MEMBERS ONLY

Sector Spotlight: It's Not Over Yet for Slumping SPY!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I address last week's rotations for asset classes and sectors. After that, I look deeper into the current structure of the S&P 500 chart in combination with the RSI and discuss the interpretation of the current...

READ MORE

MEMBERS ONLY

Which Energy Stocks Should You Be Watching?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

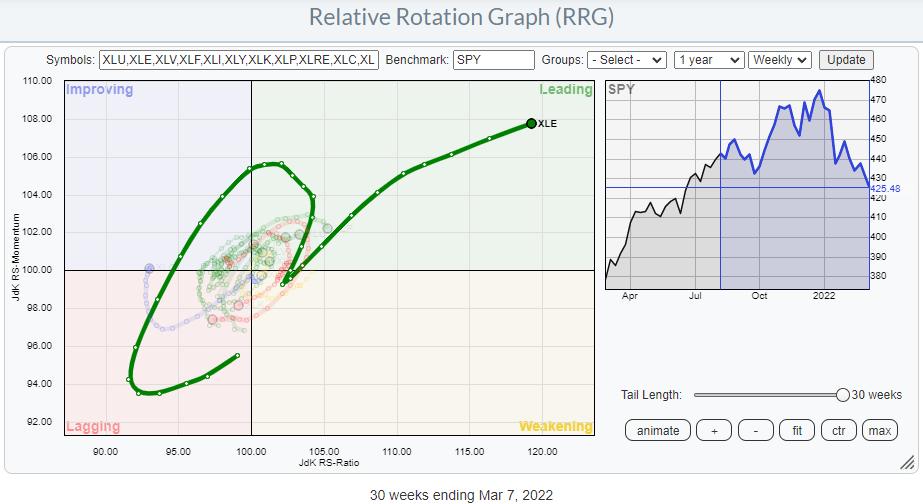

It's very clear that the Energy sector is the strongest sector inside the S&P 500 over the last several months.

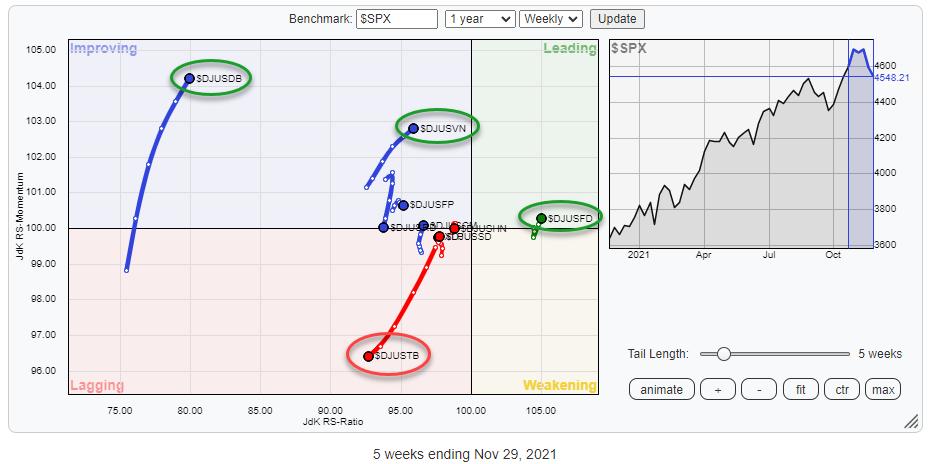

The tail on the Relative Rotation Graph above shows the rotation that the sector went through. The "hook" back up to leading from weakening...

READ MORE

MEMBERS ONLY

Monero (XMR) Starting To Lead Against BTC

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

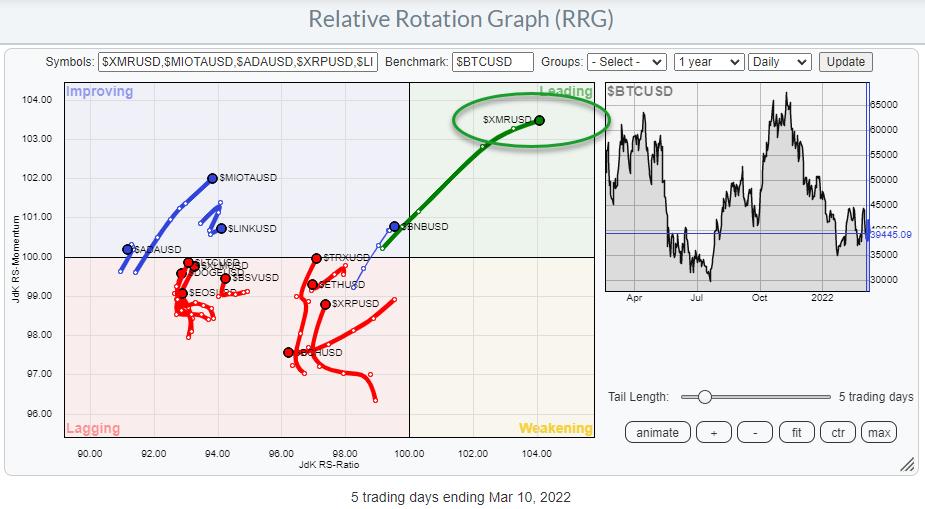

The Relative Rotation Graph above shows the rotation for a group of cryptocurrencies against BTC on a daily time frame. Looking at this chart, the tail for $XMRUSD stands out. Almost all the tails are traveling in an NW direction, which means that they are improving against BTC. However, the...

READ MORE

MEMBERS ONLY

Don't Be Fooled by a One-Day 2.5% Jump

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Yesterday (Wed 3/9), the S&P bounced up around 2.5%... And although it is a nice jump after all the declines we have seen recently, it doesn't impress me much. At least not enough to get very bullish again all of a sudden.

Of course,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Energy and Utilities Jump Amid Market Mayhem

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after another volatile week, I take a look at rotations as they unfolded in Asset Classes and sectors where I find defensive sectors topping the charts. Following the events in Eastern Europe between Russia and Ukraine, I take another look...

READ MORE

MEMBERS ONLY

Sector Spotlight: Long-Term Sector Trends are Fading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, as it is the first Tuesday of the month, I take on the monthly charts for February. After a short look at the current rotations for Asset Classes and Sectors, I jump into the long-term trends as they are unfolding...

READ MORE

MEMBERS ONLY

Breaking Down Europe (On the Charts, That Is...)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my article for the ChartWatchers newsletter this weekend, I wrote about the rotation of various stock markets against the DJ Global Index. On that Relative Rotation Graph, Europe had moved into the leading quadrant, but has since almost immediately started to lose relative momentum. The US market (SPY) had...

READ MORE

MEMBERS ONLY

Waking Up in Europe on Thursday Morning

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What a surreal experience it was waking up on Thursday morning. Switching on the news and seeing that Russia has actually invaded Ukraine. For us Europeans, wars since WWII have always been fought far away from home in Afghanistan, former Yugoslavia, Iraq, Iran, Kuwait, etc. But this is literally in...

READ MORE

MEMBERS ONLY

SPY Closing in on Important Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this week's episode of Sector Spotlight, I discussed the chart of SPY, as it is approaching an important support area between 420-425. The updated version of this chart is printed above and, as you can see, the market is getting closer and closer to this important support...

READ MORE

MEMBERS ONLY

Sector Spotlight: Looking Abroad for Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I take on the rotations in asset classes and US sectors as they unfolded last week. Because it is the last Tuesday of the month, a look at seasonality, in combination with current rotations, is also on the menu. I...

READ MORE

MEMBERS ONLY

Discretionary and Tech Are Crucial for the Direction of the Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Correlation is a useful metric to use when trying to gauge the direction of the market.

The table above shows the correlations for the 12 sectors against the S&P 500. In this version, I used a 6-month period to calculate the correlation; the drop-down selector allows users to...

READ MORE

MEMBERS ONLY

Sector Spotlight: Old Support Returns as Resistance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I go over last week's rotations in Asset Classes and Sectors and put these into a weekly perspective. In the Asset Class section, I zoom in on Stocks, Bonds and Commodities. In sectors, I look at rotations for...

READ MORE

MEMBERS ONLY

Trouble In FAANG(sta's) Paradise

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Relative Rotation Graph shows the rotation for the NYFANG+ members over the last thirteen weeks (quarter). Plotting this universe against the S&P 500 index clearly shows the weakness that crept into this universe recently.

Leading Quadrant

AAPL is the only stock that managed to keep up inside...

READ MORE

MEMBERS ONLY

Semiconductors at Risk!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

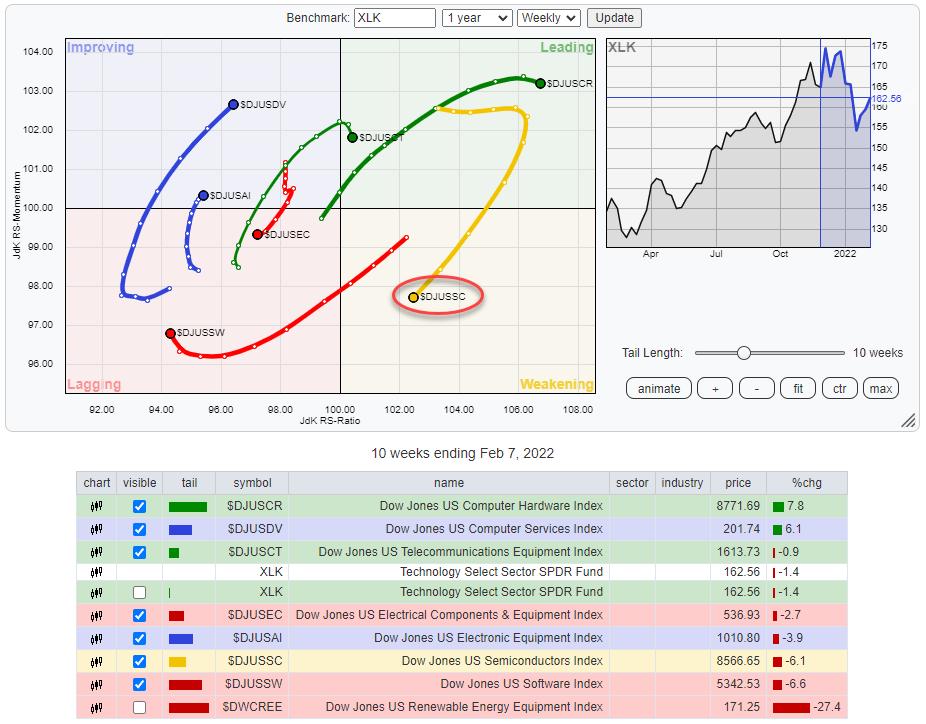

The Technology sector is under pressure for a few weeks already. We have seen a few attempts to bounce back but, so far, these have not been very successful.

The Relative Rotation Graph above shows the groups within the technology sector. The Semiconductors group was a major contributor on the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds Take a Nosedive

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after last week's look at long-term trends on monthly charts, I focus on daily and weekly rotations as I see them in asset classes and sectors. In the asset class segment, developments in the bond markets play a...

READ MORE

MEMBERS ONLY

Sector Rotation to Defense Continues

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Big drops call for big recoveries, but it's dangerous to watch these moves in isolation.

The S&P 500 dropped roughly 60 points from its peak at 480 at the start of the year to find a low recently around 420. Out of that low, the market...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Charts Showing Nasty Reversal Bars

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after a volatile week in the markets and the completion of the monthly charts for January on Monday (1/31), now is a perfect moment to take a good look at the developments on these long-term charts. In the Asset...

READ MORE

MEMBERS ONLY

C'mon Commodities, Push That Energy Sector UP!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Watchers of my show Sector Spotlight will know that I have been watching the development of commodities as an asset class that's going through a long turnaround. Recent developments continue to reinforce that view.

The Relative Rotation Graph shows the rotation for a universe of asset class ETFs...

READ MORE

MEMBERS ONLY

Large Cap vs. Small Cap... A World Of Difference

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When looking at Relative Rotation Graphs showing large-cap sectors and small-cap sectors, we usually see rotations for the various sectors that are more or less in line with each other. That's not surprising, as the small companies are active in the same sector as their large counterparts. Sometimes,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stock/Bond Ratio Signals Defense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after a rocky week and a volatile Monday, I evaluate the rotations for asset classes and sectors on Relative Rotation Graphs. Both groups are showing some important shifts that suggest a further move to defense is in order. As it...

READ MORE

MEMBERS ONLY

This Big Boy is in Trouble

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

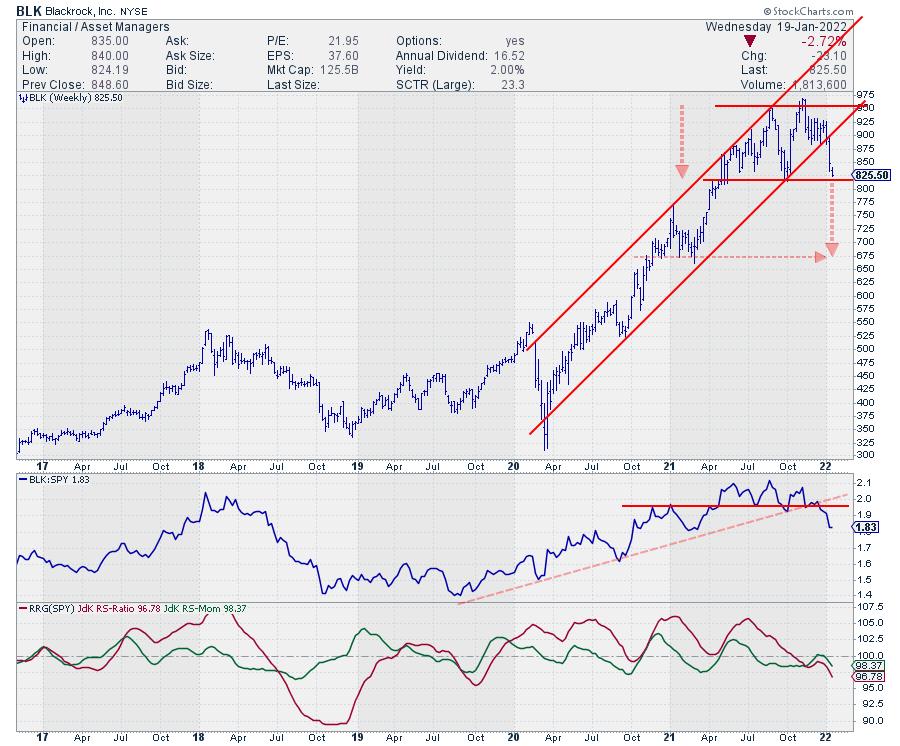

While looking at the Financial sector, I noticed that the group Asset Managers is currently at a very weak rotation against the S&P, as well as its sector index XLF.

After returning into the leading quadrant from weakening, which is usually a strong sign, $DJUSAG rapidly hooked back...

READ MORE

MEMBERS ONLY

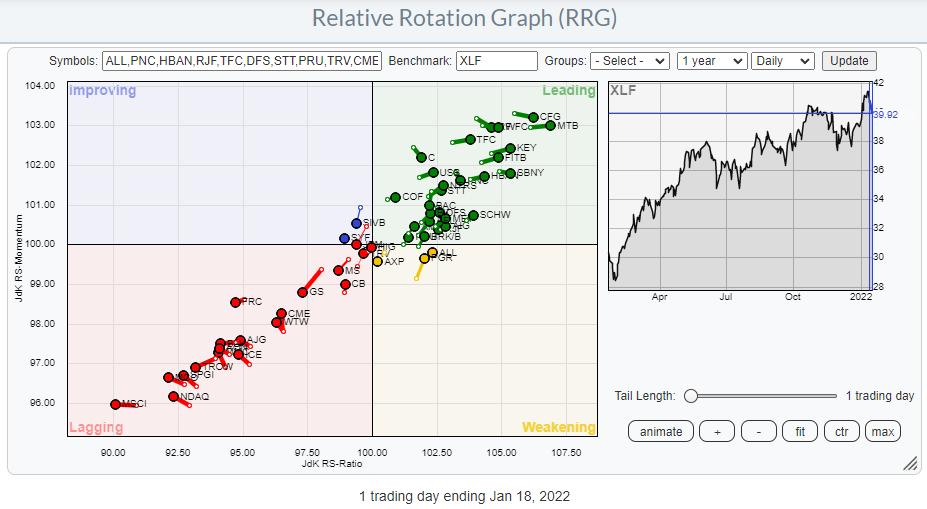

Financials are All Over the Place

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the back of a lot of earnings announcements, the financial sector is getting a lot of attention this week. A few stocks, led by SIVB, FRC and GS, got hurt pretty bad yesterday with >5% declines.

The RRG above shows the (top 50) stocks inside the financial sector....

READ MORE

MEMBERS ONLY

Sector Spotlight: Cycle Shifting Towards Full Recovery/Top

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after going over the current rotations for asset classes and sectors, I use the Equal Weight sectors to update and gauge the current position of the market in relation to the economic cycle. Since December, things seem to have shifted...

READ MORE

MEMBERS ONLY

Using RRG for Visual Inspection of Market and Sector Breadth

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are mostly used to show exactly that -- the RELATIVE Rotation of securities against a benchmark and against each other. However, they offer many more possibilities.

One of the options is to change the benchmark to $ONE. That is essentially a straight line at value 1. This...

READ MORE

MEMBERS ONLY

Useful Utes

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The utilities sector is showing a strong rotation over the last weeks. The sector moved back into lagging from improving in the week starting 18 October, then rotated through lagging and re-entered the improving quadrant again in the week starting 13 December at a strong RRG-Heading.

The next Relative Rotation...

READ MORE

MEMBERS ONLY

Sector Spotlight: Tech & Discretionary Push S&P to Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I cover the rotations for asset classes, sectors and crypto. The break below support of GOVT gets attention while the recent sector rotation out of Consumer Discretionary and Technology pushed the S&P 500 to the lower boundary of...

READ MORE

MEMBERS ONLY

Strong Rotation for Defensive Sectors is Keeping S&P Under Pressure

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the more prominent rotations on the (weekly) Relative Rotation Graph for sectors is the strength displayed by the defensive sectors.

In the RRG above, I have marked an oval around Staples, Utilities and Health Care. These are the three "defensive sectors" in the universe and they...

READ MORE

MEMBERS ONLY

Sector Spotlight: Yield Curve Supports Further Strength for Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the first 2022 edition of StockCharts TV's Sector Spotlight, I look back at rotations that happened over the holiday period and then address the monthly charts that completed in December. The long-term trend in the yield curve shows a rapid flattening in December and, historically, that seems...

READ MORE

MEMBERS ONLY

Ready for New RRG Rotations into 2022

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Here we are, on the last day of the year, writing my last ChartWatchers newsletter contribution for 2021.

By the time you are reading this, it will be 2022. So let me kick off by...

wishing you a very happy and above all healthy new year!!

Given the situation the...

READ MORE

MEMBERS ONLY

Three Groups to Watch Inside the Materials Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the past several weeks, the materials sector has continued to improve very gradually and is now on the verge of crossing over into the leading quadrant.

The bottoming process of relative strength against SPY is still ongoing and has been picked up by the RRG-Lines, which are both rising....

READ MORE

MEMBERS ONLY

Providers and Pharmaceuticals Looking Strong Inside Healthcare

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

My longer-term outlook for the general market is still based on a continuing uptrend. However, over the last few weeks, defensive sectors picked up on the Relative Rotation Graph against the S&P 500.

Of these three sectors, Healthcare (XLV) is the biggest in terms of market capitalization at...

READ MORE

MEMBERS ONLY

See the Growth -- Value Dance on Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the predefined universes/groups on the RRG page is for Growth/Value. Many investors look at this relationship to help them determine whether the market is in a risk-on or risk-off mode. Just pull down the "Groups" selection box and look for Growth / Value.

When browsing...

READ MORE

MEMBERS ONLY

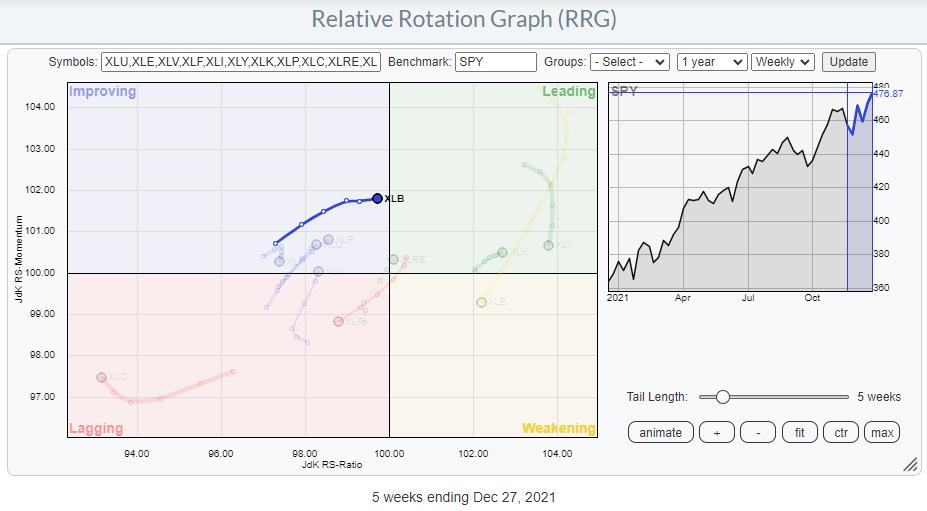

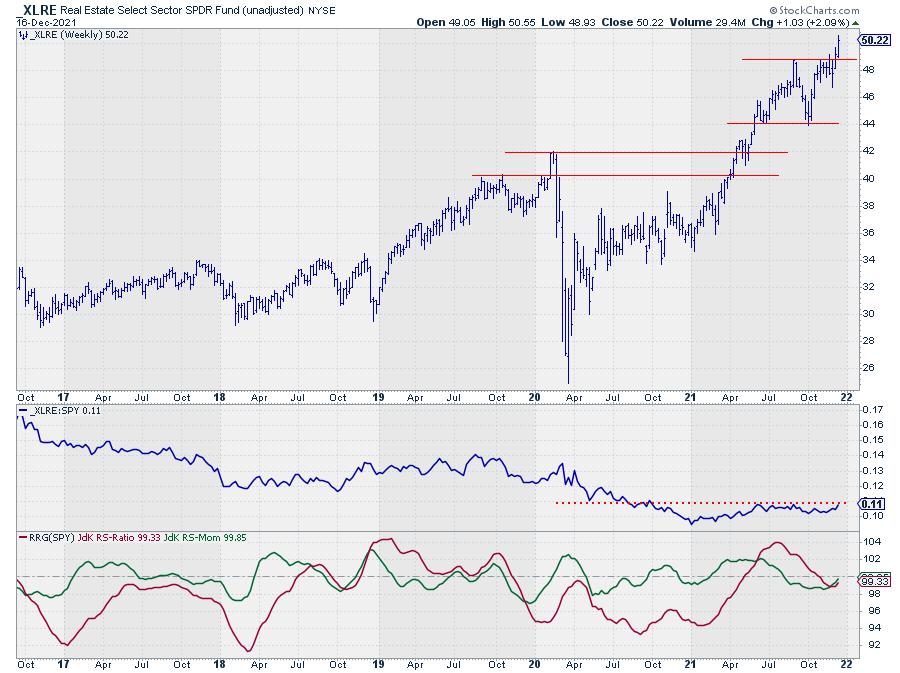

Industrial & Office REITs are Shining in the Real Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Watching the rotation of the Real Estate sector (XLRE) on a Relative Rotation Graph shows the tail inside the lagging quadrant after a long rotation through leading and weakening.

Six weeks ago, XLRE moved into the lagging quadrant, but quite rapidly started to pick up relative momentum again, pushing the...

READ MORE

MEMBERS ONLY

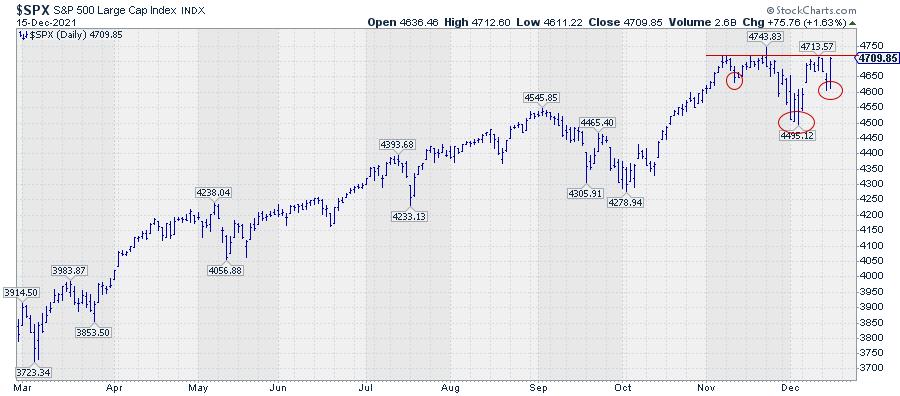

Is The S&P 500 Setting Up for a Break to New Highs?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After dipping to 4500, the development of a potential inverted head-and-shoulders pattern started to take shape on the price chart of the S&P 500.

The overhead resistance just above 4700 has already been developing since the market first reached that area at the start of November. Very recently,...

READ MORE

MEMBERS ONLY

Sector Spotlight: US Leads Internationally and XLRE Stands Out

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take on the asset class and sector rotation as it played out last week. The relationship between stocks and bonds continues to be in favour for stocks while, at the sector level, Real Estate seems to be making an...

READ MORE

MEMBERS ONLY

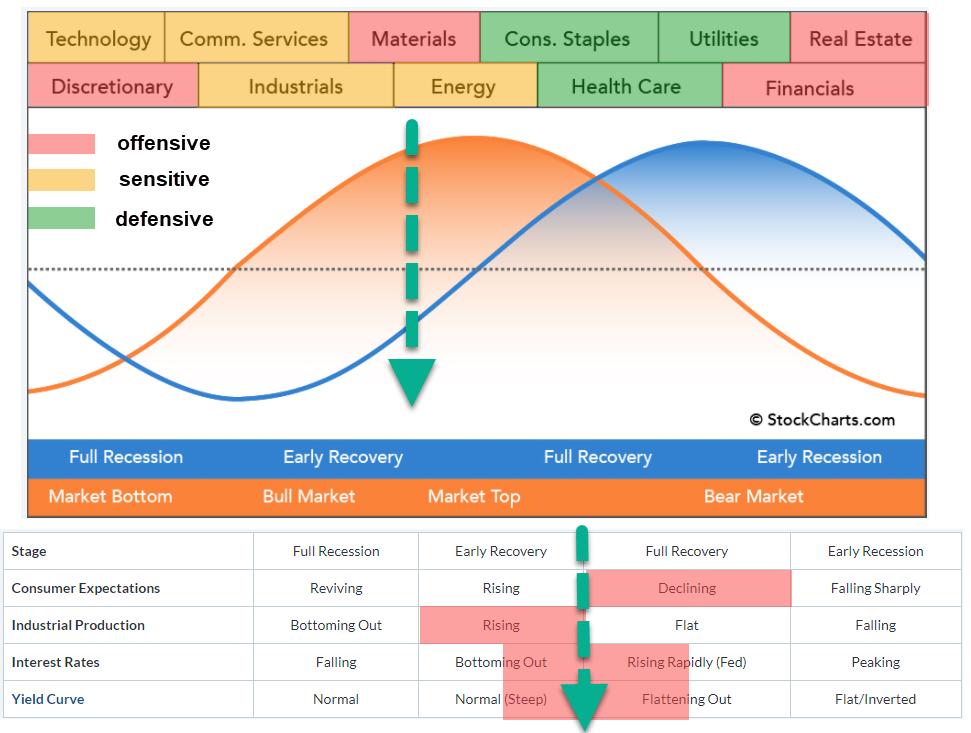

Sector Rotation Model Suggests There's Still Upside Available

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I reviewed the current position of markets (sector rotation) in combination with the theoretical framework provided by the Sector Rotation Model (Sam Stovall). This article provides a quick write-up of that segment.

The sector rotation model shows the typical cyclical movement...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation & The Business Cycle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take a good look at the current state of asset class and sector rotation. I talk you through the daily and weekly rotations on the respective Relative Rotation Graphs, highlighting the strength of the USD, the pause in commodities...

READ MORE

MEMBERS ONLY

Americans are Buying Food and Booze -- But No Cigarettes

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The S&P 500 is still holding up inside the boundaries of its rising channel, but the market is nervous, which resulted in a VIX reading above 30. That hasn't happened since February.

Nervous markets, or rather their participants, usually mean that people start checking out defensive...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Disconnected from Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take on both seasonality and the monthly charts for November, starting with a quick look and analysis of current sector rotation and its potential impact on the S&P 500. After that, I look at seasonal patterns for...

READ MORE

MEMBERS ONLY

Divergence is Back

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

First of all, I need to apologize for the absence of writing a blog article (and publishing a Sector Spotlight Video). In the intro of today's episode of Sector Spotlight, I explain a bit about what happened. But to make a long story very short, on Wednesday evening,...

READ MORE