MEMBERS ONLY

Global Stocks Join Global A/D Line Above Key Trend Lines

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, April 9th at 1:08pm ET.

Global stocks, represented in the form of the MSCI World Stock ETF (ACWI), peaked in January of last year and gradually worked their way lower into...

READ MORE

MEMBERS ONLY

Global Stocks and Bitcoin are Breaking to the Upside

by Martin Pring,

President, Pring Research

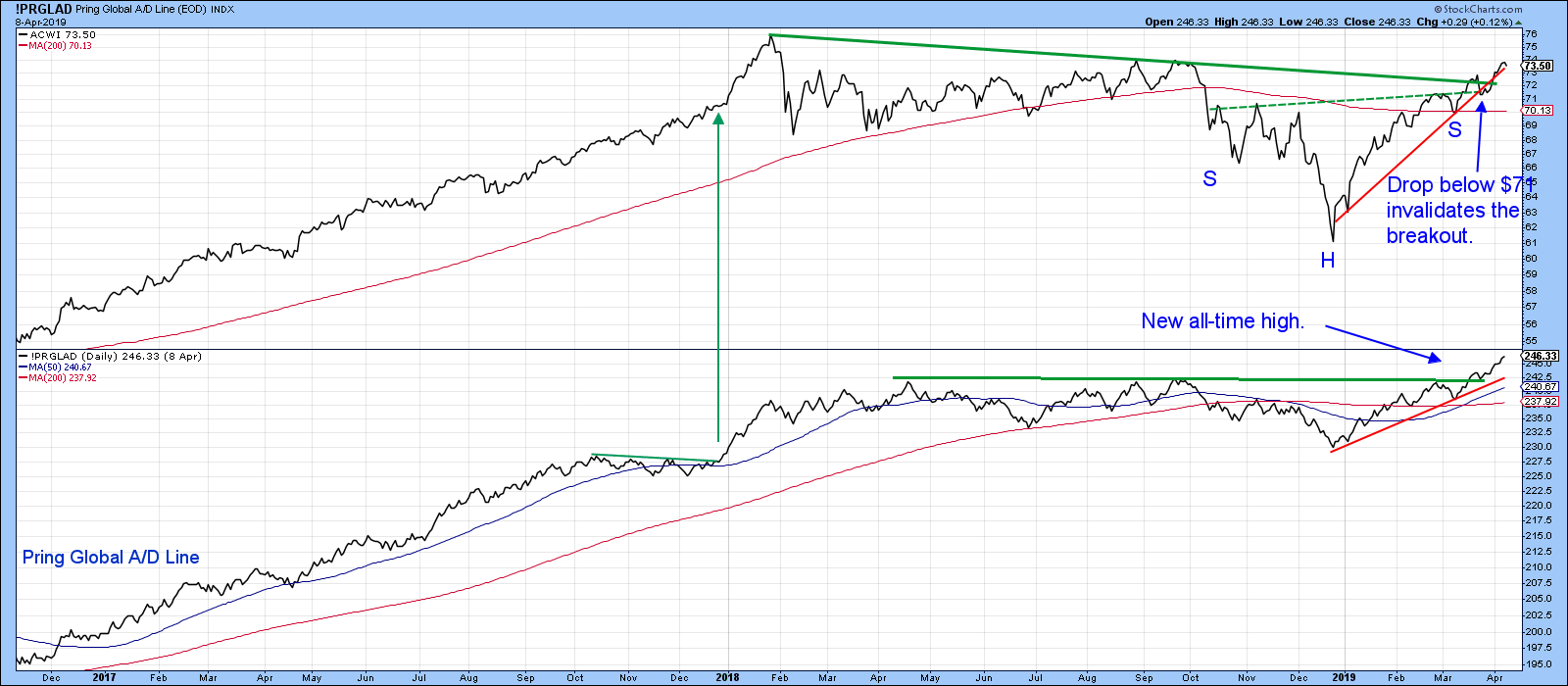

* Global Stocks Join Global A/D Line Above Key Trend Lines

* Bitcoin Looking Better After an 80% Drop

* Inflation vs. Deflation

Global Stocks Join Global A/D Line Above Key Trend Lines

Global stocks, represented in the form of the MSCI World Stock ETF (ACWI), peaked in January of last...

READ MORE

MEMBERS ONLY

Are US Equities About to Break Out Against The Rest of The World?

by Martin Pring,

President, Pring Research

* S&P Relative Action Edging Through Resistance

* British Pound Going Wobbly Before Brexit?

* Mega Buy Signal Could be in Store for the Shanghai Composite

* Gold at a Momentum Downtrend Line as Well

S&P Relative Action Edging Through Resistance

We have all heard about the US economy being...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-04-01

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for April is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

US Stocks Looking Vulnerable Again

by Martin Pring,

President, Pring Research

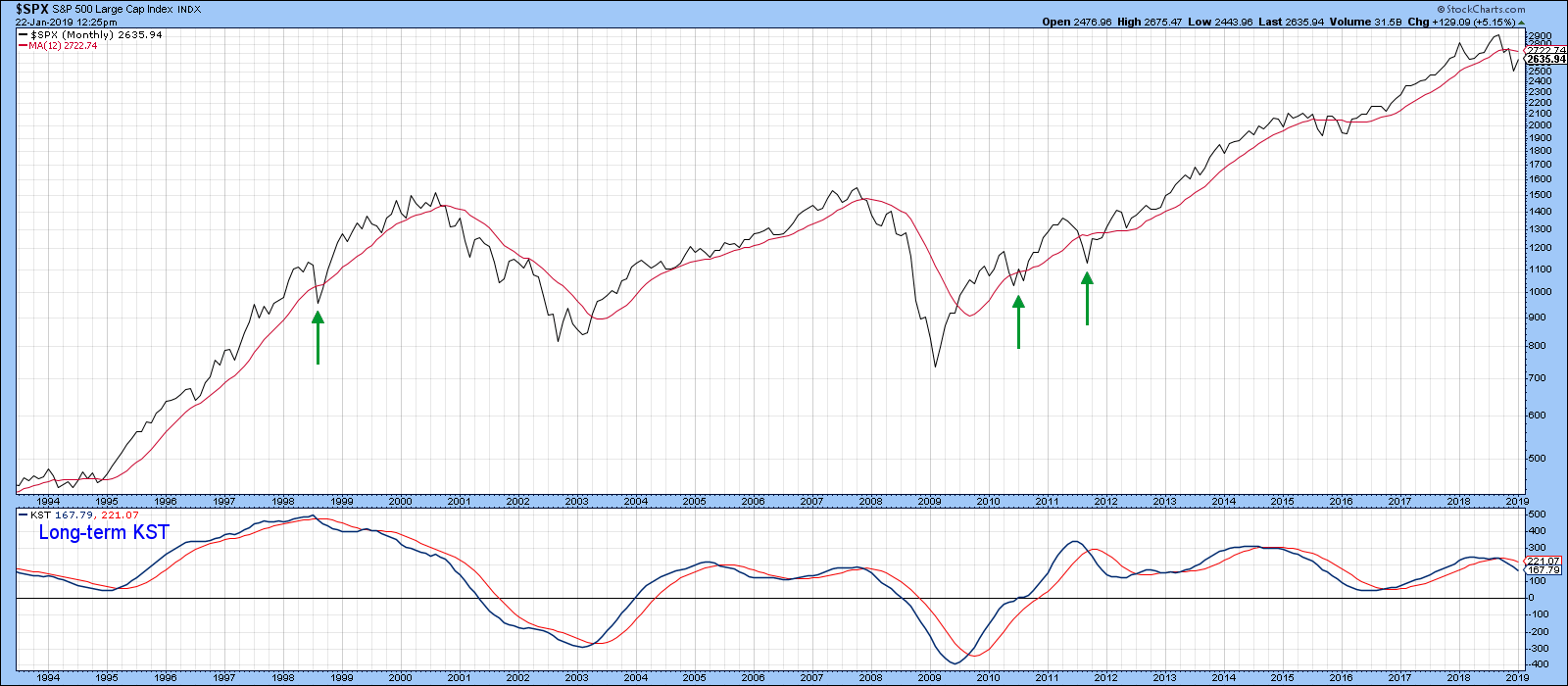

* Long-Term Picture Remains Finely Balanced

* Short-Term Indicators Still Showing Weakness

* Confidence is Starting to Erode Again

* Financials Break Down from a Broadening Wedge

Earlier in the month, I wrote about the Ides of March and the fact that the market looked overstretched, apparently in need of some mean reversal corrective...

READ MORE

MEMBERS ONLY

Deflation Sensitive Stocks Are At A New All-Time High

by Martin Pring,

President, Pring Research

* Deflation Index Leading the Market Higher

* Inflation/Deflation Ratio Starting to Break in a Deflationary Direction

* Several Deflation-Sensitive Industry Groups Looking Stronger

Deflation Index Leading the Market Higher

Last week, I wrote about the possibility of an upside price move in the bond market. So far, most areas remain below...

READ MORE

MEMBERS ONLY

Bond Prices Poised For A Major Breakout, But Will They?

by Martin Pring,

President, Pring Research

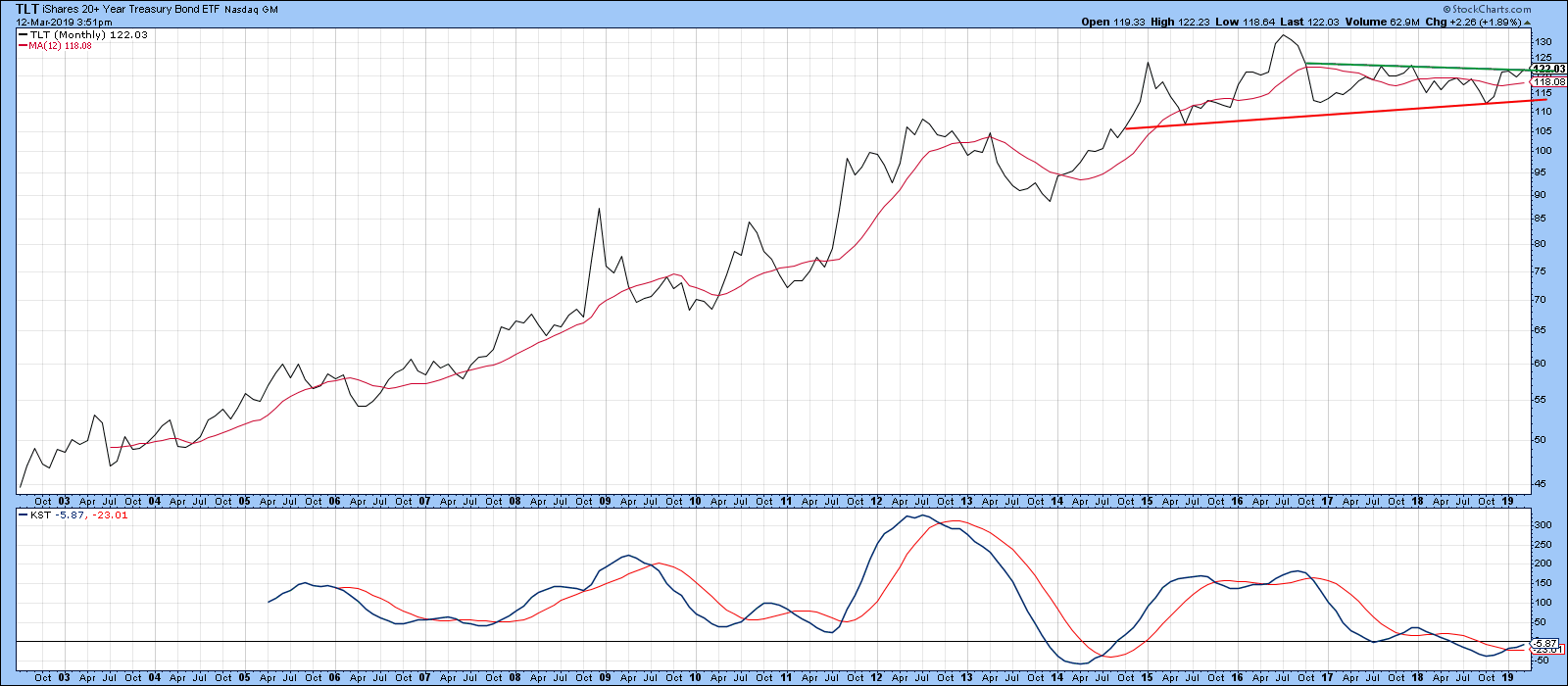

* Adjusted vs. Unadjusted Prices

* Bonds Reflect the Fine Current Balance Between Inflationary and Deflationary Forces

Adjusted vs. Unadjusted Prices

Chart 1 shows that the iShares 20-year Trust ETF, the TLT, has been in a trading range since late 2014. Currently, the price is above its 12-month MA and the long-term...

READ MORE

MEMBERS ONLY

Dollar Breaks To New Highs As Several Stock Averages Drop Below Their 200-Day Moving Averages

by Martin Pring,

President, Pring Research

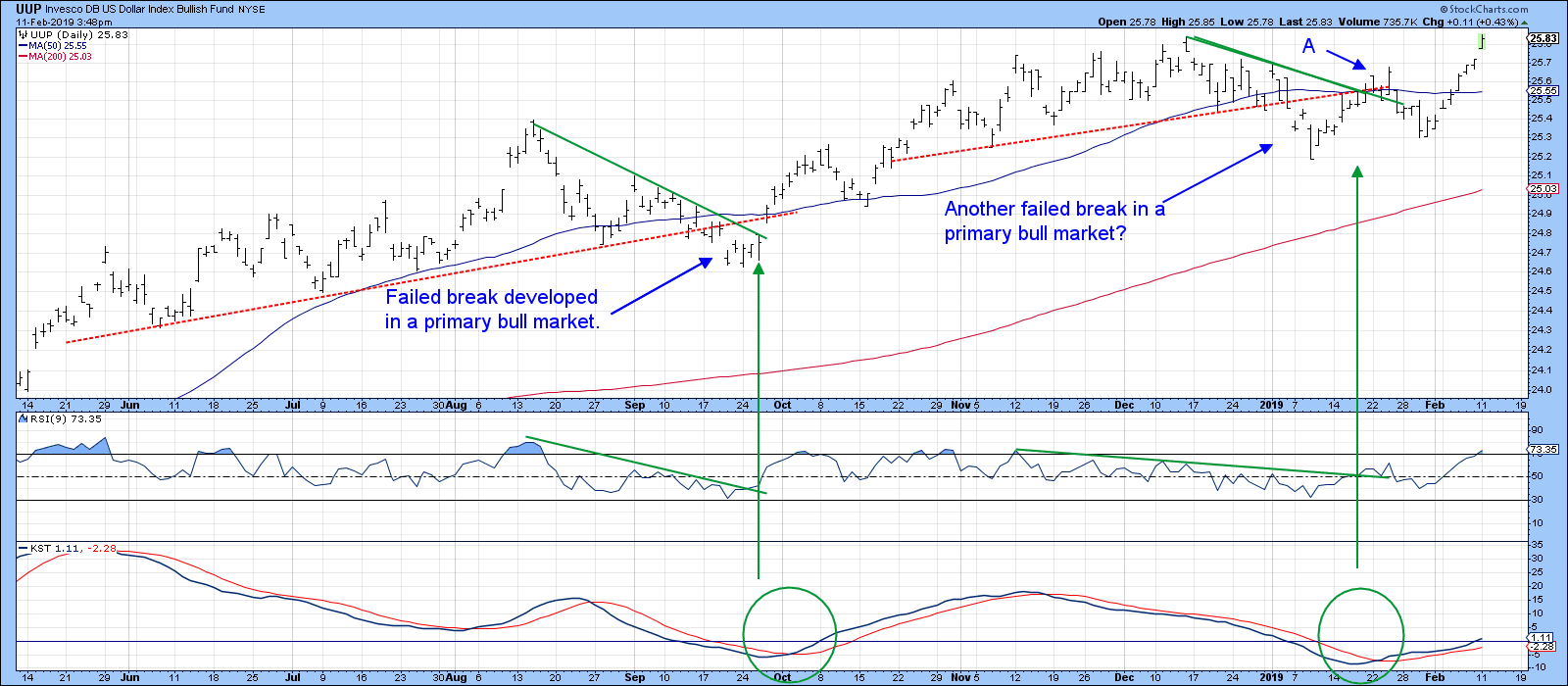

* Dollar Diffusion Gives a Buy Signal

* Differential Interest Rates Turn Bullish for the Dollar

* $NYA and $COMPQ Drop Below Their 200-Day MAs

One would think that a record trade deficit would be bearish for the dollar. However, the market does not agree, as the Invesco Bullish Dollar ETF (UUP) just...

READ MORE

MEMBERS ONLY

Beware The Ides of March - and an Overstretched Stock Market

by Martin Pring,

President, Pring Research

* Strong Broadly-Based Rally

* NYSE Declining Peaks and Troughs Still in Force

* Several Short-Term Indicators Starting to Point South

Strong Broadly-Based Rally

The rally dating from Christmas Eve has been a powerful one, generating an approximate 20% gain from its low. It has also been broad, not only enabling the NYSE...

READ MORE

MEMBERS ONLY

Monday's Sharp Rally In Shanghai Triggers Some Very Important Long-Term Signals

by Martin Pring,

President, Pring Research

* Shanghai Composite Secular Uptrend Line is Still Intact

* If China Rallies, Will It Take Commodities Along for the Ride?

* China vs. Hong Kong

* Chinese ETFs Experiencing a Reversal

Shanghai Composite Secular Uptrend Line is Still Intact

Chart 1 features a really important benchmark for the Shanghai Composite - a secular...

READ MORE

MEMBERS ONLY

A New All-Time High In The NYSE A/D Line Is Bullish Until It Isn't

by Martin Pring,

President, Pring Research

* Superior Breadth Over Price Does Not Always Have a Positive Outcome

* Weighted versus Equal Weight

Chart 1 shows that the NYSE A/D Line touched a new high last week and seems to be leading the S&P higher. The textbooks tell us that a broad advance, such as...

READ MORE

MEMBERS ONLY

Dollar Index On The Verge Of A Breakout?

by Martin Pring,

President, Pring Research

* Dollar About to Break New Ground?

* Euro Starting to Break Down

* Swiss Franc at a Major Juncture Point

* The Fortunes of the Canadian, Australian and EM Currencies are Tied to Commodities

Dollar About to Break New Ground?

I last wrote about the dollar at the end of January, pointing out...

READ MORE

MEMBERS ONLY

The State Of The 200-Day Moving Average

by Martin Pring,

President, Pring Research

* Three Major Averages are at their 200-Day MAs

* The NYSE Has Been Declining for a Year

* Will There Be Another Whipsaw?

Today, of course, is the State of the Union Address, but for the markets it might well be the “State of the 200-Day Moving Average,” as that’s the...

READ MORE

MEMBERS ONLY

Weekly Market Roundup with Martin Pring 2019-02-02

by Martin Pring,

President, Pring Research

The Market Roundup Video For February is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

If The Economy Is Truly Weakening, Commodities Should Be Vulnerable

by Martin Pring,

President, Pring Research

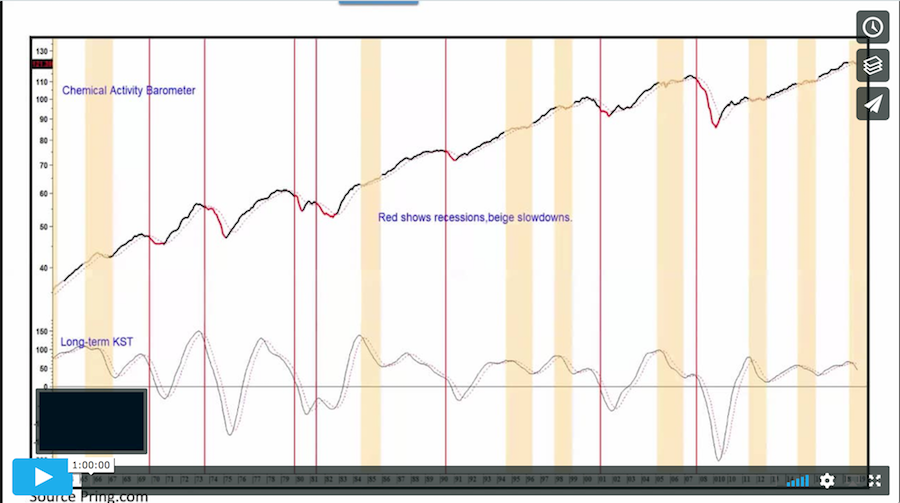

* The Long-Term Trend for Commodities Remains Bearish

* What the Stock Market is Telling Us About Commodities

* Short-Term Picture Not So Strong

Recently, we have seen several reports of a weakening economy. These include a sharp drop in both the University of Michigan and Conference Board consumer sentiment and confidence numbers,...

READ MORE

MEMBERS ONLY

Where's That Test Of The December Low?

by Martin Pring,

President, Pring Research

* Long-Term Trend Still Points South

* It Would be Unusual Not to Experience a Test of the December Low

* Dollar ETF Breaking Out?

Last week, I pointed out that the major averages were running into resistance at a moment when they were moderately overbought. At the time, some form of a...

READ MORE

MEMBERS ONLY

Market Hits Resistance, So What's Next?

by Martin Pring,

President, Pring Research

* Averages Reach Resistance

* Selected Emerging Markets Starting to Look Interesting

Last week, I wrote that, while my view on the primary trend remained bearish, I thought the lows established a couple of weeks or so ago stood a good chance of holding for a while. That view was based on...

READ MORE

MEMBERS ONLY

An Intermediate Oversold Condition Suggests That The December Low Is Likely To Hold For Several Months

by Martin Pring,

President, Pring Research

* Short/Intermediate Oversold Condition

* High-Low Data Reaches an Extreme

* The Bear is Still With Us Until It Isn’t

As we all know, markets have a strong tendency to swing from excessive optimism to extremes of pessimism. During the last month, we have certainly seen a substantial amount of pessimism...

READ MORE

MEMBERS ONLY

January 2019 Market Roundup with Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For January is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Could Gold Be The Big Winner In 2019?

by Martin Pring,

President, Pring Research

* Two Failed Outside Bars

* Long-Term Indicators Tipping to the Bullish Side

* Gold and the Shares Perking Up Against Equities in General

* Silver Setting Up for a Possible Major Breakout

Just before Christmas, I pointed out that the gold price, especially the shares, had experienced an outside day. Going by that...

READ MORE

MEMBERS ONLY

The Fed Unnerves Gold Market

by Martin Pring,

President, Pring Research

In my December Market Roundup webinar, I touched on the idea that the economy had begun to seriously slow down. Wednesday’s Fed action, actual and potential for next year, will amplify that process. The equity markets are obviously paying attention, but the increased probability of higher rates and a...

READ MORE

MEMBERS ONLY

Catch A Falling Knife?

by Martin Pring,

President, Pring Research

* The Market Remains Oversold

* More Trend Damage Triggered

* Key Ratios Have Just Broken to New Lows

As a kid, I used to love building sand castles and defending them against the ensuing wave action. If the tide was coming in, however, it always proved to be a fool’s errand...

READ MORE

MEMBERS ONLY

Year-End Rally Here We Come?

by Martin Pring,

President, Pring Research

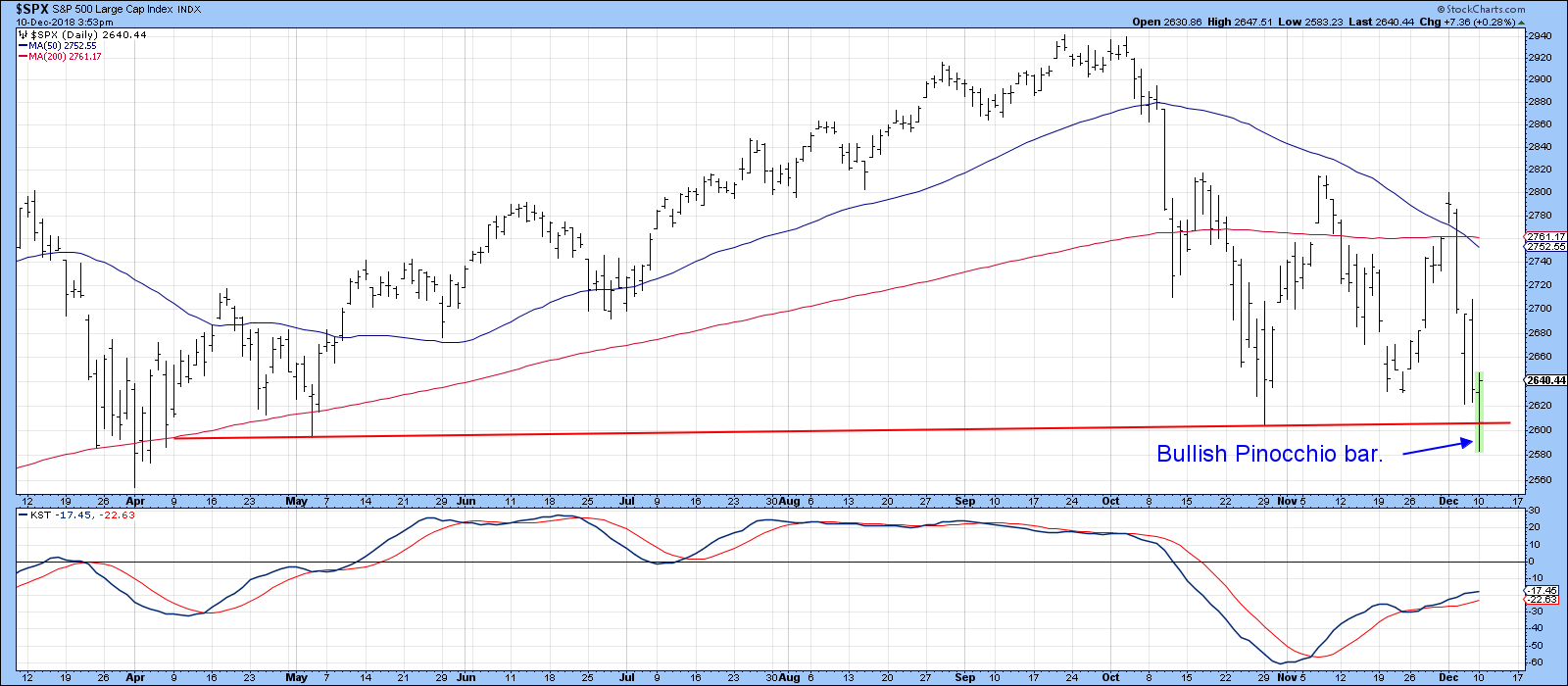

* Pinocchio Lies

* Oversold Sentiment Indicators

* Oversold Oscillators

Pinocchio Lies

Monday’s action was what I call “scary bullish.” First, we saw prices sell-off sharply, only to then rebound as if nothing had happened. Well, something did happen - the formation of a bullish Pinocchio bar on several Indexes. Chart 1...

READ MORE

MEMBERS ONLY

A Funny Thing May Have Happened To The Secular Reversal In Rates

by Martin Pring,

President, Pring Research

* The Secular Bear Market in Yields

* Near-Term Indications of a Decline in Bond Yields

* Watch That Stock/Bond Relationship for an Important Signal

The Secular Bear Market in Yields

Please note that the comments in this article relate to bond yields with maturities of 3-years or longer. They do not...

READ MORE

MEMBERS ONLY

December 2018 Market Roundup with Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For December is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

The Trend Of Housing And NYSE Margin Debt Both Reverse To The Downside

by Martin Pring,

President, Pring Research

* Housing Starts are Rolling Over

* The Trend of Margin Debt is Bearish

The NYSE Margin and the housing sector do not have much in common beyond the fact that both gave sell signals in October. Neither development bodes well for the recovery of the stock market. Let’s take a...

READ MORE

MEMBERS ONLY

Confidence Is Eroding Just When It's Needed

by Martin Pring,

President, Pring Research

* Indexes on the Brink

* Confidence Relationships Starting to Break Down

* Watch the Stock/Bond Ratio

Indexes on the Brink

More than once a week, I make sure to check several ratios that tell me whether investors and traders are getting more or less confident. These relationships, which we will get...

READ MORE

MEMBERS ONLY

Has Oil Hit A Temporary Bottom?

by Martin Pring,

President, Pring Research

* Commodities in General Remain in a Bear Market

* Oil is Also in a Primary Bear Market

* The Chart That Says That Some Kind of Bottom is at Hand

I last wrote about oil back in early August, in an article entitled More Evidence Of A Commodity Bear Market. Back then,...

READ MORE

MEMBERS ONLY

Several Indicators Point To A Test Of The October Lows

by Martin Pring,

President, Pring Research

* Indexes Reach Resistance and Retrace 61.8% of the Decline

* Hourly Charts Offer the First Domino

* Short-Term Breadth is Overstretched

* NASDAQ Sports a Series of Declining Peaks and Troughs

Indexes Reach Resistance and Retrace 61.8% of the Decline

The market has been on a tear for the last couple...

READ MORE

MEMBERS ONLY

Last Chance For Gold To Rally?

by Martin Pring,

President, Pring Research

* The Long-Term Picture

* Price Action Characteristics are Bearish

* Gold Share Breadth is Negative

* The Now or Never Chart

The Long-Term Picture

Gold was in a secular bull market between 2001 and 2011. It then sold off into 2014 and has been essentially range bound ever since. Chart 1 shows that...

READ MORE

MEMBERS ONLY

November 2018 Market Roundup with Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For November is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Comparing The Differences Between The February And October Declines

by Martin Pring,

President, Pring Research

* Key moving averages violated in October

* The world peaked in January

* What happened to sectors and breadth?

* February versus October conclusion

* Those pesky bonds

Key Moving Averages Violated in October

So far, 2018 has seen two sharp shakeouts in the market, specifically the ten-day special in early February and the...

READ MORE

MEMBERS ONLY

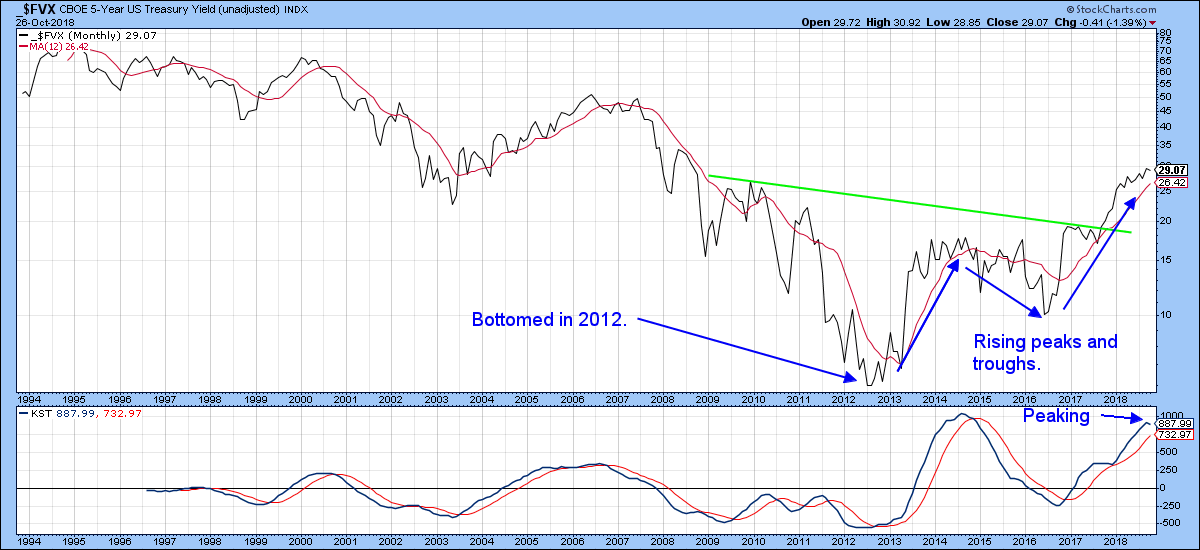

Tentative Signs That Bond Yields May Be Peaking

by Martin Pring,

President, Pring Research

* A few observations about the secular trend

* Short-term technical position

* Junk bonds peak out

* Credit spreads argue for lower government yields

A Few Observations About the Secular Trend

The 5-year yield, shown in Chart 1, has formed and broken out from a major base. It touched a low point in...

READ MORE

MEMBERS ONLY

Four Areas To Watch For A Possible Bear Market Trigger

by Martin Pring,

President, Pring Research

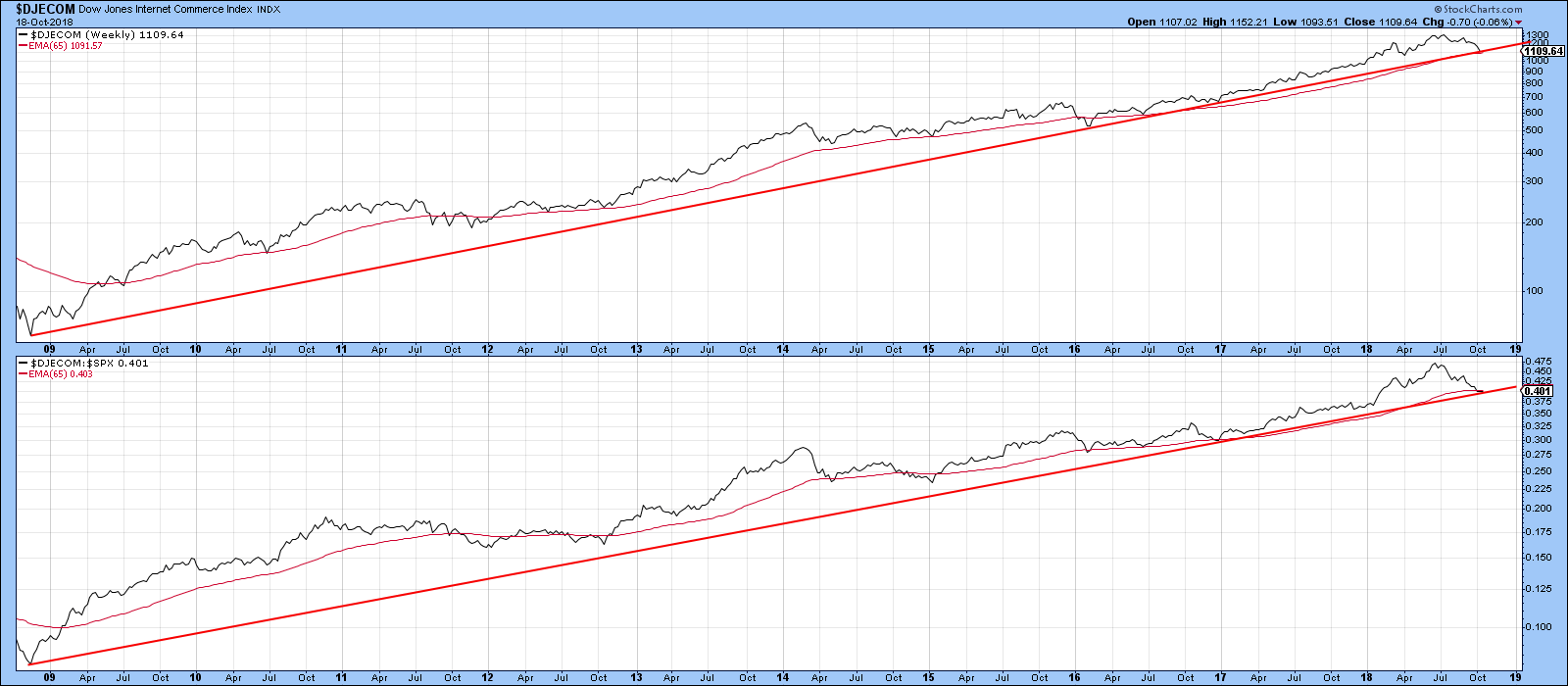

* Internet bubble

* Credit spreads

* Rising interest rates

* Contagion from abroad

On Wednesday, I joined Tom and Erin on MarketWatchers LIVE and enjoyed a spirited discussion on what signs might foreshadow an extension to last week’s decline, or even signal a bear market. The four areas I cited were the...

READ MORE

MEMBERS ONLY

Global And US Equities Violate Major Up Trendlines: More Downside To Come

by Martin Pring,

President, Pring Research

* The big global picture

* US equities are violating key trend lines

* Financials experience false upside breakout

* Energy triggers a false positive

* Bubble-prone e-commerce on the verge of being pricked!

Last week, I wrote about the possibility of an October “surprise.” I pointed out that such an event is completely random...

READ MORE

MEMBERS ONLY

New Evidence Suggests A Change In Market Leadership Is Underway

by Martin Pring,

President, Pring Research

* The US market viewed from abroad

* Resource based sectors in general are under-performing

* Defensive sectors are generally improving

* Ratio between a late and early performing sector is at a critical juncture

Back in August I wrote an article pointing out that we might be in the early stages of a...

READ MORE

MEMBERS ONLY

What Are The Odds Of An October Surprise?

by Martin Pring,

President, Pring Research

* Conditions that feed a crash

* Rising rates

* Emerging markets could be the triggering mechanism

* Market breadth not so hot

* Is the e-commerce bubble bursting?

Conditions that feed a crash

October started off as just a continuation of September’s dull price activity. However, knowing that the month of October has...

READ MORE

MEMBERS ONLY

Evidence Of A Major Upside Dollar Breakout Is Growing

by Martin Pring,

President, Pring Research

* Dollar Index experiences a false downside breakout

* Euro encounters a false upside breakout

* Yen completes a bearish multi-year continuation formation

* Swiss franc completes a broadening wedge

Back in mid-September, I wrote an article where I pointed out that the Dollar was on a knife edge. This view was based on...

READ MORE

MEMBERS ONLY

October 2018 Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For October is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

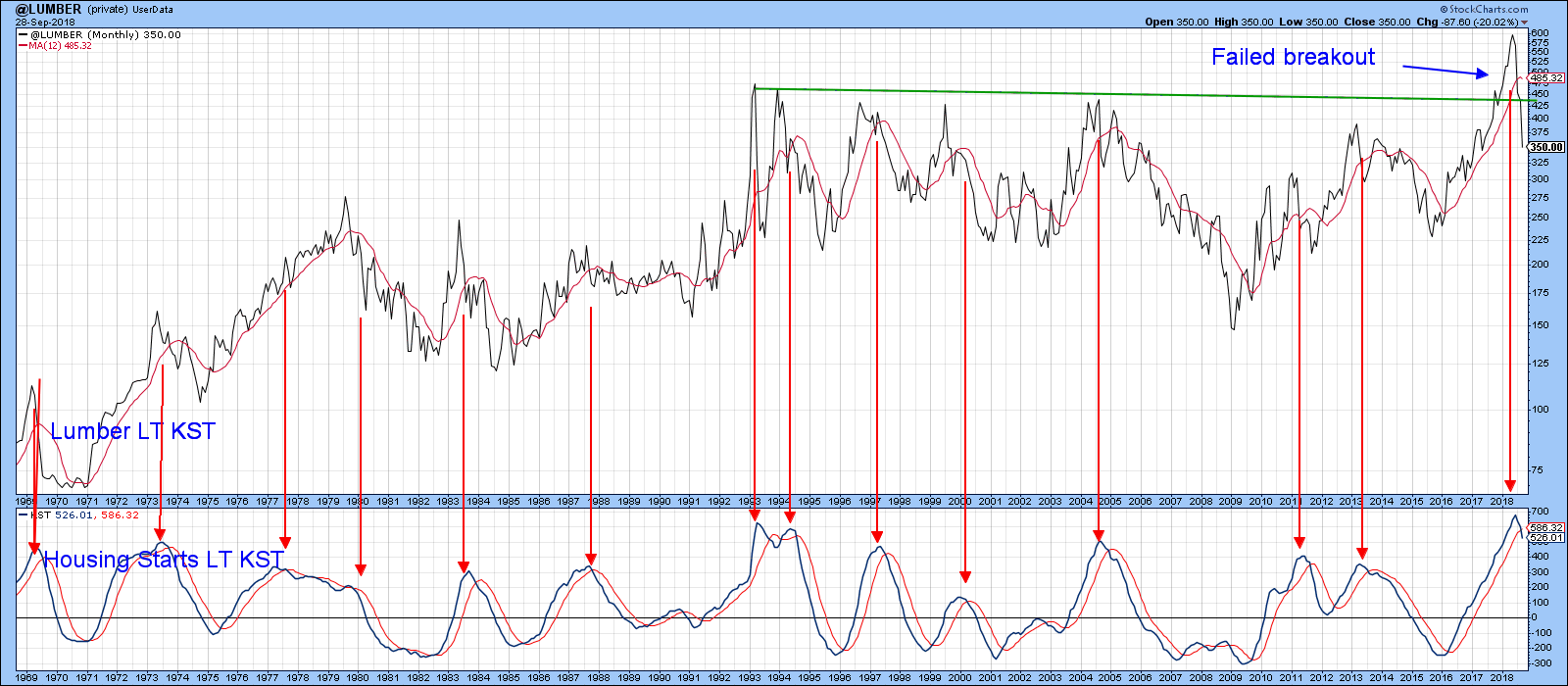

Recent Weak Lumber Prices Are Not A Good Sign For Housing Stocks

by Martin Pring,

President, Pring Research

* The connection between lumber and housing starts

* What the homebuilding ETF’s are saying

Nonfarm payrolls are an economic series that is widely followed by the investment community. However, it’s a coincident indicator, meaning it tells you what is going on now, not what might happen in the future....

READ MORE