MEMBERS ONLY

Dollar Index Is On A Knife Edge

by Martin Pring,

President, Pring Research

* Long-term dollar technical position

* Short-term picture bearish outcome

* Short-term picture bullish outcome

* Euro

* Yen

* Swiss franc

Long-term dollar technical position

I have been primary trend bullish on the dollar for several months. That opinion still stands because the Dollar Index is well above its 12-month MA and its long-term KST...

READ MORE

MEMBERS ONLY

Is It A Bubble When ...

by Martin Pring,

President, Pring Research

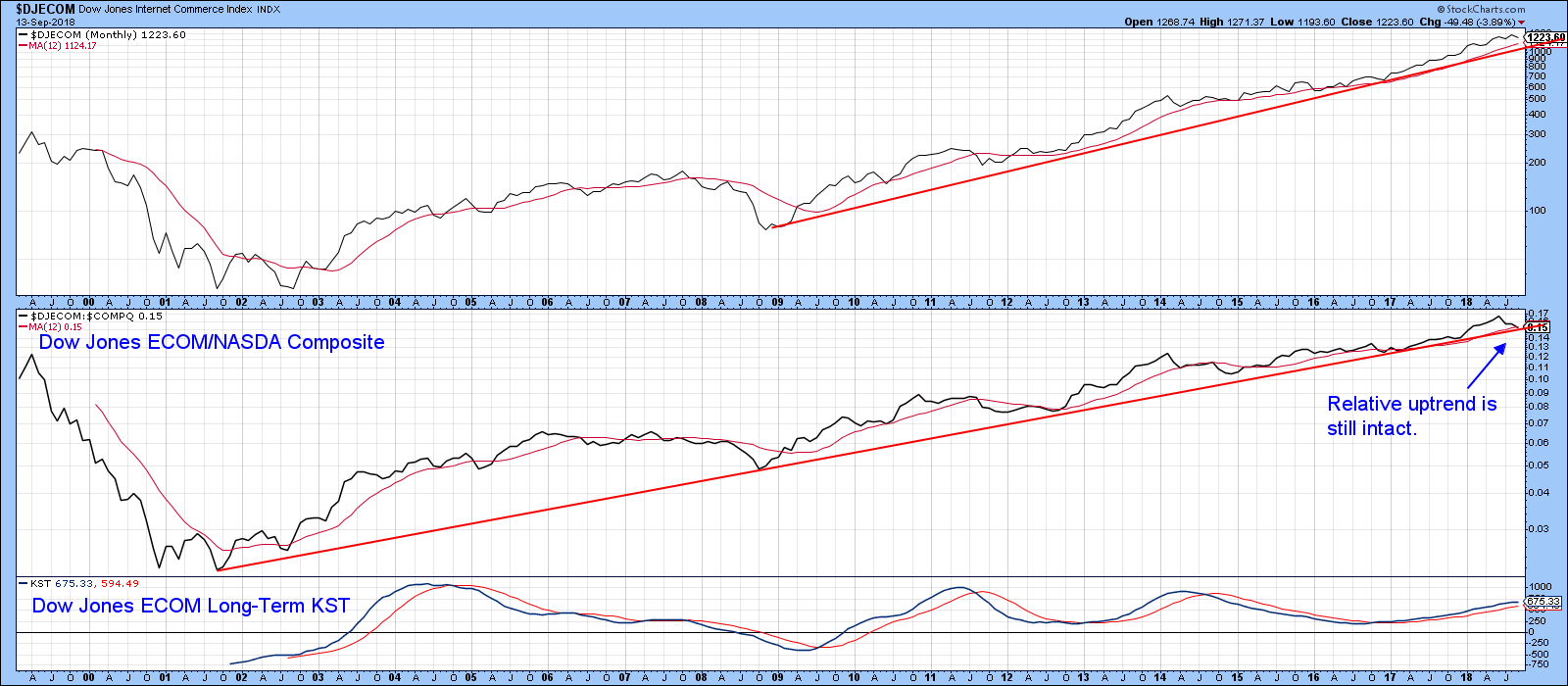

* A few thoughts on bubbles

* Technical comments on the Dow Jones Internet Commerce Index

* China on the brink

A few thoughts on bubbles

Last week, I pointed out that most of the FAANG stocks remained in uptrends, with the possible exception of Netflix and the confirmed bear market in Facebook....

READ MORE

MEMBERS ONLY

Facebook Does An About Face, But What About The Other FAANG Stocks?

by Martin Pring,

President, Pring Research

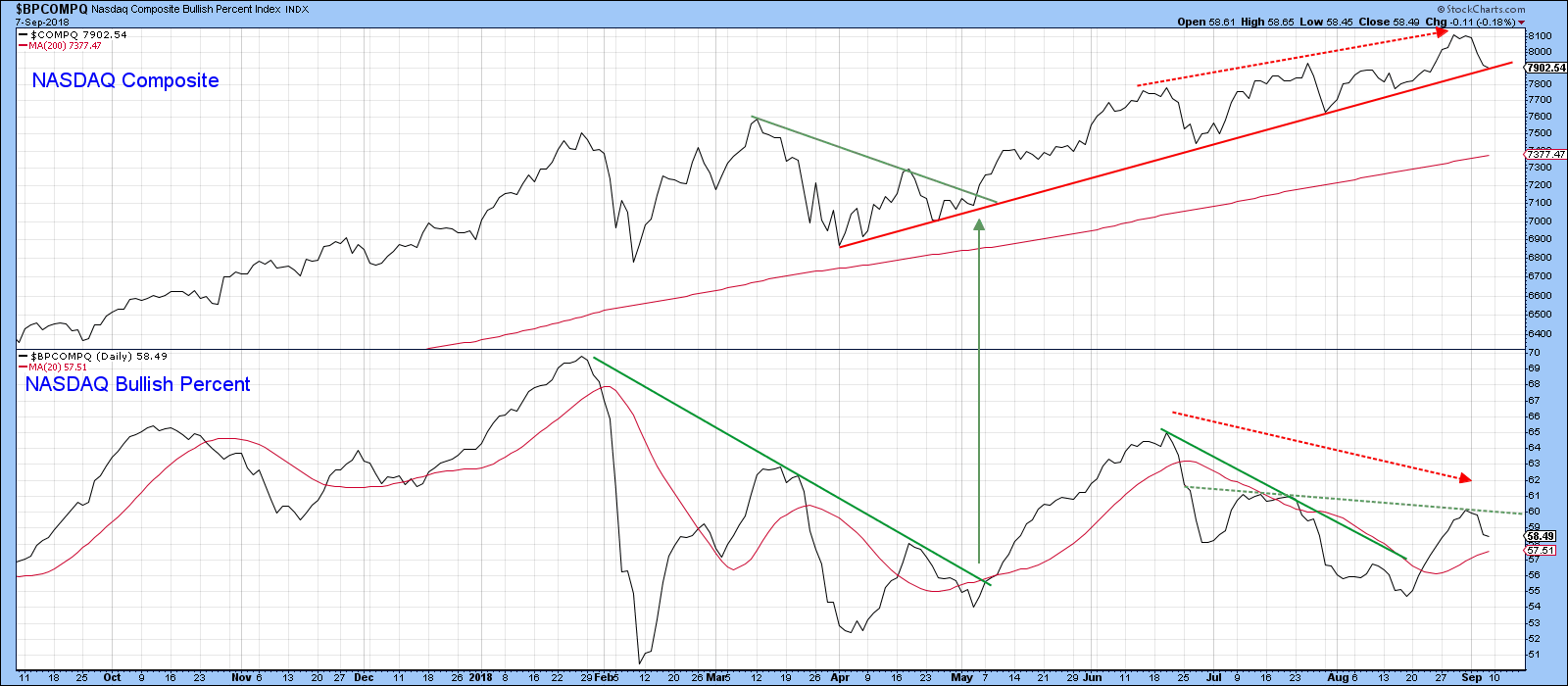

* NASDAQ breadth data offers conflicting signals

* Bullish FAANG Stocks

* De-fanged stock

NASDAQ breadth data offering conflicting signals

We have seen some attention paid to tech stocks as they have corrected in the last week or so. The so called FAANG (Facebook, Apple, Amazon, Alphabet’s Google and Netflix) have been...

READ MORE

MEMBERS ONLY

September 2018 Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

The MarketRoundup Video For September is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

US Stocks Take On Global Equities, Gold, Commodities And Bonds

by Martin Pring,

President, Pring Research

* US Equities versus the world

* Stocks versus Commodities

* Stocks and bonds

* Stocks compared to gold

There are lots of seasonal reasons to be bearish on the stock market, such as September being the weakest month and mid-term election years having a downward bias. However, if you compare the S&...

READ MORE

MEMBERS ONLY

Bond Yields Reach A Critical Support Zone

by Martin Pring,

President, Pring Research

* The longer-term picture argues for lower yields

* Deflationary forces gain the upper hand

* Bond yields at crucial short-term support

* UK Yields in a life or death struggle

The longer-term picture argues for lower yields

Earlier in the month I wrote an article pointing out that many bond yields had reached...

READ MORE

MEMBERS ONLY

More Evidence Of A Commodity Bear Market

by Martin Pring,

President, Pring Research

* Commodities starting to generate some long-term sell signals

* Internals and commodity intermarket relationships are deteriorating

* Energy has been lagging on the downside but may be ready to play catch up

Earlier in the summer I wrote a couple of articles on copper and oil suggesting some short-term vulnerability, but concluding...

READ MORE

MEMBERS ONLY

Getting Through The Old Highs Could Be A Challenge

by Martin Pring,

President, Pring Research

* Last week's test of the highs leaves a lot to be desired

* Breadth and momentum indicators fail to confirm

* Some international charts not looking so good

Last week's test of the highs leaves a lot to be desired

If the charts in this article look a...

READ MORE

MEMBERS ONLY

Are We Seeing The Early Sign Of A Change In Market Leadership?

by Martin Pring,

President, Pring Research

* The Inflation/Deflation ratio

* Lagging sectors

* Defensive sectors

The Inflation/Deflation ratio

Last week I charted my Inflation/deflation ratio for the first time in a while and was surprised to see that it had broken to the downside. For those unfamiliar with the concept, the Inflation Ratio (!PRII) consists...

READ MORE

MEMBERS ONLY

Bond Yields Hit Mega Resistance. Will They Go Through?

by Martin Pring,

President, Pring Research

* 3- and 10-year series challenging their secular down trendlines

* Three indicators that suggest lower bond yields

* The Crunch Chart

3- and 10-year series challenging their secular down trend lines

US government bond yields have reached very important resistance, at a time when they are overextended on a long-term momentum basis....

READ MORE

MEMBERS ONLY

August Market Round Up With Martin Pring Video 2018-08-01

by Martin Pring,

President, Pring Research

This month, the Market Roundup carries a lot of information about how acute the current market position is in globally.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring...

READ MORE

MEMBERS ONLY

This Week's NASDAQ High Was A Lonely Place

by Martin Pring,

President, Pring Research

* Tuesday was a Key Reversal Day

* Breadth fails to confirm Tuesday’s high

* Primary uptrend is intact, but will it be threatened?

Tuesday was a Key Reversal Day

This week the NASDAQ Composite registered a new all-time-high, but the quality of that rally leaves a lot to be desired. That...

READ MORE

MEMBERS ONLY

Is Gold In A Bear Market Or A Buying Opportunity?

by Martin Pring,

President, Pring Research

* Long-term trends rolling over to the downside

* A rising dollar does not help gold

* Gold Under-performing stocks is not a good thing….for gold

* Gold showing bear market characteristics

Long-term trends rolling over to the downside

The recent sell off in the price of gold has quite frankly surprised me....

READ MORE

MEMBERS ONLY

Bond Yields Showing Some Vulnerability

by Martin Pring,

President, Pring Research

* A look at the primary and secular trends

* Interesting momentum study points to lower bond yields

* Bond Net New Highs set to pounce in either direction

* Slight softening in confidence hints at lower yields

In the June and July editions of my Market Roundup webinars I pointed out the possibility...

READ MORE

MEMBERS ONLY

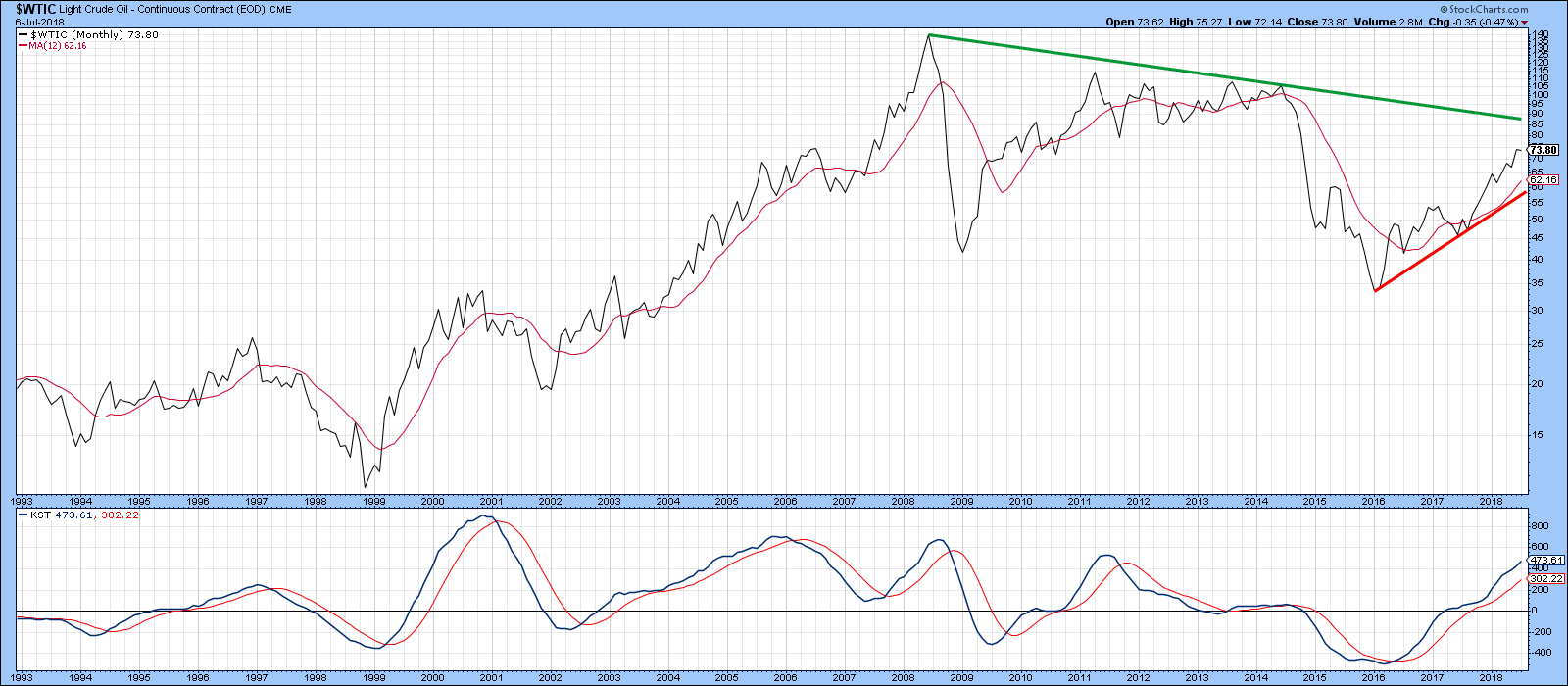

What Would It Take For The Charts To Signal A Top In Oil?

by Martin Pring,

President, Pring Research

* Technical picture is ripe for a turn, but the main trend is up right now

* Tuesday’s outside day could be the first domino

* Negative divergences between several energy components

Technical picture is ripe for a turn, but the main trend is up right now

The oil price remains in...

READ MORE

MEMBERS ONLY

Wider Implications For A Sick Looking Dr. Copper?

by Martin Pring,

President, Pring Research

* Copper signals a primary bear market

* Copper’s influence on commodities in general

* Copper and bond yields

It’s often said that Copper has a PHD in economics because it is used widely in many economic sectors. As a result, long-term reversals in its price trend often foreshadow general swings...

READ MORE

MEMBERS ONLY

July Market Round Up With Martin Pring 2018-07-01

by Martin Pring,

President, Pring Research

Here is the link to my current thoughts about the global markets.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its...

READ MORE

MEMBERS ONLY

Global and US Equity Markets On A Knife Edge

by Martin Pring,

President, Pring Research

* The US on a knife edge

* Global markets are also on the edge

* Individual regions largely around key support

Last week I wrote about the important upside breakout in the US market vis a vis the rest-of-the-world, and a previous article pointed out that the S&P had also...

READ MORE

MEMBERS ONLY

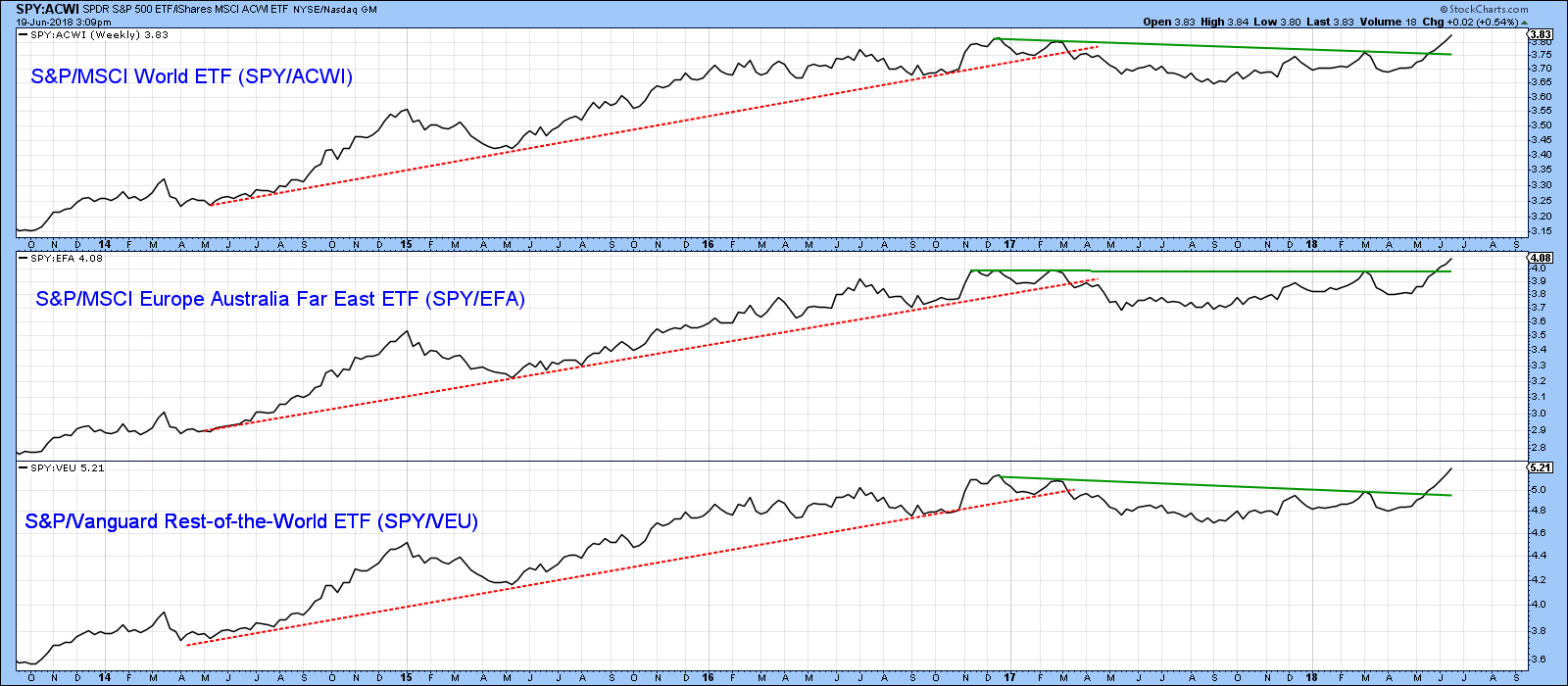

Global Equities Are Falling Apart But It's MAGA For US Relative Action

by Martin Pring,

President, Pring Research

* New bull market high for US equity relative action

* International markets are breaking down

* Commodities lose some upside momentum

US equities have been hit hard so far this week, but that’s nothing compared to China, Emerging Markets, Europe and other markets around the globe. As a result, we are...

READ MORE

MEMBERS ONLY

What Is The Gold Price Telling Us About The Stock Market?

by Martin Pring,

President, Pring Research

* Stocks are rising against gold and that’s bullish

* The long-term trend points to gold under-performing stocks

* Stock/Gold ratio breaks out from a right-angled broadening formation

The price of gold, over the short-term, typically rises and falls on global tensions or lack thereof. Longer-term trends though, are more influenced...

READ MORE

MEMBERS ONLY

NYSE Breakout Is Supported By Eight Sectors

by Martin Pring,

President, Pring Research

* NYSE breakout

* Multi-sector breakouts

* Green shoots coming through for Europe and emerging markets

NYSE breakout

Monday’s action has seen the NYSE Composite, the $NYA complete a 4-month reverse head and shoulders pattern. If that breakout holds, and there are few grounds for suspecting that it won’t, it’s...

READ MORE

MEMBERS ONLY

Market Round Up June 2018

by Martin Pring,

President, Pring Research

Here is the link for the June 2018 Market Round Up.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Equities At A Make-Or-Break Level What To Look Out For

by Martin Pring,

President, Pring Research

* CPI adjusted S&P is just above a long-term make-or-break point

* The rest of the world is at the brink

* US market looks stronger

CPI Adjusted S&P is just above a long-term make-or-break point

Last week I pointed out that US equities were experiencing a marginal upside...

READ MORE

MEMBERS ONLY

Market Roundup Live May 2018

by Martin Pring,

President, Pring Research

This is the Market Roundup for May 2018.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

US Equities Are Breaking Out Against The World

by Martin Pring,

President, Pring Research

* SPY experiences important relative breakouts

* World A/D Line unexpectedly breaks trend

* European and Emerging markets ETF’s experience major breakdowns

SPY experiences important relative breakouts

Earlier this morning I had the idea of writing about the relationship between the US and international markets, as this ratio usually does well...

READ MORE

MEMBERS ONLY

Two Markets Close To Basket Case Status

by Martin Pring,

President, Pring Research

* Commodities looking short-term toppy

* Copper close to a bear market signal that it may escape

* Oil trend is still positive but vulnerable

* Two markets close to a major breakdown

In a global stock market of predominantly long-term bullish charts, two country funds stand out as being on the verge of...

READ MORE

MEMBERS ONLY

Steady As She Goes: Several Indicators Say The Market Is Headed Higher

by Martin Pring,

President, Pring Research

Volume is offering a mixed picture

Last week I pointed out that several short-term indicators, including breadth and net new high indicators, were still pointing north. One area that was not showing any strength of note was volume, in the form of the PVO for the NYSE. Chart 1 shows...

READ MORE

MEMBERS ONLY

This Rally Looks Like It Has Legs

by Martin Pring,

President, Pring Research

* When a top is not a top

* The rally is broadly based

* Is the US about to out-perform the world again?

When a top is not a top

Last week I pointed out that several indicators were positioned for a nice rally. However, one of the lingering questions related to...

READ MORE

MEMBERS ONLY

Buy In May And Say Hooray?

by Martin Pring,

President, Pring Research

* Sell in May does not have a great track record

* Technology continues to outpace staples, and that’s bullish

* Technology, consumer cyclicals and REITS are well positioned for a rally

Sell in May does not have a great track record

If there is a seasonal saying that seems ubiquitous at...

READ MORE

MEMBERS ONLY

Dollar Breakout Starts To Infect Other Markets

by Martin Pring,

President, Pring Research

* Dollar Index breaks to the upside

* Dollar sympathy relationships

* The Aussie Dollar close to a mega signal for itself and commodities

Dollar Index breaks to the upside

Chart 1 shows that the Dollar Index falsely broke to the downside at the very beginning of the year. In the last couple...

READ MORE

MEMBERS ONLY

Who's Afraid Of The Big Bad 3%?

by Martin Pring,

President, Pring Research

* Technical position for yields still looks bullish

* International rates look higher

* Dollar breaks out, but will it hold?

* Finely balanced Gold picture needs some guidance from the Dollar

If you have punched up the symbol $TNX, you will know that the 10-year yield has recently hit 3%. Chances are that...

READ MORE

MEMBERS ONLY

Is The Breakout In The Dollar For Real?

by Martin Pring,

President, Pring Research

* The primary trend

* The short-term picture

* The Dollar, Copper and Gold

The Dollar Index showed some green shoots at the end of the week that might lead to greater things. That’s important in its own right, but since the dollar often moves inversely with commodities and gold its direction...

READ MORE

MEMBERS ONLY

More Indicators Are Flashing The All Clear

by Martin Pring,

President, Pring Research

* Bearish engulfing pattern and outside day are cancelled

* Breath indicators are firming up

Bearish engulfing pattern and outside day are cancelled

Last week I wrote that many of the short-term indicators were flashing buy signals and that we should expect the US equity market to work its way higher. I...

READ MORE

MEMBERS ONLY

DJIA Engulfing Pattern Suggests A Pause Before Higher Prices

by Martin Pring,

President, Pring Research

* A small correction ahead?

* Short-term oscillators are primed for a rally

* Bitcoin is breaking out again

A small correction ahead?

If you want to be bullish, Friday’s technical action was somewhat disappointing. That’s because it represented an engulfing pattern for the DIA, as shown in Chart 1.

Chart...

READ MORE

MEMBERS ONLY

Small Caps May Be Breaking Out But Not All Are Created Equal

by Martin Pring,

President, Pring Research

* The technical position of small caps in general

* Small cap sectors

The technical position of small caps in general

Small caps, as represented by the Russell 2000 ETF (IWM), have outperformed the market since late March and have now broken out in their own right. We can see this from...

READ MORE

MEMBERS ONLY

Identifying The Tapestry Of A Market Top

by Martin Pring,

President, Pring Research

* The importance of identifying the direction of the primary trend

* The Shiller P/E

* The four-way test

The importance of identifying the primary trend

Sometimes it’s a good idea to step back from the everyday trading of daily charts and short-term activity and look at the big picture. If...

READ MORE

MEMBERS ONLY

Bottoms Up Part II

by Martin Pring,

President, Pring Research

* Positive breadth characteristics

* VIX is less fearful

* Short-term oscillators starting to get extremely oversold

* How about trend?

Last week I suggested that the market may be in the process of forming a double bottom. This week we take that possibility one step forward. Whenever the non-financial cable networks run a...

READ MORE

MEMBERS ONLY

Market Round Up April 2018

by Martin Pring,

President, Pring Research

Here is a link to the April edition of Market Round Up for 2018.

Martin-Pring-Market-Roundup-April-2018 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring...

READ MORE

MEMBERS ONLY

Bottoms Up?

by Martin Pring,

President, Pring Research

* Is the market forming a double bottom?

* Short-term indicators suggest the bottoming process is nearly complete

Sometimes a technical event or characteristic becomes very popular very quickly as a lot of people write and blog about them. Usually, the expectations based on those forecasts are not met. For example, every...

READ MORE

MEMBERS ONLY

NYSE Composite Draws Closer To Its 200-day And 12-month Moving Averages

by Martin Pring,

President, Pring Research

* Breadth is more of a positive than a negative factor

* Global breadth is also positive

* Dow Diffusion Indicator close to a buy signal

* Consumer cyclicals versus technology

Since early February, the US equity market, in the form of the NYSE Composite, has been in a trading range. This is flagged...

READ MORE