MEMBERS ONLY

Bitcoin Is A Mania But Is It Over?

by Martin Pring,

President, Pring Research

* Longer-term perspective

* Short-term Charts

* Dollar trying to break to the upside

Longer-term perspective

At its December 18 peak of $18,723, the Bitcoin Index ($NYXBT) outstripped all other bull markets in recorded history. By this yardstick alone this phenomenon qualifies as a mania. So far, the post high, low water...

READ MORE

MEMBERS ONLY

What Will It Take To Trigger A Bull Market In The Dollar?

by Martin Pring,

President, Pring Research

* The indicated main trend is currently bearish

* What a more broadly-based Dollar index is saying

* Swiss Franc completes a small top

* Copper and the Dollar

The indicated main trend is currently bearish

The Dollar Index peaked in November 2016 and has so far bottomed in January of this year. If...

READ MORE

MEMBERS ONLY

They Just Built A New Wall Of Worry For The US Stock Market

by Martin Pring,

President, Pring Research

* Two bullish piercing white lines

* A sector spread that predicts new stock market highs

* Two sectors affected by the proposed tariffs

Last week I wrote that the indicators seemed to be calling for a test of the early February low. My expectation was for a sharper and more prolonged decline...

READ MORE

MEMBERS ONLY

Market Round Up Monthly Video 2018-03-01 With Martin Pring

by Martin Pring,

President, Pring Research

Here is the market analysis reviewing the current market outlook. There is a host of information on commodities, bonds and US equities.

Market Roundup With Martin Pring 2018-03-01 from StockCharts.com on Vimeo.

Chartcon 2018 registration is now open! Registration kicked off today, February 1st!

Chartcon 2018! Follow the link...

READ MORE

MEMBERS ONLY

US Equities Emerging from The February Shakeout As A Global Leader Again

by Martin Pring,

President, Pring Research

* US is breaking out relative to the world

* Growth breaks decisively against value

* Blue Tuesday

US is breaking out relative to the world

Chart 1 shows that the ratio between the US stock market, in the form of the S&P Composite ($SPX), and the World Index (ACWI) often...

READ MORE

MEMBERS ONLY

Emerging From The Correction The Best And Worst Looking Sectors

by Martin Pring,

President, Pring Research

* General market thoughts

* Sectors under pressure

* Stronger looking sectors

General market thoughts

My thoughts on the recent correction is that we have likely seen the low, that more ranging action is likely, probably involving a test of that low, but that eventually US equities will see new bull market highs....

READ MORE

MEMBERS ONLY

Some Equity Markets Showing Signs Of Long-term Vulnerability

by Martin Pring,

President, Pring Research

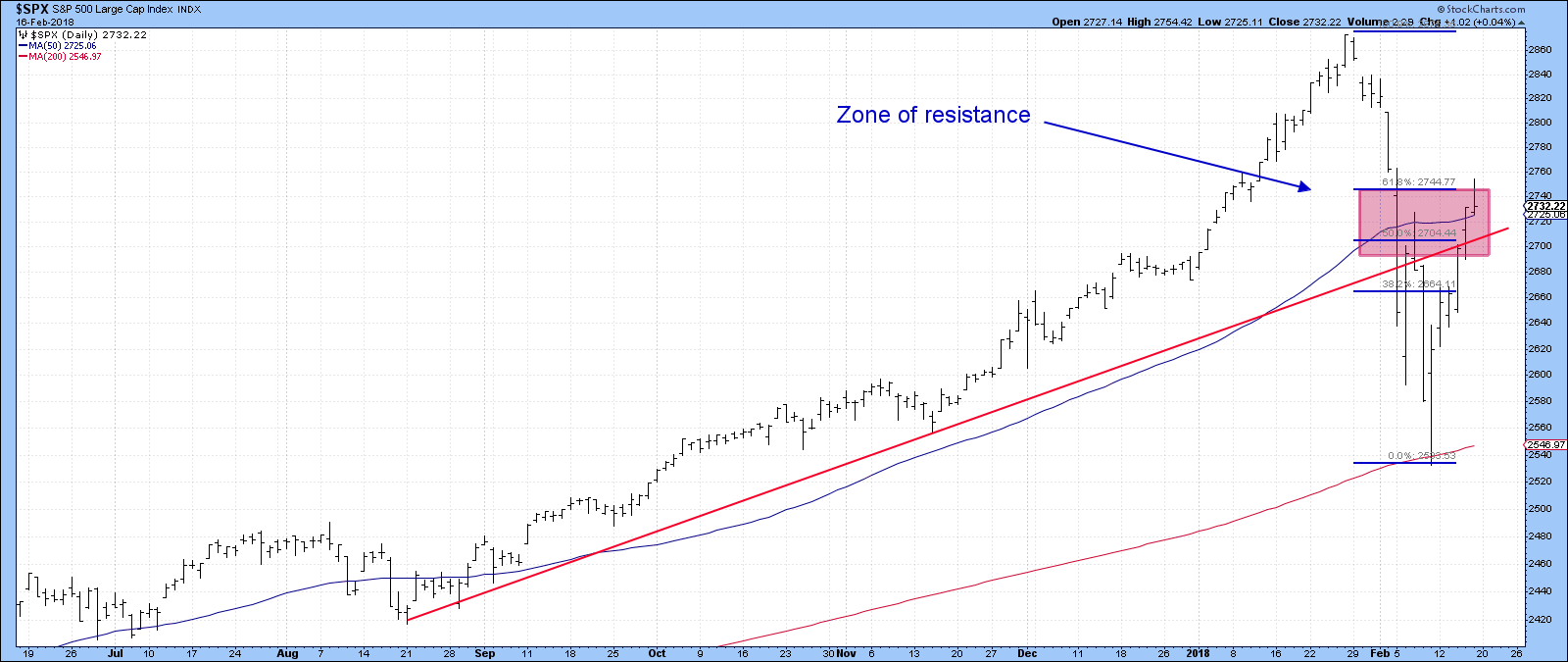

* Pinocchio argues for a test of the lows

* European equities are facing a big challenge

* Shanghai starting to look sick

Pinocchio argues for a test of the lows

Last week I suggested that the S&P had reached a resistance zone following its bounce from the early February panic...

READ MORE

MEMBERS ONLY

Time For Some Temporary Grief In The Equity Market?

by Martin Pring,

President, Pring Research

* Path of recoveries from recent declines have been mixed

* S&P is at short-term resistance

* Some reliable short-term indicators not quite there yet

* Yen breaks out from a large base

Path of recoveries from recent declines have been mixed

After five straight up days since the February 9 intraday...

READ MORE

MEMBERS ONLY

US Stock Traders Get Out Their Hammers

by Martin Pring,

President, Pring Research

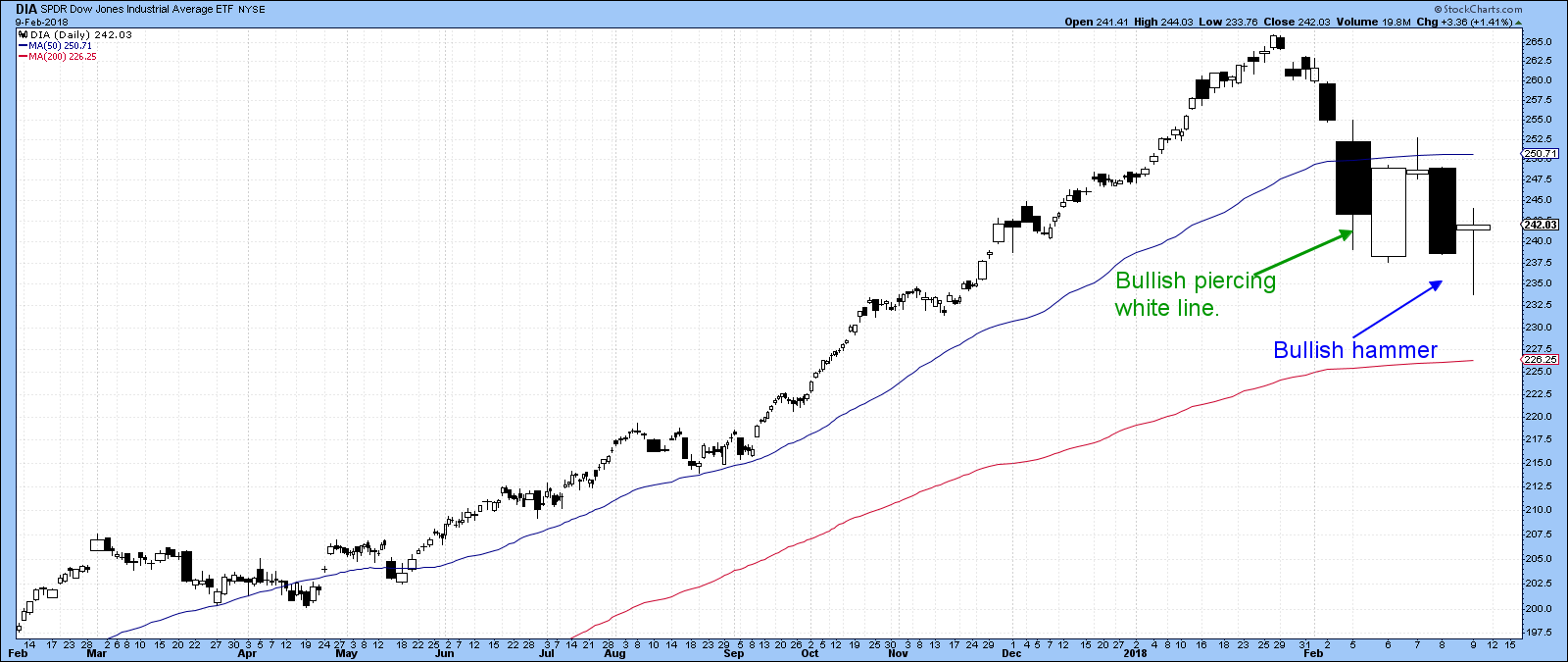

* Bottoms are being “hammered” out

* VIX is quietening down

* Net new highs offer green shoots

* NASDAQ Chart is turning

Bottoms are being “hammered” out

It has certainly been a wild ride this week, but Friday saw several major indexes trace out a Japanese candlestick pattern known as a “hammer”. This...

READ MORE

MEMBERS ONLY

Evidence of A Bottom Looking Stronger

by Martin Pring,

President, Pring Research

* Bullish piercing white line

* Bullish volume

* VIX signaling volatility retreating again

Bullish piercing white line

Tuesday’s market action suggests that the selling squall is over, at least for the time being. That’s because a couple of indexes experienced a bullish candlestick pattern known as a piercing white line....

READ MORE

MEMBERS ONLY

What To Look For Next

by Martin Pring,

President, Pring Research

* Primary trend indicators are still bullish

* Short-term indicators still overbought

* Very short-term indicators already at extremes

* Bonds bottoming short-term?

I have been saying for some time that the market’s primary trend is a bullish one and that we should not get hung up with short-term corrections. That theory is...

READ MORE

MEMBERS ONLY

Market Roundup With Martin Pring 2018-02-01

by Martin Pring,

President, Pring Research

* Big changes in all four areas

* Equities

* Commodities

* Currencies

* Bonds

This months market roundup has a lot of charts that are breaking out on long term relative strength breakouts.

Market Roundup With Martin Pring 2018-02-01 from StockCharts.com on Vimeo.

Chartcon 2018 registration is now open! Registration kicked off today,...

READ MORE

MEMBERS ONLY

Pause In An Ongoing Uptrend?

by Martin Pring,

President, Pring Research

* The underlying trend of improving confidence continues

* Several indicators are pointing to some kind of a correction

* Small caps are lagging

The underlying trend of improving confidence continues

The longer-term indicators monitoring the primary trend of the US stock market continue to point north. So too, do the various confidence...

READ MORE

MEMBERS ONLY

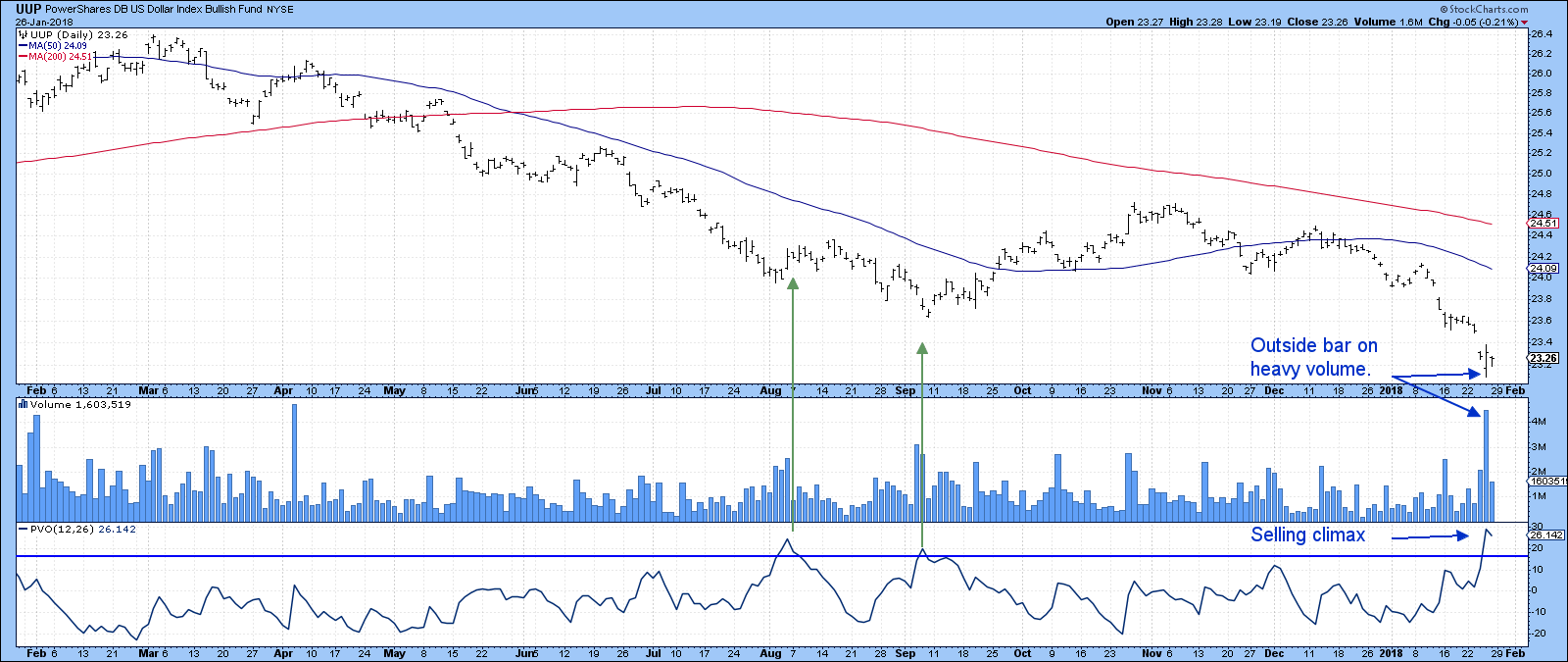

Dollar Bear Market Is Not A One Way Street

by Martin Pring,

President, Pring Research

* Dollar experiences a short-term reversal

* Commodities are in a bull market but adversely affected near-term

* Gold showing signs of tiredness but still within a base building process

Dollar experiences a short-term reversal

It’s a funny thing in markets, when you have just grown comfortable with a move, it sometimes...

READ MORE

MEMBERS ONLY

Confidence Is Breaking Out All Over

by Martin Pring,

President, Pring Research

* Last week’s bearish dark cloud cover fails

* These confidence ratios are breaking to the upside and that’s bullish for stocks

Last week’s bearish dark cloud cover fails

Last week I pointed out that many of the principal indexes had traced out bearish dark cloud cover candlestick patterns....

READ MORE

MEMBERS ONLY

Cold Weather And Dark Cloud Cover Seen Over Wall Street

by Martin Pring,

President, Pring Research

* Dark cloud cover explained

* What enhances a dark cloud signal

* How long is its bearish effect likely to last?

Dark cloud cover explained

The weather forecast this morning was for wintery weather on the East Coast. However, a more sobering non-meteorological message has been given by the stock market. Tuesday’...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships Are Forecasting Higher Commodity Prices

by Martin Pring,

President, Pring Research

* CRB Composite nudging through mega resistance

* Key intermarket relationships starting to point in an inflationary direction

* Inter-asset ratios also confirm the inflationary scenario

* Euro breaks to the upside

CRB Composite nudging through mega resistance

Late last month I wrote about several charts I was watching for a possible breakout in...

READ MORE

MEMBERS ONLY

Bond Yields Are Breaking Out All Over

by Martin Pring,

President, Pring Research

* Basic changes in long-term momentum

* The five-year maturity is signalling an end to the secular decline in yields

* Twenty-year yield showing signs of basing

* Ten-year attacking mega down trend line

* From a short-term aspect bond prices look vulnerable

* Utilities about to crash?

Basic changes in long-term momentum

Since the beginning...

READ MORE

MEMBERS ONLY

Martin Pring's Market Roundup Video January 2018-01-03

by Martin Pring,

President, Pring Research

This months Market Roundup live video has a lot of information on the bond market. The six-stage cycle is currently in Stage 3. This large overview shows some of the major macro trends that are breaking right now.

Market Roundup With Martin Pring 2018-01-03 from StockCharts.com on Vimeo.

Good...

READ MORE

MEMBERS ONLY

Dollar Index Is Just Above Make Or Break Support--- Will It Bounce Or Break?

by Martin Pring,

President, Pring Research

Dollar Index is in a confirmed bear market

* Dollar sympathy indicators are close to a major breakdown

* Canadian and Aussie dollars are driven by commodity prices

* Emerging Market ETF benefiting from a weaker dollar

Dollar Index is in a confirmed bear market

As 2018 begins to unfold the Dollar Index...

READ MORE

MEMBERS ONLY

Four Markets To Watch In 2018 For A Potentially Important Breakout

by Martin Pring,

President, Pring Research

* 10-year bond yields could be in the process of a secular reversal.

* What odds is the S. Korean ETF placing on the breakout of war?

* China has gone uncharacteristically quiet. Is this the quiet before the storm?

* CRB Composite just below mega resistance

As we approach 2018 I thought it...

READ MORE

MEMBERS ONLY

The Yield Curve Is Not Forecasting A Recession Right Now

by Martin Pring,

President, Pring Research

* What message is the yield curve giving?

* Secular reversal in short-term bond yields is being signalled

* Energy sector breaks to the upside

* Energy strength may breathe life into the CRB Composite

What message is the yield curve giving?

Despite what you may be reading, the yield curve is not forecasting...

READ MORE

MEMBERS ONLY

What's The Market Going To Do When The Tax Bill Is Passed?

by Martin Pring,

President, Pring Research

* General thoughts on the discounting process

* Short-term indicators poised for, but not yet signalling a decline

General thoughts on the discounting process

There is an old adage on Wall Street to the effect that traders should, in the case of war, sell the rumor and buy on the sound of...

READ MORE

MEMBERS ONLY

Guess What? Short Term Indicators Are Saying That Bitcoin Is Getting A Bit Frothy!

by Martin Pring,

President, Pring Research

* 18-month ROC is literally off the charts

* Bitcoin and short- term momentum

* Comparing Bitcoin to the Bitcoin Trust

* Conclusion

* Links to videos on Bitcoin

18-month ROC is literally off the charts

There are two Bitcoin directly related vehicles that are available on the StockCharts platform. These are the NYSE Bitcoin...

READ MORE

MEMBERS ONLY

December 2017 Market Roundup With Martin Pring 2017-12-06

by Martin Pring,

President, Pring Research

This months Market Roundup highlights the three main assets of bonds, commodities and stocks. Rotations between these asset classes can help find major secular moves. This month shows multiple trends changing.

Market Roundup With Martin Pring 2017-12-06 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring...

READ MORE

MEMBERS ONLY

Precious Metals And Commodities Starting To Break Down

by Martin Pring,

President, Pring Research

* Gold leads commodities

* Gold, gold shares and silver complete head and shoulder patterns

* Two confidence ratios are forecasting lower gold prices

* Commodities headed lower

Gold leads commodities

Chart 1 compares the price of gold to commodities in the form of the CRB Composite. The green shaded areas represent rally periods...

READ MORE

MEMBERS ONLY

Is The Oil Price Topping?

by Martin Pring,

President, Pring Research

* Oil experiences a major upside breakout

* Overstretched energy markets on a short-term basis

* Where oil goes commodities in general often follow

I recently came across a commitment of traders hedgers chart that shows a record low short position. Now it’s true that since the 1990’s there has been...

READ MORE

MEMBERS ONLY

Small Caps Break To The Upside Big Time

by Martin Pring,

President, Pring Research

* Small Caps breaking out

* Gold and Silver may be close to a resolution to their recent rangebound activity

* Euro in a real dilemma but with a bullish bias

In sorting through a number of charts I recently came across some potential price patterns that are developing in several key markets....

READ MORE

MEMBERS ONLY

Commodities: Are They About To Experience A Pause?

by Martin Pring,

President, Pring Research

The long-term picture

* Is the stock market smarter than the commodity market?

* Commodity indexes short-term overbought

The long-term picture

Since mid-summer, commodity prices reflected in broadly based indexes such as the CRB ($CRB), Bloomberg Commodity ETN (DJP) or the DB Commodity ETF (DBC) have been on a tear. However, short-term...

READ MORE

MEMBERS ONLY

Growth Is Breaking Out Against Value

by Martin Pring,

President, Pring Research

Growth versus value and a possible mega breakout favoring growth

* The technology/staples ratio supports the growth/value breakout

* Some credit spreads are looking shaky

* Are stocks finally breaking against commodities?

Growth versus value and a possible mega-breakout favoring growth

Chart 1 compares the performance of the S&P...

READ MORE

MEMBERS ONLY

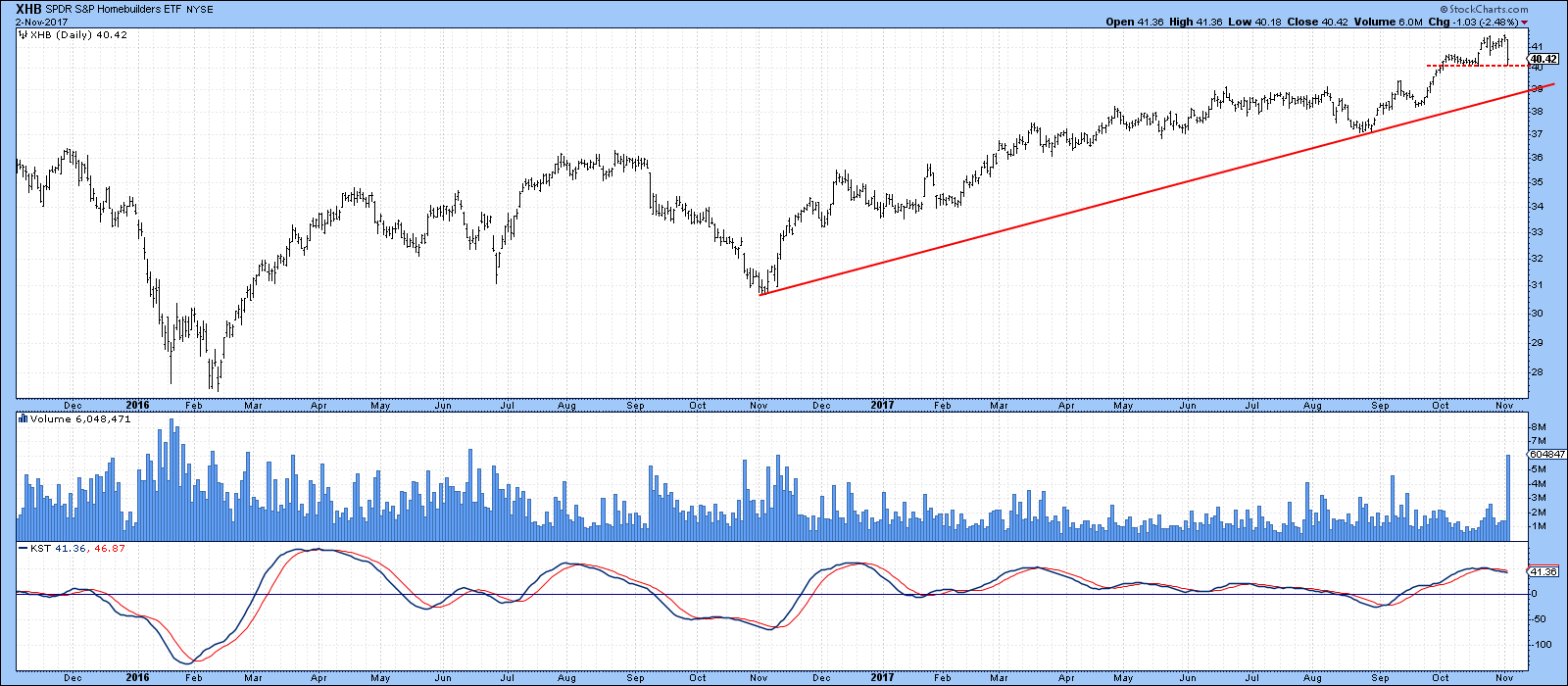

Homebuilders Hit By Tax Reform

by Martin Pring,

President, Pring Research

* SPDR Homebuilder ETF (XHB)

* iShares Home Construction ETF (ITB)

* Euro and yen looking vulnerable

Limitations being proposed for the popular interest rate deduction on tax filings hit the two homebuilder ETF’s for six on Thursday. These are the SPDR Homebuilder ETF (XHB) and the iShares Home Construction ETF (ITB)...

READ MORE

MEMBERS ONLY

Short-term Indicators Signaling Trouble Ahead?

by Martin Pring,

President, Pring Research

* Global short-term indicators start to go bearish near-term

* VIX and other US oscillators showing signs of vulnerability

Global short-term indicators start to go bearish near-term

A couple of weeks ago I suggested that several short-term indicators were hinting at a near-term downside or range bound correction. Usually, I put in...

READ MORE

MEMBERS ONLY

Green Shoots Are Starting To Appear For The Dollar

by Martin Pring,

President, Pring Research

* Special K offers a trend reversal signal

* Euro looks toppy

* Gold could be vulnerable

* Watch those commodities

Special K offers a trend reversal signal

The Dollar Index ETF, the UUP, remains below its long-term moving averages and most long-term smoothed momentum, such as the KST also continues to drop. That...

READ MORE

MEMBERS ONLY

A Pause To Refresh Before A Year End Rally?

by Martin Pring,

President, Pring Research

* Short-term October stock market correction?

* Healthcare not looking so healthy

* Dollar likely to digest recent gains over the immediate short-term

* How about a rally in gold?

Short-term October stock market correction?

The strongest seasonal of the year for equities comes at year-end. Since this is a bull market, it seems...

READ MORE

MEMBERS ONLY

Why It's Important To Watch The Stock/Gold Ratio

by Martin Pring,

President, Pring Research

The relationship between Stocks and Gold

* Long-term Picture

* Three interpretive rules

* Looking at it the other way. The Gold/stock Ratio

* Two Politically troubled ETF’s, are so technically troubled

Long-term Picture

One of the areas I focused on in my latest Market Roundup Webinar was the tight trading range...

READ MORE

MEMBERS ONLY

Market Roundup Video Recording With Martin Pring 2017-10-04

by Martin Pring,

President, Pring Research

The Market Round Up Video Recording for October is available. Use the HD button for better clarity when viewing.

Market Round Up Live With Martin Pring 2017-10-04 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the...

READ MORE

MEMBERS ONLY

Four Implications Of A US Dollar Rally

by Martin Pring,

President, Pring Research

* Two bullish dollar charts

* Several dollar sympathy relationships are likely to reverse

In a couple of September articles on the dollar I suggested that the potential for a short-term rally existed, as bearish sentiment and other indicators appeared to have moved to an extreme. A rally of some kind does...

READ MORE

MEMBERS ONLY

Staples And Materials: Which Sector To Hold And Which One To Fold?

by Martin Pring,

President, Pring Research

The relationship between Staples and Materials

* Long-term relative trends

* Breakouts and breakdowns

* Which of the materials sub-components are breaking out?

* Euro looks short-term toppy

The relationship between Staples and Materials

Most of the time I concentrate on the trend of the overall market, but some sector charts for Consumer Staples...

READ MORE

MEMBERS ONLY

Fed Unwinding Triggers Rates To Rise, A Dollar Reversal And A Boost To Financials

by Martin Pring,

President, Pring Research

* Dollar begins a short-term rally

* Fed action boosts rates

* Financials set to move higher

Fed action on Wednesday had the effect of boosting rates, thereby causing short-term reversals in several markets and relationships. These inflexion points in the markets are expected to influence prices over the next few weeks.

Dollar...

READ MORE

MEMBERS ONLY

Is It Time To Buy The US Dollar?

by Martin Pring,

President, Pring Research

* A few words on sentiment

* The long-term technical remains bearish but…

* Short-term is almost bullish

* What about the euro?

* Conclusion

A few words on sentiment

The Dollar Index has been in a virtual free fall since the end of last year. No market goes down forever, because traders exhaust their...

READ MORE