Value rotation...

READ MORE

MEMBERS ONLY

Sector Spotlight: Watch How Technology Sector Leads on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, after two episodes looking at longer term trends, first in seasonality and then in price trends on the monthly charts, I talk you through what's happening in current rotations for asset classes and sectors. We look at the...

READ MORE

MEMBERS ONLY

SPY Dips But Tech Is Now Back On Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

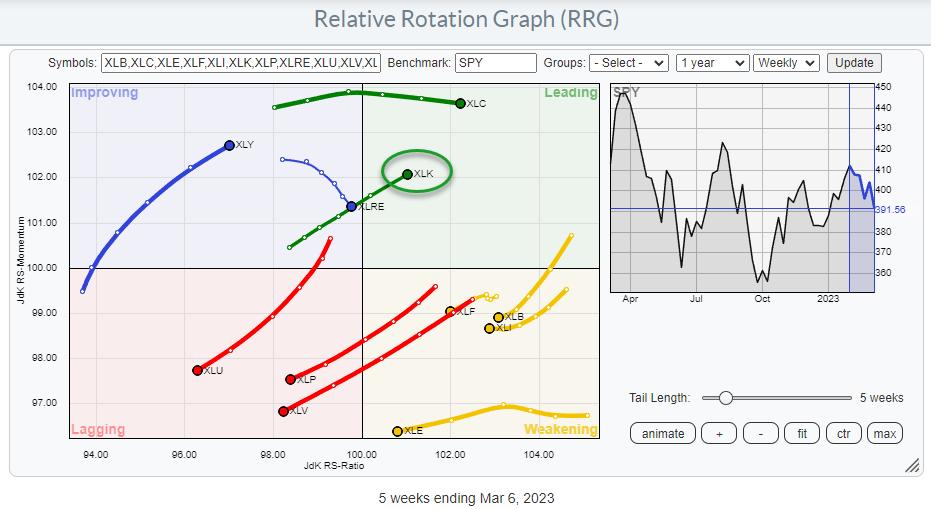

Right now, it seems the most enticing tail on the relative rotation graph for US sectors is that of XLK, the technology sector. XLK has been in a strong RRG heading for a few weeks already, crossing over into the leading quadrant last week, and has continued to push further...

READ MORE

MEMBERS ONLY

Sector Spotlight: Strong Rotation to High Beta Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, for this first Tuesday of the month, I take a look at the completed monthly charts for February for both Asset Classes and Stock sectors. While evaluating last month's performance for the individual sectors, I include the February...

READ MORE

MEMBERS ONLY

Sector Spotlight: Market Entering Period of Strong Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I assess the current state of sector rotation, highlighting the ongoing rotation out of defense in favor of more offensive and economically-sensitive sectors. As it is the last Tuesday of the month, seasonality make ups a big part of the...

READ MORE

MEMBERS ONLY

Looks Like a Major Shift in Leadership in the Energy Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

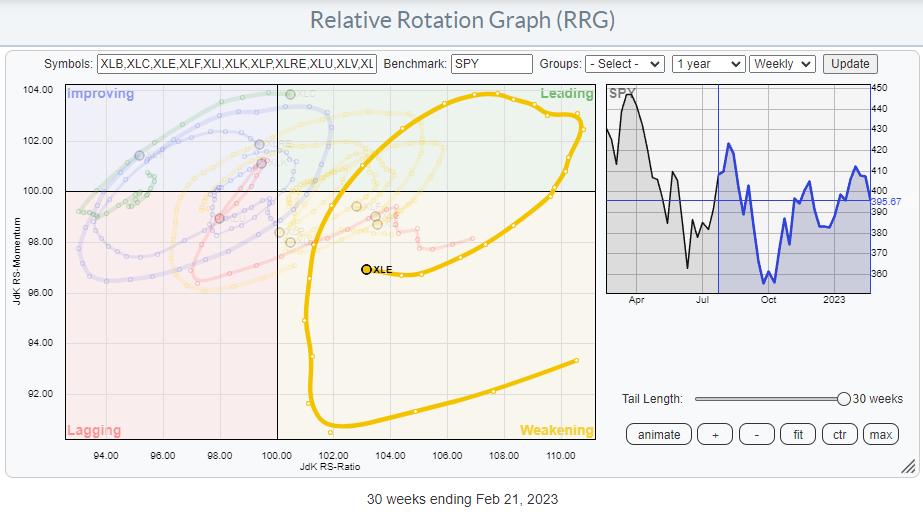

The Energy Sector Seems to be Coming Back to Life

On the Relative Rotation Graph (RRG), a long tail is visible starting in July 2022, traveling from weakening back up towards and into leading in October 2022. After another rotation through the leading quadrant, the tail for XLE crossed into...

READ MORE

MEMBERS ONLY

Ongoing Sector Rotation Out Of Defense Into Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

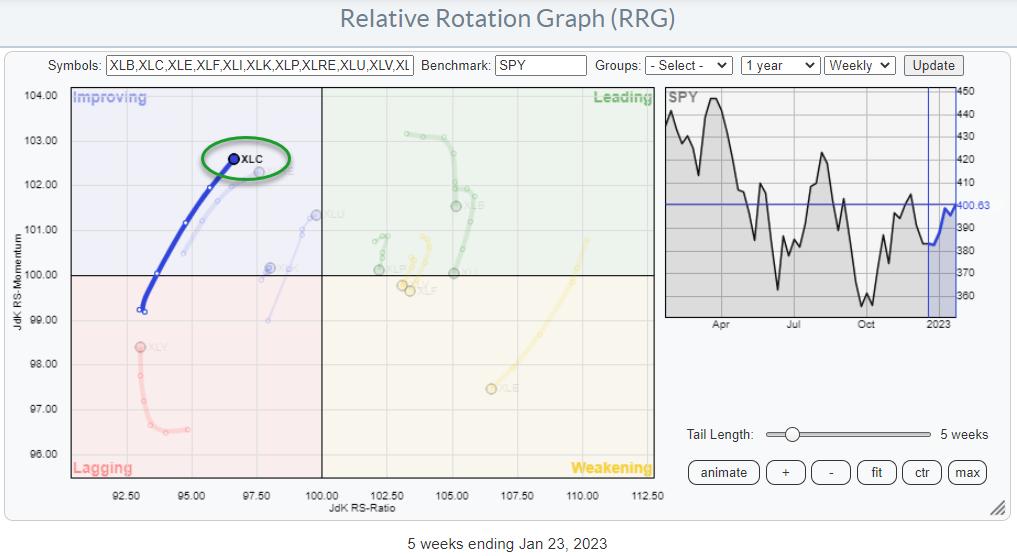

The Relative Rotation Graph for US sectors continues to show a shift out of defensive sectors into more offensive and economically sensitive ones.

The improvement for XLC (communication services, XLY (consumer discretionary), and XLK (technology) continues and is visible inside the improving quadrant. All three tails are travelling at a...

READ MORE

MEMBERS ONLY

Sector Spotlight: This Sector is On Fire

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look at the current state of sector rotation, highlighting the most important rotations from a positive as well as a negative perspective. After that, I zoom in on the Communication Services sector and highlight seven individual stocks; four worth...

READ MORE

MEMBERS ONLY

Sector Spotlight: Some Valentine Love for the Tech Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, for this first week of February, I address high level asset-class rotation, then step into sectors. From the sector level, I use Relative Rotation Graphs, in combination with the scan engine, to drill down into industries and individual stocks.

This...

READ MORE

MEMBERS ONLY

This is Your Most Important Decision

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I talk about it almost every week in Sector Spotlight, but I just realized that I have not written about it for quite a while.

The investment decision that has the most significant impact on your results...

Asset Allocation.

Many, especially retail investors, are so focused on the stock market...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation with Seasonality -- A Strong Combination

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, for this first week of February, I cover both the seasonality and the monthly charts. We have an interesting alignment of seasonal expectation and current sector rotation floating to the surface, offering a nice potential pair trading opportunity.

This video...

READ MORE

MEMBERS ONLY

You Gotta Love a Good Wedgie

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

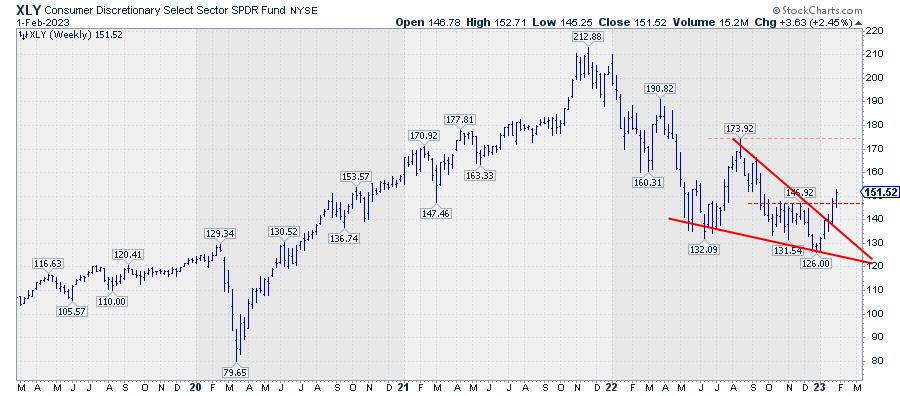

In the second half of 2022, the price chart for XLY started to form a falling wedge pattern.

This pattern or formation is characterized by two converging trendlines, BOTH moving lower. The falling wedge variant comes in two variations. It can be either a continuation within an established uptrend or...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Out of Defense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I address the current state of asset class rotation, then move on to sector rotation. I divide the market in three groups -- Offensive, Defensive and Sensitive -- and find an interesting alignment that should be taken seriously as an...

READ MORE

MEMBERS ONLY

Will This Be THE Break?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I looked at market breadth using two different variations of Relative Rotation Graphs. Following that show, I received an email from a user reminding me of another set of market breadth indices that we keep for sectors: the BullishPercent indices.

You...

READ MORE

MEMBERS ONLY

Two Highly Entertaining Stocks to Watch

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After a 50% decline, you need to make a 100% return to break even.

That is precisely what happened to the Communication Services sector. In August 2021, the Communications Services Select Sector SPDR fund (XLC) peaked at 85 and, from that point onward, started a disastrous decline, bringing its price...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Model All Over the Place

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look at the current state of sector rotation, then walk through all 11 sector charts to make an assessment on their individual (relative) trends and their near-term support and resistance levels. Next, I use all this information to "...

READ MORE

MEMBERS ONLY

Return of the REITs?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

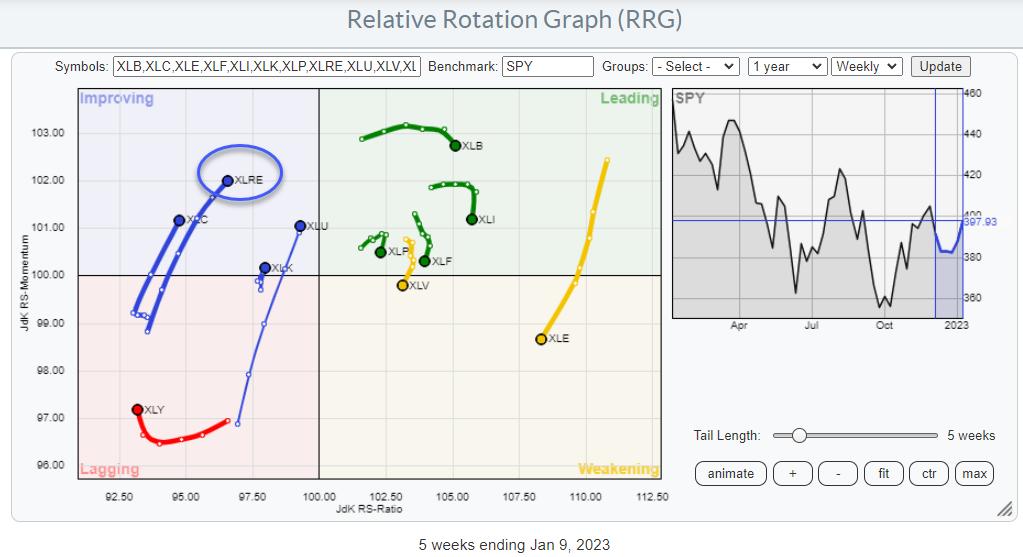

On the Relative Rotation Graph for US sectors, the tail for XLRE, the Real Estate Select Sector Fund, is inside the improving quadrant and heading towards leading at a positive RRG-Heading.

This is one of the few tails with a positive RRG-Heading, between 0-90 degrees. The other ones are Utilities,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Reverse Engineering a Price Target for SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this year's first episode of StockCharts TV's Sector Spotlight, I take a look at the Sector Rotation Model and address the current state of stock market sector rotation. Then, I discuss the four macroeconomic indicators that form an integral part of the model to assess...

READ MORE

MEMBERS ONLY

Useful (Multi)Utilities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From the Sector Level

On the Relative Rotation Graph for US sectors, the tail for the Utilities sector stands out. It is relatively long compared to the other tails on the graph, which indicates that there is quite a bit of power behind the move. With the tail moving from...

READ MORE