MEMBERS ONLY

Sector Spotlight: Growth Takes Over (for Now)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I assess the current rotation in asset classes and sectors, highlighting the rotation for commodities, which are going through a setback but are likely to come back as the leading asset class. In equity sectors, I'm seeing an...

READ MORE

MEMBERS ONLY

Sector Rotation (Model) vs Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Those of you who regularly watch Sector Spotlight on StockchartsTV will know that I have a few segments that come back on a regular basis.

Every last Tuesday of the month I discuss the seasonality for sectors going into the new month to see if the historical seasonal pattern aligns...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Model Says It's Not Over Yet

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after an update on the current rotations for various asset classes, I look at the sector rotation model and and try to make an assessment on where, and which phase, we currently are in the market cycle. I evaluate the...

READ MORE

MEMBERS ONLY

This Industry Group is Facing 60% Downside Risk

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

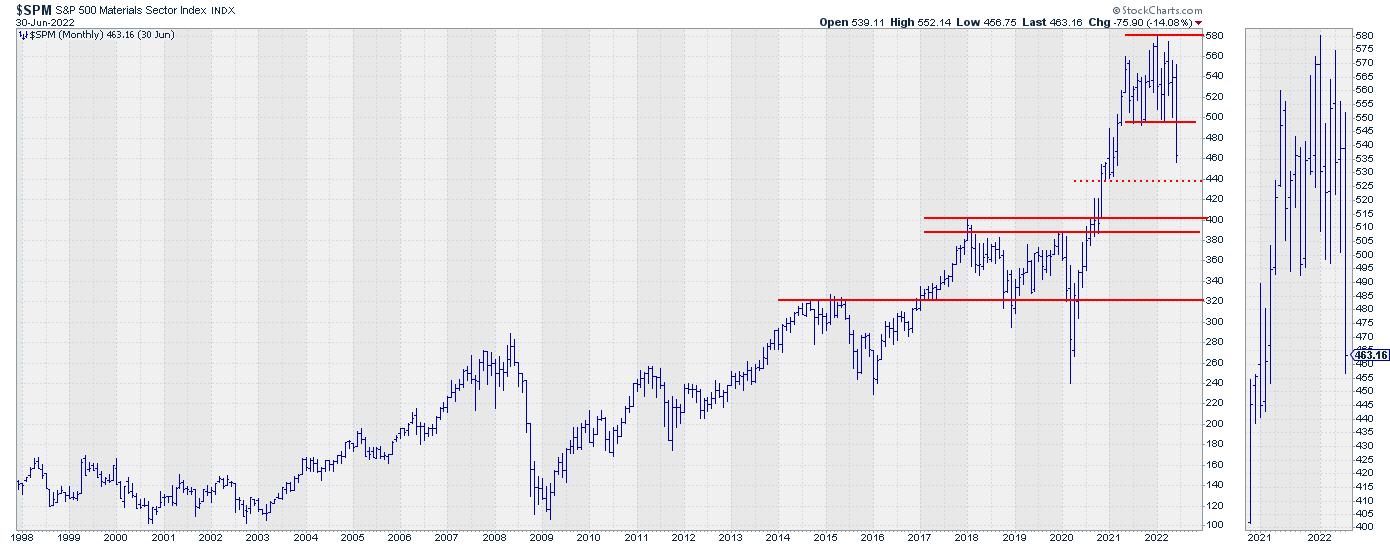

The chart above is the monthly chart for the materials sector $SPM, which I discussed in this week's episode of Sector Spotlight while going through the completed monthly charts for June.

Materials Sector Completing Big Top Formation

$SPM especially stands out, as the sector very clearly completed a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds Drop, Money Leaves Materials Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, to kick off the month of July, I dive into the status of the long-term trends as they are unfolding on the monthly charts. The main message from the asset classes is that the bond market is clear: Corporate- and...

READ MORE

MEMBERS ONLY

Money Rotating Out of Insurance Groups is Splitting The Financials Sector in Two

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Financial sector qualifies as an offensive, or cyclical, sector, together with Consumer Discretionary, Real-Estate and Materials.

On the Relative Rotation Graph for sectors, XLF is showing up inside the lagging quadrant, signaling a relative downtrend vs. the benchmark (SPY). It is interesting to see that XLF is the only...

READ MORE

MEMBERS ONLY

Isn't That Beautiful?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Yes, Technical Analysis can be (very) subjective at times. Different (types of) investors interpret charts differently. And yes, more quant-based technical approaches can make interpretation of charts or time series less subjective. Personally, I am probably somewhere in the middle of the spectrum.

BUT, looking at the chart of the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Out of Energy Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, for this last Tuesday of the month, I take a look at seasonal sector rotation and try to align that with the current reality to see if meaningful matches can be found. For this month, four sectors are providing potentially...

READ MORE

MEMBERS ONLY

The Battle Between Musk & Ma

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

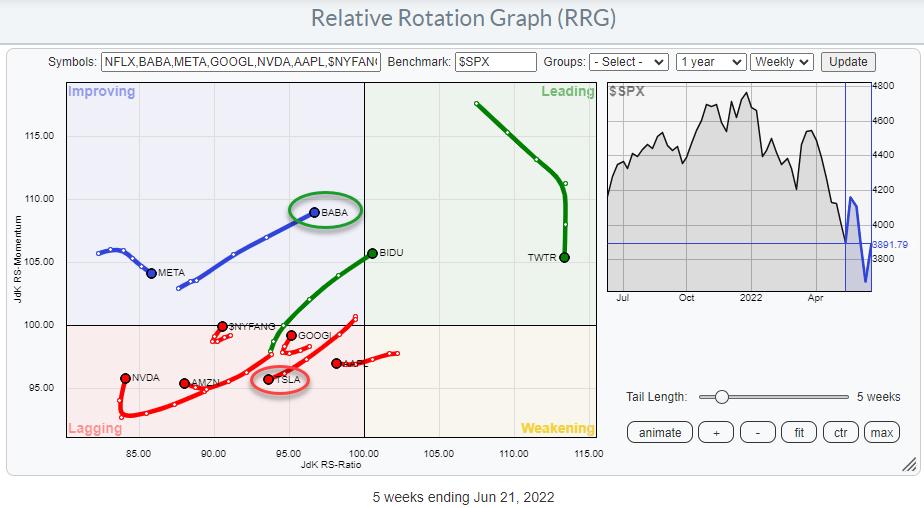

Following the recent bounce in the stock market, predominantly driven by growth stocks, I wanted to investigate the rotations within the NYFANG+ index (or should it be NYMANA, nowadays?). This is a group of mega-cap stocks from the technology, consumer discretionary and communication services sectors.

When we look at the...

READ MORE

MEMBERS ONLY

Sector Spotlight: When Defensive Sectors Break Support...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I kick off the show by answering two questions from the mailbag. I then move on to the current rotation of asset classes, observing that a more pronounced pause in the turnaround for commodities seems imminent. Meanwhile, signals suggesting a...

READ MORE

MEMBERS ONLY

One Lone Ranger Inside the Technology Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

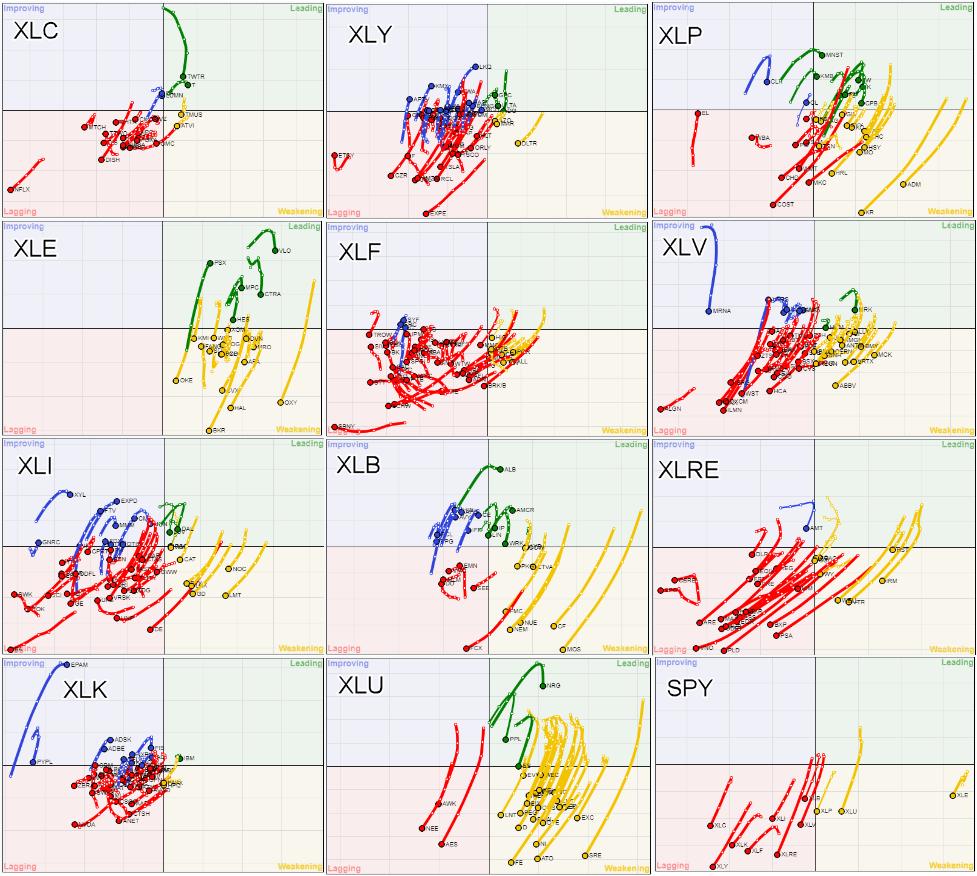

In my previous article, as well as in Tuesday's Sector Spotlight show, I touched on using Relative Rotation Graphs for gauging market breadth, showing this combination chart.

This image combines 12 Relative Rotation Graphs using $ONE as the benchmark, and it tells me, and I hope you as...

READ MORE

MEMBERS ONLY

Sector Spotlight: Tracking the Stock Market Slide on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I jump right into the rotations for asset classes and sectors. At asset class level, the only things that go up in price are commodities; the USD has made a strong move and is back on track. Meanwhile, both stocks...

READ MORE

MEMBERS ONLY

Sector Rotation At Cross Roads, Defense Likely To Take Back The Lead.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly

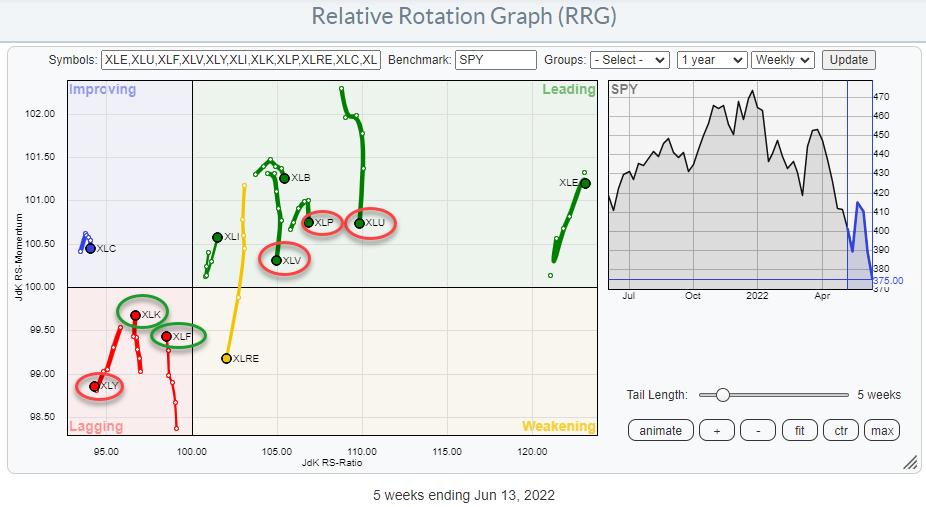

The Relative Rotation Graph for US sectors is arriving at an important juncture.

For months the defensive sectors have been the leading segment in the S&P, even before the peak was reached Utilities, Staples, and Healthcare started leading the market from a relative perspective. These sectors were...

READ MORE

MEMBERS ONLY

Sector Spotlight: Real Estate Has Peaked

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after addressing seasonality and monthly charts in last week's episode, I go back to talking you through the current rotations in Asset Classes and Sectors. The big picture is still for stocks going through a temporary recovery within...

READ MORE

MEMBERS ONLY

Defense Still Leads With a Pocket Of Strength in Commodity Chemicals

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

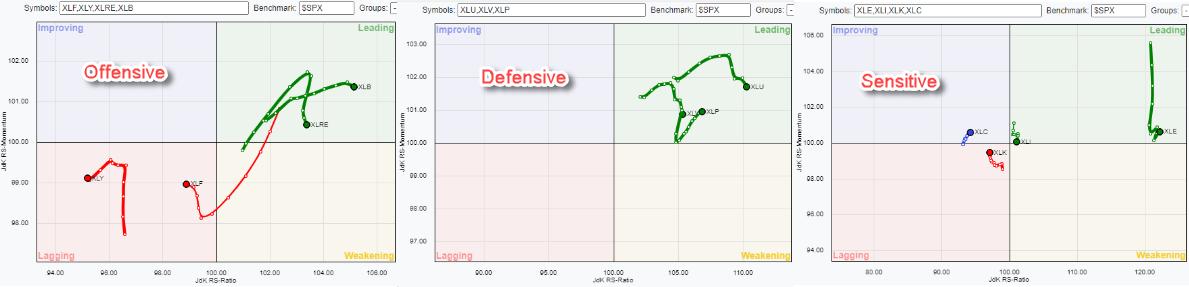

Breaking down the US sector universe into three groups (as opposed to two) -- Offensive/Cyclical, Defensive and Sensitive -- shows the current rotations as seen in the Relative Rotation Graphs above.

It is pretty clear, IMHO, that the defensive group (still) stands out. All three sectors -- Consumer Staples,...

READ MORE

MEMBERS ONLY

Sector Spotlight: 62% of the Market is Now in a Downtrend

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I begin with an update on current rotations in asset classes and sectors, highlighting continued strength for defensive sectors. As this Tuesday (5/31) is both the last Tuesday of the month (of May) and the end of the month,...

READ MORE

MEMBERS ONLY

Massive Top Formation Completed

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

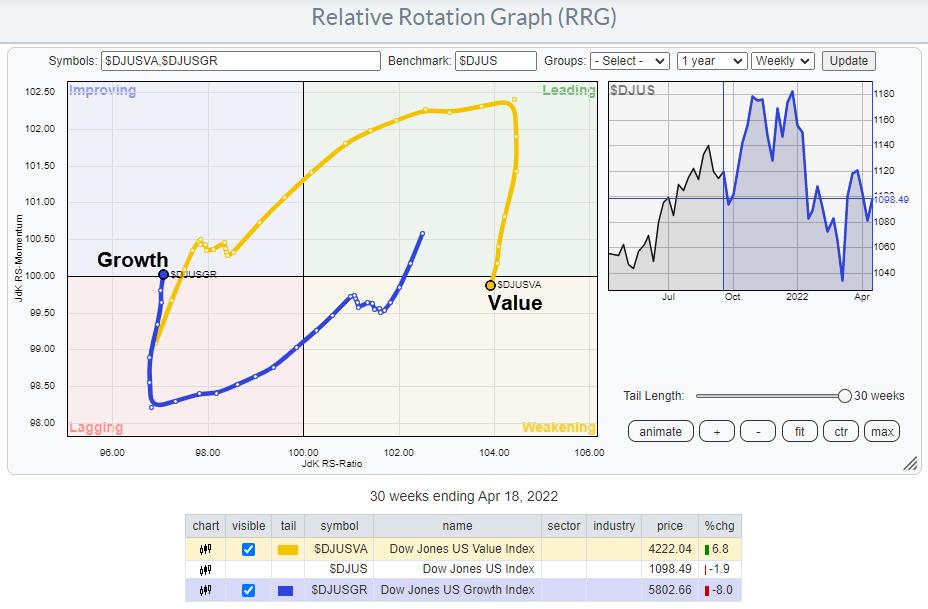

If there is one chart we should be watching at the moment, it should be, IMHO, the ratio between Growth and Value stocks.

The image above shows this relation on a weekly chart going back 15 years. After a multi-year rising trend and an almost exponential acceleration in 2019-2020, a...

READ MORE

MEMBERS ONLY

Value Knocks Out Growth

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The RRG below shows the tails for the DJ Growth and -Value indexes against the DJ US index. In January of this year, the Value tail crossed over into the leading quadrant while, at the same time, Growth crossed into the lagging quadrant.

After a strong stint, the tails started...

READ MORE

MEMBERS ONLY

Sector Spotlight: It's Just a Bounce for Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I talk you through the rotations for asset classes and sectors as they are currently unfolding. At asset class level, the improvement for fixed-income-related assets is worth noticing, as it is pushing stocks (SPY) down and into the lagging quadrant...

READ MORE

MEMBERS ONLY

The US is Dragging Stock Markets Around the World Lower

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For a bird's eye view of developments in international stock markets, I use a Relative Rotation Graph that shows the rotations for a group of international stock indexes.

The RRG below shows the weekly rotation for this group. You can find this under the pre-defined groups in the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bottom-Fishing with RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I very briefly touch on the rotation for asset classes, then spends a bit more time on sectors. I highlight how defensive sectors are still in the driving seat, but also alerting that one sector that could come up as...

READ MORE

MEMBERS ONLY

Is $ONE the Better Benchmark to Use With Relative Rotation Graphs?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Following my article "Which Stocks Inside The Dow Are Worth Holding?", I received a few questions on using $ONE as the benchmark for a Relative Rotation Graph and whether it would be the better benchmark to use. The honest answer to that question?

It depends.

Let Me Explain...

READ MORE

MEMBERS ONLY

Sector Spotlight: 50% Of Market Cap is Lagging SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after looking at seasonality and long-term monthly charts in the last two episodes, I dive deep into the current sector rotation as it is playing out in the S&P 500 at the moment. The most important takeaway is...

READ MORE

MEMBERS ONLY

USD Strength Continues with EUR/USD Arriving at Critical Junction

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

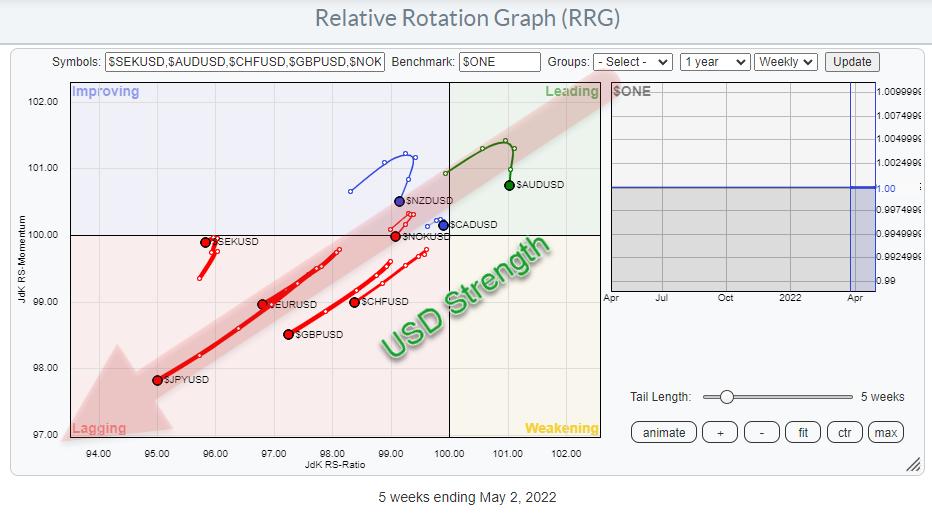

The Relative Rotation Graph that shows the rotation for currencies against the USD as the base is sending us a very clear picture!

USD Strength

The graph holds the G10 currencies. As we are plotting against the USD base, it means that there are nine tails on the canvas and...

READ MORE

MEMBERS ONLY

140 (XLK) And 160 (XLY) Are The Crucial Levels To Watch

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The current sector rotation still shows all defensive sectors inside the leading quadrant, albeit with a slight loss of relative momentum (JdK RS-Momentum scale). Nevertheless, the relative uptrends in those sectors are still intact.

Consumer Staples

Relative strength of the staples sector vs. SPY is in a clear pattern of...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts Resting at Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, for this first Tuesday for the month of May, I review the completed monthly charts for April. This process takes up almost the entire show, so you will get a thorough feel for what's going on at the...

READ MORE

MEMBERS ONLY

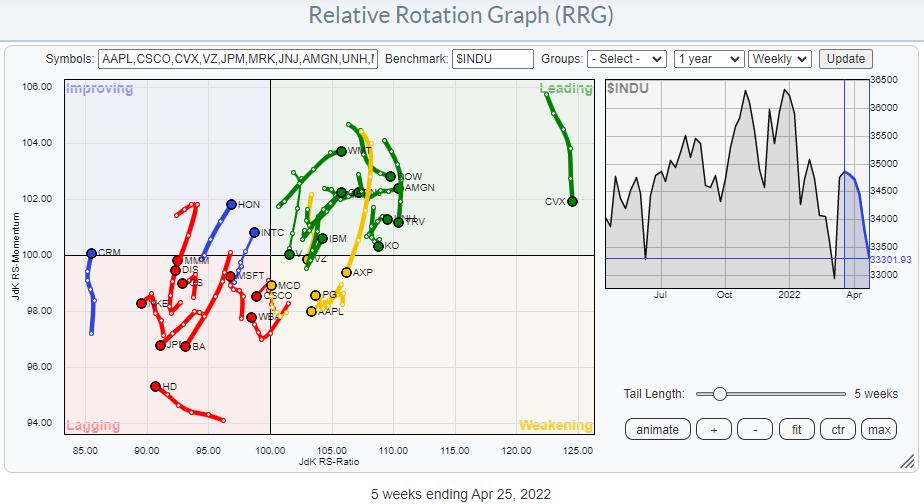

Which Stocks Inside the DOW Are Worth Holding?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

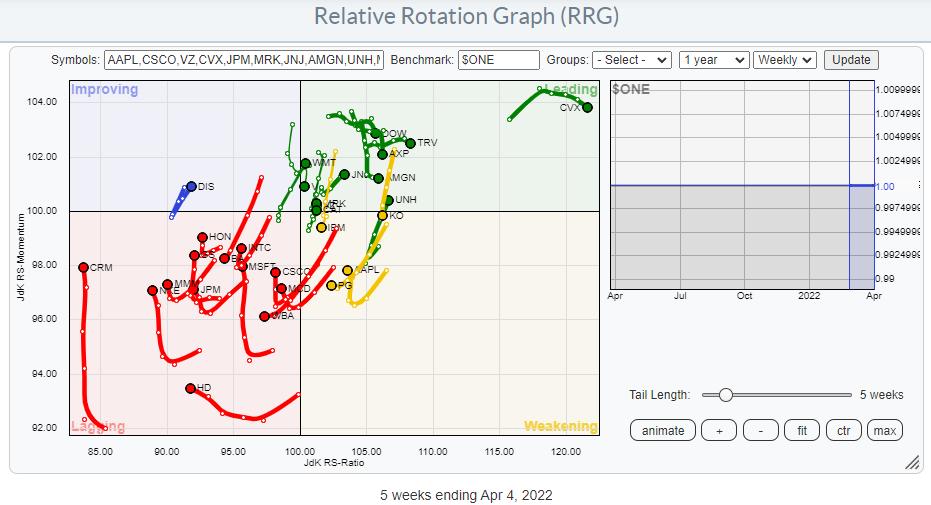

With the general market going through a rough time at the moment, it makes sense to see if we can find pockets that are worth watching and potentially holding in portfolios.

For this occasion, I am using the DJ Industrials universe.

As you know Relative Rotation Graphs are based on...

READ MORE

MEMBERS ONLY

Sector Spotlight: Financials at Risk

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, as it is the last Tuesday of the month, I bring in my analysis of the seasonal patterns for sectors for the new month (of May) and try to align them with the current rotations as I see them unfolding...

READ MORE

MEMBERS ONLY

How to Ride Out the Bear Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

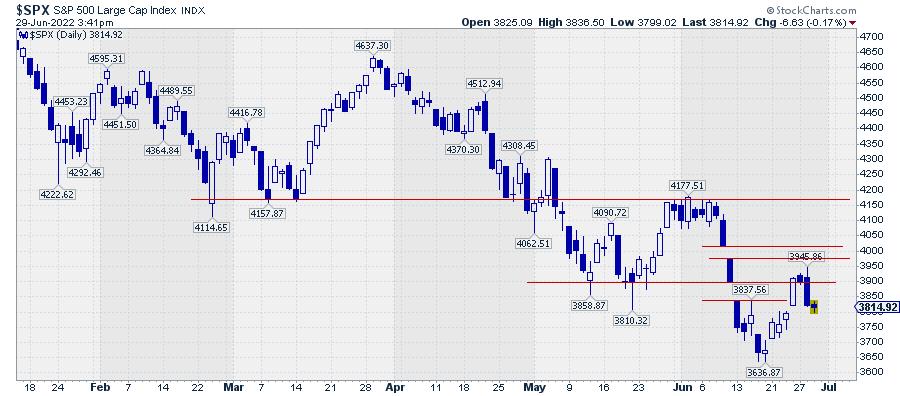

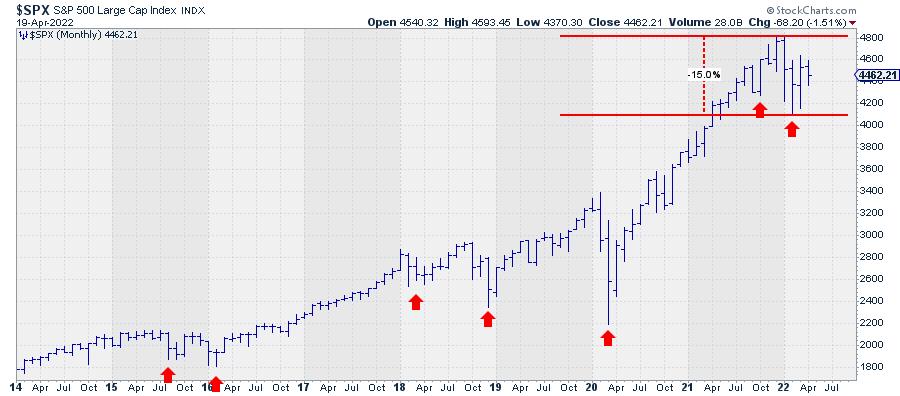

How can we ride out this bear market? Before we can answer that question, we first have to define what qualifies as a bear market. Very often, a decline of 20% or more from the most recent high is used as a yardstick to define a bear market. That seems...

READ MORE

MEMBERS ONLY

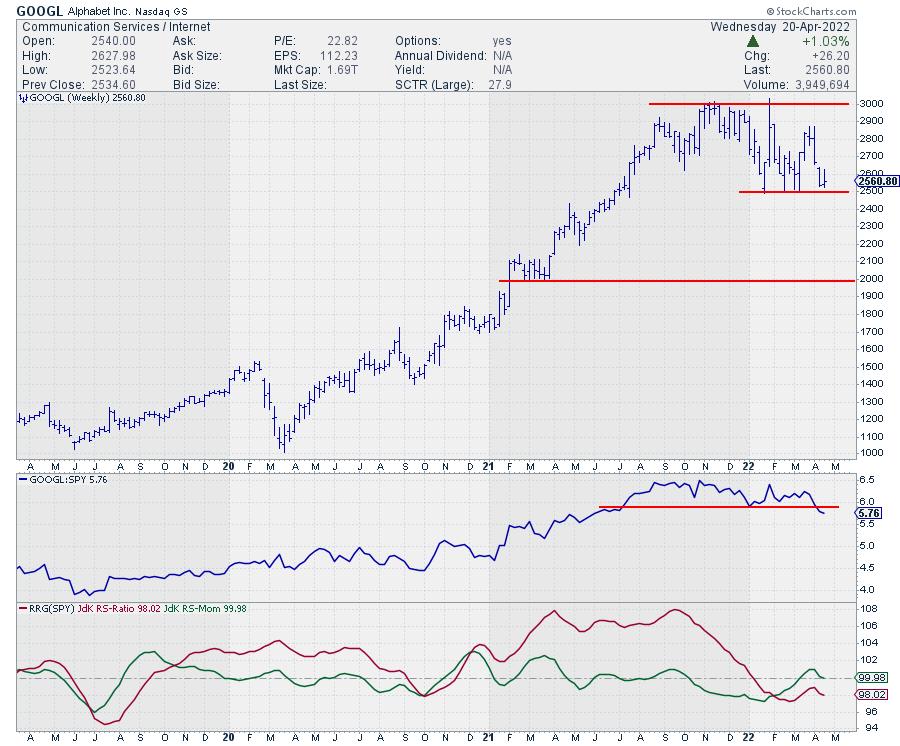

GOOGL On Track for $2000 Once This Support Level Breaks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When I brought up the Relative Rotation Graph showing the NYFANG components against $SPX, I made a few interesting observations.

In general, the rotation of almost all tails looks horrible. They are either already inside the lagging quadrant (and) at a negative RRG-Heading, or rotating back to lagging. The two...

READ MORE

MEMBERS ONLY

After a Short Break, Value is Ready to Pick Up Again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I had planned to also do a review of the current growth/value rotation. Due to bad timing on my side, or talking too long on the breakdown of sectors into cyclical, defensive and sensitive in large-cap, equal-weight and small-cap universes,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Defense, Defense, Defense!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I briefly look at the current rotations in asset classes, then dive into sectors. After a look at what happened last week, I break down the sector universes into cyclical/offensive, defensive and sensitive, then compare the rotations between large-cap,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Market Past Top Shifting Towards Early Recession

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I take a look at last week's rotations for asset classes and sectors, noticing the improving relative strength for stocks vs. bonds but a general weakening of both stock and bond markets in price terms. The rapid rise...

READ MORE

MEMBERS ONLY

Sector Rotation Model Signals Economy Moving Towards Early Recession

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

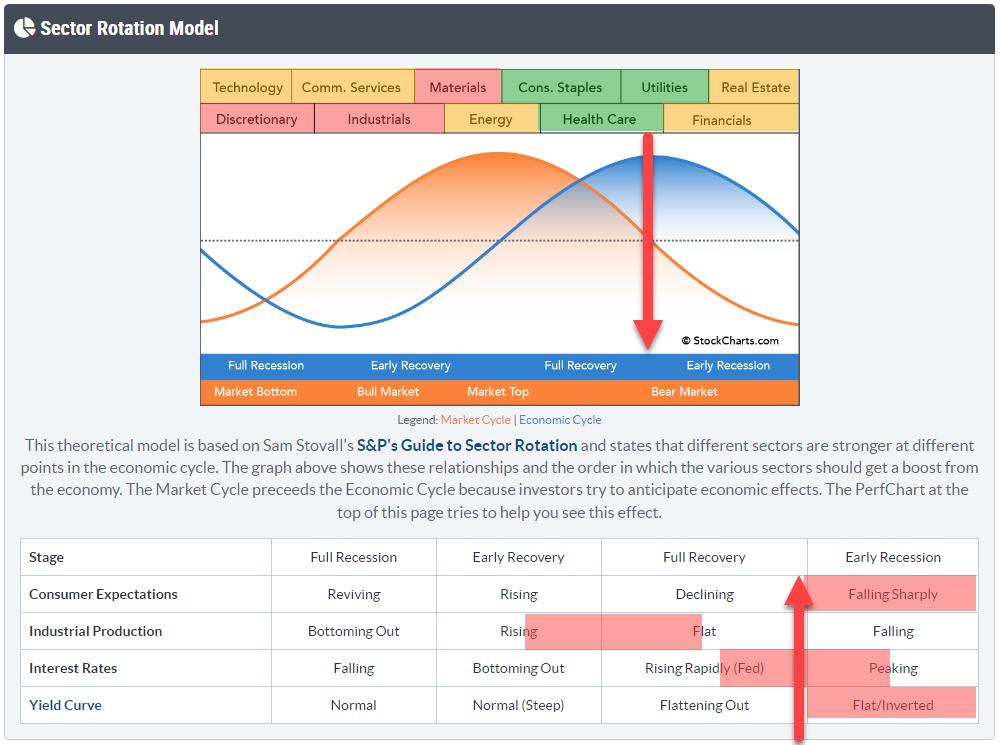

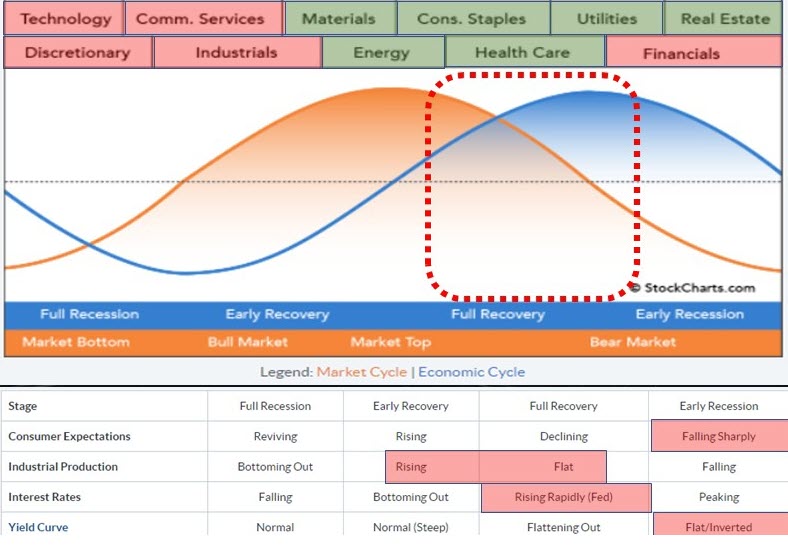

Every quarter, I try to do an update of the Sector Rotation Model. We have the framework as described by Sam Stovall here on the site. The image above shows my interpretation of the various factors that affect this model.

Across the top, you will find the eleven sectors. The...

READ MORE

MEMBERS ONLY

Who Is Swimming Against The Tide?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the members of the DJ Industrials index against $ONE as the benchmark. This way of looking at RRG helps us to gauge the price trends within the universe. You can see quite clearly that the majority of the tails are inside the lagging quadrant,...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Killer Combination - Strong Utes and Weak Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, for this first Tuesday in April, I present the monthly charts for asset classes and sectors to the forefront again. After a review of last week's rotations, I bring up the monthly charts for the most important asset...

READ MORE

MEMBERS ONLY

A Pretty Clear Message From The Dow Theory

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sometimes less is more. When things are messy and there are a lot of things that are moving markets I usually like to take a step back and look at some of the very basic stuff to get rid of all the noise and clutter.

On this occasion, I thought...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds Remain a Threat

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after having missed last week's show, I catch up with a discussion on rotations for asset classes and sectors, in particular pointing out the rapidly-rising interest rates and their potential impact on stocks. The near-term rotations are in...

READ MORE

MEMBERS ONLY

A New Round of Crypto Strength Seems to be Around the Corner!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The interest in Bitcoin or, more generally, cryptocurrencies comes and goes, and the moves are highly volatile from time to time. Nevertheless, this investment space is becoming more and more mainstream and, no matter what your personal opinion is, it is more and more a force to be reckoned with....

READ MORE

MEMBERS ONLY

Materials are Creeping Up, While PKG Breaks Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The materials sector has recently started to pick up relative strength again following a loss of relative momentum while inside the leading quadrant. The RRG above, with the XLB tail highlighted, is a nice example of how RRG-Velocity, which measures the week-to-week distances on the tail, started to shrink before...

READ MORE